Market Overview

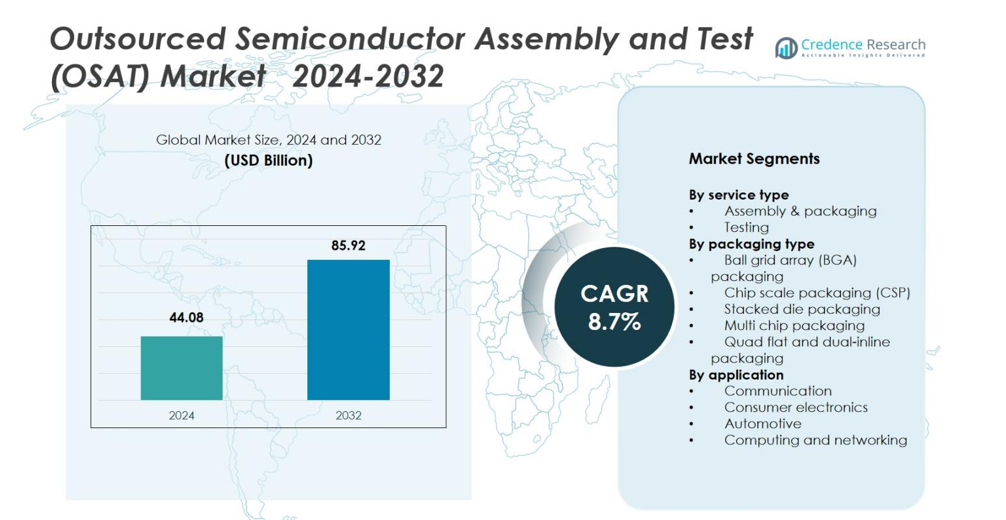

The Outsourced Semiconductor Assembly and Test (OSAT) Market size was valued at USD 44.08 Billion in 2024 and is anticipated to reach USD 85.92 Billion by 2032, at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Outsourced Semiconductor Assembly and Test (OSAT) Market Size 2024 |

USD 44.08 Billion |

| Outsourced Semiconductor Assembly and Test (OSAT) Market, CAGR |

8.7% |

| Outsourced Semiconductor Assembly and Test (OSAT) Market Size 2032 |

USD 85.92 Billion |

The Outsourced Semiconductor Assembly and Test (OSAT) Market is dominated by key players such as ASE Technology Holding Co., Ltd., Amkor Technology, Inc., Siliconware Precision Industries Co., Ltd., JCET Group Co., Ltd., and Powertech Technology Inc. These companies lead the market by offering a wide range of assembly, packaging, and testing solutions to industries including consumer electronics, automotive, and telecommunications. In terms of regional leadership, the Asia-Pacific region holds a dominant position with a market share of 73.5% in 2024, benefiting from a well-established semiconductor manufacturing infrastructure, particularly in countries like China, Taiwan, and South Korea. North America follows with an 18% share, driven by domestic semiconductor manufacturing investments and reshoring initiatives. Europe, contributing 8%, is primarily supported by automotive and industrial electronics demand, while other regions like the Middle East, Africa, and Latin America hold a smaller share of the market.

Market Insights

- The Outsourced Semiconductor Assembly and Test (OSAT) market size stood at USD 44.08 billion in 2024 and is projected to grow at a CAGR of 8.7%.

- Asia‑Pacific leads the market with a 73.5% share in 2024, supported by robust semiconductor manufacturing ecosystems in China, Taiwan, and South Korea; the assembly & packaging service type holds 58.6% of total share, driven by demand for compact, high‑performance chips.

- Rising demand for consumer electronics and the global rollout of 5G technology accelerate adoption of advanced packaging and testing services, boosting OSAT volumes.

- Growing automotive semiconductor content — especially for EVs and ADAS — expands the need for reliable OSAT services tailored to automotive-grade quality standards.

