Market Overview:

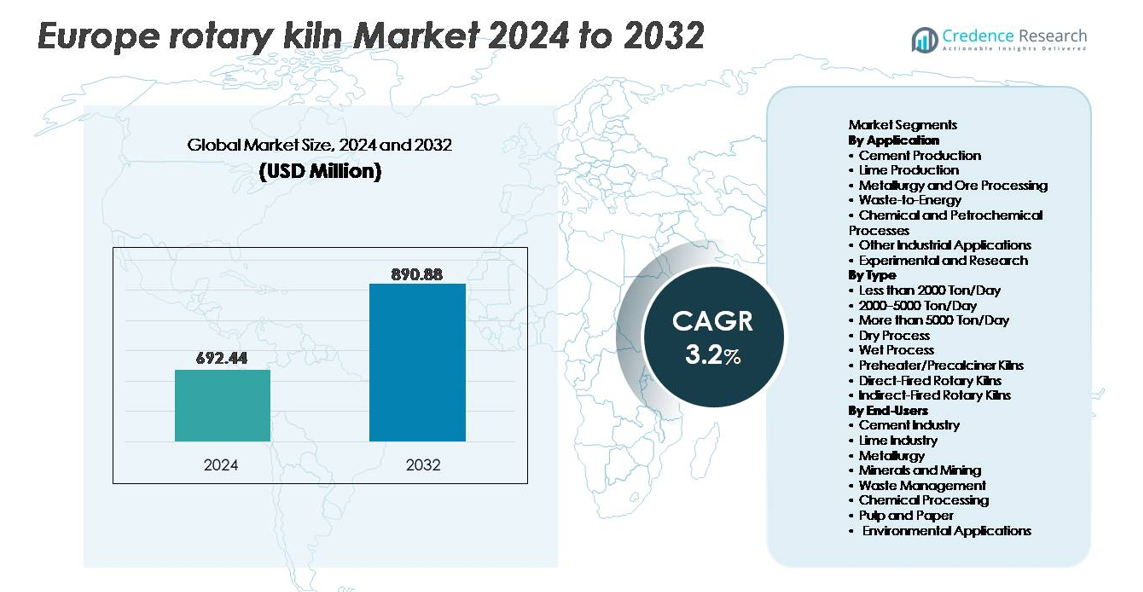

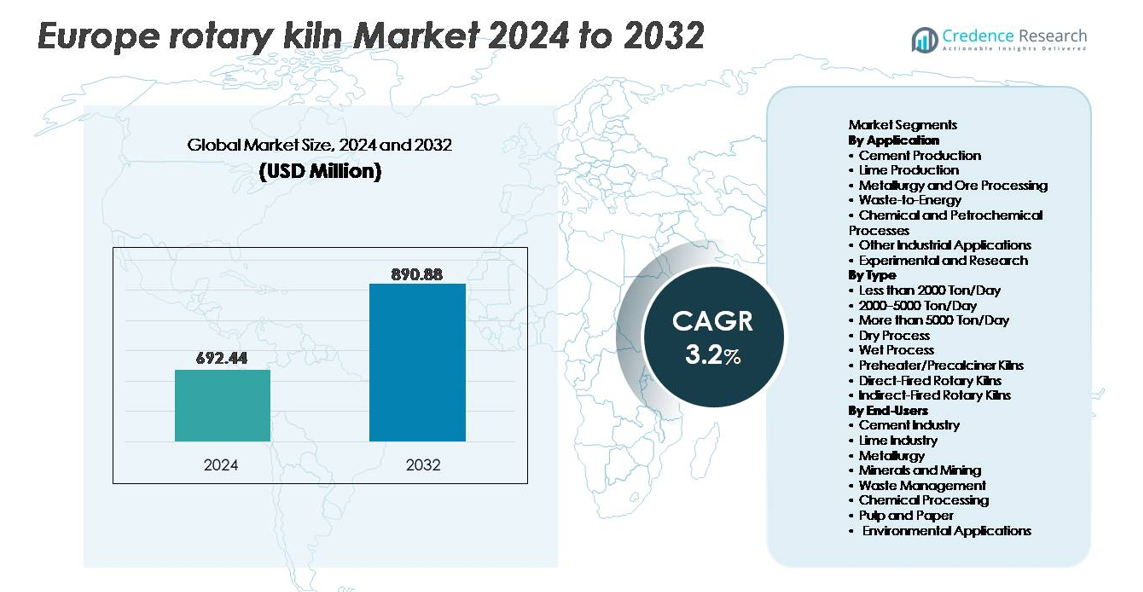

The Europe rotary kiln market was valued at USD 692.44 million in 2024 and is projected to reach USD 890.88 million by 2032, registering a CAGR of 3.2% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Rotary Kiln Market Size 2024 |

USD 692.44 million |

| Europe Rotary Kiln Market, CAGR |

3.2% |

| Europe Rotary Kiln Market Size 2032 |

USD 890.88 million |

The Europe rotary kiln market is shaped by established global and regional manufacturers, including CITIC Heavy Industries Co., Ltd., FEECO International, Tongli Heavy Machinery, LNVT, Boardman, ANSAC PTY, Pengfei Group, Shanghai Minggong, FLSmidth, and NHI, each competing through technology integration, project execution capability, and lifecycle support. Western Europe accounts for the largest share of the market at approximately 42%, driven by advanced cement production facilities, strong waste-to-energy adoption, and continuous kiln modernization cycles. Northern Europe follows with its focus on emissions-compliant installations and automated thermal processing solutions, while Central and Eastern Europe demonstrate the fastest growth potential due to infrastructure expansion and industrial refurbishment investments.

Market Insights

- The Europe rotary kiln market was valued at USD 692.44 million in 2024 and is projected to reach USD 890.88 million by 2032, expanding at a CAGR of 3.2% during the forecast period.

- Demand is driven by infrastructure modernization, emission-compliant cement production, and the rising adoption of alternative fuels and waste co-processing in industrial plants.

- Market trends highlight rapid digitalization with predictive maintenance, combustion optimization, and IoT-based process monitoring improving asset reliability and reducing operational costs.

- Competitive activity intensifies as global players emphasize high-capacity, energy-efficient preheater/precalciner kilns, while regional manufacturers compete through custom engineering and refurbishment services; the cement production segment holds the largest share.

