Market Overview

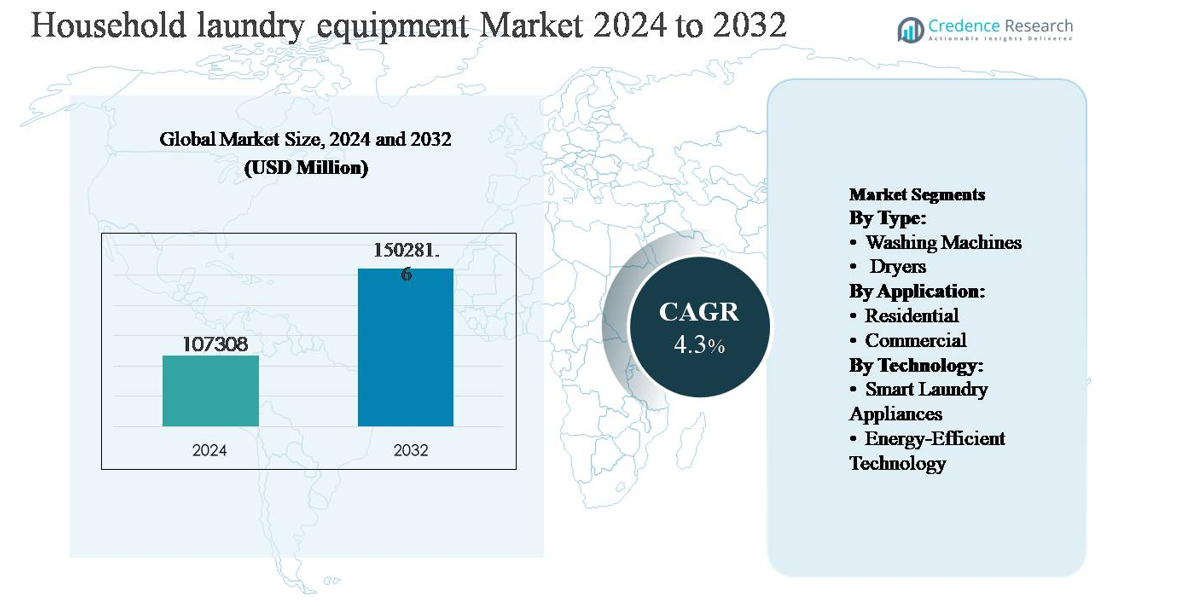

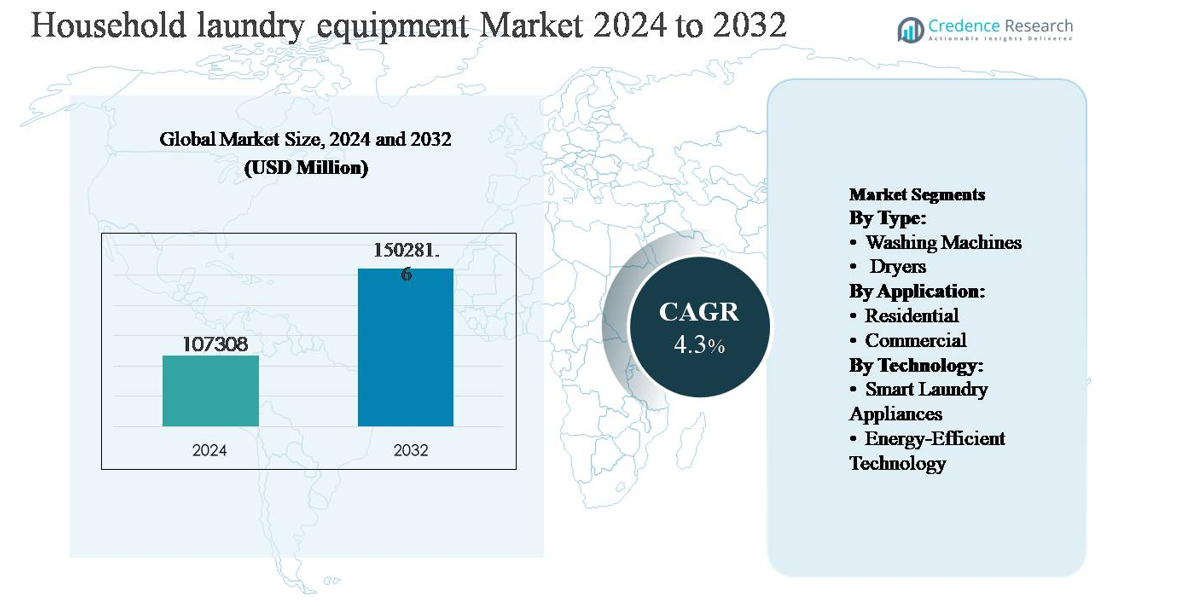

The household laundry equipment market was valued at USD 107,308 million in 2024 and is projected to reach USD 150,281.6 million by 2032, expanding at a compound annual growth rate (CAGR) of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Household Laundry Equipment Market Size 2024 |

