| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cervical Dysplasia Diagnostic Market Size 2024 |

USD 764.8 million |

| Cervical Dysplasia Diagnostic Market, CAGR |

7.23% |

| Cervical Dysplasia Diagnostic Market Size 2032 |

USD 1,331.9 million |

Market Overview

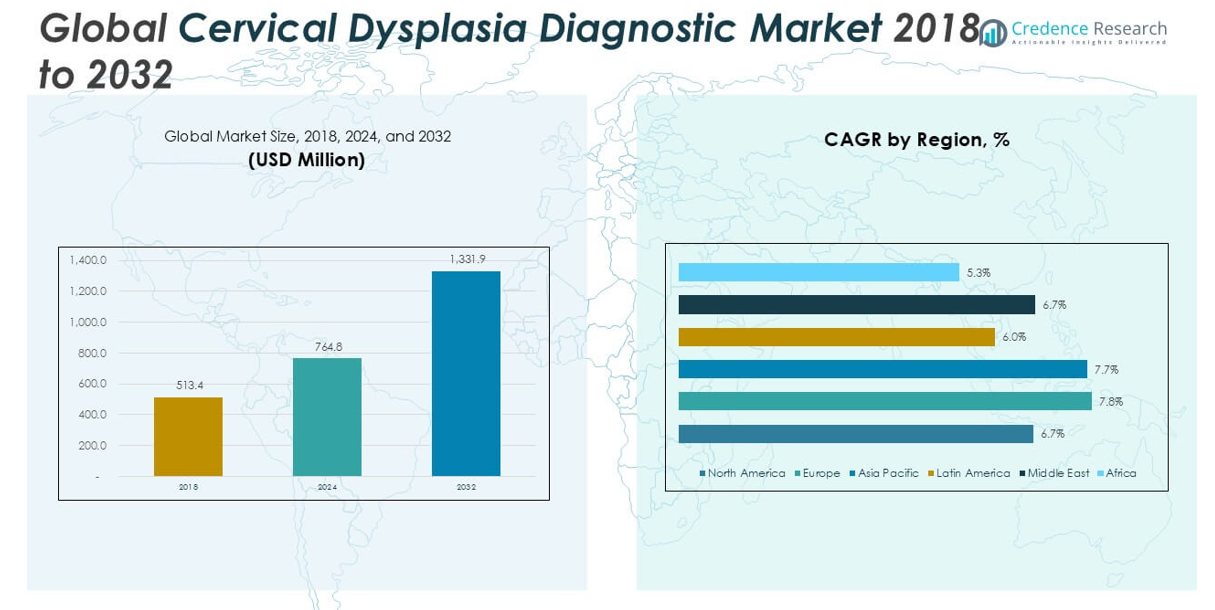

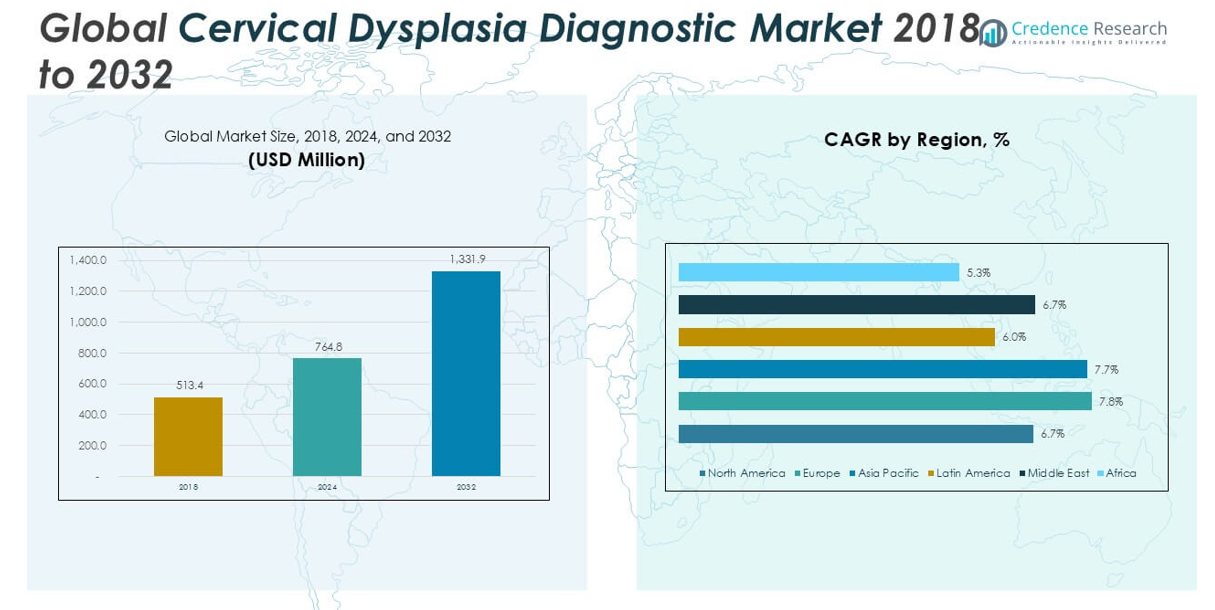

The Cervical Dysplasia Diagnostic market size was valued at USD 513.4 million in 2018, increased to USD 764.8 million in 2024, and is anticipated to reach USD 1,331.9 million by 2032, growing at a CAGR of 7.23% during the forecast period.

The Cervical Dysplasia Diagnostic market is led by key players such as Abbott Laboratories, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd., Hologic, Inc., QIAGEN N.V., and Quest Diagnostics, Inc., all of which offer advanced diagnostic platforms and broad global reach. These companies focus on innovation in molecular testing, automated cytology, and integrated diagnostic services to strengthen their market position. Regionally, Asia Pacific dominates the market with a 34.7% share in 2024, driven by increasing awareness, government-led screening programs, and rising investments in healthcare infrastructure across countries like China and India. North America and Europe follow closely due to strong reimbursement frameworks and advanced diagnostic capabilities.

Market Insights

- The Cervical Dysplasia Diagnostic market was valued at USD 764.8 million in 2024 and is projected to reach USD 1,331.9 million by 2032, growing at a CAGR of 7.23% during the forecast period.

- Market growth is primarily driven by the rising prevalence of HPV infections, increasing awareness of cervical cancer screening, and the implementation of national screening programs in both developed and emerging economies.

- A major trend includes the shift toward self-sampling HPV test kits and molecular diagnostics, improving early detection and patient compliance while expanding reach in low-resource settings.

- The market is moderately consolidated, with key players like Abbott, Roche, Hologic, and QIAGEN competing through product innovation and strategic partnerships; the Pap smear segment accounted for the largest share among diagnostic types.

- Asia Pacific led the market with a 34.7% share in 2024, followed by North America (23.9%) and Europe (22.6%), while access limitations in Africa and parts of Latin America continue to restrain growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

