Market Overview

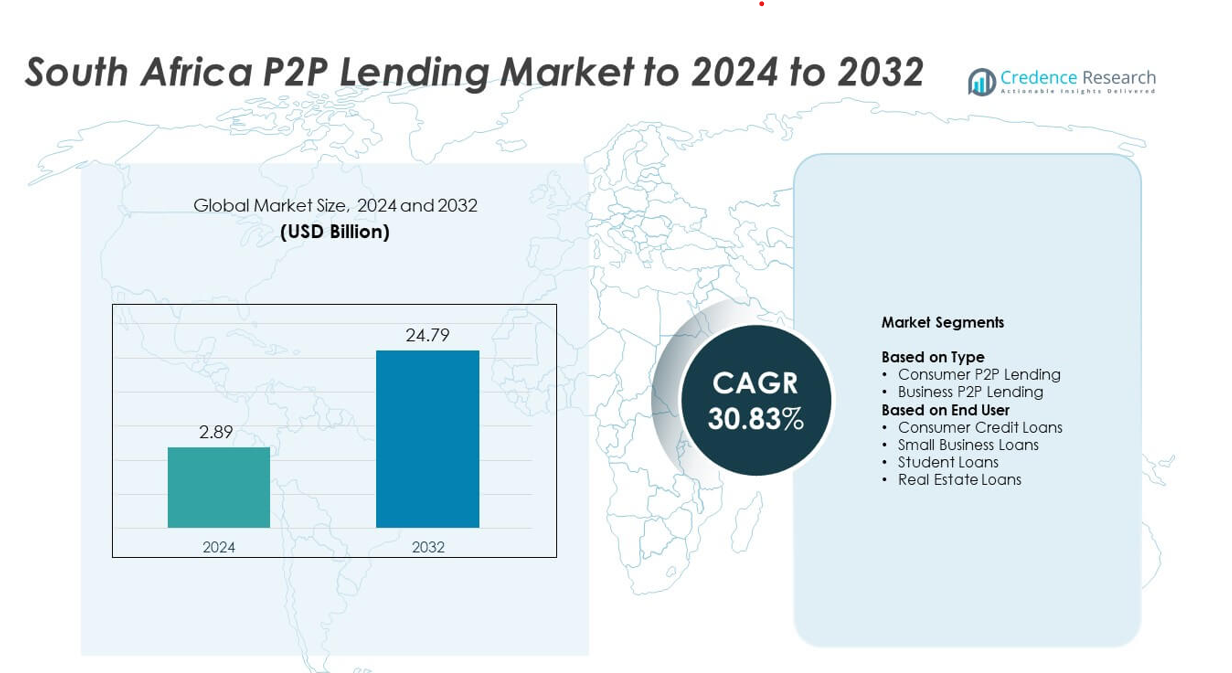

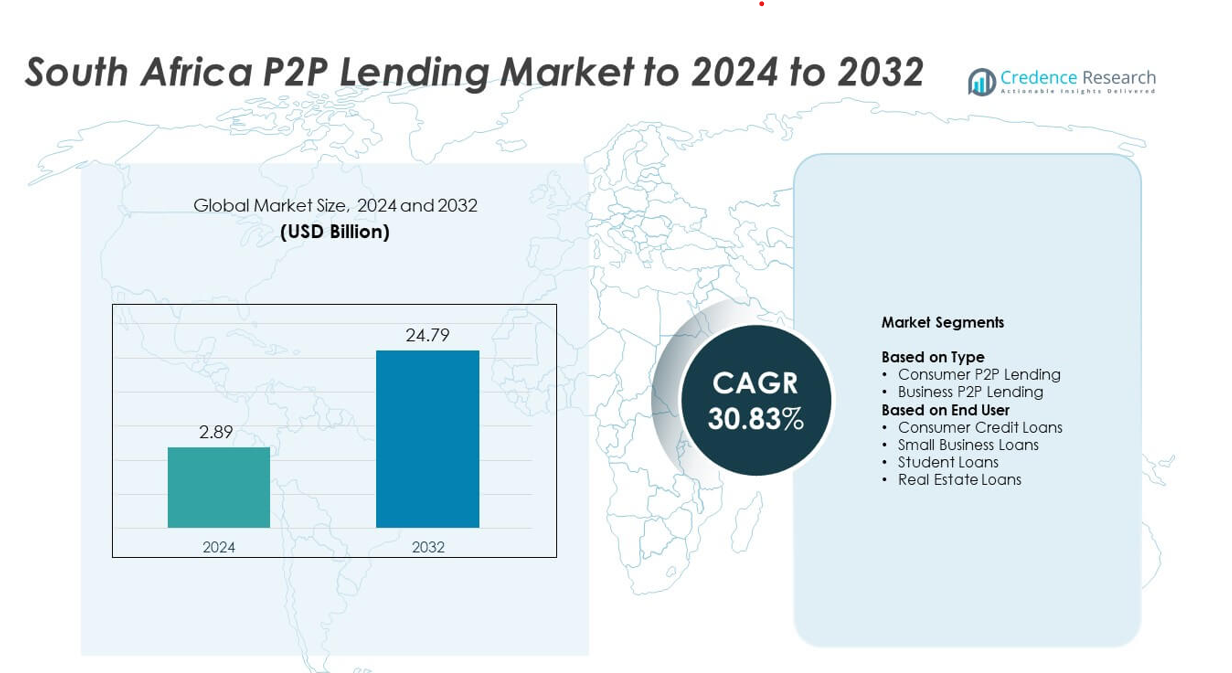

South Africa P2P Lending Market size was valued at USD 2.89 billion in 2024 and is anticipated to reach USD 24.79 billion by 2032, at a CAGR of 30.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Africa P2P Lending Market Size 2024 |

USD 2.89 billion |

| South Africa P2P Lending Market, CAGR |

30.83% |

| South Africa P2P Lending Market Size 2032 |

USD 24.79 billion |

The South Africa P2P Lending Market is shaped by leading players such as Fedgroup, Everlectric, Zopa Limited, Lulalend, RainFin, Paymenow, PeopleFund, Edge Growth, Inclusivity Solutions, FundingHub, Fincheck, Social Finance Inc., Ozow, and Naledi3d Factory. These platforms strengthen their presence through advanced digital lending tools, automated verification, and diversified loan products for consumers and SMEs. Gauteng emerged as the leading region in 2024 with about 41% share, supported by strong fintech activity, high digital adoption, and concentrated investor participation. Western Cape followed with nearly 22% share, driven by a solid innovation ecosystem and rising demand for tech-enabled credit services.

Market Insights

- The South Africa P2P Lending Market reached USD 2.89 billion in 2024 and is projected to hit USD 24.79 billion by 2032, registering a CAGR of 30.83% during the forecast period.

- Strong demand for alternative credit drives market expansion as consumers and SMEs seek fast approvals, flexible terms, and accessible digital lending options.

- Digital-first trends accelerate growth, with mobile-based onboarding, automated scoring, and rising investor participation strengthening platform adoption across borrower groups.