USD 107,308 million |

| Household Laundry Equipment Market, CAGR |

4.3% |

| Household Laundry Equipment Market Size 2032 |

USD 150,281.6 million |

The household laundry equipment market is dominated by a group of globally established manufacturers that compete through broad product portfolios, technology leadership, and strong distribution networks. Key players include Whirlpool Corporation, Electrolux AB, LG Electronics, Samsung Electronics, Haier Group, BSH Hausgeräte, Miele & Cie. KG, Panasonic Corporation, General Electric, and Siemens AG. These companies emphasize energy efficiency, smart connectivity, and premium design to address evolving consumer preferences and regulatory standards. Asia Pacific leads the global market, accounting for approximately 38% of total market share, supported by large population bases, rapid urbanization, and rising penetration of washing machines and dryers in China, India, and Southeast Asia. Europe follows, driven by replacement demand and high adoption of energy-efficient appliances, while North America remains a mature but stable market supported by innovation-led upgrades.

Market Insights

- The household laundry equipment market was valued at USD 107308 million in 2024 and is projected to reach USD 150281.6 million by 2032, expanding at a CAGR of 4.3% during the forecast period.

- Market growth is primarily driven by rising urbanization, increasing disposable incomes, and higher replacement demand for energy-efficient and water-saving washing machines, particularly in developing economies.

- Key trends include growing adoption of smart and connected laundry appliances, inverter motor technology, and front-load washing machines, which represent the dominant product segment with over 44% market share due to superior efficiency and performance.

- The competitive landscape is characterized by strong global players such as Whirlpool, LG, Samsung, Electrolux, and Haier, which focus on product innovation, premiumization, and expansion of online distribution channels to strengthen market presence.

- Asia Pacific leads the market with approximately 38% share, followed by Europe at 27% and North America at 22%, while high upfront costs and price sensitivity in emerging markets continue to restrain faster adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

By type, washing machines dominate the household laundry equipment market, accounting for the largest market share due to their essential role in daily household operations and higher penetration across both developed and emerging economies. Demand is driven by rising urbanization, increasing disposable incomes, and the replacement of semi-automatic models with fully automatic front-load and top-load machines. Continuous innovation in capacity optimization, noise reduction, and fabric-care technologies further strengthens adoption. Dryers, while growing steadily, remain secondary, with uptake primarily supported by space-constrained urban households and regions with colder or humid climates.

- For instance, LG Electronics’ front-load washers in the AI DD™ series support drum capacities up to 21 kg and operate with spin speeds reaching 1,400 rpm, while Samsung’s EcoBubble™ models integrate Digital Inverter Motors rated for operational noise levels as low as 48 dB during wash cycles.

By Application:

By application, the residential segment holds the dominant market share, supported by the widespread ownership of washing appliances in single- and multi-family homes. Growth is fueled by lifestyle modernization, rising housing construction, and growing consumer preference for convenience and time efficiency. Increasing adoption of compact and smart appliances in urban apartments further reinforces residential demand. The commercial segment, including laundromats, hospitality, and healthcare facilities, shows consistent growth, driven by higher equipment durability requirements and expanding service-based laundry models in urban and semi-urban areas.

- For instance, Samsung’s Bespoke AI washing machines integrate Wi-Fi–enabled SmartThings connectivity and support drum capacities up to 11 kg, while LG Electronics’ ThinQ-enabled washers incorporate AI DD™ motors capable of detecting fabric weight and adjusting wash motions across 6 distinct motion patterns.

By Technology:

By technology, energy-efficient laundry equipment represents the dominant sub-segment, capturing the largest market share due to stringent energy regulations and growing consumer awareness of electricity and water consumption. Manufacturers emphasize inverter motors, low-water wash systems, and high energy-rating compliance to drive adoption. Smart laundry appliances are witnessing faster growth, supported by increasing smart home penetration, IoT integration, and mobile-based remote monitoring. However, their higher upfront costs position energy-efficient models as the primary revenue contributor during the forecast period.

Key Growth Drivers

Rising Urbanization and Household Formation

Rapid urbanization and sustained growth in household formation remain primary drivers of the household laundry equipment market. Expanding urban populations are increasing demand for essential home appliances, particularly washing machines and dryers, across both developed and emerging economies. Higher apartment living and nuclear family structures favor compact, fully automatic, and space-efficient laundry solutions. In addition, rising disposable incomes and improved access to consumer financing are enabling first-time buyers to adopt modern laundry equipment. Replacement demand is also accelerating as aging appliances are substituted with technologically advanced models offering better performance, durability, and aesthetics, reinforcing steady market expansion.

