| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluoroscopy Systems Market Size 2024 |

USD 3,928.0 million |

| Fluoroscopy Systems Market, CAGR |

4.8% |

| Fluoroscopy Systems Market Size 2032 |

USD 5,722.8 million |

Market Overview:

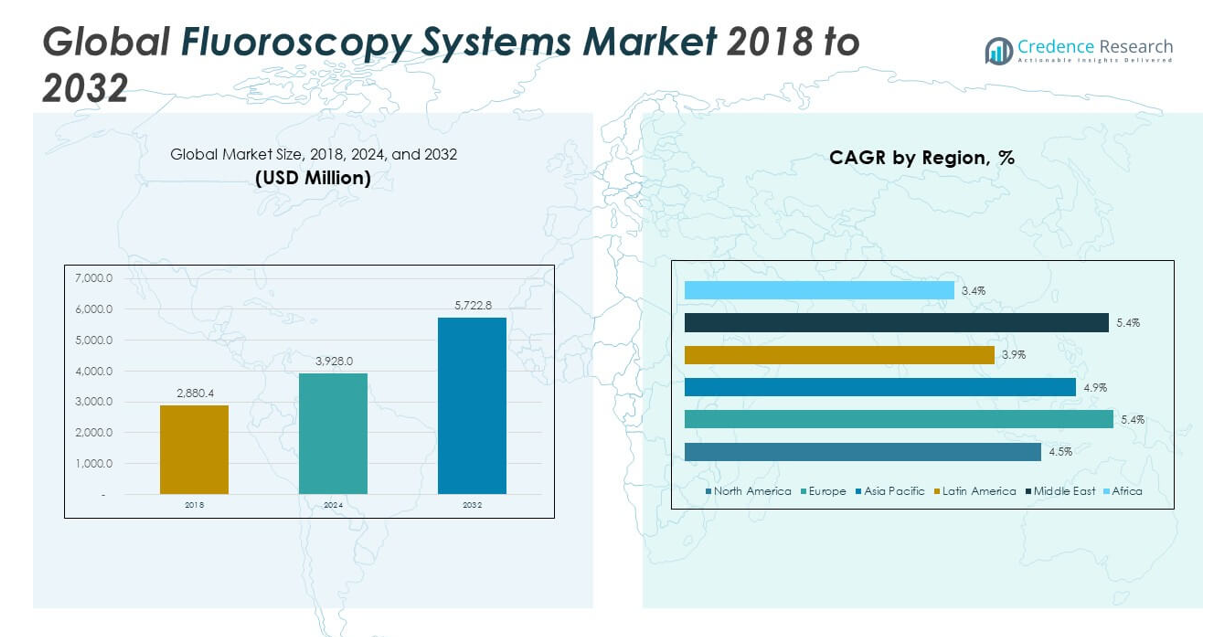

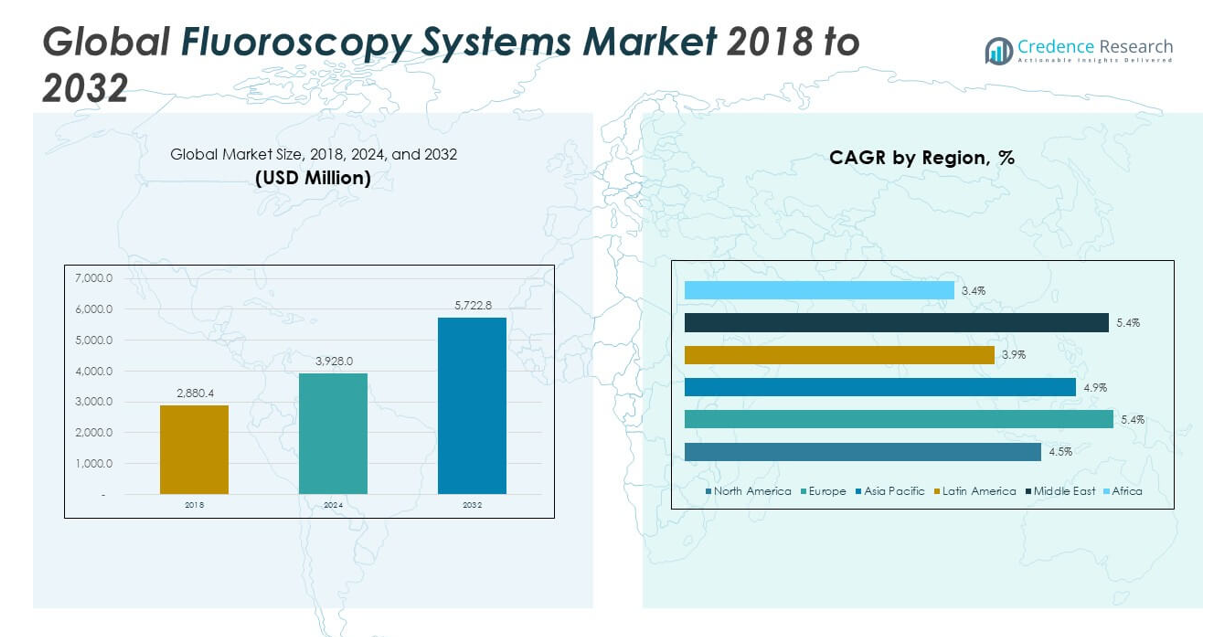

The Global Fluoroscopy Systems Market size was valued at USD 2,880.4 million in 2018 to USD 3,928.0 million in 2024 and is anticipated to reach USD 5,722.8 million by 2032, at a CAGR of 4.8% during the forecast period.

he key drivers accelerating the growth of the fluoroscopy systems market include the rising prevalence of chronic conditions such as cardiovascular disease, gastrointestinal disorders, and degenerative bone diseases, particularly among aging populations. These diseases often require timely and precise diagnostic imaging, fueling the need for advanced fluoroscopy systems in hospitals, diagnostic centers, and ambulatory surgical units. A strong shift toward minimally invasive surgeries further elevates demand, as such procedures depend heavily on real-time visualization capabilities. In addition, growing investments in hybrid imaging solutions, dose optimization technologies, and AI integration are enhancing system accuracy and workflow efficiency. The proliferation of ambulatory surgical centers, where mobile C-arm systems are favored for their versatility and space efficiency, is also contributing significantly to market growth. The push for early diagnosis, combined with regulatory support for safer, cost-effective imaging alternatives, continues to influence market adoption across both developed and developing healthcare environments.

Regionally, North America holds the dominant share of the global market, driven by advanced healthcare infrastructure, high diagnostic imaging volumes, favorable reimbursement frameworks, and strong investment in R&D. The United States in particular demonstrates high penetration of mobile and fixed fluoroscopy systems across interventional specialties. Europe remains a mature and stable market, supported by structured public