Market Overview

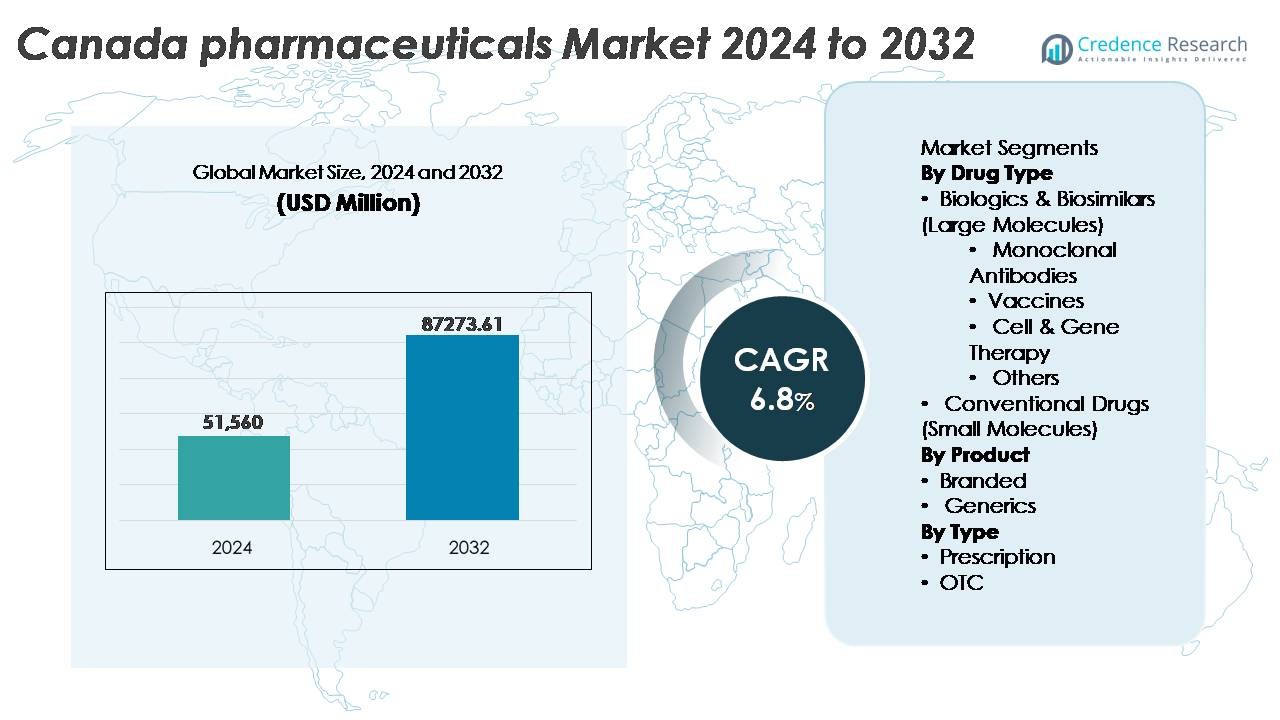

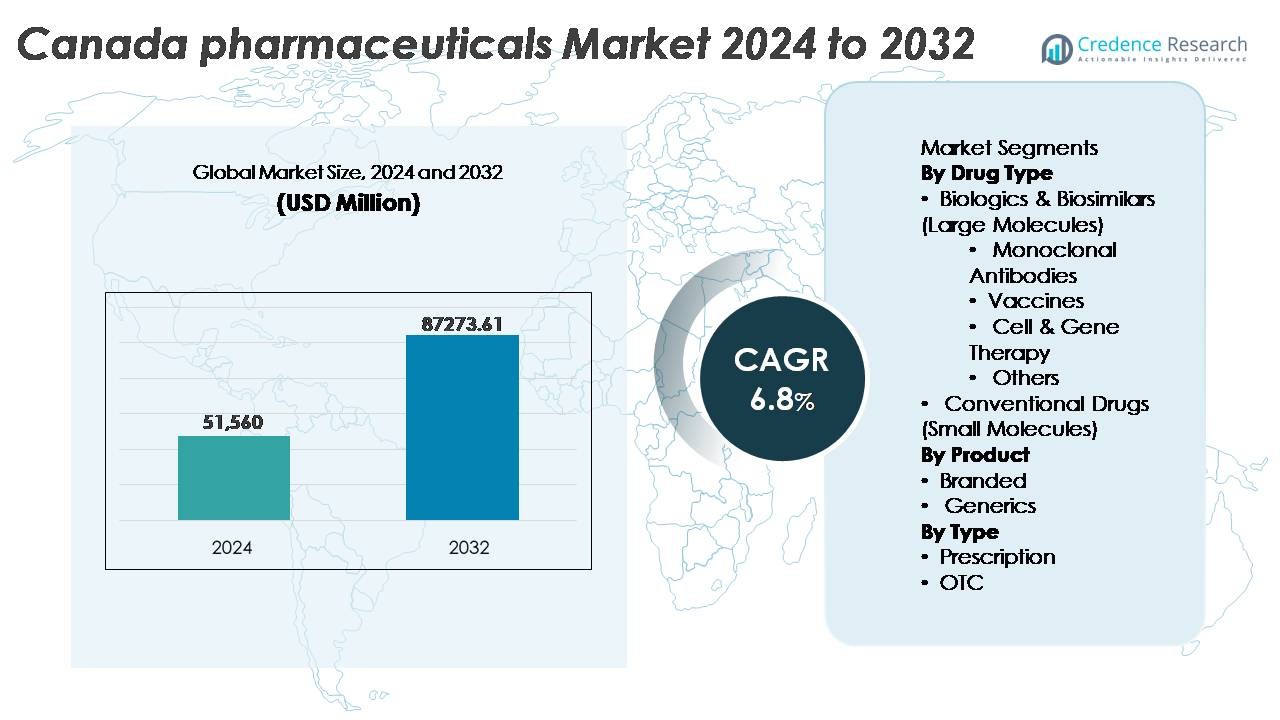

The Canada pharmaceuticals market was valued at USD 51,560 million in 2024 and is projected to reach USD 87,273.61 million by 2032, reflecting a CAGR of 6.8% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada pharmaceuticals market Size 2024 |

USD 51,560 Million |

| Canada pharmaceuticals market , CAGR |

6.8% |

| Canada pharmaceuticals market Size 2032 |

USD 87,273.61 Million |

The Canada pharmaceuticals market is driven by a highly competitive group of multinational players, including AstraZeneca, Eli Lilly and Company, Pfizer Inc., Johnson & Johnson Services, Inc., AbbVie Inc., Sanofi, Merck & Co., Inc., GSK plc, Novartis AG, and F. Hoffmann-La Roche Ltd, each contributing through strong biologics pipelines, chronic disease therapies, and specialty medicines. Ontario remains the leading region, capturing around 42% of the market, fueled by its research-intensive ecosystem, clinical trial networks, and concentration of corporate headquarters. Quebec follows with significant manufacturing capacity and tax-advantaged R&D activity, while British Columbia continues to emerge as a hub for precision medicine and biotech innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Canada pharmaceuticals market was valued at USD 51,560 million in 2024 and is anticipated to reach USD 87,273.61 million by 2032, expanding at a CAGR of 6.8% during the forecast period.

- Rising chronic illness prevalence, aging population, and growing uptake of biologics and biosimilars are major demand drivers, with monoclonal antibodies remaining the dominant sub-segment within large molecules.

- Key trends include rapid adoption of digital therapeutics, AI-enabled drug development, and increasing penetration of specialty medicines and gene-based therapies reshaping innovation pipelines.

- Competitive intensity increases as global innovators and domestic manufacturers pursue pricing sustainability, facing regulatory scrutiny, patent expirations, and accelerating biosimilar substitution.

