CHAPTER NO. 1 : INTRODUCTION 29

1.1.1. Report Description 29

Purpose of the Report 29

USP & Key Offerings 29

1.1.2. Key Benefits for Stakeholders 29

1.1.3. Target Audience 30

1.1.4. Report Scope 30

1.1.5. Regional Scope 31

CHAPTER NO. 2 : EXECUTIVE SUMMARY 32

2.1. Industrial Solvents Market Snapshot 32

2.1.1. Global Industrial Solvents Market, 2018 – 2032 (USD Million) 33

CHAPTER NO. 3 : GEOPOLITICAL CRISIS IMPACT ANALYSIS 34

3.1. Russia-Ukraine and Israel-Palestine War Impacts 34

CHAPTER NO. 4 : INDUSTRIAL SOLVENTS MARKET – INDUSTRY ANALYSIS 35

4.1. Introduction 35

4.2. Market Drivers 36

4.2.1. Rising demand for eco-friendly and bio-based solvents 36

4.2.2. Rising demand for eco-friendly and bio-based solvents 37

4.3. Market Restraints 38

4.3.1. Stringent environmental regulations regarding the use of volatile organic compounds (VOCs) 38

4.4. Market Opportunities 39

4.4.1. Innovations in green chemistry to develop sustainable solvent alternatives 39

4.5. Porter’s Five Forces Analysis 40

4.6. Value Chain Analysis 41

4.7. Buying Criteria 42

CHAPTER NO. 5 : IMPORT EXPORT ANALYSIS 43

5.1. Import Analysis by Region 43

5.1.1. Global Industrial Solvents Market Import Volume/Revenue, By Region, 2018 – 2023 43

5.2. Export Analysis by Region 44

5.2.1. Global Industrial Solvents Market Export Volume/Revenue, By Region, 2018 – 2023 44

CHAPTER NO. 6 : DEMAND SUPPLY ANALYSIS 45

6.1. Demand Analysis by Region 45

6.1.1. Global Industrial Solvents Market Demand Volume/Revenue, By Region, 2018 – 2023 45

6.2. Supply Analysis by Region 46

6.2.1. Global Industrial Solvents Market Supply Volume/Revenue, By Region, 2018 – 2023 46

CHAPTER NO. 7 : PRODUCTION ANALYSIS 47

7.1. Production Analysis by Region 47

7.1.1. Global Industrial Solvents Market Production Volume/Revenue, By Region, 2018 – 2023 47

CHAPTER NO. 8 : PRICE ANALYSIS 48

8.1. Price Analysis by Region 48

8.1.1. Global Industrial Solvents Market Price, By Region, 2018 – 2023 48

8.1.2. Global Type Market Price, By Region, 2018 – 2023 48

8.2. Price Analysis by Type 49

8.2.1. Global Industrial Solvents Market Price, By Type, 2018 – 2023 49

8.2.2. Global Type Market Price, By Type, 2018 – 2023 49

CHAPTER NO. 9 : RAW MATERIALS ANALYSIS 50

9.1. Key Raw Materials and Suppliers 50

9.2. Key Raw Materials Price Trend 50

CHAPTER NO. 10 : MANUFACTURING COST ANALYSIS 51

10.1. Manufacturing Cost Analysis 51

10.2. Manufacturing Process 51

CHAPTER NO. 11 : ANALYSIS COMPETITIVE LANDSCAPE 52

11.1. Company Market Share Analysis – 2023 52

11.1.1. Global Industrial Solvents Market: Company Market Share, by Volume, 2023 52

11.1.2. Global Industrial Solvents Market: Company Market Share, by Revenue, 2023 53

11.1.3. Global Industrial Solvents Market: Top 6 Company Market Share, by Revenue, 2023 53

11.1.4. Global Industrial Solvents Market: Top 3 Company Market Share, by Revenue, 2023 54

11.2. Global Industrial Solvents Market Company Volume Market Share, 2023 55

11.3. Global Industrial Solvents Market Company Revenue Market Share, 2023 56

11.4. Company Assessment Metrics, 2023 56

11.4.1. Stars 56

11.4.2. Emerging Leaders 56

11.4.3. Pervasive Players 56

11.4.4. Participants 56

11.5. Start-ups /SMEs Assessment Metrics, 2023 56

11.5.1. Progressive Companies 56

11.5.2. Responsive Companies 57

11.5.3. Dynamic Companies 57

11.5.4. Starting Blocks 57

11.6. Strategic Developments 58

11.6.1. Acquisitions & Mergers 58

