Market Overview:

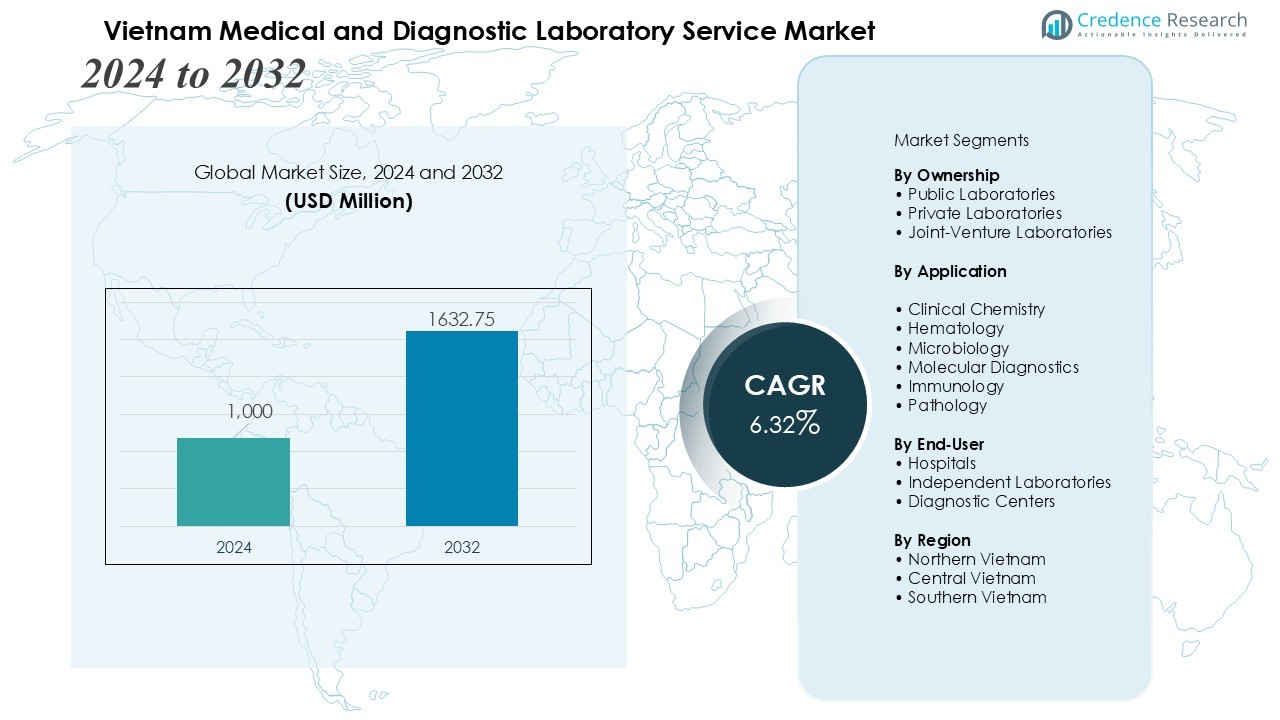

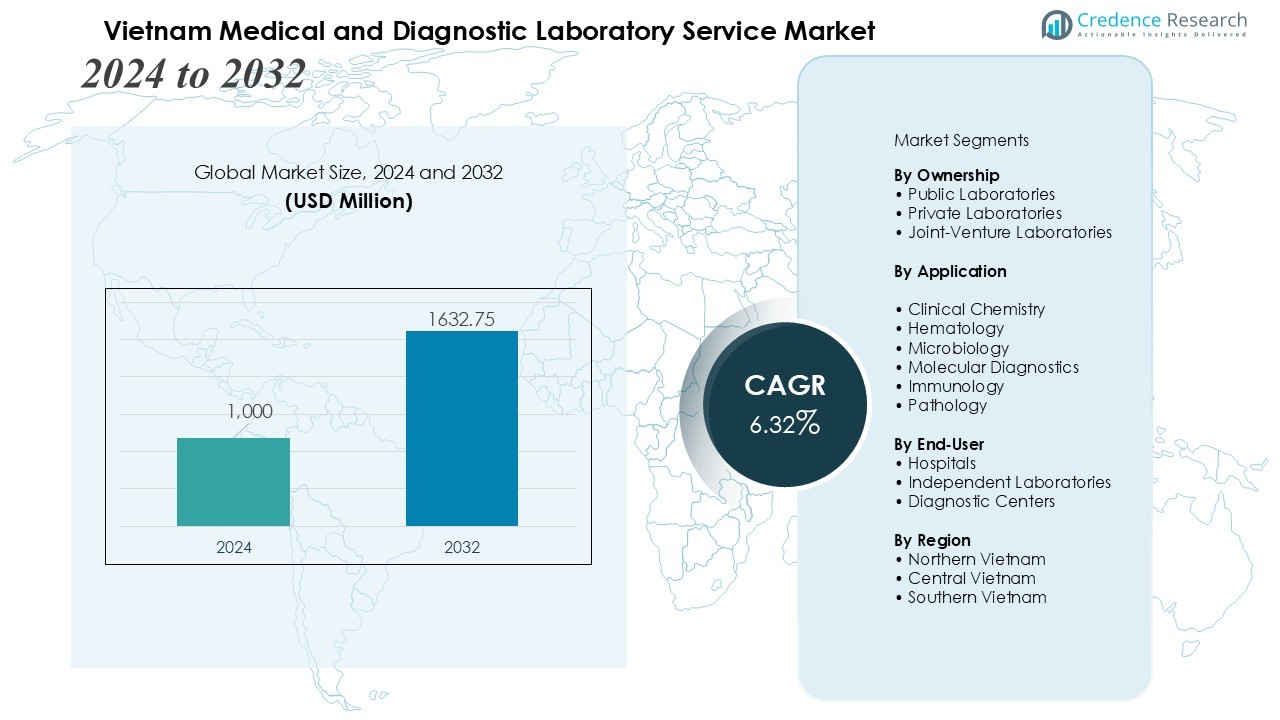

The Vietnam Medical and Diagnostic Laboratory Service Market size was valued at USD 1,000 million in 2024 and is anticipated to reach USD 1632.75 million by 2032, at a CAGR of 6.32 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam Medical and Diagnostic Laboratory Service Market Size 2024 |

USD 1,000 Million |

| Vietnam Medical and Diagnostic Laboratory Service Market, CAGR |

6.32% |

| Vietnam Medical and Diagnostic Laboratory Service Market Size 2032 |

USD 1632.75 Million |

Strong market drivers include a sharp rise in chronic diseases, particularly diabetes, cardiovascular disorders, and cancer, which elevates the need for early detection and routine screening. Higher awareness of preventive healthcare, expanding insurance coverage, and stronger spending on laboratory automation accelerate service uptake. Growing utilization of genomics, infectious disease testing, and AI-based clinical decision tools enhances diagnostic accuracy and workflow efficiency. The shift toward integrated laboratory information systems (LIS) also enables faster reporting and better patient management.

Regionally, Northern Vietnam, led by Hanoi, holds a significant share due to advanced tertiary hospitals and major public healthcare investments. Southern Vietnam, particularly Ho Chi Minh City, records the fastest growth supported by strong private-sector participation and higher patient volumes. Central Vietnam shows steady expansion driven by rising diagnostic infrastructure upgrades and growing adoption of modern testing services.

Market Insights:

Market Insights:

