Market Overview

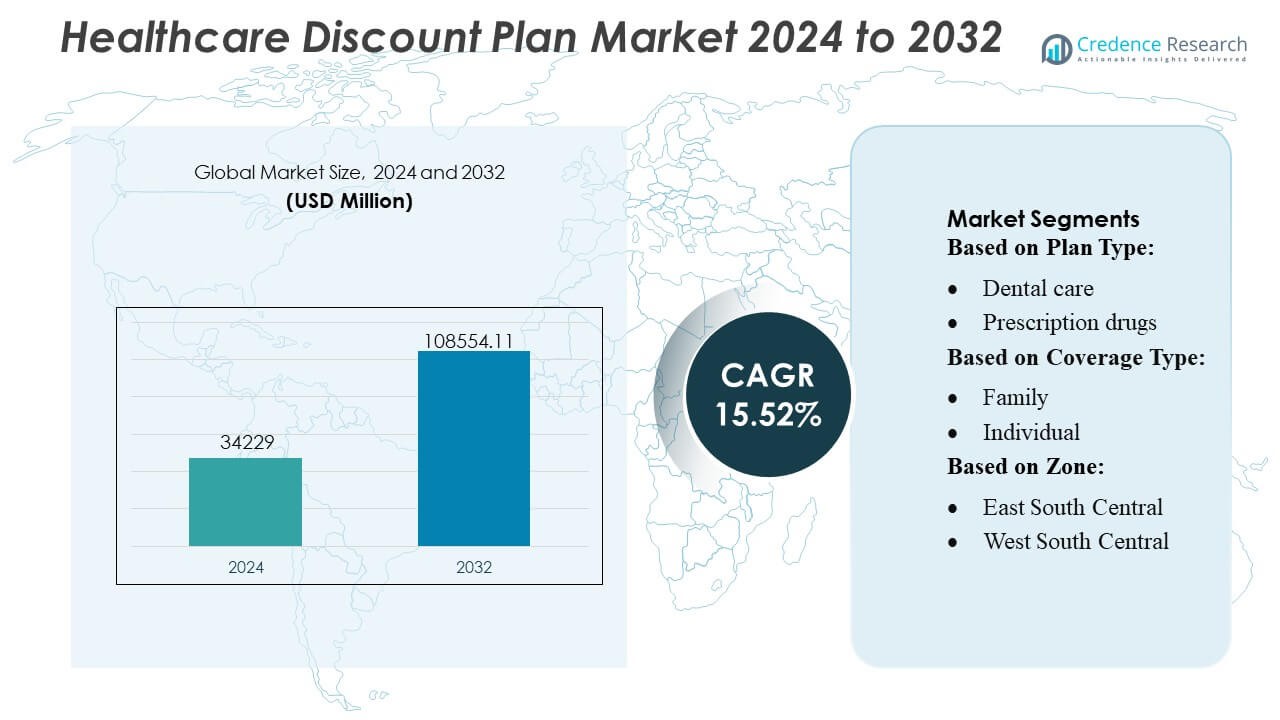

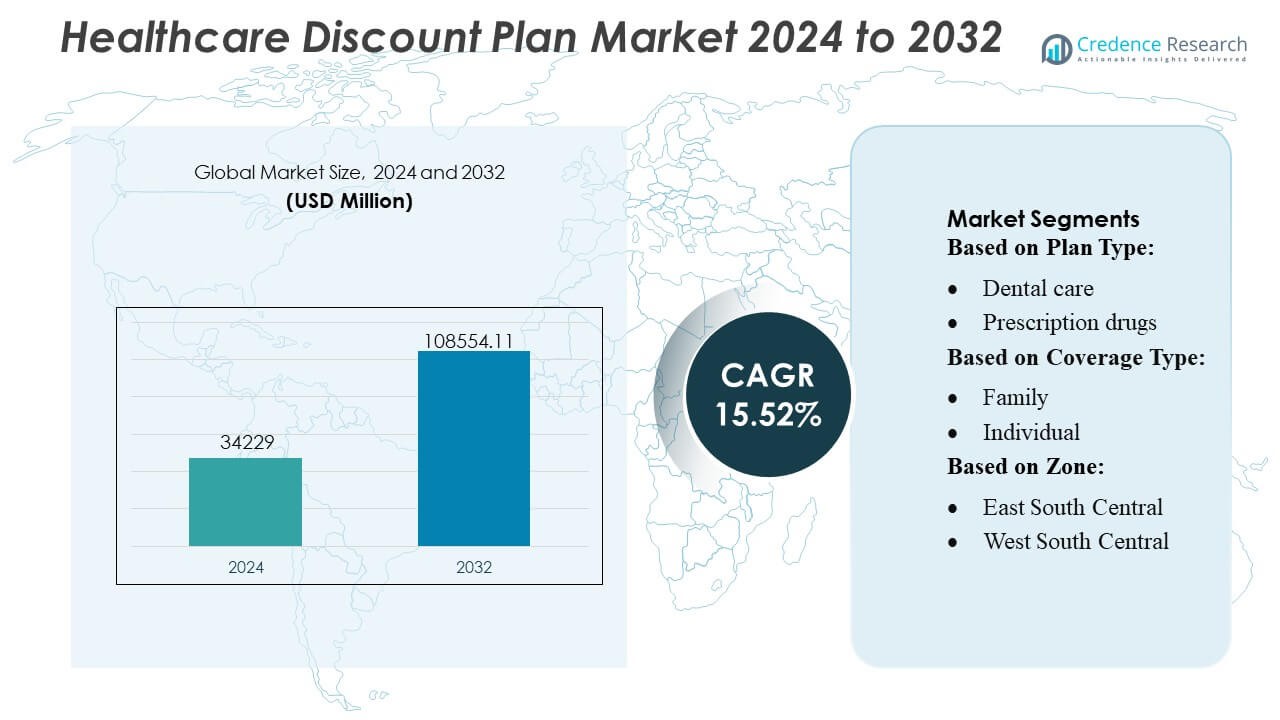

Healthcare Discount Plan Market size was valued USD 34229 million in 2024 and is anticipated to reach USD 108554.11 million by 2032, at a CAGR of 15.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Discount Plan Market Size 2024 |

USD 34229 Million |

| Healthcare Discount Plan Market, CAGR |

15.52% |

| Healthcare Discount Plan Market Size 2032 |

USD 108554.11 Million |

The Healthcare Discount Plan Market is shaped by a broad mix of established healthcare service providers, pharmacy networks, dental groups, and telehealth platforms that compete by expanding provider partnerships, improving digital enrollment capabilities, and offering multi-service discount bundles. Leading industry participants focus on strengthening nationwide networks, enhancing member engagement, and delivering transparent, low-cost healthcare savings solutions to broaden consumer reach. North America remains the leading region with an exact 32–34% share, supported by high out-of-pocket healthcare spending, strong consumer awareness, and the widespread availability of dental, vision, prescription, and virtual-care discount programs across major metropolitan and suburban areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Healthcare Discount Plan Market reached USD 34,229 million in 2024 and is projected to hit USD 108,554.11 million by 2032, advancing at a strong 15.52% CAGR driven by rising out-of-pocket medical expenses and growing demand for low-cost healthcare alternatives.

- Market growth is supported by increasing consumer preference for flexible, non-insurance savings programs and the rapid expansion of digital enrollment platforms that simplify access to dental, vision, prescription, and telehealth discount services.

- Competitive activity intensifies as major healthcare networks and providers expand partnerships to widen service availability and strengthen multi-service bundles that improve member retention.

- The market faces restraints due to varying discount levels, limited awareness in rural areas, and inconsistent provider participation, which can reduce perceived value for certain user groups.

- North America leads with a 32–34% share, while dental care plans dominate segment performance with the highest adoption due to consistently high out-of-pocket dental expenses.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Plan Type

Dental care plans hold the largest share at around 32%, supported by high demand for affordable cleanings, fillings, and preventive care. Prescription drug plans follow due to rising medication costs and strong consumer interest in pharmacy savings. Vision care and hearing aid plans grow steadily as aging populations seek cost-effective corrective solutions. Chiropractic care plans benefit from increasing musculoskeletal issues, while virtual visit plans expand quickly with wider telehealth adoption. Other plan types attract niche users searching for supplemental savings beyond traditional insurance.

- For instance, Amedisys partners with approximately 3,300 hospitals and 114,000 physicians nationwide to deliver hospice and palliative care at home.

