Market Overview

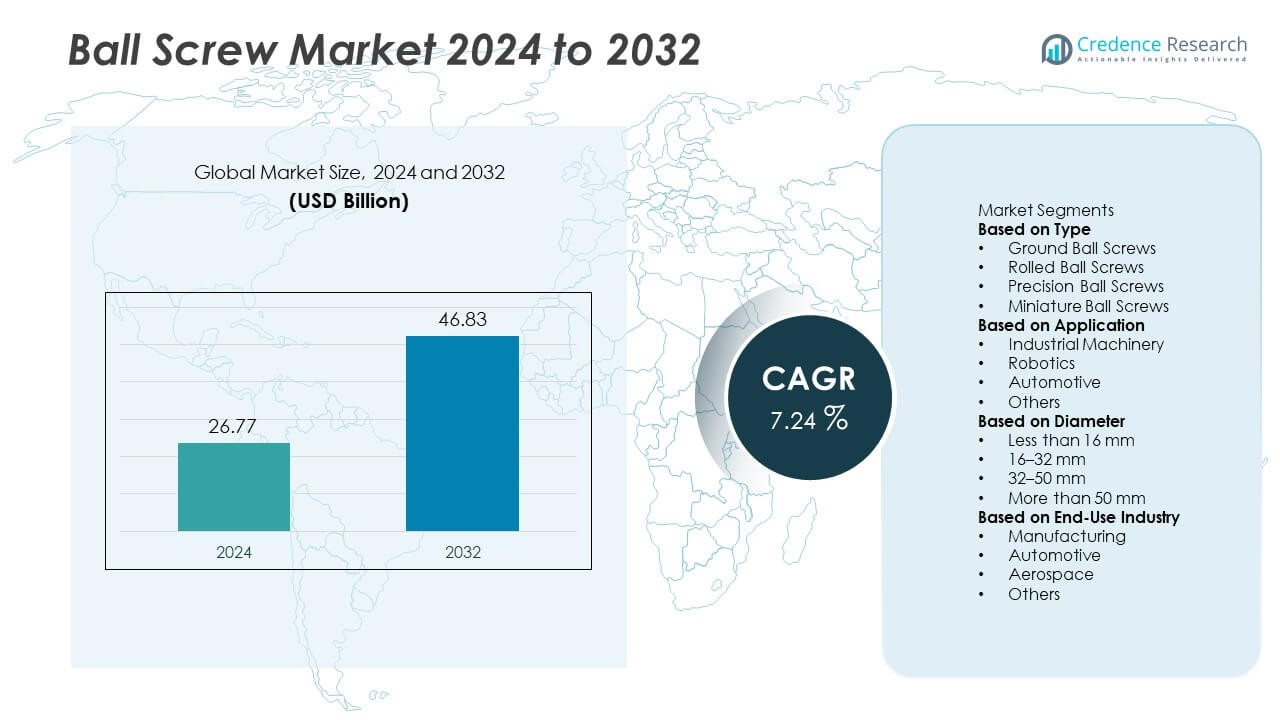

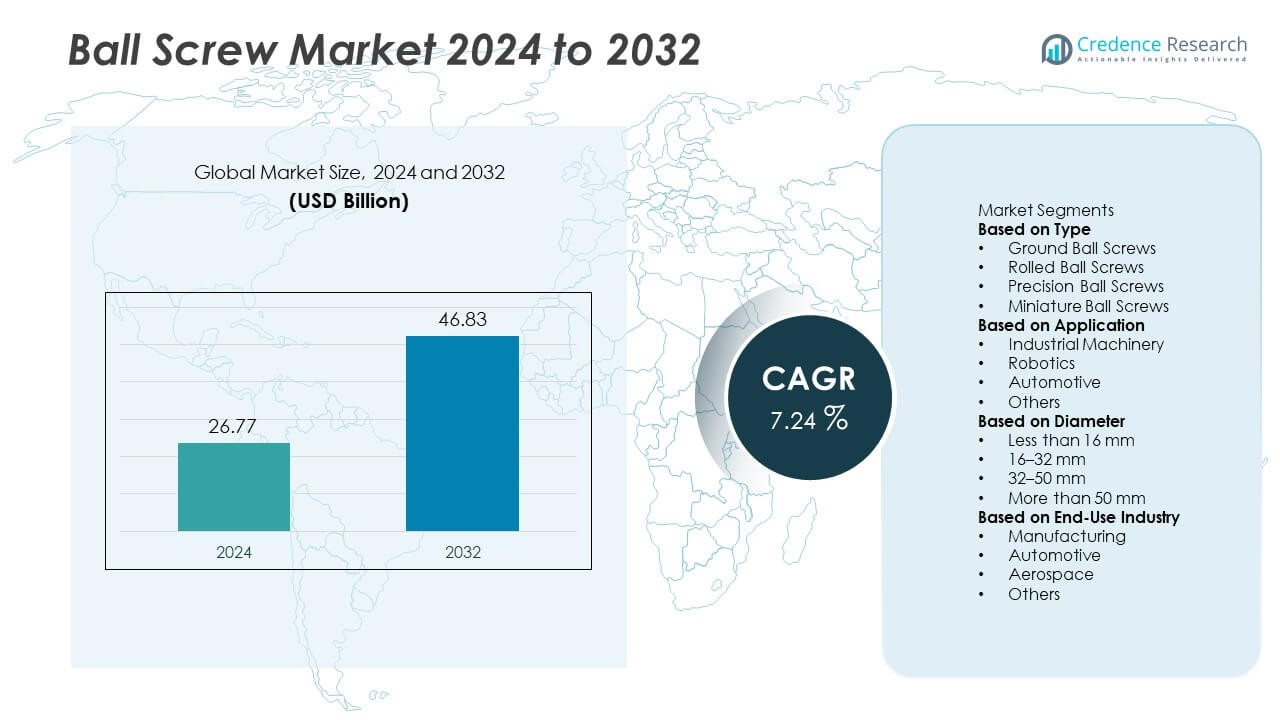

The Ball Screw Market was valued at USD 26.77 billion in 2024 and is projected to reach USD 46.83 billion by 2032, registering a CAGR of 7.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ball Screw Market Size 2024 |

USD 26.77 Billion |

| Ball Screw Market, CAGR |

7.24% |

| Ball Screw Market Size 2032 |

USD 46.83 Billion |

The Ball Screw market is driven by leading players such as THK Co., Ltd., NSK Ltd., Bosch Rexroth AG, SKF Group, HIWIN Technologies Corp., Nippon Bearing Co., Ltd., Kuroda Precision Industries, TBI Motion Technology Co., Ltd., PMI Group, and Schaeffler Technologies AG & Co. KG. These companies strengthen their competitiveness through precision manufacturing, expanded product ranges, and strong supply networks serving CNC machinery, robotics, and semiconductor applications. Asia Pacific leads the market with a 30% share, supported by large-scale industrialization and high CNC adoption, followed by North America at 34% and Europe at 28%, driven by advanced automation and strong engineering capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ball Screw market reached USD 26.77 billion in 2024 and is projected to hit USD 46.83 billion by 2032, registering a 7.24% CAGR during the forecast period.

- Market growth is driven by rising automation demand, expanding CNC machine installations, and strong usage in manufacturing and robotics, where ground ball screws lead with a 46% segment share due to high precision and durability.

- Key trends include growing adoption of miniature ball screws for compact devices, rising demand for low-noise and high-efficiency designs, and greater integration of ball screws in high-speed robotic and semiconductor equipment.

- Competitive strength increases as major players enhance precision engineering capabilities, invest in advanced grinding and heat-treatment technologies, and expand their portfolios to support aerospace, automotive, and electronics applications.

- Regionally, North America holds a 34% share, Europe accounts for 28%, and Asia Pacific leads industrial expansion with a 30% share, driven by rapid manufacturing growth and strong CNC adoption across China, Japan, and South Korea.

