| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Water Purifier Market Size 2024 |

USD 1,374.3 million |

| India Water Purifier Market, CAGR |

16.23% |

| India Water Purifier Market Size 2032 |

USD 4,589.8 million |

Market Overview:

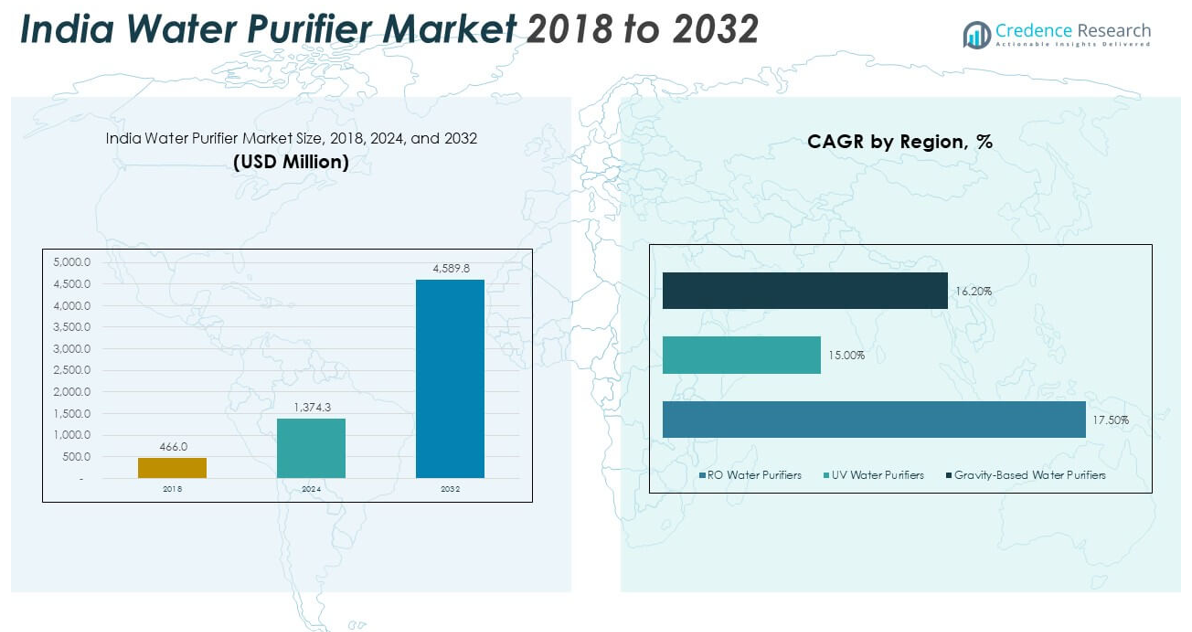

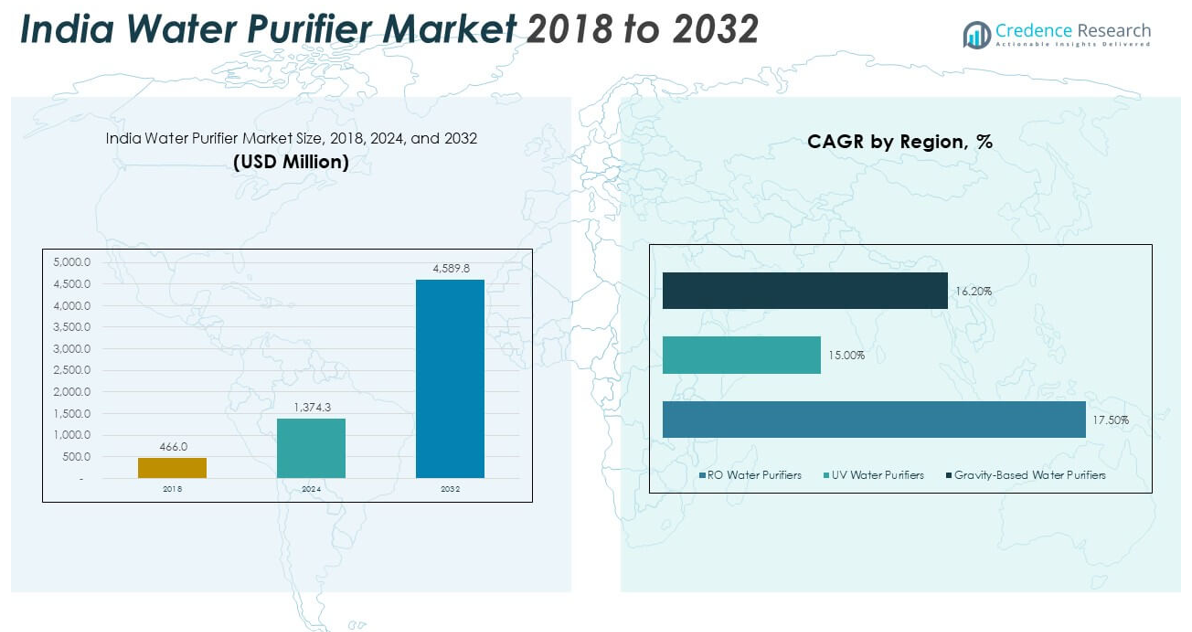

The India Water Purifier Market size was valued at USD 466.0 million in 2018 to USD 1,374.3 million in 2024 and is anticipated to reach USD 4,589.8 million by 2032, at a CAGR of 16.23% during the forecast period.

Several key factors are propelling the expansion of the water purifier market in India. The deterioration of water quality due to industrial discharge, agricultural runoff, and untreated sewage has heightened public awareness of waterborne diseases such as cholera, typhoid, and hepatitis. This awareness has led to a surge in demand for effective water purification technologies. Technological advancements in purification methods, including Reverse Osmosis (RO), Ultraviolet (UV) filtration, and Ultrafiltration (UF), have enhanced the efficiency and affordability of water purifiers, making them accessible to a broader consumer base. Additionally, government initiatives like the Jal Jeevan Mission, which aims to provide safe drinking water to rural households, have further stimulated market growth. Growing urbanization and a shift in consumer preferences towards portable and compact water purifiers are also expected to contribute to the market’s growth. The rising health consciousness among consumers further boosts the adoption of water purifiers, as people are increasingly prioritizing clean drinking water.