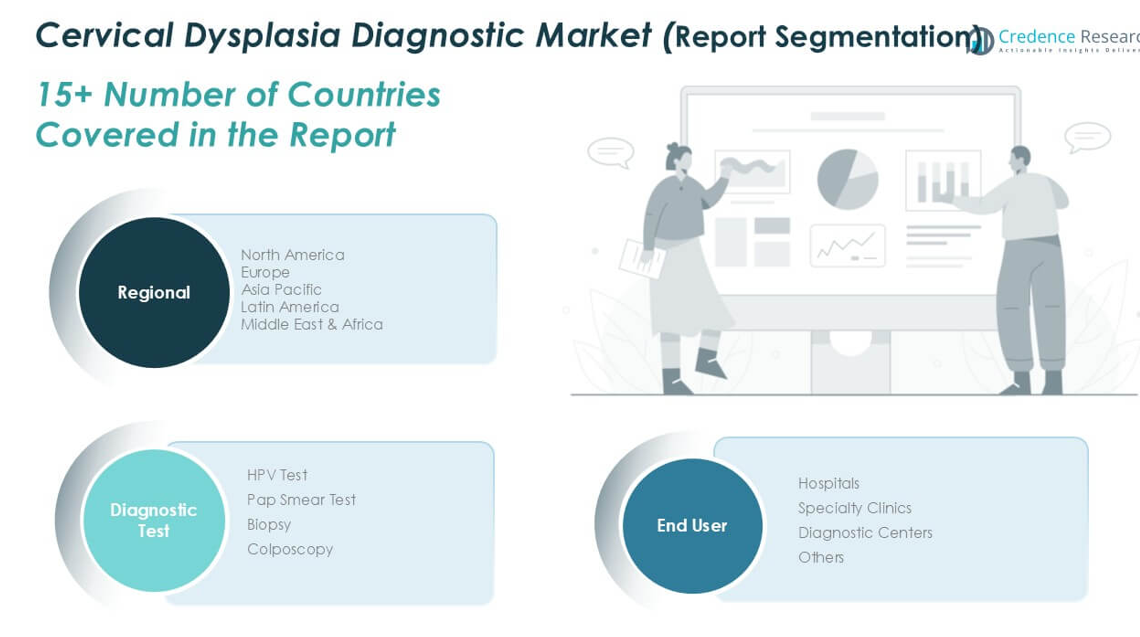

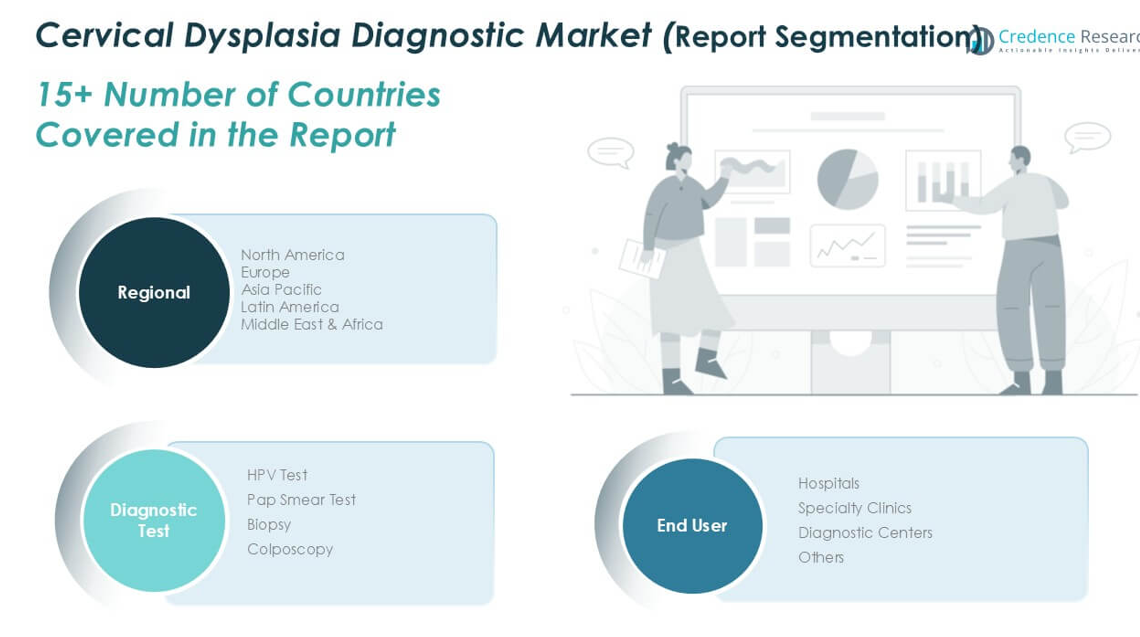

By Diagnostic Test:

The Cervical Dysplasia Diagnostic market is segmented into HPV test, Pap smear test, biopsy, and colposcopy. Among these, the Pap smear test holds the largest market share, accounting for over 35% in 2024. Its dominance is attributed to its widespread adoption in routine cervical cancer screening and cost-effectiveness in early detection. HPV tests are rapidly gaining ground due to their higher sensitivity and increasing awareness of HPV as a primary cause of cervical dysplasia. Biopsy and colposcopy, though crucial for confirmation and staging, are used less frequently due to their invasive nature.

- For instance, Hologic’s ThinPrep® Pap Test has processed over 1 billion tests globally since its launch and is approved in more than 100 countries, establishing its global dominance in cytology-based cervical screening.

By End User:

Hospitals emerged as the leading end-user segment in the Cervical Dysplasia Diagnostic market, capturing over 40% of the market share in 2024. Their dominance is driven by well-established infrastructure, availability of advanced diagnostic tools, and skilled healthcare professionals. Additionally, hospitals are often the preferred choice for follow-up procedures and treatment after initial screening. Specialty clinics are witnessing steady growth due to rising demand for personalized gynecological care, while diagnostic centers are benefiting from growing awareness and increased accessibility to standalone screening services in urban and semi-urban regions.

