| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Data Center Containment Market Size 2024 |

USD 17.09 Million |

| Indonesia Data Center Containment Market, CAGR |

10.90% |

| Indonesia Data Center Containment Market Size 2032 |

USD 39.10 Million |

Market Overview

The Indonesia Data Center Containment Market is projected to grow from USD 17.09 million in 2024 to an estimated USD 39.10 million by 2032, reflecting a compound annual growth rate (CAGR) of 10.90% from 2025 to 2032. This growth is driven by the increasing demand for efficient data management and storage solutions, as businesses and consumers generate vast amounts of data.

Key drivers of this market include the rapid digitalization of various industries, leading to a surge in data generation and the need for robust data storage infrastructures. Trends such as the adoption of edge computing and the implementation of green data center initiatives are also influencing market dynamics. Additionally, government initiatives aimed at improving digital infrastructure are expected to bolster market growth.

Geographically, the market is predominantly concentrated in urban centers like Jakarta, where the demand for data center services is highest due to the concentration of businesses and technology firms. Key players in the Indonesian data center containment market include global and regional companies such as NTT Communications, Telkomsigma, and DCI Indonesia, all striving to enhance data center efficiency and meet the growing data demands of the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Indonesia Data Center Containment Market is projected to grow from USD 17.09 million in 2024 to USD 39.10 million by 2032, with a CAGR of 10.90% from 2025 to 2032.

- The Global Data Center Containment Market is projected to grow from USD 3,719.95 million in 2024 to USD 8,654.34 million by 2032, driven by a CAGR of 11.13% from 2025 to 2032.

- Rapid digitalization across industries is driving the demand for data centers, requiring efficient data storage and containment solutions.

- The increasing need for energy-efficient and sustainable containment systems is pushing the adoption of green technologies and optimized cooling solutions in data centers.

- Indonesia’s government policies focused on enhancing digital infrastructure and cloud services are fostering market growth.

- Jakarta dominates the market, accounting for the largest share due to its concentration of businesses and technology firms.

- Adoption of edge computing and modular data centers are key trends reshaping data center operations in Indonesia.

- High energy costs and the limited availability of skilled workforce pose significant challenges for data center operators in Indonesia.

Market Drivers

Increased Focus on Energy Efficiency and Sustainability

Energy efficiency has become a critical concern for data center operators, especially in Indonesia, where energy costs can significantly affect the bottom line. With data centers consuming substantial amounts of power for cooling and operational purposes, there has been an increased focus on minimizing energy consumption without compromising performance. Data center containment systems, such as hot aisle/cold aisle containment and in-row cooling technologies, play a vital role in improving the cooling efficiency of these centers, which in turn helps in reducing energy consumption. As sustainability becomes a key priority for businesses globally, data center operators in Indonesia are adopting green initiatives to reduce their carbon footprint. This includes the implementation of energy-efficient containment systems, which not only improve operational efficiency but also help in aligning with global sustainability goals. The growing need for cost-effective energy solutions coupled with environmental considerations is driving the adoption of advanced containment technologies in the region.

Proliferation of E-commerce and Digital Services

The Indonesian market has witnessed a rapid rise in e-commerce and digital services, driving the need for more data storage and processing capabilities. As the number of online consumers continues to increase, the demand for secure, high-performance data centers also grows. This surge in e-commerce platforms, fintech, and digital entertainment services has contributed to the higher volume of data generated daily. To manage this data, businesses are establishing more data centers, and consequently, there is a growing need for containment solutions to optimize space, cooling, and energy use. Data center containment systems help manage the high heat load and dense computing environments characteristic of modern data centers, thereby supporting the growing demands of industries such as retail, finance, and telecommunications. Moreover, the increasing penetration of mobile internet services in the country further contributes to data consumption, thereby accelerating the expansion of data center infrastructure and the need for efficient containment solutions.

Increasing Demand for Data Centers and Cloud Services

The rapid digital transformation of businesses across various sectors in Indonesia is driving the growth of the Data Center Containment Market. As organizations increasingly adopt cloud-based solutions and digital tools to enhance operational efficiencies, the demand for scalable and robust data storage systems has surged. For instance, the rise of AI, big data, and IoT devices has significantly increased data traffic, compelling businesses to expand their IT infrastructure. This expansion includes investments in advanced containment solutions that optimize cooling and energy management within data centers. Such systems are critical for maintaining operational performance and reliability, especially as Indonesia’s digital economy continues to grow. Companies are leveraging colocation services and cloud providers to meet these demands while benefiting from improved inland and submarine cable connectivity. These trends collectively underscore the growing reliance on data centers as a backbone for digital transformation in Indonesia.

