Market Overview

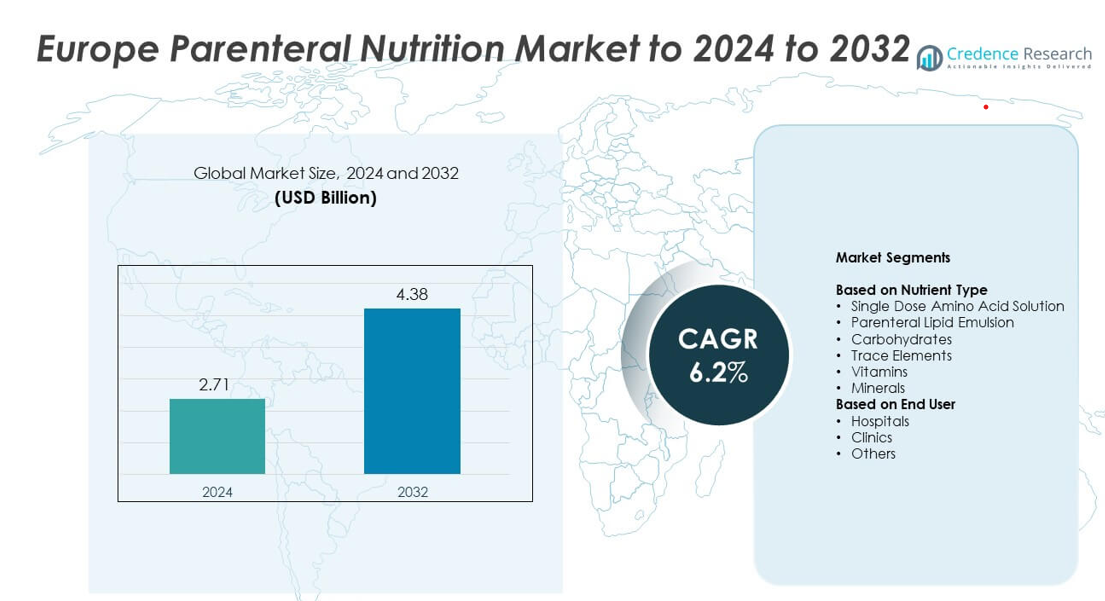

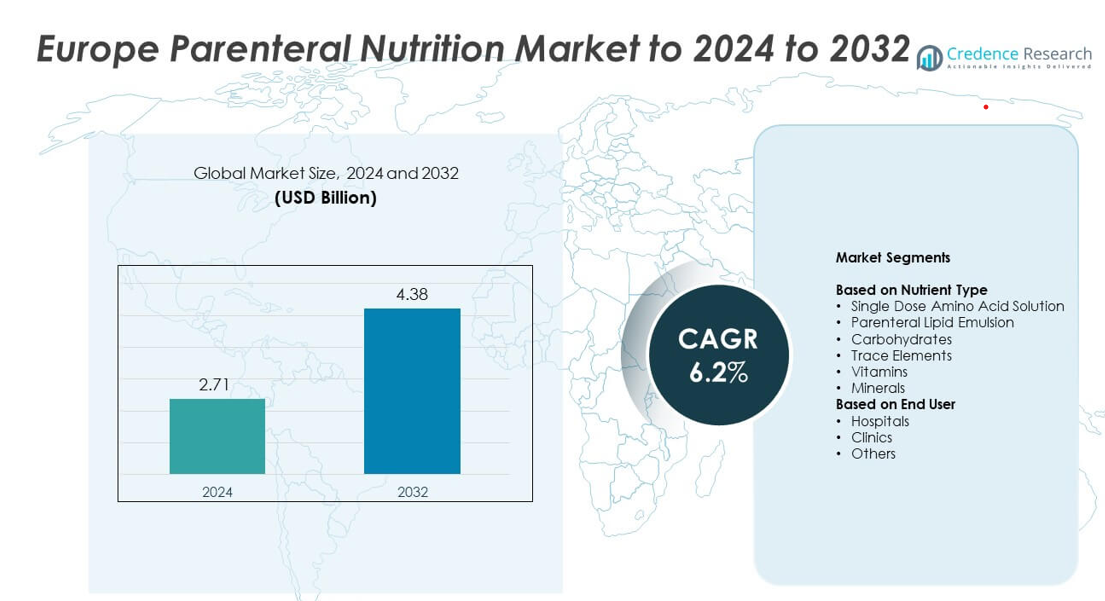

Europe Parenteral Nutrition Market size was valued USD 2.71 billion in 2024 and is anticipated to reach USD 4.38 billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Parenteral Nutrition Market Size 2024 |