healthcare systems and growing digitization across clinical settings, with Germany, France, and the UK leading adoption. In contrast, the Asia-Pacific region is the fastest-growing segment, fueled by rising chronic disease prevalence, increased healthcare expenditure, and medical tourism in countries like India, China, and Thailand. Government initiatives aimed at strengthening diagnostic imaging infrastructure and expanding hospital capacity are contributing to substantial regional gains. While Latin America and the Middle East & Africa hold relatively smaller market shares, both are witnessing gradual adoption due to urbanization, improved access to care, and strategic healthcare investments in key metropolitan regions. Collectively, the regional outlook underscores a strong opportunity landscape for market participants, especially those focused on affordable, scalable, and digitally integrated fluoroscopy solutions.

Market Insights:

- The Global Fluoroscopy Systems Market was valued at USD 2,880.4 million in 2018, reached USD 3,928.0 million in 2024, and is anticipated to grow to USD 5,722.8 million by 2032, registering a CAGR of 4.8% during the forecast period.

- Increasing prevalence of cardiovascular disease, gastrointestinal disorders, and degenerative bone conditions, particularly among aging populations, is fueling demand for real-time imaging solutions.

- The strong shift toward minimally invasive surgeries is accelerating system adoption in fields such as orthopedics, urology, pain management, and vascular interventions.

- Technological advances, including AI integration, flat-panel detectors, dose optimization technologies, and hybrid imaging platforms, are improving clinical outcomes and workflow efficiency.

- The rise of ambulatory surgical centers (ASCs) globally is increasing the need for mobile, versatile, and cost-effective fluoroscopy systems, especially for outpatient procedures.

- High equipment costs, installation requirements, and digital infrastructure limitations continue to restrict adoption in low- and middle-income countries, where affordability is a key concern.