- Ontario leads the market with approximately 42% share, followed by Quebec at 22%, while biologics & biosimilars account for the dominant drug-type share, supported by strong investment in precision medicine, immunology, and oncology therapeutics.

Market Segmentation Analysis:

By Drug Type

Biologics & biosimilars dominate the Canada pharmaceuticals market due to their effectiveness in treating chronic, autoimmune, and oncology-related conditions. Within this category, monoclonal antibodies hold the largest share, driven by strong adoption in cancer care and immunology therapies, supported by government reimbursement frameworks and expanding clinical pipelines. Vaccines continue to grow steadily as public health immunization programs expand. Cell and gene therapy remains a rapidly emerging segment fueled by investments in precision medicine. Conventional small-molecule drugs retain relevance for primary care and generics but face slower growth compared to large-molecule therapies.

- For instance, AbbVie’s Humira (adalimumab) has been supported by more than 100 clinical trials involving over 30,000 patients globally, establishing a substantial evidence base across multiple autoimmune disorders.

By Product

Branded pharmaceuticals lead the market, accounting for the dominant share due to innovation-driven launches, patent protection advantages, and strong physician preference for clinically validated therapies. High R&D expenditures and strategic partnerships with global biotech players sustain the growth of branded products in Canada. However, generics are gaining momentum as cost-containment policies and increased preference for affordable medications drive uptake across retail pharmacies and public healthcare systems. The rise of biosimilar approvals further influences product substitution trends, gradually narrowing the price gap and expanding competition.

- For instance, Johnson & Johnson reported approximately US$14.6 billion in total R&D spending in 2022, with the pharmaceutical segment representing the largest share and supporting late-stage programs in oncology, immunology, and neuroscience.

By Type

Prescription pharmaceuticals represent the dominant segment, supported by Canada’s universal healthcare system, specialist-driven treatment pathways, and increased prevalence of chronic diseases requiring long-term therapies. High-value biologics and specialty drugs primarily fall under prescription regulation, strengthening the segment’s market share. Over-the-counter (OTC) drugs continue to expand, driven by consumer preference for self-care, availability of digital pharmacy channels, and growing demand for pain management, allergy, digestive health, and wellness products. Nevertheless, prescription medicines remain the primary revenue generator due to higher treatment costs and broader therapeutic applications.

Key Growth Drivers

Rising Burden of Chronic and Lifestyle-Related Diseases

Canada faces a rapidly increasing prevalence of chronic diseases including diabetes, cardiovascular disorders, respiratory ailments, cancer, and autoimmune conditions which fuels sustained demand for advanced pharmaceutical solutions. Aging demographics intensify this trend, as nearly one in five Canadians is over age 65, driving higher prescription volumes and specialty drug utilization. Healthcare authorities continue to expand screening programs and early diagnosis initiatives, resulting in increased therapeutic intervention rates. The growth in chronic illness management encourages adoption of long-term medications, biologics, and specialty drugs. Additionally, digital health and remote monitoring tools enhance continuity of care, enabling more consistent treatment adherence and improved patient outcomes. This evolving healthcare landscape strengthens recurring pharmaceutical demand and reinforces continuous investment in novel therapies, ultimately supporting market growth.

- For instance, Eli Lilly’s tirzepatide clinical program enrolled more than 5,000 participants across multiple Phase III trials, demonstrating significant progress in diabetes and weight-management therapeutics.

Expansion of Biologics, Biosimilars, and Precision Medicine

Canada’s pharmaceutical market is witnessing accelerated adoption of biologics and biosimilars as providers seek high-efficacy solutions for oncology, rare diseases, and immunological disorders. These large-molecule therapies benefit from increasing regulatory support and investments in clinical research. Biosimilars, in particular, present opportunities for cost reduction across the national healthcare system, enabling wider patient access. Growing emphasis on precision and personalized medicine encourages targeted treatment modalities based on genetic profiling and biomarker analysis. Expanding diagnostic capabilities, including advanced molecular testing and companion diagnostics, improves therapy selection and response tracking. Pharmaceutical companies are leveraging partnerships with research institutions to expand pipelines focused on gene therapy, cell-based treatments, and immunotherapies. This shift toward precision interventions significantly reshapes the drug development ecosystem and strengthens the biologicals segment.