USD 2.71 billion |

| Europe Parenteral Nutrition Market, CAGR |

6.2% |

| Europe Parenteral Nutrition Market Size 2032 |

USD 4.38 billion |

The Europe Parenteral Nutrition Market is shaped by major players including Fresenius Kabi AG, B Braun SE, Pfizer Inc, Baxter International Inc, ICU Medical Inc, Grifols SA, Otsuka Pharmaceuticals Co Ltd, Vifor Pharma Management AG, and Aculife Healthcare Pvt Ltd. These companies expand their presence through advanced formulations, strong hospital partnerships, and wider adoption of multichamber systems. Europe remains a key regional leader within the global market, holding nearly 31% share in 2024 due to high clinical nutrition standards and strong neonatal, oncology, and critical-care demand across major healthcare systems.

Market Insights

- The Europe Parenteral Nutrition Market was valued at USD 2.71 billion in 2024 and is projected to reach USD 4.38 billion by 2032, growing at a CAGR of 6.2%.

- Growth is driven by rising ICU admissions, expanding neonatal care needs, and strong adoption of personalized nutrition therapy across major hospitals.

- Key trends include growing use of multichamber bags, innovation in lipid emulsions, and wider adoption of home parenteral nutrition programs across developed European countries.

- The market is shaped by major players offering advanced formulations and strong compounding capabilities, with single dose amino acid solutions leading the nutrient type segment at about 34% share in 2024.

- Regionally, Europe held around 31% share of the global market, with the UK, Germany, France, Russia, and Italy contributing significantly through strong clinical infrastructure and updated nutrition guidelines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Nutrient Type

Single dose amino acid solution led the Europe Parenteral Nutrition Market in 2024 with about 34% share. Strong demand came from its vital role in supporting protein synthesis and preventing muscle loss in critically ill patients. Hospitals used these solutions widely due to rising surgical procedures and higher ICU admissions. Parenteral lipid emulsions and carbohydrates also expanded as clinicians adopted balanced nutrition protocols to improve recovery outcomes. Growth across vitamins, minerals, and trace elements increased with wider adoption of individualized nutrition therapy across Europe.

- For instance, Baxter’s Numeta G13%E and G16%E, which are triple-chamber bags of amino acids, glucose, lipids, and electrolytes for pediatric and neonatal patients, were authorized via national procedures in 19 Member States as of September 2013.

By End User

Hospitals dominated the Europe Parenteral Nutrition Market in 2024 with nearly 62% share. Large inpatient volumes, higher critical care needs, and strong adoption of advanced nutrition guidelines supported this lead. Hospital pharmacies also expanded the use of standardized and customized parenteral nutrition formulations for neonatal, oncology, and post-surgery patients. Clinics recorded steady growth as outpatient care services widened, while the others category grew due to rising home parenteral nutrition programs across several European countries.

- For instance, B. Braun supplies hospitals with Nutriflex multi-chamber parenteral nutrition systems, including 3-chamber and 2-chamber bags, as part of a parenteral nutrition portfolio aimed at standardized hospital use.

Key Growth Drivers

Rising Critical Care Admissions

Higher ICU admissions across Europe increased the need for advanced parenteral nutrition support. Hospitals managed more patients with severe infections, trauma, and complex surgeries, which raised reliance on intravenous nutrient delivery. Growing awareness of early nutrition intervention helped clinicians reduce complications and improve patient recovery. The wider adoption of standardized nutrition protocols across tertiary care centers further strengthened market expansion.

