Market Overview:

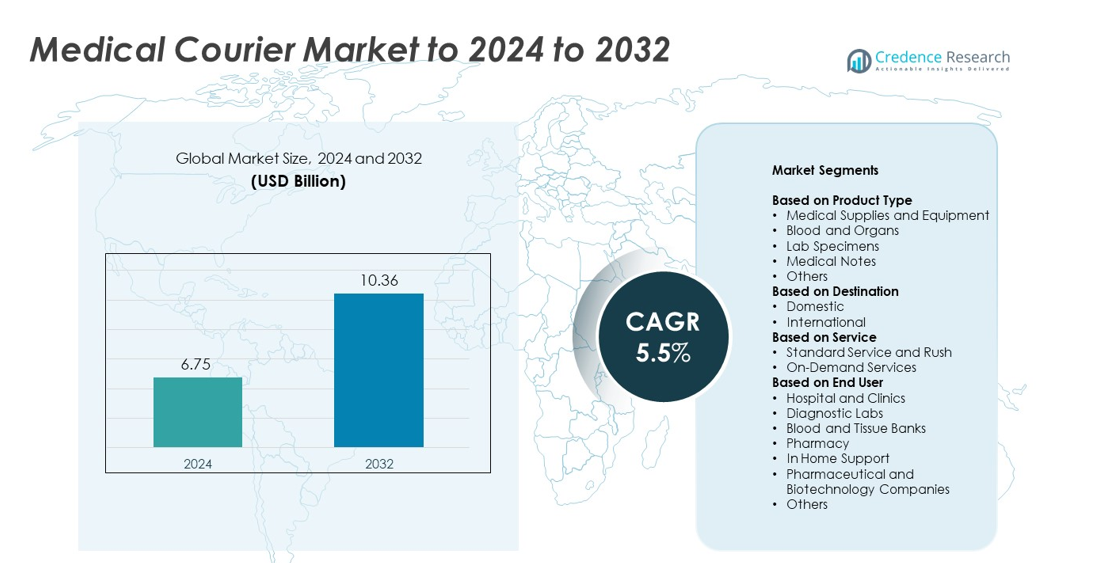

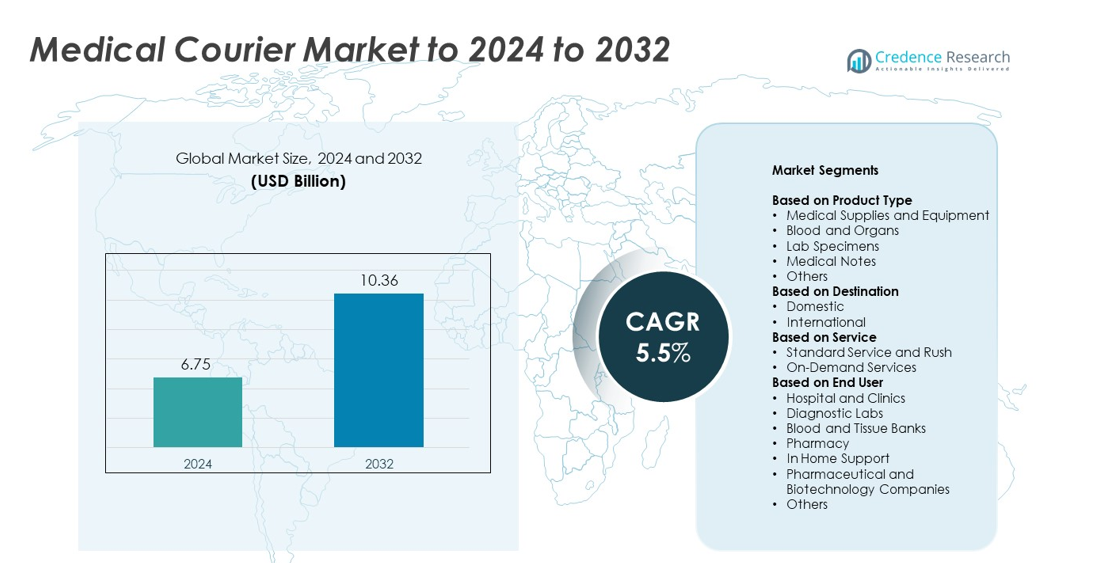

Medical Courier Market size was valued at USD 6.75 Billion in 2024 and is anticipated to reach USD 10.36 Billion by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Courier Market Size 2024 |

