Market Overview

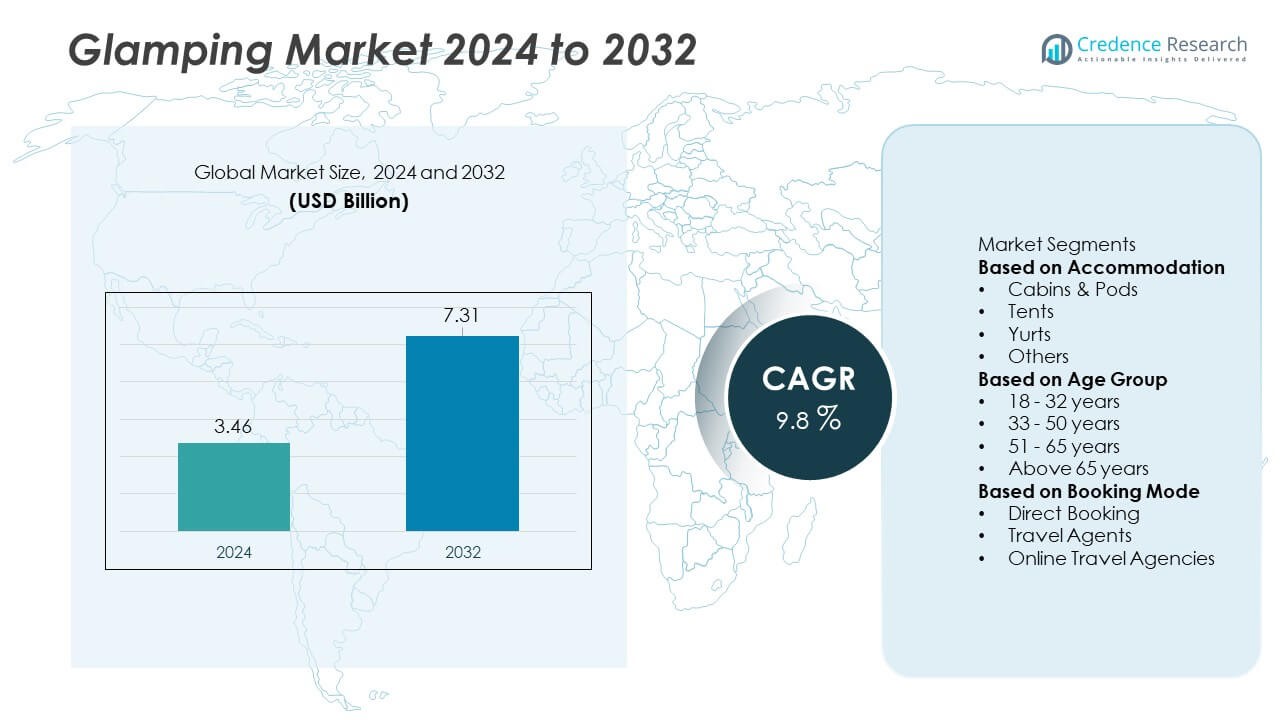

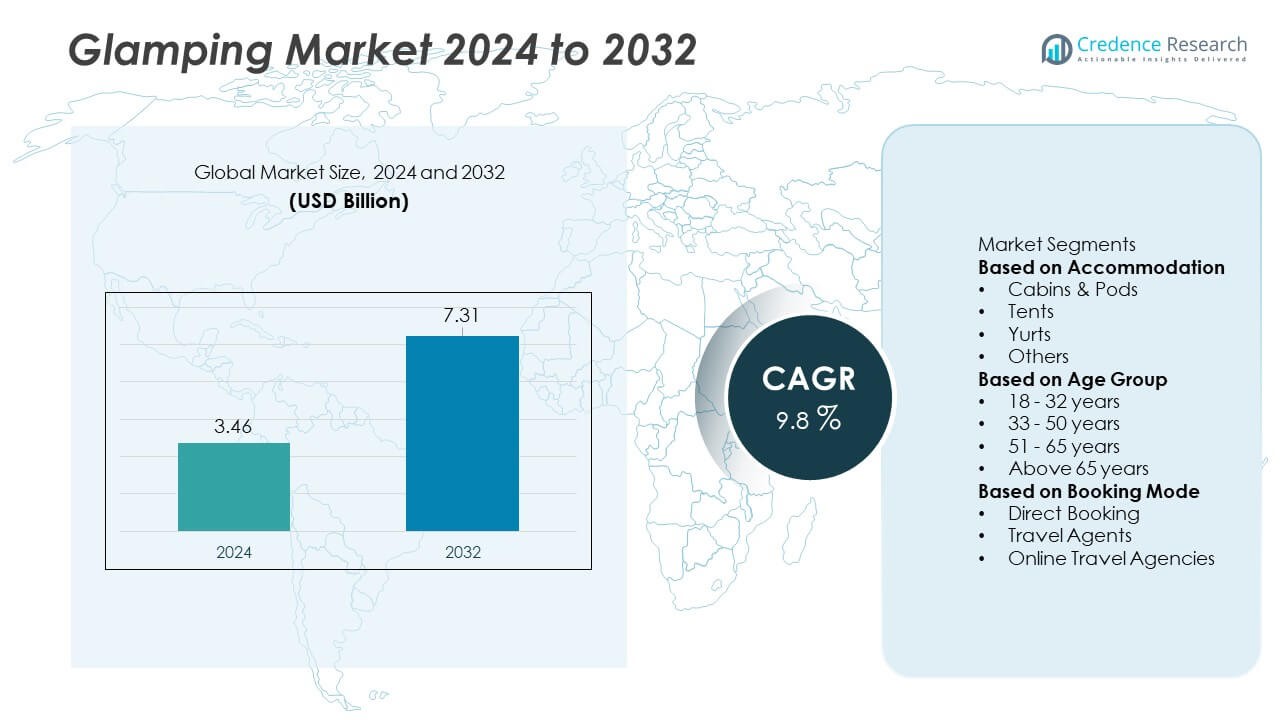

The Glamping Market was valued at USD 3.46 billion in 2024 and is projected to reach USD 7.31 billion by 2032, expanding at a CAGR of 9.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glamping Market Size 2024 |

USD 3.46 Billion |

| Glamping Market, CAGR |

9.8% |

| Glamping Market Size 2032 |

USD 7.31 Billion |

The glamping market features prominent players such as Hoshino Resorts, Nightfall Camp Pty Ltd., Tentrr, Wildman Wilderness Lodge, Baillie Lodges, Under Canvas, Paperbark Camp, Eco Retreats, Collective Retreats, and Tanja Lagoon Camp. These brands strengthen their position through premium cabin designs, luxury tents, nature-focused experiences, and digital booking capabilities. North America leads the global market with a 38% share, supported by high spending on experiential travel and strong outdoor tourism infrastructure. Europe follows with a 32% share, driven by eco-tourism growth and widespread adoption of multi-season glamping accommodations. Both regions remain the core growth centers for premium and sustainable outdoor stays.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The glamping market reached USD 3.46 billion in 2024 and is set to grow at a CAGR of 9.8% through 2032, supported by rising demand for premium outdoor stays.

- Strong market drivers include the shift toward experience-centric travel, sustainability-focused accommodations, and high demand for cabins and pods, which lead the accommodation segment with a 41% share.

- Key trends reflect the rise of luxury add-ons, wellness retreats, digital booking adoption, and technology-enhanced units that attract younger travelers and long-stay guests.

- The competitive landscape includes leading brands offering eco-friendly designs, insulated cabins, and curated nature experiences, while expanding multi-season units and improving direct booking capabilities.

- Regionally, North America dominates with a 38% share, followed by Europe at 32%, while Asia Pacific holds 21% due to growing tourism and rising disposable income; online travel agencies lead booking modes with a 45% share.

Market Segmentation Analysis:

By Accommodation

Cabins and pods lead this segment with a 41% share due to strong demand for structured, weather-resistant, and premium outdoor stays. Travelers prefer these units because they offer privacy, insulation, and modern amenities that enhance comfort in remote locations. Growth also comes from rising investments in modular wooden cabins and compact pod designs that support eco-friendly tourism. Tents hold steady demand in adventure-oriented sites, while yurts and other formats attract niche users seeking cultural or rustic experiences. Operators expand cabin-based setups to improve occupancy rates and appeal to families and couples seeking reliable, upscale glamping options.

- For instance, Under Canvas operates two Yellowstone sites with a combined over 120 safari-style canvas units, which feature amenities like wood-burning stoves for heat and private bathrooms with pull-chain showers and flushing toilets, while also implementing sustainability efforts such as using special lighting to minimize light pollution.

By Age Group

The 33–50 years segment dominates with a 38% share, driven by higher spending power, interest in wellness travel, and preference for premium nature-based experiences. Travelers in this age group book extended stays, choose upscale amenities, and seek quiet environments suited for relaxation or family outings. The 18–32 segment shows fast growth due to rising adventure tourism and social-media-driven experiences. Demand from 51–65 and above-65 groups increases as operators add accessible units, guided outdoor activities, and comfort-enhanced retreat packages. The dominant 33–50 age group continues to push revenue growth as they favor year-round, experience-centric vacations.

- For instance, Baillie Lodges operates a collection of intimate luxury lodges in remote wilderness regions, with properties like Southern Ocean Lodge on Kangaroo Island offering signature guided excursions included in the tariff.

By Booking Mode

Online travel agencies (OTAs) hold the largest 45% share, supported by strong digital visibility, user reviews, dynamic pricing, and bundled travel offerings. OTAs attract younger travelers who prefer comparing amenities, photos, and curated glamping packages online. Direct booking channels grow as brands invest in mobile sites, loyalty programs, and immersive virtual-tour content. Travel agents remain relevant for premium retreats, group reservations, and curated luxury travel. OTAs lead due to widespread platform reach and strong marketing integration, allowing glamping operators to capture higher occupancy and attract global customers seeking easy and transparent booking options.

Key Growth Drivers

Rising Demand for Experience-Centric and Premium Outdoor Travel

Experience-driven tourism boosts glamping adoption as travelers seek comfort, nature access, and unique stays. Consumers choose premium outdoor retreats because they combine hotel-like facilities with immersive natural settings. Higher demand for wellness retreats, adventure travel, and weekend getaways helps operators expand cabin, pod, and tent formats. Social media visibility also accelerates interest in scenic, design-focused sites. This shift supports higher occupancy rates and encourages brands to invest in eco-friendly structures, smart amenities, and curated outdoor experiences. The growing appeal of experiential travel remains one of the strongest forces driving long-term market expansion.

- For instance, Collective Retreats operates a luxury glamping retreat at 4 Eagle Ranch near Vail, CO, where guests stay in luxury tents featuring king beds, private bathrooms, and a wood-burning stove for heating.

Expansion of Eco-Friendly and Sustainable Tourism Initiatives

Sustainable travel drives strong growth as consumers prefer low-impact accommodations and energy-efficient outdoor stays. Operators introduce solar-powered units, recycled-material structures, and low-footprint site layouts to appeal to environmentally aware travelers. Governments also support eco-tourism zones, which encourage new glamping developments near forests, coastal regions, and mountain trails. Cabins, pods, and luxury tents designed with green materials attract families and working professionals seeking responsible leisure options. This rise in sustainability-focused travel strengthens brand differentiation and aligns with global environmental goals, boosting the adoption of high-value glamping offerings.

- For instance, Hoshino Resorts’ HOSHINOYA Karuizawa site generates almost all its necessary electricity from hydropower using the natural river flow within the property and uses geothermal energy heat pump systems for thermal energy, significantly raising the resort’s energy self-sufficiency rate to approximately 75 percent through verified renewable integration.

Growing Popularity of Digital Booking Platforms and Integrated Services

Digitalization increases market reach as users rely on mobile apps, OTAs, and brand websites to compare stays, check availability, and review amenities. Online booking improves visibility for small and large operators, helping them attract domestic and international travelers. Enhanced digital tools such as virtual tours, dynamic pricing, and instant confirmation make the booking process easier. Integration with travel packages, transport options, and curated outdoor activities raises convenience and boosts conversion rates. This digital shift allows operators to expand customer access, improve occupancy, and streamline seasonal demand across locations.

