Market Overview

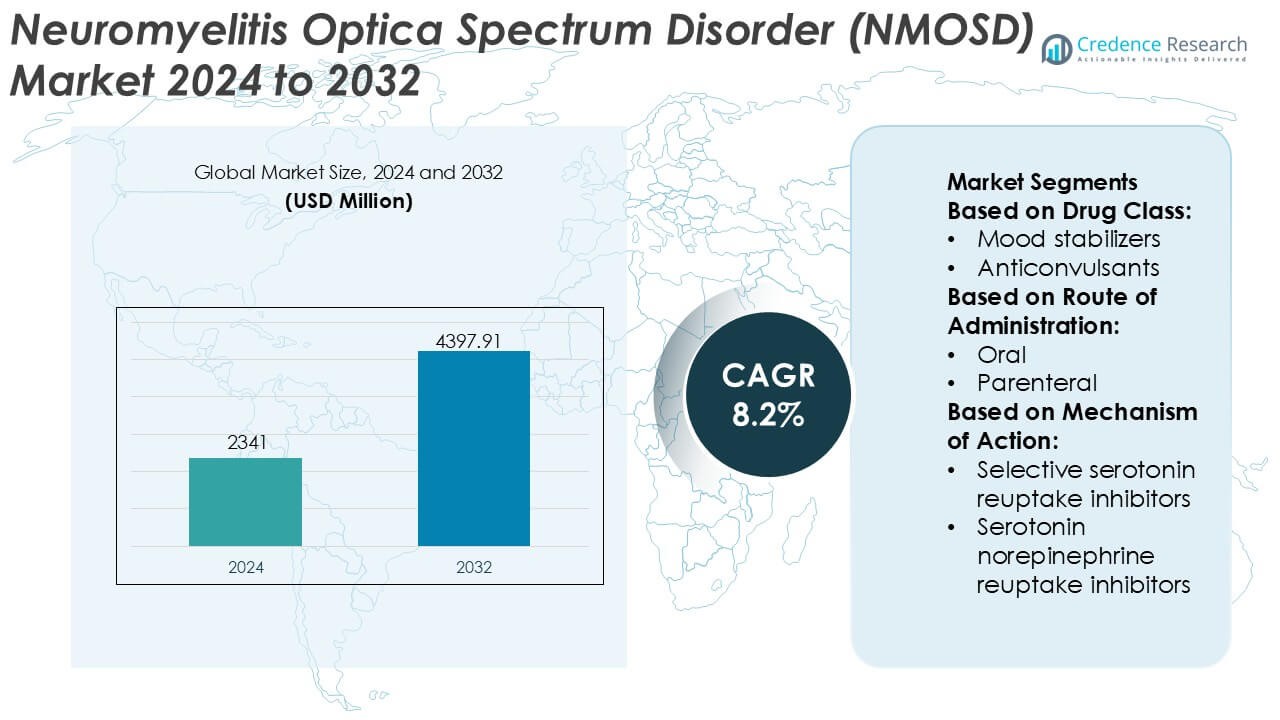

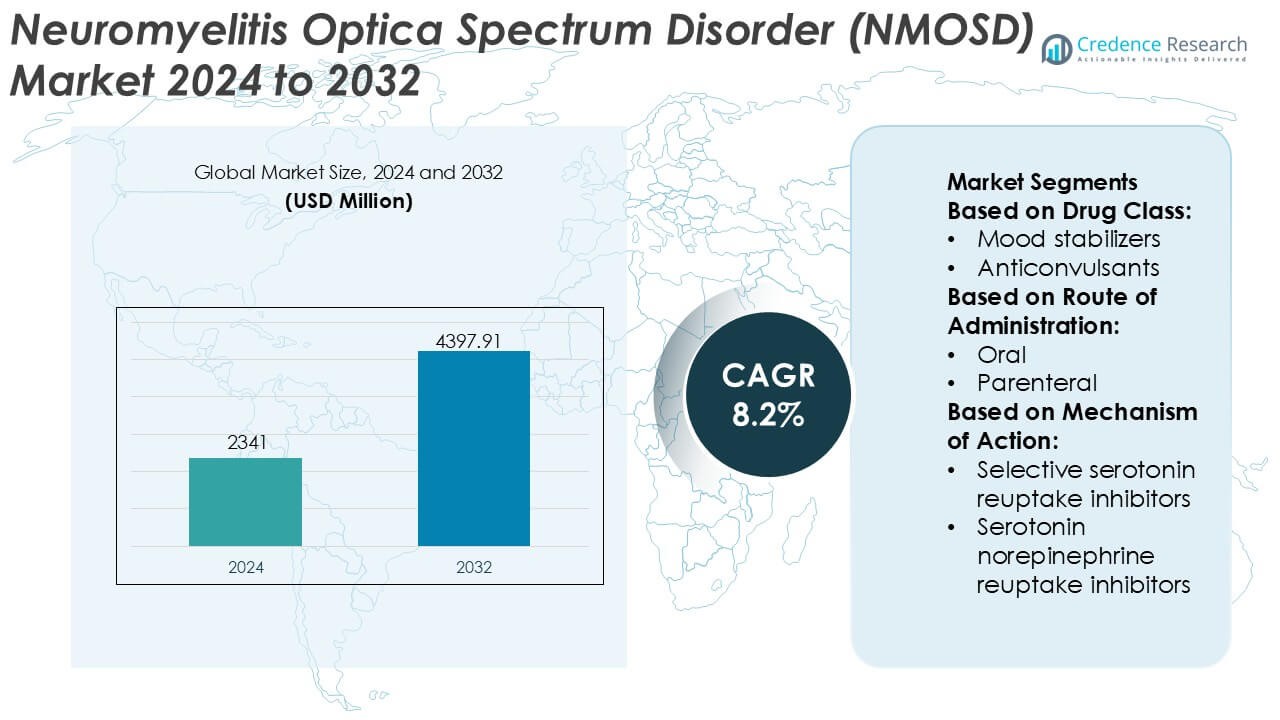

Neuromyelitis Optica Spectrum Disorder (NMOSD) Market size was valued USD 2341 million in 2024 and is anticipated to reach USD 4397.91 million by 2032, at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neuromyelitis Optica Spectrum Disorder (NMOSD) Market Size 2024 |

USD 2341 Million |

| Neuromyelitis Optica Spectrum Disorder (NMOSD) Market, CAGR |

8.2% |

| Neuromyelitis Optica Spectrum Disorder (NMOSD) Market Size 2032 |

USD 4397.91 Million |

The Neuromyelitis Optica Spectrum Disorder (NMOSD) market features a concentrated competitive landscape shaped by established pharmaceutical companies and emerging biopharma players focused on rare autoimmune neurology. Market participants compete through differentiated monoclonal antibodies, expanded indications for complement and B-cell–targeted therapies, and strong late-stage clinical pipelines designed to reduce relapse risk and long-term disability. Strategic priorities emphasize regulatory approvals in orphan indications, lifecycle management, and post-marketing evidence generation to support broader clinical adoption. Regionally, North America leads the NMOSD market with an exact 41% share, supported by early diagnosis rates, favorable reimbursement frameworks, strong patient advocacy networks, and rapid uptake of newly approved targeted therapies across specialized neurology centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The NMOSD market was valued at USD 2,341 million in 2024 and is projected to reach USD 4,397.91 million by 2032, expanding at a CAGR of 8.2%, driven by rising diagnosis rates and increasing adoption of targeted biologic therapies.

