Market Overview

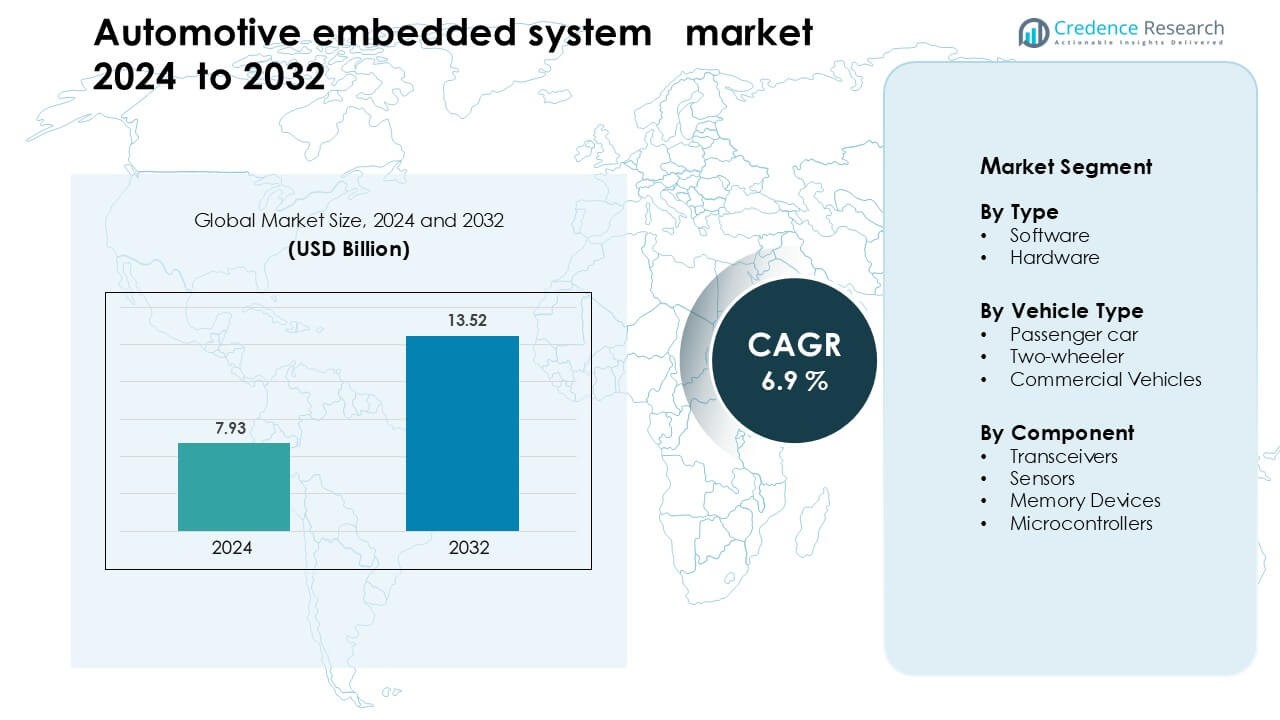

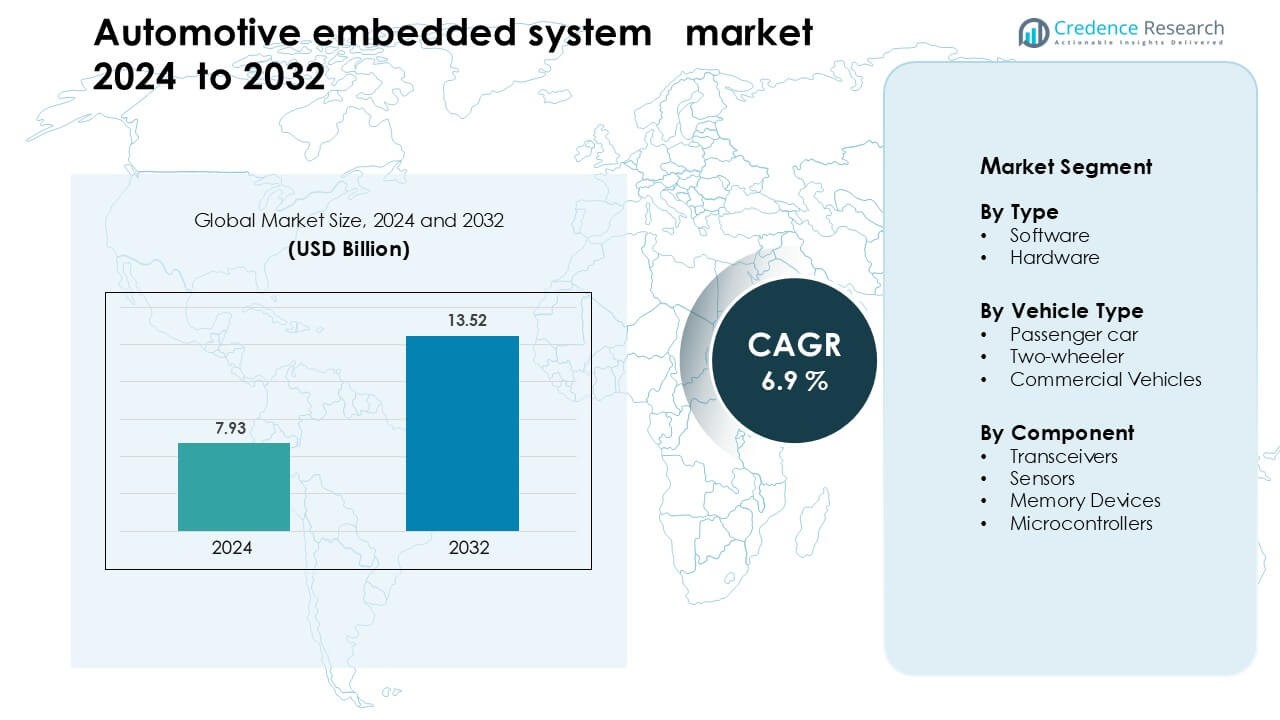

Automotive embedded system market was valued at USD 7.93 billion in 2024 and is anticipated to reach USD 13.52 billion by 2032, growing at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Embedded System Market Size 2024 |

USD 7.93 Billion |

| Automotive Embedded System Market, CAGR |

6.9% |

| Automotive Embedded System Market Size 2032 |

USD 13.52 Billion |

The automotive embedded system market is driven by major players including Texas Instruments, Harman International, Denso, Hella KGaA Hueck & Co., Infineon Technologies, Toshiba, Magna International, Mitsubishi Electric, Continental AG, and Valeo. These companies lead through strong portfolios in microcontrollers, sensors, power electronics, and software-defined vehicle platforms. They support advanced safety systems, electrification, and connected vehicle architectures, which increase embedded content across all vehicle classes. Asia Pacific remained the leading region in 2024 with about 38% share, supported by high vehicle production, strong semiconductor capacity, and rapid EV adoption in China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Automotive embedded system market was valued at USD 7.93 billion in 2024 and is anticipated to reach USD 13.52 billion by 2032, growing at a CAGR of 6.9 % during the forecast period

- Rising demand for ADAS, electrification, and vehicle connectivity is fueling growth; sensors and software combine to account for the largest components by share.

- The embedded software segment held over 70% share by type and the sensors segment led by component share, reflecting shifts toward real-time data processing and safety systems.

- Key restraints include rising system complexity and cybersecurity challenges, which drive higher integration cost and slower development cycles.

- Asia Pacific leads the market with about 38% share in 2024, driven by strong vehicle production and EV uptake; Europe and North America follow.

Market Segmentation Analysis:

By Type

Software dominated the automotive embedded system market in 2024 with about 58% share. Automakers relied on software to manage ADAS, infotainment, battery systems, and powertrain controls. Demand grew as vehicles used complex algorithms for safety, navigation, and energy management. Over-the-air updates also pushed adoption because manufacturers reduced workshop visits and improved system reliability. Hardware gained steady growth due to rising electronic control units and semiconductor content, but software stayed ahead thanks to higher integration in connected and autonomous vehicles.