New Product Launch 58

Regional Expansion 58

11.7. Key Players Product Matrix 59

CHAPTER NO. 12 : PESTEL & ADJACENT MARKET ANALYSIS 60

12.1. PESTEL 60

12.1.1. Political Factors 60

12.1.2. Economic Factors 60

12.1.3. Social Factors 60

12.1.4. Technological Factors 60

12.1.5. Environmental Factors 60

12.1.6. Legal Factors 60

12.2. Adjacent Market Analysis 60

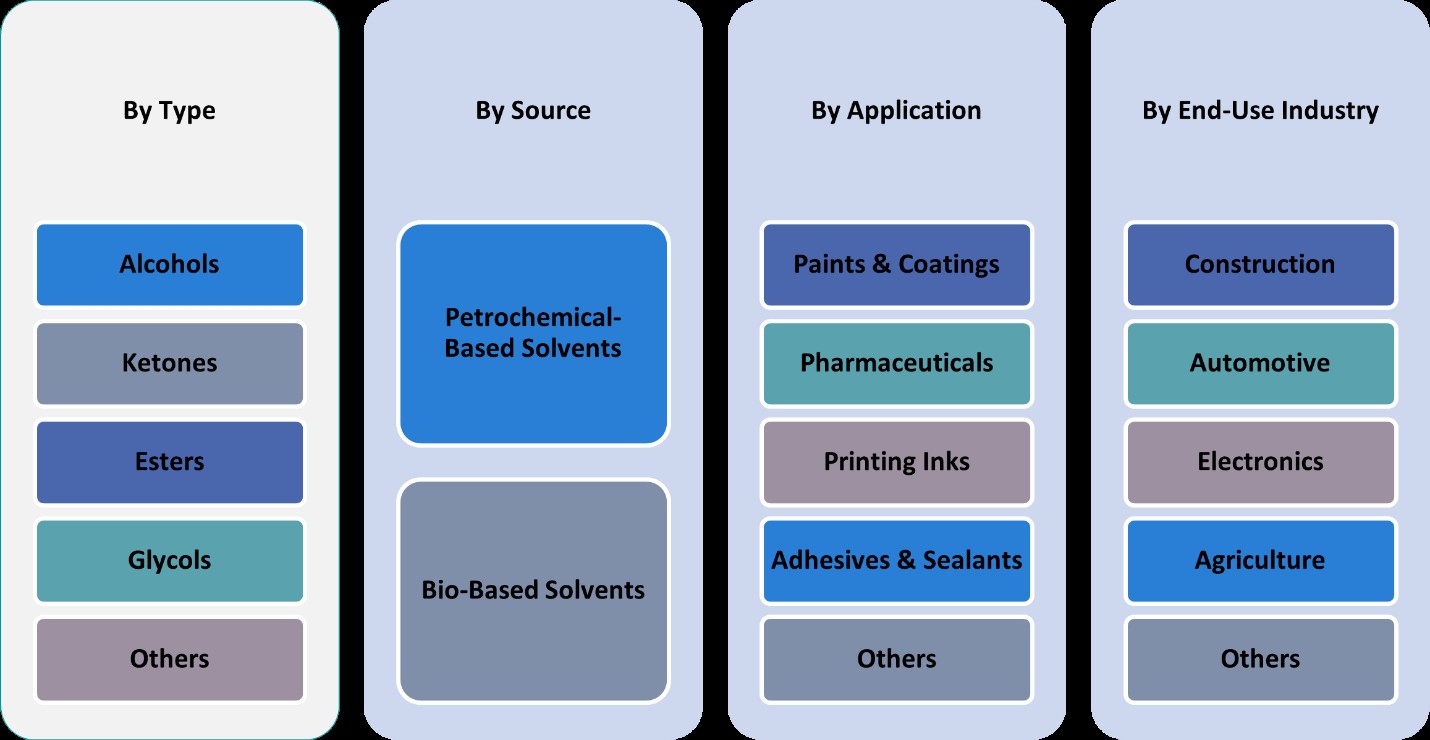

CHAPTER NO. 13 : INDUSTRIAL SOLVENTS MARKET – BY TYPE SEGMENT ANALYSIS 61

13.1. Industrial Solvents Market Overview, by Type Segment 61

13.1.1. Industrial Solvents Market Revenue Share, By Type, 2023 & 2032 62

13.1.2. Industrial Solvents Market Attractiveness Analysis, By Type 63

13.1.3. Incremental Revenue Growth Opportunity, by Type, 2024 – 2032 63

13.1.4. Industrial Solvents Market Revenue, By Type, 2018, 2023, 2027 & 2032 64

13.2. Alcohols 65

13.2.1. Global Alcohols Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 66

13.2.2. Global Alcohols Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 66

13.3. Ketones 67

13.3.1. Global Ketones Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 68

13.3.2. Global Ketones Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 68

13.4. Esters 69

13.4.1. Global Esters Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 70

13.4.2. Global Esters Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 70

13.5. Glycols 71

13.5.1. Global Glycols Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 72

13.5.2. Global Glycols Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 72

13.6. Others 73

13.6.1. Global Others Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 74

13.6.2. Global Others Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 74

CHAPTER NO. 14 : INDUSTRIAL SOLVENTS MARKET – BY APPLICATION SEGMENT ANALYSIS 75

14.1. Industrial Solvents Market Overview, by Application Segment 75

14.1.1. Industrial Solvents Market Revenue Share, By Application, 2023 & 2032 76

14.1.2. Industrial Solvents Market Attractiveness Analysis, By Application 77

14.1.3. Incremental Revenue Growth Opportunity, by Application, 2024 – 2032 77

14.1.4. Industrial Solvents Market Revenue, By Application, 2018, 2023, 2027 & 2032 78

14.2. Paints & Coatings 79

14.2.1. Global Paints & Coatings Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 80

14.2.2. Global Paints & Coatings Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 80

14.3. Pharmaceuticals 81

14.3.1. Global Pharmaceuticals Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 82

14.3.2. Global Pharmaceuticals Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 82

14.4. Printing Inks 83

14.4.1. Global Printing Inks Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 84

14.4.2. Global Printing Inks Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 84

14.5. Adhesives & Sealants 85

14.5.1. Global Adhesives & Sealants Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 86

14.5.2. Global Adhesives & Sealants Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 86

14.6. Others 87

14.6.1. Global Others Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 88

14.6.2. Global Others Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 88

CHAPTER NO. 15 : INDUSTRIAL SOLVENTS MARKET – BY END-USE INDUSTRY SEGMENT ANALYSIS 89

15.1. Industrial Solvents Market Overview, by End-Use Industry Segment 89

