Market Overview

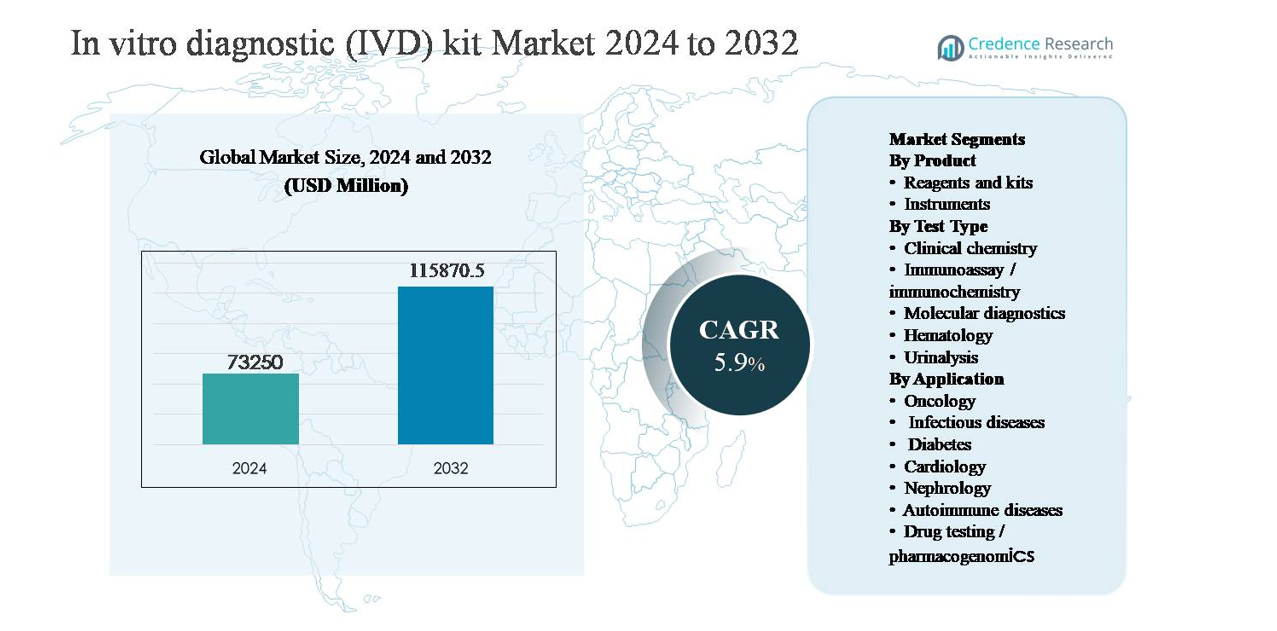

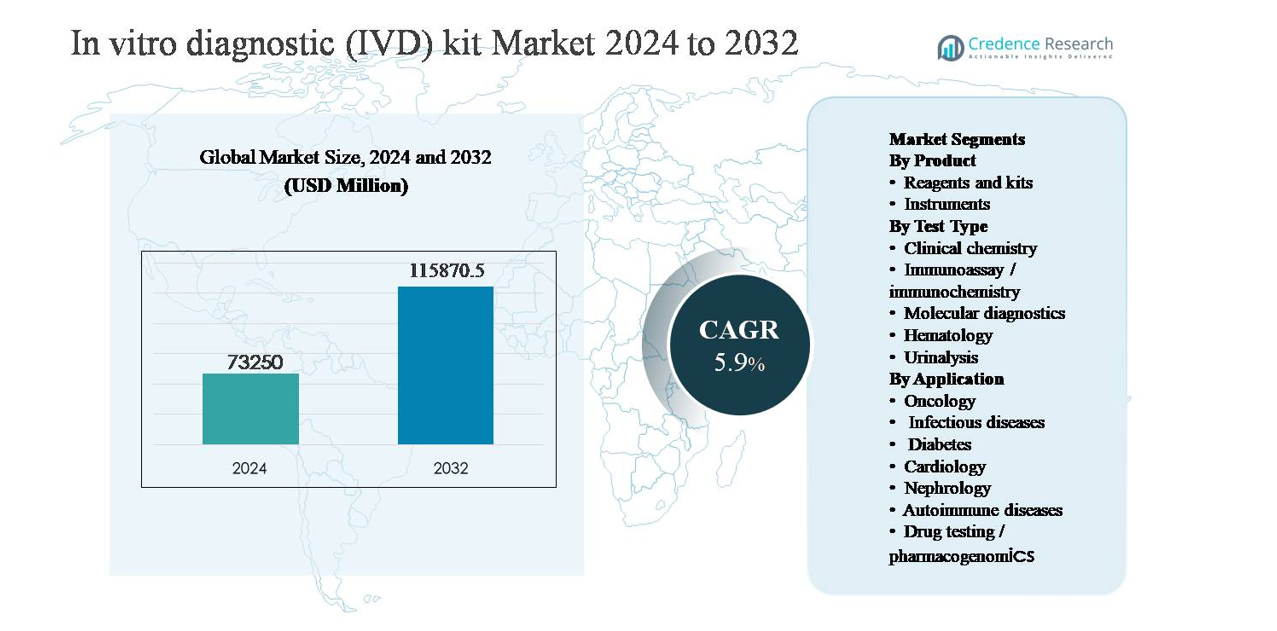

The in vitro diagnostic (IVD) kit market was valued at USD 73,250 million in 2024 and is anticipated to reach USD 115,870.5 million by 2032, expanding at a compound annual growth rate (CAGR) of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| In Vitro Diagnostic (IVD) Kit Market Size 2024 |

USD 73,250 million |

| In Vitro Diagnostic (IVD) Kit Market, CAGR |

5.9% |

| In Vitro Diagnostic (IVD) Kit Market Size 2032 |

USD 115,870.5 million |

The in vitro diagnostic (IVD) kit market is led by a group of global players with broad assay portfolios, strong regulatory capabilities, and extensive distribution networks. Companies such as Abbott Laboratories, F. Hoffmann-La Roche, Danaher Corporation, Becton, Dickinson and Company, bioMérieux, Bio-Rad Laboratories, Agilent Technologies, Medtronic, Drägerwerk, and ACON Laboratories compete through continuous expansion of reagents and kits across clinical chemistry, immunoassay, and molecular diagnostics. These players emphasize recurring reagent revenues, automation-ready solutions, and disease-specific test expansion. North America is the leading region, accounting for approximately 38% of global market share, driven by high testing volumes, strong reimbursement frameworks, and early adoption of advanced diagnostics, while Europe and Asia Pacific remain strategically important growth and volume markets.

Market Insights

- The in vitro diagnostic (IVD) kit market was valued at USD 73,250 million in 2024 and is projected to reach USD 115,870.5 million by 2032, growing at a CAGR of 5.9% during the forecast period, supported by expanding diagnostic testing volumes across routine and specialized healthcare applications.

