Market Overview

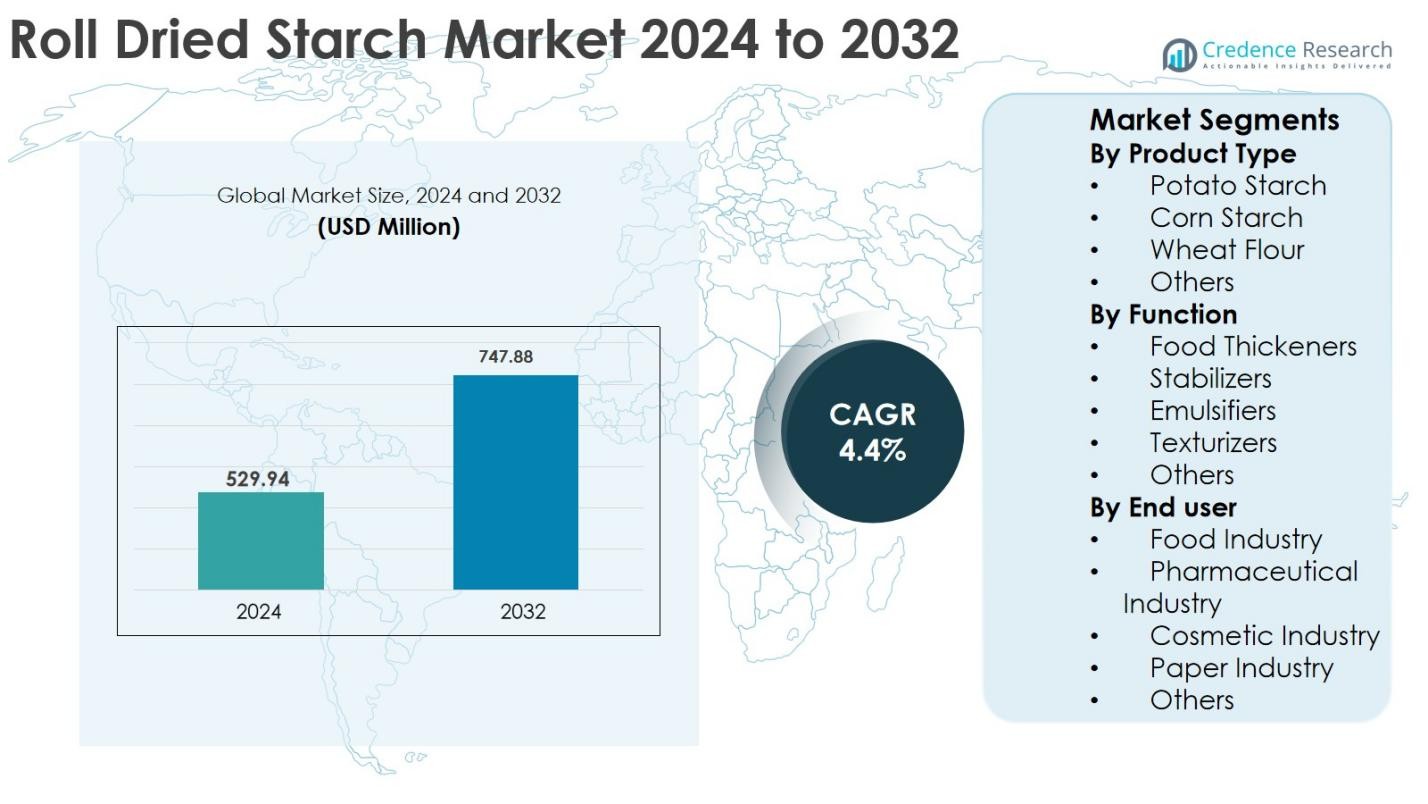

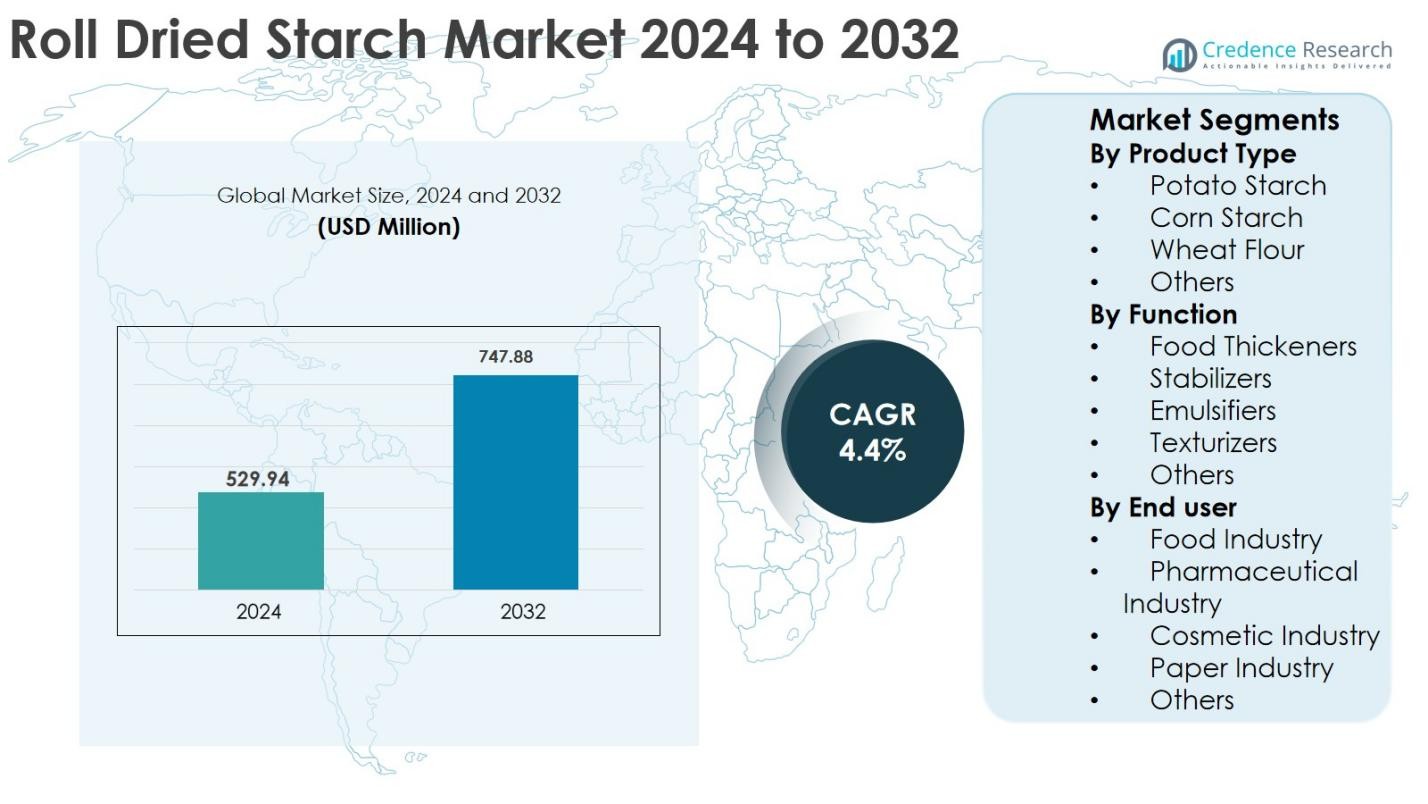

Roll dried starch market size was valued at USD 529.94 million in 2024 and is anticipated to reach USD 747.88 million by 2032, growing at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Roll dried starch market Size 2024 |

USD 529.94 Million |

| Roll dried starch market , CAGR |

4.4% |

| Roll dried starch market Size 2032 |

USD 747.88 Million |

Roll dried starch market is driven by a mix of global agribusiness leaders and regional starch manufacturers focused on functional performance and cost efficiency. Companies such as Archer Daniels Midland Company, Cargill Incorporated, Roquette Frères, Buhler AG, Grain Processing Corporation, and Galam play a significant role through strong raw material integration, advanced processing technologies, and diversified application portfolios across food, pharmaceutical, and industrial sectors. Regionally, North America led the market with a 34.2% share in 2024, supported by high processed food consumption and mature manufacturing infrastructure, followed by Europe with 28.6% share driven by clean-label demand and regulatory compliance. Asia-Pacific accounted for 24.1% share, benefiting from rapid food processing expansion and rising convenience food consumption, positioning it as the fastest-growing regional market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Roll dried starch market size stood at USD 529.94 million in 2024 and is projected to reach USD 747.88 million by 2032, registering a CAGR of 4.4% during the forecast period.

