Market Overview

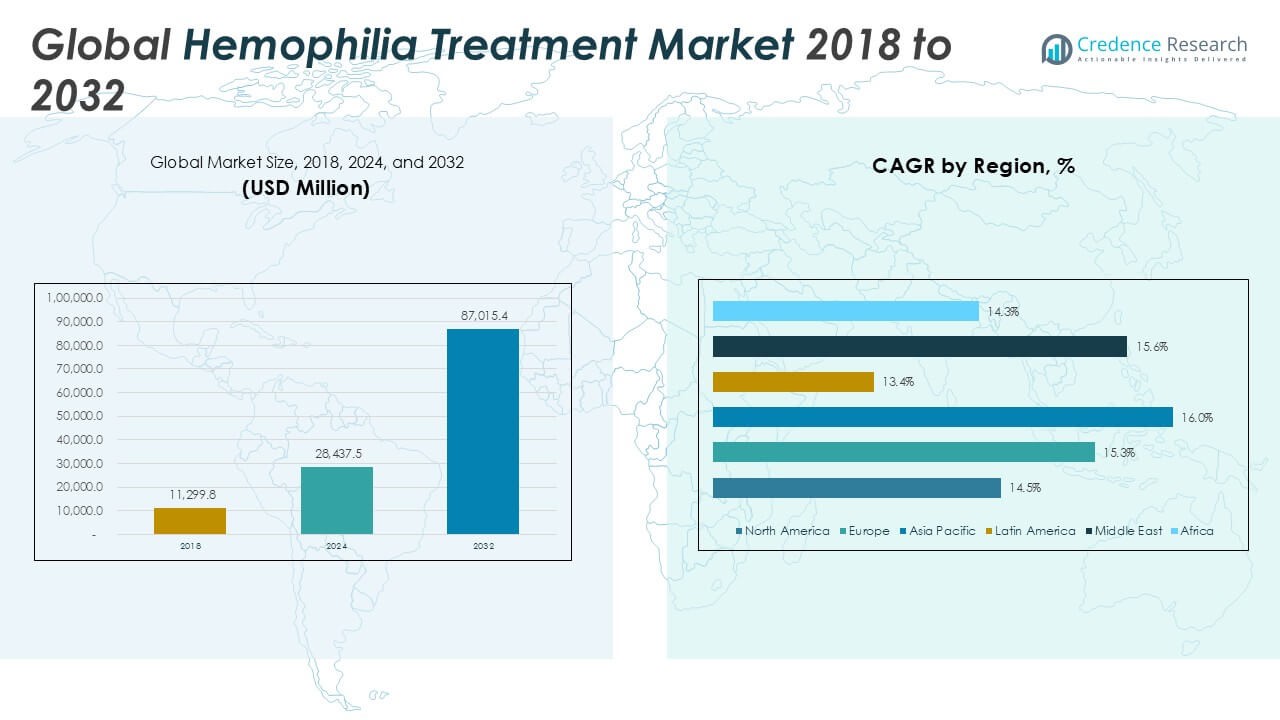

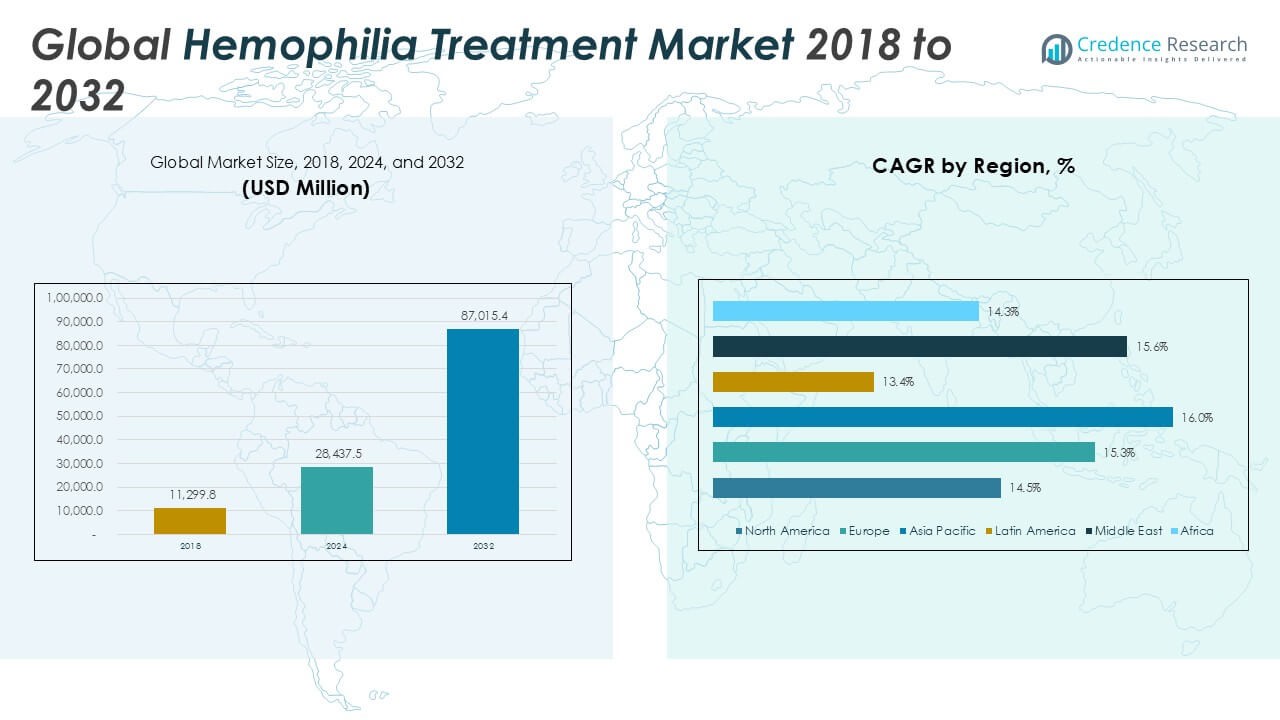

The Global Hemophilia Treatment Market is projected to grow from USD 28,437.5 million in 2024 to an estimated USD 87,015.4 million by 2032, with a compound annual growth rate (CAGR) of 15.03% from 2025 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hemophilia Treatment Market Size 2024 |

USD 28,437.5 Million |

| Hemophilia Treatment Market, CAGR |

15.03% |

| Hemophilia Treatment Market Size 2032 |

USD 87,015.4 Million |

Key market drivers include increasing investments in research and development of long-acting replacement factors and non-factor therapies. The adoption of gene therapy is accelerating due to its potential for long-term correction of hemophilia, reducing the need for frequent infusions. Additionally, favorable reimbursement policies and government initiatives aimed at improving access to treatment are fostering market expansion. Trends such as the shift from plasma-derived products to recombinant therapies and a growing pediatric patient population are also influencing market dynamics positively.

Geographically, North America holds a dominant share due to advanced healthcare infrastructure, high treatment adoption rates, and strong presence of key market players. Europe follows closely, supported by widespread access to specialized care and funding. The Asia Pacific region is expected to witness the fastest growth, driven by increasing diagnosis rates and expanding healthcare investments. Prominent players in the global hemophilia treatment market include Pfizer Inc., Takeda Pharmaceutical Company Ltd., F. Hoffmann-La Roche Ltd., Bayer AG, CSL Behring, and BioMarin Pharmaceutical Inc.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Hemophilia Treatment Market is projected to grow from USD 28,437.5 million in 2024 to USD 87,015.4 million by 2032, registering a CAGR of 15.03%.

- Growing awareness and early diagnosis of hemophilia are increasing the demand for both prophylactic and on-demand treatment solutions.

- Innovation in gene therapy and extended half-life clotting factors is reshaping treatment approaches and improving patient outcomes.

- The elevated cost of therapies, especially recombinant and gene-based treatments, continues to limit access in low-income regions.

- North America dominates the market due to advanced healthcare systems, favorable reimbursement policies, and strong presence of key players.

- Asia Pacific is expected to witness the highest growth rate, driven by rising healthcare investments and improved disease screening programs.

- Leading companies include Pfizer, Bayer, CSL Behring, Takeda, F. Hoffmann-La Roche, and BioMarin, focusing on innovation and global expansion.