Market Segmentation Analysis:

By Type

Ground ball screws dominate the type segment with a 46% market share, driven by their high precision, low friction, and superior load-handling capability. These screws are widely adopted in CNC machinery, semiconductor tools, and aerospace-grade systems where accuracy is critical. Rolled ball screws also gain traction due to lower production costs and suitability for general industrial automation. Precision and miniature variants expand with rising demand for compact linear motion systems in medical devices and robotics. Growing preference for efficient and repeatable motion control continues to strengthen the dominance of ground ball screws across high-performance applications.

- For instance, the THK precision-ground ball screw model BNFN features a double-nut preloaded design to eliminate backlash, which enables highly accurate micro-feeding and positioning.

By Application

Industrial machinery leads the application segment with a 42% market share, supported by extensive use in CNC equipment, injection molding machines, and heavy-duty automation systems. Manufacturers adopt ball screws to improve positioning accuracy, reduce backlash, and extend machine lifespan. Robotics follows as demand for high-speed actuation and precise linear motion increases across assembly, packaging, and inspection systems. The automotive sector also drives strong adoption due to expanding EV production needs and automation in powertrain assembly. Rising demand for efficient motion control solutions maintains industrial machinery as the dominant contributor to market growth.

- For instance, SKF supplied ball screws for high-tonnage electric injection molding machines, an application that generally requires high-capacity ball screws to handle heavy loads and enable larger parts manufacturing.

By Diameter

Ball screws with diameters in the 16–32 mm range hold a 39% market share, driven by their widespread use in machine tools, industrial equipment, and automated production lines. This mid-range diameter offers an optimal balance of load capacity, speed, and structural rigidity, supporting diverse applications across manufacturing. Less than 16 mm variants rise in demand due to increased use in compact robots and medical devices, while 32–50 mm screws support heavy-duty operations in metal fabrication and automotive assembly. Larger than 50 mm screws remain essential for high-load environments requiring maximum durability and torque transmission.

Key Growth Driver

Rising Demand for High-Precision Industrial Automation

Growing adoption of advanced automation systems in manufacturing strengthens demand for ball screws due to their accuracy, repeatability, and smooth linear motion. Industries such as machining, semiconductor fabrication, and aerospace rely on ground and precision ball screws to achieve tight tolerances. CNC machine installations continue to rise as factories shift toward high-productivity operations, boosting usage of linear motion components. Increased focus on energy-efficient motion control further encourages replacement of hydraulic systems with ball screws. This shift supports long-term growth as automation penetration expands across global production facilities.

- For instance, NSK is a world leader in high-precision ball screws for the CNC and machine tools industries, with standard precision grades for ground ball screws ranging from C0 to C5 in accordance with the JIS standard, which enables deployment across a vast range of high-performance CNC machining units globally.

Expansion of Robotics and Mechatronics Applications

The rapid growth of industrial and service robotics drives strong demand for compact, lightweight, and high-performance ball screws. Robots require precise and reliable actuation systems to support fast acceleration, multi-axis movement, and repetitive motion cycles. Miniature and mid-diameter ball screws are increasingly used in collaborative robots, automated inspection tools, and pick-and-place systems. Rising adoption of robotics in automotive, electronics, and logistics sectors accelerates demand. Mechatronics-driven system integration also boosts usage of ball screws as designers pursue efficient motion solutions for compact automation platforms.

- For instance, HIWIN manufactures a wide range of ball screws, including high-speed and miniature ground series, designed for use in precision machinery, automation, and robotics.

Increasing Investments in Machine Tool Modernization

Modernization of global machine tool infrastructure drives strong usage of ball screws due to their essential role in ensuring smooth, controlled linear movement. Manufacturers upgrade older equipment to boost productivity, reduce downtime, and improve machining accuracy. Precision ball screws support advanced milling, turning, and grinding operations, especially in industries with strict quality standards such as aerospace and medical components. Government-backed industrialization programs in Asia boost CNC adoption, further increasing demand. The trend toward high-speed machining and greater production efficiency continues to strengthen the need for advanced ball screw systems.

