Market Overview

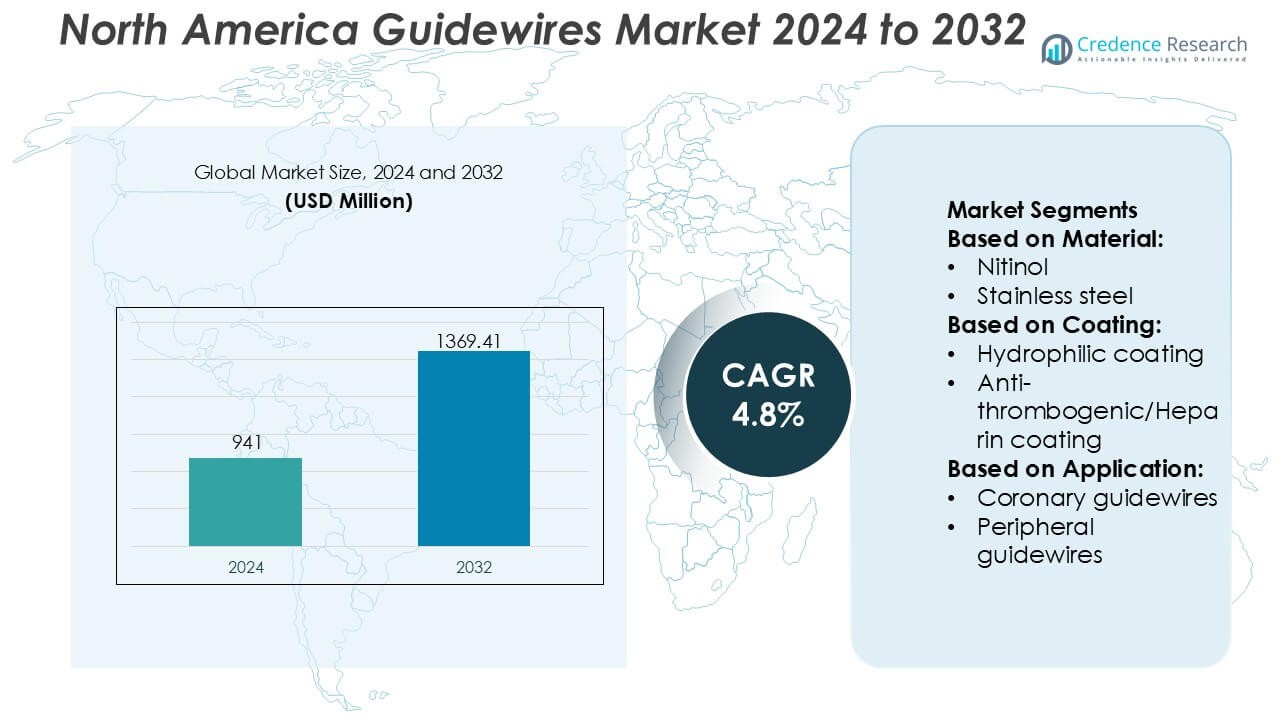

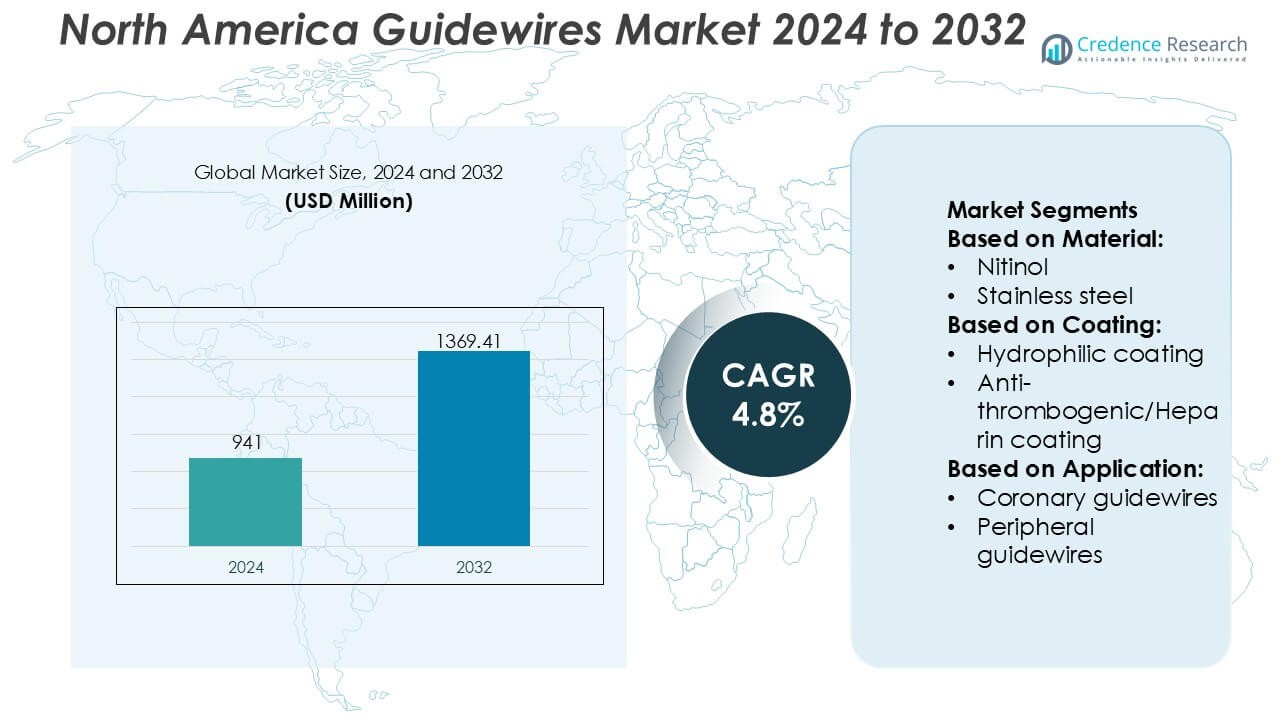

North America Guidewires Market size was valued USD 941 million in 2024 and is anticipated to reach USD 1369.41 million by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Guidewires Market Size 2024 |

USD 941 Million |

| North America Guidewires Market, CAGR |

4.8% |

| North America Guidewires Market Size 2032 |

USD 1369.41 Million |

The North America guidewires market is led by well-established medical device manufacturers with broad interventional portfolios, strong regulatory expertise, and deep relationships with hospitals and catheterization laboratories. These players compete through continuous innovation in guidewire materials, coatings, and design to improve procedural precision, safety, and efficiency across coronary, peripheral, and neurovascular applications. Robust distribution networks, clinician training programs, and compatibility with advanced catheter systems further strengthen competitive positioning. Within the region, the United States stands as the leading market, holding an exact 72% share, driven by high procedure volumes, advanced healthcare infrastructure, rapid adoption of minimally invasive techniques, and strong reimbursement frameworks. The country’s concentration of specialized interventional centers and early uptake of next-generation devices continues to reinforce its dominance in the North America guidewires market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America guidewires market was valued at USD 941 million in 2024 and is projected to reach USD 1,369.41 million by 2032, expanding at a CAGR of 4.8% over the forecast period.

- Rising volumes of minimally invasive cardiovascular and peripheral interventions continue to drive demand, with coronary guidewires remaining the dominant segment due to their extensive use in PCI procedures.

- Ongoing innovation in materials, hydrophilic coatings, and torque-control technologies shapes market trends, enabling improved procedural precision and shorter intervention times.

- Competition remains strong, supported by broad product portfolios, regulatory expertise, clinician training programs, and well-established distribution networks across hospitals and catheterization laboratories.

- Regionally, the United States leads the North America guidewires market with an exact 72% share, supported by advanced healthcare infrastructure, high procedure volumes, favorable reimbursement, and early adoption of next-generation interventional devices.

Market Segmentation Analysis:

By Material

The North America guidewires market, segmented by material, is led by Nitinol, which holds the dominant share at approximately 46%. Its prevalence stems from superior shape memory, kink resistance, and flexibility, which support complex coronary and neurovascular navigation. Nitinol guidewires enable consistent torque response and atraumatic vessel access, aligning with the region’s high procedural volumes in minimally invasive interventions. Stainless steel follows, favored for cost efficiency and pushability in standard procedures. Hybrid materials gain traction by combining torque control with flexibility, while other materials serve niche clinical needs.