- North America holds the largest market share due to advanced infrastructure and reimbursement systems, while Asia-Pacific is the fastest-growing region, driven by chronic disease burden, medical tourism, and government investments in diagnostic imaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Prevalence of Chronic and Degenerative Diseases Elevates Demand for Fluoroscopic Imaging:

The growing global burden of chronic diseases such as cardiovascular disorders, gastrointestinal conditions, and musculoskeletal degenerations is significantly driving demand in the Global Fluoroscopy Systems Market. An aging population and sedentary lifestyles are contributing to the steady rise in conditions that require precise and continuous imaging support. Fluoroscopy systems are widely used in the diagnosis and treatment of these illnesses due to their ability to provide real-time, dynamic visualization. Interventional cardiology, orthopedic procedures, and gastrointestinal diagnostics often depend on such imaging for accuracy and speed. The increasing number of patients with chronic illnesses is placing greater emphasis on early and accurate diagnostic tools. It is expected that this demand will continue to grow, reinforcing fluoroscopy as a critical modality in clinical workflows.

- For instance, in December 2024, Siemens Healthineers launched the Luminos Q.namix platform, a next-generation system that combines fluoroscopy and radiography functionalities to improve workflow efficiency and reduce radiation dose. Developed with input from over 130 fluoroscopy experts, the platform features both remote and tableside control models, enabling flexible and ergonomic operation for a wide range of clinical applications.

Expanding Application in Minimally Invasive and Image-Guided Procedures Drives System Adoption:

The trend toward minimally invasive surgeries is accelerating the adoption of fluoroscopy systems across a wide range of medical specialties. These procedures require high-resolution, real-time imaging to ensure precision, particularly in orthopedics, pain management, urology, and vascular interventions. The Global Fluoroscopy Systems Market benefits from this shift, with mobile and fixed systems being integrated into surgical suites and outpatient facilities. It offers surgeons improved visualization of anatomical structures, enabling them to reduce operative time and improve outcomes. Healthcare providers are also adopting fluoroscopic solutions to lower the risks associated with open surgeries, including infection and extended recovery. This movement toward less invasive techniques continues to reinforce the importance of advanced fluoroscopy systems in modern medicine.

- For instance, in March 2025, Canon Medical Systems USA launched the Adora DRFi following FDA 510(k) clearance. This hybrid system integrates static and dynamic radiography with low-dose fluoroscopy, offering a rotating ceiling unit, wireless detector technology, and fully automated positioning.

Technological Advancements Enhance Performance, Safety, and Clinical Versatility:

Rapid innovations in fluoroscopy technology are boosting system capabilities, enabling safer and more efficient imaging experiences. The integration of dose-reduction algorithms, digital flat-panel detectors, and hybrid functionalities has significantly improved image quality while minimizing patient exposure. The Global Fluoroscopy Systems Market is seeing rising investment in smart imaging platforms that combine radiography with fluoroscopy and support AI-driven analysis. These enhancements allow for more efficient workflows and expanded procedural use, including in trauma care and emergency diagnostics. Manufacturers are also designing systems with compact footprints and intuitive interfaces to support varied clinical settings, from large hospitals to ambulatory centers. These developments are making fluoroscopy systems more accessible and reliable for a broader user base.

Growth of Ambulatory Surgical Centers Increases Demand for Mobile and Versatile Fluoroscopy Solutions:

The increasing number of ambulatory surgical centers (ASCs) globally is contributing to the demand for mobile and adaptable fluoroscopy equipment. ASCs prioritize cost efficiency, fast patient turnover, and high procedural volume, making compact and multifunctional fluoroscopy systems highly desirable. The Global Fluoroscopy Systems Market is responding to this shift by offering lightweight, portable C-arm solutions that deliver hospital-grade imaging performance. It supports a wide range of outpatient procedures that require real-time visualization, such as orthopedic fracture repairs and endoscopic interventions. Mobile systems also appeal to facilities with limited space and infrastructure constraints. The growth of ASCs, particularly in emerging economies, is reinforcing the market’s focus on scalable and flexible imaging technologies.

Market Trends:

Integration of Artificial Intelligence and Advanced Image Processing Enhances Diagnostic Precision:

Artificial intelligence (AI) and advanced image processing tools are emerging as transformative trends in the Global Fluoroscopy Systems Market. Vendors are embedding AI algorithms to automate routine image adjustments, assist in anatomy recognition, and support decision-making in real time. These enhancements are enabling radiologists and surgeons to improve diagnostic accuracy, reduce operator dependency, and shorten procedure times. AI-driven dose optimization protocols are also gaining traction, offering better control over radiation exposure without compromising image quality. Advanced post-processing software now allows for 3D reconstruction and motion correction, which is especially valuable in complex interventional procedures. These digital upgrades are positioning fluoroscopy systems as smarter and more adaptive tools in modern healthcare environments.

