Market Overview

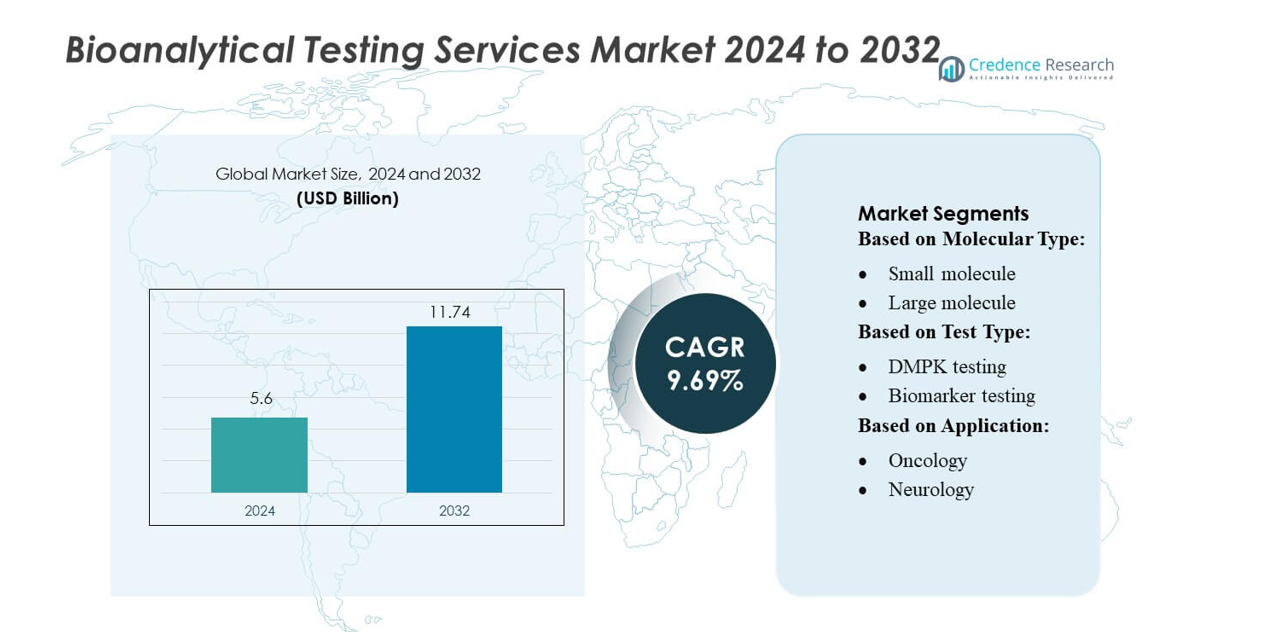

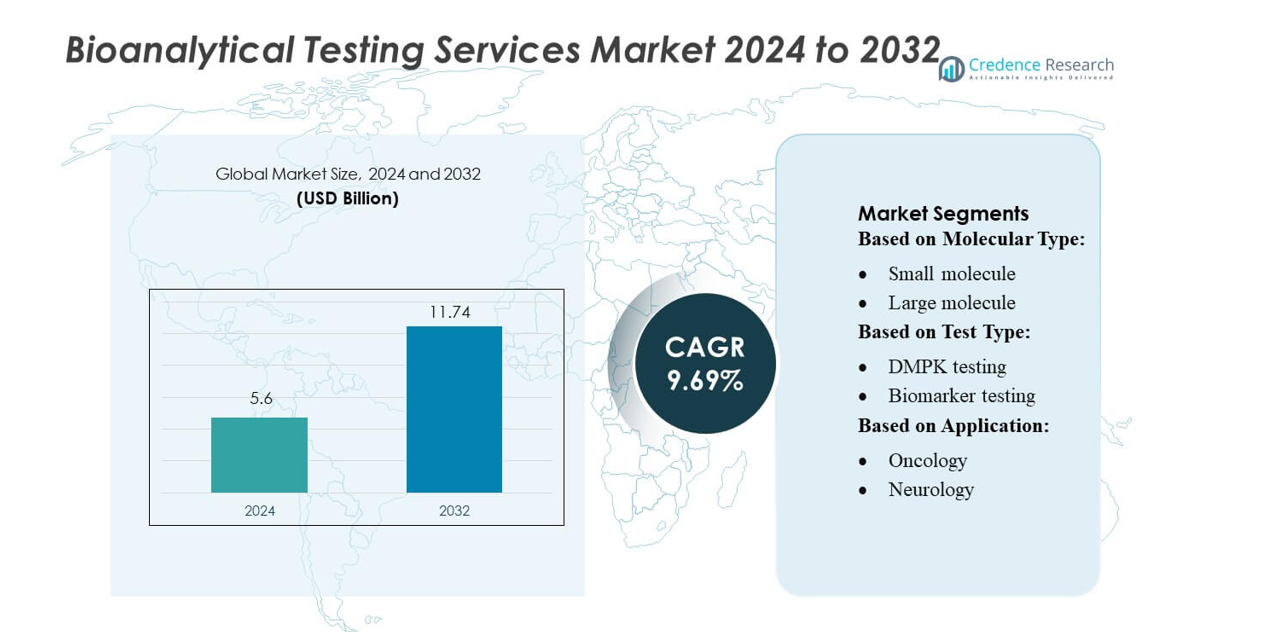

Bioanalytical Testing Services Market size was valued USD 5.6 billion in 2024 and is anticipated to reach USD 11.74 billion by 2032, at a CAGR of 9.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bioanalytical Testing Services Market Size 2024 |

USD 5.6 billion |

| Bioanalytical Testing Services Market, CAGR |

9.69% |

| Bioanalytical Testing Services Market Size 2032 |

USD 11.74 billion |

The Bioanalytical Testing Services Market is shaped by specialized contract research organizations and global laboratories that provide advanced pharmacokinetic, immunogenicity, biomarker, and virology testing solutions. Leading providers include well-established scientific service companies recognized for their GLP/GCP-compliant infrastructure, high-sensitivity LC-MS/MS platforms, and automation-driven laboratory workflows that support large clinical pipelines across biologics and small-molecule programs. These players compete by expanding assay development capabilities, enhancing data integrity systems, and strengthening global delivery networks. North America leads the market with more than 40% market share, supported by strong biopharmaceutical R&D activity, extensive clinical trials, and high adoption of outsourced analytical services.

Market Insights

- The Bioanalytical Testing Services Market reached USD 5.6 billion in 2024 and will grow to USD 11.74 billion by 2032 at a CAGR of 9.69%, driven by rising biologics development and increasing adoption of outsourced analytical support.

- Strong demand for pharmacokinetic, immunogenicity, biomarker, and virology testing continues to accelerate market expansion, supported by high clinical trial volume across oncology, infectious diseases, and neurology.

- Competitive activity intensifies as global CROs enhance GLP/GCP-compliant facilities, integrate high-sensitivity LC-MS/MS platforms, and adopt automation to improve efficiency, data integrity, and turnaround times.