- For instance, Bosch’s Serie 6 front-load washing machines are engineered with cabinet depths of approximately 600 mm and support drum capacities up to 9 kg, making them suitable for standard apartment utility spaces.

Technological Advancements and Product Innovation

Continuous technological innovation significantly drives market growth by enhancing functionality, efficiency, and user convenience. Manufacturers are introducing advanced features such as inverter motors, sensor-based load detection, steam wash, and fabric-care programs to improve washing performance while reducing water and energy consumption. Integration of smart connectivity, mobile app control, and AI-enabled cycle optimization further differentiates premium offerings. These innovations support product premiumization and encourage consumers to upgrade existing appliances. The focus on noise reduction, faster wash cycles, and multi-functionality also improves user experience, sustaining demand across diverse income groups and housing formats.

- “For instance, Electrolux AB’s SteamCare washing machines have a HygienicCare program that uses steam at 40°Cto help remove up to 99.9% of allergens and germs, while its inverter motors support spin speeds reaching 1,400 rpm for effective moisture extraction.”

Energy Efficiency Regulations and Sustainability Awareness

Stringent energy efficiency standards and rising environmental awareness strongly support market growth. Governments worldwide are implementing regulations that mandate lower energy and water consumption, encouraging manufacturers to develop compliant, high-efficiency appliances. Consumers increasingly prioritize appliances with higher energy ratings to reduce long-term operating costs and environmental impact. This shift is particularly evident in regions facing water scarcity and rising electricity tariffs. As a result, energy-efficient washing machines and dryers are becoming mainstream, driving higher replacement rates and supporting long-term market expansion.

Key Trends & Opportunities

Growing Adoption of Smart and Connected Laundry Appliances

Smart laundry equipment represents a key trend and growth opportunity, supported by increasing smart home adoption and digitalization. Consumers are showing growing interest in appliances that offer remote monitoring, predictive maintenance alerts, and customized wash programs via mobile applications. Integration with voice assistants and home automation systems enhances convenience and user engagement. While smart appliances currently account for a smaller share due to higher costs, declining component prices and expanding internet penetration are expected to broaden adoption. Manufacturers can leverage this trend through software-driven differentiation and value-added services.

- For instance, “BSH Hausgeräte GmbH has integrated its Home Connect platform across Bosch and Siemens washing machines, enabling remote cycle control and diagnosticsvia built-in Wi-Fi modules operating over encrypted networks (typically 2.4 GHz).

Premiumization and Demand for Compact Solutions

Premiumization is emerging as a major opportunity as consumers increasingly seek high-performance, aesthetically appealing, and multifunctional laundry equipment. Features such as larger capacities, faster cycles, steam-based hygiene, and low-noise operation are gaining traction, particularly in urban households. At the same time, demand for compact and stackable laundry solutions is rising due to smaller living spaces. This trend creates opportunities for manufacturers to develop modular, space-saving designs that cater to apartments and shared housing environments, supporting higher margins and brand differentiation.

- “For instance, Miele’s W1 front-load washing machines support drum capacities up to 9 kgand incorporate TwinDos automatic detergent dosing systems, which are highly precise and save up to 30% on detergent by automatically adjusting the amount to the specific load and soil level.

Key Challenges

High Initial Costs and Price Sensitivity

High upfront costs remain a significant challenge, particularly for advanced and smart laundry equipment. Price sensitivity among consumers in developing regions limits adoption of premium models, despite their long-term cost benefits. Fluctuations in raw material prices and logistics costs further constrain manufacturers’ ability to offer competitively priced products. This challenge is compounded by the presence of low-cost local players, which intensifies price competition and pressures margins for global brands.

Repair, Maintenance, and After-Sales Complexity

Increasing technological complexity in modern laundry equipment presents challenges related to maintenance and after-sales service. Advanced electronic components and software-driven features require skilled technicians, increasing repair costs and service dependency. Inadequate service infrastructure in certain regions can negatively impact customer satisfaction and brand perception. Ensuring reliable after-sales support while controlling service costs remains a critical challenge for manufacturers as product complexity continues to increase.

Regional Analysis

Asia Pacific

Asia Pacific leads the household laundry equipment market with approximately 38% market share, driven by rapid urbanization, rising disposable incomes, and expanding middle-class populations in China, India, and Southeast Asia. High-volume residential construction and increasing penetration of automatic washing machines strongly support demand. Replacement of semi-automatic units with fully automatic and energy-efficient models is a major growth driver. Local manufacturing, competitive pricing, and strong distribution networks further strengthen regional dominance. Government initiatives promoting energy-efficient appliances also contribute to sustained market expansion across both urban and semi-urban areas.