- For instance, BlackBerry’s QNX software is embedded in over 255 million vehicles worldwide, powering critical systems such as digital cockpits, ADAS, and hypervisors.

By Vehicle Type

Passenger cars led the market in 2024 with nearly 64% share. Buyers increased adoption of embedded features such as advanced safety, digital dashboards, and smart connectivity. Carmakers integrated more sensors, controllers, and software functions to meet regulatory standards and improve user comfort. Two-wheelers showed strong movement in regions with rising electric bikes, while commercial vehicles adopted embedded systems to improve fleet efficiency. Passenger cars remained dominant due to higher feature density and faster adoption of intelligent driving functions.

- For instance, Horizon Robotics’ Journey 6 chip designed for ADAS in passenger cars has secured orders and strategic partnerships with major Tier 1 suppliers, including Bosch and Denso. While the initial mass production with Bosch for a new multi-purpose camera is scheduled for mid-2026, the Journey 6E/M platforms are powering Bosch’s mid-segment ADAS family, with the first production model set to launch in June 2025.

By Component

Microcontrollers held the largest share in 2024 with around 37% of the component segment. Automotive brands used microcontrollers to operate engine control units, battery systems, braking modules, and infotainment networks. These chips offered reliable performance, low power use, and strong safety features, making them essential for vehicle electronics. Sensors grew quickly due to rising ADAS installations, while memory devices expanded with higher data storage needs. Transceivers gained traction in connected cars, yet microcontrollers remained central due to broad use across all embedded architectures.

Key Growth Drivers

Growing Demand for Advanced Safety and ADAS Features

The automotive embedded system market grows rapidly due to rising adoption of advanced driver-assistance systems. Carmakers add lane-assist, adaptive cruise control, collision warnings, and automated braking to meet global safety rules. Each safety function needs sensors, software, controllers, and real-time data processing, which boosts demand for embedded platforms. Governments also push stricter crash-avoidance standards, increasing the use of electronic control units in mass-market vehicles. Buyers expect more intelligent safety features even in entry models, which encourages manufacturers to integrate advanced embedded electronics across all price segments. This shift strengthens long-term growth as vehicles become more automated and connected.

- For instance, Mobileye has shipped over 200 million EyeQ SoCs to date, powering ADAS functions like emergency braking and lane keeping across hundreds of car models.

Rapid Shift Toward Electrification

Electric vehicles accelerate the need for embedded systems because battery monitoring, charging control, thermal balancing, and power management all depend on integrated electronics. EV makers use microcontrollers, advanced software, and high-accuracy sensors to manage battery health and optimize range. The rise of fast-charging networks also increases demand for embedded solutions that support safe, efficient energy transfer. Automakers develop specialized control units for inverters, motors, and regenerative braking, which pushes embedded content per vehicle much higher than in conventional models. As EV adoption expands worldwide, embedded platforms become essential for safety, efficiency, and performance across all electric segments.

- For instance, Infineon’s AURIX TC4x microcontroller (with its built-in Parallel Processing Unit) is used by Eatron, enabling real-time AI-based battery diagnostics and remaining useful life (RUL) prediction for 400-V and 800-V EV packs.

Growth of Connected and Software-Defined Vehicles

Connected vehicles rely on embedded systems to support real-time communication, telematics, diagnostics, and remote updates. Automakers shift toward software-defined designs that use centralized computing and flexible architectures. This shift increases reliance on embedded processors, sensors, and communication modules that manage continuous data flow. Over-the-air updates reduce maintenance costs and improve system performance, leading to higher customer satisfaction. Carmakers also use cloud-linked embedded systems to introduce new digital services, enabling revenue from subscriptions and in-car apps. Rising demand for seamless connectivity across infotainment, safety, and predictive maintenance continues to strengthen this driver.