- For instance, Quest Diagnostics operates over 2,100 patient service centers and conducts more than 20 million women’s health-related tests annually, enabling high-throughput cervical screening across hospitals and diagnostic networks.

Market Overview

Rising Prevalence of Human Papillomavirus (HPV) Infections

The increasing incidence of HPV infections, a primary cause of cervical dysplasia, is significantly driving demand for diagnostic solutions. Globally, HPV accounts for nearly all cervical cancer cases, prompting widespread screening initiatives. This growing health burden has intensified the adoption of diagnostic tests such as HPV and Pap smear tests, especially in high-risk populations. Governments and healthcare organizations are scaling up preventive care measures, including routine HPV testing, which directly supports market expansion by encouraging early detection and timely medical intervention.

- For instance, Roche’s cobas® HPV test was the first FDA-approved test for primary screening and has processed over 70 million patient samples globally, validating its role in HPV-related diagnostic workflows.

Government-Led Screening Programs and Awareness Campaigns

Governmental and non-profit organizations are actively launching cervical cancer screening programs aimed at early diagnosis and reduction of disease burden. Many developed and emerging economies have integrated Pap smear and HPV testing into national health policies, thereby increasing screening rates among women aged 21 to 65. Educational campaigns focused on women’s health are further improving awareness, particularly in underserved regions. These initiatives not only boost test volumes but also support infrastructure development in diagnostic centers and clinics, fostering sustainable market growth.

- For instance, in India, the government’s collaboration with BD (Becton, Dickinson and Company) facilitated HPV screening using BD Onclarity™ systems, screening over 250,000 women in community health programs between 2020 and 2023.

Advancements in Diagnostic Technologies

Technological innovations in diagnostic tools have improved the accuracy, efficiency, and accessibility of cervical dysplasia screening. Automated cytology systems, liquid-based cytology, and AI-assisted diagnostics are enhancing detection sensitivity while reducing human error. Additionally, the development of point-of-care and self-sampling HPV test kits is making diagnostics more patient-centric. These advancements are particularly crucial in expanding access to screening in remote or low-resource settings. As diagnostic precision improves and becomes more accessible, the market continues to witness a steady rise in adoption rates across healthcare facilities.

Key Trends & Opportunities

Shift Toward Molecular and Self-Sampling Testing

There is a notable shift from conventional cytology-based diagnostics to molecular testing methods, particularly HPV DNA tests. Self-sampling kits are gaining popularity due to their privacy, convenience, and ability to reach women who avoid clinical visits. This trend is enabling better population coverage and improving early detection rates. Market players are increasingly investing in developing cost-effective and accurate home-based testing solutions, creating new opportunities for product innovation and partnerships with public health bodies to widen diagnostic reach.

- For instance, QIAGEN’s digene® HPV Self-Collection kit has been used in more than 15 million tests globally and is part of multiple national screening programs, including those in Mexico, Rwanda, and the Netherlands.

Expansion in Emerging Economies

Emerging markets, particularly in Asia-Pacific, Latin America, and parts of Africa, present substantial growth opportunities due to improving healthcare infrastructure and increasing awareness of women’s health. These regions have a large, underserved population with rising disposable income and government backing for public health programs. International funding and global health partnerships are also enhancing access to diagnostics. Market players are tapping into these opportunities by launching low-cost diagnostic solutions and partnering with local distributors, aiming to capture market share in rapidly evolving healthcare ecosystems.

- For instance, GeneXpert HPV testing by Cepheid has been deployed in over 35 low- and middle-income countries, supported by Gavi and the Clinton Health Access Initiative, helping screen more than 3 million women through mobile and rural health units.

Key Challenges

Limited Access to Screening in Low-Income Regions

Despite growing awareness, access to cervical dysplasia diagnostics remains limited in low-income and rural regions due to lack of infrastructure, trained personnel, and financial resources. Many women in these areas remain unscreened or underdiagnosed, leading to late-stage detection and poor health outcomes. Efforts to deploy affordable and decentralized diagnostic tools face logistical and operational hurdles. This disparity continues to restrain the market’s full potential, particularly in regions with high disease burden but insufficient healthcare capacity.

