Market Overview

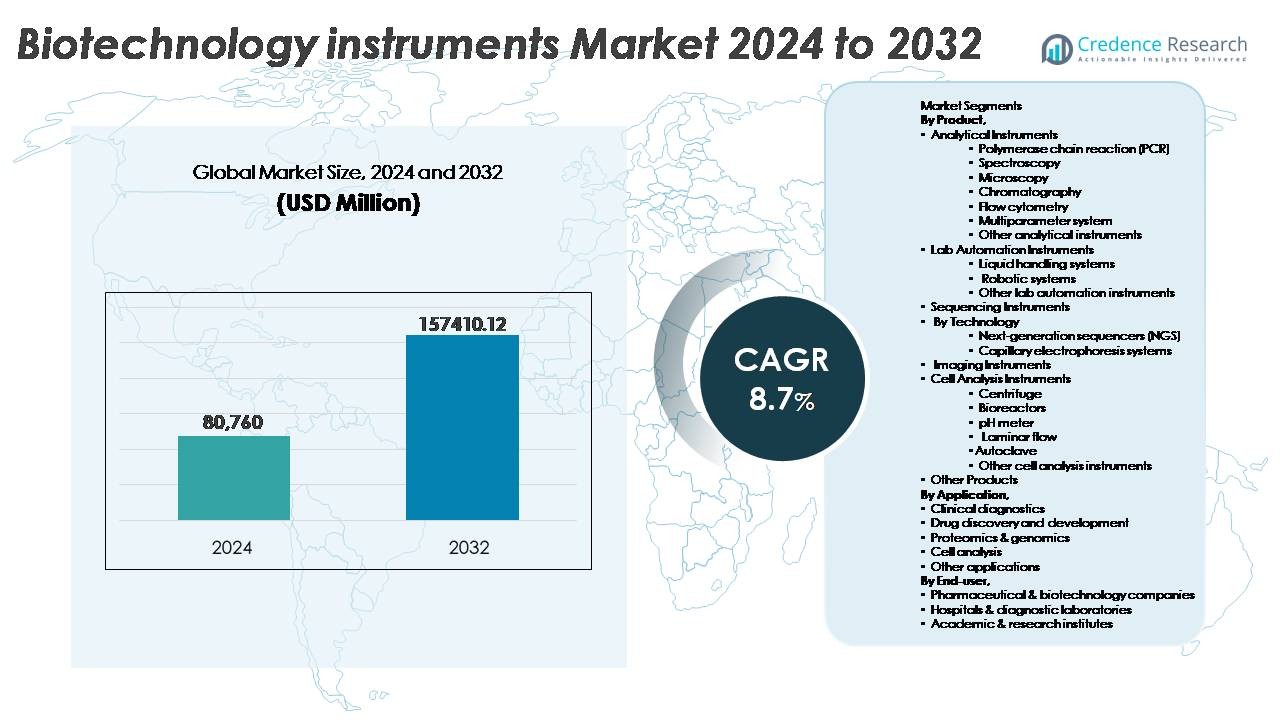

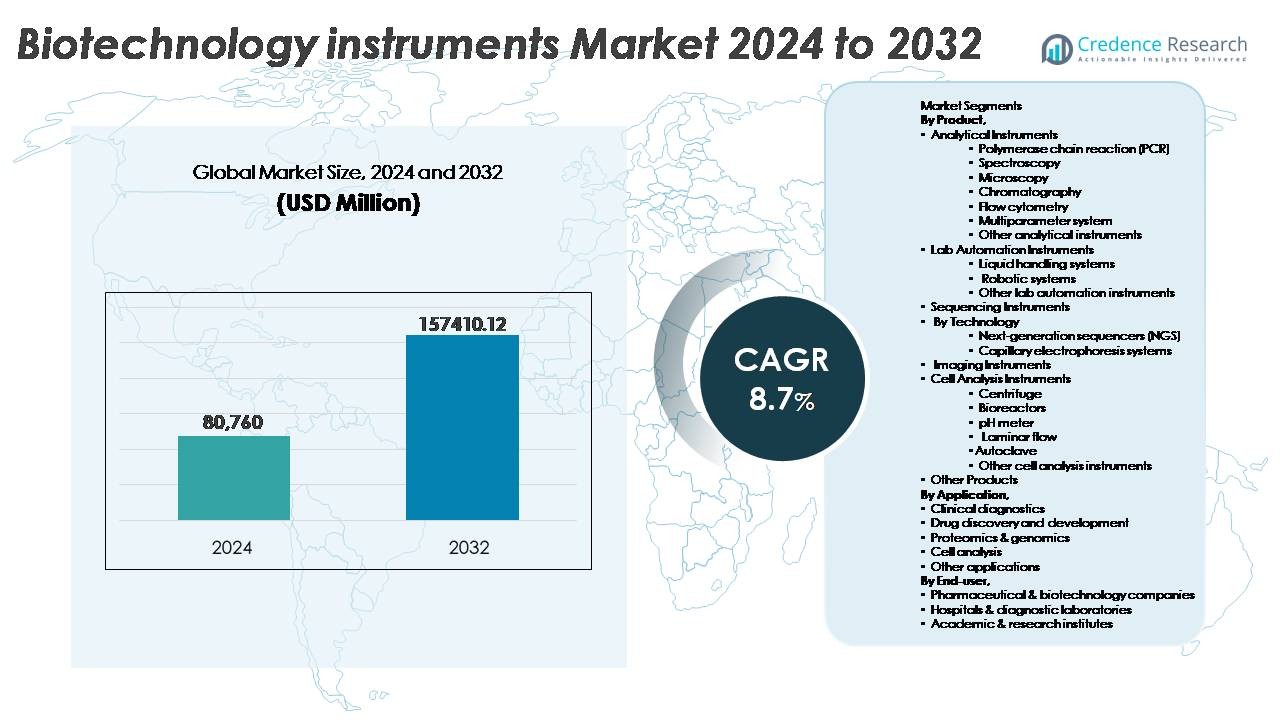

The global biotechnology instruments market was valued at USD 80,760 million in 2024 and is projected to reach USD 157,410.12 million by 2032, reflecting a steady CAGR of 8.7% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biotechnology Instruments Market Size 2024 |

USD 80,760 Million |

| Biotechnology Instruments Market, CAGR |

8.7% |

| Biotechnology Instruments Market Size 2032 |

USD 157,410.12 Million |

The biotechnology instruments market is shaped by a strong group of global players, including Bio-Rad Laboratories, Waters Corp., Illumina, PerkinElmer, Agilent Technologies, Thermo Fisher Scientific, Zeiss Group, Abbott, Shimadzu Corp., and Bruker Corp. These companies maintain leadership through diversified product portfolios spanning analytical platforms, sequencing systems, imaging instruments, and lab automation technologies. North America remains the leading region, holding 38% of the global market share, supported by advanced research infrastructure, high adoption of precision diagnostics, and sustained biopharmaceutical investment. Asia-Pacific is rapidly emerging as the fastest-growing regional cluster, driven by expanding biomanufacturing capabilities and government support for genomics and healthcare modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global biotechnology instruments market was valued at USD 80,760 million in 2024 and is projected to reach USD 157,410.12 million by 2032, expanding at a CAGR of 8.7% through the forecast period.

- Demand accelerates due to growing investment in precision medicine, biologics production, and advanced clinical diagnostics, with analytical instruments contributing the largest segment share driven by PCR, chromatography, and microscopy adoption.

- Trends include automation of laboratory workflows, expansion of multi-omics platforms, and rapid decentralization of molecular diagnostic testing supported by compact and portable instruments.

- The market features strong competition with Thermo Fisher Scientific, Agilent Technologies, Illumina, and Bio-Rad leading through product innovation, R&D partnerships, and expansion into consumables and software-integrated workflows.

- North America leads with 38% market share, followed by Europe at 28% and Asia-Pacific at 24%, with APAC emerging as the fastest-growing region supported by biomanufacturing expansion and diagnostic infrastructure modernization.