Key Trend and Opportunity

Adoption of Centralized Computing Architectures

Automotive brands move away from distributed ECUs toward centralized, high-performance computing units. This trend reduces vehicle wiring, improves processing speed, and supports advanced functions such as autonomous driving and real-time decision-making. Centralized architectures allow manufacturers to simplify software development and push faster updates across multiple vehicle domains. The shift also enables scalable platforms that support a wide range of models with shared hardware blocks. As vehicles gain more intelligence, centralized computing becomes a foundational element for future designs, improving efficiency and lowering long-term integration costs.

- For instance, General Motors announced a new centralized compute platform (for both EVs and ICE vehicles) that consolidates dozens of ECUs into a unified computing core using a liquid-cooled unit powered by NVIDIA processors.

Rising Use of AI and Edge Processing

Embedded systems increasingly integrate AI capabilities to support image recognition, predictive maintenance, and driver-monitoring functions. Edge processing helps vehicles analyze data locally with low latency, which enhances safety and response time. This shift creates opportunities for semiconductor suppliers, as demand grows for AI-optimized chips and high-speed memory. Automakers invest in embedded architectures capable of running neural networks directly inside the vehicle, reducing reliance on cloud processing. As autonomous and semi-autonomous functions expand, AI-enabled embedded systems will unlock new commercial possibilities across mobility, logistics, and premium passenger vehicles.

- For instance, Li Auto uses two NVIDIA DRIVE Orin processors in its AD Max system, combining for 508 trillion operations per second (TOPS) of AI compute to power real-time sensor fusion and driving intelligence.

Key Challenge

Cybersecurity Risks in Connected Vehicles

Connected cars face rising cyber threats as more components communicate over networks. Embedded systems must protect millions of data exchanges each second, including navigation, safety, and vehicle-to-cloud communication. Weak security can expose vehicles to hacking or unauthorized control, pushing automakers to invest heavily in encryption, intrusion detection, and secure software layers. Meeting these requirements increases development cost and slows deployment cycles. Ensuring long-term protection across the entire vehicle lifespan remains a major hurdle for manufacturers and suppliers.

Growing Complexity and Integration Costs

Modern vehicles use hundreds of embedded components, making integration difficult and expensive. Developing software that coordinates sensors, processors, memory units, and communication modules demands high technical expertise. The complexity increases validation timelines and raises production costs for automakers. Supply-chain issues in semiconductors also create fluctuations in component availability. Managing this complexity while ensuring high performance, low power use, and compliance with safety standards remains a significant challenge for the industry.

Regional Analysis

North America

North America held about 34% share of the automotive embedded system market in 2024. The region benefited from strong adoption of ADAS, telematics, and connected vehicle platforms across premium and mid-range models. Automakers used advanced controllers and sensor-based systems to meet strict safety rules set by NHTSA and Transport Canada. Rising production of electric vehicles strengthened demand for battery-management electronics and high-performance computing units. Technology suppliers in the U.S. also pushed innovation in software-defined vehicle platforms. This steady shift toward intelligent mobility kept North America a leading market with high embedded content per vehicle.

Europe

Europe accounted for nearly 28% share of the automotive embedded system market in 2024. Strict EU emission policies and strong focus on vehicle safety promoted higher use of sensors, microcontrollers, and software-driven systems. Germany, France, and the U.K. supported embedded growth through strong automotive manufacturing bases and rapid electrification. Carmakers added advanced powertrain controls, ADAS modules, and connectivity platforms to meet regulatory benchmarks. The region’s push toward autonomous mobility and centralized computing also accelerated embedded adoption. Europe’s strong R&D ecosystem ensured continuous innovation, supporting stable market expansion.