- Market competition intensifies as major platforms enhance risk models, expand loan categories, and invest in advanced analytics while focusing on user experience and transparency.

- Gauteng leads the regional landscape with about 41% share, followed by Western Cape at nearly 22%, while consumer P2P lending dominates the type segment with around 62% share in 2024 due to strong personal credit demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Consumer P2P lending dominated the South Africa P2P Lending Market in 2024 with about 62% share. Demand stayed high as borrowers sought fast approvals, flexible terms, and alternatives to bank credit amid tighter lending standards. Platforms expanded digital onboarding and risk-based pricing, which strengthened adoption across young and mid-income groups. Business P2P lending also grew as SMEs turned to online lenders due to limited access to traditional financing and rising interest in short-term working capital support.

- For instance, JUMO has reached over 31 million individuals and small businesses. The platform has administered over 250 million loans as of recent figures (mid-2025).

By End User

Consumer credit loans led this segment in 2024 with nearly 58% share of the South Africa P2P Lending Market. Growth increased as individuals used P2P platforms for personal expenses, debt consolidation, and emergency funding. Digital platforms lowered documentation needs, offered transparent rates, and enabled faster approvals, attracting a broad borrower base. Small business loans gained momentum due to increased SME financing gaps, while student and real estate loans expanded with broader investor participation and improved platform trust.

- For instance, RainFin was South Africa’s first and previously the largest peer-to-peer (P2P) lending platform. In 2016, it was processing transactions exceeding 1 million South African rand daily.