15.1.1. Industrial Solvents Market Revenue Share, By End-Use Industry, 2023 & 2032 90

15.1.2. Industrial Solvents Market Attractiveness Analysis, By End-Use Industry 91

15.1.3. Incremental Revenue Growth Opportunity, by End-Use Industry, 2024 – 2032 91

15.1.4. Industrial Solvents Market Revenue, By End-Use Industry, 2018, 2023, 2027 & 2032 92

15.2. Construction 93

15.2.1. Global Construction Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 94

15.2.2. Global Construction Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 94

15.3. Automotive 95

15.3.1. Global Automotive Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 96

15.3.2. Global Automotive Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 96

15.4. Electronics 97

15.4.1. Global Electronics Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 98

15.4.2. Global Electronics Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 98

15.5. Agriculture 99

15.5.1. Global Agriculture Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 100

15.5.2. Global Agriculture Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 100

15.6. Others 101

15.6.1. Global Others Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 102

15.6.2. Global Others Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 102

CHAPTER NO. 16 : INDUSTRIAL SOLVENTS MARKET – BY SOURCE SEGMENT ANALYSIS 103

16.1. Industrial Solvents Market Overview, by Source Segment 103

16.1.1. Industrial Solvents Market Revenue Share, By Source, 2023 & 2032 104

16.1.2. Industrial Solvents Market Attractiveness Analysis, By Source 105

16.1.3. Incremental Revenue Growth Opportunity, by Source, 2024 – 2032 105

16.1.4. Industrial Solvents Market Revenue, By Source, 2018, 2023, 2027 & 2032 106

16.2. Petrochemical-Based Solvents 107

16.2.1. Global Petrochemical-Based Solvents Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 108

16.2.2. Global Petrochemical-Based Solvents Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 108

16.3. Bio-Based Solvents 109

16.3.1. Global Bio-Based Solvents Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 110

16.3.2. Global Bio-Based Solvents Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 110

CHAPTER NO. 17 : INDUSTRIAL SOLVENTS MARKET – REGIONAL ANALYSIS 111

17.1. Industrial Solvents Market Overview, by Regional Segments 111

17.2. Region 112

17.2.1. Global Industrial Solvents Market Revenue Share, By Region, 2023 & 2032 112

17.2.2. Industrial Solvents Market Attractiveness Analysis, By Region 113

17.2.3. Incremental Revenue Growth Opportunity, by Region, 2024 – 2032 113

17.2.4. Industrial Solvents Market Revenue, By Region, 2018, 2023, 2027 & 2032 114

17.2.5. Global Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 115

17.2.6. Global Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 115

17.3. Type 116

17.3.1. Global Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 116

17.4. Global Industrial Solvents Market Revenue, By Type, 2024 – 2032 (USD Million) 116

17.5. Application 117

17.5.1. Global Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 117

17.5.2. Global Industrial Solvents Market Revenue, By Application, 2024 – 2032 (USD Million) 117

17.6. End-Use Industry 118

17.6.1. Global Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 118

17.6.2. Global Industrial Solvents Market Revenue, By End-Use Industry, 2024 – 2032 (USD Million) 118

17.7. Source 119

17.7.1. Global Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 119

