Market Overview:

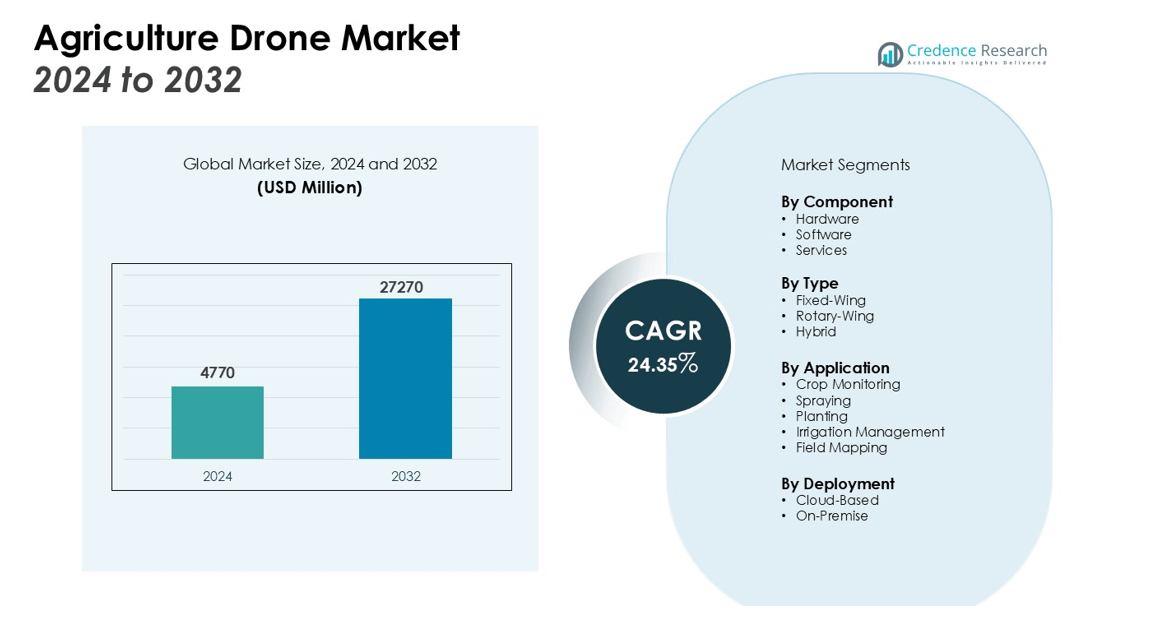

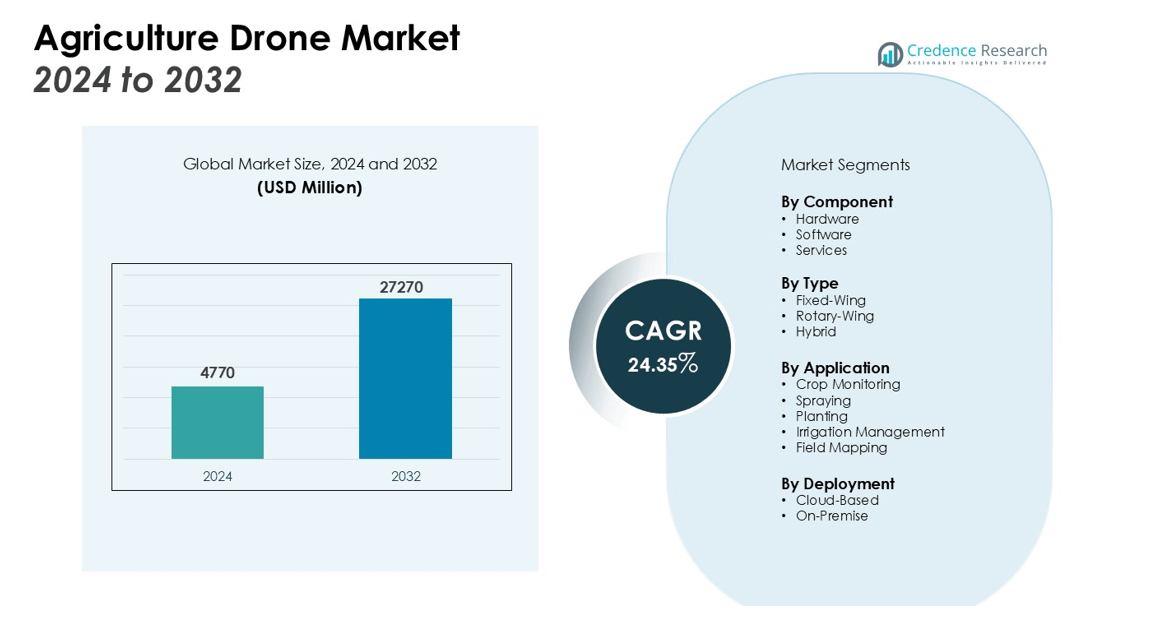

The Agriculture Drones Market size was valued at USD 4770 million in 2024 and is anticipated to reach USD 27270 million by 2032, at a CAGR of 24.35% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Agriculture Drone Market Size 2024 |

