Market Overview

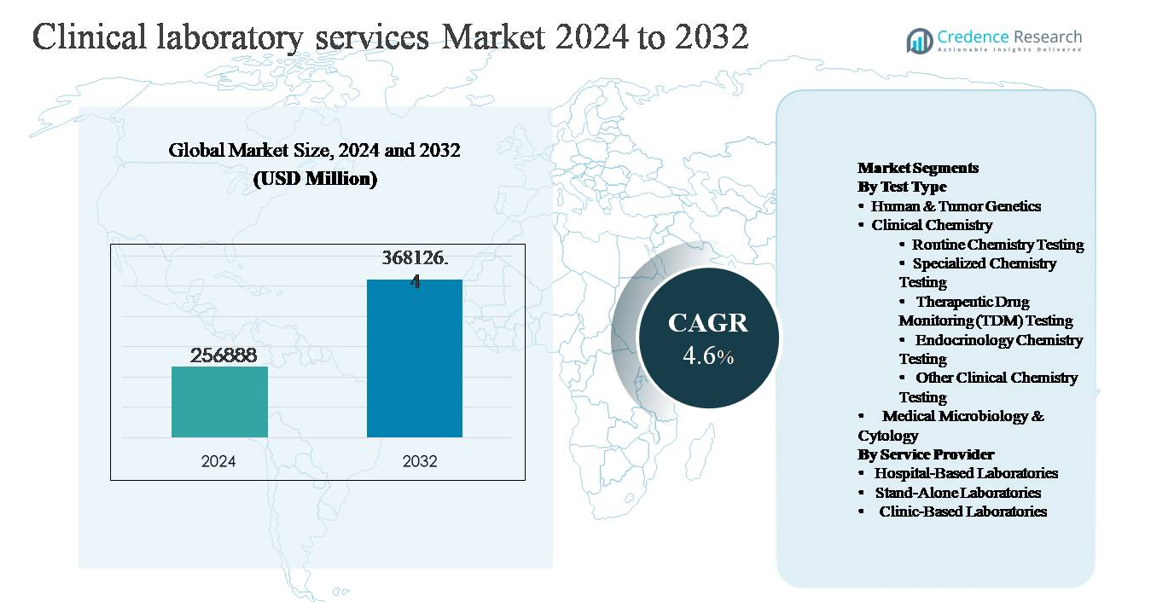

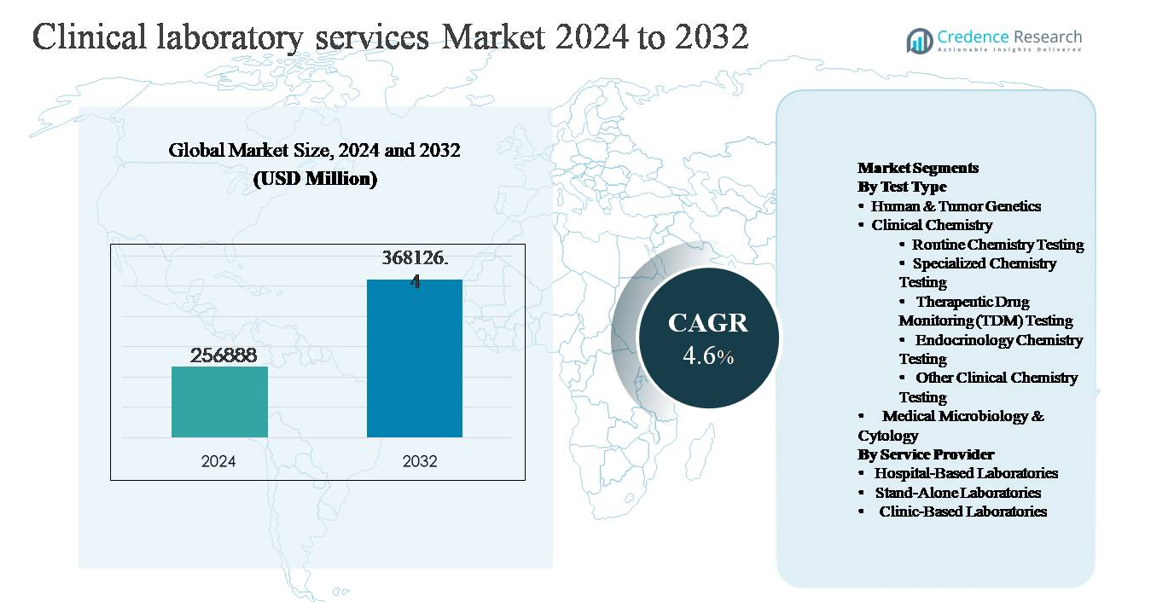

The global clinical laboratory services market was valued at USD 256,888 million in 2024 and is projected to reach USD 368,126.4 million by 2032, expanding at a compound annual growth rate (CAGR) of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

Clinical Laboratory Services Market Size 2024

|

USD 256,888 million |

| Clinical Laboratory Services Market, CAGR |

4.6% |

| Clinical Laboratory Services Market Size 2032 |

USD 368,126.4 million |

The clinical laboratory services market is led by a group of well-established global players that compete on scale, test menu breadth, automation, and geographic reach. Major companies such as Laboratory Corporation of America Holdings (Labcorp) and Quest Diagnostics Inc. dominate through extensive national laboratory networks and high-volume centralized testing models. Sonic Healthcare and Synlab International GmbH maintain strong positions across Europe and international markets through hospital partnerships and regional consolidation. Specialized providers including NeoGenomics Laboratories, Qiagen N.V., Charles River Laboratories, OPKO Health (BioReference Laboratories), ARUP Laboratories, and Fresenius Medical Care (Spectra Laboratories) strengthen the market with esoteric, genetic, and disease-specific testing capabilities. North America leads the global market with approximately 38% share, supported by advanced healthcare infrastructure, high testing utilization, and strong reimbursement frameworks.

Market Insights

- The clinical laboratory services market was valued at USD 256,888 million in 2024 and is projected to reach USD 368,126.4 million by 2032, expanding at a CAGR of 4.6% during the forecast period.