Key Trends & Opportunities

Rising Adoption of Luxury Add-Ons and Technology-Enhanced Stays

Glamping evolves with smart lighting, climate control, high-speed connectivity, and premium interiors that enhance comfort in remote settings. Luxury upgrades such as private decks, hot tubs, themed cabins, and wellness zones support higher pricing potential. Operators create new revenue streams by offering personalized adventure plans, yoga retreats, and curated dining. This trend also attracts long-stay travelers and remote workers seeking nature-based accommodations with modern utilities. As technology and luxury design merge, brands gain opportunities to differentiate their offerings and appeal to experience-focused travelers across age groups.

- For instance, Paperbark Camp modernized its safari tents by adding 10 to 13 units equipped with solar-powered, 12-volt lighting that reduces energy consumption and introduced elevated platforms, reducing ground impact while improving guest comfort and premium design appeal.

Expansion of Multi-Season Glamping and New Geographical Destinations

Four-season units such as insulated cabins and heated pods enable year-round operations, creating strong revenue opportunities. Cold-climate destinations expand glamping offerings with snow-compatible structures, winter adventure packages, and scenic remote stays. Coastal, desert, and forest-edge regions also gain traction as operators introduce climate-adaptive materials and sustainable layouts. Rising interest in unexplored destinations encourages development of themed glamping parks, boutique forest retreats, and off-grid luxury setups. This geographic diversification helps brands tap new tourist flows while reducing dependency on peak travel seasons.

- For instance, Snow Peak provides gear for four-season camping, enabling winter operations in high-altitude terrain.

Key Challenges

High Operational Costs and Infrastructure Requirements

Building durable units, installing utilities, and maintaining remote locations increase operating expenses. Premium cabins, luxury tents, and pods require climate control, sanitation, and safe access routes, which add to capital expenditure. Seasonal maintenance, safety compliance, and continuous upgrades for guest satisfaction create additional cost pressure. Small operators face hurdles in financing large-scale setups, while established brands balance expansion with long-term operating stability. These cost-intensive requirements often delay new site development and limit affordable glamping options across emerging regions.

Regulatory Barriers and Environmental Compliance Issues

Glamping sites near protected areas must follow strict rules related to land use, waste management, and impact control. Securing permits is time-consuming, especially for destinations with sensitive ecosystems or high tourism pressure. Operators must invest in eco-friendly systems, renewable energy solutions, and low-impact construction to meet compliance standards. Regulatory differences across regions create uncertainty, affecting planning and expansion timelines. These challenges make it difficult for new entrants to scale operations quickly while maintaining environmental responsibility and regulatory alignment.

Regional Analysis

North America

North America leads the glamping market with a 38% share, supported by strong demand for premium outdoor travel, eco-retreats, and technology-enhanced accommodations. The United States drives growth through well-developed camping infrastructure, high disposable income, and rising interest in experience-focused vacations. Operators expand insulated cabins, pods, and luxury tents across forests, national parks, and coastal destinations. Growing popularity of wellness retreats and digital nomad travel further boosts occupancy. Canada contributes with sustainable glamping sites that attract adventure and nature-focused travelers. The region maintains its leadership through strong investment, diverse landscapes, and mature booking platforms.

Europe

Europe holds a 32% share, driven by strong tourism activity, eco-conscious travel habits, and government support for sustainable outdoor accommodation. Countries such as the UK, France, Germany, and Italy lead with high adoption of cabins, pods, and thematic luxury tents. Travelers seek curated nature escapes, heritage-focused stays, and boutique countryside retreats. Operators invest in multi-season units to support year-round demand across forests, lakeside regions, and alpine zones. Strong preference for slow travel, wellness tourism, and cultural outdoor experiences strengthens market expansion. Europe continues to grow due to its established glamping culture and diverse geographic appeal.

Asia Pacific

Asia Pacific accounts for a 21% share, driven by rapid tourism growth, rising disposable income, and increased interest in premium nature-based experiences. Countries like Japan, Australia, China, and South Korea expand glamping offerings across mountains, deserts, islands, and coastal areas. Younger travelers favor Instagram-friendly stays and adventure-oriented accommodations such as luxury tents and eco-pods. Australia leads with well-structured outdoor tourism and sustainable cabins, while China sees demand for short-stay retreats near major cities. Growing domestic travel and investments in scenic resort-style glamping parks support strong market potential across diverse landscapes.