Market Drivers

Rising Prevalence of Hemophilia and Improved Diagnosis Driving Demand

The increasing prevalence of hemophilia, especially types A and B, is a key factor fueling demand for effective treatment options. Many developing countries are witnessing rising diagnosis rates due to improved awareness and access to healthcare services. Early diagnosis and routine screening programs have led to timely intervention, which has increased the demand for factor replacement therapies. The Global Hemophilia Treatment Market is expanding as governments and healthcare organizations invest in national hemophilia care programs. Initiatives by non-profit groups and patient advocacy organizations are also helping to improve disease recognition and support treatment access. This growth in diagnosis is directly translating into greater uptake of both prophylactic and on-demand therapies.

- For instance, the World Federation of Hemophilia’s 2024 survey reported that over 420,000 people worldwide were identified with hemophilia, with more than 210,000 registered cases of hemophilia A and over 42,000 cases of hemophilia B, reflecting the impact of improved diagnosis and reporting.

Advancements in Recombinant and Gene Therapies Boosting Innovation

Innovative treatment modalities such as recombinant factors and gene therapies are transforming the landscape of hemophilia management. Recombinant products reduce the risk of blood-borne infections and offer more consistent outcomes. Gene therapy holds the potential for a long-term cure, which appeals to both patients and healthcare providers seeking to minimize treatment burden. The market benefits from increasing clinical trial activity and positive results from ongoing research in AAV-based gene therapy. It continues to attract investment from pharmaceutical companies focused on developing therapies with extended half-lives and fewer side effects. The Global Hemophilia Treatment Market is being reshaped by these innovations, which are setting new standards for safety and efficacy.

- For instance, in 2024, pharmaceutical companies reported enrolling more than 1,500 patients globally in gene therapy clinical trials for hemophilia, with over 20 active trials investigating AAV-based gene therapies and extended half-life factor products.

Strong Government Support and Reimbursement Frameworks Encouraging Access

Government-backed initiatives and national health insurance schemes are making hemophilia treatment more accessible to larger populations. Many countries have introduced reimbursement policies that cover expensive therapies, thereby reducing out-of-pocket expenses for patients. It benefits from such policy frameworks, which help create a stable demand for high-cost biologics and novel therapies. Public healthcare systems in regions such as North America and Europe are actively supporting home infusion programs and self-care practices. These efforts enable early intervention, better compliance, and reduced emergency visits. With stable funding in place, providers are more likely to adopt long-term care strategies involving newer treatment options.

Shift Toward Preventive Therapies and Personalized Care Enhancing Market Scope

The industry is witnessing a gradual shift from on-demand treatment to preventive therapy, which is gaining popularity among both clinicians and patients. Prophylactic treatment helps maintain factor levels and prevent bleeding episodes, reducing long-term complications. This trend aligns with the growing emphasis on quality of life and patient-centric care models. The Global Hemophilia Treatment Market is evolving to include tailored treatment plans based on genetic profiles, age, and disease severity. Pharmaceutical companies are developing specialized therapies designed for pediatric and geriatric populations. It is expanding its reach by aligning with precision medicine principles that promise better clinical outcomes and improved patient satisfaction.

Market Trends

Growing Adoption of Gene Therapy Signaling a Paradigm Shift in Treatment

Gene therapy is emerging as a transformative trend in the hemophilia landscape, offering long-term or potentially curative outcomes. This approach introduces functional copies of defective genes, enabling the body to produce clotting factors naturally. Several pharmaceutical companies have advanced candidates in late-stage clinical trials, and some therapies have received regulatory approvals in major markets. The Global Hemophilia Treatment Market is witnessing increased investment and collaboration in gene therapy development. It is gradually replacing conventional factor replacement therapy for eligible patients, particularly in developed regions. The convenience of fewer doses and reduced dependency on lifelong infusions is reshaping patient expectations.

- For instance, in 2024, more than 1,100 patients with hemophilia A or B received gene therapy treatments worldwide, as reported by pharmaceutical company registries and government health agencies.

Focus on Extended Half-Life Therapies Improving Compliance and Convenience

Extended half-life (EHL) factor products are gaining traction due to their ability to maintain therapeutic levels for longer periods. These therapies reduce infusion frequency, improving patient adherence and reducing treatment fatigue. Several leading pharmaceutical firms have introduced EHL versions of Factor VIII and Factor IX, which are being adopted in both pediatric and adult care. The Global Hemophilia Treatment Market is benefiting from growing physician and patient preference for these convenient options. It supports better clinical outcomes and enhances overall quality of life. This trend is strengthening the role of prophylaxis in long-term hemophilia management.

