Market Overview

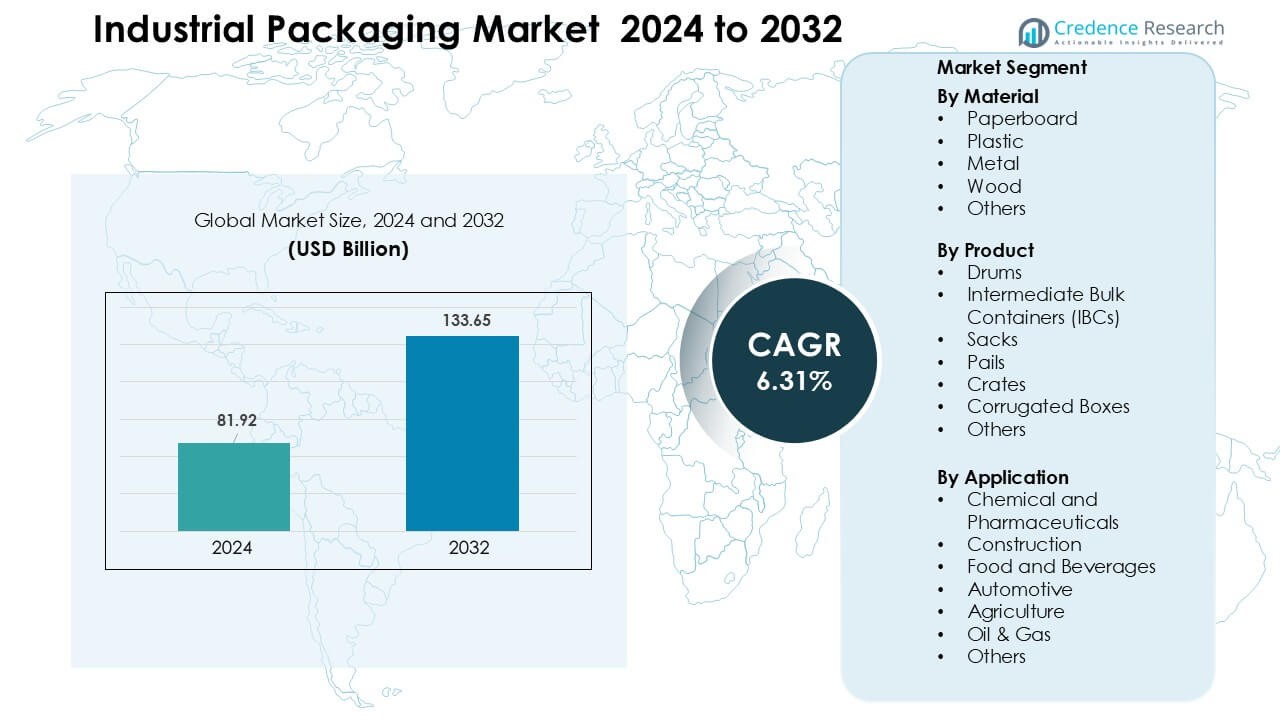

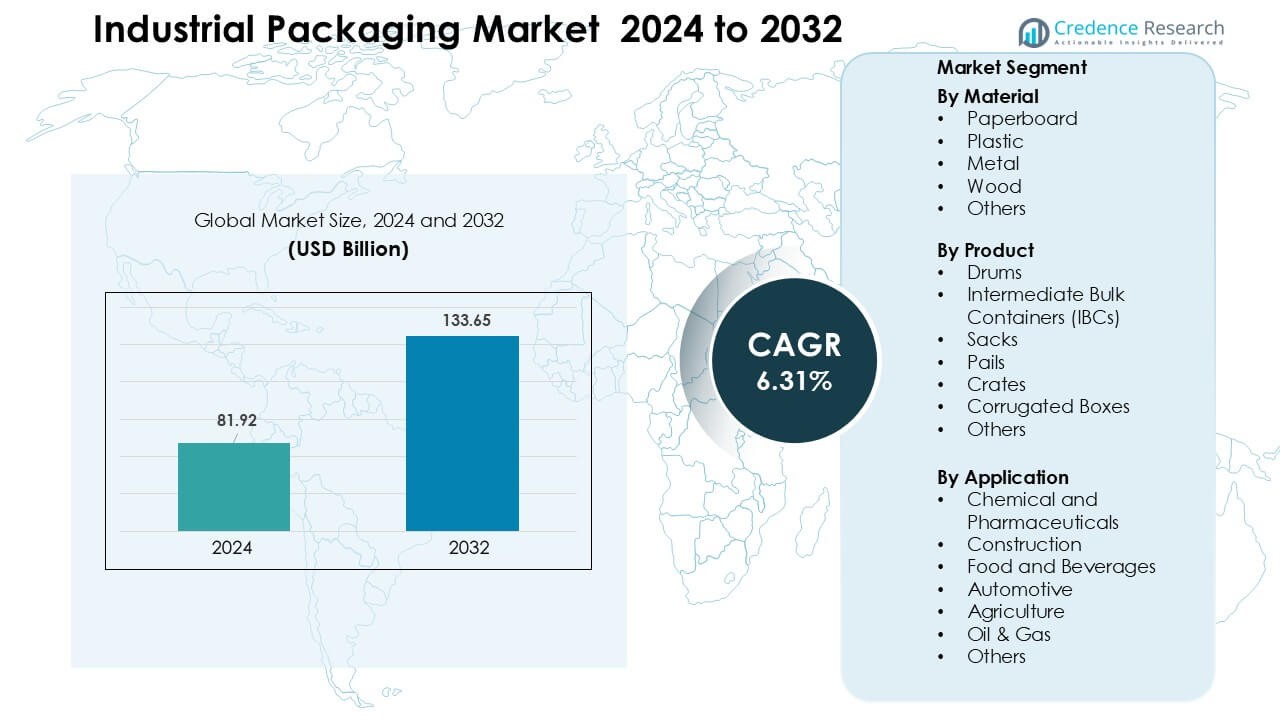

Industrial Packaging Market was valued at USD 81.92 billion in 2024 and is anticipated to reach USD 133.65 billion by 2032, growing at a CAGR of 6.31 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Packaging Market Size 2024 |

USD 81.92 Billion |

| Industrial Packaging Market, CAGR |

6.31 % |

| Industrial Packaging Market Size 2032 |

USD 133.65 Billion |

Top players in the industrial packaging market include Mauser Packaging Solutions, Smurfit Kappa, WestRock, Ball Corporation, Schütz GmbH & Co. KGaA, Sonoco, Greif Inc., DS Smith, Amcor Limited, and Mondi Group, each offering strong capabilities in bulk containers, fibre-based solutions, metal drums, and reusable systems. These companies strengthened portfolios through sustainability-focused designs, advanced recycling networks, and high-performance packaging for chemicals, food ingredients, and pharmaceuticals. North America led the industrial packaging market in 2024 with a 32% share, supported by strong manufacturing activity, strict compliance needs, and rising adoption of reusable IBCs and high-strength corrugated packaging across export-oriented industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The industrial packaging market reached USD 81.92 billion in 2024 and is projected to hit USD 133.65 billion by 2032, growing at a CAGR of 6.31%.

- Growth is driven by rising chemical, pharmaceutical, and food manufacturing, which increased demand for drums, IBCs, corrugated boxes, and heavy-duty crates across global supply chains.

- Trends include wider adoption of reusable packaging pools, automation-ready containers, and sustainable materials such as recycled paperboard and lightweight composites.

- The market remains competitive as Mauser Packaging Solutions, Smurfit Kappa, WestRock, Ball Corporation, Schütz, Sonoco, Greif, DS Smith, Amcor, and Mondi Group expand recycling systems, smart labelling, and high-strength bulk packaging lines.

- North America led the market with 32% share in 2024, while paperboard dominated materials with 37% share; Asia Pacific followed with strong manufacturing-driven demand across chemicals, food ingredients, and automotive components.

Market Segmentation Analysis:

By Material

Paperboard held the leading share in 2024 with about 37% due to strong demand from bulk food, beverage, and e-commerce shipments. Buyers preferred paperboard because the material offers low weight, easy recyclability, and lower disposal cost for high-volume industrial users. Growth also came from rising adoption of fibre-based secondary packaging as firms moved toward stricter sustainability targets. Plastic followed closely in chemical and pharma supply chains, while metal and wood formats stayed relevant for heavy-duty and export-grade loads.