- The market faces restraints linked to complex assay validation requirements, evolving regulatory expectations, and limited availability of specialized talent for large-molecule and cell-based analytical workflows.

- North America leads with over 40% share, followed by Europe at approximately 28%, while small molecules remain the dominant segment with over 55% share, supported by extensive generics pipelines and strong demand for bioequivalence testing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Molecule Type

Small molecules hold the dominant position in the Bioanalytical Testing Services Market, accounting for over 55% of the overall share due to their extensive use in generics, novel therapeutics, and complex combination formulations. Their well-established analytical pathways, shorter development cycles, and high demand for pharmacokinetic and bioequivalence studies continue to strengthen their leadership. Large molecules exhibit steady growth as biologics, cell therapies, and recombinant proteins expand in clinical pipelines. This category benefits from rising investments in antibody engineering and the growing need for sensitive assays to validate therapeutic safety and performance.

- For instance, Qualitest’s proprietary AI-led platform Qualisense supports rapid validation of complex software systems and was reported to accelerate time-to-release by approximately 6× in relevant projects.

By Test Type

DMPK testing emerges as the leading test category, capturing around 30% market share, supported by increasing requirements for absorption, distribution, metabolism, and excretion (ADME) profiling throughout early-stage drug development. The segment benefits from the rising complexity of therapeutic candidates and the need to predict in-vivo behavior with higher accuracy. Biomarker testing and immunogenicity testing follow due to strong adoption in precision medicine and biologics development. Virology testing—including in-vivo and in-vitro—continues to expand with escalating infectious disease research, vaccine development, and regulatory focus on viral safety assessment across biopharmaceutical manufacturing.