USD 6.75 Billion |

| Medical Courier Market, CAGR |

5.5% |

| Medical Courier Market Size 2032 |

USD 10.36 Billion |

The Medical Courier Market includes prominent players such as Med Logistics Grp, ZIPLINE International Inc, Reliant Couriers & Haulage Ltd, FedEx Corp, Citysprint Ltd, ERS Transition Ltd, MNX Global Logistics, UPS, United Parcel Services, and Send Direct Ltd. These companies compete by offering temperature-controlled delivery, rapid specimen transport, and advanced tracking tools for hospitals and laboratories. North America led the market in 2024 with about 39% share, supported by strong diagnostic capacity and well-developed cold-chain systems. Europe followed with nearly 28% share, while Asia Pacific accounted for around 23% due to expanding healthcare infrastructure and rising testing demand.

Market Insights

- The Medical Courier Market was valued at USD 6.75 Billion in 2024 and is projected to reach USD 10.36 Billion by 2032, growing at a CAGR of 5.5%.

- Rising diagnostic volumes and rapid adoption of home-care services drive shipment frequency, while medical supplies and equipment led the product segment with around 38% share in 2024.

- Real-time tracking, cold-chain upgrades, and expansion of decentralized clinical trials shape key trends, improving speed, accuracy, and compliance across transport networks.

- Competition intensifies as major firms strengthen temperature-controlled logistics and digital monitoring systems, focusing on reliability, chain-of-custody, and faster turnaround times.

- North America held about 39% share in 2024, supported by advanced healthcare systems, while Europe reached nearly 28% and Asia Pacific followed with about 23%, reflecting strong infrastructure growth and rising diagnostic activity in major countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Medical supplies and equipment led the product type segment in 2024 with about 38% share due to steady hospital demand, frequent device replacement cycles, and rising shipment volumes linked to home-care growth. This category benefits from strict temperature and handling needs that push healthcare providers to rely on specialized courier partners. Blood and organs, lab specimens, and medical notes showed strong use across diagnostic networks and transplant centers. Other niche products expanded as clinics adopted rapid delivery to support same-day testing and remote patient care.

- For instance, Fresenius Medical Care performed around 52 million dialysis treatments in 2023 through roughly 4,000 clinics serving more than 332,000 patients, driving constant courier movement of medical supplies and equipment.

By Destination

Domestic deliveries dominated the destination segment in 2024 with nearly 82% share, supported by dense hospital networks, regional diagnostic labs, and frequent same-day movement of samples and supplies. Growing demand for faster turnaround in pathology and imaging services further boosted local courier activity. International routes held a smaller share but grew with cross-border clinical trials and global medical device shipments. Expanding regulatory alignment and better cold-chain infrastructure helped improve reliability in long-distance transport.

- For instance, DHL Group operates nearly 600 life-science and pharma logistics sites across close to 130 countries, with over 2.5 million square meters of temperature-controlled warehouse space dedicated to medical and clinical shipments.

By Service

On-demand services led the service segment in 2024 with around 57% share due to urgent specimen movement, emergency organ transport, and rising same-day needs among hospitals and labs. Healthcare providers chose rapid services to reduce diagnostic delays and improve patient outcomes. Standard and rush services sustained demand for routine supply runs, scheduled lab pickups, and recurring hospital logistics. Growth in telehealth, decentralized trials, and home-based testing increased the need for flexible and time-critical delivery models across care networks.

Key Growth Drivers

Rising Diagnostic Testing Volume

Diagnostic labs handled more daily tests as chronic diseases increased and preventive screening expanded. Higher specimen movement pushed hospitals and labs to depend on reliable medical couriers to meet fast turnaround needs. Growth in point-of-care testing and home sample collection also raised transport frequency across regional networks. These factors strengthened demand for specialized carriers that maintain controlled environments and precise delivery timelines.