Government Initiatives to Boost Digital Infrastructure

The Indonesian government has implemented several initiatives aimed at strengthening the country’s digital infrastructure, which directly impacts the demand for data center containment systems. For instance, the “100 Smart Cities” project is accelerating digital adoption across urban and rural areas by promoting e-governance and smart technology integration. Additionally, regulatory reforms such as Government Regulation 71 of 2019 have created a favorable investment climate for data center operators while addressing concerns like data sovereignty. These policies encourage both local and international players to establish facilities that comply with national standards. The government’s focus on expanding internet access, developing 5G networks, and fostering cybersecurity measures further supports the growth of this sector. As operators prioritize energy-efficient cooling systems and capacity enhancements to align with regulatory requirements, these efforts collectively bolster Indonesia’s position as a regional hub for data center development.

Market Trends

Implementation of Energy-Efficient and Green Data Center Solutions

Sustainability continues to be a significant focus in the Indonesia Data Center Containment Market, driven by both environmental concerns and regulatory pressures. Data centers are notoriously energy-intensive, and as Indonesia pushes for greener practices in various sectors, data center operators are looking to adopt energy-efficient solutions to minimize their environmental impact. This includes the implementation of energy-efficient containment systems, which help reduce the cooling and power needs of data centers by optimizing airflow and increasing operational efficiencies. Green data center initiatives are becoming an industry norm in Indonesia, with operators turning to renewable energy sources such as solar power, hydroelectric energy, and geothermal energy to power their facilities. Many data centers are also seeking certifications such as the LEED (Leadership in Energy and Environmental Design) certification to demonstrate their commitment to sustainable practices. Furthermore, the introduction of artificial intelligence (AI) and machine learning (ML) to optimize energy usage in data centers is gaining traction, enabling real-time adjustments to cooling and power distribution based on workload demands. These energy-efficient and green solutions not only help operators reduce costs but also enhance their brand reputation as environmentally responsible organizations, which is becoming an essential differentiator in the market.

Rise of Edge Computing and Distributed Data Centers

The growing need for real-time data processing and the expansion of IoT devices are driving the rise of edge computing, which is also influencing the data center containment market in Indonesia. Edge computing involves processing data closer to the source of data generation, such as at local data centers or edge nodes, rather than sending it to centralized cloud servers. This trend is particularly relevant in industries like healthcare, manufacturing, and retail, where low latency and real-time data processing are critical. As a result, businesses in Indonesia are increasingly deploying distributed data centers and edge computing facilities to meet these demands. The expansion of edge computing is directly influencing the design and implementation of data center containment systems, as these smaller, localized data centers must still maintain optimal cooling and energy efficiency despite their reduced physical footprint. Containment systems in edge data centers must be tailored to manage smaller-scale operations while still providing efficient cooling solutions that support the growing demand for real-time data processing. The rise of edge computing is reshaping how data centers are built and operated, creating new opportunities for innovation in containment solutions, and offering greater flexibility to businesses across Indonesia.

Adoption of Advanced Cooling Technologies

One of the most prominent trends in the Indonesia Data Center Containment Market is the increasing adoption of advanced cooling technologies to enhance operational efficiency and manage power consumption effectively. As data centers in Indonesia expand, driven by the rise in cloud computing and digital services, traditional cooling systems are proving insufficient. For instance, operators are increasingly implementing containment systems such as hot aisle and cold aisle configurations, in-row cooling, and liquid cooling solutions to optimize airflow management and minimize hot spots. These innovations not only reduce reliance on energy-intensive air conditioning but also lower operational costs, which is crucial in regions with high energy prices like Indonesia. Liquid cooling systems are gaining popularity due to their ability to efficiently cool high-density environments by circulating coolant directly over servers. This approach aligns with sustainability goals, as many of these systems are designed to reduce the carbon footprint associated with data center operations. Furthermore, the use of advanced cooling technologies supports Indonesia’s digital transformation initiatives by ensuring data centers remain efficient and environmentally responsible.

Shift Towards Modular Data Centers

Modular data centers are becoming increasingly popular in Indonesia due to their flexibility, scalability, and cost-efficiency. Unlike traditional brick-and-mortar facilities, modular solutions consist of pre-fabricated units that can be quickly deployed and expanded as needed. For instance, this trend is particularly relevant in Indonesia, where rapid digitalization and fluctuating market demands require adaptable infrastructure solutions. Modular data centers enable businesses to scale operations without significant upfront capital investments, making them ideal for new entrants or companies expanding into different regions. Additionally, these centers optimize space, energy use, and cooling—key considerations for efficient containment systems. The growing adoption of modular solutions is expected to drive innovation in the Indonesian market by offering faster deployment times and more cost-effective options for operators. As demand for flexible and sustainable data storage solutions increases, modular designs are poised to play a critical role in shaping the future of Indonesia’s data center landscape.

