Market Overview

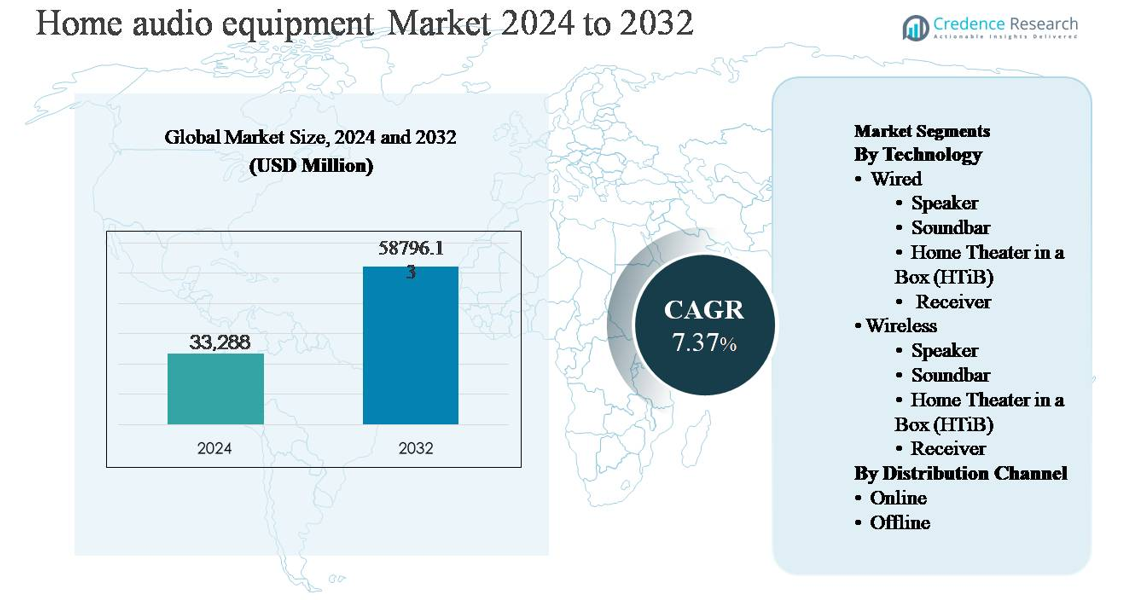

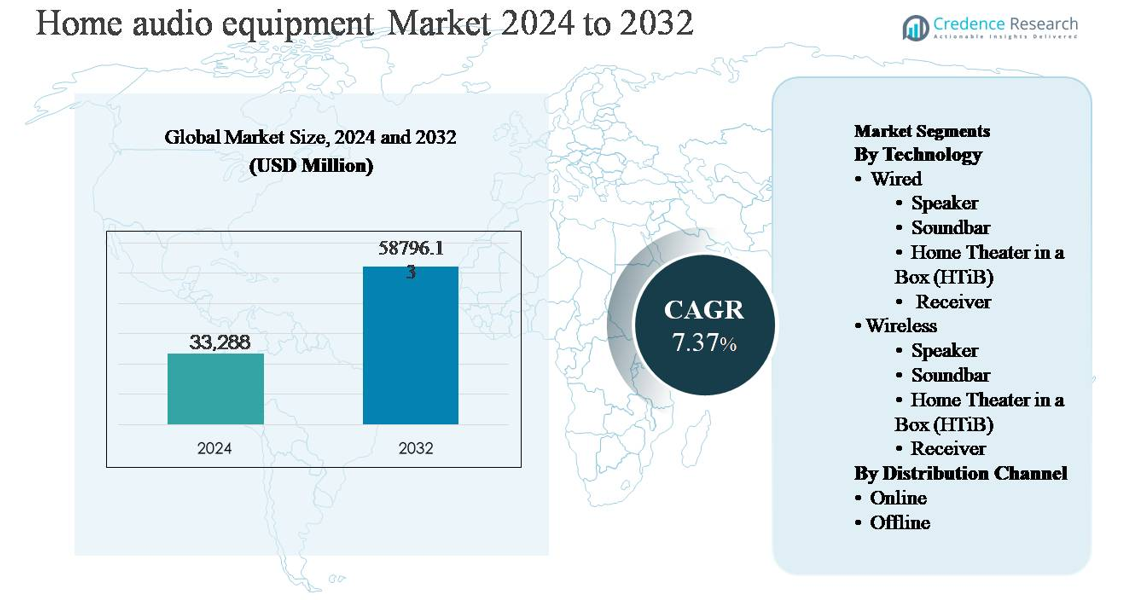

The home audio equipment market was valued at USD 33,288 million in 2024 and is projected to reach USD 58,796.13 million by 2032, growing at a compound annual growth rate (CAGR) of 7.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Home Audio Equipment Market Size 2024 |

USD 33,288 million |

| HHome Audio Equipment Market, CAGR |

7.37% |

| Home Audio Equipment Marke Size 2032 |

USD 58,796.13 million |

The home audio equipment market is led by a mix of global technology companies and specialized audio manufacturers, including Amazon.com, Inc., Apple Inc., Bose Corporation, Sony Group Corporation, Google LLC, Koninklijke Philips N.V., Bowers & Wilkins Group Ltd., Edifier Technology Co., Ltd., JVCKENWOOD Corporation, Creative Technology Ltd., and Blaupunkt GmbH. These players compete through strong brand equity, advanced wireless ecosystems, premium sound engineering, and integration with smart home platforms. Asia Pacific is the leading region, accounting for approximately 34% of the global market share, driven by high consumer electronics adoption, rapid urbanization, and expanding middle-class populations in China, India, and Southeast Asia. North America follows, supported by strong demand for premium and smart audio solutions across residential applications.

Market Insights

- The home audio equipment market was valued at USD 33,288 million in 2024 and is projected to reach USD 58,796.13 million by 2032, expanding at a CAGR of 7.37% during the forecast period, supported by steady replacement demand and rising adoption of smart and wireless audio systems.

- Market growth is primarily driven by increasing consumer preference for immersive home entertainment, rapid penetration of smart TVs and streaming platforms, and growing adoption of wireless speakers and soundbars, which together account for a dominant share of total product sales.

- Key market trends include a strong shift toward wireless and multi-room audio solutions, with the wireless segment holding the largest technology share, and soundbars emerging as the leading product category due to compact design and ease of integration.