- Market growth is primarily driven by rising prevalence of chronic and infectious diseases, increasing demand for preventive healthcare, and growing reliance on routine diagnostic testing, with clinical chemistry emerging as the dominant segment, accounting for the largest share due to high-volume routine and metabolic testing.

- Key market trends include rapid adoption of laboratory automation, expansion of molecular and genetic testing, and increasing preference for stand-alone laboratory networks, while hospital-based laboratories continue to hold a significant share due to integrated inpatient and emergency testing needs.

- Competitive dynamics are shaped by large-scale players focusing on network expansion, centralized testing models, and cost optimization, alongside specialized providers strengthening positions in oncology, genetics, and esoteric testing segments.

- Regionally, North America leads with ~38% market share, followed by Europe (~28%) and Asia Pacific (~24%), with Asia Pacific showing the strongest growth momentum driven by expanding healthcare access and private diagnostics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Test Type:

Within the clinical laboratory services market, clinical chemistry represents the dominant test type segment, supported by its high testing volumes and routine integration into preventive, diagnostic, and disease-monitoring workflows. Routine chemistry testing forms the leading sub-segment, driven by widespread use in metabolic panels, liver and kidney function tests, and cardiovascular risk assessment across inpatient and outpatient settings. Growth is further reinforced by increasing chronic disease prevalence, aging populations, and automation in high-throughput analyzers. While human & tumor genetics and specialized tests such as TDM and endocrinology chemistry are expanding rapidly, their adoption remains more selective and indication-driven.

