Market Overview:

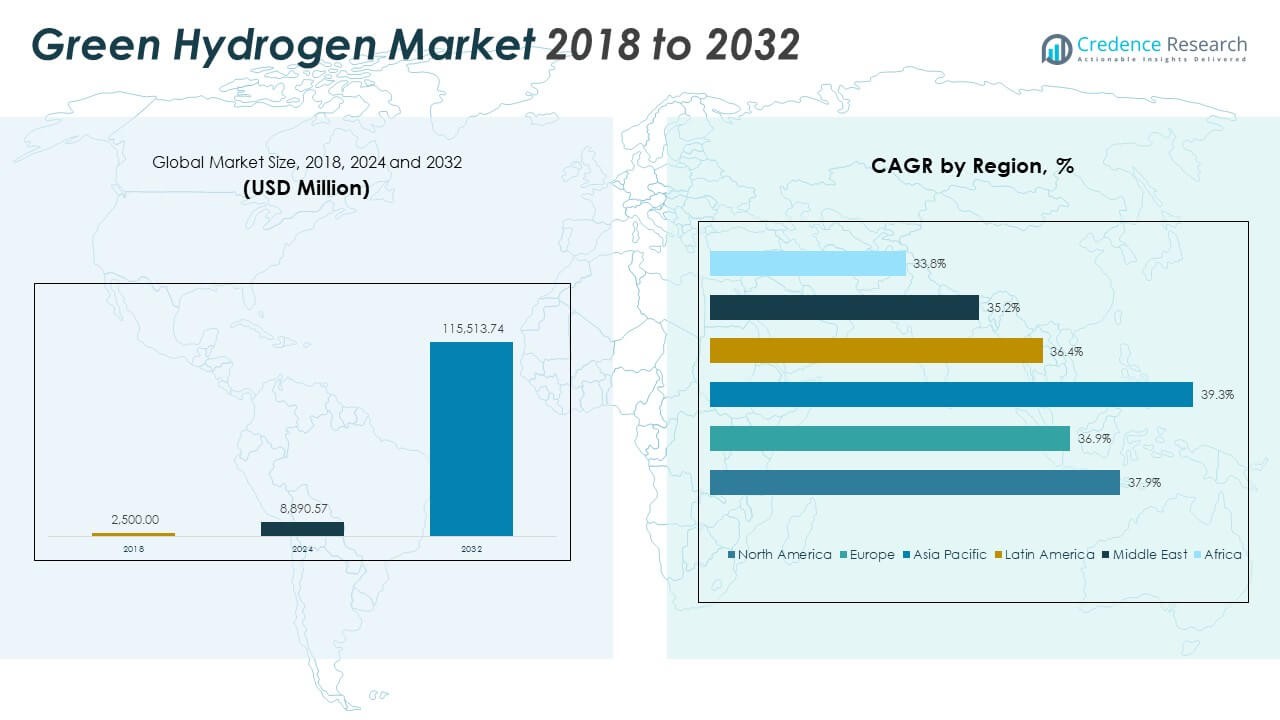

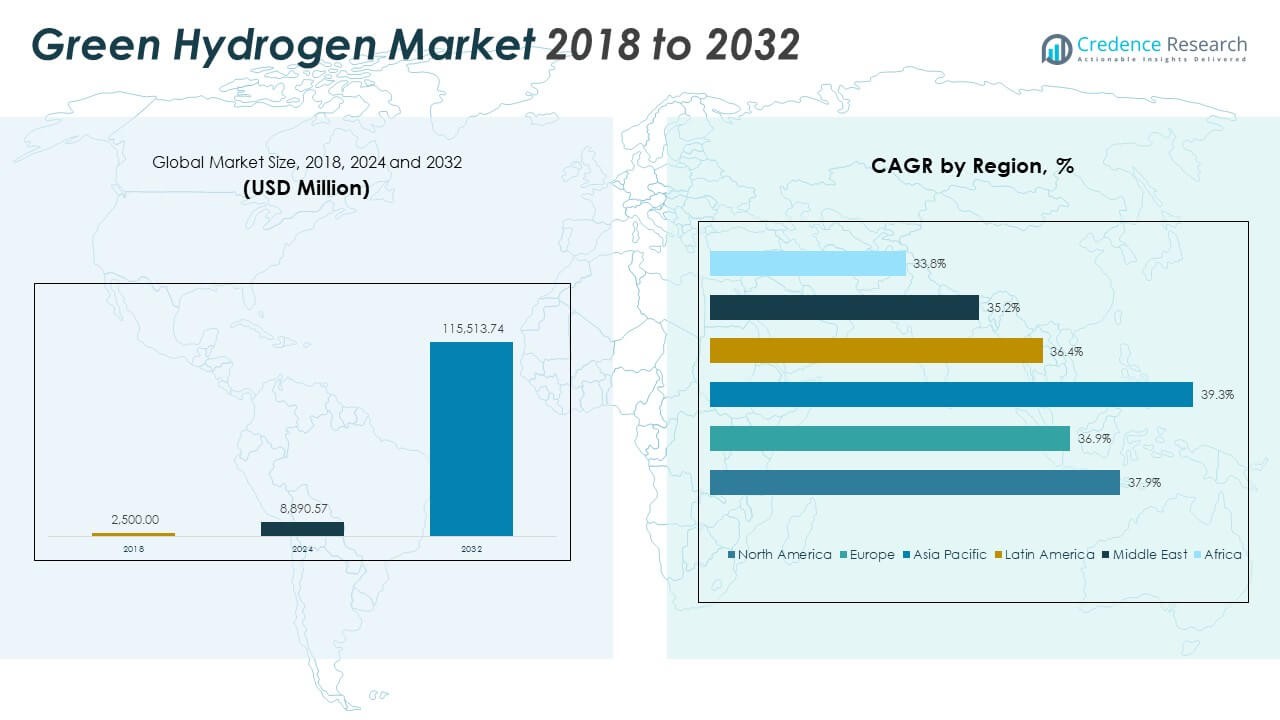

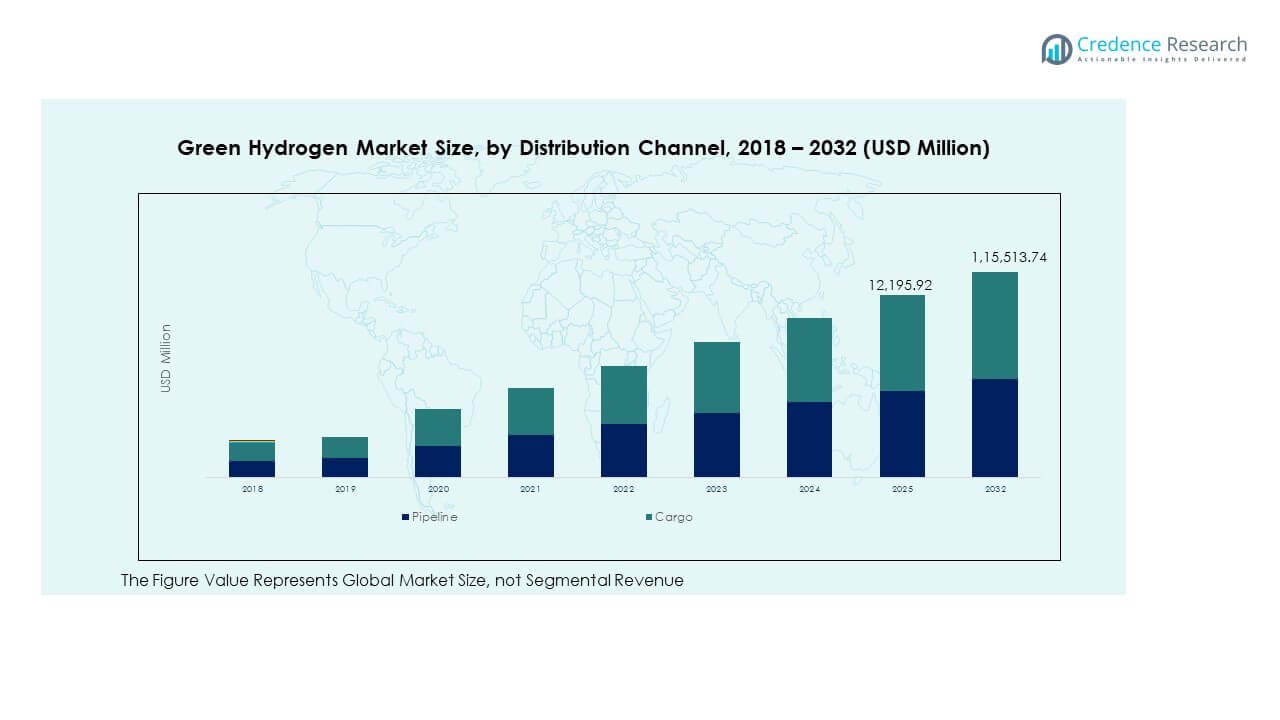

The Green Hydrogen Market size was valued at USD 2,500.00 million in 2018 to USD 8,890.57 million in 2024 and is anticipated to reach USD 1,15,513.74 million by 2032, at a CAGR of 37.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Green Hydrogen Market Size 2024 |

USD 8,890.57 Million |

| Green Hydrogen Market, CAGR |

37.88% |

| Green Hydrogen Market Size 2032 |

USD 1,15,513.74 Million |

The market is expanding rapidly due to strong policy support, rising renewable energy capacity, and advanced electrolyzer technologies. Governments are promoting clean hydrogen to achieve decarbonization goals, reduce fossil fuel dependency, and strengthen energy security. Growing adoption in power generation, transport, and industrial sectors is driving demand. Strategic investments and large-scale hydrogen production projects are improving cost competitiveness and enabling faster commercial deployment across key industries.

Europe leads the market due to ambitious climate targets, advanced regulatory frameworks, and large hydrogen infrastructure projects. North America is emerging strongly with significant investments in production hubs and transportation corridors. Asia Pacific is expanding fast, supported by national hydrogen strategies and industrial demand from major economies such as China, Japan, and India. Other regions are building capacity, focusing on exports and renewable integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Green Hydrogen Market was valued at USD 2,500.00 million in 2018, reached USD 8,890.57 million in 2024, and is projected to hit USD 1,15,513.74 million by 2032, growing at a CAGR of 37.88%.

- North America leads with a 33.7% share due to advanced infrastructure, policy support, and large hydrogen hubs. Europe follows with 24.1% backed by strong climate goals and regulatory clarity, while Asia Pacific holds 33.6% supported by renewable capacity and manufacturing strength.

- Asia Pacific is the fastest-growing region, driven by large-scale electrolyzer capacity, national hydrogen strategies, and strong industrial demand.