- For instance, Accenture worked with a global biopharmaceutical firm to implement its Digital Thread for Life Sciences framework: this reduced the technology-transfer cycle in manufacturing from 12 weeks to 7–8 weeks.

By Application

Oncology remains the dominant application area, contributing over 40% of the market share as cancer therapeutics increasingly rely on bioanalytical validation for targeted therapies, immunotherapies, and biomarker-driven drug development. Extensive oncology pipelines, high clinical trial activity, and the demand for companion diagnostics reinforce this leadership. Infectious diseases form the next major segment due to ongoing antiviral, vaccine, and biologics development. Neurology, cardiology, and gastroenterology applications continue to gain momentum as complex diseases require specialized assays to characterize therapeutic efficacy, safety profiles, and long-term treatment responses.

Key Growth Drivers

Expansion of Biologics and Advanced Therapeutics Pipelines

The Bioanalytical Testing Services Market grows strongly as biopharmaceutical companies accelerate investments in monoclonal antibodies, gene therapies, cell-based treatments, and recombinant proteins. These complex modalities require highly sensitive assays for pharmacokinetics, immunogenicity, and biomarker quantification, driving outsourcing to specialized laboratories with advanced platforms such as LC-MS/MS and ligand-binding technologies. Increasing regulatory scrutiny on biologic safety, rising global submissions, and expanding clinical trials strengthen the demand for validated analytical methods, ensuring accurate characterization of therapy performance across development phases.

- For instance, IBM Consulting’s generative-AI initiatives in life sciences leverage its consultancy arm’s expertise and technology. The company has developed AI-automation pipelines for specific workflows, such as reducing manual labor in adverse event narrative generation by approximately 50%.

Rising Clinical Trial Volume and Outsourcing Momentum

Growing clinical trial activity across oncology, infectious diseases, neurology, and rare disorders fuels significant demand for comprehensive bioanalytical testing support. Pharmaceutical companies increasingly outsource these functions to CROs to reduce internal laboratory costs, accelerate timelines, and access specialized instrumentation. Outsourcing also improves scalability for global multicenter studies requiring large sample processing and harmonized assay protocols. The shift toward lean internal R&D structures and higher dependence on external expertise accelerates adoption of end-to-end bioanalytical solutions, strengthening market growth across preclinical and clinical stages.

- For instance, DXC’s Life Sciences Software Solutions and AI Platform reports that its regulatory-automation suite has supported 76,000+ regulatory submissions and spans 250,000 global users in pharmaceutical workflows.

Increasing Regulatory Emphasis on Standardized Analytical Validation

Regulatory authorities mandate stringent analytical validation to ensure therapeutic safety, reproducibility, and clinical relevance, reinforcing the importance of robust bioanalytical testing frameworks. Agencies such as the FDA and EMA continue updating guidance for ligand-binding assays, biomarkers, and PK/PD methodologies, driving companies to adopt high-compliance environments and standardized workflows. Growing focus on biosimilar approval pathways, trace impurity detection, and viral safety assessments also expands demand for specialized testing capabilities. These tightening requirements encourage pharmaceutical developers to rely on expert service providers with established GLP-compliant infrastructure.

Key Trends & Opportunities

Adoption of High-Sensitivity and Automation-Driven Platforms

The market sees rapid integration of high-sensitivity analytical technologies, including next-generation LC-MS/MS, multiplex immunoassays, and automated sample preparation systems. Automation reduces human error, improves precision, and accelerates turnaround times for large clinical trial cohorts. Growing use of ultra-high sensitivity detection supports complex biologics, low-concentration biomarkers, and micro-sampling-based clinical designs. Providers adopting robotics, digital data management, and integrated laboratory information systems (LIMS) gain competitive advantage as clients prioritize reliability, scalability, and regulatory-ready workflows.

- For instance, Atos Polaris AI Platform which offers pre-built autonomous AI agents that can reduce development effort by 40-50 %, QA lead-time by 50-60 %, and contract-review cycle time by 30-40 %.

Rising Demand for Biomarker-Centric and Precision Medicine Studies

Biomarker-driven clinical development creates major opportunities, particularly in oncology, neurology, and immunology. Pharmaceutical companies increasingly require multi-analyte panels, genomic markers, and longitudinal biomarker profiling to support patient stratification and therapeutic response monitoring. This trend accelerates growth in bespoke assay development and validation services. The shift toward precision medicine strengthens collaborations between CROs and biopharma companies to create specialized biomarker platforms capable of supporting early detection, mechanism-of-action studies, and adaptive trial designs, enhancing scientific and commercial value.