- Western Europe leads the market with around 38% share, followed by Northern Europe and Central & Eastern Europe, driven by strong waste-to-energy deployment, plant modernization, and expansion of lime and mineral processing capacities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

By application, cement production represents the dominant sub-segment, accounting for the largest share of rotary kiln installations due to sustained infrastructure renewal programs, increased clinker capacity upgrades, and emission-compliant modernization across Europe. Lime production continues to expand driven by demand from construction, steelmaking, and flue-gas treatment in industrial plants. Metallurgy and ore processing adopt rotary kilns for controlled thermal reduction, while waste-to-energy applications gain traction with stricter landfill diversion policies. Chemical and petrochemical processes leverage rotary kilns for calcination and pyrolysis, whereas experimental use remains a niche but growing area among research institutions testing novel materials and thermal processes.

- For instance, FLSmidth’s modern rotary kilns for cement feature shell diameters of up to 6.5 meters and lengths exceeding 200 meters, supporting continuous clinker production at industrial scale with automated multi-channel burner systems capable of firing alternative fuels.

By Type

By type, preheater/precalciner kilns hold the dominant market share, primarily due to their superior thermal efficiency and ability to reduce fuel consumption compared to traditional designs. More than 5000 Ton/Day capacity kilns are preferred in high-volume cement operations, while the 2000–5000 Ton/Day category serves mid-scale plants optimizing output with lower operational burden. Direct-fired kilns remain essential in minerals and cement applications requiring high-temperature direct contact, whereas indirect-fired kilns serve sensitive chemical and metallurgical processes. Dry process kilns continue to replace wet process units as industry players pursue decarbonization targets and operational efficiency.

- For instance, FLSmidth’s preheater/precalciner kiln lines incorporate multi-stage cyclones capable of handling kiln gas volumes exceeding 600,000 cubic meters per hour, improving raw meal heat exchange and reducing thermal load on the main burner.