- For instance, Siemens Healthineers’ Luminos Q.namix platform incorporates AI-supported functionalities for standardized image acquisition and automated dose optimization, enabling consistent image quality while minimizing radiation exposure.

Rising Demand for Flat-Panel Detector Systems Over Conventional Image Intensifiers:

The shift from traditional image intensifier-based systems to flat-panel detector (FPD) technology marks a significant trend across the Global Fluoroscopy Systems Market. FPDs offer superior image resolution, wider dynamic range, and consistent image quality, leading to more accurate diagnostics. Hospitals and surgical centers are adopting FPD-based fluoroscopy systems due to their lower maintenance requirements and higher durability. These systems also provide better compatibility with digital imaging infrastructure, enabling seamless data storage, retrieval, and sharing across departments. The compact design and reduced distortion of FPDs further enhance their appeal for both fixed and mobile fluoroscopy units. It is evident that this technology shift is reshaping procurement decisions and clinical workflows.

- For instance, Ziehm Imaging’s Vision RFD C-arm, distributed in partnership with Carestream Health, features a flat-panel CMOS digital detector available in two field-of-view sizes and a 25kW generator.

Emphasis on Hybrid Imaging Systems for Multi-Functional Clinical Applications:

Hybrid imaging systems that combine fluoroscopy with radiography or other imaging modalities are becoming increasingly popular across healthcare facilities. The Global Fluoroscopy Systems Market is witnessing increased demand for equipment that supports both dynamic and static imaging within the same platform. This trend is driven by the need for cost-effective solutions that optimize space, reduce redundancy, and expand clinical capabilities. Healthcare providers are investing in hybrid systems that can handle a broader range of applications—from orthopedic assessments to catheter placements—without the need for multiple machines. These platforms allow clinicians to perform both screening and interventional procedures seamlessly, which streamlines workflow and boosts return on investment. The growing preference for hybrid configurations is influencing product development and clinical deployment strategies.

Customization and Modularity Gain Momentum Across Clinical and Operational Settings:

Healthcare institutions are increasingly seeking fluoroscopy systems that offer high levels of customization and modularity to suit diverse clinical requirements. The Global Fluoroscopy Systems Market is responding to this demand by offering equipment with flexible configurations, detachable components, and upgradable software. This approach enables providers to tailor imaging capabilities based on procedure types, available space, or workflow preferences. Modular systems also allow phased investments, helping institutions scale their imaging infrastructure as demand grows. Mobile units with modular designs are especially useful in multi-disciplinary settings and smaller facilities with variable caseloads. The growing focus on customizable solutions reflects a broader trend toward operational efficiency and clinical adaptability.

Market Challenges Analysis:

High Equipment Costs and Infrastructure Requirements Limit Broader Adoption Across Emerging Markets:

One of the primary challenges affecting the Global Fluoroscopy Systems Market is the high initial cost of equipment acquisition and installation. Advanced fluoroscopy systems, particularly those equipped with flat-panel detectors, AI integration, and dose management features, require substantial capital investment. Many healthcare facilities in low- and middle-income countries struggle to justify or fund such expenditures, especially when existing imaging alternatives offer lower upfront costs. Beyond the purchase price, the need for compatible digital infrastructure, specialized room shielding, and trained personnel adds to the overall financial burden. These factors can delay procurement decisions and restrict adoption in resource-constrained settings. The market must address these affordability and accessibility gaps to ensure broader penetration across underserved healthcare systems.

Radiation Exposure Concerns and Regulatory Scrutiny Pose Operational Barriers:

Radiation safety continues to be a critical concern in the Global Fluoroscopy Systems Market, with growing emphasis on minimizing patient and operator exposure. Although modern systems incorporate dose reduction technologies, regulatory agencies continue to tighten guidelines on permissible exposure levels and procedural compliance. Facilities must implement continuous training, rigorous safety protocols, and regular audits to align with evolving standards, which adds to their operational workload and costs. Fear of legal or regulatory non-compliance may deter smaller clinics from adopting fluoroscopy solutions, especially in outpatient settings. Manufacturers also face increasing pressure to innovate without compromising image quality or patient safety. These regulatory and clinical expectations present both technical and operational hurdles for market growth.