Market Challenges

High Energy Costs and Power Consumption

High energy costs and significant power consumption are among the most pressing challenges for the Indonesia Data Center Containment Market. Operating data centers is inherently energy-intensive due to the computational demands of digital services, cloud computing, and data storage. Cooling systems, essential for maintaining operational efficiency, further drive up energy usage. For instance, Indonesia’s reliance on fossil fuels like coal and natural gas exacerbates these issues, as renewable energy sources remain underutilized despite their potential. This dependency not only increases operational costs but also contributes to environmental concerns. Compounding the problem is the country’s evolving energy infrastructure, which struggles to meet the growing demands of data centers. Operators are under pressure to adopt energy-efficient containment solutions to mitigate power consumption and cooling requirements. While technological advancements such as renewable energy integration and innovative cooling systems offer some respite, the challenge of managing energy consumption remains critical for ensuring the long-term sustainability of Indonesia’s burgeoning data center industry.

Limited Availability of Skilled Workforce

The rapid growth of the data center sector in Indonesia has created a demand for a highly skilled workforce capable of managing and operating advanced containment systems and other critical infrastructure. However, the supply of qualified professionals in fields such as data center management, cooling technology, and energy efficiency remains limited in Indonesia. The lack of local expertise in emerging technologies, such as edge computing and AI-driven cooling systems, poses a challenge to data center operators who are looking to implement cutting-edge solutions. Training and retaining skilled workers in the data center industry require significant investments in education and workforce development, which many companies may find difficult to achieve. As the market expands, this skills gap could hinder the growth and efficiency of data center containment solutions, further complicating the efforts of businesses to meet the rising demand for advanced and energy-efficient infrastructures.

Market Opportunities

Expansion of Cloud Computing and Digital Transformation

As Indonesia continues to undergo digital transformation, the expansion of cloud computing presents a significant market opportunity for the Data Center Containment Market. With industries such as e-commerce, finance, telecommunications, and government increasingly relying on cloud services, there is a rising demand for scalable and efficient data centers to support these services. The growing adoption of cloud-based platforms requires data centers to handle vast amounts of data storage and processing while maintaining high levels of security and reliability. This, in turn, drives the need for advanced containment systems that optimize space, cooling, and energy efficiency. As more Indonesian businesses transition to digital-first models and cloud solutions, there is an emerging opportunity for data center operators to invest in modern containment technologies that meet both the scalability requirements and sustainability goals of the industry.

Government and Regulatory Support for Data Infrastructure

The Indonesian government’s initiatives to strengthen the nation’s digital infrastructure represent a key growth opportunity for the Data Center Containment Market. With the national push towards improving connectivity and the digital economy, including the development of “100 Smart Cities,” the demand for efficient data storage and processing facilities is expected to increase. Additionally, regulatory pressures around data privacy and sovereignty are encouraging companies to localize their data storage, thus fostering investment in domestic data centers. These developments provide an opportunity for the adoption of innovative containment systems that can optimize energy use and meet the country’s sustainability standards. By aligning with government initiatives and regulatory frameworks, operators can leverage these opportunities to expand their data center facilities and adopt energy-efficient containment solutions.

