Market Overview

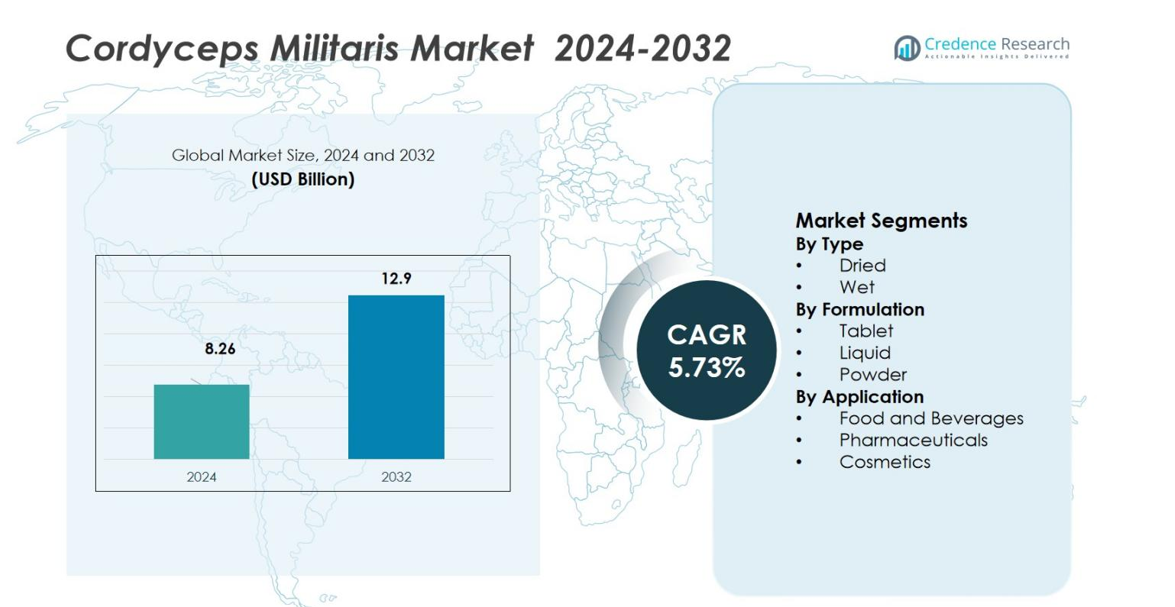

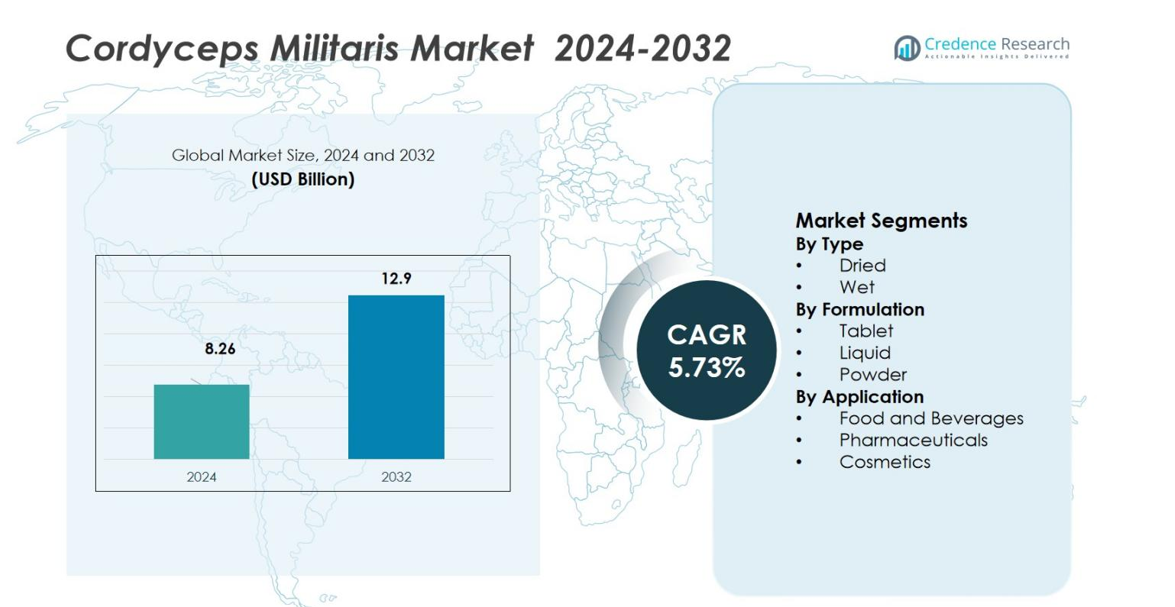

The Cordyceps Militaris Market size was valued at USD 8.26 billion in 2024 and is anticipated to reach USD 12.9 billion by 2032, growing at a CAGR of 5.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cordyceps Militaris Market Size 2024 |