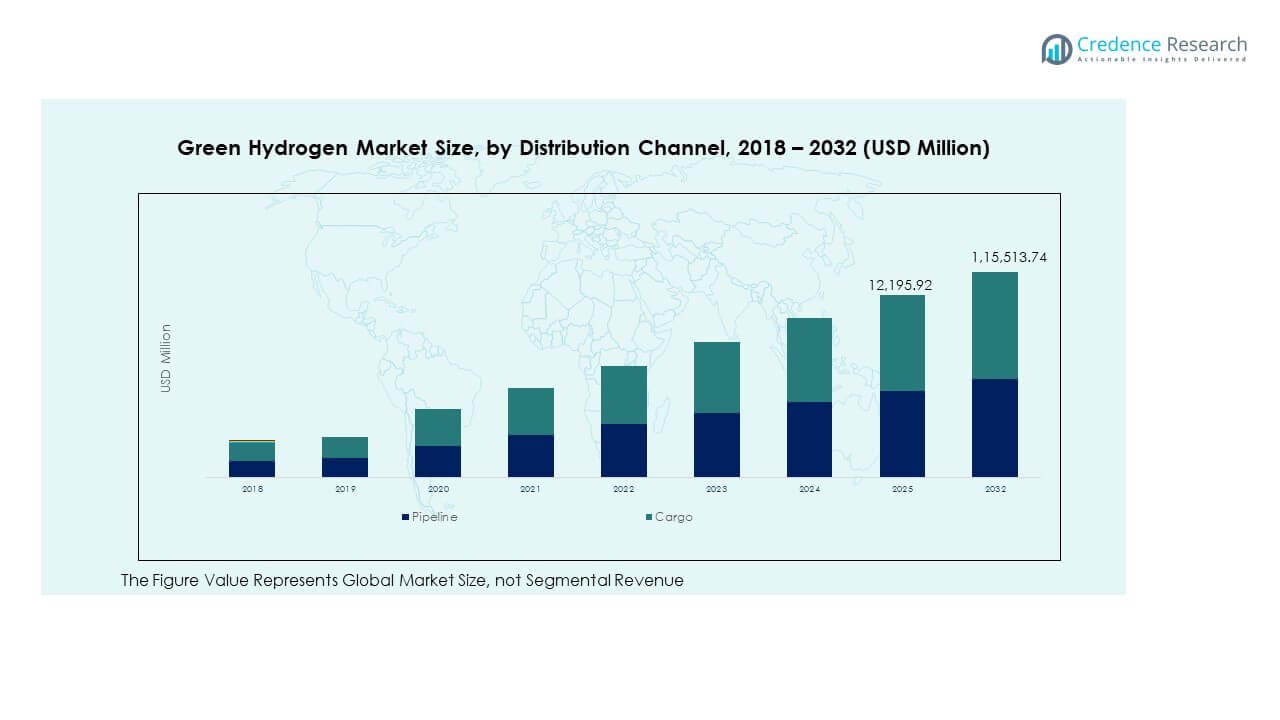

- Pipeline distribution holds nearly 55% share, supported by cost efficiency and scalable delivery infrastructure.

- Cargo distribution accounts for roughly 45%, expanding through export-focused projects and global trade route development.

Market Drivers

Strong Global Policy Frameworks and Decarbonization Targets Accelerating Hydrogen Deployment

Governments across major economies are adopting strong climate targets to reduce greenhouse gas emissions. Large-scale policy frameworks support green hydrogen adoption through subsidies, funding, and tax incentives. It benefits from net-zero commitments that align national energy strategies with renewable integration. These measures create favorable market conditions for producers, investors, and industries. Regulatory clarity encourages long-term planning and capital investments. Hydrogen is becoming a key part of national energy transition pathways. Governments are also setting up dedicated agencies and programs to scale infrastructure. The Green Hydrogen Market is positioned to expand rapidly with this policy momentum.

- For instance, under the U.S. Department of Energy’s Regional Clean Hydrogen Hubs (H2Hubs) Program, launched in 2024, $8 billion was allocated to support seven national hydrogen hubs. The DOE Inspector General Report (DOE-OIG-25-23) in June 2025 reviewed the program’s implementation to ensure funding accountability and progress toward clean hydrogen infrastructure goals.

Rising Renewable Energy Capacity and Integration with Electrolysis Systems

Global renewable energy capacity is growing steadily, creating an ideal environment for hydrogen production. Solar and wind energy are increasingly paired with electrolyzers to enable clean hydrogen generation. The cost of renewable power is declining, which improves the economics of production. It strengthens the commercial feasibility of large-scale hydrogen hubs. Many countries are advancing hybrid projects integrating renewables and electrolyzers. Grid stability and energy storage benefits make the model more attractive. Renewable energy developers see hydrogen as a strategic growth area. Strong project pipelines are emerging across major global markets.

- For instance, in October 2025, Neste Corporation commissioned the 2.6 MW MultiPLHY high-temperature electrolyzer at its Rotterdam refinery, developed with Sunfire, CEA, and ENGIE. The solid oxide unit operates at 850 °C and produces over 60 kg of renewable hydrogen per hour, reducing fossil-based hydrogen use in refining. The project is funded by the EU Clean Hydrogen Partnership under Horizon 2020 (Grant 875123).