- For instance, Quest Diagnostics serves approximately 550,000 patients every day, creating sustained daily demand for time-critical specimen transport between collection sites and central laboratories.

Expansion of Home Healthcare Services

Home-based care gained strong traction as aging populations, telehealth use, and remote monitoring increased. Medical couriers supported this shift by delivering devices, consumables, and diagnostic samples between patients and healthcare centers. Fast pickup and safe handling helped reduce treatment delays and improved patient compliance. The rise in chronic care at home increased the number of routine and urgent shipments moving through courier networks.

- For instance, Philips’ products and services reached 1.88 billion people in 2023, including 221 million in underserved communities, as part of a goal to improve 2.5 billion lives per year by 2030.

Advancements in Cold-Chain Logistics

Cold-chain systems improved through better packaging, temperature sensors, and real-time tracking tools. These upgrades ensured safe delivery of vaccines, biologics, and sensitive lab materials that require tight thermal control. Stronger compliance and reliability encouraged more hospitals, trial sites, and research centers to outsource logistics to specialized medical couriers. Enhanced cold-chain performance supported market growth by reducing spoilage risks and improving delivery accuracy.

Key Trends & Opportunities

Integration of Real-Time Tracking

Healthcare providers adopted live tracking platforms to monitor shipments from pickup to final delivery. Digital tools improved visibility, reduced lost-sample incidents, and supported compliance with handling rules. Growing use of GPS, IoT sensors, and automated alerts created opportunities for courier firms to offer premium, data-driven services. The shift toward transparent logistics strengthened trust across hospitals, labs, and research centers.

- For instance, UPS Healthcare manages over 19.2 million square feet of cGMP (Current Good Manufacturing Practice) and GDP (Good Distribution Practice)-compliant healthcare distribution space globally across over 125 facilities.

Growth of Decentralized Clinical Trials

Decentralized trials expanded as sponsors moved sample collection and patient monitoring outside traditional research sites. Medical couriers played a key role by transporting biological samples, wearable devices, and study materials across diverse locations. Rising trial activity created opportunities for specialized services that meet strict regulatory and timing requirements. This shift opened new routes and increased shipment volumes across trial phases.

- For instance, IQVIA reports supporting over 90 decentralized clinical trials across approximately 40 countries and 30 therapeutic areas (based on data from mid-2024 to early 2025).

Shift Toward Eco-Efficient Transport

Healthcare organizations explored greener delivery methods as sustainability became a priority. Courier providers responded by adding electric vehicles, optimizing routes, and reducing packaging waste. These changes lowered emissions and improved operational efficiency. Growing pressure for environmentally friendly healthcare logistics created new opportunities for firms offering certified low-impact transport solutions.

Key Challenges

Strict Regulatory and Compliance Demands

Medical couriers faced complex rules covering specimen handling, temperature control, documentation, and chain-of-custody protocols. Meeting these standards required skilled staff, certified equipment, and continuous audits. Any deviation risked delivery delays or sample rejection, increasing operational pressure. Compliance needs raised costs and slowed smaller couriers trying to scale services.

Rising Operating Costs

Fuel prices, labor expenses, and investment in cold-chain systems increased overall delivery costs. Providers needed advanced vehicles, insulated packaging, and monitoring technology to meet healthcare expectations. These cost pressures limited margins, especially for rapid or long-distance routes. High expenses challenged competitive pricing and slowed expansion for many courier firms.

Regional Analysis

North America

North America held about 39% share in 2024 due to advanced healthcare systems, a dense hospital network, and strong reliance on time-critical specimen movement. Diagnostic labs increased daily testing volumes, raising demand for specialized couriers with strict chain-of-custody controls. Growth in home healthcare, decentralized trials, and high vaccine distribution needs further supported steady service adoption. Investments in cold-chain logistics, real-time tracking, and regulatory-compliant delivery models helped maintain regional leadership.

Europe

Europe accounted for nearly 28% share in 2024, supported by well-structured healthcare networks, strong diagnostic infrastructure, and widespread adoption of temperature-controlled delivery for biologics and lab samples. Hospitals and research centers expanded courier partnerships to reduce turnaround times and support cross-border clinical activity. Sustainability initiatives encouraged gradual use of electric fleets and optimized routing. Expanding biotechnology production and centralized laboratory systems amplified the need for specialized and compliant medical transport services.