- Market growth is primarily driven by rising demand for processed and convenience foods, where roll dried starch is widely used for thickening, binding, and texture enhancement; the food industry dominated end-use demand with a 52.4% share, supported by bakery, sauces, soups, and ready-to-eat products.

- Key market trends include increasing adoption of clean-label and plant-based ingredients and growing use of roll dried starch as food thickeners, which held a leading 38.9% functional share due to rapid hydration and stable viscosity in food formulations.

- The market shows moderate competition, with global players such as Archer Daniels Midland Company, Cargill Incorporated, Roquette Frères, and Grain Processing Corporation focusing on capacity expansion, product customization, and application-specific starch solutions.

- Regionally, North America led the market with a 34.2% share, followed by Europe at 28.6%, Asia-Pacific at 24.1% driven by rapid food processing growth, Latin America at 8.1%, and Middle East & Africa accounting for 5.0% share.

Market Segmentation Analysis:

By Product Type

The roll dried starch market by product type is led by corn starch, which accounted for 41.6% market share in 2024, driven by its wide availability, cost efficiency, and consistent functional performance across food and industrial applications. Corn starch benefits from strong demand in processed foods, bakery products, and instant mixes due to its excellent thickening and binding properties. Potato starch follows, supported by clean-label preferences and superior viscosity, while wheat flour maintains steady adoption in traditional food processing. Ongoing innovation in starch modification and rising demand for plant-based ingredients continue to strengthen this segment’s growth outlook.

- For instance, Cargill uses roll-dried corn starch in several texturizing solutions within its SimPure and other specialty starch lines to improve stability and mouthfeel in sauces and bakery fillings.

By Function

Based on function, food thickeners dominated the roll dried starch market with a 38.9% share in 2024, supported by increasing consumption of convenience foods, soups, sauces, and ready-to-eat meals. Roll dried starches are preferred for thickening due to rapid hydration, smooth texture, and stable viscosity under heat processing. Stabilizers and texturizers also hold significant shares, particularly in dairy and bakery applications. Growth is further fueled by manufacturers’ focus on improving mouthfeel, shelf stability, and processing efficiency, along with rising demand for functional ingredients in clean-label and low-fat formulations.

- For instance, Ingredion’s pregelatinized starch solutions are used in instant soups and sauces to enable quick thickening and consistent texture in boil-in-bag and microwaveable formats.

By End User

The food industry emerged as the dominant end user, capturing 52.4% of the roll dried starch market share in 2024, driven by extensive usage in bakery, snacks, sauces, and instant food products. Roll dried starch offers superior dispersibility and consistency, making it ideal for high-speed food processing operations. The pharmaceutical and cosmetic industries are expanding steadily, supported by demand for excipients and texture-enhancing agents. Meanwhile, paper industry applications benefit from improved surface strength and coating performance. Increasing processed food consumption and industrial efficiency requirements continue to propel end-user demand globally.

Key Growth Drivers

Rising Demand for Processed and Convenience Foods

The roll dried starch market is strongly driven by increasing global consumption of processed and convenience foods, particularly bakery products, instant soups, sauces, and ready-to-eat meals. Roll dried starch provides rapid hydration, consistent viscosity, and smooth texture, making it highly suitable for high-throughput food manufacturing. Urbanization, changing dietary habits, and rising working populations continue to accelerate demand for easy-to-prepare food products across both developed and emerging economies. Food manufacturers increasingly prefer roll dried starch for its functional reliability, process efficiency, and compatibility with automated production lines. In addition, the expanding foodservice sector and private-label food production further support sustained demand for roll dried starch solutions.

- For instance, Tate & Lyle promotes its pregelatinized starch solutions for bakery and snack applications where rapid mixing, batter stability, and consistent crumb structure are critical for high-speed production.

Expanding Applications in Pharmaceutical and Industrial Sectors

Beyond food applications, growing utilization of roll dried starch in pharmaceuticals and industrial processes is a key market driver. In pharmaceuticals, roll dried starch is widely used as a binder, disintegrant, and filler in tablet formulations due to its uniform particle size and excellent compressibility. Industrial applications such as paper coating, adhesives, and textile sizing also benefit from its strong film-forming and binding properties. Rising pharmaceutical production volumes, coupled with increased demand for cost-effective excipients, are expanding adoption. Meanwhile, industrial manufacturers favor roll dried starch for its consistent performance and scalability, supporting steady growth across non-food end-use sectors.