- For instance, Novartis has established the largest global CAR-T manufacturing network in the world, which includes seven facilities across four continents, to support manufacturing for its individualized cell therapy, Kymriah. This expanded network has already enabled the treatment of more than 7,000 patientsas of early 2024, demonstrating the substantial and increasing scale of precision-based therapeutics.

Government Support and Healthcare Infrastructure Strengthening

Canada’s universal healthcare system and regulatory modernization are central drivers for pharmaceutical advancement. Government initiatives, such as improved formulary coverage, reimbursement strategy reforms, and accelerated approval pathways for critical drugs, promote rapid commercialization of innovative therapies. Strategic investments in clinical trial infrastructure improve the country’s attractiveness for multinational pharmaceutical partnerships and early-stage drug testing. Expansion of public funding in rare disease programs, vaccine distribution, and chronic disease management further boosts market demand. Digital health integration including electronic prescribing, telehealth platforms, and pharmacy automation enhances patient access and reduces bottlenecks in therapeutic delivery. These policy-level advancements reinforce market confidence, stimulate research collaboration, and enable faster patient adoption of high-value pharmaceuticals.

Key Trends & Opportunities

Growth of Digital Therapeutics, AI Integration, and Smart Pharma Ecosystems

Canada’s increasing adoption of digital therapeutics, AI-driven decision support, and data-enabled research is redefining pharmaceutical engagement. AI tools support drug discovery acceleration, clinical trial simulation, and predictive modeling for disease progression. Digital therapeutics especially in mental health, diabetes management, and neurological conditions are gaining acceptance alongside traditional pharmaceuticals, creating hybrid care models. The expansion of electronic pharmacies and telemedicine extends market access beyond major urban hubs, improving rural and remote treatment delivery. Pharmaceutical companies are leveraging real-world evidence and analytics to optimize outcomes-based pricing and treatment pathways. This digital transformation opens opportunities for strategic partnerships between technology firms, research organizations, and drug manufacturers.

- For instance, Amazon’s cloud infrastructure supports more than 3,500 healthcare and life sciences organizations globally, enabling secure analytics, machine learning pipelines, and digital pharma operations at scale.

Growing Opportunity in Specialty Medicines, Rare Disease Therapies, and Gene-Based Treatments

Specialty pharmaceuticals for oncology, hematology, metabolic disorders, and genetic conditions represent one of the fastest-growing opportunity clusters in the Canadian market. The introduction of orphan drug frameworks and funding programs supports access for low-prevalence disorders. Gene-editing, RNA-based therapeutics, and cell therapies continue to progress through regulatory channels, supported by improved laboratory and biomanufacturing capacity. Pharmaceutical companies targeting rare diseases benefit from reduced competitive intensity and higher therapeutic pricing potential. Rising patient advocacy group engagement and data-sharing networks enhance trial recruitment and accelerate regulatory reviews. These trends position Canada as a strategic destination for advanced therapy commercialization and clinical research collaboration.

- For instance, CRISPR Therapeutics and Vertex Pharmaceuticals achieved a milestone with the approval of their gene-edited therapy for sickle cell disease, supported by clinical trials involving more than 75 patients across multiple geographies, demonstrating the viability of CRISPR-based treatments.