- For instance, International Paper’s stated annual production capability for its remaining North American containerboard mill system was approximately 13,000 thousand short tons.

By Product

Intermediate Bulk Containers (IBCs) dominated the product segment in 2024 with nearly 34% share, supported by high usage in chemicals, lubricants, and pharmaceutical intermediates. Manufacturers adopted IBCs because the containers reduce handling time, support larger batch movement, and offer strong leak resistance during long-range transport. Steel and composite IBC designs gained wider use as firms shifted toward reusable packaging assets. Drums and sacks maintained stable demand in mid-volume liquid and powder handling, while corrugated boxes expanded with rising secondary packaging needs.

- For instance, Pyramid Technoplast, an IBC manufacturer, produces IBCs with a 1,000-litre capacity, leveraging this standard size to optimize logistics for chemical and bulk-liquid clients.

By Application

Chemical and Pharmaceuticals led the application segment in 2024 with about 32% share, driven by strict global regulations for hazardous and sensitive material transport. Companies preferred high-strength industrial packaging because it helps maintain product purity, reduces contamination risk, and meets UN-certified safety norms. Rapid expansion of specialty chemicals and biologics manufacturing further boosted demand for durable drums, IBCs, and protective secondary containers. Food and beverages, construction, and automotive industries showed steady uptake as supply chains focused on safer bulk movement and reduced product loss.

Key Growth Drivers

Expansion of Global Manufacturing and Trade

Global manufacturing growth continues to lift demand for reliable industrial packaging across chemicals, pharmaceuticals, automotive parts, food ingredients, and construction materials. Companies rely on strong packaging formats because these solutions protect high-value inputs during long transit cycles and harsh handling conditions. Rising cross-border trade has increased the need for drums, IBCs, pails, and corrugated systems that support bulk movement at lower cost. Export-oriented industries also expand their use of certified packaging to meet global safety and compliance norms. Strong output growth in Asia, flexible production in Europe, and steady activity in North America boost industrial packaging consumption across supply chains.

- For instance, according to a 2021 sustainability report from Greif, the company reconditioned, remanufactured, or recycled over 4.5 million containers across its entire Global Industrial Packaging (GIP) segment in 2021.

Shift Toward Sustainability and Circular Packaging Systems

Sustainability regulations push manufacturers to adopt recyclable, lightweight, and reusable packaging formats. Many firms now replace traditional heavy containers with paperboard composites, reusable IBCs, and metal drums that fit circular supply models. Governments promote waste-reduction targets, which has led buyers to prefer low-carbon materials and packaging options with extended life cycles. Reuse programs gain traction because they reduce disposal fees, cut material waste, and support greener logistics. This shift encourages packaging producers to invest in fibre-based materials, recycled plastics, and refill-ready bulk solutions that support long-term environmental goals.

- For instance, Greif, Inc. reconditioned more than 1.2 million steel drums through its Life Cycle Services (LCS) network in 2024, demonstrating its commitment to infinite recyclability and reuse of metal packaging.

Rising Safety and Compliance Requirements

Strict global rules for transporting chemicals, hazardous materials, and sensitive pharmaceutical ingredients drive adoption of high-performance industrial packaging. Companies focus on solutions that meet UN, DOT, and ADR standards because compliance failures raise financial and safety risks. Stronger regulatory enforcement pushes industries to use certified IBCs, reinforced drums, tamper-resistant lids, and multilayer liners. Growing production of specialty chemicals, biologics, and volatile materials increases the need for secure containment systems. This shift places industrial packaging at the center of risk management, quality assurance, and safe goods movement across regional and international routes.

Key Trend & Opportunity

Automation and Smart Packaging Integration

Industrial facilities now adopt automation-ready packaging that enhances traceability, inventory control, and process efficiency. RFID, QR coding, and sensor-enabled containers create chances for real-time monitoring of temperature, pressure, and location during transit. These additions improve safety for hazardous materials and cut losses from mishandling. Growing interest in connected supply chains encourages manufacturers to link IBCs, drums, and pallets with digital tracking tools. This shift creates opportunities for packaging suppliers to offer intelligent containers that support predictive maintenance, remote condition checks, and smoother warehouse operations.