- For instance, in 2024, a leading hemophilia registry documented that over 22,000 patients globally were treated with extended half-life Factor VIII or Factor IX products, with significant uptake in North America and Europe according to company and registry data.

Expansion of Home-Based Treatment and Self-Administration Models

The rise of home infusion programs and self-administration tools is changing how hemophilia is managed. Patients now prefer the flexibility and comfort of treating themselves at home, reducing the need for hospital visits. Portable and user-friendly drug delivery systems are making this transition easier and more effective. The Global Hemophilia Treatment Market is aligning with this trend through innovations in auto-injectors and pre-filled syringes. It enables better treatment compliance and timely intervention during bleeding episodes. Healthcare systems are also supporting training and education programs to facilitate safe home-based care.

Digital Health Integration Supporting Real-Time Monitoring and Personalized Care

Digital platforms and wearable technologies are being integrated into hemophilia care to enable real-time monitoring of symptoms and therapy outcomes. Mobile apps help patients track bleeding events, infusion schedules, and factor usage with ease. Healthcare providers use these data insights to adjust treatment plans more effectively. The Global Hemophilia Treatment Market is embracing digital tools to deliver personalized care and improve disease management. It also supports remote consultations and telemedicine, ensuring continuous care for patients in rural or underserved regions. This trend is strengthening patient engagement and optimizing therapy outcomes.

Market Challenges

High Cost of Therapies and Limited Access in Low-Income Regions Restrain Growth

The high cost of hemophilia therapies, especially gene treatments and recombinant factors, remains a significant barrier to widespread adoption. Patients in low- and middle-income countries often lack access to essential treatment due to limited healthcare funding and weak infrastructure. The Global Hemophilia Treatment Market faces challenges in achieving equitable distribution of therapies across regions. It relies heavily on government reimbursement and international aid in underserved markets, which can be inconsistent. Pharmaceutical companies face pressure to reduce prices while maintaining profitability. Without cost-effective solutions, a large portion of the global patient population remains untreated or under-treated.

- For instance, a single dose of gene therapy for hemophilia, such as Hemgenix or Pfizer’s Beqvez, is priced at 3,500,000 units per patient, while annual costs for standard recombinant factor therapies can exceed 750,000 units per patient, making these treatments unaffordable for many without substantial government or insurance support.

Inhibitor Development and Treatment Complexity Complicate Patient Outcomes

The formation of inhibitors—antibodies that neutralize clotting factor products—poses a major clinical challenge in hemophilia treatment. These immune responses reduce treatment efficacy and increase the need for bypassing agents, which are more expensive and harder to manage. The Global Hemophilia Treatment Market must address the complexities of treating inhibitor-positive patients, which often requires personalized protocols and specialized care. It also grapples with the need for regular monitoring and adjustments in therapy, adding to the overall treatment burden. Limited availability of expertise in managing such complications further restricts access to optimal care. This challenge underscores the need for innovation in immunotolerance and inhibitor prevention strategies.

Market Opportunities

Expansion in Emerging Markets Through Improved Healthcare Infrastructure and Awareness

Emerging markets present significant growth opportunities due to increasing healthcare investments and expanding awareness of hemophilia. Many countries in Asia Pacific, Latin America, and Africa are strengthening their healthcare infrastructure and implementing national programs for rare diseases. The Global Hemophilia Treatment Market can capitalize on these developments by introducing affordable and accessible treatment options. It benefits from partnerships with local governments and NGOs to enhance diagnosis and patient support services. Growing urbanization and rising income levels in these regions also support market penetration. Enhanced education and training for healthcare providers further facilitate early diagnosis and treatment adoption.

Advancement in Personalized Medicine and Innovative Therapies Creating New Avenues

Personalized medicine offers a promising avenue for the Global Hemophilia Treatment Market through tailored therapies based on genetic and clinical profiles. Innovations in gene editing, RNA interference, and next-generation replacement factors enable more precise and effective treatment approaches. It stands to gain from the development of therapies targeting rare subtypes and inhibitor-positive patients. Expanding clinical trials and regulatory approvals for novel treatments will drive market expansion. Collaborations between biotech firms and research institutions accelerate innovation pipelines. These advancements increase treatment efficacy and reduce side effects, improving patient outcomes and driving sustained market growth.