- For instance, Roche Diagnostics’ cobas® 8000 modular analyzer series is deployed in large reference and hospital laboratories to handle continuous, high-volume chemistry workloads, with a single integrated system capable of processing up to 9,800 clinical chemistry and immunochemistry tests per hour, enabling round-the-clock metabolic and organ-function testing without manual intervention.”

By Service Provider:

By service provider, hospital-based laboratories account for the dominant share of clinical laboratory services, primarily due to their ability to handle high test volumes, complex diagnostics, and emergency testing under one integrated care setting. Their dominance is driven by advanced infrastructure, access to skilled laboratory professionals, and strong alignment with inpatient care and surgical services. Stand-alone laboratories continue to gain traction through cost efficiency, centralized testing models, and broad test menus, while clinic-based laboratories serve routine and point-of-care needs, particularly in primary care, but remain comparatively limited in scale and test complexity.

- For instance, “Mayo Clinic Laboratories operates a hospital-anchored diagnostic infrastructure that performs more than 26 million laboratory tests annually, supported by over 4,400 validated test procedures and pathology services, enabling rapid turnaround for stat chemistry, hematology, microbiology, and molecular diagnostics required for acute inpatient decision-making.”

Key Growth Driver

Rising Burden of Chronic and Infectious Diseases

The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, cancer, and renal conditions is a primary driver of demand for clinical laboratory services. These conditions require regular diagnostic testing for early detection, disease staging, and ongoing monitoring, leading to sustained test volumes across clinical chemistry, hematology, and molecular diagnostics. In parallel, the continued incidence of infectious diseases including respiratory infections and hospital-acquired pathogens reinforces the need for microbiology and serology testing. Aging populations further amplify this demand, as older adults typically undergo more frequent diagnostic evaluations. Together, these factors position clinical laboratories as essential components of long-term disease management and population health strategies.

- For instance, bioMérieux’s VITEK® 2 automated microbial identification system can identify clinically relevant bacteria and yeast within approximately 8 hours, supporting timely diagnosis and antimicrobial decision-making in cases of bloodstream infections and healthcare-associated infections.

Expansion of Preventive Healthcare and Routine Screening

The global shift toward preventive healthcare is significantly increasing utilization of clinical laboratory services. Governments, payers, and healthcare providers are emphasizing early diagnosis to reduce long-term treatment costs and improve patient outcomes. This has led to higher uptake of routine health checkups, wellness panels, and risk assessment testing across both developed and emerging markets. Employer-sponsored health programs and expanding insurance coverage for diagnostic testing further support this trend. As routine chemistry and endocrinology tests become standardized elements of preventive care, laboratories benefit from recurring demand, predictable testing volumes, and deeper integration into primary healthcare delivery models.

- For instance, Siemens Healthineers’ Atellica® IM immunoassay analyzer supports preventive risk assessment by offering a broad menu of cardiac, thyroid, and metabolic markers, with the ability to perform up to 440 immunoassay tests per hour, allowing consistent, same-day reporting for routine screening programs.

Technological Advancements and Laboratory Automation

Advances in laboratory technologies are transforming service efficiency and test accuracy, directly supporting market growth. High-throughput automated analyzers, integrated laboratory information systems, and robotics-driven sample handling are enabling laboratories to process larger test volumes with reduced turnaround times. Improvements in assay sensitivity and specificity are also expanding the clinical utility of diagnostics across oncology, endocrinology, and infectious disease testing. These technologies improve operational scalability, reduce manual errors, and enhance cost efficiency, allowing service providers to manage rising demand while maintaining quality and regulatory compliance.

Key Trend & Opportunity

Growing Adoption of Molecular and Genetic Testing

Molecular diagnostics and genetic testing are emerging as high-growth segments within clinical laboratory services. Increasing use of genetic profiling in oncology, inherited disease screening, and personalized medicine is expanding the scope of laboratory testing beyond conventional assays. Advances in sequencing technologies and declining per-test costs are making these services more accessible in routine clinical practice. This trend creates opportunities for laboratories to expand esoteric test menus, establish specialized genetic testing capabilities, and form partnerships with precision medicine programs, particularly in cancer diagnostics and rare disease identification.