- For instance, the BANS report from BAPEN recorded 420 new adult home parenteral nutrition patients in the United Kingdom in 2015, compared with 262 new patients in 2011, showing a clear rise in complex cases needing long-term intravenous nutrition support

Growing Preterm Birth Rates

Preterm infants required precise nutrient delivery to support growth and prevent metabolic issues, which drove strong demand for neonatal parenteral nutrition. European neonatal intensive care units expanded specialized formulations tailored for fragile infants. Rising investments in perinatal care and improved survival rates contributed to consistent uptake. Continuous upgrades in neonatal nutrition guidelines also supported steady market growth across the region.

- For instance, Baxter’s Numeta G13E, the only approved ready-to-use intravenous nutrition product for preterm newborns in Europe, was launched across 15 Western European countries where more than 61,000 babies are born prematurely each year.

Shift Toward Personalized Nutrition Therapy

Clinicians increasingly adopted personalized nutrition based on patient condition, metabolic needs, and clinical outcomes. This shift improved treatment accuracy and reduced complications linked to malnutrition. Advanced compounding systems and safer lipid formulations supported wider use of customized nutrient mixes. Hospitals and specialty centers strengthened adoption as part of enhanced recovery protocols across Europe.

Key Trends & Opportunities

Expansion of Home Parenteral Nutrition Programs

Several European countries expanded home-based parenteral nutrition programs to reduce hospital stays and improve patient comfort. Advancements in portable infusion pumps and remote monitoring tools supported safe administration outside hospitals. Increased reimbursement support accelerated adoption among chronic intestinal failure patients. Growing awareness of long-term nutrition management created a stable opportunity for service providers.

- For instance, Calea’s home parenteral support service in the United Kingdom reports more than 1,000 active home parenteral support patients and over 112,000 nurse visits in a single year, reflecting the scale of organized home nutrition programs.

Growth in Lipid Emulsion Innovation

New-generation lipid emulsions gained traction due to improved safety and better tolerance among patients. Market players introduced formulations with advanced fatty acid profiles that supported immune function and reduced inflammation risks. Hospitals adopted these options widely as part of enhanced recovery strategies. Continuous research in lipid chemistry created opportunities for next-generation products across Europe.

- For instance, Fresenius Kabi’s SMOFlipid, the first four-oil lipid injectable emulsion, has been administered to more than 7 million patients worldwide, and its safety database in regulatory submissions includes 399 patients studied across nine clinical trials.

Rising Adoption of Multichamber Bags

Multichamber bags saw wider use due to strong demand for ready-to-use, contamination-resistant solutions. Their ability to reduce preparation time and medication errors supported rapid growth in busy hospital settings. Manufacturers expanded distribution across Europe to support emergency care and neonatal units. Increasing focus on safety and workflow efficiency continued to drive this shift.

Key Challenges

High Cost of Parenteral Nutrition Therapy

The high cost of specialized formulations, compounding systems, and infusion devices remained a major challenge. Budget constraints across healthcare systems limited access in smaller facilities. Reimbursement variations across countries created added pressure on providers. These cost barriers slowed adoption in non-tertiary settings and increased dependence on hospital-based care.

Risk of Infection and Complications

Parenteral nutrition required strict handling due to risks of catheter-related bloodstream infections and metabolic complications. Hospitals needed robust training programs and infection-control protocols to maintain safety. Supply shortages or workflow gaps increased risks during preparation and administration. These concerns pushed facilities to adopt stricter guidelines, which slowed rapid expansion in some regions.

Regional Analysis

UK

The UK captured nearly 8% share of the Europe Parenteral Nutrition Market, supported by strong adherence to national nutrition guidelines and rising use in major NHS hospitals. High surgical caseloads and growing incidence of gastrointestinal disorders increased demand for amino acid solutions and lipid emulsions. The country expanded home parenteral nutrition services through specialized centers, improving access for long-term patients. Adoption of ready-to-use multichamber bags improved workflow efficiency. Continuous upgrades to neonatal and critical-care units supported stable market expansion.

Germany

Germany held about 7% share, driven by strong clinical infrastructure and high adoption of specialized parenteral formulations across tertiary hospitals. Rising critical-care demand and robust oncology treatment pathways increased consumption of customized nutrient mixes. Hospitals widely used advanced lipid emulsions and standardized compounding systems to improve patient outcomes. The country also expanded neonatal care capacity, supporting higher use in preterm infants. Strong regulatory oversight and a well-structured reimbursement system continued to support consistent growth across the market.