Market Segmentation Analysis

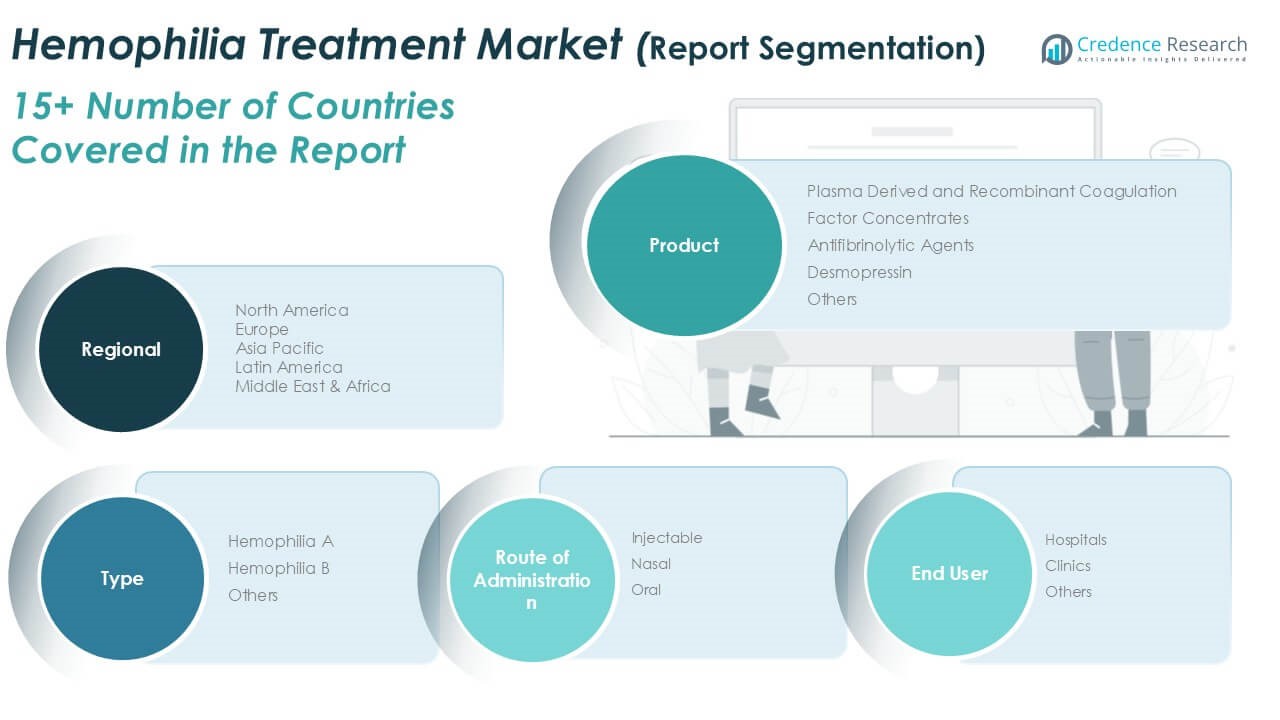

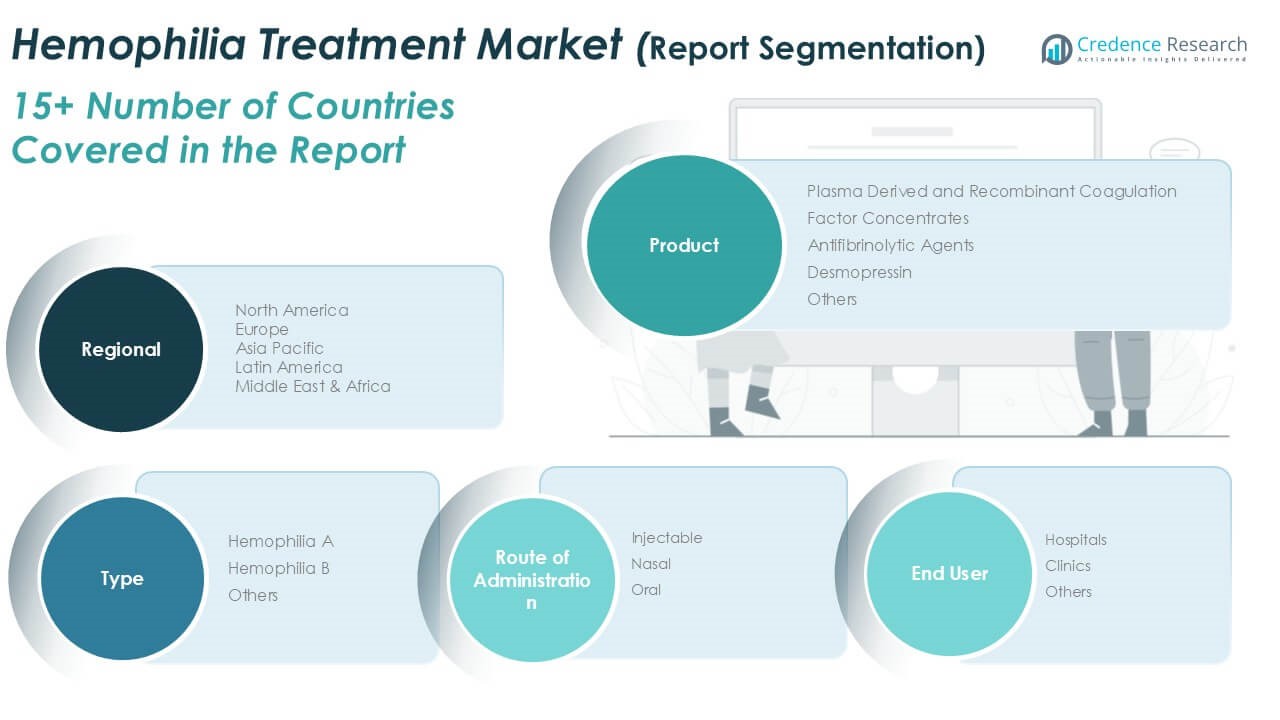

By Product

The Global Hemophilia Treatment Market, by product, is segmented into plasma-derived and recombinant coagulation factors, factor concentrates, antifibrinolytic agents, desmopressin, and others. Plasma-derived and recombinant coagulation products hold the largest revenue share due to their critical role in replacing deficient clotting factors in Hemophilia A and B. Factor concentrates are widely used for both prophylaxis and acute management, supported by strong clinical outcomes and broad availability. Antifibrinolytic agents and desmopressin offer supportive roles, particularly in mild cases or dental procedures, where they help prevent excessive bleeding. The others category includes emerging biologics and supportive care medications aimed at enhancing treatment efficacy and patient compliance. The market is witnessing strong innovation across all product types, especially with recombinant therapies and long-acting formulations.

- For instance, in 2023, more than 1.6 billion international units of recombinant factor VIII were distributed globally for hemophilia treatment, according to data from the World Federation of Hemophilia and major manufacturers.

By Type