Market Segmentation Analysis:

By Product

The biotechnology instruments market by product is dominated by analytical instruments, accounting for the largest market share, driven by increasing deployment of PCR systems, chromatography platforms, and microscopy solutions for disease profiling, genetic quantification, and cellular morphology studies. PCR remains a critical tool for molecular diagnostics and biomarker screening, while chromatography and spectroscopy enable high-precision compound separation and structural determination in biologics development. Lab automation instruments, including liquid handling and robotic systems, continue gaining adoption as laboratories prioritize accuracy, throughput, and contamination control. Additionally, cell analysis instruments such as centrifuges, bioreactors, and laminar flow units are witnessing steady demand as cell-based therapies and regenerative medicine scale globally.

- For instance, Agilent’s 1290 Infinity II LC system offers up to 1200 bar pressure and supports injection cycles as fast as 10 seconds, enabling high-resolution separation for complex biologics.

By Application

Clinical diagnostics represents the dominant application segment, with rapid expansion driven by the rising prevalence of infectious diseases, oncology screening, and genetic disorder diagnosis. The integration of PCR-based assays, immunodiagnostics, and sequencing solutions enables earlier disease detection and personalized treatment decisions. Drug discovery and development is another fast-evolving segment propelled by biologics, mRNA therapeutics, and antibody–drug conjugates. Meanwhile, proteomics and genomics gain momentum as multi-omics workflows become essential for precision medicine research. Cell analysis tools support stem cell investigations, toxicity testing, and ex vivo manipulation, further extending the role of biotechnology instruments into translational research and pharmaceutical innovation.

- For instance, Abbott’s Alinity m molecular platform can process up to 300 samples in a continuous-access workflow and delivers qualitative and quantitative PCR results in under 115 minutes, supporting rapid clinical decision-making.

By End-user

Pharmaceutical and biotechnology companies hold the dominant share in the biotechnology instruments market due to significant capital investments, expanding biologics pipelines, and adoption of advanced sequencing and automation technologies. These enterprises rely on high-throughput analytical platforms to expedite clinical trials, enhance lead optimization, and ensure regulatory compliance through precision QC testing. Hospitals and diagnostic laboratories exhibit rising demand for PCR analyzers, imaging instruments, and flow cytometry solutions for molecular diagnostics and personalized treatment pathways. Academic and research institutes remain key contributors to early-stage innovation, supported by grants and government funding that accelerate foundational genomics and proteomics research.

Key Growth Drivers

Expanding Adoption of Precision Medicine and Personalized Therapeutics

The growing shift toward precision medicine significantly drives demand for advanced biotechnology instruments that support genetic profiling, biomarker quantification, and treatment stratification. As healthcare systems prioritize individualized therapeutic plans, researchers increasingly rely on high-throughput sequencing, flow cytometry, and single-cell analysis tools to evaluate patient-specific disease progression and drug responsiveness. Clinical diagnostics increasingly incorporates PCR and NGS technologies for oncology screening, infectious disease surveillance, and hereditary risk assessment. Pharmaceutical developers leverage multi-omics platforms to design targeted biologics and companion diagnostics that improve therapeutic efficacy while reducing adverse effects. Additionally, governments and insurers are expanding reimbursement coverage for molecular diagnostic testing, fueling broader clinical adoption. The convergence of bioinformatics, AI-supported analysis, and improved sample processing enhances data reliability, reducing barriers to integration within routine care. As healthcare transitions from reactive treatment to predictive and preventive models, the market for biotechnology instruments will continue to accelerate.

- For instance, Illumina’s NovaSeq X platform achieves output of up to 16 terabases per run with read lengths of 2 × 150 bp, enabling rapid whole-genome sequencing at population scale.

Accelerating Investments in Biopharmaceutical Research and Biologics Manufacturing

Growing investment in biologics including monoclonal antibodies, cell and gene therapies, and mRNA platforms serves as a primary market catalyst for biotechnology instrumentation. Biopharmaceutical manufacturers depend on chromatography systems, automated bioreactors, and spectroscopy tools to optimize upstream and downstream processing while ensuring product quality and regulatory compliance. Large-scale production of viral vectors, RNA vaccines, and recombinant proteins necessitates robust real-time monitoring capabilities, spurring adoption of advanced analytical and laboratory automation instruments. The rise of contract development and manufacturing organizations (CDMOs) expands access to specialized technology for emerging biotech firms, amplifying market penetration. National healthcare strategies, aging demographics, and chronic disease prevalence further support long-term demand for biologics pipelines. Strategic collaborations among academic institutions, manufacturers, and government agencies accelerate innovation in cell therapy, immuno-oncology, and rare-disease treatments, reinforcing the essential role of biotechnology instrumentation across the global value chain.