- For instance, Illumina’s NovaSeq™ 6000 sequencing system supports comprehensive genomic profiling by generating up to 6 terabases of sequencing data per run, allowing laboratories to perform large-panel oncology sequencing, whole-exome sequencing, and inherited disease screening within a single integrated workflow.

Shift Toward Decentralized and Outpatient Testing Models

Healthcare delivery is increasingly shifting from hospital-centric models toward outpatient, clinic-based, and home-focused care. This trend supports demand for decentralized laboratory services, including satellite labs, rapid testing centers, and sample collection networks. Stand-alone laboratories are leveraging centralized processing combined with widespread collection points to improve accessibility and turnaround times. The expansion of outpatient diagnostics creates opportunities for service providers to optimize logistics, improve patient convenience, and capture higher testing volumes from preventive care and chronic disease monitoring outside acute care settings.

- For instance, Abbott’s ID NOW™ molecular platform is widely deployed in outpatient clinics and urgent care centers, delivering isothermal molecular test results for infectious diseases in as little as 13 minutes, enabling immediate clinical decisions without reliance on central hospital laboratories.

Key Challenge

Cost Pressures and Reimbursement Constraints

Clinical laboratory service providers face ongoing cost pressures due to reimbursement limitations imposed by public and private payers. Pricing controls on routine tests and delayed reimbursement cycles can impact profitability, particularly for high-volume laboratories. Rising costs associated with advanced equipment, skilled personnel, and regulatory compliance further strain operating margins. Smaller laboratories are especially vulnerable, as they often lack the scale needed to absorb pricing pressure or invest in efficiency-enhancing technologies, leading to consolidation within the market.

Workforce Shortages and Regulatory Complexity

The clinical laboratory services sector continues to face shortages of qualified laboratory technologists and pathologists, affecting operational capacity and service quality. Training requirements and workforce aging exacerbate staffing challenges, particularly in specialized testing areas. At the same time, laboratories must comply with complex and evolving regulatory standards related to quality control, data security, and test validation. Managing regulatory compliance while maintaining operational efficiency increases administrative burden and costs, posing a significant challenge for sustained growth.

Regional Analysis

North America:

North America holds the largest share of approximately 38% of the global clinical laboratory services market, driven by high healthcare expenditure, widespread insurance coverage, and strong adoption of advanced diagnostics. The region benefits from a high volume of routine and specialized testing supported by well-established hospital networks and large stand-alone laboratory chains. Strong demand for preventive screenings, chronic disease monitoring, and molecular diagnostics further supports market leadership. Continuous investments in laboratory automation, digital pathology, and integrated health IT systems reinforce efficiency and scale, positioning North America as the most mature and technologically advanced regional market.

Europe:

Europe accounts for an estimated 28% market share, supported by universal healthcare systems and a strong emphasis on preventive diagnostics. Countries such as Germany, the United Kingdom, France, and Italy drive testing volumes through organized screening programs and structured referral pathways. Growth is underpinned by aging demographics and rising demand for clinical chemistry, microbiology, and oncology-related tests. While cost containment policies influence pricing, steady investments in laboratory modernization and quality standards sustain demand. Increasing cross-border testing networks and consolidation among laboratory providers further strengthen Europe’s regional position.

Asia Pacific:

Asia Pacific represents around 24% of the global market and is the fastest-growing region for clinical laboratory services. Expansion is driven by large patient populations, rising chronic disease prevalence, and improving access to healthcare services in China, India, and Southeast Asia. Growth in private diagnostics, increasing health awareness, and expanding insurance coverage are boosting test volumes. Rapid development of stand-alone laboratories and adoption of automated platforms enhance service capacity. Although per-capita spending remains lower than in developed regions, the scale of demand positions Asia Pacific as a key long-term growth engine.