- The Vietnam Medical and Diagnostic Laboratory Service Market grows from USD 1,000 million in 2024 to USD 1,632.75 million by 2032, supported by rising chronic diseases and higher demand for early detection.

- Preventive healthcare adoption and broader insurance coverage increase routine test volumes, pushing laboratories toward automation, digital reporting, and integrated LIS platforms.

- Rapid advancement in molecular diagnostics, genetic testing, and AI-based decision tools strengthens accuracy, reduces turnaround time, and enhances disease surveillance across major hospitals and independent labs.

- Strong investment in laboratory infrastructure—especially in Hanoi and Ho Chi Minh City—drives expansion, with private-sector participation enabling wider access to advanced and specialized testing.

- Skill shortages, uneven service quality, and limited rural infrastructure remain key challenges, increasing costs and restricting uniform access to modern diagnostics nationwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Chronic Disease Burden and Expanding Need for Early Detection

The Vietnam Medical and Diagnostic Laboratory Service Market gains strong momentum due to the rapid rise in diabetes, cardiovascular disorders, cancer, and respiratory conditions. It supports early detection by enabling broader access to biochemical, molecular, and imaging-based testing. Hospitals and diagnostic centers prioritize timely screening to reduce disease progression and improve clinical outcomes. Growing patient awareness strengthens routine test demand and drives consistent service utilization.

- For instance, Vietnam reports over 170,000 new tuberculosis cases annually, driving demand for advanced molecular diagnostics like PCR testing in labs such as the National Reference Laboratory for TB.