- Market growth is primarily driven by rising prevalence of chronic diseases and infectious conditions, with reagents and kits dominating the product segment due to their recurring usage and accounting for the majority of overall consumption, while clinical chemistry remains the leading test type by volume.

- Key trends include increasing adoption of molecular diagnostics, automation-compatible kits, and decentralized testing models, alongside growing demand for oncology and infectious disease diagnostics across hospital and reference laboratory settings.

- The competitive landscape is shaped by multinational players focusing on broad test portfolios, regulatory strength, and recurring reagent revenues, with pricing pressure and reimbursement variability acting as key market restraints.

- Regionally, North America leads with about 38% market share, followed by Europe at ~27% and Asia Pacific at ~23%, while Latin America and Middle East & Africa together account for the remaining share, supported by gradual healthcare infrastructure expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Within the IVD kit market, reagents and kits represent the dominant product sub-segment, accounting for well over half of total market revenue. Their leadership is driven by recurring consumption, short shelf-life, and routine replacement across clinical laboratories, hospitals, and diagnostic centers. High test volumes in infectious disease screening, clinical chemistry panels, and immunoassays sustain continuous demand for reagents. In contrast, instruments contribute a smaller but stable share, supported by periodic upgrades, automation adoption, and consolidation of laboratory workflows, particularly in high-throughput and centralized testing environments.