- Market growth is supported by strong demand for relapse-prevention therapies, wider use of aquaporin-4 antibody testing, and improved access to orphan drugs across advanced healthcare systems.

- Monoclonal antibody–based therapies represent the dominant treatment segment, accounting for over two-thirds of total demand, reflecting their superior efficacy in reducing relapse frequency and long-term neurological damage.

- The competitive landscape remains concentrated, with leading players focusing on complement inhibition, B-cell targeting mechanisms, and post-approval evidence generation to strengthen long-term therapy adoption.

- Regionally, North America leads with an exact 41% market share, supported by early diagnosis, favorable reimbursement, strong patient advocacy, while high treatment costs and limited awareness restrain faster uptake in emerging regions.

Market Segmentation Analysis:

By Drug Class

By drug class, anticonvulsants emerge as the dominant sub-segment in the NMOSD market, accounting for an estimated 34% market share. Their dominance reflects widespread use in managing neuropathic pain, spasticity, and seizure-like manifestations that frequently accompany NMOSD. Clinicians favor anticonvulsants due to their established efficacy, predictable dosing profiles, and compatibility with long-term neurological care. Antidepressant and anti-anxiety drugs follow, driven by the high prevalence of mood disorders and chronic fatigue in NMOSD patients. Ongoing optimization of combination regimens further sustains demand across this segment.