Key Trend & Opportunity

Advancements in High-Efficiency and Low-Noise Ball Screw Designs

Growing preference for smoother, quieter, and more energy-efficient motion control creates opportunities for next-generation ball screw technologies. Manufacturers develop optimized groove profiles, improved heat-treated materials, and enhanced lubrication systems to reduce wear and friction. These upgrades support longer service life and higher load capacity in compact designs. Quiet-drive ball screws gain traction in robotics, semiconductor tools, and medical systems where low vibration is essential. The trend toward high-speed automated equipment further opens opportunities for premium performance ball screws with superior dynamic characteristics.

- For instance, SKF has developed solutions, such as specific spherical roller bearings for vibrating machinery, which can tolerate extremely high linear acceleration levels (up to 31g, or approximately 300 m/s² for smaller shafts) by managing lubrication within the bearing.

Rising Adoption of Miniaturized Motion Components

Miniature ball screws gain significant traction as industries adopt compact machines, lightweight robots, and portable medical devices. These components support precise movement in limited spaces while maintaining high efficiency and durability. Growth in wearable health devices, micro-handling equipment, and compact laboratory automation strengthens demand. Electronics and semiconductor manufacturing also drive adoption due to shrinking device sizes and tighter assembly tolerances. The shift toward miniaturization creates strong opportunities for manufacturers offering precision-engineered screws with enhanced rigidity and minimal backlash.

- For instance, Kuroda Precision Industries manufactures a wide range of precision ball screws, including models with a 4 mm shaft diameter, that achieve high accuracy in applications such as semiconductor manufacturing equipment and industrial robots.

Key Challenge

High Production Costs and Complex Manufacturing Processes

Ball screws require advanced grinding, heat treatment, and precision finishing, leading to high production costs and long manufacturing cycles. Ground ball screws, in particular, involve expensive machinery and skilled labor, limiting affordability for smaller manufacturers. Variations in material quality and machining accuracy can directly impact performance, creating challenges in maintaining consistency. High costs also restrain adoption in cost-sensitive markets, where rolled ball screws or alternative linear systems are preferred. These factors limit the market’s expansion across low-budget automation sectors.

Competition from Alternative Linear Motion Systems

Ball screws face increasing competition from linear motors, belt-drives, and pneumatic actuators that offer benefits such as higher speeds, lower maintenance, or simpler integration. Linear motors challenge ball screws in high-speed applications like semiconductor tools, while belt systems attract cost-focused industries. These alternatives reduce reliance on mechanical components, especially in environments demanding minimal friction or contactless motion. Manufacturers must innovate with improved efficiency, durability, and precision to maintain competitiveness. The presence of multiple motion technologies complicates adoption decisions for end users, slowing ball screw market penetration in certain segments.

Regional Analysis

North America

North America holds a 34% market share in the Ball Screw market, driven by strong automation adoption, robust CNC machine installations, and rising investments in aerospace and defense manufacturing. The U.S. leads demand due to advanced machining capabilities, high robotics integration, and continuous upgrades in precision engineering facilities. Manufacturers adopt ground and precision ball screws to improve accuracy, reduce downtime, and support high-speed machining. Growth in electric vehicle production and semiconductor fabrication also strengthens regional demand. Improved industrial modernization programs and strong presence of key motion-control suppliers continue to support market expansion.

Europe

Europe accounts for a 28% market share, supported by strong adoption of precision manufacturing technologies and well-established automotive, aerospace, and industrial machinery sectors. Germany, Italy, and France lead the region due to high investments in CNC machinery and Industry 4.0 initiatives. Demand for ground ball screws remains strong in high-precision applications, including metalworking, medical device production, and automation systems. Robotics integration in automotive assembly lines further boosts usage. Stringent quality standards and growing focus on energy-efficient motion control systems continue to support stable market growth across major European economies.

Asia Pacific

Asia Pacific dominates with a 30% market share, driven by rapid industrialization, strong robotics adoption, and large-scale investments in semiconductor, automotive, and electronics manufacturing. China, Japan, South Korea, and India remain key contributors due to expanding CNC machining industries and growing demand for accurate linear motion systems. Cost-effective production capabilities in the region also support large-volume ball screw manufacturing. Rising EV production, medical equipment expansion, and government-backed smart factory initiatives further strengthen demand. Increasing preference for precision and miniature ball screws continues to shape high-growth opportunities across Asia Pacific.