Increasing Preference for Preventive Healthcare and Higher Test Volumes

Preventive healthcare adoption elevates routine diagnostic workloads and strengthens laboratory capacity requirements. The Vietnam Medical and Diagnostic Laboratory Service Market benefits from higher screening participation supported by insurance expansion and public health campaigns. It responds to greater demand by adopting automated analyzers and digital reporting systems. Wider availability of comprehensive test packages encourages regular health evaluations across multiple age groups.

- For Instance, Bach Mai Hospital completed its transition to a comprehensive paperless smart hospital management system, integrating electronic medical records across all departments. As a result, the hospital saves approximately VND 100 billion (around US$3.9 million) annually by eliminating the need for imaging film and paper-based records.

Rapid Advancement in Molecular Diagnostics, Genetic Testing, and AI Tools

Innovations in genomics, infectious disease testing, and AI-driven decision support tools transform laboratory operations. The Vietnam Medical and Diagnostic Laboratory Service Market leverages advanced platforms to improve accuracy, reduce turnaround times, and strengthen disease surveillance. It integrates high-throughput analyzers to support precision diagnostics in oncology, cardiology, and metabolic disorders. Wider use of digital pathology and automated workflows enhances service capacity.

Expansion of Laboratory Infrastructure and Strong Private-Sector Participation

Continuous investment in independent laboratories, hospital-based diagnostic units, and specialty testing centers strengthens nationwide coverage. The Vietnam Medical and Diagnostic Laboratory Service Market expands through private sector involvement in urban hubs. It supports infrastructure upgrades, including LIS deployment and quality assurance systems. Rising demand in secondary cities encourages facility modernization and broader access to accredited testing services.

Market Trends:

Adoption of Advanced Diagnostics, Automation, and Digital Integration

The Vietnam Medical and Diagnostic Laboratory Service Market evolves rapidly with stronger uptake of molecular diagnostics, genetic panels, and high-sensitivity assays. It integrates automation to reduce manual workloads and improve accuracy in clinical chemistry, hematology, and microbiology. Laboratories deploy digital pathology systems and AI-powered tools to support faster interpretation and higher diagnostic confidence. Wider implementation of laboratory information systems streamlines data flow between hospitals and diagnostic centers. Remote reporting strengthens operational efficiency and supports real-time clinical decisions. Demand for point-of-care platforms rises due to the need for faster results in emergency and outpatient settings. Cloud-based data storage expands interoperability and supports nationwide diagnostic networks.

- For instance, partnerships exist with local Vietnamese IT firms such as FPT, Link Toan Cau, Dang Quang, and OneNet, which public hospitals outsource to for developing digital solutions for their facilities. More than 92% of public hospitals in Vietnam, collectively, utilize outsourced digital solutions from these and other local IT companies for operational improvements, not solely from Link Toan Cau

Growth of Preventive Health Testing, Specialized Services, and Private Lab Expansion

The Vietnam Medical and Diagnostic Laboratory Service Market responds to rising demand for preventive screening and wellness-oriented diagnostics. It offers broader test menus that include allergy profiles, hormone evaluations, and advanced metabolic panels. Private laboratories strengthen their footprint in major cities and introduce home sample collection to improve patient convenience. Hospitals expand specialized units for oncology diagnostics, infectious disease identification, and fertility testing. Demand for high-throughput sequencing platforms increases due to rising interest in personalized medicine. Accreditation and quality certification gain priority as laboratories seek to enhance credibility and clinical reliability. Partnerships between private labs, digital health platforms, and international diagnostic firms accelerate modernization and service diversification.

- For instance, Siemens Healthineers installed the NAEOTOM Alpha Photon-Counting CT Scanner at S.I.S Hospital in December 2023, featuring dual X-ray tubes for 2x higher resolution imaging.

Market Challenges Analysis:

Shortage of Skilled Professionals and Uneven Quality Standards

The Vietnam Medical and Diagnostic Laboratory Service Market faces constraints due to limited availability of trained laboratory technologists, molecular specialists, and quality assurance personnel. It struggles to maintain uniform service standards across public and private facilities. Smaller laboratories experience difficulty in adopting advanced technologies due to skill gaps and resource constraints. Variation in accreditation levels reduces consistency in test accuracy and turnaround time. High workloads in urban centers create operational pressure and increase risk of diagnostic errors. Limited continuous training programs restrict the development of specialized expertise.