- For instance, Chugai Pharmaceutical (a member of the Roche Group) discovered and developed satralizumab. It is marketed globally by Roche and Genentech. The regimen consists of a 120 mg subcutaneous dose at weeks 0, 2, and 4 (loading phase), followed by 120 mg every four weeks (maintenance).

By Route of Administration

By route of administration, oral formulations dominate the NMOSD market with an estimated 56% market share, supported by ease of administration and suitability for chronic symptom management. Oral therapies enable long-term outpatient treatment, improve patient adherence, and reduce reliance on hospital-based care. Parenteral routes maintain relevance in acute disease flares and severe symptom control, particularly in hospital settings. However, growing emphasis on home-based care and patient convenience continues to strengthen the position of oral drugs. Advances in extended-release formulations also contribute to sustained uptake within this segment.

- For instance, Pfizer Inc. has advanced oral drug development through small-molecule therapies like etrasimod, engineered for once-daily administration at a 2 mg dose. Validated in controlled clinical programs like ELEVATE UC 52, the therapy demonstrated consistent systemic exposure over 52 weeks and long-term tolerability in patients with chronic autoimmune inflammatory conditions, supported by a pharmacokinetic half-life of approximately 33 hours.

By Mechanism of Action

By mechanism of action, selective serotonin reuptake inhibitors (SSRIs) hold the leading position, capturing approximately 31% market share. Their dominance stems from effectiveness in addressing depression, anxiety, and fatigue commonly associated with NMOSD, while offering favorable safety and tolerability profiles. Clinicians prefer SSRIs for long-term use due to lower cardiovascular and anticholinergic risks compared to tricyclic antidepressants. Serotonin norepinephrine reuptake inhibitors gain traction for patients with concomitant pain symptoms, while other mechanisms remain adjunct options. Expanding recognition of neuropsychiatric burden continues to drive this segment’s growth.

Key Growth Drivers

Rising Awareness and Improved Diagnostic Accuracy

Growing clinical awareness of NMOSD among neurologists and expanded access to advanced diagnostic tools strongly drive market growth. Wider adoption of cell-based assays for aquaporin-4 (AQP4-IgG) and myelin oligodendrocyte glycoprotein (MOG) antibodies enables earlier and more accurate differentiation from multiple sclerosis. Earlier diagnosis supports timely initiation of targeted therapies, reduces relapse severity, and improves long-term outcomes. Education initiatives by specialty societies and patient advocacy groups further accelerate diagnosis rates, expanding the treated patient pool and sustaining demand for disease-specific therapeutics.

- For instance, Roche and Amgen, have supported centralized trial infrastructures utilizing live cell-based AQP4-IgG assays. These programs have screened more than 1,000 patients globally to ensure diagnostic consistency in NMOSD research, often employing longitudinal testing at baseline and subsequent 24-week intervals to monitor serostatus and treatment response.

Expansion of Targeted and Approved Therapies

The introduction and broader adoption of targeted biologics significantly propel the NMOSD market. Therapies that inhibit complement activation, B-cell depletion, or interleukin-6 signaling address core disease mechanisms and demonstrate superior relapse prevention compared with off-label immunosuppressants. Regulatory approvals across major regions increase physician confidence and standardize treatment pathways. As treatment guidelines increasingly recommend targeted agents for maintenance therapy, prescription volumes rise, treatment persistence improves, and manufacturers benefit from sustained, long-term therapy utilization.

- For instance, AbbVie Inc. has expanded its immunology biologics portfolio through monoclonal antibody programs like risankizumab, manufactured using high-concentration subcutaneous formulations delivered in fixed 1-milliliter volumes.

Increasing Focus on Relapse Prevention and Long-Term Management

Clinical emphasis has shifted from acute attack management to proactive relapse prevention and chronic disease control. Evidence linking relapse frequency with irreversible disability encourages clinicians to adopt continuous maintenance therapy. Improved understanding of NMOSD disease burden, including visual impairment and mobility loss, strengthens payer support for preventive treatments. Long-term management strategies, supported by real-world evidence and post-marketing studies, reinforce therapy adoption and expand the market beyond episodic treatment toward sustained care models.