The demand for water purifiers exhibits regional variations across India. Northern states, particularly Delhi, Haryana, Uttar Pradesh, and Punjab, face significant water quality challenges due to industrial activities and high population density. These regions are witnessing a rapid adoption of water purification solutions. Western and Central India, encompassing cities like Mumbai, Pune, and Ahmedabad, also show a strong market presence, driven by urbanization and increased consumer awareness. The market in these regions is characterized by high competition and a wide variety of water purifiers catering to both premium and budget segments. In contrast, Southern and Eastern regions are experiencing gradual growth, influenced by infrastructural development and rising health consciousness among consumers. These regions are also benefiting from regional government efforts to enhance water infrastructure, which further strengthens the demand for water purifiers.

Market Insights:

- The India Water Purifier Market was valued at USD 466.0 million in 2018 and is expected to reach USD 1,374.3 million by 2024, growing at a CAGR of 16.23% during the forecast period.

- Increasing water contamination due to industrial discharge, agricultural runoff, and untreated sewage is driving the demand for water purifiers, especially in regions with high waterborne disease risks.

- Technological advancements in water purification methods, including Reverse Osmosis (RO), Ultraviolet (UV), and Ultrafiltration (UF), have enhanced the efficiency and affordability of purifiers, making them accessible to a broader consumer base.

- Government initiatives such as the Jal Jeevan Mission, which aims to provide safe drinking water to rural areas, have stimulated the demand for water purifiers in underserved regions.

- The urbanization trend, coupled with changing consumer lifestyles and rising health consciousness, is significantly boosting the demand for reliable and convenient water purification solutions in urban areas.

- The high cost of advanced filtration systems, especially those using RO technology, remains a challenge, limiting the accessibility of such solutions to lower-income and rural consumers.