Key Growth Drivers

Rising Demand for Alternative Credit

South Africa P2P Lending Market expands as borrowers seek flexible loans outside traditional banks. Many consumers face strict credit checks and long approval times, pushing them toward digital lending platforms. P2P lenders offer faster processing, transparent rates, and easier qualification standards, which attract underserved groups. Growing smartphone usage and stronger digital trust also support wider platform adoption.

- For instance, TymeBank announced reaching 10 million customers on its digital platform by October 2024.

Growth of SME Financing Needs

Small businesses continue to struggle with limited access to bank credit, creating strong demand for P2P lending solutions. Platforms fill this gap by offering quicker approvals and tailored loan structures that support working capital and expansion needs. As SMEs adopt digital financing, P2P platforms gain steady traction. Wider investor participation also improves liquidity, helping strengthen loan availability for the sector.

- For instance, Lulalend is a South African online lending platform that has received investment from Triodos Bank. As of a specific impact reporting period, 1,056 borrowers were reached through Triodos Bank’s microfinance fund’s private equity and debt allocation to Lulalend.

Advancement in Digital Lending Technologies

Improved analytics, automated verification, and AI-driven risk scoring drive strong efficiency gains. These tools help platforms lower default risks and approve loans faster, which boosts user confidence. Enhanced security features and digital onboarding reduce friction during the lending process. As platforms invest in better technology, the market attracts more borrowers and investors seeking reliable, data-backed lending systems.

Key Trends & Opportunities

Expansion of Investor Participation

More retail and institutional investors enter the South Africa P2P Lending Market to access higher yields and diversify portfolios. Platforms offer structured investment options that balance risk and return, encouraging broader engagement. Improved transparency in loan performance and stronger platform governance support investor confidence. This trend helps create deeper liquidity and encourages long-term market growth.

- For instance, Orange Money has more than 90 million total customers in 17 countries across Africa and the Middle East, as reported by the end of 2023. As of the end of September 2025, the platform had 44.2 million active users.

Growth of Niche Lending Categories

Specialized segments gain traction as platforms offer loans tailored for education, real estate, and micro-enterprise needs. These categories attract borrowers who previously lacked strong access to targeted finance options. Growing demand for structured products allows platforms to serve new market groups. Such diversification strengthens overall ecosystem stability and opens new revenue opportunities for digital lenders.

- For instance, Student Hero is a South African finance facilitation service that partnered with colleges such as IIE Varsity College as of early 2025. Another company, Student Loan Hero, was founded in the U.S. in 2012 and was acquired by LendingTree in 2018. Before its acquisition, Student Loan Hero had helped over 200,000 borrowers manage and pay off more than $3.5 billion in student loans.

Rising Adoption of Mobile-First Lending

Mobile lending enhances accessibility across urban and semi-urban regions. Users prefer mobile apps due to simple registration, quick loan tracking, and real-time updates. Platforms expand mobile-first features such as automated KYC and instant credit scoring. This shift supports faster market penetration and improves borrower engagement across diverse demographics.

Key Challenges

High Default Risk and Credit Assessment Issues

P2P lenders face challenges in accurately assessing borrower risk, especially in under-documented segments. Limited credit histories and inconsistent income records make screening harder. Platforms must refine scoring models to maintain investor trust. High default potential affects platform stability and deters long-term investment if not managed well.

Regulatory Uncertainty and Compliance Pressure

The market grows within evolving financial regulations that require clear standards for consumer protection, investor safety, and platform governance. Frequent updates create compliance burdens for smaller platforms. Uncertainty around future rules slows innovation and increases operational costs. Stronger regulatory clarity is needed to support sustainable expansion and greater industry trust.

Regional Analysis

Gauteng

Gauteng held the largest share of the South Africa P2P Lending Market in 2024 with about 41%. The region benefits from high digital penetration, a dense urban population, and strong borrower demand across consumer and SME segments. Fintech activity remains concentrated in Johannesburg and Pretoria, enabling faster platform expansion. Strong investor participation and widespread mobile lending adoption further support regional dominance. Growth continues as fintech providers introduce advanced scoring tools and expand loan categories to meet rising urban credit needs.