- For instance, Abbott’s Alinity i immunoassay system supports a menu of more than 100 immunoassays, with individual analyzers capable of processing up to 200 tests per hour, resulting in sustained, high-frequency consumption of proprietary reagents in routine hospital laboratories

By Test Type

By test type, clinical chemistry remains the dominant sub-segment, contributing the largest share of IVD kit demand globally, supported by its broad application in routine health assessments, metabolic profiling, and organ function testing. High test frequency, standardized workflows, and cost efficiency reinforce its leadership. Immunoassay/immunochemistry and molecular diagnostics follow, driven by expanding infectious disease testing, oncology biomarkers, and precision diagnostics. Molecular diagnostics shows the fastest momentum due to PCR and nucleic acid-based assays, while hematology and urinalysis maintain steady demand in routine diagnostics.

- For instance, Roche’s cobas c 702 clinical chemistry module is designed to deliver up to 2,000 photometric tests per hour, with onboard capacity for 70 reagent positions, enabling laboratories to run continuous, multi-analyte testing across high patient volumes while maintaining rapid turnaround times.

By Application

Among applications, infectious diseases constitute the dominant sub-segment, holding the highest market share due to sustained testing volumes for respiratory infections, sexually transmitted diseases, and hospital-acquired infections. Strong surveillance programs, rapid test adoption, and decentralized diagnostics reinforce this position. Oncology and diabetes follow, supported by rising cancer incidence and long-term disease monitoring needs. Oncology benefits from biomarker-driven testing, while diabetes relies on frequent glucose and HbA1c testing. Cardiology, nephrology, autoimmune diseases, and pharmacogenomics contribute steadily through specialized and chronic-care diagnostics.

Key Growth Drivers

Rising Burden of Chronic and Infectious Diseases

The increasing global prevalence of chronic conditions such as diabetes, cardiovascular disorders, cancer, and autoimmune diseases remains a primary growth driver for the IVD kit market. These diseases require frequent and long-term diagnostic monitoring, significantly increasing test volumes across clinical chemistry, immunoassay, and molecular diagnostics. Simultaneously, the persistent threat of infectious diseases, including respiratory, sexually transmitted, and hospital-acquired infections, continues to drive demand for rapid and accurate diagnostic kits. Aging populations in developed economies and expanding access to healthcare in emerging markets further amplify testing needs. Preventive healthcare initiatives and routine health screenings have also elevated the role of early diagnosis, reinforcing sustained consumption of IVD kits across hospitals, reference laboratories, and decentralized testing settings.

- For instance, Cepheid’s GeneXpert® systems deliver real-time PCR results for assays such as Xpert Xpress SARS-CoV-2 and Xpert MTB/RIF within 45 minutes, with modular configurations supporting up to 16 independent testing modules, allowing simultaneous processing of multiple patient samples in emergency departments and microbiology laboratories.

Expansion of Laboratory Infrastructure and Diagnostic Access

Ongoing expansion of diagnostic laboratories and healthcare infrastructure, particularly in emerging economies, is accelerating IVD kit adoption. Governments and private healthcare providers are investing in laboratory modernization, automation, and capacity expansion to support growing patient volumes. The establishment of new diagnostic centers in urban and semi-urban regions has widened access to routine and specialized testing, increasing reagent and kit utilization. Additionally, the integration of diagnostics into primary care settings has shifted testing closer to patients, boosting demand for standardized and easy-to-use kits. Rising health insurance coverage and public reimbursement programs further support higher diagnostic testing rates, directly contributing to market growth.

- For instance, Beckman Coulter’s DxC 700 AU clinical chemistry analyzer supports throughput of up to 800 tests per hour, allowing laboratories participating in public health and insured testing programs to efficiently process increased sample inflows while maintaining standardized analytical performance.

Technological Advancements and Test Menu Expansion

Continuous innovation in diagnostic technologies is a major catalyst for IVD kit market growth. Advances in assay sensitivity, specificity, and turnaround time have enhanced clinical utility across multiple disease areas. Molecular diagnostics, multiplex assays, and high-throughput immunoassays have expanded test menus, enabling simultaneous detection of multiple biomarkers from a single sample. Automation-compatible reagents and ready-to-use kits improve laboratory efficiency and reduce operational errors, encouraging broader adoption. The development of companion diagnostics and biomarker-driven tests for targeted therapies has further strengthened the strategic role of IVD kits in precision medicine, supporting long-term market expansion.