By End Users

By end user, the cement industry emerges as the dominant sub-segment, driven by investments in low-NOx burners, alternative fuel integration systems, and clinker line expansion across Europe. The lime industry contributes significantly through demand for construction-grade and environmental-grade lime for soil stabilization and emission control. Metallurgy and mining companies utilize rotary kilns for ore roasting, reduction, and pelletizing. Waste management operators deploy kilns for hazardous waste incineration and recycling. Chemical processors benefit from controlled thermal reactions, while pulp and paper, along with broader environmental applications, adopt rotary kilns for residue treatment and material recovery.

Key Growth Drivers:

Infrastructure Modernization and Expansion of Cement Capacity

Infrastructure modernization across Europe acts as a core driver for rotary kiln demand as governments prioritize renovation of transport networks, energy infrastructure, industrial facilities, and low-income housing. Regulatory pushes for sustainable cement production encourage replacement of older, inefficient kilns with upgraded energy-efficient configurations featuring automated combustion control, high-performance refractory linings, and preheater systems. Additionally, expanded use of blended cements and alternative raw materials has propelled investments in adaptable kiln designs capable of processing durable composites. Continuous clinker output growth in regions meeting post-industrial development and urban density demands supports long-term equipment cycles. The modernization wave also aligns with aging plant infrastructure nearing end-of-life and requiring full-line refurbishment to maintain output reliability.

- For instance, VDZ Germany has documented continuous operation cycles for modern dry-process kilns exceeding 330 operational days per year with planned downtime intervals under 30 days.

Increasing Adoption of Alternative Fuels and Waste Co-Processing

The rapid shift toward energy substitution in cement and lime plants serves as a significant growth catalyst, as rotary kilns enable co-processing of municipal solid waste, biomass residues, sewage sludge, and industrial byproducts. The ability to achieve complete destruction with high thermal efficiency supports compliance with carbon reduction and waste management directives. Alternative fuel-compatible kiln systems reduce fossil fuel dependence and create economic advantages amid volatile natural gas pricing. As Europe intensifies waste-to-fuel programs and circular economy frameworks, operators invest in retrofitting existing kilns to handle varied feedstock moisture and calorific values. This transition strengthens the economic and sustainability case for rotary kilns through dual-value utilization energy recovery and waste minimization.

- For instance, Heidelberg Materials has launched its “GeZero” carbon capture project at its Geseke plant in Germany, which aims to capture 700,000 tonnes of CO₂ annually from 2029.

Expansion of Lime and Chemical Processing for Environmental and Industrial Use

Demand growth for lime, caustic materials, and specialty chemical compounds drives adoption of rotary kilns in calcination and thermal decomposition applications. These materials are essential for water treatment, flue-gas desulfurization, soil stabilization, and metal refining all sectors experiencing regulatory-driven expansion. Rotary kilns provide controlled temperature gradients and consistent product quality, making them indispensable in processes producing reactants for power plants, steel smelting, and municipal waste incinerators. Increased reliance on industrial-grade lime for carbon capture sorbents and environmental purification accelerates kiln installations. The chemical sector’s shift toward specialty intermediates and advanced material synthesis further reinforces investment in precision-controlled indirect and direct-fired kilns.

Key Trends and Opportunities:

Automation, Digital Optimization, and Predictive Maintenance Technologies

Digitalization is reshaping rotary kiln operations through the integration of sensor-based process monitoring, AI-driven combustion optimization, and predictive maintenance analytics that minimize downtimes. Smart control systems evaluate flame shape, heat profiles, torque load, and emissions in real-time, ensuring fuel efficiency and consistent product characteristics. These technologies reduce operator-based variability and support regulatory compliance through continuous emissions monitoring. Opportunities emerge for OEMs offering digital retrofits and connected service models that extend asset lifespan and enhance kiln reliability. The trend aligns with the broader adoption of Industry 4.0 in cement, metallurgy, and waste sectors seeking operational certainty and cost transparency.

- For instance, FLSmidth’s ECS/ProcessExpert software uses advanced process control and AI algorithms to track and optimize a vast number of kiln and calciner operating parameters simultaneously, making real-time, continuous adjustments to manage complex process conditions and stabilize temperature fluctuations.