- For instance, Cytiva’s Xcellerex XDR single-use bioreactors support working volumes up to 2000 liters, enabling scalable production of viral vectors and recombinant proteins in GMP environments.

Growing Demand for Automation and Digitalization Across Laboratory Workflows

Automation has become essential for laboratories seeking to improve throughput, reduce manual errors, and lower operational costs, fueling adoption of robotic systems, liquid handling platforms, and integrated sample-to-result instrumentation. Biotech companies and clinical labs increasingly implement automated PCR setups, sequencing libraries, and ELISA workflows to meet demand for rapid turnaround results in diagnostics and research. Digitally enabled instruments equipped with AI-driven data models, real-time sensors, and cloud connectivity enhance traceability, regulatory reporting, and predictive quality control. Automation also supports decentralized testing, enabling point-of-care diagnostics and distributed sample processing networks. As labor shortages and rising biosafety requirements challenge global research environments, automation mitigates risk and increases workforce efficiency. Additionally, laboratory information systems (LIS) and device interoperability create seamless data exchange, unifying research pipelines from discovery to commercialization and strengthening the long-term opportunity for digital and robotic-driven instrumentation.

Key Trends & Opportunities

Integration of Multi-Omics Platforms and Single-Cell Analysis

The rapid convergence of genomics, transcriptomics, proteomics, and metabolomics presents a transformative opportunity for biotechnology instrumentation. Single-cell sequencing and high-resolution cytometry enable researchers to unravel cellular heterogeneity, identify rare cell subpopulations, and understand disease at unprecedented granularity. This trend aligns with oncology, autoimmune research, and regenerative medicine, where cellular behavior significantly influences treatment outcomes. Instrument manufacturers are developing multi-modal systems capable of simultaneous imaging, sequencing, and functional analysis, reducing sample requirements and increasing analytical depth. The opportunity extends to computational platforms that manage and interpret large-scale datasets, opening avenues for specialized software and AI-driven analytics solutions.

- For instance, 10x Genomics’ Chromium X platform enables high-throughput single-cell workflows processing hundreds of thousands of cells per run, supporting large-cohort immune profiling and transcriptomic studies with scalable droplet-partitioning chemistry.

Rising Shift Toward Decentralized and Point-of-Care Molecular Diagnostics

The demand for rapid, field-deployable diagnostic solutions is creating substantial opportunities for portable PCR analyzers, compact sequencing devices, and microfluidics-based lab-on-chip systems. Advancements in consumables, integrated biosensors, and automated data interpretation support high-accuracy testing outside traditional laboratory settings, from emergency departments to remote clinics. Point-of-care molecular diagnostics gained momentum through infectious disease outbreaks, strengthening investment in instruments capable of handling diverse sample types with minimal operator training. This shift supports healthcare accessibility goals and reduces dependency on centralized facilities. Manufacturers offering cost-effective, scalable, and battery-operated platforms stand to capitalize on this growing demand.

- For instance, Cepheid’s GeneXpert Xpress platform delivers PCR-based results in as little as 30 minutes and is designed to operate in non-laboratory environments with minimal sample preparation.

Growing Opportunity in Synthetic Biology and Digital Biomanufacturing

Synthetic biology is transforming biotechnology instrumentation, requiring advanced automation, high-precision genetic design tools, and smart bioreactors for controlled expression and bioprocess optimization. Digital biomanufacturing integrating real-time analytics, digital twins, and AI-enabled optimization presents long-term commercial prospects for instrument suppliers. Industries leverage engineered microbes and enzymes for sustainable chemicals, food ingredients, and bio-materials, extending market reach beyond healthcare. The opportunity expands as startups drive innovation while established players diversify into modular bioprocessing platforms. Reduced production timelines, scalable experimentation, and predictive control capabilities accelerate adoption and create new demand for sensors, analytical modules, and closed-loop laboratory systems.