- For instance, ASAHI INTECC’s CHIKAI and SION series utilize composite cores featuring proprietary ACT ONE™ technology, a multi-wire stainless steel coil construction. These wires are available in a standard 0.014-inch diameter and working lengths up to 300 cm.

By Coating

Based on coating, hydrophilic-coated guidewires dominate the North America market with an estimated 52% share, driven by their low-friction surface that improves trackability and reduces vessel trauma. High adoption reflects growing preference for complex coronary and peripheral interventions that demand smooth lesion crossing. Anti-thrombogenic/heparin coatings support procedures requiring reduced clot formation risk, particularly in prolonged interventions. Hydrophobic, silicone, and TFE coatings address specific handling and durability requirements. Non-coated guidewires retain limited use in cost-sensitive or short-duration procedures where advanced lubricity is not critical.

- For instance, Cook Medical’s Roadrunner® PC guidewire utilizes a proprietary AQ® hydrophilic coating and is available in 0.035-inch or 0.038-inch diameters with working lengths extending to 260 cm.

By Application

By application, coronary guidewires represent the dominant sub-segment in North America, accounting for around 48% of total demand. This leadership is driven by high prevalence of cardiovascular disease, advanced catheterization lab infrastructure, and strong adoption of PCI procedures across the U.S. and Canada. Continuous innovation in torque control and tip load optimization supports clinical outcomes in complex coronary lesions. Peripheral guidewires follow, supported by rising PAD interventions, while neurovascular and urology guidewires grow steadily due to expanding minimally invasive treatment adoption.

Key Growth Drivers

Rising Prevalence of Cardiovascular and Peripheral Vascular Diseases

The North America guidewires market benefits strongly from the high and growing burden of cardiovascular and peripheral vascular diseases. Aging demographics, sedentary lifestyles, obesity, and diabetes increase the incidence of coronary artery disease, peripheral artery disease, and complex vascular conditions that require catheter-based diagnosis and intervention. Interventional cardiology and endovascular procedures rely heavily on high-performance guidewires to navigate tortuous anatomy with precision. Continuous procedural volume growth across hospitals and ambulatory surgical centers sustains consistent demand for advanced coronary and peripheral guidewires.

- For instance, Abbott Cardiovascular’s HI-TORQUE BALANCE MIDDLEWEIGHT™ (BMW™) Universal II guidewire features a 0.014-inch diameter with an ELASTINITE™ nitinol distal core.

Expansion of Minimally Invasive and Image-Guided Procedures

Clinical preference continues to shift toward minimally invasive procedures due to shorter recovery times, lower complication rates, and reduced overall healthcare costs. Guidewires form a foundational component of these procedures across cardiology, neurovascular, urology, and peripheral interventions. In North America, strong reimbursement frameworks and widespread adoption of image-guided technologies support procedural expansion. This environment accelerates demand for guidewires with enhanced torque control, lubricity, and visibility, supporting safer navigation and improved procedural efficiency in complex interventions.

- For instance, Cordis has advanced its guidewire portfolio through platforms such as the Emerald®, AQUATRACK®, and VASSALLO™ GT families. These incorporate stainless-steel and nitinol core constructions in standard diameters of 0.014-inch, 0.018-inch, and 0.035-inch, with working lengths extending to 260 cm and 300 cm to facilitate complex peripheral interventions and device exchanges.

Continuous Product Innovation and Technological Advancements

Ongoing innovation in guidewire design acts as a critical growth catalyst in the region. Manufacturers focus on advanced materials such as nitinol cores, hybrid constructions, and specialized coatings to improve flexibility, kink resistance, and tactile feedback. These innovations address clinician demand for greater control and safety during complex procedures. Rapid integration of hydrophilic and anti-thrombogenic coatings further enhances clinical performance. North America’s strong regulatory clarity and high clinician receptivity to innovation support faster commercialization and adoption of next-generation guidewires.

Key Trends & Opportunities

Shift Toward Specialized and Application-Specific Guidewires

A clear trend toward application-specific guidewires is reshaping the North America market. Clinicians increasingly prefer guidewires optimized for coronary, peripheral, neurovascular, and urology procedures rather than general-purpose products. This shift creates opportunities for differentiated portfolios targeting lesion complexity, vessel size, and procedural goals. Manufacturers that offer broad yet specialized product ranges gain competitive advantage. Customization around stiffness profiles, tip load, and coating combinations supports improved procedural success and drives premium product adoption.