- The competitive landscape is characterized by intense rivalry among global electronics brands and premium audio specialists, focusing on innovation, ecosystem integration, pricing strategies, and omnichannel distribution to strengthen market positioning.

- Regionally, Asia Pacific leads with approximately 34% market share, followed by North America at 32% and Europe at 24%, while Latin America and the Middle East & Africa collectively account for the remaining share, reflecting emerging growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The home audio equipment market by technology is categorized into wired and wireless systems, encompassing speakers, soundbars, home theater in a box (HTiB), and receivers. Wireless technology constitutes the dominant sub-segment, capturing the majority market share, primarily driven by consumer preference for convenience, minimal cabling, and seamless connectivity with smartphones, smart TVs, and voice-enabled ecosystems. Wireless speakers and soundbars lead adoption due to compact designs and easy installation. Advancements in Bluetooth, Wi-Fi streaming, multi-room audio, and improved sound fidelity continue to accelerate demand, while wired systems retain niche appeal among performance-focused users.

- “For instance, Samsung’s HW-Q990D wireless soundbar system incorporates 11 front and surround channels, one subwoofer channel, and four up-firing channels, delivering a total of 16 discrete audio channels (an 11.1.4 configuration) through its 22 built-in speakers.

By Distribution Channel

By distribution channel, the market is segmented into online and offline sales. Offline channels remain the dominant sub-segment, holding a substantial market share due to strong consumer reliance on physical product demonstrations, expert guidance, and bundled installation services for home audio setups. Specialty electronics retailers and large-format stores play a critical role in driving premium product sales, particularly receivers and HTiB systems. However, online channels are gaining momentum, supported by extensive product assortments, competitive pricing, flexible delivery options, and growing consumer confidence in digital purchasing platforms.