Based on type, the market is segmented into Hemophilia A, Hemophilia B, and others. Hemophilia A dominates the market with the highest revenue share due to its higher global prevalence. Hemophilia B accounts for a smaller yet significant portion, requiring similar but distinct treatment protocols. The others segment includes rare bleeding disorders like Hemophilia C, which are often underdiagnosed but gradually gaining clinical attention. The Global Hemophilia Treatment Market benefits from rising disease awareness and diagnostic improvements across all types. It continues to expand with focused research on subtype-specific therapies and genetic variations impacting treatment response.

- For instance, the World Federation of Hemophilia’s 2023 survey reported over 230,000 individuals diagnosed with hemophilia worldwide, including approximately 180,000 with Hemophilia A and 35,000 with Hemophilia B.

By Route of Administration

By route of administration, the market is divided into injectable, nasal, and oral segments. Injectable treatments lead the market due to their widespread use in factor replacement therapy and the current standard of care. Nasal and oral routes are gaining attention due to ease of use, especially for non-severe cases and pediatric patients. The nasal route, primarily represented by desmopressin, offers a non-invasive alternative with fast absorption. Oral agents are still limited but show promise in supporting adjunct therapies. It is exploring delivery technologies that improve bioavailability and patient compliance, which will broaden treatment access in the future.