- For instance, B. Braun SE designs specialty guidewires for vascular access and urology procedures using stainless-steel and nitinol constructions in standard diameters such as 0.018-inch and 0.035-inch, with J-tip and straight-tip options to support controlled entry and reduced vessel trauma.

Growth of Outpatient and Ambulatory Surgical Centers

The rapid expansion of ambulatory surgical centers presents a significant opportunity for the guidewires market. Cost containment pressures and patient preference for outpatient care push a growing number of vascular and cardiac interventions outside traditional hospitals. These settings prioritize efficient, reliable, and easy-to-use devices that support high case turnover. Guidewire suppliers benefit from increased procedure volumes and recurring demand, particularly for versatile products that balance performance with cost-effectiveness in outpatient clinical environments.

- For instance, AngioDynamics offers guidewire solutions within its peripheral access portfolio, including hydrophilic-coated guidewires with standard diameters of 0.035 inch and working lengths up to 260 cm, designed to support efficient navigation during peripheral vascular interventions.

Integration of Training, Simulation, and Clinical Support Programs

Manufacturers increasingly invest in clinician training, simulation platforms, and procedural support programs to strengthen product adoption. In North America, hospitals value suppliers that provide education alongside devices to improve outcomes and reduce learning curves. This trend creates opportunities for companies to build long-term relationships with clinicians and healthcare systems. Enhanced training also encourages the adoption of advanced guidewire technologies, particularly in complex coronary and peripheral interventions.

Key Challenges

Pricing Pressure and Cost Containment Initiatives

Despite strong demand fundamentals, the North America guidewires market faces ongoing pricing pressure. Hospitals and group purchasing organizations emphasize cost containment, placing downward pressure on margins, especially for commoditized guidewire segments. Competitive tendering and bundled purchasing limit pricing flexibility for manufacturers. Companies must balance innovation investment with cost efficiency, while clearly demonstrating clinical and economic value to maintain premium pricing in an increasingly cost-sensitive procurement environment.

Regulatory and Clinical Validation Requirements

Stringent regulatory and clinical validation requirements present another key challenge. Guidewires must meet rigorous safety, performance, and biocompatibility standards before commercialization. Any design modification or material change can trigger additional testing and approval timelines. In North America, heightened scrutiny around device safety and post-market surveillance increases compliance costs. These requirements may slow product launches and create barriers for smaller manufacturers, intensifying competition among established players with robust regulatory capabilities.

Regional Analysis

North America

North America dominates the global guidewires market with an estimated 41% market share, supported by high procedural volumes and early adoption of advanced interventional technologies. The region benefits from a strong prevalence of cardiovascular and peripheral vascular diseases, well-established reimbursement systems, and widespread availability of catheterization laboratories. Hospitals and ambulatory surgical centers consistently adopt premium guidewires with advanced coatings and superior torque control to support complex interventions. Continuous product innovation, strong regulatory clarity, and the presence of leading medical device manufacturers further reinforce North America’s leadership position.

Europe

Europe accounts for approximately 27% of the global guidewires market, driven by a mature healthcare infrastructure and steady growth in minimally invasive procedures. Countries such as Germany, France, and the United Kingdom lead demand due to high cardiovascular disease burden and strong interventional cardiology adoption. Public healthcare systems emphasize clinical outcomes and safety, supporting consistent use of high-quality guidewires. While pricing pressure remains moderate due to centralized procurement, technological upgrades and replacement demand sustain stable market growth across Western and Northern Europe.

Asia-Pacific

Asia-Pacific holds an estimated 21% market share and represents the fastest-growing regional market for guidewires. Rapid expansion of healthcare infrastructure, rising cardiovascular disease prevalence, and increasing access to interventional procedures drive demand. China, Japan, and India lead regional growth, supported by expanding cath lab capacity and improving physician expertise. Cost-sensitive procurement favors a mix of premium and value-based guidewires. Increasing investments in private hospitals and medical tourism further enhance adoption of advanced guidewire technologies across the region.