USD 4770 million |

| Agriculture Drone Market, CAGR |

24.35% |

| Agriculture Drone Market Size 2032 |

USD 27270 million |

The agriculture drone market is driven by rising demand for precision agriculture, labor shortages, and environmental concerns. Drones enable accurate pesticide and fertilizer application, which reduces waste and minimizes chemical runoff. They also support crop health monitoring through multispectral sensors, allowing early detection of diseases. Continuous advances in artificial intelligence, longer battery life, and improved affordability further strengthen adoption. Additionally, policy support and subsidies in major farming regions accelerate the integration of drone technology into modern farming practices.

Asia-Pacific leads the global market, with China and India at the forefront due to large-scale farming operations and strong government initiatives. North America ranks next, benefiting from technological innovation and active collaboration between agriculture and technology companies. Europe shows consistent growth, supported by sustainability regulations and precision farming programs. Latin America and Africa, though still developing in this segment, present significant opportunities as farming infrastructure improves and awareness of drone benefits increases.

Market Insights:

- The Agriculture Drone Market was valued at USD 4770 million and will reach USD 27270 million by 2032, growing at a CAGR of 24.35%.

- Asia-Pacific leads with 38% share, supported by China’s manufacturing strength and India’s government-backed initiatives.

- North America follows with 30% share, driven by innovation, strong digital infrastructure, and active industry collaborations.

- Europe holds 22% share, guided by strict sustainability regulations, while Latin America and Africa together account for 10%.

- Rising demand for precision agriculture, crop monitoring, and optimized input use is driving consistent adoption.

- High costs, technical barriers, and regulatory restrictions continue to challenge smaller farms and developing regions.

- Supportive government policies, subsidies, and integration with AI-driven solutions strengthen future market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Precision Agriculture Technologies

The Agriculture Drone Market benefits from the global shift toward precision agriculture. Farmers use drones for accurate field mapping, soil analysis, and crop monitoring. It enables targeted use of water, fertilizers, and pesticides, improving efficiency and lowering costs. This adoption reduces environmental impact while ensuring higher yields. The growing need to optimize inputs and maximize output fuels consistent demand.

- For instance, the company Equinox Drones, with its product EquiAgra 16.0, uses automated plant count algorithms to track agricultural yield across many acres of land, demonstrating the technology’s ability to precisely monitor large-scale operations.

Addressing Labor Shortages and Enhancing Efficiency

Labor shortages in agriculture accelerate drone adoption across both developed and developing regions. It supports farmers by performing tasks like spraying, planting, and crop surveillance with greater speed. Drones reduce dependency on manual labor while ensuring consistent accuracy. This efficiency allows farmers to manage large-scale farms with fewer workers. The technology creates measurable improvements in productivity and cost savings.

- For instance, The DJI Agras T30 drone has a maximum advertised spraying capacity of up to 40 acres per hour. Its actual hourly work efficiency can vary based on factors such as field size and shape, application rates, drone refilling, and battery charging logistics.

Technological Advancements and Cost Reductions

Advances in artificial intelligence, machine learning, and sensor integration strengthen the capabilities of agricultural drones. It enables early detection of pests, diseases, and nutrient deficiencies, helping farmers make timely decisions. Improved battery performance and flight control extend operational time in the field. Costs continue to fall, making drones more accessible to medium and small-scale farmers. These developments ensure steady growth across the sector.

Supportive Policies and Sustainability Goals

Government policies and subsidies encourage the deployment of drones in agriculture. It aligns with sustainability objectives by minimizing chemical overuse and conserving natural resources. Many regions invest in agtech initiatives, providing financial and technical support to farmers adopting drones. Sustainability goals across Europe, Asia-Pacific, and North America drive structured implementation of drone solutions. This policy support reinforces long-term growth in the Agriculture Drone Market.

Market Trends:

Integration of Advanced Technologies and Data-Driven Solutions

The Agriculture Drone Market is witnessing a clear shift toward advanced technologies that enhance precision and efficiency. Drones equipped with multispectral, hyperspectral, and thermal sensors deliver real-time insights into soil health, crop stress, and water distribution. Artificial intelligence and machine learning algorithms now process drone-captured images, enabling predictive analytics and actionable recommendations for farmers. It supports decision-making by detecting early signs of disease and nutrient deficiencies. Cloud-based platforms and farm management software integrate with drone data, creating a seamless digital ecosystem for agriculture. This trend not only improves operational control but also strengthens long-term sustainability practices.