Technological Advancements Driving Electrolyzer Efficiency and Cost Reduction

Electrolyzer technology is evolving with a focus on improving performance and reducing capital costs. New designs enhance energy conversion rates, allowing scalable and flexible operations. Prefabricated modular systems are enabling faster deployment and better cost control. It supports more competitive pricing for hydrogen supply in industrial and transport applications. Research programs are accelerating innovation in PEM, Alkaline, and SOEC technologies. Equipment suppliers are expanding production capacity to meet rising demand. Lower equipment and operating costs improve project viability. These advancements make hydrogen a more competitive energy carrier.

Growing Industrial and Transportation Demand for Clean Hydrogen Applications

Heavy industries and transportation are adopting hydrogen to reduce their carbon intensity. Steel, cement, and chemical producers are integrating hydrogen into their production processes. Hydrogen-powered vehicles and refueling infrastructure are expanding globally. It enables industries to meet stricter emission regulations while enhancing energy security. Large logistics hubs and ports are developing hydrogen corridors. OEMs are investing in fuel cell technologies for trucks, buses, and trains. The combination of industrial use and mobility applications is creating consistent demand. This demand foundation is strengthening overall market stability and growth.

Market Trends

Scaling of Giga-Scale Hydrogen Production Plants to Achieve Economies of Scale

Global developers are focusing on gigawatt-scale hydrogen projects to drive cost competitiveness. Large capacity plants allow operators to standardize equipment and optimize supply chains. Modular and prefabricated systems support quick scaling and lower construction time. It encourages new business models based on centralized production and regional supply networks. Developers are aligning production capacity with export opportunities. Countries with strong renewable resources are positioning themselves as future suppliers. These mega projects attract strategic investors and technology partners. Their scale helps accelerate the shift from pilot to commercial production.

- For instance, the NEOM Green Hydrogen Project in Saudi Arabia, developed by NEOM, ACWA Power, and Air Products, reached 80% construction completion in June 2025. The facility is designed to use 4 GW of renewable energy to produce up to 219,000 tons of hydrogen annually, making it one of the world’s largest green hydrogen projects under construction.

Hydrogen Integration into Existing Energy Infrastructure and Industrial Ecosystems

Many countries are upgrading existing infrastructure to support hydrogen integration. Natural gas pipelines and storage facilities are being adapted for hydrogen use. It reduces the need for building entirely new networks. Refineries and industrial clusters are adopting hydrogen for decarbonization. Ports and logistics hubs are becoming major nodes in hydrogen distribution. Energy companies are integrating hydrogen with renewable and grid systems. Industrial parks are using hydrogen as a clean energy input. These shifts reflect a practical strategy to reduce costs and accelerate adoption.

Advancement of Mobility Solutions through Hydrogen Fueling Infrastructure Expansion

Hydrogen mobility is gaining traction with expanding fueling station networks and vehicle fleets. OEMs and infrastructure operators are collaborating to build reliable supply chains. It supports the adoption of heavy-duty vehicles and long-haul transport solutions. Hydrogen trucks, buses, and trains are entering commercial use in multiple regions. Urban mobility planners are integrating hydrogen into sustainable transport strategies. Ports and airports are adopting hydrogen to reduce operational emissions. Mobility integration also stimulates upstream investments in production capacity. This ecosystem approach accelerates adoption across the transport sector.

- For instance, in April 2025, Plug Power Inc. and Olin Corporation commissioned the St. Gabriel Green Hydrogen Plant in Louisiana through their Hidrogenii joint venture. The facility has a production capacity of 15 tons of hydrogen per day, strengthening North America’s clean hydrogen infrastructure.

Rising Role of Public-Private Partnerships in Accelerating Market Development

Public-private partnerships are becoming critical in hydrogen project financing and development. Governments provide regulatory support and funding, while private firms contribute technology and execution. It allows sharing of risks and enhances project bankability. Many large hydrogen hubs are emerging through consortia involving multiple stakeholders. These collaborations improve technology transfer and infrastructure rollout. Regional governments are forming alliances with energy companies and industrial users. This structure ensures stable long-term demand and operational efficiency. Strong alliances are accelerating the global deployment of hydrogen ecosystems.