- Major OSAT players, including ASE Technology, Amkor, and JCET, dominate the market, focusing on advanced packaging, quality, and global expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

The Outsourced Semiconductor Assembly and Test (OSAT) market is primarily segmented by service type into assembly & packaging and testing. In 2024, the assembly & packaging segment dominates the market, accounting for 58.6% of the total market share. This segment is driven by the increasing demand for miniaturized and high-performance semiconductors, particularly in consumer electronics and automotive applications. The growth in 5G technology and the rising need for advanced packaging solutions further contribute to the segment’s dominance. Testing services hold the remaining 41.4% market share and are driven by the need for quality assurance in complex semiconductor products.

- For instance, ASE Technology has developed advanced fan-out wafer-level packaging that enhances performance and reduces size for mobile devices.

By Packaging Type

In terms of packaging type, the Ball Grid Array (BGA) packaging segment leads the OSAT market with a share of 34.2% in 2024. BGA’s dominance is attributed to its ability to handle high-performance and complex semiconductor devices, especially in the consumer electronics and automotive industries. Chip Scale Packaging (CSP) follows with a 27.3% share, offering compact size and high efficiency, driving its growth in mobile devices and wearables. Stacked Die and Multi-Chip Packaging, with shares of 16.8% and 12.5% respectively, are growing due to the rising demand for memory chips and multi-functional semiconductors.

- For instance, Samsung’s stacked die technology in their V-NAND memory products exemplifies this trend, enabling higher storage capacity and faster performance.

By Application

The application segment of the OSAT market is led by consumer electronics, commanding 41.5% of the market share in 2024. This is due to the escalating demand for advanced semiconductor components in smartphones, wearables, and other connected devices. The automotive sector holds the second-largest share at 28.9%, driven by the integration of semiconductors in electric vehicles, autonomous driving, and infotainment systems. Communication applications account for 19.4%, with growth fueled by the rollout of 5G infrastructure. Lastly, the computing and networking sector makes up 10.2% of the market, benefiting from the increasing adoption of cloud computing and data centers.

Key Growth Drivers

Increasing Demand for Miniaturized Electronics

The growing demand for miniaturized, high-performance electronic devices is a major driver of the Outsourced Semiconductor Assembly and Test (OSAT) market. As consumer electronics, including smartphones, wearables, and IoT devices, become more compact and powerful, the need for advanced semiconductor packaging and testing services escalates. OSAT providers are increasingly focused on developing smaller, more efficient packaging solutions that can handle the complex functionalities required in these devices. This trend is set to continue as the electronics industry drives further innovation in form factor and performance.

- For instance, ROHM’s PMIC BD868A0MUF-C, a 3.5×3.5 mm chip that integrates all required power supplies, meeting strict safety and automotive standards, showcasing advanced miniaturization in power management components.

Expansion of 5G Technology

The rollout of 5G networks globally is a significant growth driver for the OSAT market. 5G technology demands high-performance, low-latency chips that require advanced packaging and testing to ensure optimal functionality. OSAT providers are addressing these needs by enhancing their services to support the production of 5G-enabled semiconductors. The increase in 5G infrastructure, coupled with the demand for 5G-enabled consumer electronics and automotive applications, is expected to propel the OSAT market, as companies seek to ensure reliable performance and quality in their semiconductor products.

- For instance, companies like Amkor have opened new facilities in Vietnam to provide advanced packaging solutions specifically for high-performance computing and automotive sectors, which benefit from 5G connectivity.

Automotive Electronics Growth

The increasing integration of electronics in automotive applications, particularly in electric vehicles (EVs) and autonomous driving systems, is driving growth in the OSAT market. Advanced semiconductors are crucial for enabling functions such as infotainment, driver assistance systems, and battery management. The growing trend toward electrification and autonomous vehicles demands specialized packaging and testing services for automotive-grade chips. As automotive manufacturers adopt more sophisticated semiconductor technologies, OSAT providers are positioned to capture a significant share of this expanding market.