17.7.2. Global Industrial Solvents Market Revenue, By Source, 2024 – 2032 (USD Million) 119

CHAPTER NO. 18 : INDUSTRIAL SOLVENTS MARKET – NORTH AMERICA 120

18.1. North America 120

18.1.1. Key Highlights 120

18.1.2. North America Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 121

18.1.3. North America Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 122

18.1.4. North America Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 123

18.1.5. North America Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 124

18.1.6. North America Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 125

18.2. U.S. 126

18.3. Canada 126

18.4. Mexico 126

CHAPTER NO. 19 : INDUSTRIAL SOLVENTS MARKET – EUROPE 127

19.1. Europe 127

19.1.1. Key Highlights 127

19.1.2. Europe Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 128

19.1.3. Europe Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 129

19.1.4. Europe Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 130

19.1.5. Europe Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 131

19.1.6. Europe Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 132

19.2. UK 133

19.3. France 133

19.4. Germany 133

19.5. Italy 133

19.6. Spain 133

19.7. Russia 133

19.8. Belgium 133

19.9. Netherland 133

19.10. Austria 133

19.11. Sweden 133

19.12. Poland 133

19.13. Denmark 133

19.14. Switzerland 133

19.15. Rest of Europe 133

CHAPTER NO. 20 : INDUSTRIAL SOLVENTS MARKET – ASIA PACIFIC 134

20.1. Asia Pacific 134

20.1.1. Key Highlights 134

20.1.2. Asia Pacific Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 135

20.1.3. Asia Pacific Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 136

20.1.4. Asia Pacific Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 137

20.1.5. Asia Pacific Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 138

20.1.6. Asia Pacific Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 139

20.2. China 140

20.3. Japan 140

20.4. South Korea 140

20.5. India 140

20.6. Australia 140

20.7. Thailand 140

20.8. Indonesia 140

20.9. Vietnam 140

20.10. Malaysia 140

20.11. Philippines 140

20.12. Taiwan 140

20.13. Rest of Asia Pacific 140

CHAPTER NO. 21 : INDUSTRIAL SOLVENTS MARKET – LATIN AMERICA 141

21.1. Latin America 141

21.1.1. Key Highlights 141

21.1.2. Latin America Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 142

21.1.3. Latin America Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 143

21.1.4. Latin America Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 144

21.1.5. Latin America Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 145

21.1.6. Latin America Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 146

21.2. Brazil 147

21.3. Argentina 147

21.4. Peru 147

21.5. Chile 147

21.6. Colombia 147

21.7. Rest of Latin America 147

CHAPTER NO. 22 : INDUSTRIAL SOLVENTS MARKET – MIDDLE EAST 148

22.1. Middle East 148

22.1.1. Key Highlights 148

22.1.2. Middle East Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 149

22.1.3. Middle East Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 150

22.1.4. Middle East Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 151

22.1.5. Middle East Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 152

22.1.6. Middle East Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 153

22.2. UAE 154

22.3. KSA 154

22.4. Israel 154

22.5. Turkey 154

22.6. Iran 154

22.7. Rest of Middle East 154