Key Trends & Opportunities

Pipeline Innovation and Next-Generation Therapeutics

Robust research pipelines create meaningful opportunities in the NMOSD market. Developers advance next-generation monoclonal antibodies, long-acting formulations, and subcutaneous delivery options to improve convenience and adherence. Investigational agents targeting novel immune pathways aim to enhance efficacy while reducing infection risk. Combination strategies and personalized treatment approaches based on antibody status further differentiate emerging therapies, offering manufacturers opportunities to address unmet needs and strengthen competitive positioning.

- For instance, AstraZeneca (through Alexion) has advanced next-generation monoclonal antibody platforms like ravulizumab, utilizing Fc-engineering technologies that extend antibody half-life to enable subcutaneous or intravenous dosing intervals of 8 weeks.

Geographic Expansion and Improved Access in Emerging Markets

Improving diagnostic infrastructure and specialist access in emerging economies open new growth avenues. Governments and healthcare systems increasingly recognize rare autoimmune neurological disorders, leading to better referral networks and reimbursement pathways. Partnerships with regional distributors, physician training programs, and patient support initiatives facilitate market entry. As awareness rises and biologic access improves, treatment penetration expands beyond traditionally established markets.

- For instance, Nipocalimab is in late-stage Phase 3 evaluation for NMOSD and Sjögren’s disease, and has already received regulatory submissions for Generalized Myasthenia Gravis (gMG) following successful pivotal trials.

Growing Role of Real-World Evidence and Patient-Centered Care

Stakeholders increasingly rely on real-world evidence to guide treatment decisions and reimbursement. Patient registries, long-term outcome studies, and digital monitoring tools support evidence generation on relapse reduction, safety, and quality-of-life benefits. Patient-centered care models emphasizing adherence support and shared decision-making strengthen therapy persistence. These trends enhance brand credibility, support payer negotiations, and create differentiation in a specialized therapeutic landscape.

Key Challenges

High Treatment Costs and Reimbursement Constraints

The high cost of targeted biologics presents a major challenge for NMOSD market expansion. Budget impact concerns limit reimbursement in cost-sensitive healthcare systems and delay access in emerging regions. Complex prior authorization requirements and step-therapy policies can restrict timely treatment initiation. Manufacturers face pressure to demonstrate long-term value through outcomes data and patient support programs, increasing commercialization complexity while potentially constraining uptake.

Disease Rarity and Limited Patient Identification

NMOSD’s low prevalence complicates patient identification, clinical trial recruitment, and commercial scaling. Misdiagnosis and under-recognition persist in non-specialist settings, limiting timely referral to appropriate care. Small patient populations increase per-patient development and marketing costs, while fragmented care pathways challenge consistent treatment adoption. Overcoming these barriers requires sustained education efforts, specialized networks, and collaboration with advocacy groups to improve diagnosis and long-term engagement.

Regional Analysis

North America

North America dominates the Neuromyelitis Optica Spectrum Disorder (NMOSD) market with an estimated 41% market share, driven by advanced diagnostic capabilities, high disease awareness, and early adoption of targeted biologic therapies. The region benefits from widespread availability of AQP4-IgG testing, strong neurologist density, and well-established referral pathways. Favorable reimbursement frameworks and rapid regulatory approvals support uptake of approved complement inhibitors and B-cell–targeted therapies. Ongoing clinical research activity and strong patient advocacy further enhance early diagnosis and long-term treatment adherence, sustaining North America’s leading position.

Europe

Europe accounts for an estimated 29% share of the global NMOSD market, supported by robust healthcare systems and growing adoption of guideline-driven treatment protocols. Countries such as Germany, France, the UK, and Italy lead regional demand due to specialized neurology centers and improved access to antibody testing. Regulatory harmonization and inclusion of NMOSD therapies in national reimbursement lists strengthen market penetration. However, cost-containment policies and varied reimbursement timelines across countries moderate growth. Increasing real-world evidence generation and cross-border clinical collaboration continue to support steady expansion across the region.

Asia-Pacific

Asia-Pacific holds approximately 18% of the NMOSD market and represents the fastest-expanding regional landscape. Rising disease recognition, expanding neurologist training programs, and improving access to diagnostic assays drive market development. Japan, China, and South Korea contribute significantly due to higher reported prevalence and growing biologic adoption. Government efforts to strengthen rare disease frameworks and expand insurance coverage improve treatment access. While affordability constraints persist in some markets, increasing urban healthcare investment and partnerships with global pharmaceutical companies support accelerating uptake of disease-specific therapies.