- For instance, SCHÄFER Container Systems, together with Packwise, offers the Packwise Smart Cap, which provides real‑time monitoring of fill levels, temperature, and geo‑location via IoT, enabling automated alerts and ERP integration for container fleets.

Growth of Reusable and Rental Packaging Pools

Reusable and rental packaging pools gain strong acceptance as industries shift toward cost-efficient logistics. Companies adopt rental IBCs, metal cages, and heavy-duty pallets because shared assets reduce upfront purchase costs and improve fleet utilization. Rental providers handle cleaning, repair, and return logistics, which lowers operational burden for industrial buyers. Growing demand for circular material loops encourages standardized packaging assets that move through repeated cycles. This creates an opportunity for suppliers to expand pooling networks in chemicals, lubricants, food ingredients, and agricultural inputs.

- For instance, Hoyer Group operates a pool of over 50,000 IBCs globally, enabling customers to rent rather than own these containers and benefit from reverse logistics and reconditioning.

Demand for Custom Packaging for Specialized Goods

Industries seek tailored packaging solutions to support unique shapes, high-hazard content, and sensitive goods. Customized crates, reinforced drums, and multilayer pouches help preserve product stability, reduce contamination risk, and improve packaging-to-product fit. Companies in pharmaceuticals, electronics, and specialty chemicals invest more in engineered designs because uniform packaging fails to meet stricter purity and performance needs. The rise of niche formulations and precision components increases the need for custom-built containers with stronger surface protection, anti-static layers, and moisture barriers.

Key Challenge

Fluctuations in Raw Material Costs

Volatility in resin, paper pulp, metal, and wood prices disrupts cost planning for packaging producers. Industrial buyers often face sudden price increases due to supply shortages, energy cost spikes, and geopolitical constraints that limit material flow. Producers struggle to maintain stable margins when raw materials represent a large share of total production cost. This challenge pushes firms to redesign products, explore alternative materials, or pass costs to customers. Frequent fluctuations also slow investment decisions for new packaging formats that depend on stable long-term material pricing.

Environmental Compliance and Recycling Complexity

Industrial packaging generates large waste volumes, and many regions now impose strict recycling and take-back rules. Companies face difficulties meeting these requirements because industrial containers often combine multiple materials, include chemical residues, or require certified cleaning before reuse. Limited recycling infrastructure in emerging markets increases landfill pressure and reduces circularity. Compliance adds administrative and operational cost for firms that use large packaging fleets. Many companies must redesign products to meet extended producer responsibility rules, which increases complexity and slows the transition to sustainable packaging formats.

Regional Analysis

North America

North America held about 32% share in 2024, supported by strong demand from chemical, pharmaceutical, and food processing industries. Manufacturers in the U.S. and Canada invested in high-strength IBCs, steel drums, and corrugated solutions to meet strict compliance norms and rising export activity. Growth in e-commerce logistics further lifted secondary industrial packaging needs. The region’s focus on sustainability encouraged wider use of recycled paperboard and reusable containers. Steady investment in automation and digital tracking across warehouses also strengthened adoption of smart industrial packaging formats.

Europe

Europe accounted for nearly 29% share in 2024, driven by strict environmental regulations and advanced manufacturing activity across Germany, France, Italy, and the U.K. Industries adopted recyclable materials, metal drums, and reusable IBCs to meet evolving EU circular economy targets. Chemical and specialty materials producers remained major buyers of certified transport packaging. Strong automotive and machinery production also increased demand for heavy-duty crates and pallets. High standards for safety and traceability promoted digital labelling, RFID-enabled packaging, and enhanced containment systems across distribution networks.

Asia Pacific

Asia Pacific led many volume-driven segments with around 28% share in 2024, supported by rapid expansion in manufacturing, construction, and chemical production across China, India, Japan, and Southeast Asia. Strong export flows of industrial goods increased demand for drums, IBCs, corrugated boxes, and bulk transport solutions. Rising investment in pharmaceuticals and specialty chemicals lifted adoption of UN-certified containers. Growing regulatory focus on packaging waste in China and Japan encouraged broader use of recyclable and lightweight materials. Fast growth in industrial output continues to position Asia Pacific as a key demand center.