Latin America:

Latin America holds approximately 6% market share, supported by gradual improvements in healthcare infrastructure and diagnostic access. Brazil and Mexico lead regional demand due to expanding private healthcare sectors and growing utilization of routine laboratory testing. Public health initiatives focused on infectious disease detection and chronic disease management support steady testing volumes. However, budget constraints and uneven access across rural areas limit market expansion. Increasing private investment, laboratory network expansion, and rising awareness of preventive diagnostics are expected to gradually strengthen the region’s contribution to global revenues.

Middle East & Africa:

The Middle East & Africa region accounts for about 4% of the global clinical laboratory services market. Growth is supported by healthcare infrastructure development in Gulf Cooperation Council countries and rising demand for diagnostic services linked to lifestyle diseases. Investments in hospital expansion and reference laboratories are improving testing capacity. In contrast, parts of Africa face limitations related to funding, workforce availability, and access to advanced diagnostics. Despite these challenges, increasing public–private partnerships and international support programs are gradually enhancing laboratory service availability across the region.

Market Segmentations:

By Test Type

- Human & Tumor Genetics

- Clinical Chemistry

- Routine Chemistry Testing

- Specialized Chemistry Testing

- Therapeutic Drug Monitoring (TDM) Testing

- Endocrinology Chemistry Testing

- Other Clinical Chemistry Testing

- Medical Microbiology & Cytology

By Service Provider

- Hospital-Based Laboratories

- Stand-Alone Laboratories

- Clinic-Based Laboratories

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the clinical laboratory services market is characterized by the presence of large multinational diagnostic service providers alongside strong regional and local laboratory networks. Leading players compete primarily on test portfolio breadth, turnaround time, geographic coverage, and operational efficiency. Major providers leverage centralized high-throughput laboratories, advanced automation, and integrated laboratory information systems to manage large testing volumes while maintaining quality standards. Strategic initiatives focus on laboratory network expansion, acquisitions of regional laboratories, and partnerships with hospitals and healthcare systems to strengthen referral channels. Investment in specialized and esoteric testing, including molecular diagnostics and genetic assays, is increasingly used to differentiate service offerings. Competitive intensity is further shaped by cost optimization strategies, workforce management, and compliance with stringent regulatory and quality requirements, driving continued consolidation across mature markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Laboratory Corporation of America Holdings (Labcorp) announced it will offer the Elecsys pTau181 blood test (FDA-cleared) to help assess Alzheimer’s-related amyloid pathology in adults aged 55+ presenting with cognitive decline. This expands access to Alzheimer’s biomarker testing in primary care settings nationwide, making early neurological evaluation more accessible outside specialty clinics. Labcorp plans to make this test broadly available by early 2026.

- In July 2025, Sonic Healthcare completed the acquisition of LADR Laboratory Group in Germany, strengthening its European laboratory footprint and esoteric testing capabilities.

Report Coverage

The research report offers an in-depth analysis based on Test type, Service provider and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Clinical laboratory services will continue to expand as preventive healthcare and routine screening become standard components of care delivery.

- Demand for high-volume clinical chemistry testing will remain strong, supported by chronic disease monitoring and aging populations.

- Molecular diagnostics and genetic testing will gain wider clinical adoption, particularly in oncology and personalized medicine.

- Laboratory automation and digital workflows will play a critical role in improving efficiency, accuracy, and turnaround times.

- Stand-alone laboratories will expand collection networks to improve accessibility and capture outpatient testing demand.

- Hospital-based laboratories will focus on complex and emergency diagnostics requiring integrated clinical support.

- Artificial intelligence and data analytics will increasingly support test interpretation and laboratory decision-making.

- Market consolidation will intensify as larger players acquire regional laboratories to achieve scale and cost efficiency.

- Workforce optimization and advanced training will become essential to address ongoing skilled labor shortages.

- Emerging markets will contribute a growing share of testing volumes as healthcare access and diagnostic awareness improve.