USD 8.26 billion |

| Cordyceps Militaris Market, CAGR |

5.73% |

| Cordyceps Militaris MarketSize 2032 |

USD 12.9 billion |

The Cordyceps Militaris Market features key players such as Dalong Biotechnology Co., Ltd., Health Choice Limited, MycoForest, Naturalin Bio‑Resources Co., Ltd., NU SKIN ENTERPRISES, INC, Nutra Green Biotechnology Co., Ltd., Quyuan Sunnycare Inc., Shanghai Kangzhou Fungi Extract Co., Ltd., Sunrise Nutrachem Group Ltd., and Xi’an Saina Biological Technology Co., Ltd. These companies are driving growth through global expansion, product innovation, and distribution partnerships. Regionally, North America leads with a market share of 38.2%, reflecting high consumer awareness, developed regulatory frameworks for natural health products, and robust retail channels.

Market Insights

- The Cordyceps Militaris market reached USD 8.26 billion in 2024 and is projected to grow at a CAGR of 5.73 %, reaching USD 12.9 billion by 2032.

- Strong demand for natural‑supplement formats, especially the dried type holding 65.2 % share in 2024, drives market expansion through supplement and functional‑food applications.

- A key trend shows the food and beverage application dominating with 58.3 % share in 2024, while regions such as North America lead geographically with a 40 % share of global revenue in the same year.

- Competitive dynamics are shaped by major players such as Dalong Biotechnology Co., Ltd., MycoForest, NU SKIN Enterprises, Inc., and Naturalin Bio‑Resources Co., Ltd., who focus on R&D, global supply chains, and new‑format launches.

- Market restraint arises from fragmented regulatory standards across regions and supply‑chain challenges including seasonal cultivation and extraction bottlenecks that limit consistent high‑volume production and global scale.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

In the Cordyceps Militaris Market, the dried segment holds the dominant position, accounting for 65.2% of the market share in 2024. This sub-segment is favored due to its longer shelf life and ease of storage, making it a preferred choice for both manufacturers and consumers. The dried form of Cordyceps Militaris retains its potency and is widely used in the production of supplements and food additives. Additionally, its popularity in traditional medicine as a natural remedy contributes to its strong demand.

- For instance, Nammex publishes analytical results showing its organic dried Cordyceps Militaris fruiting-body powder contains a quantified cordycepin level of 3 mg per gram, verified through third-party HPLC testing.

By Formulation

Among the formulations, the tablet form is the leading sub-segment, commanding 47.5% of the market share. This is driven by the convenience and ease of dosage that tablets offer to consumers. As the demand for functional foods and health supplements rises, the tablet format remains the most favored due to its precise formulation and widespread availability in the pharmaceutical and wellness industries. Furthermore, the growing trend of preventive healthcare is a key driver in the growth of this segment.

- For instance, Biofinest formulates Cordyceps tablets delivering 1,000 mg of powdered Cordyceps Militaris fruiting body per serving, a dosage consistent with general recommendations found in scientific literature (typically 1-3 grams daily).

By Application

In the application segment, food and beverages dominate with a substantial market share of 58.3%. The inclusion of Cordyceps Militaris in functional foods and drinks, such as energy drinks, smoothies, and health bars, is contributing significantly to its widespread use. The segment’s growth is driven by the increasing consumer preference for natural and organic ingredients in everyday consumables, as well as the growing awareness of the health benefits, such as boosting immunity and energy levels.

Key Growth Drivers

Rising Demand for Natural Supplements

The increasing preference for natural and organic supplements is a major growth driver in the Cordyceps Militaris market. As consumers become more health-conscious, they are increasingly turning to plant-based and fungi-derived products that offer a variety of health benefits, such as improved immunity, energy, and stamina. This shift towards holistic and natural health solutions is boosting the demand for Cordyceps Militaris-based supplements, particularly in the dietary and wellness segments. Additionally, rising awareness of preventive healthcare is further propelling market growth.

- For instance, Host Defense formulates its Cordyceps supplement with 1,000 mg of freeze-dried mycelium per two-capsule serving (or 1.5g per powder serving), which includes the fermented brown rice biomass substrate. The company reports general polysaccharide content in its product assays but does not specify the concentration of the more highly valued beta-glucans or active compounds like cordycepin, which is common practice for competitors who use mushroom fruiting bodies.