- The lack of awareness and misconceptions about water purification technologies, particularly in rural areas, hinders adoption and leads many consumers to rely on traditional and less-effective purification methods.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Water Contamination and Rising Health Concerns

The rising contamination of water resources due to industrial discharge, sewage, and agricultural runoff is one of the key drivers of the India Water Purifier Market. Urbanization, rapid industrial growth, and inadequate water treatment facilities contribute to the deteriorating quality of water across the country. Contaminants such as heavy metals, bacteria, and chemicals pose significant health risks, fueling the demand for effective water purification solutions. This growing awareness of waterborne diseases like cholera, typhoid, and hepatitis is prompting consumers to invest in water purifiers for cleaner and safer drinking water. The increasing occurrence of water contamination in both urban and rural areas drives the market’s growth by encouraging widespread adoption of advanced purification technologies.

Technological Advancements in Water Purification Solutions

Technological advancements in water purification technologies are significantly influencing the growth of the India Water Purifier Market. Innovations such as Reverse Osmosis (RO), Ultraviolet (UV) filtration, and Ultrafiltration (UF) have made water purification more effective, efficient, and accessible to a broader consumer base. These technologies ensure the removal of harmful pathogens, chemicals, and other impurities, making water safer for consumption. The affordability of these systems, coupled with improvements in their energy efficiency, has made them suitable for various market segments, from premium urban households to rural consumers. Enhanced filtration technologies not only offer superior quality but also provide long-term cost savings, further boosting market demand.

- For example, Asmi Innovations has introduced a patented graphene-based filtration system that removes up to 99% of heavy metals and enables up to 100% water recovery, as detailed in their 2024 technical whitepaper.

Government Initiatives and Policies Supporting Safe Drinking Water

Government initiatives such as the Jal Jeevan Mission play a pivotal role in promoting clean and safe drinking water, particularly in rural India. The mission aims to provide tap water connections to every rural household, significantly improving access to clean water across the country. Such policies contribute to the increased demand for water purifiers, as rural populations increasingly seek solutions to address local water quality issues. The government’s focus on improving water infrastructure, combined with the promotion of water conservation and sustainability efforts, has created a favorable environment for the India Water Purifier Market. These initiatives, coupled with increased funding from public health organizations, strengthen the demand for efficient water purification technologies.

- For instance, the National Rural Drinking Water Programme (NRDWP) focuses on sustainable water supply and quality monitoring in rural areas, as reported in the Government of India’s annual report for 2023.

Urbanization, Changing Lifestyles, and Consumer Awareness

Urbanization and changing lifestyles are contributing to the rising demand for water purifiers in India. Rapid urban growth, coupled with the increasing number of working professionals and health-conscious consumers, has amplified the need for convenient and reliable water purification solutions. In urban areas, the availability of clean water is inconsistent, leading consumers to prioritize water purifiers to safeguard their health. Increasing consumer awareness regarding the health risks associated with impure water further drives the market’s growth. The shift towards a more health-conscious lifestyle, coupled with the growing trend of disposable income, makes the adoption of advanced water purifiers an attractive option for urban dwellers seeking better water quality for drinking and daily use.

Market Trends:

Shift Toward Advanced Filtration Technologies

The India Water Purifier Market is experiencing a shift toward advanced filtration technologies, with consumers increasingly opting for systems that provide superior purification. Reverse Osmosis (RO) technology continues to dominate the market due to its high efficiency in removing contaminants, including heavy metals, bacteria, and dissolved salts. However, other filtration technologies, such as Ultrafiltration (UF) and Ultraviolet (UV) systems, are gaining popularity for their ability to offer faster and more affordable solutions. The growing preference for hybrid models that combine multiple technologies, such as RO-UV or RO-UF, is a key trend driving the market. These multi-stage filtration systems are seen as more effective and reliable, especially in areas where water quality issues are diverse and complex.

- For example, AO Smith’s ProPlanet P6 utilizes an 8-stage purification process, including proprietary Silver Charged Membrane Technology (SCMT), and achieves 100% RO purification with hot water dispensing at 45°C and 80°C. This model features Advanced Recovery Technology™, which saves up to 2X more water than conventional RO purifiers, a significant leap in water recovery rates.

Rising Demand for Compact and User-Friendly Purifiers

There is an increasing demand for compact, user-friendly water purifiers in the India Water Purifier Market. With space constraints in urban areas and a growing number of smaller households, consumers are looking for water purifiers that are not only efficient but also space-saving. The demand for sleek, modern designs that can fit into smaller kitchens is rising. Consumer preferences are shifting toward water purifiers that offer ease of use, such as touch-screen controls, smart features, and automatic shut-off mechanisms. This trend is particularly noticeable in the urban market, where convenience and aesthetics play a significant role in purchasing decisions.