By End User Industry

The end user segment includes hospitals, clinics, and others. Hospitals account for the majority share due to the requirement for advanced diagnostic tools, infusion capabilities, and specialist care. Clinics serve as secondary treatment hubs, particularly in urban and semi-urban areas, offering routine infusions and follow-up care. The others category includes home care settings, which are gaining traction with the rise of self-administration and telemedicine support. The Global Hemophilia Treatment Market supports this shift by promoting education and training programs for caregivers and patients. It is aligned with healthcare systems’ efforts to decentralize care and reduce hospital dependency.

Segments

Based on Product

- Plasma Derived and Recombinant Coagulation

- Factor Concentrates

- Antifibrinolytic Agents

- Desmopressin

- Others

Based on Type

- Hemophilia A

- Hemophilia B

- Others

Based on Route of Administration

Based on End User Industry

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Hemophilia Treatment Market

North America held a 31.7% share of the Global Hemophilia Treatment Market in 2024, with a market value of USD 9,022.0 million, projected to reach USD 26,591.89 million by 2032, growing at a CAGR of 14.5%. The United States leads this region, supported by robust healthcare infrastructure, early adoption of advanced therapies, and strong reimbursement policies. High disease awareness and access to specialized hemophilia treatment centers also contribute to regional dominance. It benefits from the presence of major pharmaceutical companies and ongoing clinical research activities in gene therapy. Strategic collaborations and continuous investment in R\&D strengthen the region’s innovation pipeline. North America remains the largest contributor to global revenue due to the widespread use of extended half-life and recombinant therapies.

Europe Hemophilia Treatment Market

Europe accounted for 26.5% of the global market in 2024, valued at USD 7,533.50 million, and is projected to reach USD 23,494.15 million by 2032, registering a CAGR of 15.3%. Countries such as Germany, the UK, and France drive market growth through government-funded treatment programs and national hemophilia registries. It shows strong demand for personalized and prophylactic care, supported by highly regulated healthcare systems. Europe has advanced in adopting home infusion practices and digital health tools for real-time monitoring. Pharmaceutical companies in the region actively collaborate with academic institutions for innovation in hemophilia research. Market growth is also influenced by expanding access to non-factor therapies and biosimilars.

Asia Pacific Hemophilia Treatment Market

The Asia Pacific region held 24.3% of the global market share in 2024, with a value of USD 6,922.50 million, projected to grow to USD 22,623.99 million by 2032, at a CAGR of 16.0%. Rapid urbanization, growing awareness, and expanding healthcare coverage are key growth enablers. Countries like China, Japan, and India are increasing investments in rare disease treatment and diagnostics. The Hemophilia Treatment Market in this region benefits from government initiatives and collaborations with global organizations to improve patient care. It faces challenges in rural areas but gains momentum through local production and distribution of recombinant therapies. The region holds potential for long-term growth with the expansion of clinical trials and rising private healthcare investments.

Latin America Hemophilia Treatment Market

Latin America contributed 9.6% to the global market in 2024, with a market size of USD 2,741.37 million, expected to reach USD 7,483.32 million by 2032, at a CAGR of 13.4%. Brazil and Mexico lead the regional market, supported by government-subsidized treatment plans and improving hemophilia care networks. It shows progress in patient registries, early screening programs, and training of healthcare professionals. While access remains uneven, multinational drug companies are expanding their presence in the region. Latin America is gradually increasing adoption of prophylactic therapy and advanced clotting factor products. Strengthening public-private partnerships is expected to improve treatment affordability and accessibility.

Middle East Hemophilia Treatment Market

The Middle East represented 4.8% of the global market in 2024, with a value of USD 1,368.25 million, projected to reach USD 4,350.77 million by 2032, growing at a CAGR of 15.6%. Countries like Saudi Arabia and the UAE are investing in rare disease infrastructure and expanding access to high-cost treatments. It focuses on early diagnosis and specialist care through national hemophilia programs and international collaborations. Increasing adoption of advanced therapies and import of recombinant factors drive growth. Government-backed initiatives are strengthening local treatment networks and supporting continuous care. Rising public awareness and digital health adoption are improving patient outcomes in this region.

Africa Hemophilia Treatment Market

Africa held 3.0% of the global market in 2024, with a size of USD 849.87 million, projected to reach USD 2,471.24 million by 2032, at a CAGR of 14.3%. The region faces limited access to care, underdiagnosis, and low availability of factor replacement therapies. The Hemophilia Treatment Market in Africa is driven by international aid programs and nonprofit partnerships aimed at improving diagnosis and access. It is gradually advancing through mobile clinics, training programs, and regional treatment centers. Governments in countries such as South Africa and Nigeria are taking steps to integrate rare disease care into public health policy. With infrastructure development and global support, Africa holds long-term growth potential in hemophilia care.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Bayer AG

- Biogen

- Biotest AG

- CSL Behring

- Ferring B.V

- Hoffmann-La Roche Ltd

- Chugai Pharmaceutical Co.

- Genentech, Inc.

- Hospira, Inc.

- Kedrion

Competitive Analysis

The Global Hemophilia Treatment Market is highly competitive, with key players focusing on innovation, partnerships, and geographical expansion to strengthen their positions. Companies such as Bayer AG, CSL Behring, and F. Hoffmann-La Roche Ltd lead the market through extensive product portfolios and ongoing investment in long-acting and gene therapies. It sees strong R\&D activity aimed at enhancing safety profiles and reducing treatment frequency. Firms like Biogen and Genentech continue to launch advanced biologics tailored to specific hemophilia types and patient needs. The market favors players with strong global distribution networks and regulatory expertise. Strategic acquisitions and collaboration with research institutions remain common approaches to expand market share and accelerate new therapy development.

Recent Developments

- In May 2025, Bayer AG received FDA approval to expand the use of Jivi® to include pediatric patients aged 7-11 with hemophilia A. This approval was based on data from the PROTECT Kids and Alfa‑PROTECT trials. The approval means that Jivi, previously approved for older patients, can now be used to treat younger children with this condition.

- In February 2025, CSL Behring released four-year post-infusion data for Hemgenix®, demonstrating its continued efficacy and safety in adults with hemophilia B. The data, derived from the HOPE-B study, showed that a single infusion of Hemgenix led to sustained factor IX activity levels and reduced bleeding rates. Specifically, 94% of patients discontinued prophylactic treatment and remained bleed-free through four years. Mean factor IX activity levels were sustained at approximately 37%. Additionally, the adjusted annualized bleeding rate (ABR) for all bleeds was reduced by approximately 90% compared to the lead-in period.

Market Concentration and Characteristics

The Global Hemophilia Treatment Market is moderately concentrated, with a few major players accounting for a significant share of global revenue. It features strong barriers to entry due to the complexity of biologic drug development, regulatory requirements, and high capital investment. Leading companies maintain their positions through continuous innovation, proprietary technologies, and well-established distribution networks. The market is characterized by high dependence on recombinant and gene therapies, long development timelines, and strong demand for personalized care. It remains driven by clinical outcomes, safety profiles, and treatment convenience, prompting firms to invest in extended half-life and curative therapies. Strategic alliances, licensing agreements, and global expansion further define its competitive landscape.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Route of Administration, End User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Gene therapy is expected to revolutionize hemophilia treatment by offering long-term or permanent relief from bleeding episodes with a single-dose solution.

- Improved healthcare infrastructure and rising awareness will expand access to advanced hemophilia treatments in countries across Asia, Latin America, and Africa.

- Preventive treatment will become the standard of care globally, reducing joint damage and improving long-term patient outcomes through consistent factor level maintenance.

- Tailored treatment regimens based on genetic profiling and patient response will improve therapy effectiveness and reduce complications like inhibitor development.

- Wearable devices, mobile apps, and remote monitoring will enhance real-time disease management, increasing patient engagement and treatment compliance.

- Biopharma companies will continue to focus on extended half-life clotting factors that reduce infusion frequency and improve quality of life for patients.

- Alternative therapies such as monoclonal antibodies and RNA-based drugs will see broader adoption for patients with inhibitors or challenging responses to factor treatments.

- International funding bodies and health ministries will strengthen national hemophilia programs, promoting equitable access to treatment and better patient registries.

- Introduction of biosimilars will increase treatment affordability and accessibility, especially in low- and middle-income regions with constrained healthcare budgets.

- Academic institutions, biotech firms, and pharmaceutical companies will collaborate more closely to accelerate development of safer, more effective therapies and next-generation solutions.