Market Opportunities:

Expanding Healthcare Infrastructure in Emerging Economies Opens New Growth Channels:

The ongoing expansion of healthcare infrastructure in emerging economies presents strong growth opportunities for the Global Fluoroscopy Systems Market. Governments across Asia-Pacific, Latin America, and Africa are increasing investments in diagnostic imaging to improve clinical outcomes and access to care. New hospital construction, rising medical tourism, and broader insurance coverage are boosting demand for advanced imaging systems. The market can benefit by introducing cost-effective, scalable fluoroscopy solutions tailored to mid-tier and public healthcare institutions. Local manufacturing partnerships and government tenders can further accelerate market entry and adoption. It has the potential to capture significant value by aligning with regional healthcare priorities.

Growing Focus on Outpatient and Ambulatory Surgical Centers Drives Demand for Mobile Solutions:

The global shift toward outpatient care and the rapid proliferation of ambulatory surgical centers are creating sustained demand for compact, mobile fluoroscopy systems. These facilities prioritize high throughput, space efficiency, and cost control, which aligns well with mobile C-arm configurations. The Global Fluoroscopy Systems Market can capitalize on this trend by offering lightweight, modular systems with quick setup and multipurpose use. Vendors who prioritize ease of use, minimal maintenance, and digital integration will gain a competitive edge. It supports greater procedural flexibility across orthopedics, urology, and pain management. This shift in care delivery settings continues to unlock new revenue streams for market players.

Market Segmentation Analysis:

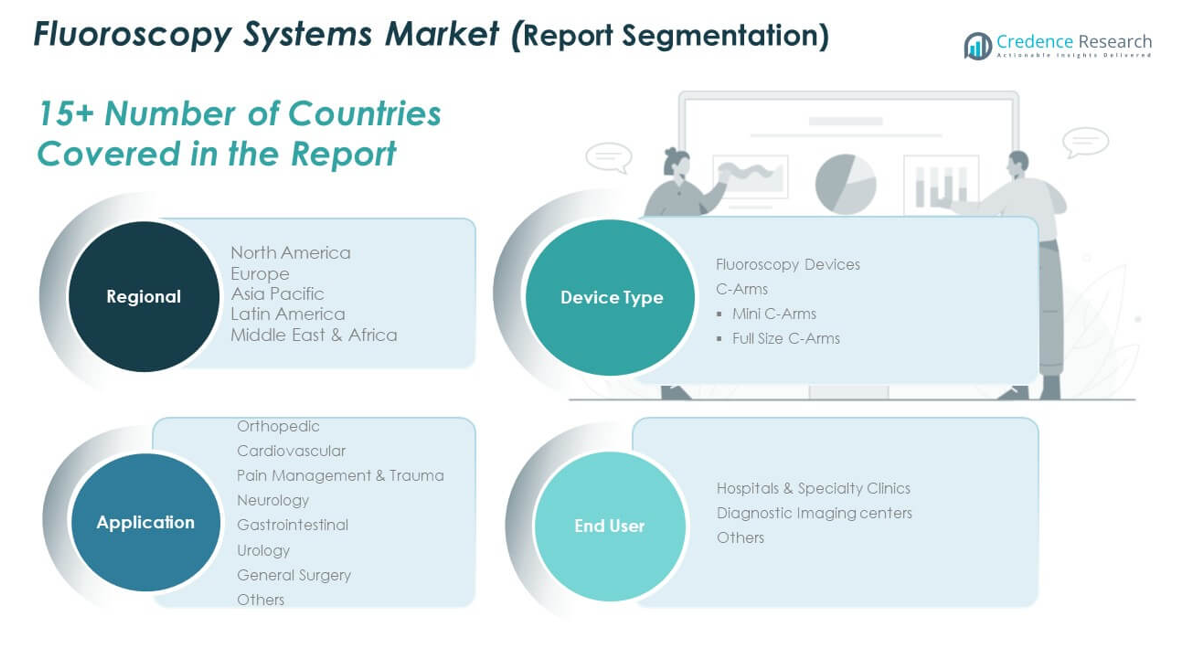

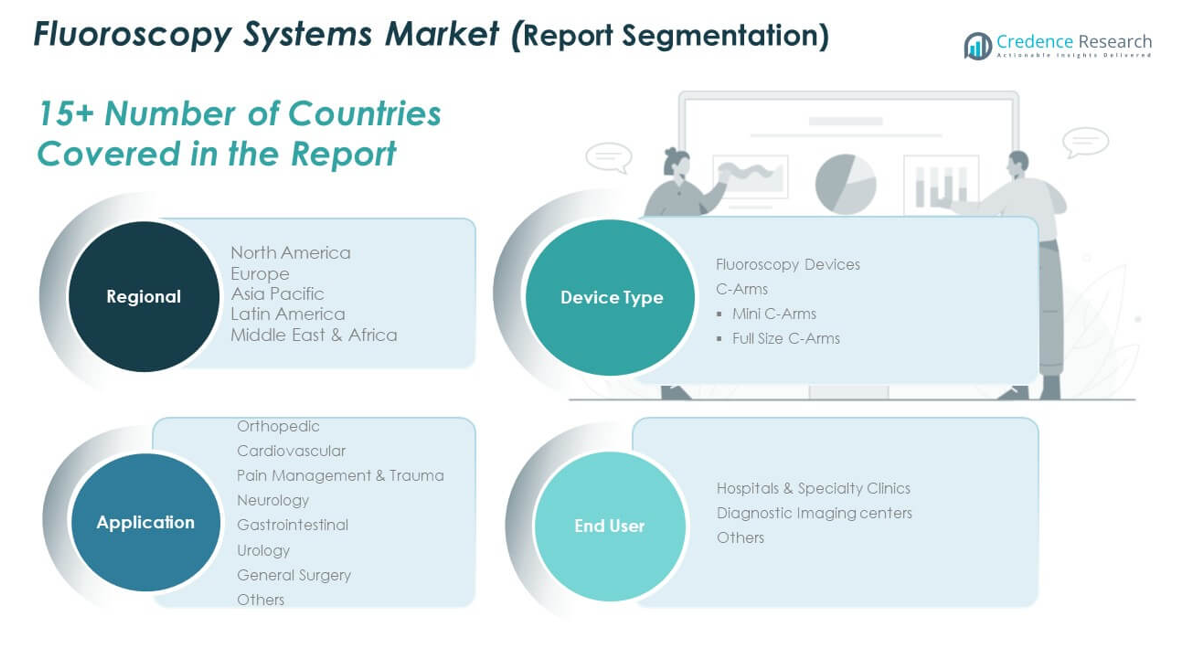

By Device Type

The Global Fluoroscopy Systems Market segments by device type into fluoroscopy devices and C-arms. C-arms hold the dominant share due to their flexibility across surgical, orthopedic, and trauma settings. Within this category, full-size C-arms are widely used for complex, high-precision procedures in hospitals and surgical suites, while mini C-arms are gaining popularity in orthopedic practices for extremity imaging. Fluoroscopy devices remain essential in diagnostic and routine imaging applications, particularly where continuous visualization is necessary.

- For example, Ziehm Imaging’s Vision RFD C-arm is specifically designed for vascular, cardiac, spine, ortho-trauma, and pain management cases, offering advanced usability and significant reductions in radiation exposure through its SmartDose technology.

By Application

Orthopedic applications lead the market, driven by the growing need for real-time imaging in fracture repairs, joint replacements, and spinal surgeries. Cardiovascular procedures contribute substantially, supported by rising interventional cardiology volumes. Pain management & trauma, neurology, gastrointestinal, urology, and general surgery segments each exhibit expanding usage of fluoroscopic guidance to improve procedural outcomes and efficiency. The “others” category includes emerging interventional specialties that are steadily adopting fluoroscopic techniques.

- For instance, Luminos Q. namix, are engineered to support complex procedures across these specialties with features like automated positioning, wireless detectors, and ergonomic controls, ensuring high-quality imaging and efficient workflow for clinicians.

By End User

Hospitals and specialty clinics dominate the end user segment, backed by robust imaging infrastructure and high patient throughput. Diagnostic imaging centers represent a growing user base due to their role in preventive and outpatient care. The “others” category, including ambulatory surgical centers, is gaining traction with rising adoption of mobile and compact fluoroscopy systems. Each end user segment reflects the market’s broader movement toward scalable, real-time imaging solutions that support both complex and routine clinical needs.