Latin America

Latin America holds a 6% share, supported by rising demand for eco-tourism, adventure travel, and remote scenic stays. Countries such as Brazil, Chile, Argentina, and Costa Rica expand glamping units in rainforests, coastlines, deserts, and volcanic regions. Travelers prefer cabins, safari tents, and jungle pods that offer comfort without compromising environmental authenticity. Operators promote wellness retreats, wildlife-focused stays, and premium outdoor experiences to attract domestic and international visitors. Growing awareness of sustainable travel and improved digital booking access support market momentum, though infrastructure limitations slow large-scale expansion across certain regions.

Middle East & Africa

The Middle East & Africa region captures a 3% share, driven by rising interest in luxury desert camps, coastal retreats, and safari-style glamping lodges. The UAE, Saudi Arabia, and Oman expand high-end desert glamping experiences with climate-controlled tents and premium amenities. Africa sees strong demand for wildlife lodges in Kenya, Tanzania, and South Africa, where eco-friendly units enhance guest comfort while preserving natural habitats. Investments in tourism diversification, national park development, and high-value adventure travel support growth. Despite climate and infrastructure challenges, the region’s unique landscapes create strong potential for upscale glamping experiences.

Market Segmentations:

By Accommodation

- Cabins & Pods

- Tents

- Yurts

- Others

By Age Group

- 18 – 32 years

- 33 – 50 years

- 51 – 65 years

- Above 65 years

By Booking Mode

- Direct Booking

- Travel Agents

- Online Travel Agencies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features key players such as Under Canvas, Hoshino Resorts, Collective Retreats, Tentrr, Baillie Lodges, Nightfall Camp Pty Ltd., Tanja Lagoon Camp, Wildman Wilderness Lodge, Paperbark Camp, and Eco Retreats. These companies expand their presence through premium designs, sustainable construction, and multi-season accommodation formats that enhance guest comfort. Many operators invest in insulated cabins, climate-controlled tents, and themed luxury pods to support year-round occupancy. Digital integration remains a core focus, with brands improving direct booking platforms, virtual tour features, and loyalty programs. Partnerships with tour operators, national parks, and eco-tourism boards help companies secure high-traffic sites and strengthen destination appeal. The competitive environment continues to intensify as operators introduce wellness retreats, curated outdoor experiences, and eco-certified units to attract high-value travelers. This strategic diversification supports strong brand positioning in an expanding global glamping market.

Key Player Analysis

- Hoshino Resorts

- Nightfall Camp Pty Ltd.

- Tentrr

- Wildman Wilderness Lodge

- Baillie Lodges

- Under Canvas

- Paperbark Camp

- Eco Retreats

- Collective Retreats

- Tanja Lagoon Camp

Recent Developments

- In June 2025, Collective Retreats reopened its site on Governors Island (New York) for the 2025 season with 29 units (canvas tents, cabins, glass-walled suites), new culinary programmes and on-site activities.

- In 2025, Hoshino Resorts’ resort HOSHINOYA Fuji offered a “Rainy Season Glamping” program from June 6 to July 10, 2025, which invited guests to explore the sensory and emotional aspects of Japan’s rainy season.

- In August 2023, Under Canvas Lake Powell–Grand Staircase was certified as the world’s first-ever DarkSky-certified single lodging property.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Accommodation, Age Group, Booking Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for luxury outdoor stays will rise as travelers prefer comfort-focused nature experiences.

- Multi-season cabins and insulated pods will expand to support year-round operations.

- Digital bookings will grow as operators enhance mobile platforms and online visibility.

- Eco-friendly structures and low-impact site designs will gain priority for sustainability goals.

- Wellness retreats and curated experience packages will attract higher-spending travelers.

- Remote work trends will boost long-stay glamping options with better connectivity.

- Emerging regions will invest in scenic destinations to diversify tourism offerings.

- Partnerships with national parks and tour operators will increase brand reach.

- Technology upgrades such as smart lighting and climate control will enhance guest comfort.

- Premium themed units and boutique-style retreats will strengthen market differentiation.