Key Trends & Opportunities

Shift Toward Molecular and Precision Diagnostics

A key trend shaping the IVD kit market is the growing shift toward molecular diagnostics and precision testing. PCR-based assays, nucleic acid amplification tests, and genetic profiling kits are increasingly used for infectious disease detection, oncology, and pharmacogenomics. These technologies offer high accuracy and early disease detection, improving clinical decision-making. Expanding applications in personalized medicine create opportunities for specialized IVD kits tailored to specific patient populations and therapeutic pathways. As healthcare systems emphasize outcome-based care, demand for advanced diagnostic tools that support targeted treatment selection continues to rise.

- For instance, Thermo Fisher Scientific’s Oncomine™ Precision Assay panels are designed to detect DNA and RNA variants across 50key genes from a single sample, enabling comprehensive genomic profiling using next-generation sequencing workflows within a single laboratory run.

Growth of Decentralized and Point-of-Care Testing

The increasing adoption of decentralized and point-of-care (POC) testing represents a significant opportunity for IVD kit manufacturers. Healthcare providers are prioritizing rapid diagnostics in emergency rooms, outpatient clinics, and remote settings to reduce turnaround times and improve patient outcomes. Compact, user-friendly test kits that require minimal instrumentation are gaining traction, particularly in infectious disease screening and chronic disease management. This trend is further supported by home-based testing and community healthcare programs, expanding the addressable market beyond traditional laboratory environments.

- For instance, QuidelOrtho’s Sofia® 2 Fluorescent Immunoassay Analyzer processes individual tests in approximately 15 minutes and supports wireless data connectivity, enabling deployment across community clinics, mobile testing units, and decentralized public health programs with consistent result reporting.

Key Challenges

Regulatory Complexity and Compliance Requirements

Stringent regulatory frameworks pose a major challenge for the IVD kit market. Compliance with evolving regulatory standards for quality, safety, and clinical performance increases development timelines and costs for manufacturers. Differences in regulatory requirements across regions complicate global product launches and market access. Post-market surveillance obligations and documentation requirements further strain operational resources, particularly for small and mid-sized companies. Delays in regulatory approvals can limit timely commercialization of innovative diagnostic kits, impacting competitive positioning.

Pricing Pressure and Reimbursement Constraints

Intense pricing pressure remains a key challenge, especially in highly competitive and cost-sensitive markets. Hospitals and diagnostic laboratories increasingly negotiate pricing contracts, limiting margins for reagent and kit suppliers. Inadequate or inconsistent reimbursement policies for advanced diagnostic tests further restrict adoption, particularly in emerging economies. Budget constraints within public healthcare systems drive preference for lower-cost alternatives, affecting the uptake of premium or specialized IVD kits. These financial pressures require manufacturers to balance innovation investments with cost efficiency to sustain profitability.

Regional Analysis

North America

North America represents the largest regional market, accounting for approximately 38% of global IVD kit revenue. Market leadership is driven by high diagnostic testing volumes, strong reimbursement frameworks, and widespread adoption of advanced diagnostic technologies. The region benefits from well-established laboratory infrastructure, early uptake of molecular diagnostics, and strong demand for oncology and infectious disease testing. The United States dominates regional demand due to high healthcare spending, routine screening programs, and continuous test menu expansion. Ongoing innovation, automation adoption, and integration of diagnostics into clinical decision-making further reinforce North America’s leading position.

Europe

Europe accounts for around 27% of the global IVD kit market, supported by robust public healthcare systems and standardized diagnostic protocols. Countries such as Germany, France, the UK, and Italy drive demand through high testing frequency in clinical chemistry, immunoassays, and hematology. Aging populations and rising chronic disease prevalence sustain long-term diagnostic needs. The region shows strong adoption of laboratory automation and quality-controlled reagent usage. Regulatory harmonization under regional frameworks supports market stability, while expanding oncology diagnostics and infectious disease surveillance programs continue to strengthen Europe’s contribution.

Asia Pacific

Asia Pacific holds approximately 23% of the global IVD kit market and represents the fastest-growing regional segment. Growth is fueled by expanding healthcare infrastructure, increasing diagnostic access, and rising disease burden across China, India, Japan, and Southeast Asia. Large population bases, improving insurance coverage, and government-led screening initiatives significantly increase testing volumes. Demand is particularly strong for cost-effective reagents, infectious disease diagnostics, and diabetes testing kits. Rapid expansion of private diagnostic laboratories and growing adoption of automated platforms further accelerate regional market development.