By Coverage Type

Family plans dominate the market with about 48% share, driven by households choosing bundled discounts for dental, vision, and prescriptions. Individual plans remain popular among young adults, gig workers, and retirees who need low-cost alternatives to insurance. Other coverage types, such as group or employer-linked plans, gain attention as organizations add affordable health savings options to support broader employee wellness needs.

- For instance, Sunrise Medical designs, manufactures, and distributes both manual and powered wheelchairs globally. The company has manufacturing sites in 10 countries and sells its products in over 130 countries.

By Zone

The South Atlantic zone leads with nearly 22% share, supported by dense populations and strong provider networks. West South Central and East South Central zones show fast adoption due to higher uninsured rates and demand for low-cost healthcare support. The North East maintains steady growth as urban consumers seek supplemental savings. East North Central and West North Central regions expand through employer-backed memberships, while Pacific Central and Mountain States grow as digital enrollment and telehealth usage increase accessibility.

Key Growth Drivers

1. Rising Out-of-Pocket Healthcare Expenses

Escalating out-of-pocket healthcare costs significantly drive demand for healthcare discount plans as consumers seek affordable access to dental, vision, and prescription services. High deductibles in traditional insurance plans push households toward low-cost alternatives that offer immediate savings without complex eligibility requirements. Growing cost sensitivity among uninsured and underinsured populations further accelerates adoption. The rapid rise in dental and pharmacy expenses enhances the appeal of discount memberships, enabling consumers to manage routine healthcare needs through predictable, budget-friendly pricing structures.

- For instance, Medtronic began the U.S. commercial launch of the MiniMed™ 780G system integrated with the Instinct sensor (from partner company Abbott Laboratories). The Instinct sensor is among the world’s smallest and thinnest continuous glucose monitors, with a wear time of up to 15 days — enabling real-time glucose readings.

2. Growing Preference for Flexible, Non-Insurance Healthcare Options

Consumers increasingly prefer healthcare solutions that provide flexibility, transparent pricing, and no long-term contractual commitments. Discount plans meet these expectations by allowing members to access savings across multiple services without underwriting or waiting periods. The simplicity of enrollment, combined with customizable plan choices, strengthens their appeal among gig workers, retirees, students, and self-employed individuals. As traditional insurance becomes more complex and expensive, healthcare discount plans gain traction as a practical supplemental or standalone alternative supporting everyday healthcare needs.

- For instance, Abbott, use of FreeStyle Libre technology was linked with a 78% reduction in cardiovascular disease-related hospitalizations for people with Type 1 diabetes who had prior severe low-blood-sugar episodes — compared to traditional glucose monitoring methods.

3. Expansion of Provider Networks and Digital Distribution Channels

The market benefits from expanding provider networks that improve plan accessibility and perceived value. Dental clinics, vision centers, pharmacies, and telehealth providers increasingly partner with discount plan administrators to attract new patient volumes. Digital distribution channels accelerate this momentum by enabling easy comparison, enrollment, and automated membership management. Online platforms and mobile apps enhance convenience, while targeted digital marketing increases consumer awareness. These advancements strengthen market penetration and drive continuous member acquisition across diverse demographic segments.

Key Trends & Opportunities

1. Rapid Adoption of Telehealth and Virtual Care Plans

The rapid scaling of telehealth services creates substantial opportunities for virtual visit-based discount plans. Consumers seek affordable, on-demand consultations for primary care, behavioral health, and chronic condition management. Discount plans offering reduced teleconsultation fees or bundled virtual care services gain strong traction, especially among younger, tech-savvy populations. As digital health platforms form more partnerships with discount plan providers, the market is positioned for sustained expansion. The shift toward remote care also aligns with consumers’ preferences for convenience, short wait times, and cost-effective access.

- For instance, Cardinal Health serves more than 75% of hospitals in the United States and supports tens of thousands of pharmacies and care facilities, making it one of the largest providers enabling healthcare services, including those delivered via telehealth or virtual care setups.

2. Growing Integration of Multi-Service Bundles

A major trend shaping the market is the rising popularity of bundled healthcare discount plans that combine dental, vision, chiropractic, hearing, and prescription savings into a single package. These bundles deliver stronger perceived value and encourage broader consumer adoption. Providers benefit from improved cross-service utilization, while customers appreciate simplified membership management and cost efficiency. Bundling supports higher retention rates and allows plan administrators to differentiate themselves with tiered offerings tailored to families, seniors, and individuals seeking comprehensive yet affordable healthcare coverage.