Market Challenges Analysis

High Initial Capital Expenditure and Infrastructure Development Barriers

Capital intensity remains one of the most significant challenges for hydrogen projects. Electrolyzer systems, storage facilities, and transport networks require heavy investment. Many early-stage projects struggle to secure financing without long-term offtake agreements. It creates uncertainty for developers and slows down deployment. Infrastructure gaps limit accessibility and scalability. Building a comprehensive pipeline or distribution system involves complex permitting and regulatory processes. Lack of standardization further adds to cost pressure. These barriers can delay project timelines and affect investor confidence. Addressing cost and financing challenges remains crucial for market acceleration.

Regulatory Uncertainty and Supply Chain Limitations Affecting Market Stability

Regulatory frameworks for hydrogen are still evolving in many regions. Inconsistent standards create uncertainty for investors and project developers. It complicates international trade and cross-border collaboration. Supply chain readiness is also a major concern, with limited capacity for electrolyzer production and storage equipment. Delays in equipment delivery affect project execution timelines. Workforce skill gaps further slow adoption. Governments and industries must align policies and capacity-building efforts. Addressing these regulatory and logistical issues is key to building a resilient and scalable market.

Market Opportunities

Rapid Expansion of Export-Oriented Hydrogen Projects and Global Trade Routes

Export-oriented projects present strong opportunities for market expansion. Countries with abundant renewable resources can become global hydrogen suppliers. It creates new trade routes linking producers and energy-importing nations. Regional hubs are developing infrastructure to handle liquefaction, storage, and shipping. Global demand from industries and transport sectors drives this expansion. Technology innovation enhances supply chain efficiency. Long-term contracts and strategic partnerships ensure stable revenue streams. This trend can reshape global energy trade dynamics.

Integration of Hydrogen into Industrial Clusters and Renewable Energy Hubs

Industrial clusters offer high potential for hydrogen integration due to concentrated demand. It enables efficient infrastructure deployment and lower transportation costs. Pairing hydrogen with renewable hubs improves energy security and grid stability. Industrial users can reduce emissions and enhance operational efficiency. Large-scale adoption supports cost reduction and technology maturity. Governments and private firms are aligning strategies to attract investment. These integrated developments can accelerate hydrogen’s role in decarbonizing multiple sectors.

Market Segmentation Analysis:

The Green Hydrogen Market is segmented

By technology into Alkaline Electrolyzer, Polymer Electrolyte Membrane (PEM) Electrolyzer, and SOEC Electrolyzer. Alkaline Electrolyzer holds a strong share due to its proven design, lower production cost, and long operational life. PEM Electrolyzer is gaining traction due to its high efficiency and flexibility in integrating with renewable energy sources. SOEC Electrolyzer shows strong potential in industrial applications due to its high operating temperature and improved energy conversion efficiency.

- For instance, in March 2024, L&T Electrolysers Ltd commissioned India’s first indigenously produced alkaline electrolyzer at its Hazira facility in Gujarat. The 1 MW unit, expandable to 2 MW, can produce around 200 Nm³ of hydrogen per hour using two stacks and an EPU ML-400 system.

By application, the market is divided into Power Generation, Transport, and Others. Power Generation leads the segment due to the rising use of hydrogen in utility-scale energy projects and grid stabilization. The transport segment is expanding with the growing adoption of hydrogen-powered vehicles, supported by investments in refueling infrastructure. Other applications include industrial processes such as ammonia production and refining, where hydrogen use is scaling rapidly.

- For instance, in April 2025, Plug Power Inc. and Olin Corporation commissioned the St. Gabriel hydrogen liquefaction plant in Louisiana through their Hidrogenii joint venture. The facility has a production capacity of 15 tons of hydrogen per day, increasing Plug Power’s total U.S. hydrogen capacity to roughly 40 tons per day.