Latin America

Latin America represents an estimated 7% market share in the NMOSD market, characterized by gradual improvement in diagnosis and treatment access. Brazil and Mexico lead regional demand due to expanding neurology infrastructure and growing awareness of autoimmune neurological disorders. Access to advanced biologics remains uneven, with reliance on public healthcare systems influencing therapy availability. Delayed diagnosis and reimbursement variability continue to challenge growth. Nevertheless, increasing inclusion of rare diseases in national health agendas and expanding private healthcare participation support moderate but consistent market development.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of the global NMOSD market, reflecting limited diagnosis rates and constrained access to specialized care. Gulf Cooperation Council countries lead regional adoption due to better healthcare funding, availability of biologics, and specialist centers. In contrast, parts of Africa face significant gaps in awareness, diagnostic testing, and reimbursement. Ongoing investments in tertiary care hospitals, physician education initiatives, and gradual expansion of rare disease policies are expected to improve diagnosis and treatment uptake over the forecast period.

Market Segmentations:

By Drug Class:

- Mood stabilizers

- Anticonvulsants

By Route of Administration:

By Mechanism of Action:

- Selective serotonin reuptake inhibitors

- Serotonin norepinephrine reuptake inhibitors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Neuromyelitis Optica Spectrum Disorder (NMOSD) market features including Bristol-Myers Squibb Company, Otsuka Holdings Co., Ltd., Pfizer Inc., Sumitomo Pharma America, Inc., AbbVie Inc., GSK plc, Teva Pharmaceutical Industries Ltd., Johnson & Johnson Services, Inc., Eli Lilly and Company, and AstraZeneca. The Neuromyelitis Optica Spectrum Disorder (NMOSD) market exhibits a competitive environment shaped by innovation intensity, targeted therapy development, and strong regulatory focus on rare neurological diseases. Market participants prioritize biologic therapies that address core immune mechanisms to reduce relapse risk and long-term disability. Competition centers on clinical efficacy, safety differentiation, dosing convenience, and long-term treatment sustainability. Companies actively strengthen their positions through expanded clinical programs, real-world evidence generation, and lifecycle management strategies. Strategic collaborations, licensing agreements, and geographic expansion support broader market access. Reimbursement alignment and physician education remain critical competitive levers, particularly in cost-sensitive regions. Overall, sustained investment in research, regulatory engagement, and patient-centric support programs continues to define competitive success in this specialized and rapidly evolving therapeutic landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Johnson & Johnson acquired Intra-Cellular Therapies, adding CAPLYTA (lumateperone) to its portfolio. This acquisition strengthens the company’s position in the market, expanding treatment options for bipolar I and II depression.

- In October 2024, AbbVie and Gedeon Richter announced a new collaboration to discover and develop new targets for neuropsychiatric conditions. This partnership strengthens AbbVie’s position in the market, focusing on developing new therapies for mood disorders.

- In January 2024, Thorlabs licensed Sensirion’s patented Quantum Cascade Laser (QCL)-based dual-frequency-comb spectroscopy (DFCS) technology to develop new mid-infrared (Mid-IR) sensing platforms for environmental and industrial uses, combining high-speed, high-resolution capabilities for applications like gas sensing and chemical analysis.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Route of Administration, Mechanism of Action and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Targeted biologic therapies will continue to gain prominence as standard-of-care options for long-term relapse prevention.

- Expanded use of advanced antibody testing will enable earlier diagnosis and more precise patient stratification.

- Treatment strategies will increasingly emphasize sustained disease control to limit cumulative neurological disability.

- Ongoing pipeline innovation will introduce therapies with improved safety profiles and more convenient dosing schedules.

- Real-world evidence will play a larger role in guiding clinical decisions and supporting reimbursement discussions.

- Patient-centric care models will strengthen adherence through education, monitoring, and support programs.

- Geographic expansion will improve access to NMOSD therapies in emerging and underserved markets.

- Regulatory frameworks for rare diseases will continue to encourage accelerated development and approval pathways.

- Digital health tools will support long-term disease monitoring and outcome assessment.

- Competitive differentiation will increasingly depend on clinical value, access strategies, and long-term patient outcomes.