- Eureka Forbes’ Aquaguard Designo NXT, for example, is India’s slimmest purifier at just 21 cm width, designed for under-sink installation and equipped with a scratch-resistant glass exterior. It features a 7-liter stainless steel tank, zero-pressure pump for low-pressure environments, and a 3-in-1 active copper cartridge that infuses copper, calcium, and magnesium into the water.

Growing Popularity of Smart Water Purifiers

The integration of smart features into water purifiers is another notable trend in the India Water Purifier Market. Smart water purifiers equipped with IoT (Internet of Things) capabilities allow consumers to monitor the water quality, filter status, and maintenance needs remotely through mobile applications. This trend is gaining traction among tech-savvy consumers who seek convenience and greater control over their water purification systems. These devices provide real-time data and alerts, such as when the filters need replacement, ensuring optimal performance and enhancing user experience. The rising adoption of smart homes and smart appliances in India is further propelling the demand for smart water purifiers, reflecting the overall shift toward automation and connectivity in household devices.

Increased Focus on Eco-Friendly and Sustainable Solutions

Eco-friendly and sustainable water purifiers are becoming increasingly popular in the India Water Purifier Market. Consumers are becoming more environmentally conscious and are seeking products that offer energy-efficient operations and minimal environmental impact. Water purifiers with features such as low power consumption, recyclable materials, and waste reduction are gaining traction. In addition, many brands are adopting sustainable practices in the production and packaging of their products. The trend towards eco-friendly solutions aligns with broader global sustainability goals and is encouraging manufacturers to innovate and create products that cater to environmentally aware consumers. This focus on sustainability is helping brands differentiate themselves in a competitive market.

Market Challenges Analysis:

High Cost of Advanced Water Purifiers

One of the key challenges faced by the India Water Purifier Market is the high cost of advanced filtration systems, particularly those using Reverse Osmosis (RO) technology. Although RO systems provide effective water purification, their initial purchase price and ongoing maintenance costs are relatively high compared to simpler filtration methods. This has limited their accessibility, particularly in lower-income segments and rural areas where affordability is a significant concern. Consumers are often deterred by the recurring expenses associated with replacing filters and maintaining the system, which can add up over time. The high upfront costs and maintenance burdens make it challenging for some consumers to invest in these advanced systems, slowing market penetration in certain regions.

Lack of Awareness and Misconceptions About Water Purification

The lack of awareness regarding water purification technologies and their benefits remains another significant hurdle for the India Water Purifier Market. While water contamination is a widely recognized issue, many consumers, particularly in rural areas, still lack detailed knowledge about the different purification technologies available. Misconceptions regarding the necessity and effectiveness of water purifiers contribute to low adoption rates in some regions. In addition, a significant portion of the population continues to rely on traditional methods like boiling water or using inexpensive, less-effective filtration solutions. Educating consumers on the importance of investing in high-quality water purifiers, and how these systems can improve overall health, is critical to overcoming this challenge and driving further market growth.

Market Opportunities:

Expansion into Rural and Semi-Urban Areas

The India Water Purifier Market presents significant opportunities for growth in rural and semi-urban areas, where access to clean drinking water remains a challenge. Government initiatives like the Jal Jeevan Mission are enhancing water infrastructure, creating a favorable environment for water purifier adoption in these regions. Manufacturers can capitalize on this by offering affordable, easy-to-maintain purification systems tailored to the needs of rural consumers. Focused marketing efforts and local partnerships can drive product penetration in underserved areas, tapping into the large rural population that is becoming more aware of waterborne diseases.

Increasing Demand for Eco-Friendly and Smart Solutions

The rising trend of sustainability and digital innovation presents opportunities in the India Water Purifier Market. Eco-conscious consumers are seeking energy-efficient, environmentally friendly solutions that reduce water wastage and operate on minimal power. Companies that integrate smart features, such as IoT connectivity for real-time monitoring and maintenance alerts, are likely to attract tech-savvy urban customers. Expanding product lines with smart, energy-efficient models and promoting eco-friendly features can help manufacturers differentiate themselves in an increasingly competitive market. This shift towards sustainable, intelligent products is expected to drive long-term market growth.