Growing Applications in Pharmaceuticals

The pharmaceutical industry’s increasing adoption of Cordyceps Militaris is another key driver. The bioactive compounds found in Cordyceps, such as cordycepin, have been shown to possess therapeutic properties that support immune function, energy levels, and anti-inflammatory effects. As research into these benefits expands, pharmaceutical companies are integrating Cordyceps into various formulations, including those targeting chronic fatigue, diabetes, and respiratory issues. This growing acceptance within the pharmaceutical sector significantly contributes to the market’s expansion.

- For instance, Pharmanex commercialized its CordyMax Cs-4 supplement based on several studies, including one in healthy elderly subjects where a daily intake of 1 gram (333 mg capsules three times a day) over 12 weeks resulted in a documented increase in ventilatory threshold.

Expansion in Emerging Markets

Cordyceps Militaris market growth is also fueled by its rising acceptance in emerging markets, particularly in Asia-Pacific and Latin America. As consumers in these regions become more aware of the benefits of Cordyceps, both in traditional medicine and modern wellness products, demand is surging. Growing disposable incomes and the increasing adoption of health-conscious lifestyles are encouraging the market’s expansion. Moreover, local manufacturers are capitalizing on this demand by producing Cordyceps-based products for both regional consumption and export.

Key Trends & Opportunities

Integration in Functional Foods

Cordyceps Militaris is increasingly being incorporated into functional foods and beverages, presenting a significant opportunity for market growth. Consumers are seeking products that not only satisfy nutritional needs but also provide additional health benefits. With growing awareness of the potential health benefits of Cordyceps, food manufacturers are integrating this ingredient into a range of products, including energy drinks, protein bars, and smoothies. This trend aligns with the broader movement towards functional and personalized nutrition, offering a lucrative opportunity for businesses in the food and beverage sector.

- For instance, HIFAS da Terra, a leading biotechnology company in the development of natural products based on fungi, produces cordyceps supplements and is involved in over 15 active clinical studies

Technological Advancements in Cultivation and Extraction

Advances in cultivation and extraction technologies are creating new opportunities for the Cordyceps Militaris market. Innovations in controlled cultivation techniques, such as bioreactor systems and optimized growth conditions, have led to more efficient production of high-quality Cordyceps. Additionally, improved extraction methods ensure higher yields of bioactive compounds, making it more cost-effective and accessible for manufacturers. These advancements enhance the scalability of Cordyceps production and offer businesses a competitive advantage, allowing them to meet growing global demand.

- For instance, Nammex sources C. militaris from small-scale organic farms in China, where it is grown using solid-state cultivation methods to produce the full fruiting body.

Key Challenges

Regulatory Hurdles

One of the key challenges faced by the Cordyceps Militaris market is the varying regulatory standards across different regions. While the ingredient is widely accepted in traditional medicine in some countries, its status as a food supplement or pharmaceutical product can differ significantly in others. These inconsistencies in regulation can lead to delays in product approval, additional compliance costs, and restrictions on market entry. Companies need to navigate these regulatory complexities, which can hinder the expansion of the market, especially in regions with stricter regulatory environments.

Supply Chain Constraints

The supply chain for Cordyceps Militaris can be subject to disruptions, particularly in the cultivation and harvest stages. While the demand for Cordyceps is growing, the supply of this specialty ingredient is often limited by seasonal fluctuations and geographical restrictions. Additionally, challenges related to quality control during large-scale cultivation and extraction can impact the consistency of the final product. Companies in the market must address these supply chain constraints to ensure a steady supply of high-quality Cordyceps Militaris to meet global demand.

Regional Analysis

North America

The North America region commands the largest share of the Cordyceps militaris market, capturing 40 % of global revenue in 2024. High disposable income, strong consumer awareness of dietary supplements, and mature regulatory frameworks supporting natural health products underpin this dominance. Market players in the U.S. and Canada are investing heavily in R&D, brand building and distribution of cordyceps‑based formulations. This region benefits from sophisticated retail channels and established wellness ecosystems, which accelerate product adoption and expansion of both pharmaceutical and functional‑food applications.

Europe

In Europe, the market holds a significant share, estimated at around 20 % of the global total in 2024 and is driven by increasing consumer preference for preventive healthcare and natural ingredients. Wellness‑oriented trends, combined with favorable regulatory support for herbal supplements, are pushing growth in Western European countries such as the UK, Germany and France. Supplementation through food and beverages incorporating cordyceps is gaining traction. Regional manufacturers and importers are expanding their portfolios to meet demand, while regulatory harmonization across the EU is reducing barriers for cross‑border trade and product launches.