Market Segmentation Analysis

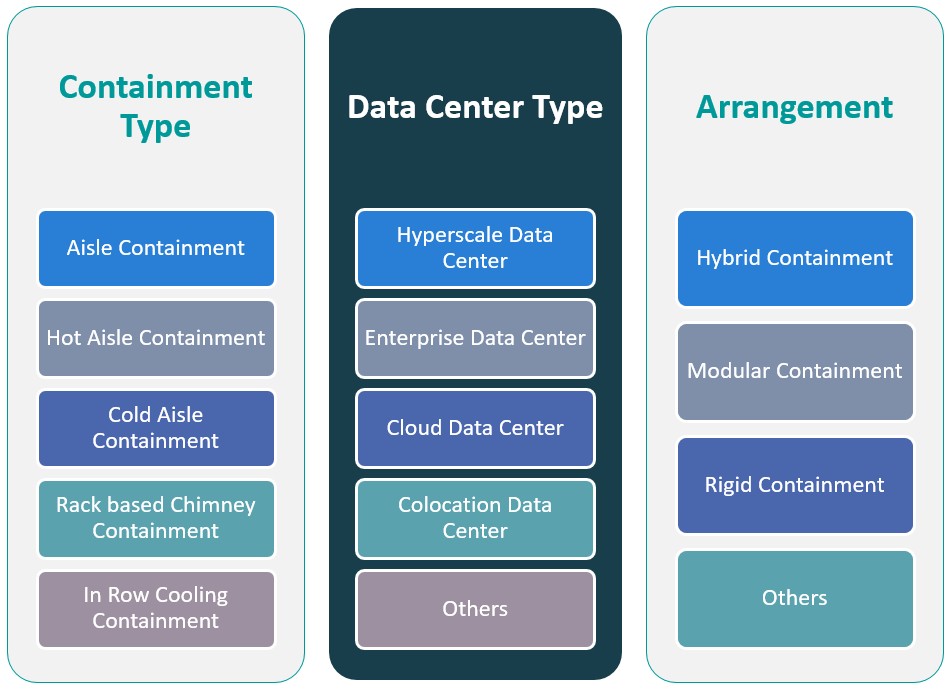

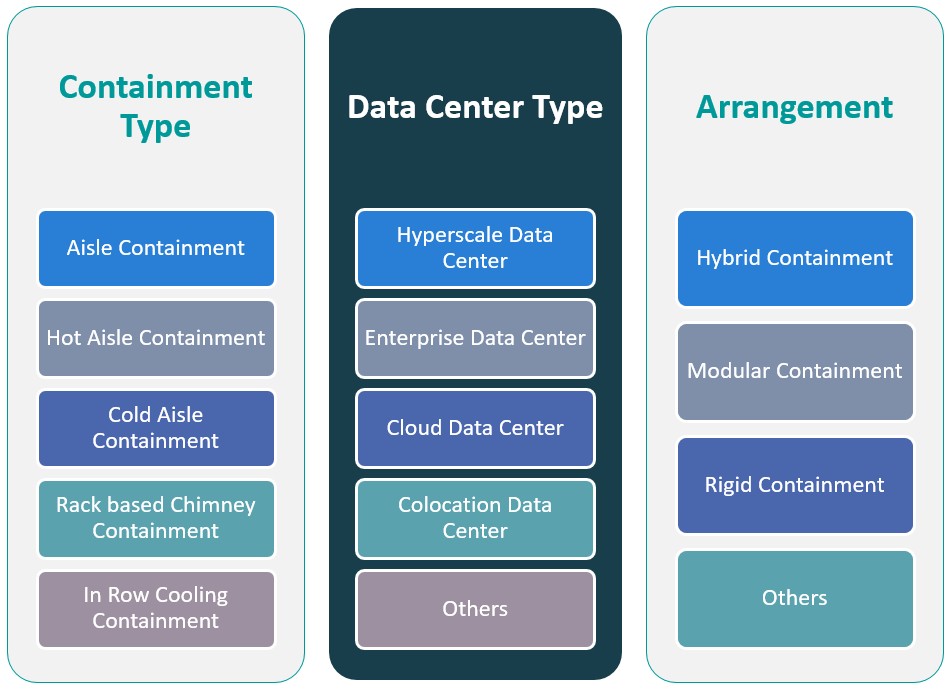

By Containment Type

The Indonesia Data Center Containment Market can be segmented by containment type, where various containment systems are deployed to improve the operational efficiency of data centers. Hot Aisle Containment (HAC) is one of the most commonly used containment systems, focusing on separating hot exhaust air from cold air to optimize cooling performance. This method reduces the amount of energy consumed by cooling systems and prevents hot spots in data centers. HAC is highly favored for its ability to increase cooling efficiency in high-density environments, making it ideal for large-scale data centers in Indonesia. Cold Aisle Containment (CAC), on the other hand, works by enclosing cold air aisles to prevent the mixing of cold and hot air. This containment type is particularly effective for older data center infrastructures looking to retrofit containment solutions. It also minimizes energy consumption by ensuring more effective airflow management. Rack-Based Chimney Containment is another emerging solution in the market, which focuses on optimizing the airflow directly around server racks. This type of containment system helps reduce heat exposure and is particularly useful in environments with high rack density. In-Row Cooling Containment has also gained traction due to its precision cooling capabilities. This system places cooling units close to the heat source, reducing the need for large-scale cooling systems and providing a more energy-efficient solution. These containment types are becoming increasingly important as businesses seek to optimize energy usage and maintain a sustainable operational footprint while meeting the growing demand for digital infrastructure in Indonesia.