Market Segmentation Analysis:

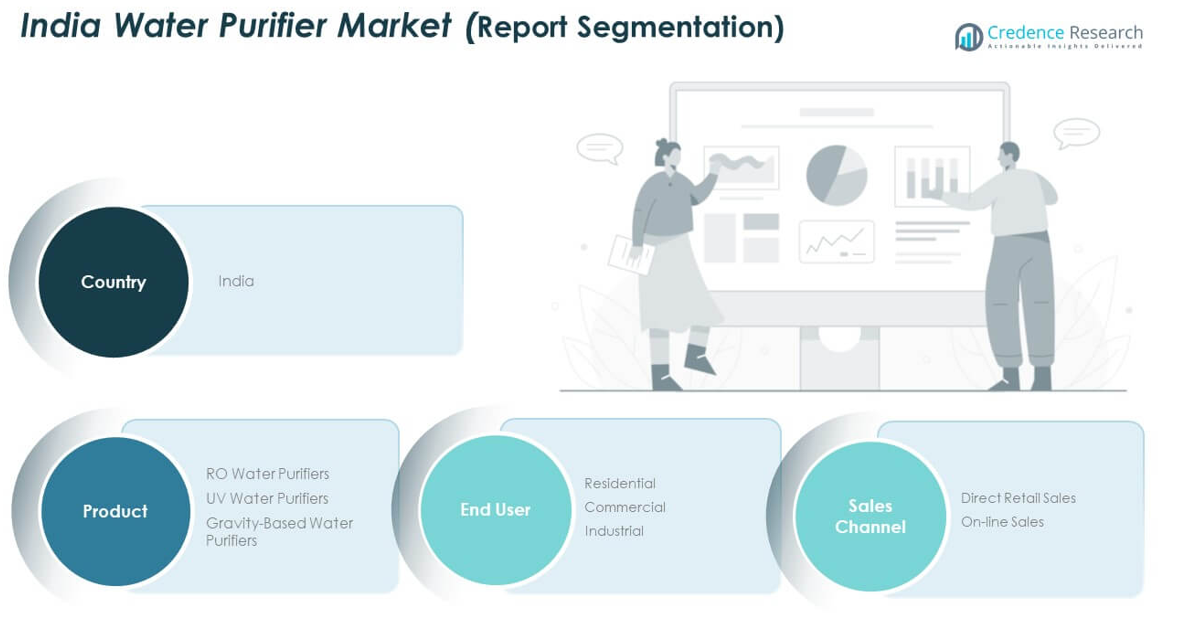

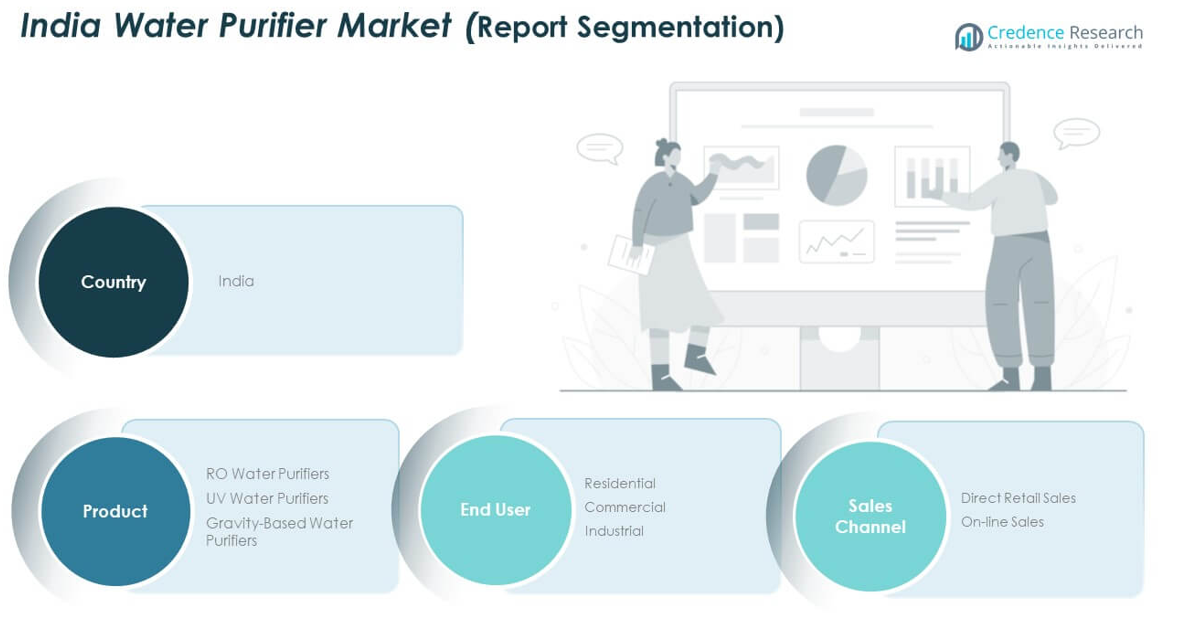

The India Water Purifier Market is segmented by product type, end user, and sales channel, each contributing to the market’s growth and diversification.

By Product Type, the market is primarily driven by RO (Reverse Osmosis) Water Purifiers, which dominate due to their high efficiency in removing contaminants such as bacteria, viruses, and heavy metals. UV (Ultraviolet) water purifiers are also popular, particularly in areas where water contamination is primarily biological. Gravity-based water purifiers, while less common, remain a cost-effective solution for regions with lower levels of contamination.

- For example, Hindustan Unilever’s Pureit Classic, a gravity-based purifier, is marketed as a cost-effective solution for rural and semi-urban regions. The company’s 2024 sustainability report confirms that over 2 million units have been deployed in areas with low TDS (Total Dissolved Solids) water, offering protection from bacteria and cysts without electricity.

By End User, the residential segment holds the largest share, driven by growing awareness of waterborne diseases and the increasing demand for clean drinking water. Commercial and industrial segments are also expanding, particularly in urban centers where businesses and industries require high-volume purification solutions to ensure the safety of their employees and products.

By Sales Channel, both direct retail and online sales are important, with online sales gaining significant traction due to the increasing preference for e-commerce in urban and semi-urban areas. Direct retail sales remain significant, especially in rural areas where consumers rely on physical stores for purchasing water purifiers. The convenience of online shopping and the growing use of digital platforms have made online sales a key driver in the market’s expansion.

- For example, major brands such as Kent, AO Smith, and Eureka Forbes have expanded their direct-to-consumer (D2C) online platforms and partnered with Amazon and Flipkart, as confirmed in their respective annual reports.