High Capital Investment, Infrastructure Gaps, and Limited Access in Rural Areas

The Vietnam Medical and Diagnostic Laboratory Service Market must address high costs associated with automation, molecular platforms, and digital systems. It requires significant investment in equipment maintenance and quality control frameworks. Many provincial and rural regions lack modern diagnostic infrastructure, which restricts access to timely testing. Limited reimbursement coverage for advanced diagnostics reduces affordability for lower-income groups. Integration of data systems across hospitals and laboratories remains incomplete and slows clinical coordination. Private operators encounter challenges in expanding nationwide due to regulatory requirements and operational costs.

Market Opportunities:

Expansion of Advanced Diagnostics, Digital Health Integration, and Preventive Screening

The Vietnam Medical and Diagnostic Laboratory Service Market presents strong opportunities for advanced molecular testing, high-throughput platforms, and AI-supported diagnostics. It benefits from rising demand for personalized medicine and precision oncology. Wider use of digital health tools creates scope for tele-diagnostics and remote reporting models. Preventive screening programs encourage broader adoption of wellness panels and chronic disease monitoring. Investment in automated analyzers strengthens operational scalability and accelerates service delivery. Growing awareness of early detection supports higher test participation across urban and semi-urban populations.

Strengthening Private Sector Presence, International Partnerships, and Regional Expansion

The Vietnam Medical and Diagnostic Laboratory Service Market gains opportunities from private laboratory expansion across major cities and emerging secondary markets. It can leverage strategic collaborations with global diagnostic firms to introduce specialized assays and quality systems. Rising healthcare expenditure supports new laboratory setups with advanced equipment and digital workflows. Demand for home sample collection creates growth potential in patient-centric service models. Government initiatives that promote healthcare modernization create incentives for infrastructure enhancement. Expansion into underserved rural regions offers a long-term opportunity for broader nationwide coverage.

Market Segmentation Analysis:

By Ownership

The Vietnam Medical and Diagnostic Laboratory Service Market includes public laboratories, private laboratories, and joint-venture setups. Private laboratories record strong expansion due to higher investment capacity, wider test menus, and faster adoption of automation. It benefits from rising demand for convenience-driven services such as home sample collection and digital reporting. Public laboratories maintain significant volume due to broad national coverage and integration with government hospitals. Joint-venture laboratories introduce global quality standards and advanced diagnostic platforms, which strengthen competition and service differentiation.

- For instance, Bach Mai Hospital implemented electronic medical records, saving nearly US$2 million annually on imaging film through automated processing.

By Application

The market covers clinical chemistry, hematology, microbiology, molecular diagnostics, immunology, and pathology services. Molecular diagnostics gains strong traction due to its relevance in oncology, infectious disease identification, and genetic testing. It supports rapid detection requirements and improves clinical decision accuracy. Clinical chemistry and hematology maintain the largest share due to routine test volume from chronic disease monitoring. Microbiology services expand as hospitals strengthen infection control programs. Immunology and pathology also gain importance due to rising demand for specialized disease profiling.

- For instance, Roche Diagnostics’ cobas c 501 or cobas c 503 analytical units process up to 1,000 tests per hour for clinical chemistry parameters (such as glucose, lipids, and HbA1c in whole blood) in chronic monitoring.

By End-User

Hospitals, independent laboratories, and diagnostic centers drive service utilization. Independent laboratories capture rising demand from urban populations seeking fast and accessible test results. It adopts advanced analyzers and workflow systems to support high daily volumes. Hospitals maintain strong participation due to integrated diagnostic services that support inpatient and outpatient care. Diagnostic centers grow rapidly with specialized testing capabilities and wider adoption of molecular platforms.

Segmentations:

By Ownership

- Public Laboratories

- Private Laboratories

- Joint-Venture Laboratories

By Application

- Clinical Chemistry

- Hematology

- Microbiology

- Molecular Diagnostics

- Immunology

- Pathology

By End-User

- Hospitals

- Independent Laboratories

- Diagnostic Centers

By Region

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Regional Analysis:

Strong Diagnostic Infrastructure and High Service Penetration in Northern Vietnam

The Vietnam Medical and Diagnostic Laboratory Service Market records strong participation in Northern Vietnam due to advanced public hospitals, research institutions, and specialized diagnostic centers. It benefits from sustained government investment aimed at modernizing laboratory infrastructure and strengthening healthcare delivery in Hanoi and surrounding provinces. Public laboratories maintain high service volumes due to strong referral networks and integration with national health programs. Private laboratories expand their presence by offering advanced molecular diagnostics and digital reporting systems. Urban populations adopt preventive screening at a faster pace, which supports higher routine test demand. Strong academic and clinical collaboration promotes the adoption of new diagnostic technologies across the region.

