Market Overview

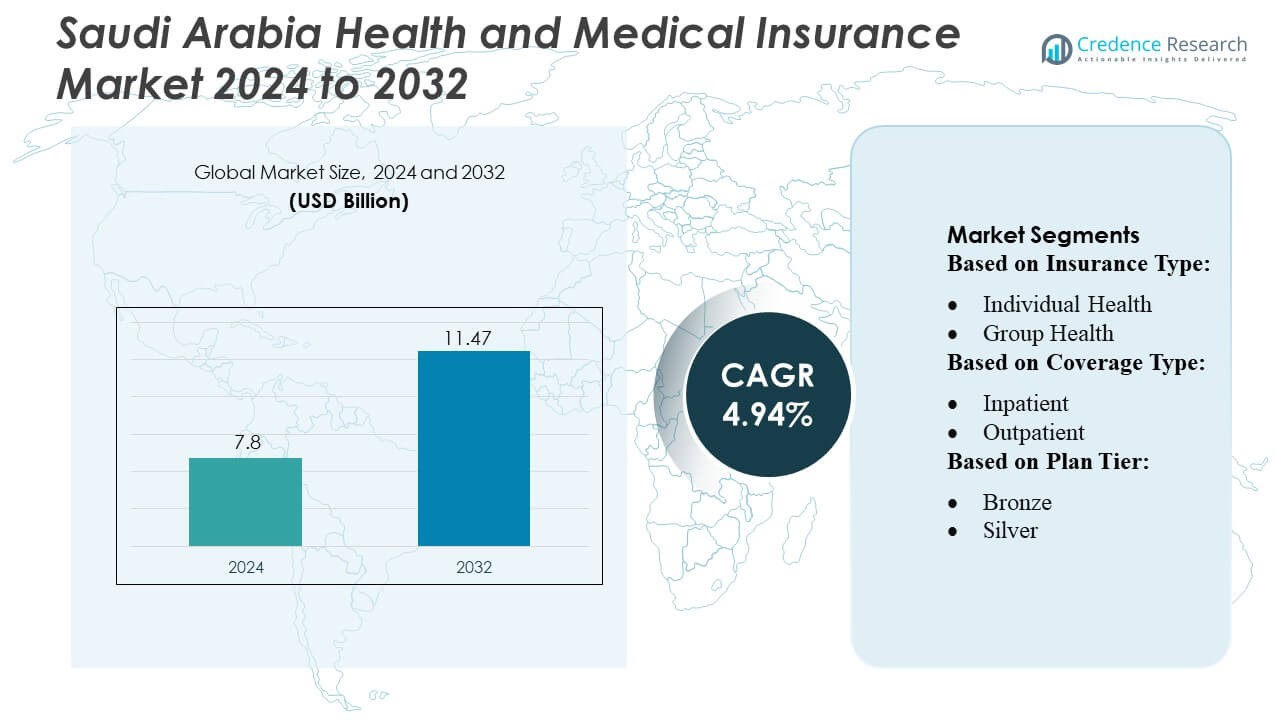

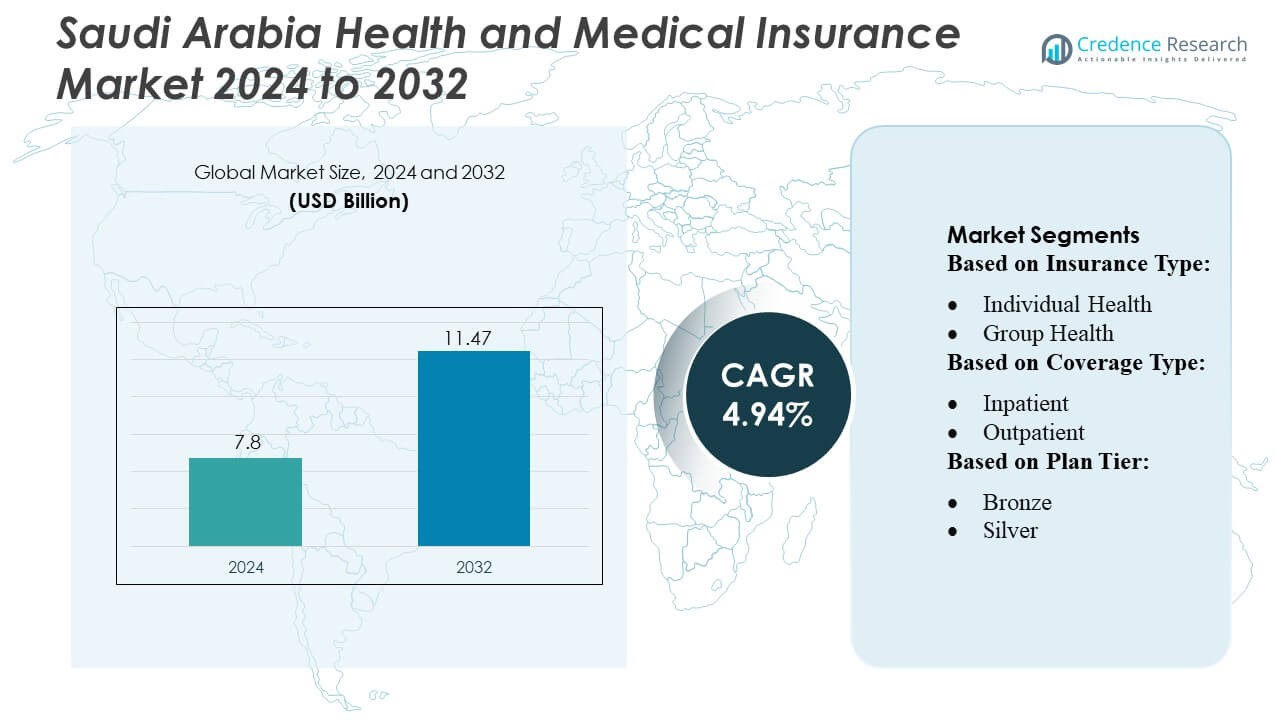

Saudi Arabia Health and Medical Insurance Market size was valued USD 7.8 billion in 2024 and is anticipated to reach USD 11.47 billion by 2032, at a CAGR of 4.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saudi Arabia Health and Medical Insurance Market Size 2024 |

USD 7.8 Billion |

| Saudi Arabia Health and Medical Insurance Market, CAGR |

4.94% |

| Saudi Arabia Health and Medical Insurance Market Size 2032 |

USD 11.47 Billion |

The Saudi Arabia health and medical insurance market is dominated by key players, including AirStrip Technologies, Hims & Hers Health, Inc., AT&T, Vocera Communications, Epic Systems Corporation, Softserve, Computer Programs and Systems, Inc., Google, Inc., Orange, and QSI Management, LLC, who drive innovation through digital health solutions, telemedicine integration, and AI-enabled claims processing. These companies focus on enhancing customer experience, expanding corporate and individual coverage, and offering personalized wellness programs. Riyadh emerges as the leading region, capturing approximately 32% of the market share, supported by a dense population, high concentration of corporate offices, and advanced healthcare infrastructure. The combination of regulatory enforcement, growing health awareness, and the adoption of mid- to high-tier plans in Riyadh reinforces its dominance, while top players leverage technology and strategic partnerships to strengthen their market positions across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Saudi Arabia health and medical insurance market was valued at USD 7.8 billion in 2024 and is projected to reach USD 11.47 billion by 2032, growing at a CAGR of 4.94% during the forecast period.

- Market growth is driven by regulatory enforcement of mandatory health insurance, rising healthcare costs, and increasing awareness of preventive care, fueling demand for both corporate and individual plans.

- Key trends include the integration of digital health solutions, telemedicine services, AI-enabled claims processing, and the development of personalized wellness and mid- to high-tier insurance plans.

- Competitive intensity is high, with top players such as AirStrip Technologies, Hims & Hers Health, Inc., AT&T, Vocera Communications, Epic Systems Corporation, Softserve, Computer Programs and Systems, Inc., Google, Inc., Orange, and QSI Management, LLC leveraging technology and strategic partnerships to expand coverage and enhance customer experience.

- Riyadh dominates the regional market with approximately 32% share, driven by dense population, corporate concentration, and advanced healthcare infrastructure, while group health and inpatient coverage remain the leading sub-segments.