Segmentation:

By Product Type:

- RO Water Purifiers

- UV Water Purifiers

- Gravity-Based Water Purifiers

By End User:

- Residential

- Commercial

- Industrial

By Sales Channel:

- Direct Retail Sales

- Online Sales

Regional Analysis:

North India: Dominance Due to Water Quality Concerns

North India holds a significant share of the India Water Purifier Market, driven by the region’s severe water contamination issues. States like Delhi, Haryana, Uttar Pradesh, and Punjab face challenges from industrial discharge, untreated sewage, and high population density, resulting in poor water quality. These areas account for a large portion of the market, with Delhi alone contributing a substantial share due to its high urban population and widespread awareness of waterborne diseases. The region’s demand for advanced water purification technologies, such as Reverse Osmosis (RO) and UV filters, is expected to remain high. North India’s market share is estimated to be around 30%, with growing urbanization and rising health consciousness supporting continued growth in the region.

West India: Robust Market Growth in Urban Areas

Western India, comprising states like Maharashtra, Gujarat, and Rajasthan, contributes significantly to the India Water Purifier Market, with Maharashtra being a major contributor due to the large metropolitan cities like Mumbai and Pune. Urban areas in this region are increasingly adopting water purifiers, driven by rising awareness about water quality and the need for effective purification solutions. The demand for water purifiers is also growing in smaller towns and rural areas, supported by improving infrastructure and rising incomes. This region accounts for roughly 25% of the market share, with urban consumers increasingly opting for advanced models that offer both convenience and high performance. The region’s strong industrial and economic base also fuels demand for large-scale water purification systems.