Key Challenges

Pricing Pressures and Increasing Regulatory Scrutiny

Despite strong market growth, pharmaceutical companies face mounting cost-containment policies and pricing reforms. Regulatory bodies continue to scrutinize price justification, particularly for specialty drugs and biologics, while reimbursement negotiations grow increasingly complex. Cost pressures encourage adoption of biosimilars and generics, reducing revenue margins for patented therapies. Longer regulatory review timelines, evolving data requirements, and heightened pharmacovigilance obligations present compliance challenges. These dynamics require pharmaceutical companies to balance innovation investment with cost-efficiency and transparent value demonstration to maintain market competitiveness.

Supply Chain Vulnerabilities and Dependence on Imported APIs

Canada’s pharmaceutical supply chain heavily relies on imported active pharmaceutical ingredients (APIs) and finished formulations, making it vulnerable to external disruptions. Geopolitical shifts, export restrictions, transportation constraints, and raw material shortages can delay production and distribution, affecting availability of essential medications. Increased demand during public health emergencies highlights systemic capacity limitations. Domestic manufacturing expansion requires significant capital investment, regulatory alignment, and skilled workforce development. To mitigate supply risks, pharmaceutical firms explore localized production partnerships, nearshoring strategies, and adoption of digital procurement systems. However, structural constraints continue to challenge Canada’s long-term supply chain resilience.

Regional Analysis

Ontario

Ontario holds the largest share of the Canada pharmaceuticals market, accounting for around 42%, driven by its concentration of research hospitals, biotechnology clusters, and pharmaceutical corporate headquarters. The province benefits from strong clinical trial capacity and government-funded academic medical centers that support innovation. Toronto and Ottawa serve as major hubs for oncology, immunology, and neurosciences research, attracting global investment and partnerships. Demand for specialty medicines remains robust due to high chronic disease prevalence and aging demographics. Expansion in digital health adoption, prescription volumes, and advanced biologics commercialization further reinforces Ontario’s leading market position.

Quebec

Quebec represents approximately 22% of the Canada pharmaceuticals market, supported by a well-established manufacturing footprint, extensive life sciences workforce, and competitive tax incentives for R&D. Montreal anchors a strong pharmaceutical supply chain, including production, biologics research, and packaging operations. Provincial funding programs for rare diseases and vaccines elevate demand for specialty treatments. Collaboration between universities, biotech startups, and global drug developers enhances pipeline development. Increasing hospital procurement and biosimilar penetration contribute to market expansion. Quebec’s bilingual market access and export-aligned manufacturing make it a strategic location for pharmaceutical operations.

British Columbia

British Columbia accounts for around 14% of the market, driven by its growing biotech ecosystem and strong focus on genomics, cell therapy, and precision medicine. Vancouver’s cluster of research institutions and technology startups enables cross-sector innovation in digital therapeutics and AI-enabled drug development. The region benefits from public investment in cancer research and rare disease programs, boosting demand for advanced therapies. Population growth, rising prescription volumes, and a high acceptance of telehealth-supported treatment monitoring contribute to expansion. British Columbia’s vibrant venture investment landscape positions the region as an emerging hub for next-generation pharmaceuticals.

Prairie Provinces (Alberta, Saskatchewan, Manitoba)

The Prairie Provinces collectively represent about 15% of the Canada pharmaceuticals market, primarily driven by expanding healthcare infrastructure and demand for chronic disease management therapies. Alberta, the largest contributor within the region, leads in clinical trial activity and specialty drug utilization. Public investments in ambulatory care, diabetes management, and cardiovascular treatment support sustained growth. Increasing biosimilar adoption and generics uptake reduce cost pressures for healthcare providers. Despite slower penetration of advanced biologics compared to Ontario and Quebec, rising urban populations and continued technology integration strengthen market opportunities across the Prairies.

Atlantic Canada

Atlantic Canada, including Nova Scotia, New Brunswick, Prince Edward Island, and Newfoundland & Labrador, holds around 6% market share, reflecting its smaller population size but growing demand for prescription medicines. A high proportion of seniors drives sustained need for treatments addressing hypertension, respiratory diseases, and arthritis. Regional health modernization initiatives improve access to specialty drugs and digital pharmacy services. Challenges remain in terms of supply chain reach and specialist availability; however, telemedicine expansion and community pharmacy networks mitigate care gaps. Increasing policy support for biosimilars and home-based treatment models contributes to stable market growth.