- For instance, Charles River Laboratories expanded its biomarker discovery capabilities through the acquisition of SAMDI Tech, enabling high-throughput, label-free mass spectrometry workflows capable of screening over 100,000 compounds per day using their proprietary SAMDI® MS platform.

Expansion of Virology and Vaccine Development Capabilities

Growing global focus on antiviral therapeutics, pandemic preparedness, and vaccine R&D drives continuous expansion of virology testing capabilities. In-vitro viral assays, viral load quantification, neutralization studies, and serological testing gain higher demand across biopharma pipelines. Opportunities grow for providers offering high-biosafety-level facilities, automated viral analytics, and rapid assay development expertise. The need for viral clearance validation in biologics manufacturing further strengthens demand, positioning virology as one of the fastest-evolving segments within bioanalytical outsourcing.

Key Challenges

High Complexity of Large Molecule and Cell-Based Assays

Bioanalytical testing for large molecules, cell therapies, and gene-based treatments presents significant methodological challenges due to structural complexity, stability issues, and matrix interference. Developing sensitive assays for immunogenicity, bioactivity, and viral vector characterization requires specialized skills, advanced platforms, and extensive validation timelines. Variability in biomarker expression across patient populations further complicates assay standardization. These technical constraints increase development costs and prolong clinical timelines, limiting some organizations’ ability to meet accelerated regulatory and commercialization targets.

Stringent Compliance Burden and Evolving Regulatory Expectations

Service providers face challenges in maintaining GLP/GCP compliance as regulatory bodies introduce continuous updates related to assay validation, biomarker qualification, and bioanalytical data integrity. Meeting these requirements demands significant investment in documentation, training, instrument calibration, and audit readiness. Global studies add complexity due to differing regional regulatory expectations for sample handling, reporting formats, and acceptance criteria. These rising compliance obligations strain smaller laboratories and increase operational overhead, creating barriers for rapid scale-up and competitive differentiation.

Regional Analysis

North America

North America leads the Bioanalytical Testing Services Market with over 40% market share, driven by a mature biopharmaceutical ecosystem, advanced clinical trial activity, and strong regulatory emphasis on validated analytical processes. The region benefits from extensive investments in biologics, biosimilars, and gene therapies, which require high-precision pharmacokinetic, immunogenicity, and biomarker testing. Major CROs and specialized laboratories maintain large GLP-compliant facilities and integrate high-sensitivity LC-MS/MS platforms, automated workflows, and digital data systems. Supportive FDA guidelines, growing outsourcing preference, and a robust pipeline of oncology and rare disease trials continue to reinforce regional leadership.

Europe

Europe holds around 28% market share, supported by strong pharmaceutical R&D clusters across Germany, the U.K., France, and Switzerland. The region benefits from rising adoption of biologics, advanced therapeutic medicinal products, and complex biosimilar programs that require extensive analytical validation and long-term stability studies. EMA’s evolving guidance on biomarkers and immunogenicity strengthens the need for standardized workflows and high-quality bioanalytical support. Growth is further driven by expanding clinical trials in oncology, neurology, and infectious diseases. Increasing collaboration between CROs and academic research centers accelerates development of next-generation testing capabilities across the European market.

Asia-Pacific

Asia-Pacific accounts for nearly 22% market share and represents the fastest-growing region due to expanding pharmaceutical manufacturing, rising biologics production, and increasing multinational clinical trial activity. China, India, South Korea, and Japan invest heavily in bioanalytical infrastructure, including high-throughput LC-MS/MS systems, immunoassay platforms, and virology testing facilities. Cost-effective outsourcing, rapid regulatory modernization, and growing domestic biotech pipelines strengthen the region’s competitive position. Increasing investment from global CROs and partnerships with regional innovators enhance service capacity, particularly across oncology, infectious disease, and biosimilar development programs, driving sustained market acceleration.

Latin America

Latin America contributes approximately 6% market share, supported by rising pharmaceutical outsourcing and expanding clinical trial networks in Brazil, Mexico, and Argentina. The region experiences growing demand for bioanalytical testing in infectious diseases, oncology, and metabolic disorders, driven by increasing therapeutic innovation and public health requirements. Providers enhance service capabilities by adopting validated immunoassays, biomarker panels, and pharmacokinetic testing frameworks. Regulatory harmonization efforts and collaborations with global CROs improve compliance standards and scientific quality. Despite infrastructure constraints, expanding local biotech activity and interest from multinational sponsors drive steady adoption of specialized testing services.