Asia Pacific

Asia Pacific held about 23% share in 2024, driven by rising healthcare investment, expanding diagnostic capacity, and increased chronic disease testing across major countries. Growth in home-based care and telemedicine boosted specimen pickup services in urban hubs. The region saw rapid upgrades in cold-chain logistics as vaccine programs and clinical research expanded. Strong e-health adoption and improving transport infrastructure supported broader courier penetration across hospitals, labs, and pharmaceutical networks.

Latin America

Latin America secured roughly 6% share in 2024 as diagnostic networks expanded and more hospitals adopted structured courier partnerships to improve sample turnaround times. Urban regions showed faster growth due to rising private healthcare presence and greater investment in cold-chain handling. Limited infrastructure in rural areas slowed service reach, but growing clinical research activity and wider telehealth use encouraged higher demand for reliable specimen transport services.

Middle East & Africa

Middle East and Africa captured around 4% share in 2024, supported by growing healthcare modernization efforts, expanding lab networks, and rising demand for cold-chain delivery of vaccines and biologics. Larger markets invested in regulated courier solutions to improve diagnostic accuracy and reduce delays. Adoption remained uneven across regions due to infrastructure gaps, but improved hospital capacity and increasing chronic disease testing helped accelerate long-term growth momentum.

Market Segmentations:

By Product Type

- Medical Supplies and Equipment

- Blood and Organs

- Lab Specimens

- Medical Notes

- Others

By Destination

By Service

- Standard Service and Rush

- On-Demand Services

By End User

- Hospital and Clinics

- Diagnostic Labs

- Blood and Tissue Banks

- Pharmacy

- In Home Support

- Pharmaceutical and Biotechnology Companies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Medical Courier Market features key players such as Med Logistics Grp, ZIPLINE International Inc, Reliant Couriers & Haulage Ltd, FedEx Corp, Citysprint Ltd, ERS Transition Ltd, MNX Global Logistics, UPS, United Parcel Services, and Send Direct Ltd. Companies focus on expanding temperature-controlled delivery, strengthening chain-of-custody systems, and improving service reliability for hospitals, labs, and research centers. Firms invest in real-time tracking, automated routing, and faster turnaround capabilities to meet rising diagnostic and home-care needs. Many providers enhance cold-chain assets to support vaccines, biologics, and critical specimens. Sustainability initiatives drive adoption of electric fleets and route-optimization tools, while regulatory compliance remains central to service differentiation. Expanding clinical trials, cross-border shipments, and emergency transport needs further intensify competition across global and regional networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Med Logistics Grp

- ZIPLINE International Inc

- Reliant Couriers & Haulage Ltd

- FedEx Corp

- Citysprint Ltd

- ERS Transition Ltd

- MNX Global Logistics

- UPS

- United Parcel Services

- Send Direct Ltd

Recent Developments

- In 2023, UPS launched its cloud-based visibility platform, “Supply Chain Symphony,” bringing advanced tracking and temperature monitoring capabilities to healthcare customers.

- In 2023, ERS Transition Ltd merged with E-zec Medical, creating the UK’s largest provider of specialist transport services including medical courier services.

- In 2022, CitySprint expanded its fleet with EAV 2Cubed e-cargo bikes, bridging the gap between cargo bikes and electric vans for low-emission same-day deliveries, including healthcare work.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Destination, Service, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Medical courier networks will expand as diagnostic testing volumes continue to rise.

- On-demand delivery services will grow with higher demand for faster specimen movement.

- Cold-chain capacity will strengthen as biologics and advanced therapies increase.

- Digital tracking tools will become standard to improve shipment visibility and compliance.

- Home healthcare growth will drive more routine pickups and device deliveries.

- Decentralized clinical trials will increase specialized courier routes and regulatory needs.

- Electric vehicles will gain adoption as providers shift toward low-emission transport.

- Automation and route optimization will help reduce delays and improve service accuracy.

- Cross-border medical shipping will expand with global trial activity and device trade.

- Partnerships between hospitals, labs, and logistics firms will deepen to support reliable healthcare transport.