Latin America

Latin America captured close to 7% share in 2024, influenced by steady growth in agriculture, food processing, mining, and petrochemical industries. Brazil and Mexico remained major adopters of drums, sacks, and bulk containers for domestic and export shipments. Suppliers expanded returnable packaging programs to reduce costs and improve logistics efficiency. Industrial expansion in fertilizers, lubricants, and chemical blends supported greater use of IBCs and steel drums. Rising attention to environmental regulations encouraged early adoption of recycled paper-based and reusable industrial packaging formats.

Middle East & Africa

The Middle East & Africa region held around 4% share in 2024, driven by strong demand from oil & gas, construction, and mineral extraction industries. Industrial users preferred robust drums, metal containers, and heavy-duty crates for transporting chemicals, lubricants, and engineered materials under harsh climate conditions. Infrastructure projects across GCC countries increased uptake of bulk packaging formats. South Africa and the UAE advanced regulations supporting safer chemical handling, which boosted certified packaging demand. Gradual adoption of recyclable materials and reusable assets created early opportunities for sustainable industrial packaging solutions.

Market Segmentations

By Material

- Paperboard

- Plastic

- Metal

- Wood

- Others

By Product

- Drums

- Intermediate Bulk Containers (IBCs)

- Sacks

- Pails

- Crates

- Corrugated Boxes

- Others

By Application

- Chemical and Pharmaceuticals

- Construction

- Food and Beverages

- Automotive

- Agriculture

- Oil & Gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Leading companies in the industrial packaging market include Mauser Packaging Solutions, Smurfit Kappa, WestRock, Ball Corporation, Schütz GmbH & Co. KGaA, Sonoco, Greif Inc., DS Smith, Amcor Limited, and Mondi Group, each holding strong positions across bulk, rigid, and fibre-based packaging segments. These players expanded global footprints through new manufacturing sites, advanced recycling infrastructure, and strategic partnerships with chemical, pharmaceutical, and food industries. Many firms focused on lightweight materials, reusable IBCs, and high-strength drums to align with stricter safety and sustainability regulations. Investments in automation, smart labelling, and IoT-enabled tracking improved efficiency across supply chains. Companies also strengthened portfolios by offering circular packaging services, including container reconditioning, pooling, and closed-loop recovery programs. This mix of innovation, scale, and sustainability-driven expansion keeps competition intense across major regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mauser Packaging Solutions (U.S.)

- Smurfit Kappa (Ireland)

- WestRock (U.S.)

- Ball Corporation (U.S.)

- Schütz GmbH & Co. KGaA (Germany)

- Sonoco (U.S.)

- Greif Inc. (U.S.)

- DS Smith (U.K.)

- Amcor Limited (Australia)

- Mondi Group (U.K.)

Recent Developments

- In November 2025, DS Smith announced several new fibre-based and recyclable transport/ protective packaging solutions (including 100% recyclable cardboard buffers and fibre-based e-commerce protections), highlighting continued product innovation under the combined group.

- In November 2025, Amcor announced a major expansion of flexible-packaging capacity for protein/food markets in North America (ramping up printing, lamination and converting capabilities).

- In November 2025, Mondi launched an extended corrugated and solid-board portfolio for the food packaging industry (new SKUs and digital-printing options following the Schumacher Packaging acquisition).

Report Coverage

The research report offers an in-depth analysis based on Material, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and recyclable materials will rise across major industries.

- Reusable IBCs and drums will gain wider adoption as circular systems expand.

- Smart tracking technologies will integrate into bulk containers for better visibility.

- Automation-ready packaging designs will support faster warehouse operations.

- Growth in chemicals and pharmaceuticals will boost certified high-strength containers.

- Lightweight fibre-based packaging will replace traditional heavy formats in many segments.

- Digital labelling and RFID tools will enhance safety and compliance management.

- Emerging markets will drive strong demand due to rising industrial output.

- Packaging rental and pooling models will scale as companies reduce ownership costs.

- Increased regulatory focus on waste reduction will accelerate redesign of industrial packaging formats.