France

France accounted for nearly 6% share, supported by strong national nutrition policies and higher utilization of parenteral solutions in post-surgical and critical-care settings. Hospitals adopted modern lipid formulations and multichamber bags to enhance safety and reduce preparation time. Growing rates of chronic intestinal disorders and preterm births increased clinical reliance on intravenous nutrition. Expansion of home parenteral nutrition programs improved long-term patient management. Investments in hospital modernization and pharmacy automation further supported steady demand.

Russia

Russia held about 5% share, driven by rising ICU admissions, higher surgical procedure volumes, and broader adoption of clinical nutrition in major urban hospitals. Growth came from increased usage of amino acid solutions and carbohydrate formulations in acute and chronic care. The country improved access to advanced parenteral products through expanded domestic manufacturing and distribution. However, adoption varied across regions due to infrastructure gaps. Expanding neonatal care services and updated clinical protocols continued to support market progress.

Italy

Italy captured nearly 5% share due to strong demand in surgical recovery, oncology, and critical-care units across major hospitals. Rising focus on malnutrition management increased use of standardized parenteral formulations. The country also expanded home parenteral nutrition services, improving treatment continuity for chronic patients. Adoption of multichamber bags and advanced lipid emulsions grew with better safety awareness. Upgrades in neonatal intensive care and regional healthcare reforms supported consistent market expansion across key Italian regions.

Market Segmentations:

By Nutrient Type

- Single Dose Amino Acid Solution

- Parenteral Lipid Emulsion

- Carbohydrates

- Trace Elements

- Vitamins

- Minerals

By End User

By Geography

- UK

- Germany

- France

- Russia

- Italy

Competitive Landscape

The Europe Parenteral Nutrition Market is shaped by leading companies such as Fresenius Kabi AG, B Braun SE, Pfizer Inc, Baxter International Inc, ICU Medical Inc, Grifols SA, Otsuka Pharmaceuticals Co Ltd, Vifor Pharma Management AG, and Aculife Healthcare Pvt Ltd. These players strengthen competitiveness through advanced formulations, wider adoption of multichamber bags, and strong compounding capabilities that support safe and accurate nutrient delivery. Major manufacturers continue to expand regional production capacity to improve supply reliability across hospitals and specialty centers. Growing emphasis on personalized nutrition drives innovation in lipid emulsions, amino acid solutions, and balanced nutrient mixes. Companies also invest in automation, digital compounding workflows, and enhanced quality systems to meet strict European regulatory standards. Rising demand for neonatal, oncology, and critical-care nutrition further encourages product upgrades and broader distribution networks across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fresenius Kabi AG

- B Braun SE

- Pfizer Inc

- Baxter International Inc

- ICU Medical Inc

- Grifols SA

- Otsuka Pharmaceuticals Co Ltd

- Vifor Pharma Management AG

- Aculife Healthcare Pvt Ltd

Recent Developments

- In 2024, Otsuka Pharmaceutical Factory launched KIDPAREN Injection, an amino acid multivitamin, glucose, and electrolyte solution for high-calorie parenteral nutrition.

- In 2024, Fresenius Kabi launched Peditrace Novum, a parenteral micronutrient formula for pediatric use.

- In 2024, ICU medical Formed a $200 million joint venture with Otsuka Pharmaceutical Factory to create a 1.4-billion-unit IV network, completed in 2025.

Report Coverage

The research report offers an in-depth analysis based on Nutrient Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for personalized parenteral nutrition will rise as hospitals adopt tailored therapy.

- Adoption of advanced lipid emulsions will grow due to improved safety profiles.

- Europe will expand home parenteral nutrition programs supported by better monitoring tools.

- Neonatal units will increase use of specialized formulations for preterm infants.

- Automation in compounding will improve accuracy and reduce preparation errors.

- Multichamber bags will gain stronger adoption for faster and safer administration.

- Clinical nutrition guidelines will advance, pushing wider use across surgical and ICU care.

- Regional manufacturers will expand production capacity to strengthen supply stability.

- Digital tracking systems will improve nutrition management and reduce complications.

- Hospitals will increase investments in training to enhance safe parenteral nutrition handling.