Asia Pacific

Asia Pacific led the global market with around 38% share in 2024. China, Japan, and South Korea expanded production of electric and hybrid vehicles, which rely heavily on embedded controllers and battery electronics. High vehicle output and strong semiconductor manufacturing capabilities supported faster integration of advanced systems. Carmakers deployed telematics, infotainment, and ADAS features across mass-market models to meet rising consumer expectations. Government incentives for EV adoption further boosted demand for embedded platforms. Asia Pacific’s cost-efficient manufacturing and rapid technology adoption kept the region the fastest-growing market.

Latin America

Latin America held about 6% share in 2024. The region saw gradual adoption of embedded systems as automakers added more safety and connectivity features in new models. Demand grew in Brazil and Mexico due to higher production volumes and improving regulatory standards. Embedded controllers supported emissions compliance and enhanced braking and stability systems. Growth remained moderate because of economic constraints, but rising interest in digital dashboards and basic ADAS functions helped expand market penetration. Increasing investments by global OEMs continued to support long-term opportunities in the region.

Middle East & Africa

Middle East & Africa captured nearly 4% share of the market in 2024. Adoption rose as governments pushed advanced safety norms and fuel-efficiency standards in key countries such as the UAE, Saudi Arabia, and South Africa. The market expanded with rising imports of premium vehicles that offered ADAS, telematics, and infotainment systems. Local assembly growth in North Africa also supported embedded component demand. However, limited EV infrastructure and lower purchasing power slowed wider adoption. Increasing connectivity requirements and gradual modernization of vehicle fleets are expected to strengthen future growth in the region.

Market Segmentations:

By Type

By Vehicle Type

- Passenger car

- Two-wheeler

- Commercial Vehicles

By Component

- Transceivers

- Sensors

- Memory Devices

- Microcontrollers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the automotive embedded system market is shaped by leading companies such as Texas Instruments, Harman International, Denso, Hella KGaA Hueck & Co., Infineon Technologies, Toshiba, Magna International, Mitsubishi Electric, Continental AG, and Valeo. These firms strengthen their positions by expanding semiconductor production, advancing software-defined vehicle platforms, and developing high-performance controllers for ADAS, powertrain, and connectivity functions. Suppliers invest in AI-enabled chips, sensor fusion systems, and centralized computing architectures to support autonomous driving and electrification. Strategic partnerships with automakers help accelerate integration of telematics, infotainment, and battery-management technologies. Continuous R&D in microcontrollers, sensors, memory devices, and communication modules enables companies to increase system reliability and reduce latency in real-time vehicle operations. As vehicles become more connected and software-driven, competition intensifies around cybersecurity, edge processing capability, and scalable embedded architectures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Texas Instruments

- Harman International

- Denso

- Hella KGaA Hueck & Co.

- Infineon Technologies

- Toshiba

- Magna International

- Mitsubishi Electric

- Continental AG

- Valeo

Recent Developments

- In December 2024, Harman Automotive launched Ready CQuence Loop and Ready Link Marketplace for software-defined vehicles. The tools virtualize development and distribution of in-vehicle software, accelerating embedded feature deployment.

- In 2024, Texas Instruments introduced new C2000 microcontrollers with edge AI for automotive real-time control. These microcontrollers target safety-critical embedded applications and support ASIL D functional safety levels.

Report Coverage

The research report offers an in-depth analysis based on Type, Vehicle Type, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Embedded systems will gain higher adoption as vehicles move toward software-defined architectures.

- Automakers will integrate more centralized computing units to support advanced automation.

- ADAS and autonomous driving will push strong demand for high-accuracy sensors and controllers.

- Electric vehicle growth will expand the need for advanced battery-management electronics.

- Over-the-air updates will become standard across most new passenger and commercial models.

- AI-enabled embedded platforms will strengthen real-time decision-making inside vehicles.

- Cybersecurity solutions will expand as connected vehicle risks continue to rise.

- Memory and processing requirements will increase due to richer connectivity and infotainment features.

- Semiconductor innovation will remain crucial as automakers seek smaller, faster, and energy-efficient chips.

- Asia Pacific will continue leading market expansion due to EV production strength and large-scale manufacturing.