North America

North America accounts for around 26% of the global market, supported by high household appliance penetration and strong replacement demand. Consumers in the U.S. and Canada prioritize advanced features, large-capacity machines, and energy-efficient technologies, driving premium product sales. Widespread adoption of dryers, higher awareness of sustainability, and strong smart home integration further reinforce demand. Growth remains steady due to product upgrades rather than first-time purchases. Well-established after-sales infrastructure and strong brand loyalty among consumers continue to support stable revenue generation in the region.

Europe

Europe holds approximately 22% market share, driven by stringent energy efficiency regulations and strong environmental awareness among consumers. Demand is led by Western Europe, where front-load washing machines and high-efficiency appliances dominate. Replacement cycles are accelerated by regulatory compliance requirements and rising electricity costs. Compact and built-in laundry solutions are increasingly preferred due to smaller living spaces. Eastern Europe contributes incremental growth through improving household incomes and appliance penetration. Manufacturers focus on innovation, low water consumption, and premium designs to maintain competitiveness across the region.

Latin America

Latin America represents about 8% of the global household laundry equipment market, supported by gradual urban expansion and improving consumer purchasing power. Brazil and Mexico are key contributors, driven by rising demand for automatic washing machines in urban households. Market growth is primarily volume-driven, with affordability and durability being key purchase criteria. Energy-efficient models are gaining traction as electricity costs rise. However, economic volatility and price sensitivity limit rapid adoption of premium appliances, resulting in moderate but steady regional growth.

Middle East & Africa

The Middle East & Africa accounts for approximately 6% of the market, driven by urban housing development and increasing appliance adoption in Gulf countries. Demand is strongest in urban centers, supported by higher disposable incomes and preference for fully automatic washing machines. In Africa, growth remains gradual due to lower penetration rates, though rising electrification and urbanization create long-term opportunities. Climatic conditions limit dryer adoption, while demand for durable, water-efficient machines remains strong. Infrastructure development and expanding retail networks support incremental market growth.

Market Segmentations:

By Type:

By Application:

By Technology:

- Smart Laundry Appliances

- Energy-Efficient Technology

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The household laundry equipment market features a competitive landscape dominated by globally established manufacturers alongside strong regional players. Leading companies such as Whirlpool Corporation, LG Electronics, Samsung Electronics, Haier Group, AB Electrolux, Bosch (BSH Home Appliances), Panasonic Corporation, Miele Group, Hitachi Appliances, and Sharp Corporation compete through broad product portfolios, technological innovation, and extensive distribution networks. Market leaders focus on energy-efficient designs, smart connectivity, and premium features to strengthen brand positioning and margins. Strategic initiatives include continuous product launches, capacity expansion, localization of manufacturing, and partnerships with retail and e-commerce platforms. Companies also invest heavily in after-sales service infrastructure and warranty programs to enhance customer loyalty. Competitive intensity remains high due to pricing pressure from regional manufacturers, driving established players to emphasize product differentiation, reliability, and sustainability to maintain market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2025: LG Electronics launched a new range of AI-powered washing machines featuring its AI DD 2.0 technology in India. This lineup comprises 10 distinct models across Front Load, Top Load, and Washer-Dryer formats, engineered for intelligent fabric detection, improved hygiene cycles, and adaptive load handling to balance performance and convenience.

- In May 2025, Samsung expanded its laundry portfolio in India by launching Bespoke AI Top-Load Washing Machines available with capacities of 8 kg, 10 kg, 12 kg, and 14 kg, incorporating AI Wash, AI Energy Mode, and AI Vibration Reduction Technology Plus (VRT+) to optimize fabric care, water levels, and cycle performance. These models also feature Digital Inverter Motors with a 20-year warranty on the motor for extended durability.

- In April 2025, Samsung Electronics Co., Ltd. In international markets, Samsung introduced Bespoke AI Top-Load Washers in 21-inch, 24-inch, and 25-inch variants, marking the first integration of its AI suite (AI Wash, AI Energy Mode, and VRT+T) into top-load configurations to enhance smart washing efficiency and quiet operation.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will steadily increase as urbanization and household formation continue across emerging economies.

- Smart and connected laundry appliances will see higher adoption due to growing integration with home automation ecosystems.

- Energy-efficient and water-saving technologies will remain a primary focus in response to stricter environmental regulations.

- Front-load and inverter-based washing machines will strengthen their dominance due to lower operating costs and improved performance.

- Manufacturers will increasingly emphasize premium features to drive value growth in mature markets.

- Online and direct-to-consumer sales channels will expand, improving product accessibility and price transparency.

- Compact and space-saving laundry equipment will gain traction in urban apartments and smaller households.

- Product replacement cycles will shorten as consumers upgrade to advanced and smart-enabled models.

- Sustainability initiatives, including recyclable materials and low-impact manufacturing, will influence product development strategies.

- Competition will intensify as global brands and regional players invest in innovation, localization, and after-sales service.