CHAPTER NO. 23 : INDUSTRIAL SOLVENTS MARKET – AFRICA 155

23.1. Africa 155

23.1.1. Key Highlights 155

23.1.2. Africa Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 156

23.1.3. Africa Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 157

23.1.4. Africa Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 158

23.1.5. Africa Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 159

23.1.6. Africa Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 160

23.2. Egypt 161

23.3. Nigeria 161

23.4. Algeria 161

23.5. Morocco 161

23.6. Rest of Africa 161

CHAPTER NO. 24 : COMPANY PROFILES 162

24.1. BASF SE 162

24.1.1. Company Overview 162

24.1.2. Product Portfolio 162

24.1.3. Swot Analysis 162

24.1.4. Business Strategy 163

24.1.5. Financial Overview 163

24.2. Dow Inc. 164

24.3. ExxonMobil Corporation 164

24.4. Shell Chemicals 164

24.5. LyondellBasell Industries 164

24.6. Solvay S.A. 164

24.7. Eastman Chemical Company 164

24.8. INEOS Group 164

24.9. Arkema S.A. 164

24.10. Ashland Global Holdings Inc. 164

List of Figures

FIG NO. 1. Global Industrial Solvents Market Revenue, 2018 – 2032 (USD Million) 33

FIG NO. 2. Porter’s Five Forces Analysis for Global Industrial Solvents Market 40

FIG NO. 3. Value Chain Analysis for Global Industrial Solvents Market 41

FIG NO. 4. Global Industrial Solvents Market Import Volume/Revenue, By Region, 2018 – 2023 43

FIG NO. 5. Global Industrial Solvents Market Export Volume/Revenue, By Region, 2018 – 2023 44

FIG NO. 6. Global Industrial Solvents Market Demand Volume/Revenue, By Region, 2018 – 2023 45

FIG NO. 7. Global Industrial Solvents Market Supply Volume/Revenue, By Region, 2018 – 2023 46

FIG NO. 8. Global Industrial Solvents Market Production Volume/Revenue, By Region, 2018 – 2023 47

FIG NO. 9. Global Industrial Solvents Market Price, By Region, 2018 – 2023 48

FIG NO. 10. Global Industrial Solvents Market Price, By Type, 2018 – 2023 49

FIG NO. 11. Raw Materials Price Trend Analysis, 2018 – 2023 50

FIG NO. 12. Manufacturing Cost Analysis 51

FIG NO. 13. Manufacturing Process 51

FIG NO. 14. Company Share Analysis, 2023 52

FIG NO. 15. Company Share Analysis, 2023 53

FIG NO. 16. Company Share Analysis, 2023 53

FIG NO. 17. Company Share Analysis, 2023 54

FIG NO. 18. Industrial Solvents Market – Company Volume Market Share, 2023 55

FIG NO. 19. Industrial Solvents Market – Company Revenue Market Share, 2023 56

FIG NO. 20. Industrial Solvents Market Revenue Share, By Type, 2023 & 2032 62

FIG NO. 21. Market Attractiveness Analysis, By Type 63

FIG NO. 22. Incremental Revenue Growth Opportunity by Type, 2024 – 2032 63

FIG NO. 23. Industrial Solvents Market Revenue, By Type, 2018, 2023, 2027 & 2032 64

FIG NO. 24. Global Industrial Solvents Market for Alcohols, Revenue (USD Million) 2018 – 2032 65

FIG NO. 25. Global Industrial Solvents Market for Ketones, Revenue (USD Million) 2018 – 2032 67

FIG NO. 26. Global Industrial Solvents Market for Esters, Revenue (USD Million) 2018 – 2032 69

FIG NO. 27. Global Industrial Solvents Market for Glycols, Revenue (USD Million) 2018 – 2032 71

FIG NO. 28. Global Industrial Solvents Market for Others, Revenue (USD Million) 2018 – 2032 73

FIG NO. 29. Industrial Solvents Market Revenue Share, By Application, 2023 & 2032 76

FIG NO. 30. Market Attractiveness Analysis, By Application 77

FIG NO. 31. Incremental Revenue Growth Opportunity by Application, 2024 – 2032 77