Social Stigma and Lack of Awareness

Cultural stigma, limited knowledge, and misconceptions about cervical health continue to hinder routine screening, particularly in conservative and low-literacy populations. Many women avoid gynecological examinations due to embarrassment or fear of diagnosis. This resistance negatively impacts test uptake rates, despite the availability of diagnostic services. Overcoming these socio-cultural barriers requires sustained community outreach, education programs, and trust-building initiatives, which can be resource-intensive and time-consuming, posing a challenge for healthcare providers and market stakeholders.

Regional Analysis

North America

North America accounted for approximately 23.9% of the global cervical dysplasia diagnostic market in 2024, with a valuation of USD 182.72 million, up from USD 126.10 million in 2018. The market is projected to reach USD 306.34 million by 2032, expanding at a CAGR of 6.7%. Growth in this region is driven by high awareness, established screening programs, and technological advancements in diagnostics. The presence of leading healthcare facilities and favorable reimbursement policies further support market penetration. The U.S. remains the dominant contributor, with strong uptake of HPV testing and routine Pap smears across various healthcare settings.

Europe

Europe held a 22.6% share of the cervical dysplasia diagnostic market in 2024, with market size rising from USD 111.82 million in 2018 to USD 172.34 million in 2024. The region is anticipated to reach USD 313.54 million by 2032, growing at a CAGR of 7.8%, the highest among developed markets. Europe’s growth is supported by national cancer screening programs, early adoption of molecular diagnostics, and public healthcare funding. Countries like Germany, the UK, and France are at the forefront of screening compliance. Technological integration and expanded access through public health services are accelerating diagnostics uptake across the region.

Asia Pacific

Asia Pacific dominated the global market with the largest regional share of 34.7% in 2024, reaching USD 265.27 million, up from USD 173.02 million in 2018. The market is forecasted to hit USD 479.49 million by 2032, expanding at a robust CAGR of 7.7%. This growth is attributed to improving healthcare infrastructure, rising awareness, and increased government focus on women’s health across countries such as China, India, and Japan. Expanding access to low-cost diagnostics and international support for cancer screening initiatives are transforming the regional landscape. Private sector investment in diagnostics is also accelerating market development.

Latin America

In 2024, Latin America represented around 9.9% of the global cervical dysplasia diagnostic market, with a market size of USD 75.47 million, up from USD 54.01 million in 2018. The market is projected to grow to USD 119.87 million by 2032 at a CAGR of 6.0%. Regional growth is driven by gradual expansion in diagnostic infrastructure, increased awareness of cervical cancer risks, and public health campaigns. Brazil and Mexico lead in market adoption, supported by both government programs and international partnerships. However, uneven healthcare access across rural areas poses ongoing challenges to full market penetration.

Middle East

The Middle East accounted for approximately 6.6% of the global cervical dysplasia diagnostic market in 2024, valued at USD 49.93 million, rising from USD 34.40 million in 2018. The market is forecasted to reach USD 83.91 million by 2032, growing at a CAGR of 6.7%. Rising investment in healthcare infrastructure and growing efforts toward women’s health screening programs are fueling regional demand. Countries like the UAE and Saudi Arabia are adopting advanced diagnostics within public and private healthcare systems. Nonetheless, disparities in access across less-developed areas remain a key concern for long-term regional expansion.

Africa

Africa represented the smallest share of the cervical dysplasia diagnostic market in 2024, accounting for 2.5%, with a valuation of USD 19.05 million, up from USD 14.07 million in 2018. The market is projected to reach USD 28.77 million by 2032, growing at a modest CAGR of 5.3%. Despite a high burden of cervical cancer, limited access to diagnostic services, lack of awareness, and underfunded healthcare systems are restraining market growth. Efforts by NGOs and international health agencies are ongoing to improve screening access, but significant investment and policy support are required to drive meaningful progress in the region.