Key Challenges

High Capital Investment and Cost Barriers in Advanced Instrumentation

The biotechnology instruments market faces significant cost challenges as high equipment pricing, complex maintenance requirements, and recurring consumables expenses limit adoption, particularly for small biotech firms and academic laboratories. Advanced sequencing systems, robotic platforms, and high-performance analytical instruments demand substantial upfront investment, while software licenses and technical support further increase total cost of ownership. Budget constraints affect replacement cycles and slow modernization of laboratory infrastructure. In developing economies, limited reimbursement policies and rely-on outsourced research hinder domestic acquisition. These financial constraints create competitive pressure on manufacturers to offer flexible pricing, leasing models, and scalable modular solutions to expand accessibility.

Technical Complexity, Data Management Burden, and Skilled Workforce Shortages

Increasing instrument sophistication presents challenges associated with system integration, calibration, regulatory documentation, and cybersecurity compliance. The generation of massive multi-omics and imaging datasets creates substantial storage, processing, and interoperability burdens. Laboratories often struggle to recruit personnel skilled in bioinformatics, automation engineering, and AI-supported analytics, extending learning curves and slowing return on investment. Human error in protocol setup, data labeling, and sample handling persists despite automation advances. Additionally, the need to align with evolving regulatory standards including Good Laboratory Practices and data integrity frameworks adds operational complexity. Addressing workforce capability gaps through training solutions and user-friendly automation will be vital to sustaining market growth.

Regional Analysis

North America

North America holds the largest share of the biotechnology instruments market, accounting for approximately 38% of global revenue, driven by mature biopharmaceutical manufacturing, advanced clinical diagnostics adoption, and sustained federal funding for genomics and precision medicine initiatives. The U.S. leads regional demand, supported by strong integration of lab automation, next-generation sequencing platforms, and digitalized research environments across pharmaceutical and academic institutions. High availability of skilled professionals, presence of major industry players, and rapid adoption of AI-enabled analytical systems strengthen the region’s competitiveness. Growth is further supported by expanding investments in cell and gene therapy infrastructure and regulatory pathways favoring innovation.

Europe

Europe represents around 28% of the biotechnology instruments market, supported by robust pharmaceutical R&D investments, well-established academic research hubs, and increasing adoption of molecular diagnostics across public healthcare systems. Germany, the U.K., and France remain leading contributors due to active funding for proteomics, synthetic biology, and translational research. The region’s regulatory framework encourages standardization and quality assurance, driving demand for compliant analytical and automation technologies. Advancements in bioreactors, flow cytometry, and spectroscopy tools accelerate biologics development. Moreover, the strategic expansion of biotech clusters and cross-border research partnerships sustains momentum in precision medicine and bioinformatics-enabled laboratory workflows.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, capturing nearly 24% share, propelled by rising healthcare expenditure, expanding biotechnology startups, and increasing government support for genomics, vaccine production, and biomanufacturing capacity. China, Japan, South Korea, and India are driving adoption of PCR, sequencing, and cell analysis instruments for infectious disease surveillance, oncology diagnostics, and regenerative medicine programs. Rapid modernization of laboratory infrastructure and outsourcing of clinical trials to the region contribute to cost-effective research capabilities. Favorable investment policies, growing domestic production, and technology transfer agreements enhance market penetration, establishing Asia-Pacific as a core hub for high-throughput research and biologics manufacturing.

Latin America

Latin America accounts for approximately 6% of the biotechnology instruments market, with demand primarily driven by increasing investment in diagnostic modernization, pharmaceutical manufacturing, and infectious disease management. Brazil and Mexico lead regional adoption, supported by expanding private laboratory networks and growing interest in biosimilars production. The uptake of PCR, immunoassay platforms, and centrifuges is rising as healthcare systems aim to strengthen disease surveillance and reduce dependence on imported diagnostics. However, limited R&D funding and uneven regulatory harmonization moderate expansion. Partnerships with multinational companies and investment in local bioprocessing capabilities present opportunities for long-term regional growth.