Key Trends & Opportunities

Adoption of Advanced Packaging Solutions

One of the key trends in the OSAT market is the rising adoption of advanced packaging technologies such as 3D stacking, system-in-package (SiP), and chip-on-chip (CoC) solutions. These packaging techniques allow for higher functionality in smaller footprints, catering to the needs of industries like consumer electronics, telecommunications, and automotive. As devices become more complex and demand higher processing power, advanced packaging solutions present an opportunity for OSAT providers to offer differentiated services, gaining a competitive edge while meeting the evolving needs of end users.

- For instance, Freescale’s fan-out wafer-level packaging (FO-WLP) has facilitated novel SiP solutions that significantly reduce package size and improve system performance by shortening signal traces compared to traditional packaging methods.

Shift Towards Outsourcing by Semiconductor Companies

Another significant opportunity in the OSAT market is the shift towards outsourcing by semiconductor companies. As semiconductor manufacturing becomes increasingly capital-intensive, many companies are turning to third-party OSAT providers to handle assembly, testing, and packaging. This trend is especially prevalent among fabless semiconductor companies that focus on design and rely on OSAT providers for production. This outsourcing trend presents growth potential for OSAT companies as they expand their service offerings and cater to the increasing demand from global semiconductor designers.

- For instance, fabless semiconductor companies like MediaTek outsource packaging and testing to OSAT providers to focus on chip design and increase efficiency.

Key Challenges

Complexity in Meeting High-Quality Standards

One of the key challenges faced by OSAT providers is the increasing complexity in meeting the high-quality standards required by industries like automotive, healthcare, and consumer electronics. These sectors demand highly reliable and durable semiconductor products, especially as devices become more sophisticated. OSAT providers must invest in state-of-the-art testing and inspection technologies to meet stringent quality control standards. Failing to ensure consistent quality can result in product failures, damaging the reputation of both the OSAT provider and their clients.

Pressure on Profit Margins Due to Cost Competition

The OSAT market faces significant pressure on profit margins due to intense cost competition. As semiconductor companies strive to reduce manufacturing costs, OSAT providers are often forced to lower their prices to remain competitive. This is particularly challenging for smaller OSAT companies with limited economies of scale. The increasing complexity of semiconductor packaging and testing processes, coupled with the need for continuous investment in new technologies, further strains profitability. OSAT providers must focus on operational efficiencies and innovation to maintain margins while staying competitive in the global market.

Regional Analysis

Asia‑Pacific

The Asia‑Pacific region dominates the OSAT market, accounting for 73.5% of the global revenue in 2024. This region’s leadership is driven by a well-established semiconductor manufacturing ecosystem, particularly in countries like China, Taiwan, South Korea, and Japan. Strong demand from industries such as consumer electronics, automotive, and telecommunications, along with robust foundry‑OSAT linkages, reinforce this dominance. The region benefits from economies of scale, a mature supply chain, and proximity to major chip design houses, securing Asia‑Pacific’s continued position as the global OSAT hub.

North America

North America holds 18% of the OSAT market share in 2024 and is expected to experience significant growth over the coming years. This growth is fueled by increased investments in domestic semiconductor manufacturing, rising demand from high-performance computing, AI, automotive, and defense sectors, and efforts to diversify supply chains. Government incentives and reshoring initiatives are boosting demand for advanced packaging and testing services locally. As semiconductor design houses seek secure, regionally-based supply chains, North America’s OSAT market is positioned for accelerated expansion.

Europe

Europe contributes 8% of the global OSAT market in 2024. The demand in the region is driven by its strong automotive and industrial electronics sectors, which require reliable and high-quality semiconductor packaging and testing services. However, Europe’s OSAT market is smaller compared to Asia‑Pacific, due to less concentrated semiconductor manufacturing ecosystems. While recent efforts to bolster regional packaging and testing capabilities are underway, Europe’s OSAT market remains secondary, with the region focusing on meeting the needs of its established industries while facing increasing competition from other regions.