By distribution channel, the market is classified into Pipeline and Cargo. Pipeline transport dominates because it provides efficient and large-scale delivery of hydrogen to end users. Cargo transport is growing, driven by the need to support exports and supply remote areas. Each segment plays a critical role in accelerating the market’s infrastructure and enabling a broader energy transition.

Segmentation:

By Technology

- Alkaline Electrolyzer

- Polymer Electrolyte Membrane (PEM) Electrolyzer

- SOEC Electrolyzer

By Application

- Power Generation

- Transport

- Others

By Distribution Channel

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Green Hydrogen Market size was valued at USD 855.00 million in 2018 to USD 3,001.40 million in 2024 and is anticipated to reach USD 38,939.89 million by 2032, at a CAGR of 37.9% during the forecast period. It holds nearly 33.7% of the global share. Strong policy support, advanced energy infrastructure, and large renewable energy projects drive regional expansion. The United States leads with several large-scale electrolysis projects and hydrogen hubs supported by government funding. Canada focuses on leveraging its renewable resources for clean hydrogen exports. Mexico is emerging with strategic initiatives to build hydrogen corridors. Major investments target the development of green industrial clusters and decarbonization of transport. The presence of key technology providers strengthens market competitiveness. Strategic collaborations between energy companies and governments enhance infrastructure development and accelerate adoption.

Europe

The Europe Green Hydrogen Market size was valued at USD 662.50 million in 2018 to USD 2,265.07 million in 2024 and is anticipated to reach USD 27,810.24 million by 2032, at a CAGR of 36.9% during the forecast period. It holds nearly 24.1% of the global share. Strong climate targets and ambitious policy frameworks drive regional leadership. Germany, France, and the Netherlands are front-runners in large-scale electrolyzer deployment and hydrogen corridors. The European Union provides significant funding to accelerate clean energy transition. The region focuses on integrating hydrogen into transport, heavy industry, and energy storage. Its infrastructure development supports cross-border trade and grid balancing. Strong regulatory support ensures market stability and growth. Strategic alliances between governments and private firms enhance competitiveness.

Asia Pacific

The Asia Pacific Green Hydrogen Market size was valued at USD 745.00 million in 2018 to USD 2,745.82 million in 2024 and is anticipated to reach USD 38,731.85 million by 2032, at a CAGR of 39.3% during the forecast period. It holds nearly 33.6% of the global share. Rapid energy transition, industrial decarbonization, and export potential drive strong growth. China leads with extensive electrolyzer manufacturing capacity and renewable integration. Japan and South Korea prioritize hydrogen imports to support clean transport and energy security. India focuses on scaling domestic production through national hydrogen missions. Australia strengthens its role as an export hub for Asia and Europe. Investments in storage and transport infrastructure enhance market maturity. Policy initiatives and public-private partnerships sustain momentum and competitiveness.

Latin America

The Latin America Green Hydrogen Market size was valued at USD 135.00 million in 2018 to USD 474.67 million in 2024 and is anticipated to reach USD 5,645.16 million by 2032, at a CAGR of 36.4% during the forecast period. It holds nearly 4.9% of the global share. Brazil drives regional growth with renewable energy resources and strategic investments in hydrogen projects. Argentina focuses on early-stage infrastructure and policy development. Chile is positioning itself as a key exporter due to its strong solar and wind potential. The region benefits from abundant resources but faces challenges in large-scale deployment. Governments are forming partnerships with global technology providers to attract investment. Infrastructure and regulatory clarity are improving to support commercial adoption. Market momentum is building, supported by export ambitions and clean energy strategies.

Middle East

The Middle East Green Hydrogen Market size was valued at USD 65.00 million in 2018 to USD 209.76 million in 2024 and is anticipated to reach USD 2,322.46 million by 2032, at a CAGR of 35.2% during the forecast period. It holds nearly 2.1% of the global share. The region leverages its renewable and natural gas resources to diversify energy exports. Saudi Arabia and the UAE lead with giga-scale hydrogen projects aimed at decarbonization and export. Hydrogen production aligns with national strategies to transition toward clean fuels. Investment in infrastructure and technology is rising, supported by sovereign wealth funds. Green hydrogen is gaining importance for future energy trade. Strategic collaborations with international partners accelerate technology transfer. The region focuses on becoming a key global supplier.