Waste-to-Energy and Material Recovery as High-Growth Deployment Areas

Europe’s strict waste management legislation accelerates demand for rotary kilns in waste-to-energy, hazardous waste treatment, and recycling of industrial residues. Kilns capable of achieving high-temperature oxidation and controlled atmosphere processing enable recovery of metals, heat, and usable byproducts. The move toward circular manufacturing unlocks opportunities for co-processing plants integrating fuel generation and raw material recovery. Municipalities and private waste operators increasingly deploy rotary kiln systems for incineration and pyrolysis to improve landfill diversion rates. Growth prospects strengthen as sustainability-linked investments incentivize thermal recovery technologies in chemicals, plastics, and construction waste streams.

- For instance, the FLSmidth HOTDISC system processes up to 4,500 kilograms of mixed municipal waste per hour directly in the calciner, enabling fossil fuel substitution without pre-shredding.

Key Challenges:

High Capital Expenditure and Cost of Modernization

Rotary kiln construction, installation, and operational modernization require significant capital expenditure, which constrains adoption for small and mid-sized operators. The cost burden includes refractory materials, emission control systems, automation integration, and reinforced foundations. Retrofitting existing infrastructure to handle alternative fuels or stricter emission standards increases investment complexity. Long payback cycles deter players in markets with volatile demand or limited financing access. The challenge intensifies with energy price unpredictability and maintenance costs associated with high-temperature mechanical fatigue, component replacement, and periodic overhauls.

Stringent Emission Regulations and Compliance Barriers

Compliance with Europe’s tightening environmental standards presents operational and technological challenges for rotary kiln operators. Kilns face rigorous controls on CO₂ output, NOₓ emissions, particulates, and volatile organic compounds, demanding advanced filtration, optimized combustion, and fuel switching systems. Implementation timelines and cross-border regulatory differences add complexities to capital planning. Failure to meet emission thresholds risks financial penalties, production shutdowns, or restricted operational hours. While regulations accelerate innovation, they also impose technical burdens requiring continuous monitoring, skilled personnel, and compliance cost absorption challenging operators with limited resources.

Regional Analysis:

Western Europe – 38% Share

Western Europe holds the largest market share at 38%, led by Germany, France, and the Benelux countries. Strong cement production, modern kiln lines, and mature waste co-processing networks support steady growth. High investment capacity and strict emission rules drive replacement of old wet-process units with efficient preheater and precalciner systems. Waste-to-energy projects also expand due to circular economy goals and landfill reduction laws.

Southern Europe – 22% Share

Southern Europe accounts for 22% of the market. Cement demand links to tourism-related construction, urban renovation, and seismic resilience programs in Italy, Greece, and Spain. Lime production for agriculture and steelmaking boosts rotary kiln use. Modernization moves at a moderate pace due to economic limits, while waste incineration and biomass co-firing create new opportunities for thermal recovery.

Northern Europe – 18% Share

Northern Europe holds 18% of the rotary kiln market. Sweden, Norway, and Denmark lead with advanced waste systems and carbon-neutral strategies. The pulp, paper, metals, and chemical sectors support adoption of indirect-fired and precision thermal units. Fuel substitution rules and automation upgrades create steady demand for retrofits as cement capacity remains stable.

Central & Eastern Europe – 17% Share

Central and Eastern Europe account for 17% of the market. Countries upgrade old industrial plants, increase cement output, and expand mineral processing facilities. EU-aligned emission targets encourage conversions to alternative fuels and digital combustion controls. Major infrastructure projects raise clinker demand, while cost-focused operators adopt robust, high-capacity kilns suited for long service life.