Middle East & Africa (MEA) and Latin America / Rest of World (ROW)

The combined share of the Middle East & Africa (MEA) and Latin America / Rest of World (ROW) in the OSAT market is 8% in 2024. These regions are currently underdeveloped in terms of large-scale semiconductor manufacturing infrastructure, limiting the demand for OSAT services. However, as industrialization policies evolve and electronics manufacturing expands, these regions present future growth opportunities. With the ongoing trend of global supply chain diversification, MEA and ROW are expected to gradually attract OSAT capacity expansions, although their market share remains relatively small in the near term.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By service type

- Assembly & packaging

- Testing

By packaging type

- Ball grid array (BGA) packaging

- Chip scale packaging (CSP)

- Stacked die packaging

- Multi chip packaging

- Quad flat and dual-inline packaging

By application

- Communication

- Consumer electronics

- Automotive

- Computing and networking

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Outsourced Semiconductor Assembly and Test (OSAT) market is highly competitive, with key players including ASE Technology Holding Co., Ltd., Amkor Technology, Inc., Siliconware Precision Industries Co., Ltd., JCET Group Co., Ltd., and Powertech Technology Inc. These companies dominate the market by providing comprehensive assembly, packaging, and testing solutions across various semiconductor applications, including consumer electronics, automotive, and telecommunications. The market is characterized by intense competition due to the increasing demand for advanced semiconductor technologies, requiring continuous innovation in packaging solutions and testing capabilities. Leading players focus on expanding their service offerings, investing in new technologies such as 3D stacking, system-in-package (SiP), and advanced ball grid array (BGA) solutions. Additionally, strategic partnerships, mergers, and acquisitions are common, enabling companies to strengthen their capabilities and geographical reach. As the OSAT industry grows, companies are also concentrating on expanding their presence in emerging markets, ensuring long-term sustainability and market share growth.

Key Player Analysis

Recent Developments

- In August 2025, CG Semi launched a full-service OSAT pilot line facility in Sanand, Gujarat, marking one of India’s first end-to-end OSAT offerings.

- In September 2025, Kaynes Semicon entered into an equity-linked collaboration with UST Technology International (UST), agreeing to issue convertible preference shares a move that supports Kaynes’ plan to establish an OSAT plant in Sanand, Gujarat.

- In November 2025, Aehr Test Systems announced a strategic partnership with ISE Labs (a subsidiary of ASE, Inc.) to deliver advanced wafer-level test and burn-in services tailored for high-performance computing (HPC) and AI processors a development relevant to the OSAT ecosystem.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Packaging Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The OSAT market is expected to experience significant growth due to the increasing demand for miniaturized, high-performance semiconductor devices across various industries.

- Advancements in 5G technology will drive further growth as the demand for high-performance semiconductor packaging and testing solutions increases.

- The automotive sector will continue to be a key growth driver, particularly with the rise of electric vehicles and autonomous driving technologies.

- The adoption of advanced packaging technologies, such as 3D stacking and system-in-package (SiP), will continue to shape the market, enabling higher functionality in smaller form factors.

- North America is likely to see accelerated OSAT market growth driven by reshoring initiatives and increased domestic semiconductor production.

- Emerging markets, particularly in Asia-Pacific and Latin America, will present new opportunities for OSAT providers due to growing semiconductor demand in these regions.

- Increasing integration of AI and IoT technologies in consumer electronics will create greater demand for advanced semiconductor testing and packaging services.

- Companies are expected to invest more in research and development to support innovation in packaging solutions, improving performance and cost-efficiency.

- Environmental sustainability will play an increasingly important role, with OSAT providers focusing on energy-efficient and eco-friendly packaging solutions.

- Strategic partnerships, mergers, and acquisitions will be crucial for OSAT companies to enhance their technological capabilities and expand their market reach.