Latin America

Latin America holds a 5% market share, supported by growing industrial automation, rising adoption of CNC machinery, and increasing modernization of manufacturing facilities. Brazil and Mexico drive demand due to expanding automotive production, metal fabrication, and electronics assembly. Manufacturers in the region increasingly adopt rolled and mid-diameter ball screws for cost-efficient motion control in general industrial applications. Economic constraints limit adoption of premium precision ball screws, but demand continues to grow in automotive and packaging sectors. Rising investments in industrial equipment and automation upgrades support steady regional growth.

Middle East & Africa

The Middle East & Africa region accounts for a 3% market share, driven by rising automation adoption in manufacturing, oil and gas equipment, and industrial infrastructure projects. Gulf countries, including the UAE and Saudi Arabia, invest in advanced machining capabilities to support diversification of their industrial sectors. Demand for durable and high-load ball screws grows in energy, construction, and defense applications. Africa shows gradual growth due to limited manufacturing capacity, but increased development of industrial zones supports adoption. Expanding interest in robotics and precision machining slowly contributes to market progress across the region.

Market Segmentations:

By Type

- Ground Ball Screws

- Rolled Ball Screws

- Precision Ball Screws

- Miniature Ball Screws

By Application

- Industrial Machinery

- Robotics

- Automotive

- Others

By Diameter

- Less than 16 mm

- 16–32 mm

- 32–50 mm

- More than 50 mm

By End-Use Industry

- Manufacturing

- Automotive

- Aerospace

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ball Screw market is shaped by major players such as THK Co., Ltd., NSK Ltd., Bosch Rexroth AG, SKF Group, HIWIN Technologies Corp., Nippon Bearing Co., Ltd., Kuroda Precision Industries, TBI Motion Technology Co., Ltd., PMI Group, and Schaeffler Technologies AG & Co. KG. These companies strengthen their position through precision engineering capabilities, advanced manufacturing technologies, and wide product portfolios covering ground, rolled, and miniature ball screws. Manufacturers focus on enhancing durability, load capacity, and efficiency to meet rising demand from CNC machinery, robotics, aerospace, and semiconductor industries. Strategic investments in automation, material innovation, and quality control improve performance standards across product lines. Companies expand their global presence through distribution partnerships, localized production facilities, and tailored solutions for high-performance applications. Growing emphasis on energy-efficient motion systems and automation upgrades continues to drive competitive differentiation in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- THK Co., Ltd.

- NSK Ltd.

- Bosch Rexroth AG

- SKF Group

- HIWIN Technologies Corp.

- Nippon Bearing Co., Ltd.

- Kuroda Precision Industries

- TBI Motion Technology Co., Ltd.

- PMI Group

- Schaeffler Technologies AG & Co. KG

Recent Developments

- In November 2024, THK Co., Ltd. launched its Model SDA-VZ ball screw drive system, targeting compact machine designs and reducing design time for installation.

- In October 2024, NSK Ltd. announced the development of its MT-Frix™ low-friction ball screw for machine tools, which reduces dynamic friction torque and heat generation while maintaining nut rigidity.

- In December 2023, NSK also developed the HTF-SRM ball screws (high-speed, heat-resistant) aimed at injection-molding and high-load drive applications, improving permissible operating conditions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Diameter, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-precision ball screws will rise as factories adopt advanced automation.

- CNC machine installations will increase, boosting the need for durable and accurate motion systems.

- Robotics expansion will drive stronger adoption of miniature and mid-diameter ball screws.

- Semiconductor and electronics manufacturing will fuel demand for ultra-precision linear motion components.

- Aerospace and medical device industries will adopt more ground ball screws for high-accuracy applications.

- Energy-efficient and low-noise ball screw designs will gain wider acceptance in modern machinery.

- Manufacturers will invest in improved materials and heat-treatment processes to enhance durability.

- Asia Pacific will strengthen its position as a key production hub for high-volume ball screw manufacturing.

- Partnerships between machine builders and motion-control suppliers will support integrated system development.

- Growth in EV production and automated assembly systems will continue to drive long-term market expansion.