Northern Canada

Northern Canada including Yukon, Northwest Territories, and Nunavut accounts for approximately 1% of the pharmaceutical market, influenced by dispersed populations and limited healthcare accessibility. Demand is concentrated in essential medicines, vaccination programs, and chronic disease treatments. Logistical constraints and higher delivery costs present challenges, although government-funded prescription coverage and remote telehealth expansion improve access. Public health initiatives targeting infectious diseases, mental health, and respiratory conditions play a key role in pharmaceutical consumption. While specialty drug uptake remains limited, opportunities are emerging through digitally supported care models and controlled distribution partnerships.

Market Segmentations:

By Drug Type

- Biologics & Biosimilars (Large Molecules)

- Monoclonal Antibodies

- Vaccines

- Cell & Gene Therapy

- Others

- Conventional Drugs (Small Molecules)

By Product

By Type

By Geography

- Ontario

- Quebec

- British Columbia

- Prairie Provinces

- Atlantic Canada

- Northern Canada

Competitive Landscape

The Canada pharmaceuticals market features a competitive landscape shaped by global pharmaceutical corporations, regional drug manufacturers, biotechnology companies, and specialty medicine developers. Large multinational players dominate branded and specialty drug portfolios, leveraging strong R&D pipelines, biologics expertise, and robust commercial distribution. Domestic firms focus on generics, biosimilars, and value-driven formulations aligned with cost-containment policies and public healthcare needs. Strategic alliances, licensing agreements, and co-development partnerships are increasing as companies pursue access to advanced therapies and precision treatment platforms. Digital health integration and data-driven clinical decision tools are emerging differentiators in commercialization strategies. Meanwhile, pricing pressures, reimbursement negotiations, and regulatory expectations intensify competition, encouraging companies to demonstrate therapeutic value and real-world outcomes. The rise of biosimilars, growing consumer preference for OTC healthcare, and emerging gene-based treatments continue to reshape the market dynamics, prompting sustained investment, product diversification, and technology-enabled patient engagement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, GSK plc Health Canada approved GSK’s Jemperli (dostarlimab) with chemotherapy for all adults with primary advanced or first recurrent endometrial cancer.

- In March 2025, Shield Therapeutics plc, in collaboration with Kye Pharmaceuticals, launched ACCRUFeR (ferric maltol) in Canada following Health Canada’s August 2024 approval. The drug is now available as a prescription for adults with iron deficiency anemia (IDA).

- In January 2025, AstraZeneca announced a major investment of C$820 million (~US$570 million) in Canada to expand its global R&D hub and clinical delivery operations creating more than 700 high-skilled jobs in the Greater Toronto Area and positioning Canada as a strategic base for its global trials and pipeline work.

Report Coverage

The research report offers an in-depth analysis based on Drug type, Product, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Canada will experience continued growth in biologics, biosimilars, and specialty medicines driven by chronic disease management and precision-based care.

- Gene, cell, and RNA-based therapies will expand treatment capabilities for rare and genetic disorders.

- Digital therapeutics and remote patient monitoring will become integral components of hybrid treatment models.

- AI-driven drug discovery and clinical trial optimization will accelerate development timelines and reduce R&D costs.

- Increased focus on real-world evidence will influence pricing models and outcome-based reimbursement decisions.

- Domestic manufacturing and supply chain resilience will strengthen through nearshoring and automation initiatives.

- Greater adoption of biosimilars will improve affordability and widen access for high-cost therapies.

- Regulatory frameworks will evolve to support faster approvals for breakthrough and orphan drugs.

- Personalized medicine and genomic testing will drive targeted therapy development and diagnostic integration.

- Strategic collaborations between pharma firms, research institutions, and technology providers will intensify to enhance innovation and commercialization.