Market Segmentations:

By Diagnostic Test:

- HPV Test

- Pap Smear Test

- Biopsy

- Colposcopy

By End User:

- Hospitals

- Specialty Clinics

- Diagnostic Centers

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cervical dysplasia diagnostic market is moderately consolidated, with a mix of global diagnostic leaders and specialized biotechnology firms competing to expand their market presence. Major players such as Abbott Laboratories, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd., and Hologic, Inc. dominate the landscape through their robust product portfolios, established distribution networks, and ongoing innovation in molecular diagnostics and automated cytology systems. Companies like QIAGEN N.V. and Quest Diagnostics, Inc. are investing in advanced HPV DNA testing and expanding their presence through strategic partnerships and laboratory service offerings. Competitive strategies include mergers and acquisitions, regional expansion, and product innovation to strengthen diagnostic accuracy and market reach. As technological advancements accelerate and self-sampling methods gain traction, competition is expected to intensify, particularly in emerging markets and underserved regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Abbott Laboratories

- Becton, Dickinson and Company

- Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Micromedic Technologies Ltd.

- OncoHealth Corporation

- PDS Biotechnology Corporation

- Quest Diagnostics, Inc.

- QIAGEN N.V.

Recent Developments

- In January 2025, BD (Becton, Dickinson and Company)released survey results indicating a strong preference among women for more comfortable and less invasive HPV/cervical cancer testing options. The BD Onclarity™ HPV Assay, which is FDA-approved for self-collection, was highlighted for its ability to identify more individual high-risk HPV types than other tests, aiding in targeted patient management and potentially reducing the need for invasive procedures, according to the company.

- In November 2024, BD launched a first-of-its-kind HPV self-collection study aimed at improving cervical cancer screening in underserved communities, reflecting a broader industry shift toward self-sampling and patient-centered diagnostics.

- In May 2024, Roche announced that the FDA approved its HPV self-collection solution in the U.S., marking a significant milestone as one of the first widely available options for patients to collect their own samples for HPV testing at home, significantly improving access to cervical cancer screening, particularly for underserved populations by eliminating barriers related to privacy and convenience.

- In February 2024, Hologic’s Genius™ Digital Diagnostics System, featuring the Genius™ Cervical AI algorithm, became the first and only FDA-cleared digital cytology system in the U.S. This system uses deep-learning AI and advanced volumetric imaging to improve the detection of pre-cancerous lesions and cervical cancer cells. It demonstrated a 28% reduction in false negatives for high-grade lesions compared to traditional microscopic review, and enables remote collaboration among experts.

Market Concentration & Characteristics

The Cervical Dysplasia Diagnostic Market exhibits moderate market concentration, with a mix of established diagnostic leaders and emerging biotechnology firms competing across developed and developing regions. It is characterized by strong technological innovation, particularly in molecular diagnostics and HPV DNA testing, which has reshaped clinical practices for early detection. Leading companies focus on integrated diagnostic platforms, regulatory approvals, and global expansion to strengthen their positions. Demand remains driven by public health initiatives, rising awareness, and increasing screening compliance. The market also reflects significant variation in access and adoption, with developed countries showing high penetration of advanced diagnostic tools while many low-income regions still face infrastructure limitations. Growth potential remains strong in underserved areas, where governments and NGOs are investing in awareness campaigns and low-cost screening solutions. Strategic collaborations between private firms and public health bodies continue to influence pricing models and distribution. Market players differentiate through test accuracy, ease of use, and accessibility. It responds well to evolving healthcare policies that mandate preventive care. Despite barriers in rural access and cultural stigma, consistent demand from hospitals, clinics, and diagnostic centers sustains competitive intensity and encourages innovation across segments.

Report Coverage

The research report offers an in-depth analysis based on Diagnostic Test, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to the rising global incidence of HPV-related cervical abnormalities.

- Increasing adoption of molecular diagnostics and HPV DNA testing will enhance early detection accuracy.

- Self-sampling and home-based test kits will gain popularity, improving screening rates in underserved populations.

- Technological advancements will lead to the development of more efficient and user-friendly diagnostic tools.

- Government-led awareness programs and national screening initiatives will drive higher participation rates.

- Emerging economies will offer significant growth opportunities due to improving healthcare infrastructure.

- Strategic collaborations between diagnostic companies and public health agencies will expand market access.

- Digital health integration and telemedicine will support diagnostic outreach in remote regions.

- Continued investment in R&D will enable the development of non-invasive and rapid diagnostic solutions.

- Market players will focus on affordability and accessibility to strengthen their presence in low-income regions.