Segmentation:

By Device Type

- Fluoroscopy Devices

- C-Arms

- Mini C-Arms

- Full Size C-Arms

By Application

- Orthopedic

- Cardiovascular

- Pain Management & Trauma

- Neurology

- Gastrointestinal

- Urology

- General Surgery

- Others

By End User

- Hospitals & Specialty Clinics

- Diagnostic Imaging Centers

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Fluoroscopy Systems Market size was valued at USD 982.49 million in 2018 to USD 1,316.93 million in 2024 and is anticipated to reach USD 1,874.22 million by 2032, at a CAGR of 4.5% during the forecast period. North America accounts for the largest share of the Global Fluoroscopy Systems Market, contributing approximately 33.5% of global revenue. The region benefits from a strong clinical infrastructure, advanced imaging technologies, and favorable reimbursement policies. The U.S. dominates this space due to high surgical volumes and increasing adoption of interventional procedures. Hospitals and outpatient centers across the region widely use full-size and mini C-arms for precision imaging. Growth is further supported by continuous R&D investment and regulatory support for AI-driven imaging systems. It remains a mature, innovation-led market with sustained demand across specialties.

Europe

The Europe Fluoroscopy Systems Market size was valued at USD 627.34 million in 2018 to USD 887.33 million in 2024 and is anticipated to reach USD 1,354.59 million by 2032, at a CAGR of 5.4% during the forecast period. Europe represents about 24.5% of the global market and is led by Germany, the UK, and France. The region benefits from universal healthcare systems, robust clinical protocols, and an aging population. Demand is rising for fluoroscopy systems in cardiology, gastroenterology, and orthopedic applications. Diagnostic imaging centers and outpatient care facilities are adopting digital and hybrid fluoroscopy platforms to improve procedural accuracy. Digitization, safety regulations, and focus on radiation dose reduction drive system upgrades. It offers a stable and structured environment for technology expansion.

Asia Pacific

The Asia Pacific Fluoroscopy Systems Market size was valued at USD 764.45 million in 2018 to USD 1,050.90 million in 2024 and is anticipated to reach USD 1,547.45 million by 2032, at a CAGR of 4.9% during the forecast period. Asia Pacific holds approximately 26% of the global market and shows strong growth momentum. China, India, and Japan are the largest contributors, supported by rapid urbanization and expanding hospital infrastructure. The rise in trauma cases, chronic diseases, and interventional procedures boosts demand for advanced imaging. Mobile C-arms are widely adopted in ambulatory settings due to flexibility and cost efficiency. Government-led healthcare reforms and private sector investment further strengthen market performance. It remains a high-potential region for scalable and affordable fluoroscopy solutions.

Latin America

The Latin America Fluoroscopy Systems Market size was valued at USD 291.20 million in 2018 to USD 378.43 million in 2024 and is anticipated to reach USD 515.05 million by 2032, at a CAGR of 3.9% during the forecast period. Latin America contributes around 10% of global market revenue, with Brazil and Mexico leading the region. The market benefits from growing access to advanced surgical services in private hospitals and diagnostic centers. Economic constraints and infrastructure disparities limit broader adoption. Demand is concentrated in urban areas, where full-size and mini C-arms are used for orthopedics and gastroenterology. Public-private partnerships are helping to expand imaging capabilities in underserved regions. It continues to develop steadily, driven by targeted investments and healthcare modernization.

Middle East

The Middle East Fluoroscopy Systems Market size was valued at USD 155.54 million in 2018 to USD 219.18 million in 2024 and is anticipated to reach USD 333.07 million by 2032, at a CAGR of 5.4% during the forecast period. The Middle East accounts for nearly 6% of global revenue, with key contributions from the UAE, Saudi Arabia, and Israel. The region shows strong demand for digital and hybrid fluoroscopy systems in tertiary care hospitals. Investment in radiology departments, coupled with rising surgical interventions, supports growth. High-income economies prioritize advanced imaging infrastructure with a focus on orthopedic, cardiovascular, and trauma care. Strategic partnerships with international vendors help bridge technological gaps. It presents a high-value market driven by quality-oriented healthcare delivery.

Africa

The Africa Fluoroscopy Systems Market size was valued at USD 59.34 million in 2018 to USD 75.19 million in 2024 and is anticipated to reach USD 98.43 million by 2032, at a CAGR of 3.4% during the forecast period. Africa contributes less than 2% of the global market but is witnessing gradual improvement. South Africa and Egypt are key markets with better access to diagnostic infrastructure. Fluoroscopy adoption is largely limited to public hospitals and university health systems. Budget limitations and limited technical expertise restrict high-end system installations. Demand is growing for mobile, low-maintenance C-arm units suitable for use in rural and regional facilities. It offers long-term growth opportunities with the right mix of affordability and clinical functionality.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Canon Medical Systems Corporation

- Hitachi Medical Systems

- Siemens Healthineers

- Koninklijke Philips NV

- GE HealthCare

- Ziehm Imaging GmbH

- Shimadzu Corporation

- Orthoscan Inc.

- Hologic Inc.

- Other Key Players

Competitive Analysis:

The Global Fluoroscopy Systems Market is moderately consolidated, with a mix of multinational corporations and specialized imaging firms competing across developed and emerging regions. Leading players such as GE HealthCare, Siemens Healthineers, Philips, and Canon Medical Systems hold significant market shares due to their broad portfolios, strong distribution networks, and consistent innovation in digital fluoroscopy platforms. Companies like Shimadzu Corporation, Ziehm Imaging, and Orthoscan Inc. focus on niche segments such as mobile C-arms and mini C-arms, offering tailored solutions to orthopedic and outpatient settings. Strategic partnerships, product upgrades, and AI integration define competitive positioning. Price competitiveness, after-sales service, and radiation safety compliance are key differentiators in procurement decisions. The market favors companies that provide scalable, low-dose, and hybrid imaging solutions suited to both high-throughput hospitals and ambulatory surgical centers. It continues to attract investment in emerging markets where cost-effective, mobile, and digital-ready systems meet growing procedural and diagnostic needs.

Recent Developments:

- In March 2025, Canon Medical Systems USA announced the U.S. market launch of the Adora DRFi, following its FDA 510(k) clearance on December 23, 2024. The Adora DRFi is a hybrid imaging system that combines static and dynamic radiography with low-dose fluoroscopy, featuring a rotating ceiling unit, independently moving X-ray tube and detector arms, and the new CXDI-RF Wireless B1 Detector. The system is designed for flexible exposures from virtually any angle and includes PositionAnywhere technology and inMotion auto-positioning, enhancing workflow efficiency and reducing physical strain for staff.

- In March 2025, Canon Medical Systems USA also announced major AI enhancements for the Aquilion ONE / INSIGHT Edition, including the new PIQE 1024 matrix and SilverBeam, expanding the device’s clinical applications and furthering Canon’s leadership in advanced imaging technology.

- In May 2024, Hitachi High-Tech and Roche extended their longstanding partnership for an additional ten years, committing to further breakthroughs in diagnostic testing and innovation. This alliance, which has resulted in over 84,000 diagnostic platforms installed globally and more than 21 billion tests performed annually, will soon see the launch of new analytical units and integrated mass spectrometry solutions, supporting clinical diagnostics and laboratory medicine.

Market Concentration & Characteristics:

The Global Fluoroscopy Systems Market exhibits a moderate to high level of market concentration, with a few dominant players controlling a significant share of global revenues. It is characterized by steady technological advancement, a strong emphasis on radiation safety, and increasing integration of AI and digital imaging capabilities. The market favors vendors with comprehensive portfolios covering both fixed and mobile C-arm systems. It remains highly competitive in developed regions, where hospitals demand high-performance, low-dose solutions. In contrast, emerging markets prioritize affordability, system scalability, and service accessibility. The market structure supports long-term contracts, public tenders, and recurring revenue from maintenance and software upgrades. It continues to evolve with a growing focus on outpatient care, hybrid imaging platforms, and modular system design.

Report Coverage:

The research report offers an in-depth analysis based on device type, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for fluoroscopy systems will rise due to the global increase in minimally invasive surgical procedures.

- Integration of AI and machine learning will improve image quality, workflow efficiency, and diagnostic accuracy.

- Mobile C-arm adoption will grow in outpatient and ambulatory surgical centers for cost-effective imaging.

- Hybrid imaging platforms combining radiography and fluoroscopy will gain traction in multi-specialty facilities.

- Vendors will focus on developing low-dose systems to meet stricter regulatory and patient safety standards.

- Emerging markets will drive volume growth with increased public healthcare investment and hospital expansion.

- Technological advancements will enable compact, portable fluoroscopy systems suitable for rural or resource-limited settings.

- Remote diagnostics and cloud-based imaging platforms will support telehealth expansion and cross-site access.

- Growing aging population will lead to higher demand for orthopedic, cardiovascular, and trauma imaging applications.

- Competitive pricing and service models will shape vendor strategies in cost-sensitive regions.