Asia‑Pacific

The Asia‑Pacific region is an important contributor, accounting for 25 % of the global Cordyceps militaris market in 2024. This region’s share is supported by strong traditional use of medicinal mushrooms in China, Japan and South Korea, combined with rapidly increasing demand for natural health supplements among younger, affluent populations. Cultivation infrastructure is well‑established, and domestic manufacturers are scaling operations to meet both local consumption and exports. Government initiatives promoting functional foods and traditional medicine further bolster market expansion across this region.

Latin America

Latin America occupies 8 % of the global market in 2024. Growth in this region is propelled by rising health consciousness, improving retail networks, and an expanding middle class, especially in Brazil and Mexico. Local distributors are importing cordyceps‑based products to satisfy growing interest in immune‑boosting and energy‑enhancing supplements. Nevertheless, regulatory fragmentation and limited awareness compared to mature markets remain barriers. With continued investment in education, distribution and product innovation, Latin America presents a meaningful growth opportunity for the near future.

Middle East & Africa

The Middle East & Africa region holds 7 % share of the global Cordyceps militaris market in 2024. Market growth here is being driven by increasing acceptance of nutraceuticals and functional foods in urban centres of the Gulf and South Africa, along with rising wellness tourism and health‑conscious lifestyles. However, market penetration remains lower than in developed regions due to logistic challenges, regulatory complexity and lower awareness of medicinal mushroom benefits. As suppliers enhance supply chains and tailor products to regional needs, this region is expected to exhibit steady but moderate growth ahead.

Market Segmentations:

By Type

By Formulation

By Application

- Food and Beverages

- Pharmaceuticals

- Cosmetics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape/analysis: The market for Cordyceps militaris features key players such as Dalong Biotechnology Co., Ltd., Health Choice Limited, MycoForest, Naturalin Bio‑Resources Co., Ltd., NU SKIN ENTERPRISES, INC, Nutra Green Biotechnology Co., Ltd., Quyuan Sunnycare Inc., Shanghai Kangzhou Fungi Extract Co., Ltd., Sunrise Nutrachem Group Ltd. and Xi’an Saina Biological Technology Co., Ltd.. These companies actively drive market growth through strategic initiatives including increasing production capacities, entering joint ventures, enhancing extraction technologies for bioactive compounds, and broadening distribution channels internationally. The competitive intensity is further elevated as new entrants focus on certification, ingredient traceability and online direct‐to‐consumer platforms to capture niche wellness segments. Meanwhile, incumbents leverage brand strength and global supply networks to advance market share. Continuous investment in R&D and regulatory alignment are critical differentiators in this evolving landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dalong Biotechnology Co., Ltd.

- Sunrise Nutrachem Group Ltd.

- Xi’an Saina Biological Technology Co., Ltd.

- MycoForest

- Naturalin Bio-Resources Co., Ltd.

- NU SKIN ENTERPRISES, INC

- Nutra Green Biotechnology Co., Ltd.

- Quyuan Sunnycare Inc.

- Health Choice Limited

- Shanghai Kangzhou Fungi Extract Co., Ltd.

Recent Developments

- In February 2024, Odyssey secured USD 6 million funding for its line of mushroom‑based products, including those featuring Cordyceps militaris, reflecting investor interest in the category.

- In January 2023, Mallipathra Nutraceutical Pvt Ltd. (Bangalore, India) announced the rollout of its “Malli’s Cordycep Capsule” and “Malli’s Cordycep Infusion” nutraceutical lines based on cordyceps.

Report Coverage

The research report offers an in-depth analysis based on Type, Formulation, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growth of e‑commerce channels will accelerate market reach as online retail and direct‑to‑consumer platforms expand globally.

- Greater integration of C. militaris into functional foods, beverages and snack formats will unlock new consumption occasions beyond traditional supplements.

- Advances in cultivation and fermentation technologies will improve yield efficiencies and product quality, reducing costs and broadening accessibility.

- Increasing clinical research into cordycepin and other bioactive constituents will strengthen scientific validation and open pharmaceutical applications.

- Expansion into emerging markets (Asia‑Pacific, Latin America, Middle East & Africa) will diversify geographic revenue and reduce dependency on mature markets.

- Development of novel product formulations (powder mixes, liquids, ready‑to‑drink formats) will cater to consumer demand for convenience and dosage flexibility.

- Strategic collaborations between suppliers, biotech firms and consumer brands will drive innovation, co‑branding and premium positioning in wellness ecosystems.

- Rise in regulatory recognition of medicinal mushrooms and traditional‑medicine ingredients will support market legitimisation and streamline approvals.

- Sustainability and traceability criteria (organic cultivation, certified supply chains) will become differentiators, particularly for eco‑conscious consumers.

- Supply‑chain optimisations and scale‑up of industrial production will address current constraints and enable broader mainstream adoption.