Middle East & Africa

The Middle East & Africa region holds roughly 4% market share, with gradual adoption driven by healthcare infrastructure upgrades, rising chronic disease burden, and increased focus on genomic screening programs. The Gulf Cooperation Council (GCC) countries demonstrate higher spending on laboratory automation, bioreactors, and diagnostic sequencing, driven by national healthcare diversification strategies. Africa shows incremental growth supported by infectious disease diagnostics and donor-funded laboratory capacity programs. Despite progress, challenges persist in workforce skills and capital investment accessibility. Expansion of research centers, technology transfer initiatives, and collaborations with global biotechnology firms are expected to accelerate future regional adoption.

Market Segmentations:

By Product,

- Analytical Instruments

- Polymerase chain reaction (PCR)

- Spectroscopy

- Microscopy

- Chromatography

- Flow cytometry

- Multiparameter system

- Other analytical instruments

- Lab Automation Instruments

- Liquid handling systems

- Robotic systems

- Other lab automation instruments

- Sequencing Instruments

By Technology

-

- Next-generation sequencers (NGS)

- Capillary electrophoresis systems

- Imaging Instruments

- Cell Analysis Instruments

- Centrifuge

- Bioreactors

- pH meter

- Laminar flow

- Autoclave

- Other cell analysis instruments

- Other Products

By Application,

- Clinical diagnostics

- Drug discovery and development

- Proteomics & genomics

- Cell analysis

- Other applications

By End-user,

- Pharmaceutical & biotechnology companies

- Hospitals & diagnostic laboratories

- Academic & research institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The biotechnology instruments market features a highly competitive landscape characterized by global manufacturers, specialized instrumentation developers, and fast-growing technology-focused entrants. Established companies dominate through broad portfolios spanning analytical platforms, sequencing systems, lab automation equipment, and cell analysis instruments. Competitive advantage is driven by innovation in precision diagnostics, miniaturization, high-throughput workflows, and AI-enabled data interpretation. Strategic priorities include expanding consumable-based recurring revenue models, enhancing interoperability, and integrating cloud-based monitoring and predictive analytics. Mergers, acquisitions, and R&D collaborations with research institutes and biopharmaceutical companies remain central strategies to accelerate product development and market penetration. Meanwhile, emerging firms are disrupting segments such as portable sequencing, robotic automation, and synthetic biology tools. As demand increases for decentralized diagnostics, digital biomanufacturing, and multi-omics integration, competition is expected to intensify, with vendors focused on scaling reliability, reducing cost barriers, and meeting stringent regulatory and compliance requirements across diverse regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bio-Rad Laboratories, Inc.

- Waters Corp.

- Illumina, Inc.

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- Thermo Fisher Scientific, Inc.

- Zeiss Group

- Abbott

- Shimadzu Corp.

- Bruker Corp.

Recent Developments

- In October 2025, Waters introduced the Xevo Charge Detection Mass Spectrometer (CDMS), a new instrument offering advanced measurement and characterization capabilities for large biomolecules, supporting next-generation therapeutics and structural biology applications.

- In July 2025, Bio-Rad Laboratories, Inc. the company expanded its digital PCR portfolio by launching multiple new Droplet Digital PCR (ddPCR) platforms, following a strategic acquisition to enhance its capabilities in high-precision nucleic acid quantification.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Biotechnology instruments will become more automated, enabling higher throughput and improved accuracy in laboratory workflows.

- Multi-omics integration will expand, supporting deeper insights across genomics, proteomics, and metabolomics research.

- Portable and decentralized diagnostic instruments will gain adoption for point-of-care testing and rapid field deployment.

- AI and machine learning will enhance data interpretation, predictive analytics, and process optimization.

- Digital biomanufacturing and smart bioreactors will reshape production models for biologics and cell therapies.

- Cloud-connected instrumentation will improve real-time monitoring, compliance, and remote troubleshooting.

- Single-cell analysis technologies will advance precision medicine and targeted therapy development.

- Sustainability initiatives will drive demand for energy-efficient instruments and reduced consumables waste.

- Modular and customizable platforms will support flexible lab expansion and scalable research environments.

- Government funding and public–private collaborations will accelerate innovation in diagnostics and bioprocessing technologies.