KwaZulu-Natal

KwaZulu-Natal accounted for nearly 18% share of the South Africa P2P Lending Market in 2024. The region’s growing urban centers, such as Durban and Pietermaritzburg, support solid adoption of digital credit services. Borrowers rely on P2P platforms for personal loans and small business financing as traditional credit remains difficult to access. Increased smartphone usage and expanding fintech awareness drive stronger participation from younger consumers. Platforms are improving regional onboarding processes, which helps accelerate market penetration and increases borrower-to-investor activity.

Western Cape

Western Cape captured about 22% share of the South Africa P2P Lending Market in 2024. Cape Town’s strong fintech ecosystem supports rapid platform innovation, better digital infrastructure, and high investor activity. Borrowers adopt P2P lending for personal, education, and small enterprise needs as regional credit demand rises. Higher digital literacy improves trust in online lending systems, contributing to faster approval cycles. The region continues to gain traction as fintech hubs expand risk assessment capabilities and diversify lending products.

Mpumalanga

Mpumalanga represented around 9% share of the South Africa P2P Lending Market in 2024. Adoption grows steadily as consumers in semi-urban and mining-linked areas turn to digital lending for faster access to short-term funds. Mobile-first lending platforms help bridge credit gaps for workers and small enterprises. Increased awareness of alternative lending encourages more borrowers to shift away from informal credit. Continued improvements in digital connectivity and targeted lending products support market expansion across local communities.

Eastern Cape

Eastern Cape held nearly 10% share of the South Africa P2P Lending Market in 2024. Growth remains modest but rising as borrowers seek convenient financing options due to limited access to bank branches in many towns. Digital lending platforms gain ground through simplified verification and wider mobile reach. Small business users adopt P2P channels for working capital and microenterprise funding. Platform expansion and financial awareness campaigns support broader adoption, strengthening the region’s contribution to the national market.

Market Segmentations:

By Type

- Consumer P2P Lending

- Business P2P Lending

By End User

- Consumer Credit Loans

- Small Business Loans

- Student Loans

- Real Estate Loans

By Geography

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

Competitive Landscape

The South Africa P2P Lending Market features key players such as Fedgroup, Everlectric, Zopa Limited, Lulalend, RainFin, Paymenow, PeopleFund, Edge Growth, Inclusivity Solutions, FundingHub, Fincheck, Social Finance Inc., Ozow, and Naledi3d Factory. The competitive landscape continues to evolve as leading platforms invest in advanced credit assessment tools, mobile-first lending systems, and enhanced security layers that improve borrower trust. Companies focus on expanding consumer and SME portfolios while strengthening investor engagement through transparent loan performance dashboards. Many providers refine automated underwriting to reduce approval times and improve risk accuracy. Partnerships with fintech developers, banks, and enterprise platforms also support deeper ecosystem integration. Growing interest from institutional investors and rising demand for structured lending products encourage platforms to broaden their offerings. As digital adoption accelerates, competition intensifies around user experience, loan flexibility, and data-driven decision-making, reinforcing continuous innovation across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fedgroup

- Everlectric

- Zopa Limited

- Lulalend

- RainFin

- Paymenow

- PeopleFund

- Edge Growth

- Inclusivity Solutions

- FundingHub

- Fincheck

- Social Finance Inc.

- Ozow

- Naledi3d Factory

Recent Developments

- In 2025, Everlectric secured venture debt funding in February 2025 to offer financial solutions designed to facilitate the adoption of electric vehicle fleets.

- In July 2025, Paymenow raised $22.4 million in conventional debt funding to expand its employee wellness and on-demand pay platform.

- In 2023, Lulalend secured a $35 million Series B equity funding round to accelerate the rollout of its new digital business banking platform and expand its lending services for SMEs in South Africa.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow quickly as digital lending becomes more trusted across borrower groups.

- SME financing demand will rise, pushing platforms to expand business-focused lending products.

- Mobile-first platforms will gain wider adoption due to faster onboarding and simple user journeys.

- AI-driven credit scoring will improve risk control and attract more retail and institutional investors.

- Regulatory clarity will strengthen platform stability and support long-term ecosystem growth.

- Investor diversification will increase as structured lending products gain stronger visibility.

- Regional expansion will continue as platforms target semi-urban areas with rising credit needs.

- Collaboration between fintech firms and financial institutions will support safer and faster lending.

- Growth of niche loan categories such as education and real estate will broaden revenue streams.

- Better data integration tools will enhance transparency and improve loan performance tracking.