Latin America

Latin America contributes around 7% of the global guidewires market, supported by gradual improvements in healthcare access and procedural capabilities. Brazil and Mexico dominate regional demand due to expanding interventional cardiology services and growing private healthcare investment. Public-sector budget constraints limit adoption of premium products, encouraging demand for cost-effective guidewires. However, rising awareness of minimally invasive procedures and steady growth in cardiovascular interventions continue to support incremental market expansion across major urban centers.

Middle East & Africa

The Middle East & Africa region accounts for approximately 4% market share, reflecting developing procedural infrastructure and uneven healthcare access. Gulf Cooperation Council countries drive most demand through investments in advanced hospitals and specialist cardiac centers. In contrast, parts of Africa show limited adoption due to resource constraints. Growth remains supported by rising non-communicable disease prevalence and government initiatives to strengthen tertiary care capabilities. Demand centers on reliable, versatile guidewires suited for both basic and complex interventions.

Market Segmentations:

By Material:

By Coating:

- Hydrophilic coating

- Anti-thrombogenic/Heparin coating

By Application:

- Coronary guidewires

- Peripheral guidewires

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The North America guidewires market players such as Merit Medical Systems, ASAHI INTECC, Cook Medical, Abbott Laboratories, Cordis, B. Braun SE, AngioDynamics, Medtronic, Boston Scientific, and Becton, Dickinson and Company. The North America guidewires market exhibits a highly competitive landscape driven by continuous product innovation, strong clinical adoption, and a mature healthcare infrastructure. Market participants compete by enhancing guidewire performance characteristics such as torque response, tip durability, kink resistance, and surface coatings to support complex interventional procedures. Portfolio depth across coronary, peripheral, neurovascular, and urology applications remains a key competitive factor, enabling suppliers to address diverse procedural needs. Companies prioritize regulatory compliance, quality assurance, and clinician training to strengthen market credibility and long-term adoption. Strategic focus on hospital contracts, group purchasing organizations, and integrated catheter-system compatibility further shapes competitive dynamics. In addition, investments in advanced materials and coating technologies support differentiation in procedure efficiency and patient safety. Overall, competition centers on clinical reliability, innovation cadence, and strong distribution capabilities across the North America guidewires market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Merit Medical Systems

- ASAHI INTECC

- Cook Medical

- Abbott Laboratories

- Cordis

- Braun SE

- AngioDynamics

- Medtronic

- Boston Scientific

- Becton, Dickinson and Company

Recent Developments

- In June 2025, MedHub-AI, an Israel-based startup specializing in AI-powered cardiovascular diagnostics, received approval from Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) for AutocathFFR. This innovative software solution uses AI to evaluate coronary physiology non-invasively, calculating fractional flow reserve values from standard X-ray coronary angiograms without requiring guidewires or vasodilatory agents.

- In February 2025, Asahi Intecc Co., Ltd. announced the launch of its ASAHI Miracle Neo 3 guidewire, designed to enhance safety and precision in complex coronary interventions. Blunt Tip Design The 0.36mm (0.014″) diameter tip with a 3gf load minimizes the risk of vessel trauma while ensuring smooth navigation through.

- In January 2025, Olympus Latin America (OLA), a subsidiary of Olympus Corporation, acquired the distribution business of Sur Medical SpA in Chile, establishing a direct presence in the Chilean medical technology market.

Report Coverage

The research report offers an in-depth analysis based on Material, Coating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will benefit from rising procedural volumes in cardiovascular, peripheral, and neurovascular interventions across North America.

- Manufacturers will continue advancing guidewire materials to improve torque control, flexibility, and kink resistance for complex anatomies.

- Adoption of hydrophilic and specialty coatings will expand to enhance trackability and reduce procedural time.

- Demand will grow for application-specific guidewires tailored to coronary, peripheral, neurovascular, and urology procedures.

- Hospitals and ambulatory surgical centers will increasingly prioritize guidewires that integrate seamlessly with advanced catheter systems.

- Ongoing investments in physician training and clinical education will support faster adoption of next-generation guidewire technologies.

- Regulatory approvals for innovative designs will accelerate product refresh cycles and intensify competitive differentiation.

- Supply chain resilience and localized manufacturing strategies will gain importance to ensure consistent product availability.

- Cost-efficiency and value-based procurement will influence purchasing decisions without compromising clinical performance.

- Technological innovation and strong distribution networks will remain central to sustaining growth in the North America guidewires market.