- For instance, Roquette’s pharmaceutical-grade starches (such as pregelatinized maize starch) are formulated into oral solid doses as multifunctional binders and disintegrants to support high-speed tableting and robust tablets.

Growth in Clean-Label and Plant-Based Ingredient Demand

The shift toward clean-label, plant-based, and minimally processed ingredients is significantly boosting demand for roll dried starch. Food manufacturers are reformulating products to remove synthetic additives while maintaining texture, stability, and shelf life. Roll dried starch derived from corn, potato, and wheat aligns well with clean-label requirements, as it is perceived as natural and consumer-friendly. Increasing health awareness, regulatory pressure on artificial additives, and demand for transparency in ingredient labeling are accelerating adoption. This trend is particularly strong in premium food segments, organic products, and plant-based alternatives, positioning roll dried starch as a preferred functional ingredient.

Key Trends & Opportunities

Technological Advancements in Starch Processing

Continuous innovation in starch processing technologies presents significant opportunities for the roll dried starch market. Manufacturers are investing in advanced drying techniques, improved drum-drying efficiency, and process optimization to enhance starch functionality and consistency. These advancements enable customized starch solutions with improved solubility, viscosity control, and thermal stability tailored to specific applications. Enhanced processing efficiency also reduces energy consumption and production costs, improving profitability. As end-use industries demand high-performance ingredients with precise functional attributes, technology-driven differentiation is becoming a key competitive advantage, opening new opportunities in specialty food and industrial applications.

- For instance, leading specialty starch suppliers now offer heat- and shear-stable drum-dried starches designed for retorted or frozen-ready meals, maintaining texture and stability through intense thermal processing.

Rising Demand from Emerging Markets

Emerging economies present strong growth opportunities for the roll dried starch market due to rapid urbanization, expanding food processing industries, and increasing disposable incomes. Countries in Asia-Pacific, Latin America, and parts of the Middle East are witnessing rising demand for packaged and convenience foods, driving starch consumption. Local food manufacturers are upgrading production capabilities and seeking cost-effective functional ingredients, supporting roll dried starch adoption. Additionally, growth in pharmaceutical manufacturing and paper production in these regions further strengthens demand. Favorable government initiatives supporting food processing and industrial development enhance long-term market expansion potential.

- For instance, in China and Southeast Asia, major instant noodle and ready-meal producers use drum- and roll-dried starches to achieve reliable thickening and stability in seasoning sachets and sauce bases.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in the prices of key raw materials such as corn, wheat, and potatoes pose a significant challenge for the roll dried starch market. Agricultural output is highly dependent on weather conditions, crop yields, and global supply-demand dynamics, leading to price instability. Rising input costs directly impact production margins for starch manufacturers and can result in higher product prices for end users. This volatility complicates long-term pricing strategies and supply contracts, particularly for small and medium-scale producers. Managing raw material sourcing, inventory, and cost pass-through remains a critical challenge for market participants.

Competition from Alternative Starch Technologies

The roll dried starch market faces increasing competition from alternative starch processing technologies, including spray-dried and modified starches. These alternatives often offer enhanced solubility, improved functionality, and broader application flexibility, making them attractive to certain end users. Food and industrial manufacturers may prefer alternative starches for specialized applications, limiting roll dried starch penetration. Additionally, continuous innovation in enzyme-modified and chemically modified starches intensifies competitive pressure. To remain relevant, roll dried starch producers must invest in product differentiation, application-specific solutions, and technological upgrades to address evolving customer requirements.

Regional Analysis

North America

North America accounted for 34.2% of the roll dried starch market share in 2024, driven by strong demand from the food processing, pharmaceutical, and paper industries. The region benefits from advanced food manufacturing infrastructure and high consumption of convenience and ready-to-eat products. Roll dried starch is widely used in bakery, soups, sauces, and snack formulations due to its consistent performance and ease of processing. The presence of major starch producers and continuous product innovation further support market growth. Additionally, rising clean-label trends and demand for plant-based functional ingredients continue to strengthen adoption across the United States and Canada.

Europe

Europe held a 28.6% share of the roll dried starch market in 2024, supported by strong demand from bakery, dairy, and processed food segments. Stringent food quality regulations and a growing preference for natural and clean-label ingredients drive the use of roll dried starch in food formulations. Countries such as Germany, France, and the United Kingdom lead regional consumption due to well-established food and pharmaceutical industries. The region also benefits from increasing applications in paper and industrial processing. Ongoing product reformulation initiatives and demand for texture-enhancing ingredients are expected to sustain steady market growth.