South and East India: Gradual Growth with Emerging Demand

South and East India are seeing gradual growth in the water purifier market, with regions like Tamil Nadu, Karnataka, Andhra Pradesh, West Bengal, and Odisha contributing to the overall demand. The market share in these regions is estimated to be around 40%, with South India leading due to its rapidly growing urban population and rising disposable incomes. As awareness about waterborne diseases and the importance of clean drinking water increases, consumers in these regions are moving toward higher-end filtration solutions. The demand for water purifiers is also growing in rural areas, where government initiatives aimed at improving water access are creating more opportunities for affordable solutions. The growing middle class and urbanization in cities like Bengaluru, Chennai, and Hyderabad contribute significantly to this emerging market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Eureka Forbes

- Kent RO Systems Ltd.

- Hindustan Unilever Ltd.

- Godrej Industries Ltd.

- Hi-Tech RO

- Livpure Private Ltd.

- Aquafresh

- Other Key Players

Competitive Analysis:

The India Water Purifier Market is highly competitive, with a mix of established players and new entrants vying for market share. Leading companies like Kent RO, Eureka Forbes, and Aquaguard dominate the market, offering a wide range of water purification technologies, including Reverse Osmosis (RO), Ultra Violet (UV), and Ultrafiltration (UF) systems. These companies focus on innovation, product differentiation, and strong distribution networks to maintain their leadership positions. Newer brands are also gaining traction by offering affordable, efficient solutions targeted at price-sensitive consumers in rural and semi-urban areas. The market is characterized by frequent product upgrades and the introduction of smart features such as IoT connectivity and automatic filter monitoring. Intense competition pushes companies to continually improve product performance and expand their geographic reach. Companies are also focusing on after-sales service and customer education to strengthen their positions in the growing market.

Recent Developments:

- In July 2024, Hindustan Unilever Ltd. signed an agreement to sell its Pureit water purification business to A. O. Smith India Water Products for INR 601 crore (approximately USD 72 million). The deal, which was completed in November 2024, includes the transfer of the Pureit brand, trademarks, and associated assets.

- In August 2024, Livpure, a prominent water purifier brand, announced a significant funding round securing INR 233 crore.The investment was led by M&G Investments, contributing INR 208 crore, and Ncubate Capital Partners, adding INR 25 crore.This capital infusion aims to accelerate Livpure’s growth by expanding its product portfolio, enhancing research and development capabilities, and increasing its market presence across India.

Market Concentration & Characteristics:

The India Water Purifier Market is moderately concentrated, with a few major players commanding a significant share, including Kent RO, Eureka Forbes, and Aquaguard. These companies leverage strong brand recognition, extensive distribution networks, and innovative product offerings to maintain their leadership positions. The market is characterized by a diverse range of products catering to various consumer needs, from budget-friendly options to high-end, technologically advanced models. Consumer preference for advanced features like RO, UV, and smart functionalities has fueled competition among leading brands. The presence of several local and regional manufacturers also intensifies competition, driving product differentiation and frequent technological advancements. A key characteristic of the market is the growing demand for compact, user-friendly, and eco-friendly water purifiers, particularly in urban and semi-urban areas. Market players are increasingly focusing on after-sales service and customer education to build long-term relationships and ensure customer loyalty.

Report Coverage:

The research report offers an in-depth analysis based on product type, end user, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The India Water Purifier Market is expected to grow at a robust pace, driven by increasing health awareness and rising water contamination concerns.

- Government initiatives such as the Jal Jeevan Mission will significantly boost the adoption of water purifiers, particularly in rural areas.

- Urbanization and the rising middle class will further propel demand for advanced, premium purification solutions in metropolitan regions.

- Technological innovations, including smart and energy-efficient purifiers, will attract tech-savvy consumers seeking convenience and sustainability.

- Consumer preference for multi-stage filtration systems, combining RO, UV, and UF technologies, will continue to rise.

- The demand for compact, user-friendly purifiers will increase, particularly in urban households with limited space.

- Manufacturers will focus on providing affordable yet effective solutions for the rural market, enhancing product accessibility.

- E-commerce platforms will become key distribution channels, enabling brands to reach a wider audience.

- Increased environmental consciousness will drive the demand for eco-friendly and energy-efficient purification systems.

- Intense competition among established brands and new entrants will lead to continuous product innovations and improvements in after-sales services.