Market Overview:

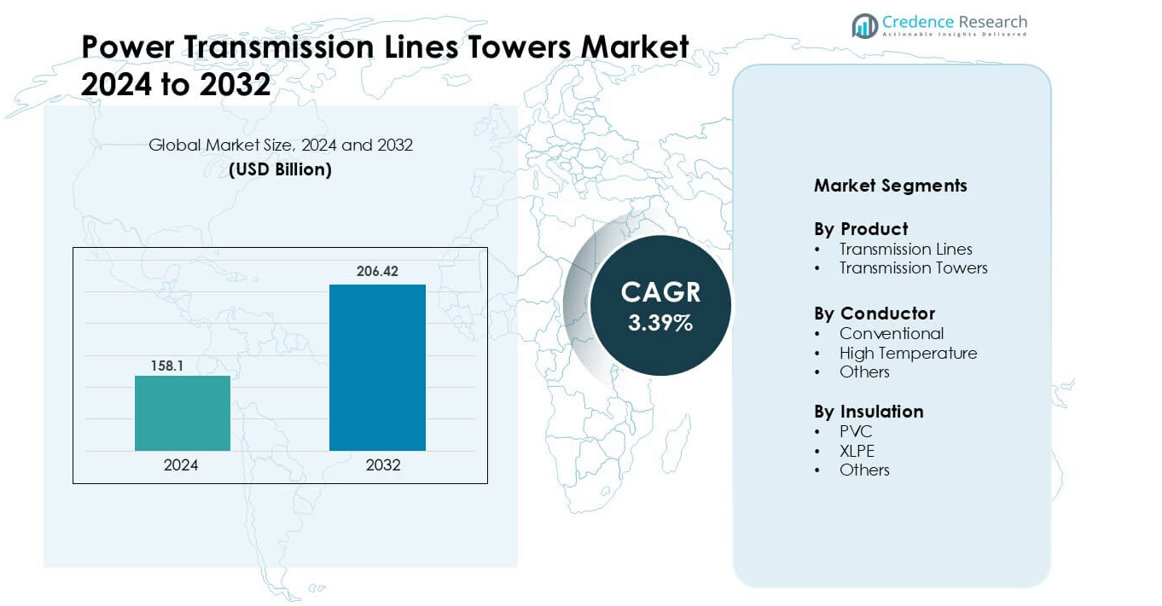

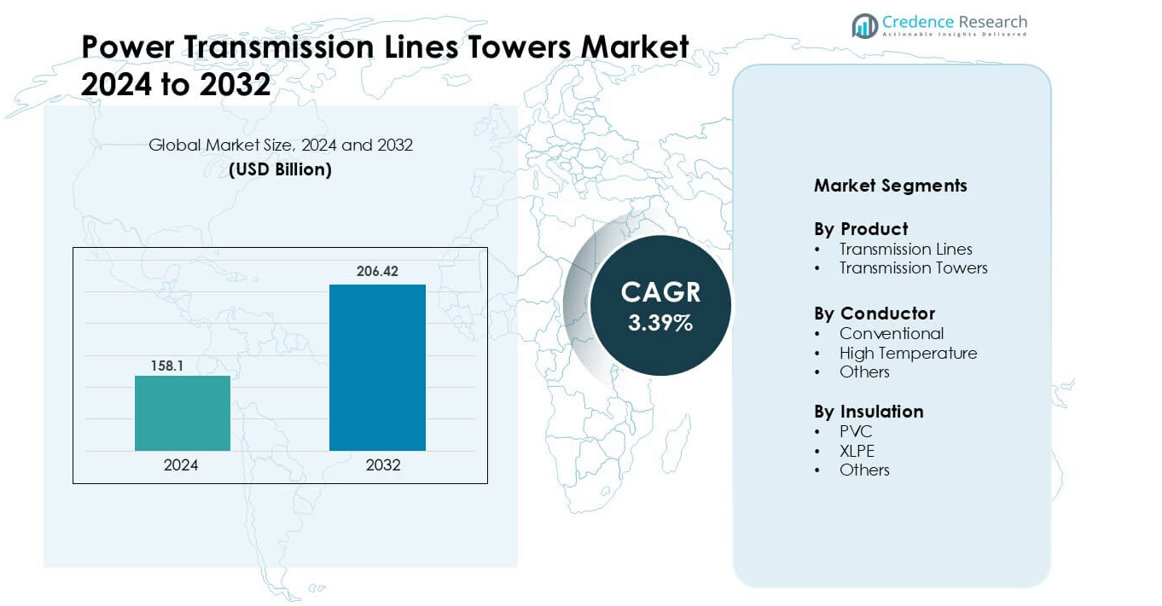

Power Transmission Lines Towers Market was valued at USD 158.1 billion in 2024 and is anticipated to reach USD 206.42 billion by 2032, growing at a CAGR of 3.39 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Transmission Lines Towers Market Size 2024 |

USD 158.1 billion |

| Power Transmission Lines Towers Market, CAGR |

3.39% |

| Power Transmission Lines Towers Market Size 2032 |

USD 206.42 billion |

The Power Transmission Lines and Towers market includes key players such as APAR Industries Ltd., Bekaert, CABCON India Private Limited, CMI Limited, CTC Global Corporation, Eland Cables, Elsewedy Electric, Gupta Power Infrastructure Ltd., KEI Industries Limited, and Kelani Cables. These companies compete through high-capacity conductors, corrosion-resistant tower designs, and advanced insulation technologies that support grid expansion and renewable integration. Many players collaborate with utilities for large EPC contracts and digital monitoring solutions. Asia Pacific remains the leading region with a 38% market share, driven by rapid industrial growth, urban power demand, and extensive high-voltage transmission projects across China, India, and Southeast Asia.

Market Insights

- The market for Power Transmission Lines and Towers reached USD 158.1 billion in 2024 and will grow at a 3.39% CAGR, driven by grid expansion and modernization efforts.

- Rising electricity demand, renewable energy integration, and cross-border power transfer projects drive strong investment in high-capacity overhead and underground networks.

- Advanced trends include high-temperature conductors, XLPE-insulated cables, and digital monitoring systems that reduce line losses and improve reliability across long-distance corridors.

- Competition involves key players such as APAR Industries Ltd., CTC Global Corporation, Eland Cables, Elsewedy Electric, and KEI Industries Limited, who focus on high-efficiency materials and large EPC contracts to strengthen their global presence.

- Asia Pacific leads with a 38% regional share, while the transmission lines segment holds a 64% share, supported by large-scale renewable projects, urban grid upgrades, and extensive UHV network construction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The transmission lines segment holds the dominant share of 64% in 2024. Demand is driven by grid modernization, cross-border interconnect projects, and large-scale renewable energy integration. Nations expand extra-high-voltage (EHV) and ultra-high-voltage (UHV) line networks to reduce transmission losses and improve long-distance power flow. The increasing adoption of smart grid systems and digital monitoring also supports new line deployments. Transmission towers grow at a steady pace due to ongoing refurbishment of aging infrastructure. Steel-lattice and monopole towers remain preferred designs for high-capacity overhead networks, supporting reliability and grid security.

- For instance, ABB Group secured orders to supply equipment for the world’s first 1,100 kV UHVDC link in China a line capable of 12,000 MW over more than 3,000 km.

By Conductor

Conventional conductors command a 58% share in 2024, supported by their proven durability, cost effectiveness, and established supply chains. These conductors remain widely used in overhead transmission projects in developing economies where affordability and ease of installation are key factors. High-temperature conductors gain traction due to their ability to carry heavier electrical loads in compact corridors. They support grid upgrades without building new lines, helping utilities manage demand in dense urban areas. Other conductor types serve niche requirements and special environments, including coastal networks and corrosive industrial zones.

- For instance, APAR Industries has a manufacturing capacity for HTLS (High‑Temperature Low‑Sag) conductors reportedly increased from approximately 3 120 km per month to 5 722 km per month.

By Insulation

PVC insulation accounts for a 52% market share in 2024, driven by affordability, availability, and strong resistance to moisture and abrasion. Utilities prefer PVC for moderate-voltage transmission segments and environments requiring stable dielectric performance. XLPE insulation expands steadily due to its higher thermal resistance and lower dielectric losses, making it suitable for high-capacity underground and submarine power links. Advanced XLPE compounds support longer service life and reduced maintenance. Other insulation materials remain limited to specific climates and high-temperature installations, including harsh deserts and coastal belts where thermal and chemical stress is significant.

Key Growth Drivers

Expansion of Renewable Energy and Cross-Border Power Trade

Countries add wind and solar plants at grid scale, increasing demand for new transmission corridors. Renewable projects often sit far from load centers, so utilities install long-distance, high-capacity lines and towers to balance supply. Cross-border power trade also grows as regions share surplus electricity for grid stability. New interconnectors support energy security and reduce blackout risks. Governments approve large investments for extra-high-voltage routes to reduce technical losses and improve efficiency. Smart monitoring systems allow faster fault detection and lower downtime. These upgrades push continuous demand for steel-lattice, monopole, and tubular towers across utility networks.

- For instance, Power Grid Corporation of India reported that as of January 31, 2022. their interregional transfer capacity stood at 112,250 MW.

Modernization of Aging Grid Infrastructure

Many countries operate transmission network-built decades ago, which need urgent upgrades. Renewables, electric mobility, and industrial growth increase grid load, stressing old conductors and tower structures. Utilities replace outdated lines with high-strength steel towers, aluminum conductors, and high-capacity insulators. Refurbishment programs reduce power losses, improve safety ratings, and extend asset life. Governments provide funding to modernize rural and urban transmission routes. Digital inspection tools, drones, and thermal sensors enhance asset monitoring and cut maintenance cost. These modernization efforts create steady demand for new tower installations and heavy-duty conductors.

- For instance, Entergy Mississippi initiated a program to replace more than 1,000 wooden transmission poles with steel or concrete poles in its service territory covering 461,000 customers.

Growth in Urban Power Demand and Industrial Expansion

Cities consume rising electricity due to data centers, factories, and commercial spaces. Transmission networks expand to support smart cities, metro rail systems, and industrial clusters. Towers and lines handle higher load density, requiring stronger conductors and heat-resistant insulation. Substations upgrade to extra-high-voltage standards to maintain stable power. Industries rely on continuous supply for automation and robotics, reducing tolerance for outages. Governments approve fast-track grid projects in urban belts and special economic zones. This consistent rise in demand drives tower installation, conductor upgrades, and network reinforcement.

Key Trends & Opportunities

Shift Toward High-Temperature and High-Capacity Conductors

Utilities adopt high-temperature conductors to increase load without building new corridors. These conductors sustain greater current and operate at higher thermal limits, reducing sag and improving stability. Compact designs save land and reduce tower count, ideal for dense cities. Advanced composite cores allow lighter weight and lower line losses. This shift offers strong growth opportunities for manufacturers supplying advanced aluminum, carbon-core, and steel-reinforced conductors. Countries with strict right-of-way rules prefer capacity upgrades on existing routes, creating sustained demand. Utilities also combine these conductors with condition-monitoring systems for real-time performance tracking.

- For instance, TGTransco in Telangana upgraded over 10–15 of its 220 kV lines and 5–6 of its 130 kV lines to HTLS conductors, enabling a typical 220 kV line to increase its capacity from ~210 MW to ~400–420 MW.

Rising Use of Smart Grid and Digital Monitoring Technologies

Smart grid adoption drives investments in automated fault detection, self-healing networks, and digital inspection. Transmission operators use sensors, fiber-optic monitoring, and drone surveillance to detect corrosion, line sag, and tower stress. Predictive analytics reduce maintenance cost and unplanned outages. Utilities integrate SCADA and AI-based diagnostics for remote supervision of transmission corridors. This trend increases demand for digital-ready towers and conductor components. Growth in data centers, EV charging, and distributed energy systems also requires real-time grid control. The shift toward automation creates new opportunities for technology vendors and system integrators.

- For instance, Power Grid Corporation of India Limited (Powergrid) set up its National Transmission Asset Management Centre (NTAMC) in Manesar, Haryana, to remotely monitor its transmission system in real time. This centre was dedicated to the nation on April 29, 2015. In financial year 2021-22, Powergrid successfully inaugurated the remote operation of its 250th substation (the 765/400 kV Khetri Sub-station) from the NTAMC in November 2021. At that time, the company’s total number of substations was 263.

Key Challenges

High Project Cost and Long Approval Cycles

Transmission projects require heavy capital, land acquisition, and strict regulatory approval. Urban and forest locations face strong environmental clearance rules and right-of-way restrictions. Delays increase material cost and contractor overhead. High-capacity steel towers, smart monitoring, and advanced conductors further raise investment. Developing countries struggle with funding limits and complicated tender processes. Currency fluctuations, interest rates, and steel price volatility add cost pressure. These financial and administrative barriers slow network expansion and reduce project speed.

Environmental Concerns and Public Opposition

Transmission lines may disturb forests, farmland, and wildlife zones. Communities oppose tower installation due to land disruption, perceived health impact, and visual changes. Routing through protected ecosystems demands expensive underground options or re-alignment. Delays arise from legal disputes, compensation negotiations, and environmental impact studies. Some regions enforce strict construction bans in sensitive belts. Wildlife protection rules require bird-diverter systems and special tower designs. These challenges extend project timelines, raise cost, and limit corridor availability in crowded regions.

Regional Analysis

North America

North America holds a 28% share in the Power Transmission Lines and Towers market in 2024. The region invests in grid modernization, renewable energy integration, and cross-border transmission between the U.S., Canada, and Mexico. Utilities replace aging steel-lattice structures with monopole and tubular towers to improve reliability and reduce land usage. High-temperature conductors support capacity upgrades for urban corridors. Federal and state programs fund extra-high-voltage lines to support data centers, EV charging networks, and industrial clusters. Ongoing refurbishment of hurricane-prone coastal networks also drives steady demand for tower reinforcement and advanced insulation systems.

Europe

Europe accounts for a 22% market share, supported by renewable expansion, offshore wind integration, and smart grid adoption. Countries deploy high-capacity overhead and underground lines to manage fluctuating wind and solar power. Interconnection projects link power systems across Scandinavia, Central Europe, and the Mediterranean to improve energy security. Regions with dense population use compact towers and underground XLPE cable systems. The European Union promotes low-loss conductor technologies and digital monitoring for grid efficiency. Replacement of old transmission corridors in aging industrial belts continues to create long-term opportunities for equipment suppliers and system integrators.

Asia Pacific

Asia Pacific leads with a 38% share, driven by rapid urbanization, industrial growth, and strong power demand. China and India build new high-voltage and ultra-high-voltage corridors to move electricity from generation hubs to cities. Governments invest heavily in renewable energy, requiring long-distance transmission lines. Rural electrification and cross-border grids also boost demand for conventional and high-temperature conductors. Large-scale tower installations support hydropower, solar parks, and wind farms. Investments in smart monitoring and fiber-optic line supervision continue to expand. The region remains the fastest-growing market due to ongoing infrastructure projects and significant grid expansion plans.

Latin America

Latin America holds a 7% share, supported by hydropower capacity, industrial development, and cross-country grid upgrades. Brazil, Chile, and Argentina expand transmission networks to connect remote renewable installations with major cities. Governments encourage private investments in high-voltage lines to reduce outages and regional bottlenecks. Mountainous terrain and long-distance routes raise demand for corrosion-resistant towers and high-strength conductors. Grid modernization projects also include digital monitoring and smart substations. Although growth is steady, economic and regulatory challenges create project delays, causing slower execution compared to Asia Pacific and North America.

Middle East & Africa

The Middle East & Africa region captures a 5% share, driven by energy diversification and industrial development. Gulf countries expand high-voltage overhead networks to support petrochemical zones, desalination plants, and smart cities. Solar megaprojects require long-distance transmission links, boosting demand for steel-lattice towers and XLPE-insulated systems. African nations focus on electrification, grid interconnection, and upgrading weak transmission corridors. Harsh climates increase the need for heat-resistant conductors and weather-resilient tower designs. Limited funding and slow permitting remain challenges, yet rising infrastructure spending and renewable investments offer long-term market opportunities.

Market Segmentations:

By Product

- Transmission Lines

- Transmission Towers

By Conductor

- Conventional

- High Temperature

- Others

By Insulation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Power Transmission Lines and Towers market features strong competition among global and regional manufacturers offering conductors, insulators, steel-lattice towers, monopoles, and smart monitoring systems. Companies focus on high-capacity overhead and underground solutions, driven by demand for renewable energy integration and grid modernization. Leading players invest in high-temperature conductors, corrosion-resistant tower materials, and XLPE insulation to improve efficiency and reduce line losses. Partnerships with utilities support large-scale EPC contracts and long-term maintenance agreements. Technological advances such as drone-based inspection, fiber-optic monitoring, and predictive analytics improve asset reliability. Pricing competition remains intense due to steel cost fluctuations and tender-based procurement. Companies also expand in emerging markets through joint ventures and local manufacturing. Continuous product innovation and digital grid solutions shape competitive positioning, as utilities prefer suppliers offering long service life, stronger load handling, and reduced downtime across diverse environmental conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, CTC GLOBAL, published blog article titled Securing the Grid, Empowering the World, highlighting the role of ACCC® conductors in national-security and grid-resilience applications.

- In July 2025, Eland cables Announced achievement of ISO 27001 Information Security Management certification.

Report Coverage

The research report offers an in-depth analysis based on Product, Conductor, Insulation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Utilities will continue expanding high-voltage networks to support renewable energy integration.

- High-temperature conductors will gain wider adoption to increase capacity on existing routes.

- Smart monitoring systems will reduce outages through real-time fault detection and predictive maintenance.

- Underground and submarine transmission projects will rise in urban and coastal regions.

- Steel-lattice and monopole tower designs will evolve to offer lighter weight and higher corrosion resistance.

- Cross-border power trade will expand regional interconnections and long-distance power transfer.

- Investments in grid modernization will accelerate replacement of aging lines and insulation systems.

- Digital inspection using drones and sensors will reduce maintenance cost and improve safety.

- Private and public partnerships will grow to finance large EPC transmission projects.

- Emerging markets in Asia and Africa will drive the fastest installation growth due to electrification demand.