Asia-Pacific

Asia-Pacific emerged as the fastest-growing region, capturing 24.1% of the roll dried starch market share in 2024, driven by rapid urbanization, expanding food processing industries, and rising disposable incomes. Increasing consumption of instant foods, snacks, and bakery products across China, India, Japan, and Southeast Asia is fueling demand. Local manufacturers increasingly adopt roll dried starch for its cost efficiency and functional versatility. Growth in pharmaceutical manufacturing and paper production further supports regional demand. Government initiatives promoting food processing and industrial development enhance long-term market expansion across emerging economies.

Latin America

Latin America accounted for 8.1% of the roll dried starch market share in 2024, supported by growing food and beverage production and expanding industrial applications. Countries such as Brazil and Mexico are key contributors due to rising demand for processed foods and bakery products. Roll dried starch is increasingly used to improve texture, stability, and processing efficiency in local food manufacturing. The region also benefits from abundant raw material availability, particularly corn. While market growth remains moderate, increasing investment in food processing infrastructure is expected to gradually enhance regional adoption.

Middle East & Africa

The Middle East & Africa region held 5.0% of the roll dried starch market share in 2024, driven by increasing demand for packaged foods and expanding industrial activities. Growth in urban populations and changing dietary patterns are boosting consumption of processed and convenience foods. Roll dried starch is gaining traction in bakery, sauces, and foodservice applications due to its functional reliability. The pharmaceutical and paper industries also contribute to demand growth. Although market penetration remains relatively low, improving food processing capabilities and rising imports of functional ingredients support steady regional expansion.

Market Segmentations:

By Product Type

- Potato Starch

- Corn Starch

- Wheat Flour

- Others

By Function

- Food Thickeners

- Stabilizers

- Emulsifiers

- Texturizers

- Others

By End user

- Food Industry

- Pharmaceutical Industry

- Cosmetic Industry

- Paper Industry

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The roll dried starch market features a moderately consolidated competitive landscape characterized by the presence of global agribusiness firms and specialized starch manufacturers focusing on product consistency, functional performance, and application-specific solutions. Key players such as Archer Daniels Midland Company, Cargill Incorporated, Roquette Frères, Buhler AG, Grain Processing Corporation, and Galam leverage strong raw material sourcing, advanced processing capabilities, and extensive distribution networks to maintain their market positions. Regional producers including Banpong Tapioca Flour Industrial, Mesa Foods LLC, S A Pharmachem Pvt Ltd, and Karandikars Cashell strengthen competition by offering cost-effective and customized starch products tailored to local demand. Companies increasingly invest in capacity expansion, process optimization, and clean-label product development to address evolving customer requirements. Strategic collaborations with food and pharmaceutical manufacturers, along with continuous innovation in starch functionality, remain key approaches to sustaining long-term growth and market differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Ingredion Incorporated announced a $50 million investment to modernize and expand production at its Cedar Rapids, Iowa facility to increase capacity for industrial starches used in packaging, papermaking, and related applications.

- In August 2024, Roquette Frères expanded its texturizing solutions portfolio with the launch of four new tapioca-based cook-up starches CLEARAM TR 2010, TR 2510, TR 3010, and TR 4010 enhancing plant-based and starch-derived functional ingredient offerings for food manufacturers

- In February 2024, Ingredion Incorporated launched NOVATION® Indulge 2940 functional native clean label starch, designed to provide improved gelling and mouthfeel for dairy and alternative dairy products, expanding its clean-label starch portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Function, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Roll dried starch market demand will continue to expand steadily, supported by rising consumption of processed and convenience food products.

- Food manufacturers will increasingly adopt roll dried starch to achieve consistent texture, viscosity, and processing efficiency.

- Clean-label and plant-based ingredient trends will strengthen the preference for natural starch solutions over synthetic additives.

- Product innovation will focus on enhancing functionality, including improved solubility and thermal stability.

- Applications in pharmaceuticals will grow as demand increases for reliable binders and disintegrants in solid dosage forms.

- Industrial uses in paper, adhesives, and textiles will support diversified end-user demand.

- Emerging markets will offer strong growth potential due to expanding food processing infrastructure.

- Manufacturers will invest in process optimization to improve energy efficiency and reduce production costs.

- Strategic partnerships with food and industrial producers will support long-term market positioning.

- Competition will intensify as players focus on differentiation through customized and application-specific starch products.