Latin America

Latin America contributes about 7% of global IVD kit revenue, driven by improving healthcare access and expanding diagnostic networks. Brazil and Mexico dominate regional demand due to higher laboratory density and increasing investments in healthcare modernization. Infectious disease testing and routine clinical chemistry assays remain key demand drivers, supported by public health programs and epidemiological surveillance. While pricing sensitivity remains a constraint, gradual improvements in reimbursement and laboratory capacity are increasing reagent and kit utilization. The region shows steady growth as diagnostic awareness and preventive testing continue to expand.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of the global IVD kit market. Growth is supported by rising healthcare investments, particularly in Gulf Cooperation Council countries, where advanced diagnostic infrastructure and laboratory automation adoption are increasing. Infectious disease screening, chronic disease monitoring, and hospital-based diagnostics drive demand. In Africa, international health initiatives and public screening programs support essential diagnostic testing, though access remains uneven. Overall, expanding healthcare infrastructure and gradual improvement in diagnostic capabilities underpin steady regional market growth.

Market Segmentations:

By Product

- Reagents and kits

- Instruments

By Test Type

- Clinical chemistry

- Immunoassay / immunochemistry

- Molecular diagnostics

- Hematology

- Urinalysis

By Application

- Oncology

- Infectious diseases

- Diabetes

- Cardiology

- Nephrology

- Autoimmune diseases

- Drug testing / pharmacogenomics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the in vitro diagnostic (IVD) kit market is characterized by the presence of well-established multinational corporations alongside specialized diagnostic companies competing on test portfolio breadth, technological innovation, and global distribution strength. Leading players focus on expanding high-volume reagent and kit offerings across clinical chemistry, immunoassay, and molecular diagnostics to secure recurring revenue streams. Strategic priorities include continuous assay development, automation-compatible kit design, and expansion of test menus aligned with oncology, infectious disease, and chronic disease diagnostics. Companies actively pursue partnerships with hospitals and reference laboratories, while also strengthening regional manufacturing and supply chains to improve responsiveness. Competitive intensity is further shaped by regulatory compliance capabilities and pricing strategies, particularly in cost-sensitive markets. Overall, differentiation through innovation, scalability, and integrated diagnostic solutions remains central to sustaining market position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 17, 2025,Danaher announced a strategic diagnostic development and commercialization partnership with AstraZeneca aimed at scaling precision diagnostics and next-generation AI-powered diagnostic solutions. This initiative focuses on leveraging Danaher’s diagnostics platforms, including molecular and immunoassay technologies, to enhance detection accuracy and integrate advanced analytics into clinical workflows reinforcing Danaher’s long-term innovation pipeline in IVD testing technologies.

- In February 5, 2025, Strategic Diagnostic Business Separation Plan BD announced a plan to separate its Biosciences and Diagnostic Solutions business to enhance focus on growth and innovation in diagnostics and life sciences tools. While not a specific kit launch, this structural move was positioned to sharpen investment in the IVD and diagnostic portfolio and could accelerate future kit development and regulatory submissions.

- In October 2024, WHO Emergency Use Listing for IVD Test Abbott Molecular’s Alinity m MPXV assay received listing on the World Health Organization (WHO) Emergency Use Listing in October 2024. This approval made it the first in-vitro diagnostic test authorized for emergency use for mpox (monkeypox) detection, expanding global access to rapid molecular diagnostics in outbreaks where accurate, scalable testing is essential.

Report Coverage

The research report offers an in-depth analysis based on Product, Test type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The IVD kit market will continue to benefit from rising diagnostic testing volumes driven by chronic disease management and preventive healthcare adoption.

- Reagents and kits will remain the dominant product category due to their recurring consumption across routine and specialized diagnostics.

- Molecular diagnostics will gain stronger traction as precision medicine and early disease detection become central to clinical decision-making.

- Automation-compatible and ready-to-use kits will see increased demand as laboratories prioritize efficiency and error reduction.

- Decentralized and point-of-care testing will expand further across outpatient, emergency, and home-based care settings.

- Oncology and infectious disease applications will remain key demand generators, supported by biomarker-driven testing and surveillance programs.

- Emerging markets will contribute a larger share of global demand as laboratory infrastructure and diagnostic access improve.

- Regulatory compliance and quality standardization will increasingly influence product development and market entry strategies.

- Competitive intensity will remain high, with leading players focusing on portfolio expansion and strategic partnerships.

- Integration of diagnostics with digital health and data analytics will gradually reshape testing workflows and clinical utilization.