FIG NO. 32. Industrial Solvents Market Revenue, By Application, 2018, 2023, 2027 & 2032 78

FIG NO. 33. Global Industrial Solvents Market for Paints & Coatings, Revenue (USD Million) 2018 – 2032 79

FIG NO. 34. Global Industrial Solvents Market for Pharmaceuticals, Revenue (USD Million) 2018 – 2032 81

FIG NO. 35. Global Industrial Solvents Market for Printing Inks, Revenue (USD Million) 2018 – 2032 83

FIG NO. 36. Global Industrial Solvents Market for Adhesives & Sealants, Revenue (USD Million) 2018 – 2032 85

FIG NO. 37. Global Industrial Solvents Market for Others, Revenue (USD Million) 2018 – 2032 87

FIG NO. 38. Industrial Solvents Market Revenue Share, By End-Use Industry, 2023 & 2032 90

FIG NO. 39. Market Attractiveness Analysis, By End-Use Industry 91

FIG NO. 40. Incremental Revenue Growth Opportunity by End-Use Industry, 2024 – 2032 91

FIG NO. 41. Industrial Solvents Market Revenue, By End-Use Industry, 2018, 2023, 2027 & 2032 92

FIG NO. 42. Global Industrial Solvents Market for Construction, Revenue (USD Million) 2018 – 2032 93

FIG NO. 43. Global Industrial Solvents Market for Automotive, Revenue (USD Million) 2018 – 2032 95

FIG NO. 44. Global Industrial Solvents Market for Electronics, Revenue (USD Million) 2018 – 2032 97

FIG NO. 45. Global Industrial Solvents Market for Agriculture, Revenue (USD Million) 2018 – 2032 99

FIG NO. 46. Global Industrial Solvents Market for Others, Revenue (USD Million) 2018 – 2032 101

FIG NO. 47. Industrial Solvents Market Revenue Share, By Source, 2023 & 2032 104

FIG NO. 48. Market Attractiveness Analysis, By Source 105

FIG NO. 49. Incremental Revenue Growth Opportunity by Source, 2024 – 2032 105

FIG NO. 50. Industrial Solvents Market Revenue, By Source, 2018, 2023, 2027 & 2032 106

FIG NO. 51. Global Industrial Solvents Market for Petrochemical-Based Solvents, Revenue (USD Million) 2018 – 2032 107

FIG NO. 52. Global Industrial Solvents Market for Bio-Based Solvents, Revenue (USD Million) 2018 – 2032 109

FIG NO. 53. Global Industrial Solvents Market Revenue Share, By Region, 2023 & 2032 112

FIG NO. 54. Market Attractiveness Analysis, By Region 113

FIG NO. 55. Incremental Revenue Growth Opportunity by Region, 2024 – 2032 113

FIG NO. 56. Industrial Solvents Market Revenue, By Region, 2018, 2023, 2027 & 2032 114

FIG NO. 57. North America Industrial Solvents Market Revenue, 2018 – 2032 (USD Million) 120

FIG NO. 58. Europe Industrial Solvents Market Revenue, 2018 – 2032 (USD Million) 127

FIG NO. 59. Asia Pacific Industrial Solvents Market Revenue, 2018 – 2032 (USD Million) 134

FIG NO. 60. Latin America Industrial Solvents Market Revenue, 2018 – 2032 (USD Million) 141

FIG NO. 61. Middle East Industrial Solvents Market Revenue, 2018 – 2032 (USD Million) 148

FIG NO. 62. Africa Industrial Solvents Market Revenue, 2018 – 2032 (USD Million) 155

List of Tables

TABLE NO. 1. : Global Industrial Solvents Market: Snapshot 31

TABLE NO. 2. : Drivers for the Industrial Solvents Market: Impact Analysis 35

TABLE NO. 3. : Restraints for the Industrial Solvents Market: Impact Analysis 37

TABLE NO. 4. : Global Industrial Solvents Market Revenue, By Region, 2018 – 2023 47

TABLE NO. 5. : Global Industrial Solvents Market Revenue, By Type, 2018 – 2023 48

TABLE NO. 6. : Key Raw Materials & Suppliers 49

TABLE NO. 7. : Global Alcohols Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 65

TABLE NO. 8. : Global Alcohols Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 65