Middle East & Africa

The Middle East & Africa region holds around 4% market share, reflecting a developing but steadily expanding market supported by investments in healthcare modernization and clinical research capabilities. Countries such as the UAE, Saudi Arabia, and South Africa foster growth through improved laboratory infrastructure, rising clinical trial participation, and increasing availability of GLP-compliant analytical services. Demand for bioanalytical testing is driven by expanding infectious disease research and growing interest in biologics and vaccines. Although capacity remains limited compared with major regions, international partnerships and government-backed R&D initiatives support gradual market advancement.

Market Segmentations:

By Molecular Type:

- Small molecule

- Large molecule

By Test Type:

- DMPK testing

- Biomarker testing

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Bioanalytical Testing Services Market features a competitive landscape shaped by global technology and consulting leaders such as Infosys Limited, Capgemini, Qualitest Group, Accenture, Deloitte Touche Tohmatsu Limited, DeviQA Solutions, IBM Corporation, DXC Technology Company, TATA Consultancy Services Limited, and Atos SE. The Bioanalytical Testing Services Market is defined by a growing focus on scientific precision, regulatory compliance, and digital transformation across laboratory operations. Leading service providers differentiate themselves by expanding high-sensitivity analytical platforms, strengthening GLP/GCP infrastructure, and integrating automation to support large-scale clinical trial workflows. The market continues to shift toward specialized capabilities in pharmacokinetics, immunogenicity, biomarker quantification, and virology testing, driven by the increasing complexity of biologics and advanced therapies. Companies invest heavily in data integrity systems, workflow digitization, and AI-enabled analytical tools to improve accuracy, accelerate turnaround times, and support multi-regional submissions. Partnerships between CROs, biopharmaceutical innovators, and technology vendors further enhance operational scalability and global service delivery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Infosys Limited

- Capgemini

- Qualitest Group

- Accenture

- Deloitte Touche Tohmatsu Limited

- DeviQA Solutions

- IBM Corporation

- DXC Technology Company

- TATA Consultancy Services Limited

- Atos SE

Recent Developments

- In June 2024, SGS SA announced the addition of new stability studies, including sample storage facilities, to its biopharmaceutical services at its Birsfelden laboratory in Switzerland. This expansion broadened the company’s service portfolio and enhanced its customer reach in the Swiss market, providing critical services for biopharmaceutical products.

- In January 2024, Frontage Laboratories completed the acquisition of Accelera S.r.l.’s Bioanalytical and Drug Metabolism & Pharmacokinetics (DMPK) businesses. This strategic move was carried out through Frontage’s wholly-owned subsidiary, Frontage Europe S.r.l., which expanded the company’s market presence.

- In January 2024, Capgemini SE and Orange, introduced its “trusted cloud” services. This platform aims to provide the specific cloud needs of the French State, public agencies, hospitals, regional authorities, Vital Importance Operators (OIVs), and Essential Service Operators (OSEs), enabling them to use Microsoft 365 and Microsoft Azure services within a sovereign and highly secure environment

Report Coverage

The research report offers an in-depth analysis based on Molecular Type, Test Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as biologics, cell therapies, and gene therapies increase in global development pipelines.

- Demand for high-sensitivity assays will rise with growing emphasis on precision medicine and biomarker-driven clinical designs.

- Automation and digital laboratory systems will become central to improving data integrity, efficiency, and regulatory readiness.

- Advanced LC-MS/MS platforms and multiplex immunoassays will gain broader adoption across complex analytical workflows.

- Virology and serology testing capacity will expand as vaccine development and antiviral research continue to strengthen.

- Global CRO collaborations will intensify to support multicenter trials and harmonized assay validation.

- Outsourcing momentum will accelerate as biopharma companies streamline internal R&D structures.

- Data analytics, AI tools, and machine learning–driven interpretation models will enhance decision-making in PK/PD studies.

- Regulatory expectations for standardized assay validation will shape quality frameworks and investment priorities.

- Emerging markets will strengthen their position as regional bioanalytical hubs with improved infrastructure and specialized capabilities.