- For instance, Crutchfield’s direct-to-consumer platform provides online access to more than 18,000 individual audio and video SKUs and supports virtual system design using its proprietary SpeakerCompare tool, which is powered by reference recordings captured through over 70 calibrated speakers in its Virginia-based audio labs, enabling consumers to make informed purchasing decisions without visiting physical stores.

Key Growth Driver

Rising Adoption of Smart and Connected Home Ecosystems

The growing penetration of smart home ecosystems is a major driver for the home audio equipment market. Consumers increasingly integrate audio devices with smart TVs, voice assistants, lighting systems, and home automation platforms, elevating audio from a standalone product to a core component of connected living environments. Soundbars, wireless speakers, and AV receivers that support Wi-Fi, Bluetooth, and voice control experience strong demand due to seamless interoperability and ease of use. The expansion of IoT-enabled households and rising preference for centralized control through smartphones and smart hubs further accelerate adoption. Manufacturers continue to embed AI-based sound optimization, multi-room synchronization, and app-based customization, enhancing user experience and driving replacement purchases. This shift toward intelligent, integrated audio systems sustains long-term market growth across both premium and mass-market segments.

- For instance, Sonos’ S2 platform enables synchronized multi-room audio across up to 32 distinct rooms from a single mobile application, while supporting Wi-Fi streaming, Bluetooth input on newer models, and native integration with major voice assistants, illustrating how connected audio has become embedded within broader smart-home control frameworks.

Increasing Demand for Immersive Home Entertainment Experiences

Rising consumer demand for cinematic and immersive entertainment at home significantly propels the home audio equipment market. The rapid growth of streaming platforms, gaming consoles, and high-definition televisions has increased expectations for superior sound quality that replicates theater-like experiences. Soundbars, HTiB systems, and receivers equipped with surround sound technologies are increasingly adopted to enhance audio depth and realism. Consumers prioritize richer bass, spatial audio, and clarity for movies, sports, and gaming, driving upgrades from basic speakers to advanced multi-channel systems. Additionally, urban lifestyles and smaller living spaces favor compact yet powerful audio solutions, encouraging adoption of high-performance soundbars and wireless speakers. This entertainment-driven consumption pattern continues to expand the installed base of home audio systems globally.

- For instance, advanced soundbar systems integrate multi-channel configurations, including up-firing drivers and dedicated subwoofers, and deliver high-resolution audio processing with support for immersive sound formats, illustrating how compact yet powerful audio architectures address entertainment needs while fitting urban home layouts.

Technological Advancements and Product Innovation

Continuous technological innovation remains a key catalyst for market growth. Manufacturers focus on improving sound fidelity, connectivity, and form factors to meet evolving consumer expectations. Advancements in wireless transmission, low-latency audio codecs, and energy-efficient components enable high-quality performance without complex installations. Integration of features such as adaptive sound calibration, noise optimization, and voice recognition enhances usability and differentiation. Compact designs and modular configurations allow consumers to scale systems based on room size and usage preferences. These innovations not only attract first-time buyers but also stimulate replacement demand, particularly in mature markets where consumers seek upgraded performance and modern aesthetics.

Key Trend & Opportunity

Rapid Shift Toward Wireless and Multi-Room Audio Solutions

The market is witnessing a strong shift toward wireless and multi-room audio solutions, creating significant growth opportunities. Consumers increasingly favor cable-free installations that offer flexibility in placement and scalability across multiple rooms. Wireless speakers and soundbars that support synchronized playback enable users to create unified audio experiences throughout their homes. This trend aligns with modern interior design preferences and the growing adoption of smart devices. Manufacturers can capitalize on this opportunity by expanding ecosystem-based product portfolios that encourage brand loyalty and repeat purchases. Enhanced interoperability across devices and platforms further strengthens the long-term growth potential of wireless audio solutions.

- “For instance, Bose’s SimpleSync technology allows compatible Bose smart soundbars and speakers to pair wirelessly with select Bose headphones or another compatible speaker, enabling simultaneous playback with independent volume control via the Bose Music app.

Expansion of Online Distribution and Direct-to-Consumer Sales

The increasing penetration of e-commerce platforms presents a major opportunity for home audio equipment manufacturers. Online channels allow brands to reach wider audiences, offer detailed product comparisons, and showcase advanced features through digital content. Direct-to-consumer strategies enable better pricing control, improved customer engagement, and access to valuable usage data. Consumers increasingly rely on online reviews and virtual demonstrations, reducing dependency on physical retail. This shift supports faster product launches and broader geographic reach, particularly in emerging markets where organized retail remains limited. As digital purchasing confidence grows, online sales channels are expected to play an increasingly strategic role.

- For instance, Bang & Olufsen’s DTC platform integrates its Bang & Olufsen App, which supports real-time sound tuning through adjustable equalizer bands and multi-room grouping across up to 20 compatible speakers, alongside centralized account-based device management, highlighting how online distribution combined with proprietary software ecosystems strengthens brand relationships and supports scalable global reach without dependence on traditional retail infrastructure.

Key Challenge

Intense Market Competition and Price Pressure

The home audio equipment market faces intense competition from established brands and emerging low-cost manufacturers. Rapid product commoditization, particularly in wireless speakers and soundbars, exerts strong price pressure and compresses margins. Consumers often compare products based on price rather than brand differentiation, making it difficult for manufacturers to sustain premium positioning. Frequent promotional pricing and discount-driven sales further intensify competitive dynamics. To remain competitive, companies must balance cost efficiency with continuous innovation, which increases operational complexity. This competitive environment challenges long-term profitability, especially for mid-sized players with limited scale advantages.

Compatibility Issues and Rapid Technology Obsolescence

Rapid technological evolution poses a significant challenge for the home audio equipment market. Frequent updates in connectivity standards, operating systems, and smart home platforms can lead to compatibility issues across devices. Consumers may delay purchases due to concerns about product longevity and future-proofing. Additionally, rapid obsolescence shortens product life cycles, increasing inventory risks for manufacturers and retailers. Ensuring seamless software updates and cross-platform compatibility requires sustained investment in R&D and after-sales support. These factors add complexity to product development and can impact consumer trust if performance expectations are not consistently met.

Regional Analysis

North America

North America represents a leading region in the home audio equipment market, accounting for approximately 32% of the global market share. Strong consumer spending power, high penetration of smart homes, and widespread adoption of premium entertainment systems drive regional demand. The U.S. dominates the region, supported by rapid replacement cycles for soundbars, wireless speakers, and AV receivers integrated with smart TVs and voice assistants. Growth is further reinforced by strong presence of global brands, advanced retail infrastructure, and high subscription penetration of streaming and gaming platforms, which continuously elevate demand for immersive and high-performance home audio solutions.

Europe

Europe holds nearly 24% of the global home audio equipment market share, supported by strong demand across Western European countries such as Germany, the U.K., and France. Consumers in the region emphasize sound quality, design aesthetics, and energy efficiency, driving steady adoption of soundbars, wireless speakers, and premium receivers. High urbanization and apartment living favor compact, high-fidelity audio systems. Additionally, the presence of established audio brands and well-developed offline retail networks strengthens market stability. Growing adoption of smart home platforms and rising online sales channels continue to support moderate but consistent regional growth.

Asia Pacific

Asia Pacific is the fastest-growing regional market and accounts for approximately 34% of the global market share, making it the dominant region. Rapid urbanization, rising disposable incomes, and expanding middle-class populations in China, India, Japan, and Southeast Asia drive strong demand. Consumers increasingly invest in wireless speakers and soundbars as affordable upgrades to television audio. High smartphone penetration and growing adoption of smart devices further accelerate wireless audio adoption. The region also benefits from strong local manufacturing capabilities, competitive pricing, and expanding e-commerce platforms, which collectively fuel high-volume sales and long-term market expansion.

Latin America

Latin America contributes around 6% of the global home audio equipment market share, with growth led by Brazil and Mexico. Rising urban populations, increasing internet penetration, and expanding access to streaming services support gradual market development. Consumers primarily favor mid-range soundbars and wireless speakers due to price sensitivity and compact living spaces. Offline retail remains important, though online channels are gaining traction as logistics infrastructure improves. Economic volatility and currency fluctuations limit premium product adoption; however, improving consumer electronics penetration and growing youth demographics continue to create steady demand across residential segments.

Middle East & Africa

The Middle East & Africa region accounts for approximately 4% of the global market share, supported by growing consumer electronics adoption in the Gulf Cooperation Council (GCC) countries. Demand is driven by high-income households, luxury residential developments, and strong interest in premium home entertainment systems. Soundbars and multi-room wireless speakers see increasing adoption in urban centers. In Africa, market growth remains gradual due to lower purchasing power, but expanding mobile connectivity and retail penetration support long-term potential. Infrastructure development and rising digital media consumption are expected to sustain regional demand over time.

Market Segmentations:

By Technology

- Wired

- Speaker

- Soundbar

- Home Theater in a Box (HTiB)

- Receiver

- Wireless

- Speaker

- Soundbar

- Home Theater in a Box (HTiB)

- Receiver

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The home audio equipment market features a highly competitive landscape characterized by the presence of global consumer electronics leaders and specialized audio brands competing across technology, performance, and pricing tiers. Major players focus on expanding wireless and smart audio portfolios, with strong emphasis on soundbars, wireless speakers, and integrated home theater systems that align with evolving smart home ecosystems. Product differentiation increasingly centers on audio quality, compact design, software integration, and ease of connectivity. Companies invest heavily in research and development to enhance sound processing, voice assistant compatibility, and multi-room functionality. Strategic initiatives such as product launches, portfolio upgrades, and partnerships with streaming and smart TV platforms are common. Additionally, manufacturers leverage omnichannel distribution strategies to strengthen market reach, while competitive pricing and bundled offerings remain critical to maintaining market share in both mature and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Apple Inc.

- Bose Corporation

- Koninklijke Philips N.V.

- Google LLC

- Sony Group Corporation

- Bowers & Wilkins Group Ltd.

- Edifier Technology Co., Ltd.

- JVCKENWOOD Corporation

- Creative Technology Ltd.

- Blaupunkt GmbH

Recent Developments

- In April 2025, Sony expanded its living-room audio portfolio with new BRAVIA Theatre home audio systems designed to pair directly with BRAVIA TVs. The BRAVIA Theatre System 6 delivers a 5.1-channel configuration with 1,000 W total output, while the BRAVIA Theatre Bar 6 integrates a 3.1.2-channel soundbar with up-firing drivers for height effects, supporting Dolby Atmos and DTS:X through Sony’s Vertical Surround Engine and S-Force PRO Front Surround processing.

- In October 2024, Bowers & Wilkins advanced its premium home audio lineup with continued rollout of the Formation Series, centered on high-resolution wireless playback. Products such as Formation Duo utilize two decoupled carbon-dome tweeters and two Continuum cone mid-bass drivers per speaker, powered by 1,250 W of total amplification per stereo pair, and support 24-bit/96 kHz wireless audio streaming, reinforcing the brand’s focus on audiophile-grade, cable-free home listening.

- In September 2024, Bose launched the Smart Ultra Soundbar, expanding its premium home audio lineup with a system built around nine integrated speakers, including two upward-firing drivers for height channels. The soundbar supports Dolby Atmos decoding, integrates Bose TrueSpace digital signal processing, and offers Wi-Fi and Bluetooth connectivity alongside voice control through built-in microphones, strengthening Bose’s focus on immersive, connected living room audio.

Report Coverage

The research report offers an in-depth analysis based on Technology, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Wireless and smart audio solutions will continue to dominate new product demand as consumers prioritize convenience and seamless connectivity.

- Soundbars and compact home theater systems will see sustained growth driven by space-efficient home entertainment setups.

- Integration with smart home ecosystems and voice-controlled platforms will become a standard feature across product categories.

- Multi-room and synchronized audio capabilities will gain wider adoption in both premium and mid-range segments.

- Continuous improvements in audio processing and sound optimization technologies will enhance user experience.

- Online sales channels will expand further, supported by growing consumer confidence in digital purchasing.

- Manufacturers will focus on modular and upgradeable designs to extend product life cycles.

- Price competition will intensify, encouraging brands to balance affordability with feature differentiation.

- Emerging markets will contribute a larger share of volume growth due to rising urbanization and digital media consumption.

- Sustainability and energy-efficient designs will increasingly influence product development and consumer purchasing decisions.