TABLE NO. 9. : Global Ketones Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 67

TABLE NO. 10. : Global Ketones Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 67

TABLE NO. 11. : Global Esters Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 69

TABLE NO. 12. : Global Esters Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 69

TABLE NO. 13. : Global Glycols Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 71

TABLE NO. 14. : Global Glycols Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 71

TABLE NO. 15. : Global Others Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 73

TABLE NO. 16. : Global Others Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 73

TABLE NO. 17. : Global Paints & Coatings Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 79

TABLE NO. 18. : Global Paints & Coatings Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 79

TABLE NO. 19. : Global Pharmaceuticals Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 81

TABLE NO. 20. : Global Pharmaceuticals Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 81

TABLE NO. 21. : Global Printing Inks Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 83

TABLE NO. 22. : Global Printing Inks Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 83

TABLE NO. 23. : Global Adhesives & Sealants Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 85

TABLE NO. 24. : Global Adhesives & Sealants Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 85

TABLE NO. 25. : Global Others Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 87

TABLE NO. 26. : Global Others Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 87

TABLE NO. 27. : Global Construction Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 93

TABLE NO. 28. : Global Construction Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 93

TABLE NO. 29. : Global Automotive Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 95

TABLE NO. 30. : Global Automotive Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 95

TABLE NO. 31. : Global Electronics Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 97

TABLE NO. 32. : Global Electronics Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 97

TABLE NO. 33. : Global Agriculture Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 99

TABLE NO. 34. : Global Agriculture Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 99

TABLE NO. 35. : Global Others Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 101

TABLE NO. 36. : Global Others Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 101

TABLE NO. 37. : Global Petrochemical-Based Solvents Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 107

TABLE NO. 38. : Global Petrochemical-Based Solvents Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 107

TABLE NO. 39. : Global Bio-Based Solvents Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 109

TABLE NO. 40. : Global Bio-Based Solvents Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 109

TABLE NO. 41. : Global Industrial Solvents Market Revenue, By Region, 2018 – 2023 (USD Million) 114

TABLE NO. 42. : Global Industrial Solvents Market Revenue, By Region, 2024 – 2032 (USD Million) 114

TABLE NO. 43. : Global Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 115

TABLE NO. 44. : Global Industrial Solvents Market Revenue, By Type, 2024 – 2032 (USD Million) 115

TABLE NO. 45. : Global Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 116

TABLE NO. 46. : Global Industrial Solvents Market Revenue, By Application, 2024 – 2032 (USD Million) 116

TABLE NO. 47. : Global Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 117

TABLE NO. 48. : Global Industrial Solvents Market Revenue, By End-Use Industry, 2024 – 2032 (USD Million) 117

TABLE NO. 49. : Global Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 118

TABLE NO. 50. : Global Industrial Solvents Market Revenue, By Source, 2024 – 2032 (USD Million) 118

TABLE NO. 51. : North America Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 120

TABLE NO. 52. : North America Industrial Solvents Market Revenue, By Country, 2024 – 2032 (USD Million) 120

TABLE NO. 53. : North America Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 121

TABLE NO. 54. : North America Industrial Solvents Market Revenue, By Type, 2024 – 2032 (USD Million) 121

TABLE NO. 55. : North America Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 122

TABLE NO. 56. : North America Industrial Solvents Market Revenue, By Application, 2024 – 2032 (USD Million) 122

TABLE NO. 57. : North America Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 123

TABLE NO. 58. : North America Industrial Solvents Market Revenue, By End-Use Industry, 2024 – 2032 (USD Million) 123

TABLE NO. 59. : North America Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 124

TABLE NO. 60. : North America Industrial Solvents Market Revenue, By Source, 2024 – 2032 (USD Million) 124

TABLE NO. 61. : Europe Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 127

TABLE NO. 62. : Europe Industrial Solvents Market Revenue, By Country, 2024 – 2032 (USD Million) 127

TABLE NO. 63. : Europe Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 128

TABLE NO. 64. : Europe Industrial Solvents Market Revenue, By Type, 2024 – 2032 (USD Million) 128

TABLE NO. 65. : Europe Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 129

TABLE NO. 66. : Europe Industrial Solvents Market Revenue, By Application, 2024 – 2032 (USD Million) 129

TABLE NO. 67. : Europe Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 130

TABLE NO. 68. : Europe Industrial Solvents Market Revenue, By End-Use Industry, 2024 – 2032 (USD Million) 130