Africa

The Africa Green Hydrogen Market size was valued at USD 37.50 million in 2018 to USD 193.85 million in 2024 and is anticipated to reach USD 2,064.14 million by 2032, at a CAGR of 33.8% during the forecast period. It holds nearly 1.8% of the global share. South Africa leads regional growth with strong renewable energy potential and industrial initiatives. Egypt is advancing projects focused on green ammonia production for export. Several countries explore hydrogen strategies to attract foreign investment. Infrastructure development is at an early stage but gaining momentum. Abundant solar and wind resources position Africa as a future hub for low-cost hydrogen. International partnerships are increasing to build capacity and strengthen policy frameworks. Regional focus remains on building export-oriented projects and energy diversification.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Air Liquide

- Air Products Inc.

- Bloom Energy

- Cummins Inc.

- Engie

- Linde plc.

- Nel ASA

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

- Uniper SE

Competitive Analysis:

The Green Hydrogen Market features strong competition among global energy companies and technology developers. It is shaped by strategic investments, large-scale electrolyzer deployments, and rapid infrastructure expansion. Leading players such as Air Liquide, Air Products Inc., Bloom Energy, Cummins Inc., Engie, Linde plc., Nel ASA, Siemens Energy, Toshiba Energy Systems & Solutions Corporation, and Uniper SE focus on scaling production capacity and securing long-term supply agreements. Companies emphasize advanced electrolyzer technology, cost optimization, and renewable integration to strengthen market positions. Strategic partnerships between industry leaders and governments support large hydrogen hubs. Mergers, acquisitions, and regional expansion help widen their global footprint and improve competitiveness. Strong innovation pipelines and diversified portfolios enable leading companies to address demand across power, transport, and industrial applications.

Recent Developments:

- In October 2025, ITM Power announced the launch of its new flagship 50 MW green hydrogen plant, named ALPHA 50, on October 21, 2025. The ALPHA 50 represents a new global benchmark for scalable and cost-efficient hydrogen production, integrating prefabricated, modular design with energy efficiency and rapid load adaptability.

- In October 2025, Daimler Truck and Hamburger Hafen und Logistik AG (HHLA) announced a new partnership to establish a liquid hydrogen supply chain through the Port of Hamburg. This collaboration aims to create one of Europe’s first large-scale logistics corridors for hydrogen-fueled trucks and port operations, making Hamburg a central hub for hydrogen mobility infrastructure in the region.

- In October 2025, Air Liquide announced a major move in the green hydrogen sector by investing $50 million to expand its hydrogen pipeline network along the U.S. Gulf Coast. The project, revealed on October 7, 2025, aims to strengthen the company’s supply infrastructure to support long-term hydrogen contracts with American refiners.

- In October 2025, Bloom Energy secured new partnerships in the green hydrogen domain with major energy and industrial players such as Chart Industries and AEP Ohio. The company finalized a commercial deployment of solid oxide fuel cell (SOFC) systems for data centers and direct air capture projects and expanded its agreement with Equinix to exceed 100 MW of clean power capacity.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Application and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising government support and policy frameworks will accelerate investment in large-scale hydrogen projects.

- Electrolyzer manufacturing capacity will expand rapidly to meet increasing global demand.

- Integration with renewable power sources will strengthen the role of hydrogen in decarbonization strategies.

- Transport and power generation applications will remain key growth drivers across multiple regions.

- Advancements in SOEC technology will improve efficiency and open new industrial use cases.

- Strategic collaborations between governments and private players will expand hydrogen infrastructure.

- Export-oriented projects will increase, positioning several regions as major global suppliers.

- Cost optimization and technology standardization will enhance commercial viability.

- Hydrogen storage and transport solutions will advance, supporting broader energy system integration.

- Market consolidation through mergers and acquisitions will strengthen the competitive landscape.