Market Segmentations:

By Application

- Cement Production

- Lime Production

- Metallurgy and Ore Processing

- Waste-to-Energy

- Chemical and Petrochemical Processes

- Other Industrial Applications

- Experimental and Research

By Type

- Less than 2000 Ton/Day

- 2000–5000 Ton/Day

- More than 5000 Ton/Day

- Dry Process

- Wet Process

- Preheater/Precalciner Kilns

- Direct-Fired Rotary Kilns

- Indirect-Fired Rotary Kilns

By End-Users

- Cement Industry

- Lime Industry

- Metallurgy

- Minerals and Mining

- Waste Management

- Chemical Processing

- Pulp and Paper

- Environmental Applications

By Geography

- Western Europe

- Southern Europe

- Northern Europe

- Central and Eastern Europe

Competitive Landscape:

The competitive landscape of the Europe rotary kiln market features a mix of global manufacturers, engineering solution providers, kiln service specialists, and regional fabrication companies competing across system design, fuel flexibility, digital optimization, and lifecycle maintenance. Large multinational players focus on supplying high-capacity, preheater and precalciner rotary kilns equipped with automation and emission control technologies, while mid-sized firms differentiate through customized configurations for lime, minerals, and chemical applications. Strategic partnerships between OEMs, refractory suppliers, and digital platform developers enhance system performance and predictive maintenance capabilities. Retrofitting and refurbishment services represent a fast-growing competitive segment as operators prioritize modernization over full replacement to reduce capital expenditure. The competitive edge increasingly depends on energy efficiency, alternative-fuel compatibility, operational reliability, and after-sales service networks that support long-term plant optimization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- FLSmidth announced a transformational divestment of its cement business in June 2025, entering into an agreement with Pacific Avenue Capital Partners for an initial consideration of EUR 75 million plus conditional deferred cash consideration of up to EUR 75 million. The transaction, expected to close in the second half of 2025, represents FLSmidth’s strategic shift toward becoming a pure-play supplier to the global mining industry. Prior to this divestment, FLSmidth delivered a cutting-edge 115-meter rotary kiln to Sibanye-Stillwater’s Keliber lithium refinery in May 2024, advancing sustainable lithium production technology.

- Indonesia Morowali Industrial Base Project: In January 2025, Pengfei Group was recognized as “Annual Excellent Supplier” and “Outstanding Contribution Partner for Overseas Projects in 2024” by Zhongwei New Materials Co., Ltd. This was for their work on high-capacity roasting and drying kilns for the first high ice nickel production line at the Zhongwei Indonesia Morowali Industrial Base, a project that successfully used the oxygen-enriched side-blowing furnace process for laterite nickel ore smelting industrially for the first time.

- Green Energy Strategy: Pengfei Group is implementing a strategy to integrate hydrogen energy. In March 2025, Chairman and President Zheng Peng spoke about the company’s “dual carbon” initiatives at a 2025 Global South Financiers Forum event. In February 2025, they partnered with China Mobile Shanxi branch to create an AI industrial intelligence laboratory to support the hydrogen industry. The company intends to expedite the launch of two wind and solar power-to-hydrogen projects in Qinyuan and Chifeng in 2025.

- In March 2024, Pengfei secured an order with Valmet Europe for two wet-pulp caustic rotary kilns, indicating active supply of kiln systems to European clients.

- In January 2023, FLSmidth signed a contract to deliver pyro-processing technology including a rotary kiln to the lithium-hydroxide refinery project of Keliber in Finland.

Report Coverage:

The research report offers an in-depth analysis based on Application, Type, End-Users and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption of energy-efficient preheater and precalciner kilns will accelerate as operators prioritize fuel cost reduction and emission compliance.

- Digital monitoring, automation, and predictive maintenance will become standard integration features across new and refurbished installations.

- Co-processing of industrial waste, biomass, and alternative fuels will expand as part of circular economy and waste-to-energy strategies.

- Retrofitting and refurbishment demand will increase as plants extend asset life instead of pursuing full replacement.

- Stricter environmental regulations will drive advanced emission control and low-NOx combustion solutions.

- Growth will strengthen in lime and mineral processing applications supporting steel, construction, and environmental treatment markets.

- Indirect-fired kilns will gain traction for chemical, specialty material, and temperature-sensitive applications.

- Regional consolidation among kiln manufacturers and service providers will intensify competition and technology partnerships.

- Financing models favoring energy-savings and operational performance contracts will emerge.

- Central and Eastern Europe will remain the most attractive expansion corridor driven by industrial upgrades and new capacity additions.