TABLE NO. 69. : Europe Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 131

TABLE NO. 70. : Europe Industrial Solvents Market Revenue, By Source, 2024 – 2032 (USD Million) 131

TABLE NO. 71. : Asia Pacific Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 134

TABLE NO. 72. : Asia Pacific Industrial Solvents Market Revenue, By Country, 2024 – 2032 (USD Million) 134

TABLE NO. 73. : Asia Pacific Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 135

TABLE NO. 74. : Asia Pacific Industrial Solvents Market Revenue, By Type, 2024 – 2032 (USD Million) 135

TABLE NO. 75. : Asia Pacific Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 136

TABLE NO. 76. : Asia Pacific Industrial Solvents Market Revenue, By Application, 2024 – 2032 (USD Million) 136

TABLE NO. 77. : Asia Pacific Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 137

TABLE NO. 78. : Asia Pacific Industrial Solvents Market Revenue, By End-Use Industry, 2024 – 2032 (USD Million) 137

TABLE NO. 79. : Asia Pacific Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 138

TABLE NO. 80. : Asia Pacific Industrial Solvents Market Revenue, By Source, 2024 – 2032 (USD Million) 138

TABLE NO. 81. : Latin America Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 141

TABLE NO. 82. : Latin America Industrial Solvents Market Revenue, By Country, 2024 – 2032 (USD Million) 141

TABLE NO. 83. : Latin America Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 142

TABLE NO. 84. : Latin America Industrial Solvents Market Revenue, By Type, 2024 – 2032 (USD Million) 142

TABLE NO. 85. : Latin America Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 143

TABLE NO. 86. : Latin America Industrial Solvents Market Revenue, By Application, 2024 – 2032 (USD Million) 143

TABLE NO. 87. : Latin America Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 144

TABLE NO. 88. : Latin America Industrial Solvents Market Revenue, By End-Use Industry, 2024 – 2032 (USD Million) 144

TABLE NO. 89. : Latin America Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 145

TABLE NO. 90. : Latin America Industrial Solvents Market Revenue, By Source, 2024 – 2032 (USD Million) 145

TABLE NO. 91. : Middle East Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 148

TABLE NO. 92. : Middle East Industrial Solvents Market Revenue, By Country, 2024 – 2032 (USD Million) 148

TABLE NO. 93. : Middle East Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 149

TABLE NO. 94. : Middle East Industrial Solvents Market Revenue, By Type, 2024 – 2032 (USD Million) 149

TABLE NO. 95. : Middle East Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 150

TABLE NO. 96. : Middle East Industrial Solvents Market Revenue, By Application, 2024 – 2032 (USD Million) 150

TABLE NO. 97. : Middle East Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 151

TABLE NO. 98. : Middle East Industrial Solvents Market Revenue, By End-Use Industry, 2024 – 2032 (USD Million) 151

TABLE NO. 99. : Middle East Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 152

TABLE NO. 100. : Middle East Industrial Solvents Market Revenue, By Source, 2024 – 2032 (USD Million) 152

TABLE NO. 101. : Africa Industrial Solvents Market Revenue, By Country, 2018 – 2023 (USD Million) 155

TABLE NO. 102. : Africa Industrial Solvents Market Revenue, By Country, 2024 – 2032 (USD Million) 155

TABLE NO. 103. : Africa Industrial Solvents Market Revenue, By Type, 2018 – 2023 (USD Million) 156

TABLE NO. 104. : Africa Industrial Solvents Market Revenue, By Type, 2024 – 2032 (USD Million) 156

TABLE NO. 105. : Africa Industrial Solvents Market Revenue, By Application, 2018 – 2023 (USD Million) 157

TABLE NO. 106. : Africa Industrial Solvents Market Revenue, By Application, 2024 – 2032 (USD Million) 157

TABLE NO. 107. : Africa Industrial Solvents Market Revenue, By End-Use Industry, 2018 – 2023 (USD Million) 158

TABLE NO. 108. : Africa Industrial Solvents Market Revenue, By End-Use Industry, 2024 – 2032 (USD Million) 158

TABLE NO. 109. : Africa Industrial Solvents Market Revenue, By Source, 2018 – 2023 (USD Million) 159

TABLE NO. 110. : Africa Industrial Solvents Market Revenue, By Source, 2024 – 2032 (USD Million) 159