Rapid Private Sector Expansion and High Patient Volumes in Southern Vietnam

Southern Vietnam, led by Ho Chi Minh City, represents the fastest-growing region due to rapid urbanization, higher patient inflows, and expanding private healthcare networks. The Vietnam Medical and Diagnostic Laboratory Service Market gains strong momentum in this region due to wider adoption of automated analyzers and specialized testing platforms. It supports growing demand for chronic disease monitoring and advanced molecular assays. Independent laboratories introduce home sample collection and digital health interfaces to increase service accessibility. Hospitals develop dedicated diagnostic units to manage rising outpatient and emergency care volumes. Partnerships with international diagnostic firms strengthen quality assurance and service diversification.

Steady Modernization and Improving Access to Testing Across Central Vietnam

Central Vietnam shows steady progress supported by continuous upgrades in secondary healthcare facilities and rising awareness of early disease detection. The Vietnam Medical and Diagnostic Laboratory Service Market finds new opportunities in this region due to investment in essential laboratory equipment and gradual introduction of advanced diagnostic capabilities. It supports increasing demand for routine blood tests, microbiology evaluations, and chronic disease screening. Public hospitals enhance diagnostic workflows to reduce turnaround times and improve clinical outcomes. Private laboratories expand into mid-sized cities to address service gaps and strengthen regional coverage. Training programs and digitization efforts gradually elevate overall diagnostic quality in the region.

Key Player Analysis:

- Lab Group International Vietnam Co. Ltd.

- Medic Medical Diagnostic Center

- Medical Laboratory and Technology Co. Ltd.

- Chemedic Test Center

- Hi-Medic Laboratory Co., Ltd.

- Vietnam Lab Testing Center (Labo TH Việt Nam

- Hoan My Medical Corporation

- Vietlife Medical And Pharmaceutical Joint Stock Company

- Plus Diagnostics (d+)

- Medlab Vietnam

Competitive Analysis:

Competitive landscape in the Vietnam Medical and Diagnostic Laboratory Service Market features a mix of established local laboratories and expanding private players. Key companies include Lab Group International Vietnam Co. Ltd., Medic Medical Diagnostic Center, Medical Laboratory and Technology Co. Ltd., Chemedic Test Center, and Hi-Medic Laboratory Co., Ltd. The market gains strong competitive momentum as laboratories upgrade molecular platforms, digital reporting tools, and quality assurance systems. It encourages investments in automated analyzers, LIS integration, and advanced infectious disease testing. Leading laboratories strengthen their presence in major cities through wider service portfolios and home sample collection models. Emerging players focus on specialized diagnostics, faster turnaround times, and international accreditation to differentiate their capabilities. Growing collaborations with global diagnostic firms elevate standards and support the introduction of high-complexity assays, which intensifies competition across urban hubs.

Recent Developments:

- In October 2025, Hoan My Medical Group partnered with Gene Solutions to expand access to international genetic testing services, including non-invasive prenatal screening.

- In September 2025, Hoan My achieved Australian Council on Healthcare Standards International (ACHSI) certification across its entire network, marking it as the first private healthcare system in Vietnam to do so.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Ownership, Application, End-User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Future demand for advanced molecular diagnostics will rise due to higher cancer detection needs and broader infectious disease surveillance.

- Adoption of AI-supported interpretation tools will strengthen accuracy and reduce turnaround times across major laboratories.

- Expansion of digital health platforms will support remote reporting, tele-diagnostics, and integrated patient management.

- Private laboratories will scale operations into secondary cities to improve access and reduce regional testing gaps.

- Public hospitals will upgrade laboratory automation and strengthen quality control frameworks to improve service reliability.

- Home sample collection models will gain stronger acceptance among urban consumers seeking convenience and faster results.

- Growth in preventive health screening will drive higher routine test volumes and expand wellness-focused diagnostic packages.

- Collaborations with international diagnostic firms will introduce specialized assays and improve technology transfer.

- Investment in laboratory information systems will enhance interoperability between hospitals, clinics, and diagnostic centers.

- Rural and underserved regions will experience gradual expansion of essential testing services through targeted government initiatives.

Market Insights:

Market Insights: