Market Overview

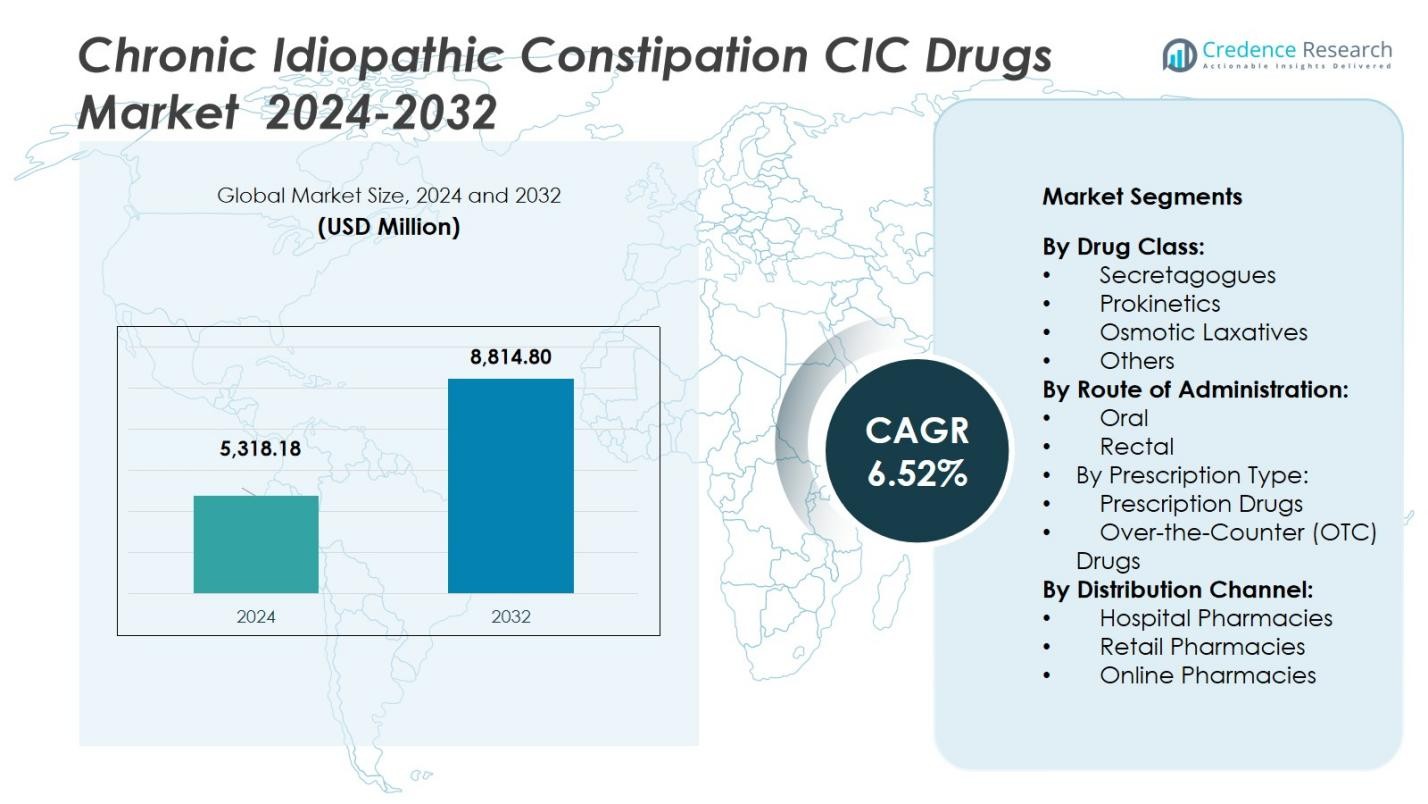

The Chronic Idiopathic Constipation (CIC) Drugs Market size was valued at USD 5,318.18 million in 2024 and is anticipated to reach USD 8,814.80 million by 2032, growing at a CAGR of 6.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chronic Idiopathic Constipation (CIC) Drugs Market Size 2024 |

USD 5,318.18 Million |

| Chronic Idiopathic Constipation (CIC) Drugs Market, CAGR |

6.52% |

| Chronic Idiopathic Constipation (CIC) Drugs Market Size 2032 |

USD 8,814.80 Million |

The Chronic Idiopathic Constipation (CIC) Drugs Market is led by prominent companies such as Actavis Generics, Chugai Pharmaceutical Co., Ltd., Ferring International Center, S.A., Synergy Pharmaceuticals, Pfizer Inc., GlaxoSmithKline plc, F. Hoffmann-La Roche AG, Sanofi S.A., Bayer AG, and Salix Pharmaceuticals, Inc. These key players are driving the market through continuous innovation in drug formulations, strategic collaborations, and geographic expansion. North America dominates the market with a 41% share, driven by a high prevalence of CIC, strong healthcare infrastructure, and significant adoption of prescription treatments. Europe follows with a 28% share, while Asia Pacific holds a 21% share, benefiting from growing healthcare access and rising awareness of CIC treatments. Latin America and the Middle East & Africa represent smaller shares, contributing to incremental growth as healthcare systems improve in these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market for Chronic Idiopathic Constipation (CIC) drugs was valued at USD 5,318.18 million in 2024 and is projected to reach USD 8,814.80 million by 2032 with a CAGR of 6.52% during the forecast period.

- Rising incidence of CIC driven by ageing populations, sedentary lifestyles and dietary habits continues to expand the addressable patient base and drives demand for effective therapies.

- A growing shift toward novel mechanisms (such as secretagogues capturing 46% share in the drug‑class segment) and oral administration (84% route share) underscores strong innovation and patient convenience trends.

- Firms face restraint from high costs of prescription drugs and under‑diagnosis in emerging regions, which limits uptake and broad market access.

- Regionally, North America commands a 41% share, Europe holds 28%, Asia Pacific accounts for 21%, Latin America about 6% and Middle East & Africa around 4%, with mature markets dominating and developing regions offering expansion potential.

Market Segmentation Analysis:

By Drug Class

In the drug‑class segmentation of the Chronic Idiopathic Constipation (CIC) drugs market, the Secretagogues sub‑segment holds the dominant share at 46 %. These agents (e.g., chloride‑channel activators and guanylate cyclase‑C agonists) lead due to their demonstrated efficacy in boosting intestinal fluid secretion and improving bowel movement frequency. Key growth drivers include rising diagnosis rates of CIC, increased physician adoption of novel mechanisms for refractory patients, and strong reimbursement support for specialty therapies. Prokinetics, osmotic laxatives and other classes support the broader market but trail behind secretagogues in share.

- For instance, Plecanatide, initially developed by Synergy Pharmaceuticals and marketed under the brand name Trulance, demonstrated durable responder rates of around 20% in its pivotal chronic idiopathic constipation (CIC) trials, which was significantly higher than the placebo rate of approximately 10-13%.

By Route of Administration

Within the route‑of‑administration segmentation, the Oral sub‑segment commands a leading share of 84 %, reflecting its prevalence in the CIC drugs market. Oral formulations deliver convenience, patient adherence and suitability for chronic management, making them the preferred mode of administration. Factors driving this dominance include broader availability of oral dosage forms, minimal invasiveness compared to rectal options, and strong pipeline activity in oral secretagogue and prokinetic agents. Rectal formulations remain niche, often reserved for acute relief or specific patient cohorts unable to tolerate oral administration.

- For instance, the drug Lubiprostone (approved in capsule form) is indicated for chronic idiopathic constipation and must be taken orally at 24 µg twice daily with food and water.

By Prescription Type

In the segmentation by prescription type, Prescription Drugs represent the overwhelmingly dominant sub‐segment, accounting for 70% of the market share. Prescription treatments are favored owing to their higher efficacy, more rigorous regulatory approval, and use in moderate to severe CIC cases. The growth drivers here include increasing unmet medical needs among patients unresponsive to over‐the‐counter (OTC) laxatives, greater physician awareness of prescription treatment opportunities, and expanding indications across adult and geriatric populations. OTC drugs continue to grow as self‐medication trends rise, but they remain secondary to prescription therapies in the global CIC drugs market, holding around 30% of the market share.

Key Growth Drivers

Rising Prevalence of Chronic Idiopathic Constipation

The increasing prevalence of Chronic Idiopathic Constipation (CIC) is a major growth driver in the CIC drugs market. Factors such as aging populations, lifestyle changes, and dietary habits contribute to the higher incidence of CIC. As healthcare providers improve diagnostic capabilities, more patients are being identified and treated. The rise in prevalence, especially among older adults, expands the addressable market for CIC drugs, prompting greater demand for effective treatments. Increased patient awareness and better access to healthcare are accelerating market growth.

- For instance, the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) reports that about 16% of the U.S. adult population experiences chronic constipation, with the prevalence rising significantly in individuals aged 60 and older.

Advancements in Drug Formulations

Continuous innovation in drug formulations is propelling the CIC drugs market. Newer treatments, such as secretagogues and prokinetics, offer improved efficacy and fewer side effects compared to traditional treatments. These advancements are making medications more effective for patients, particularly those with refractory cases of CIC who previously had limited treatment options. The development of oral formulations that are easier to administer and better tolerated by patients is further boosting market growth. As pharmaceutical companies invest in R&D, the pipeline of innovative CIC drugs remains robust.

- For instance, Lubiprostone (Amitiza), a treatment for CIC, was found to significantly improve bowel movement frequency and alleviate abdominal discomfort, offering a better alternative to stimulant laxatives.

Increasing Adoption of Prescription Treatments

The growing adoption of prescription drugs is significantly contributing to the expansion of the CIC drugs market. Prescription medications are preferred by healthcare providers for managing moderate to severe cases of CIC due to their higher efficacy and targeted action. The shift from over-the-counter (OTC) to prescription drugs is a key trend driven by the increasing recognition of CIC as a chronic condition requiring specialized care. Prescription medications not only offer better symptom control but also address the underlying causes of CIC, which enhances patient quality of life and adherence.

Key Trends & Opportunities

Shift Towards Personalized Medicine

A notable trend in the CIC drugs market is the shift towards personalized medicine. Healthcare providers are increasingly tailoring treatments based on individual patient needs, genetics, and response to previous therapies. This trend allows for more effective treatment regimens and better outcomes for patients suffering from CIC. Companies that develop targeted therapies and diagnostic tools to identify the most suitable treatments are poised to capitalize on this opportunity. Personalized medicine could significantly enhance the precision and efficacy of CIC drugs, offering new avenues for market expansion.

- For instance, imatinib, developed for chronic myeloid leukemia, targets the BCR-ABL fusion gene present in over 95% of cases, exemplifying precision therapy that inhibits the cancer-driving protein effectively.

Growing Market for Over-the-Counter (OTC) Solutions

The demand for Over-the-Counter (OTC) drugs in the CIC market presents a significant opportunity. As patients increasingly seek self-care options for managing milder forms of CIC, OTC products such as osmotic laxatives are gaining traction. The convenience and accessibility of OTC solutions are key factors contributing to their popularity, particularly in regions with high healthcare accessibility. With expanding consumer awareness about CIC and its management, OTC solutions are expected to see increased market penetration, providing a growth opportunity for both existing and new players in the CIC drugs market.

- For instance, the brand MiraLAX (polyethylene glycol 3350) is positioned as the “#1 doctor‑recommended OTC laxative” in the U.S. and is formulated as a 17 g powder dose for daily use.

Key Challenges

High Cost of Prescription Drugs

One of the major challenges in the CIC drugs market is the high cost associated with prescription medications. Despite the effectiveness of newer treatments, the price point remains a barrier for many patients, particularly in low-income regions or among those without comprehensive insurance coverage. The cost of treatment can limit access to vital drugs, thereby hindering broader adoption. As a result, healthcare systems may need to address pricing strategies, reimbursement policies, and support programs to ensure that all patients can benefit from available therapies.

Lack of Awareness and Diagnosis in Emerging Markets

In emerging markets, the lack of awareness and underdiagnosis of Chronic Idiopathic Constipation (CIC) presents a significant challenge. Many patients in these regions are either unaware of their condition or delay seeking treatment, resulting in an underreporting of CIC cases. This gap in diagnosis limits the market potential for CIC drugs, as many individuals remain untreated or self-medicate without professional guidance. Overcoming this challenge requires increased awareness campaigns, education for both healthcare providers and patients, and improved healthcare infrastructure in emerging regions to facilitate earlier diagnosis and treatment.

Regional Analysis

North America

The North America region holds a 41% share of the global Chronic Idiopathic Constipation (CIC) Drugs market, driven by a high prevalence of CIC and strong adoption of prescription therapies. Healthcare systems in the U.S. and Canada emphasise chronic gastrointestinal treatment, with advanced diagnostics and specialist gastroenterology services fostering greater uptake of novel secretagogue and prokinetic drugs. Robust reimbursement frameworks and presence of major pharmaceutical players further reinforce regional leadership. Given the established market infrastructure, North America is expected to maintain its dominance through 2032.

Europe

Europe holds a 28% share in the global CIC Drugs market, supported by established public‑health systems and clinical guidelines for gastrointestinal disorders. Countries such as Germany, the United Kingdom, France and Italy are leading in terms of prescriptions for moderate to severe CIC cases. Inflation of geriatric populations, rising awareness of functional bowel disorders and increasing physician prescribing of advanced agents contribute to growth. While access varies regionally, the overall infrastructure and regulatory environment position Europe as a strong secondary region in the CIC Drugs market.

Asia Pacific

The Asia Pacific region accounts for a 21% share of the global CIC Drugs market. Market growth is propelled by rising healthcare expenditures, expanding access to prescription therapies and increasing awareness of CIC among adult and elderly populations in China, India, Japan and Southeast Asia. A growing middle‑class population, improving gastroenterology infrastructure and wider rollout of advanced formulations are key drivers. Although per‑capita spending remains lower than Western markets, rapid growth potential positions Asia Pacific as a significant expansion zone through the forecast period.

Latin America

Latin America represents a 6% share of the global CIC Drugs market, reflecting emerging adoption of prescription therapies and improving access to specialist care. Brazil and Mexico remain key markets as healthcare penetration improves and awareness of CIC grows. However, market growth is moderated by reimbursement challenges, lower treatment penetration and reliance on over‑the‑counter laxatives for milder symptoms. Through enhanced physician education, expanded distribution networks and generics entry, Latin America offers incremental growth potential for CIC drug manufacturers.

Middle East & Africa

The Middle East & Africa region holds a 4% share in the global CIC Drugs market. Regional growth stems from increasing investments in specialty clinics, expanding healthcare infrastructure in Gulf Cooperation Council (GCC) countries and rising awareness of chronic gastrointestinal conditions. However, limited diagnostic capacity, variable reimbursement frameworks and access disparities in rural areas constrain uptake. As telemedicine expands and pharmaceutical distribution strengthens, the region’s share is expected to rise, albeit from a small base relative to mature markets.

Market Segmentations:

By Drug Class:

- Secretagogues

- Prokinetics

- Osmotic Laxatives

- Others

By Route of Administration:

By Prescription Type:

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis of the Chronic Idiopathic Constipation (CIC) Drugs Market reveals a moderately concentrated yet evolving field, with major key players including Actavis Generics, Chugai Pharmaceutical Co., Ltd., Ferring International Center, S.A., Synergy Pharmaceuticals, Pfizer Inc., GlaxoSmithKline plc, F. Hoffmann‑La Roche AG, Sanofi S.A., Bayer AG and Salix Pharmaceuticals, Inc.. These leaders compete across innovation, therapeutic coverage, geographic reach and distribution strength. They deploy diversified strategies including product pipeline investments in secretagogue and prokinetic therapies, strategic alliances or acquisitions to bolster existing portfolios, and geographic expansion into emerging markets. Additionally, generics players and OTC alternatives steadily exert pressure on pricing and market access, compelling legacy manufacturers to differentiate through novel mechanisms of action, patient‑support programs and lifecycle management. Competition also accelerates in regions such as Asia‑Pacific and Latin America where localized regulatory and reimbursement trends affect market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- The Chugai Pharmaceutical Co., Ltd (Japan)

- Bayer AG (Germany)

- Salix Pharmaceuticals, Inc. (US)

- F. Hoffmann‑La Roche AG (Switzerland)

- GlaxoSmithKline plc (UK)

- Actavis Generics (US)

- Pfizer Inc. (US)

- Ferring International Center, S.A. (Switzerland)

- Sanofi S.A. (France)

- Synergy Pharmaceuticals (US)

Recent Developments

- In August 2025, Dr. Reddy’s Laboratories launched Linaclotide under the brand name “Colozo®” in India, indicated for adult CIC – marking its entry in the Indian market.

- In July 2025, Camber Pharmaceuticals launched Prucalopride Tablets (1 mg & 2 mg) in the U.S. under its portfolio for adult CIC treatment.

- In June 2025, Lupin Limited received U.S. FDA approval for its generic version of Prucalopride Tablets (1 mg & 2 mg) indicated for the treatment of CIC in adults.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Roue of Administration, Proscription Type, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growth in geriatric populations will expand the patient pool for CIC drugs as age‑related gastrointestinal motility issues become more prevalent.

- Rising adoption of novel mechanism therapies such as GC‑C agonists and 5‑HT₄ receptor agonists will drive demand for more effective CIC treatment options.

- Expansion into emerging markets with improving healthcare access and growing awareness of CIC will open new revenue streams for key players.

- Increased reimbursement support and favourable regulatory approvals for prescription CIC therapies will improve market penetration and patient uptake.

- Growth in digital health tools and remote monitoring will support earlier diagnosis and treatment adherence in CIC management.

- Shift toward orally administered therapies will satisfy patient preference, boost compliance, and reinforce market growth for CIC drugs.

- Greater collaboration between pharmaceutical companies and gastroenterology specialists will accelerate clinical trial pipelines and new treatment launches for CIC.

- Increased competition from generics and biosimilars will pressure branded CIC drugs to differentiate via patient‑support services and value‑based pricing.

- Broader adoption of OTC treatments in milder CIC cases will complement prescription drug growth, expanding overall market size and segment diversity.

- Growing emphasis on personalized medicine and biomarker‑driven therapy selection will enhance treatment outcomes and foster niche‑segment development within the CIC drugs market.