- For instance, Solventum’s 3M™ Littmann® CORE Digital Stethoscope provides up to 40-times sound amplification and active noise cancellation reducing ambient noise by 40 dB, enabling clinicians to deliver more accurate cardiac and respiratory assessments across remote-care and in-office scenarios.

3. Rising Employer Adoption and Workforce Wellness Initiatives

Employers increasingly adopt discount plans to enhance workforce wellness while maintaining cost control. These plans offer affordable supplemental benefits that reduce employee out-of-pocket expenses without raising healthcare premiums. Small and mid-sized businesses, in particular, view discount plans as an accessible way to expand benefit packages. Growing emphasis on preventive care and employee satisfaction strengthens this trend. As hybrid and gig workforce models expand, employers recognize discount plans as a flexible, cost-effective tool to support diverse workforce needs.

Key Challenges

1. Limited Consumer Awareness and Misconceptions

Despite growing adoption, many consumers still misunderstand the role and value of healthcare discount plans, confusing them with traditional insurance. This lack of awareness restricts market potential and slows membership growth. Misconceptions regarding coverage depth, provider availability, and actual savings can deter potential users. Providers and plan administrators must invest in clearer communication, transparency, and educational outreach to address consumer hesitations. Without targeted awareness efforts, a significant portion of the market remains untapped, particularly in rural and low-income regions.

2. Variability in Discounts and Provider Participation

The market faces challenges due to inconsistent discount levels and differences in provider participation across regions. Some consumers encounter variations in savings or limited access to participating specialists, reducing satisfaction and weakening trust in the model. Maintaining robust and standardized provider networks is essential for long-term retention. Regional disparities in healthcare service availability also influence discount performance. To remain competitive, providers must expand partnerships, ensure transparent discount structures, and maintain service consistency that aligns with consumer expectations.

Regional Analysis

North America

North America holds the largest share of the Healthcare Discount Plan Market at 32–34%, driven by high out-of-pocket medical expenses and strong penetration of dental and prescription discount programs. The U.S. leads regional adoption due to its uninsured and underinsured populations seeking affordable alternatives to traditional insurance. Extensive provider networks, rising telehealth usage, and strong digital enrollment platforms further support market expansion. Canada contributes moderately as consumers adopt supplemental savings plans to offset rising dental and vision care costs. Overall, the region benefits from a mature healthcare service ecosystem, high consumer awareness, and robust plan marketing.

Europe

Europe accounts for 24–26% of the global market, supported by growing demand for supplemental healthcare savings outside public health systems. While universal healthcare reduces basic cost burdens, consumers increasingly use discount plans to manage dental, vision, and elective procedure expenses not fully covered by national programs. Western European countries lead adoption due to higher disposable incomes and strong provider partnerships, while Eastern Europe shows rising interest as private healthcare facilities expand. The region also benefits from increased digital health engagement, enabling easier enrollment in virtual care and multi-service discount bundles tailored to diverse population needs.

Asia-Pacific

Asia-Pacific captures 28–30% of market share, emerging as the fastest-growing region due to rising medical costs, expanding middle-class populations, and increased consumer interest in low-cost healthcare alternatives. India, China, and Southeast Asia drive large-scale adoption as private clinics collaborate with discount plan providers to attract patients. Urban populations increasingly choose dental, vision, and telehealth savings plans to bypass long wait times and reduce out-of-pocket spending. Japan, South Korea, and Australia exhibit stable growth, supported by digital healthcare ecosystems and strong preventive care awareness. Rapid smartphone penetration further strengthens access to online membership platforms.

Latin America

Latin America holds 8–10% share, supported by growing private healthcare spending and strong demand for affordable medical savings solutions. Brazil, Mexico, and Colombia lead adoption as consumers seek cost relief for dental, vision, and pharmaceutical services not fully accessible through public systems. Expansion of private clinics and pharmacies strengthens provider participation, while urban populations increasingly rely on discount plans for routine care. Economic pressures and uneven insurance coverage make discount memberships an appealing alternative. Digital enrollment is rising, though infrastructure gaps in rural areas limit full penetration. Overall, the region shows significant long-term growth potential.