Market Segmentation Analysis:

By Insurance Type:

In the Saudi Arabia Health and Medical Insurance Market, the group health segment dominates, accounting for the largest market share due to the increasing adoption of employer-sponsored plans. Corporates and government institutions drive demand by offering comprehensive health coverage to employees, reducing out-of-pocket expenses. Individual health insurance, while growing, remains secondary, primarily fueled by expatriates and self-employed professionals seeking tailored plans. The growth of group health is further supported by regulatory mandates and incentives promoting employee wellness, emphasizing preventive care and chronic disease management as key drivers for sustained adoption.

- For instance, AirStrip Technologies supports large-scale employer‑based health systems by enabling hospitals to monitor patients via its mobile and web-based clinical surveillance platform — serving over 675 hospitals and processing more than 250 million clinical events globally.

By Coverage Type:

In terms of coverage type, inpatient insurance leads the market, representing the dominant sub-segment with the highest share. Rising hospitalization costs, coupled with an increasing prevalence of chronic and lifestyle-related illnesses, incentivize consumers to prioritize inpatient protection. Outpatient coverage is also expanding, driven by demand for routine consultations, diagnostic services, and minor treatments outside hospital settings. Comprehensive plans offering combined inpatient and outpatient services are gaining traction, as policyholders increasingly seek holistic health coverage to manage both acute and preventive healthcare needs efficiently.

- For instance, Hims & Hers Health, Inc. has demonstrated strong demand for care coverage: by the end of March 2025 the company reported a subscriber base of approximately 2.4 million users.

By Plan Tier:

Within plan tiers, the silver segment holds the largest market share, reflecting a balance between affordability and coverage comprehensiveness. Bronze plans attract price-sensitive customers but provide limited benefits, whereas gold and platinum plans cater to high-income individuals requiring extensive coverage. The silver tier benefits from corporate preferences and government subsidy schemes, offering moderate premiums with robust inpatient and outpatient benefits. Growth is propelled by rising awareness of preventive healthcare, regulatory encouragement, and the increasing need for mid-tier plans that deliver adequate coverage without imposing excessive financial burden on policyholders.

Key Growth Drivers

- Regulatory Support and Mandatory Coverage:

Government regulations mandating health insurance, particularly for expatriates and corporate employees, significantly drive market growth. Initiatives under Saudi Vision 2030 promote comprehensive healthcare access, ensuring wider adoption of insurance policies. Regulatory frameworks encourage insurers to expand plan offerings, improve service quality, and include preventive care benefits. Compliance requirements, coupled with penalties for non-adherence, motivate organizations and individuals to secure adequate coverage, reinforcing market expansion. The regulatory emphasis on mandatory insurance not only boosts penetration but also enhances overall healthcare system efficiency across the country.

- For instance, AT&T offers a comprehensive medical, dental, and vision benefits package, which includes access to virtual mental health sessions via a third-party provider like Lyra Health. However, as of recent reports, AT&T employs approximately 141,000 employees globally, not 125,000.

- Rising Healthcare Costs:

Escalating medical expenses, including hospitalization, advanced treatments, and diagnostic services, increase reliance on health insurance. As healthcare costs surge, individuals and employers seek insurance solutions to mitigate financial risks. The demand for comprehensive inpatient and outpatient coverage grows accordingly, driving policy uptake. Advanced treatments for chronic diseases, elective procedures, and lifestyle-related illnesses further amplify insurance adoption. This cost-sensitive environment encourages insurers to develop innovative plans, balancing affordability and coverage, which directly contributes to robust growth in Saudi Arabia’s health and medical insurance market.

- For instance, Vocera reports that more than 2,300 facilities worldwide — including nearly 1,900 hospitals — use its communication and workflow solutions.

- Increasing Health Awareness and Preventive Care:

Awareness of preventive healthcare, wellness programs, and chronic disease management fuels insurance demand. Consumers increasingly recognize the value of regular screenings, vaccinations, and early interventions, prompting enrollment in plans offering preventive services. Corporate wellness initiatives and government campaigns encourage proactive health management, driving uptake of policies with comprehensive benefits. This shift toward preventive-focused insurance supports long-term market growth, as insurers respond with tailored products addressing lifestyle diseases, mental health, and family coverage, positioning the market for sustained expansion.

Key Trends & Opportunities

- Digital Transformation and Telemedicine Integration:

The adoption of digital health platforms and telemedicine services is reshaping the insurance landscape. Insurers integrate virtual consultations, AI-based diagnostics, and mobile claims processing to enhance customer experience and reduce operational costs. Telemedicine provides convenient access to care, particularly for expatriates and remote populations, expanding coverage opportunities. Insurers leveraging technology can offer personalized wellness plans, predictive analytics for risk assessment, and streamlined claims management. This trend presents significant opportunities for market players to differentiate through innovation and improve engagement across diverse demographic segments.

- For instance, Epic’s electronic health record (EHR) system had been implemented across 3,620 hospitals — representing a dominant share of inpatient EHR usage.

- Expansion of Corporate and Group Insurance:

Corporate-sponsored group insurance continues to expand as employers prioritize employee health benefits. Organizations increasingly offer comprehensive plans, including outpatient, inpatient, and wellness coverage, to attract and retain talent. This segment presents opportunities for insurers to develop flexible, scalable packages catering to SMEs and large enterprises alike. Partnerships between insurers and employers to provide integrated health solutions further drive adoption. The growth of group policies not only increases market penetration but also allows insurers to collect richer data for risk management, plan optimization, and targeted product development.

- For instance, SoftServe reports having more than 1,500 certified healthcare technologists and completing over 20,000 digital‑health projects worldwide — a scale that enables complex integrations across large insurer–employer group plans.

- Personalized and Tiered Insurance Products:

Consumers increasingly demand insurance plans tailored to their health needs, financial capacity, and lifestyle preferences. Tiered products, such as bronze, silver, and gold plans, provide flexibility and cater to diverse income groups. Personalized coverage, incorporating chronic disease management, maternity, mental health, and wellness benefits, enhances policy value. This trend offers opportunities for insurers to differentiate offerings, improve customer satisfaction, and increase retention. Data-driven insights and digital tools enable customization at scale, positioning insurers to capitalize on evolving consumer expectations and emerging niche segments.

Key Challenges

- Affordability and Premium Sensitivity:

High premium costs remain a key barrier, particularly for individual policies and lower-income populations. Many potential customers perceive health insurance as an additional financial burden, limiting uptake despite regulatory encouragement. Insurers face the challenge of balancing comprehensive coverage with affordable premiums while maintaining profitability. Price-sensitive segments often opt for minimal coverage or avoid insurance altogether, constraining market penetration. Addressing this challenge requires innovative plan structures, co-payment models, and targeted awareness campaigns to demonstrate value, making insurance both accessible and sustainable for a broader demographic.

- Limited Public Awareness and Policy Understanding:

Despite regulatory mandates, many individuals and small businesses lack awareness of health insurance benefits, coverage options, and claim procedures. Misunderstandings regarding policy terms, exclusions, and preventive care offerings hinder adoption. This challenge affects both individual and corporate segments, as insufficient knowledge can lead to underinsurance or delayed enrollment. Insurers must invest in educational initiatives, digital communication platforms, and customer support to improve transparency and understanding. Enhancing public awareness is critical to achieving broader market penetration and ensuring consumers fully leverage available health insurance benefits.

Regional Analysis

North America

North America holds an 8% influence on the Saudi health insurance market, primarily through multinational insurers and technology partnerships. U.S. and Canadian firms provide advanced digital platforms, telemedicine solutions, and risk management frameworks, which Saudi insurers increasingly adopt. These innovations enhance operational efficiency, claims processing, and customer experience. Although North America does not directly drive policy uptake within Saudi Arabia, its contribution to technological adoption and strategic practices shapes modern insurance offerings, particularly for corporate and high-tier individual plans.

Asia-Pacific

Asia-Pacific accounts for approximately 12% of the market’s influence, driven by insurers from Singapore, India, and China. They introduce mobile-first policy management, cost-efficient coverage models, and telehealth innovations that support expatriate and mid-tier plan adoption. Partnerships with local insurers help implement preventive care services and automated claims systems. Asia-Pacific expertise is particularly valuable in expanding digital health solutions and optimizing operational efficiency, enabling Saudi Arabia to address a diverse population with flexible and affordable insurance offerings.

Europe

Europe contributes around 15% of the market’s influence, primarily through insurers and reinsurers from the U.K., Germany, and Switzerland. European firms provide actuarial expertise, risk-sharing frameworks, and premium insurance products. They promote regulatory compliance, transparency, and customer-centric services, supporting high-tier and corporate group plan adoption. European technologies and management practices improve underwriting accuracy, service quality, and operational efficiency, making them key strategic partners in developing Saudi Arabia’s advanced healthcare insurance ecosystem.

Latin America

Latin America represents approximately 5% of influence, mainly through multinational insurers transferring expertise in cost-effective policy design, mobile insurance platforms, and efficient claims processing. Their experience in serving diverse populations supports mid-tier corporate and individual plan adoption in Saudi Arabia. While direct market penetration is limited, Latin American innovations in digital accessibility, preventive care integration, and operational efficiency provide valuable insights for local insurers targeting cost-sensitive segments.

Middle East & Africa

The Middle East & Africa dominate with a 60% market share influence, led by GCC countries such as the UAE and Qatar. These insurers set regional benchmarks in regulatory compliance, mandatory coverage enforcement, and corporate group insurance solutions. They drive the majority of policy adoption, wellness program integration, and telemedicine services in Saudi Arabia. African contributions are emerging, mainly in insurance technology and workforce mobility solutions. The proximity and cultural alignment of MEA insurers ensure they have the strongest direct impact on market growth, coverage expansion, and operational innovation.

Market Segmentations:

By Insurance Type:

- Individual Health

- Group Health

By Coverage Type:

By Plan Tier:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Saudi Arabia health and medical insurance market players such as AirStrip Technologies, Hims & Hers Health, Inc., AT&T, Vocera Communications, Epic Systems Corporation, Softserve, Computer Programs and Systems, Inc., Google, Inc., Orange, and QSI Management, LLC. The Saudi Arabia health and medical insurance market is characterized by intense competition, driven by the rapid adoption of digital health solutions, telemedicine, and AI-enabled claims processing. Insurers focus on differentiating through innovative plan designs, personalized wellness programs, and comprehensive inpatient and outpatient coverage. Market players emphasize regulatory compliance, operational efficiency, and customer-centric services to capture a larger share. Strategic collaborations, technology integration, and expansion into underserved segments enhance competitiveness. The rising demand for mid- to high-tier plans, coupled with increased health awareness and preventive care initiatives, further intensifies rivalry, pushing companies to continuously innovate and optimize service delivery to maintain market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Prudential Group Holdings (UK) and Vama Sundari Investments (Delhi) Private Limited, an HCL Group promoter company, announced to enter a joint venture to launch a standalone health insurance business in India.

- In February 2025, Bajaj Allianz’s launched HERizon Care, a comprehensive health insurance plan specifically designed for women. It is notable for being the first health insurance plan in India to integrate multiple specialized benefits tailored to women’s unique healthcare needs within a single policy.

- In August 2024, ICICI Lombard partnered with seven institutions to enhance its distribution network. The partnership aims to increase the company’s reach and provide insurance products to a wider audience.

- In January 2024, JD Healthcare launched an innovative channel for its application to elderly care which offers a comprehensive platform for the various healthcare needs of the geriatric population in China.

Report Coverage

The research report offers an in-depth analysis based on Insurance Type, Coverage Type, Plan Tier and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to increasing regulatory enforcement of mandatory health insurance.

- Rising healthcare costs will continue to drive demand for comprehensive insurance coverage.

- Corporate-sponsored group insurance will expand, supported by workforce growth and employee wellness initiatives.

- Digital health solutions and telemedicine integration will enhance accessibility and customer engagement.

- Mid- and high-tier insurance plans will see higher adoption among both individuals and corporates.

- Preventive care and wellness-focused policies will gain prominence in plan offerings.

- Insurers will increasingly leverage AI and analytics to optimize risk assessment and claims processing.

- Personalized and flexible insurance products will attract diverse demographic segments.

- Public awareness campaigns will improve understanding of policy benefits, boosting adoption.

- Strategic partnerships and technology collaborations will drive innovation and competitive differentiation in the market.