- For instance, DJI’s P4 Multispectral drone achieves centimeter-level precision, with a horizontal positioning accuracy of 1 cm + 1 ppm, enhancing the reliability of farm data.

Expansion of Commercial Applications and Growing Adoption Globally

The Agriculture Drone Market shows a strong expansion of applications beyond monitoring and spraying. Drones are increasingly used for crop planting, irrigation management, and livestock monitoring, broadening their role in farm operations. It accelerates adoption among commercial farms that seek scalable solutions for large fields. Governments and private players are promoting pilot projects, grants, and partnerships to improve awareness and encourage usage. Regional adoption patterns highlight strong growth in Asia-Pacific and North America, where technological ecosystems support rapid deployment. Europe maintains steady adoption driven by environmental policies, while Latin America and Africa are emerging with growing interest. These expanding applications and global adoption trends solidify the role of drones in modern agriculture.

- For instance, AeroVironment’s Quantix drone is built for large-scale crop scouting and can survey an area of up to 400 acres in one 45-minute flight.

Market Challenges Analysis:

High Costs, Technical Barriers, and Limited Awareness

The Agriculture Drone Market faces challenges linked to high initial investment and technical complexity. Many small and medium-scale farmers find advanced drones costly, limiting widespread adoption. It also requires specialized training to operate drones and interpret collected data, creating barriers in rural areas with limited technical knowledge. Maintenance and repair costs further increase financial pressure, especially in developing regions. Limited awareness of the long-term benefits of drones reduces adoption rates in traditional farming communities. These challenges slow market penetration despite strong potential.

Regulatory Restrictions and Infrastructure Limitations

Strict aviation regulations and complex approval processes create significant hurdles for the Agriculture Drone Market. It is often restricted by rules on altitude, range, and data privacy, which differ across regions. Inconsistent policies hinder large-scale deployment and discourage smaller players from investing in drone technology. Poor connectivity and limited digital infrastructure in rural areas reduce the effectiveness of data-driven drone solutions. Concerns over data security and integration with farm management systems also create resistance. These regulatory and infrastructural limitations remain major challenges for market growth.

Market Opportunities:

Rising Role of Smart Farming and Digital Transformation

The Agriculture Drone Market presents strong opportunities through the expansion of smart farming practices. Growing reliance on digital agriculture creates demand for drones that deliver accurate and timely insights. It supports sustainable farming by enabling resource optimization, reducing chemical usage, and improving crop yields. Integration with IoT devices, satellite imaging, and artificial intelligence enhances precision agriculture systems. Increasing adoption of farm management software creates synergy with drone-based data collection. These factors open new growth avenues for companies offering integrated drone solutions.

Expansion in Emerging Markets and Government Support

Emerging economies provide significant opportunities for the Agriculture Drone Market due to large agricultural bases and rising food demand. Governments in Asia-Pacific, Latin America, and Africa are promoting technology adoption through subsidies, training programs, and pilot projects. It encourages farmers to adopt drones for irrigation management, spraying, and field mapping. Agritech startups and partnerships with established manufacturers strengthen accessibility in cost-sensitive markets. Expanding applications in forestry, livestock management, and environmental monitoring further extend market scope. These developments highlight strong growth prospects across both developed and developing regions.

Market Segmentation Analysis:

By Component

The Agriculture Drone Market by component is divided into hardware, software, and services. Hardware dominates due to strong demand for advanced sensors, cameras, and navigation systems. Software is expanding with AI-driven analytics platforms that improve image processing and predictive insights. It strengthens decision-making by integrating drone data with farm management solutions. Services such as training, maintenance, and consulting also gain momentum, supported by rising adoption among medium and large-scale farms.

- For instance, in hardware, DJI’s Agras T50 drone can carry a spraying payload of 40 kg. In software, PrecisionHawk’s platform uses AI to automate plant inventory and health analysis.

By Type

The Agriculture Drone Market by type includes fixed-wing, rotary-wing, and hybrid drones. Rotary-wing drones hold the largest share because of their maneuverability and suitability for small and fragmented farms. Fixed-wing models are effective in covering large agricultural fields with efficiency and speed. It is especially valuable in regions with expansive farmland such as North America and Asia-Pacific. Hybrid drones are emerging as a promising category, offering the combined advantages of fixed and rotary-wing systems.

- For instance, the DJI Agras T40, a rotary-wing model, has an obstacle detection range of up to 50 meters.

By Applications

The Agriculture Drone Market by application spans crop monitoring, spraying, planting, irrigation management, and field mapping. Crop monitoring leads the segment, supported by the need for real-time insights and early disease detection. Spraying applications are expanding rapidly, driven by the focus on reducing chemical waste and improving efficiency. It helps farmers optimize input use while ensuring higher yields. Field mapping and irrigation management also show consistent growth, aligning with global precision agriculture initiatives and sustainability practices.