Middle East & Africa

The Middle East & Africa region represents 6–8% of the market, driven by growing private healthcare investments and rising awareness of low-cost supplemental healthcare programs. GCC countries lead adoption due to strong urbanization, higher disposable incomes, and expanding private dental and vision clinics partnering with discount plan providers. In North Africa and Sub-Saharan Africa, uptake remains gradual because of limited provider networks and lower consumer awareness, though interest is increasing among young urban populations seeking affordable care options. Telehealth-driven discount plans offer strong potential as digital health platforms expand across emerging healthcare markets.

Market Segmentations:

By Plan Type:

- Dental care

- Prescription drugs

By Coverage Type:

By Zone:

- East South Central

- West South Central

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Healthcare Discount Plan Market features a competitive environment shaped by major healthcare and medical service providers such as Amedisys, Inc., Sunrise Medical, Air Liquide, Medtronic PLC, Abbott, Cardinal Health Inc., 3M Healthcare, B. Braun Melsungen AG, F. Hoffmann-La Roche AG, and Baxter International Inc. The Healthcare Discount Plan Market features an increasingly competitive landscape shaped by expanding provider networks, rapid digital enrollment, and growing consumer demand for low-cost healthcare alternatives. Market participants focus on strengthening partnerships with dental clinics, vision centers, pharmacies, and telehealth platforms to widen service accessibility and enhance perceived value. Companies differentiate themselves through multi-service bundles, flexible membership tiers, and transparent pricing models that support strong customer retention. Digital platforms play a central role by enabling seamless comparison, instant activation, and automated renewal processes, which improve user experience and drive continuous membership growth. As affordability and convenience remain major priorities for consumers, competitors emphasize preventive care solutions, enhanced virtual care options, and localized partnerships across high-demand zones to maintain a strong market position.

Key Player Analysis

- Amedisys, Inc.

- Sunrise Medical

- Air Liquide

- Medtronic PLC

- Abbott

- Cardinal Health Inc.

- 3M Healthcare

- Braun Melsungen AG

- Hoffmann-La Roche AG

- Baxter International Inc.

Recent Developments

- In July 2024, Star Health and Allied Insurance launched home healthcare services in over 50 cities across India, partnering with providers like Portea, Care24, and CallHealth. This initiative provides customers with medical care at home for conditions like fever and gastroenteritis, which can be more convenient and cost-effective than traditional hospital care.

- In April 2024, The U.S. FDA initiated a program known as the Home as a Health Care Hub, aimed at transforming the home environment into an integral part of the healthcare system. This initiative is particularly focused on advancing health equity across diverse populations in the U.S., especially those who are underserved or have limited access to traditional healthcare facilities.

- In January 2024, Cardinal Health, Inc., a leading healthcare company, announced its acquisition of specialty networks, demonstrating the company’s goal to expand its business within the specialty domain. The aim of this acquisition is clearly to enhance Cardinal Health’s market position on a global scale while incorporating highly advanced and innovative technologies and expertise to find out and resolve consumer queries.

- In April 2023, Careington Benefit Solutions announced a new facility to expand its printing and fulfillment services, which include digital printing, custom marketing materials, membership ID cards, and mailing services. This expansion, supported by new, state-of-the-art printing machines, was designed to improve efficiency and support the company’s business growth by enhancing its in-house administrative services for clients.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Plan Type, Coverage Type, Zone and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady adoption as consumers increasingly prefer low-cost alternatives to traditional insurance.

- Digital enrollment platforms will expand, making discount plans easier to access and manage for wider populations.

- Telehealth-based discount plans will grow rapidly as virtual care becomes a mainstream healthcare channel.

- Multi-service bundles combining dental, vision, pharmacy, and virtual care will become standard offerings.

- Provider networks will broaden as clinics and pharmacies partner more actively to attract new patient volumes.

- Employers will integrate discount plans into workforce wellness programs to control benefit costs.

- Younger demographics will adopt flexible, subscription-style healthcare savings options at higher rates.

- Awareness campaigns and transparent pricing will help overcome consumer misconceptions and boost enrollment.

- Regional penetration will increase as underserved and uninsured populations seek affordable healthcare solutions.

- Competitive differentiation will intensify, driven by technology integration, stronger service bundles, and improved customer experience.

Market Segmentation Analysis:

Market Segmentation Analysis: