Market Overview

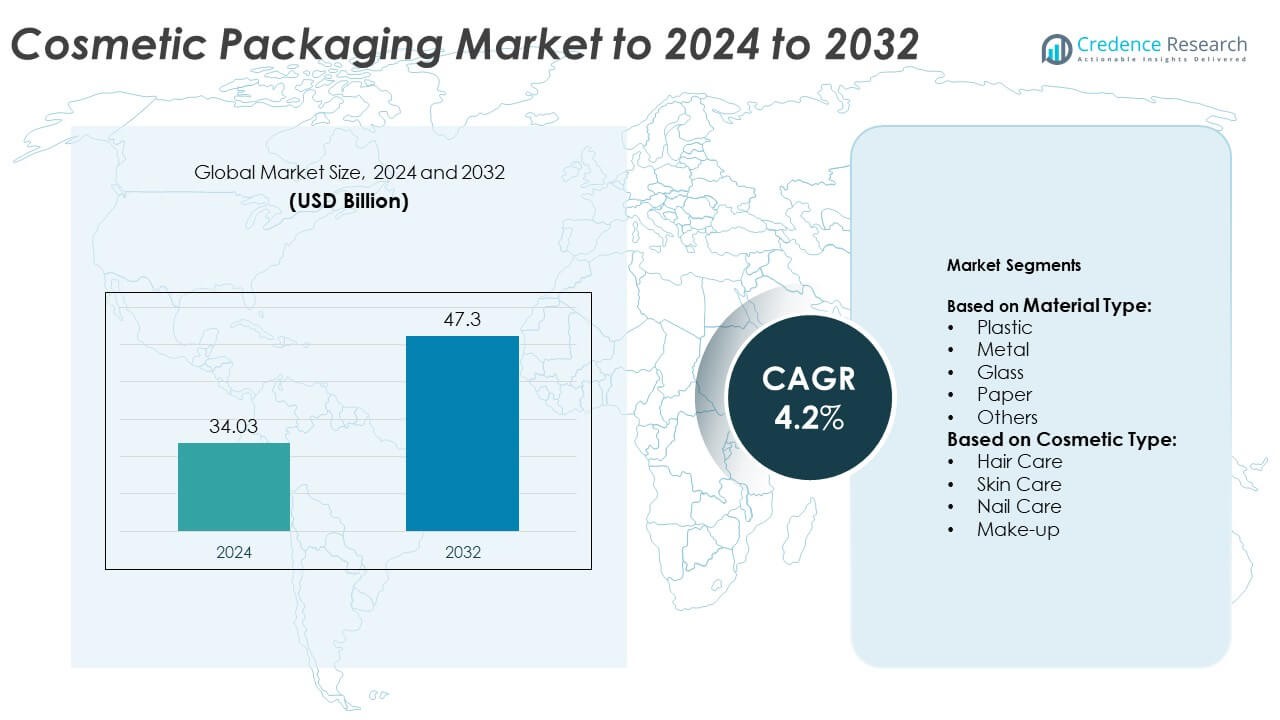

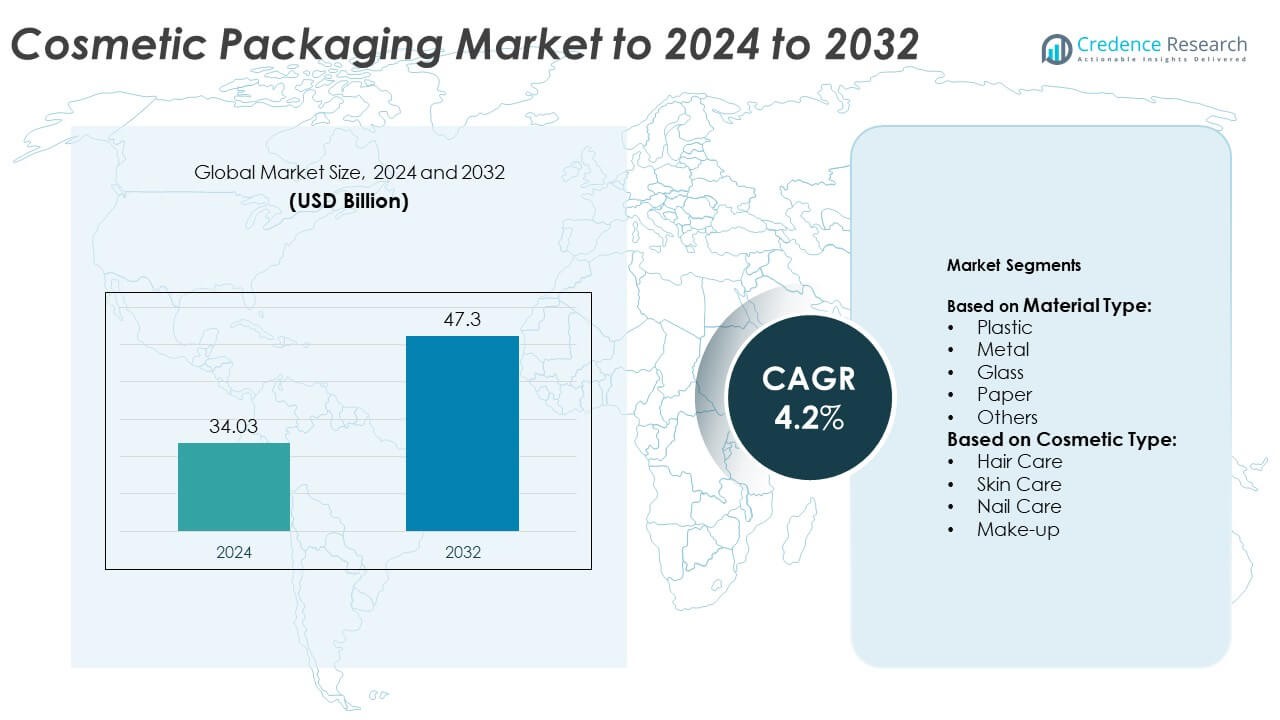

Cosmetic Packaging Market size was valued at USD 34.03 billion in 2024 and is anticipated to reach USD 47.3 billion by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Packaging Market Size 2024 |

USD 34.03 Billion |

| Cosmetic Packaging Market, CAGR |

4.2% |

| Cosmetic Packaging Market Size 2032 |

USD 47.3 Billion |

The cosmetic packaging market is led by major companies such as AptarGroup Inc., Ball Corporation, Amcor Group GmbH, Albea SA, and DS Smith PLC. These players focus on innovation in sustainable materials, lightweight designs, and premium aesthetics to meet rising consumer demand for eco-friendly and visually appealing packaging. They invest in recyclable plastics, glass, and refillable formats to align with global sustainability targets. Asia Pacific dominated the market in 2024 with a 34% share, driven by high cosmetic consumption in China, Japan, and South Korea, followed by North America with 32% and Europe with 28%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cosmetic packaging market was valued at USD 34.03 billion in 2024 and is projected to reach USD 47.3 billion by 2032, growing at a CAGR of 4.2%.

- Rising demand for sustainable, recyclable, and refillable packaging solutions is driving market growth across skincare, makeup, and haircare categories.

- Trends such as smart labeling, premium design aesthetics, and digital customization are shaping the market’s future direction.

- The market is competitive, with major players focusing on eco-friendly materials, lightweight formats, and strategic collaborations with global cosmetic brands.

- Asia Pacific led with 34% of the share in 2024, followed by North America at 32% and Europe at 28%, while plastic remained the dominant material segment with over 45% of total market share.

Market Segmentation Analysis:

By Material Type

Plastic dominated the cosmetic packaging market in 2024, holding over 45% of the total share. Its dominance stems from flexibility, light weight, and cost-effective production for mass-market cosmetic brands. Plastic materials such as PET, PP, and PE are widely used for bottles, tubes, and jars due to durability and design adaptability. Growing use of post-consumer recycled resins and bio-based plastics supports sustainability goals and brand image. However, increasing regulatory focus on single-use plastics encourages investment in recyclable and biodegradable alternatives within the segment.

- For instance, Beiersdorf uses certified renewable polypropylene in its NIVEA Naturally Good line, replacing fossil-based plastic in ~30 countries worldwide.

By Cosmetic Type

Skin care products accounted for the largest share of around 38% in the cosmetic packaging market in 2024. The segment’s leadership is driven by rising global demand for anti-aging creams, moisturizers, and serums, which require advanced airless and protective packaging solutions. Brands are adopting eco-friendly and refillable containers to appeal to environmentally conscious consumers. Additionally, the premiumization of skincare lines encourages innovative designs and materials, enhancing consumer experience and shelf appeal. The trend toward personalized skincare continues to boost packaging innovation and volume growth across major markets.

- For instance, Beiersdorf’s Eucerin Hyaluron Filler cream introduced a refill concept: the refill inner jar uses only about 8 g of plastic vs 89 g for a full jar—saving nearly 90 %.

Key Growth Drivers

Rising Demand for Sustainable Packaging

Growing environmental awareness is driving brands to adopt eco-friendly cosmetic packaging solutions. Manufacturers are shifting toward recyclable, biodegradable, and refillable materials to meet sustainability goals and comply with regulations. Consumers increasingly prefer packaging made from recycled plastics, glass, or paper-based alternatives. This shift supports brand reputation and aligns with circular economy targets. Major companies are investing in green packaging technologies to reduce carbon emissions and plastic waste, making sustainability a central factor influencing purchasing decisions and long-term brand loyalty.

- For instance, The Estée Lauder Companies (ELC) reported that in fiscal 2024, 71% of their packaging by weight was recyclable, refillable, reusable, recycled, or recoverable.

Expansion of E-Commerce and Direct-to-Consumer Brands

The global surge in online cosmetic sales is fueling demand for durable, lightweight, and attractive packaging. E-commerce platforms require packaging that ensures product safety during transport while enhancing visual appeal. Brands are adopting compact and tamper-proof designs optimized for shipping efficiency. The rise of direct-to-consumer (D2C) cosmetic brands, especially in emerging markets, has increased customization needs. This trend encourages innovations in labeling, branding, and secondary packaging to enhance consumer engagement and create differentiation in digital marketplaces.

- For instance, Too Faced used connected packaging with NFC tags on 100,000 lip gloss samples—letting users tap to access discount pages.

Growth in Premium and Personal Care Products

Rising disposable incomes and the growing preference for premium cosmetic products are expanding the demand for high-quality packaging. Luxury brands increasingly use glass, metal, and textured finishes to create an elegant appeal. Personalized and travel-sized packaging formats are gaining traction among urban consumers. Additionally, smart packaging technologies such as RFID tags and QR codes are being integrated for authentication and traceability. This focus on aesthetics and innovation strengthens brand value and supports market expansion across premium beauty and skincare categories.

Key Trends & Opportunities

Adoption of Refillable and Reusable Packaging

Brands are introducing refillable and reusable cosmetic containers to reduce waste and attract eco-conscious consumers. Refill stations and subscription-based refills are gaining popularity among skincare and fragrance brands. Companies like L’Oréal and Unilever are piloting sustainable refill programs to promote circular packaging. This trend supports long-term cost savings and enhances customer loyalty through repeat purchases. Growing acceptance of refillable systems across high-end and mass-market cosmetics presents significant growth opportunities for packaging manufacturers and beauty retailers.

- For instance, Beiersdorf’s refill concept for Eucerin’s Hyaluron Filler can save ~24 tonnes of plastic annually.

Integration of Smart and Digital Packaging

Digital transformation is reshaping cosmetic packaging through smart labeling, augmented reality (AR), and near-field communication (NFC) technology. These solutions allow brands to offer interactive experiences, product authenticity verification, and ingredient transparency. Smart packaging enhances consumer trust and engagement, particularly among tech-savvy younger demographics. The integration of traceability and data-driven insights also supports supply chain optimization. As beauty brands embrace digital marketing, smart packaging becomes an essential tool for enhancing visibility and strengthening brand-customer relationships.

- For instance, Estée Lauder aims that by 2025, 75-100% of its packaging by weight meets its “5 Rs” (recyclable, refillable, reusable, recycled or recoverable) target.

Key Challenges

High Production and Material Costs

The shift toward sustainable and high-quality materials increases production expenses for cosmetic packaging manufacturers. Bio-based plastics, recycled resins, and specialty coatings are costlier than traditional polymers. Smaller cosmetic brands face challenges in adopting eco-friendly solutions due to limited budgets and low economies of scale. Additionally, fluctuating raw material prices and global supply chain disruptions further impact profitability. Balancing sustainability goals with affordability remains a critical concern, compelling manufacturers to invest in cost-efficient technologies and material innovation.

Stringent Regulatory Compliance

Tightening environmental regulations across regions pose compliance challenges for packaging producers. Restrictions on single-use plastics, extended producer responsibility (EPR) programs, and labeling standards require frequent redesigns and documentation. Manufacturers must ensure that materials meet regional recycling and chemical safety norms such as REACH and FDA standards. These evolving laws increase operational complexities and costs, especially for global brands managing multiple product lines. Maintaining compliance while ensuring design innovation and performance consistency remains a significant barrier to market growth.

Regional Analysis

North America

North America held a 32% share of the cosmetic packaging market in 2024, driven by high consumer spending on beauty and personal care products. The United States leads the region due to strong demand for premium skincare and sustainable packaging solutions. Brands emphasize recyclable plastics and glass containers to align with eco-conscious consumer preferences. Growth in e-commerce and digital cosmetic brands also supports innovation in lightweight and protective packaging. Increasing regulatory focus on packaging sustainability continues to encourage material advancements and design innovations across both the U.S. and Canada markets.

Europe

Europe accounted for about 28% of the cosmetic packaging market in 2024, supported by strong sustainability initiatives and stringent environmental regulations. Countries such as Germany, France, and the U.K. are leading in adopting recyclable and biodegradable packaging materials. The presence of luxury cosmetic brands drives demand for glass and metal containers that reflect premium aesthetics. The EU’s green packaging policies and circular economy goals promote eco-friendly material innovation. Growing consumer interest in refillable and minimal-waste packaging formats continues to fuel steady regional market expansion.

Asia Pacific

Asia Pacific dominated the global cosmetic packaging market with a 34% share in 2024, making it the largest regional contributor. Rapid urbanization, expanding middle-class income, and increasing beauty product consumption in China, Japan, South Korea, and India are driving growth. Local and international brands are investing in innovative packaging designs that cater to diverse preferences. The region also benefits from cost-effective manufacturing and material availability. Growing awareness of sustainable beauty and eco-friendly packaging options further strengthens market opportunities, especially within skincare and personal care segments.

Latin America

Latin America captured nearly 4% of the global cosmetic packaging market in 2024, with Brazil and Mexico leading regional demand. The market benefits from the growing popularity of locally produced beauty and personal care brands. Consumers increasingly prefer affordable yet attractive packaging options, encouraging brands to adopt lightweight plastic and paper-based formats. Expanding online retail platforms and the growing influence of social media marketing are boosting cosmetic sales. Although sustainability awareness is rising, cost-sensitive consumers continue to drive preference for budget-friendly packaging materials.

Middle East & Africa

The Middle East & Africa region accounted for around 2% of the cosmetic packaging market in 2024. Market growth is driven by increasing consumer interest in personal grooming and premium beauty products, particularly in the UAE and Saudi Arabia. Rising tourism and the presence of global cosmetic retailers have boosted demand for luxury packaging. Manufacturers are focusing on durable and visually appealing designs suitable for high-end skincare and fragrance products. Despite relatively small market size, the region offers long-term potential through growing urbanization and premiumization trends.

Market Segmentations:

By Material Type:

- Plastic

- Metal

- Glass

- Paper

- Others

By Cosmetic Type:

- Hair Care

- Skin Care

- Nail Care

- Make-up

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cosmetic packaging market is highly competitive, with leading players such as AptarGroup Inc., Ball Corporation, Libo Cosmetics Company Ltd, Gerresheimer AG, Amcor Group GmbH, DS Smith PLC, HCP Packaging Co. Ltd, Albea SA, Verescence France, Quadpack Industries SA, SKS Bottle & Packaging Inc., Rieke Corporation, RPC Group PLC (Berry Global Group), Graham Packaging LP, Cosmopak Ltd, Altium Packaging (Loews Corporation), Raepak Ltd, and Silgan Holdings Inc. Companies in this market focus on product differentiation, sustainable material innovation, and premium design aesthetics to strengthen brand partnerships. The industry is witnessing rising investments in recyclable plastics, glass packaging, and eco-friendly coatings to meet green standards. Strategic collaborations with cosmetic brands help enhance global reach and supply chain efficiency. Manufacturers are also integrating digital printing and smart labeling technologies to improve customization and traceability. Continuous R&D efforts aim to balance sustainability, durability, and cost-effectiveness, shaping future market competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AptarGroup Inc.

- Ball Corporation

- Libo Cosmetics Company Ltd

- Gerresheimer AG

- Amcor Group GmbH

- DS Smith PLC

- HCP Packaging Co. Ltd

- Albea SA

- Verescence France

- Quadpack Industries SA

- SKS Bottle & Packaging Inc.

- Rieke Corporation

- RPC Group PLC (Berry Global Group)

- Graham Packaging LP

- Cosmopak Ltd

- Altium Packaging (Loews Corporation)

- Raepak Ltd

- Silgan Holdings Inc.

Recent Developments

- In 2025, Aptar Beauty expanded its “local for local” airless packaging portfolio in Latin America with the release of the Sierra, Moda, and Luna solutions.

- In 2025, RPC Group PLC (Berry Global Group) Expanded its Stick and Refill product line by launching smaller 15ml, 20ml, and 25ml sizes for cosmetics. These products are made from recyclable materials.

- In 2023, Albea SA Partnered with Oriflame to launch the Duologi range, using tubes aligned with Albea’s sustainability goals.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Cosmetic Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cosmetic packaging market will continue expanding with strong demand for sustainable materials.

- Brands will increasingly shift toward recyclable, refillable, and biodegradable packaging formats.

- Smart packaging with QR codes and NFC technology will enhance product transparency and traceability.

- Growth in e-commerce will boost demand for lightweight and protective packaging solutions.

- Premium and personalized packaging designs will attract high-end consumers across major markets.

- Advances in bio-based plastics and paper composites will reduce environmental impact.

- Regional manufacturers will focus on cost-effective production and localized supply chains.

- Refillable systems will become mainstream, supported by sustainability-driven consumers.

- Emerging economies in Asia and Latin America will drive large-scale market adoption.

- Collaboration between packaging producers and cosmetic brands will accelerate innovation and circular design.