Segmentations:

By Component

- Hardware

- Software

- Services

By Type

- Fixed-Wing

- Rotary-Wing

- Hybrid

By Applications

- Crop Monitoring

- Spraying

- Planting

- Irrigation Management

- Field Mapping

By Deployment

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific Leading with Strong Adoption and Government Support

Asia-Pacific holds 38% share of the Agriculture Drone Market, making it the largest regional market. China accounts for a major portion, supported by domestic manufacturing strength and government subsidies. India contributes significantly through government-backed digital farming programs and demand for higher productivity. It benefits from advanced technology ecosystems and training initiatives that lower adoption barriers. Japan and South Korea also add momentum through AI-enabled drone research and commercial integration. The region continues to expand its lead with large-scale adoption and robust policy support.

North America Driving Growth with Innovation and Partnerships

North America captures 30% share of the Agriculture Drone Market, ranking second globally. The United States leads regional adoption with strong investments in precision agriculture and widespread digital infrastructure. Canada adds to the share through sustainability-focused programs and digital monitoring practices. It benefits from collaborations between drone makers, software firms, and farm cooperatives that create scalable solutions. Favorable regulations encourage broad usage across small and large farms. The region continues to drive global innovation and advanced deployment.

Europe and Emerging Regions Expanding Steadily

Europe accounts for 22% share of the Agriculture Drone Market, driven by regulatory alignment with sustainable farming goals. Germany, France, and the UK are leading adopters, integrating drones to achieve efficiency and environmental compliance. It reflects the region’s focus on digital farming strategies under EU policies. Latin America and Africa together hold 10% share, supported by rising agricultural demand and government-backed pilot projects. Infrastructure growth and farmer awareness are gradually removing adoption barriers. These regions remain important future growth areas as technology costs decline and accessibility improves.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DJI (China)

- DroneDeploy (US)

- 3DR (US), Sentera Inc. (US)

- PrecisionHawk (US)

- ATMOS UAV (Netherlands)

- Delair (France)

- Trimble Inc. (US)

- SlantRange (US)

- Nileworks Inc. (Japan)

- Parrot Drones (France)

- AeroVironment, Inc. (US)

- Yamaha Motor Co., Ltd. (Japan)

- AgEagle Aerial Systems, Inc. (US)

Competitive Analysis:

The Agriculture Drone Market is highly competitive, with global and regional players focusing on innovation and scalability. Leading companies invest in advanced technologies such as multispectral sensors, AI-driven analytics, and automated spraying systems to differentiate their offerings. It is characterized by strategic partnerships between drone manufacturers, software developers, and agtech firms that expand application scope and improve integration with farm management platforms. Cost optimization and user-friendly designs remain priorities to attract small and medium-scale farmers, especially in emerging markets. Companies also pursue mergers, acquisitions, and collaborations to strengthen distribution networks and increase market presence. Growing emphasis on regulatory compliance and sustainability drives firms to align their products with government initiatives and precision farming programs. The competition continues to intensify, as established aerospace and technology firms enter the sector alongside specialized agricultural drone startups, broadening market opportunities while increasing rivalry across all regions.

Recent Developments:

- In May 2025, DJI launched the Mavic 4 Pro, which features a triple camera system and an extended flight time of up to 52 minutes.

- In February 2025, Platform Science completed its acquisition of Trimble’s global transportation telematics business units, with Trimble becoming a strategic investor and shareholder in Platform Science.

- In August 2025, AeroVironment delivered its P550 small Unmanned Aircraft Systems (sUAS) to the U.S. Army for its Long-Range Reconnaissance (LRR) program.

Report Coverage:

The research report offers an in-depth analysis based on Component, Type, Applications, Deployment and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Precision agriculture will remain the primary growth driver, with drones becoming integral to field monitoring and crop management.

- Integration of AI and machine learning will enhance data accuracy, enabling predictive insights for disease and pest detection.

- Drone-based spraying systems will expand further, reducing chemical usage and improving resource efficiency.

- Governments will strengthen support through subsidies, training programs, and regulatory reforms to encourage broader adoption.

- Sustainability goals will drive greater use of drones to minimize environmental impact and conserve water, soil, and energy.

- Expansion in emerging economies will accelerate, supported by rising food demand and improving agricultural infrastructure.

- Collaboration between drone manufacturers, software firms, and agricultural cooperatives will create comprehensive solutions for farmers.

- Advances in battery technology and automation will extend flight duration and reduce operational costs.

- Large-scale farms will adopt drones rapidly, while affordability improvements will expand access for small and medium farms.

- Growing applications in forestry, livestock management, and environmental monitoring will further diversify the market landscape.