By Data Center Type

The Indonesia Data Center Containment Market is also segmented by data center type, with several distinct categories driving the adoption of containment solutions. Hyperscale Data Centers are among the largest and most complex facilities, requiring advanced containment solutions to handle high-density computing and massive data loads. These data centers are typically used by major tech companies and cloud service providers. The demand for containment systems in hyperscale data centers is particularly high as these facilities focus on maximizing efficiency and minimizing energy consumption. With the rapid rise of cloud computing in Indonesia, hyperscale data centers are expected to continue expanding, creating substantial growth opportunities for containment solutions. Enterprise Data Centers, often operated by large organizations for internal use, also represent a significant segment of the market. These data centers typically require containment systems that can support moderate to high-density configurations and ensure efficient cooling. Cloud Data Centers, which support cloud service providers, are experiencing strong growth in Indonesia as businesses increasingly rely on cloud infrastructure for data storage and processing. The adoption of containment solutions in cloud data centers is crucial to optimize performance and energy usage as data volumes increase. Additionally, Colocation Data Centers are becoming more prevalent, where multiple clients share space in a single facility. These data centers benefit from flexible and scalable containment solutions that can accommodate the diverse needs of multiple tenants. With the growing demand for data processing and storage, all these data center types are contributing to the rising demand for efficient containment systems in Indonesia.

Segments

Based on Containment Type

- Aisle Containment

- Hot Aisle Containment

- Cold Aisle Containment

- Rack based Chimney Containment

- In Row Cooling Containment

Based on Data Center Type

- Hyperscale Data Center

- Enterprise Data Center

- Cloud Data Center

- Colocation Data Center

- Others

Based on Arrangement

- Hybrid Containment

- Modular Containment

- Rigid Containment

- Others

Based on Region

- Jakarta

- West Java

- East Java

Regional Analysis

Jakarta (45%)

Jakarta, the capital city and Indonesia’s economic hub, holds the largest market share in the Data Center Containment Market, accounting for approximately 45% of the total market share. The city’s well-established business ecosystem, coupled with the concentration of multinational corporations and technology companies, makes it a prime location for data centers. Jakarta’s infrastructure is being rapidly developed to support the growing demand for cloud services, e-commerce, and telecommunications, further boosting the adoption of efficient data center containment solutions. The rising demand for data storage and processing is spurred by the city’s expanding tech-savvy consumer base and businesses transitioning to digital-first operations. Consequently, Jakarta remains the focal point for data center development and is expected to continue dominating the market.

West Java (20%)

In West Java, which includes cities like Bandung, the demand for data center containment solutions is growing steadily, contributing approximately 20% of the total market share. West Java benefits from its proximity to Jakarta and its growing role as a business and technology hub, making it a strategic location for companies looking to expand outside the capital. With the Indonesian government’s focus on improving digital infrastructure in this region, West Java is witnessing increased investments in data center facilities. These developments are expected to drive the demand for advanced containment technologies as more companies look to optimize their data storage and processing operations.

Key players

- ABB Ltd.

- Honeywell

- Emerson Electric Co.

- Panduit Corporation

- Siemens

Competitive Analysis

The Indonesia Data Center Containment Market is characterized by the presence of several global players who provide innovative containment solutions to optimize energy efficiency and cooling systems in data centers. ABB Ltd. leads the market with its comprehensive portfolio of advanced containment solutions and focus on energy-efficient systems. Similarly, Honeywell excels with its integrated building management systems that offer smart containment solutions to enhance operational efficiency. Emerson Electric Co. and Panduit Corporation are also strong competitors, with robust product offerings in aisle containment, rack-based solutions, and cooling management technologies. Their emphasis on sustainability and energy optimization aligns with the increasing demand for green data centers in Indonesia. Siemens stands out with its advanced digital solutions, supporting automation and energy efficiency in data center operations. The competitive landscape remains dynamic, with players focusing on innovation, scalability, and adaptability to meet the growing data demands in Indonesia.

Recent Developments

- In November 2023, Huawei introduced two new additions to its Smart Modular Data Center and SmartLi uninterruptible power supply (UPS) series – FusionModule2000 6.0, a modular small/medium-sized data center solution, and UPS2000-H, a small-footprint power supply solution running on SmartLi Mini.

- In February 2025, Trane Technologies expanded its data center solutions to include liquid cooling thermal management systems, introducing the Trane 1MW Coolant Distribution Unit for high-performance workloads.

- In 2025, Honeywell launched a data center management suite to improve efficiency and sustainability by integrating operational and IT infrastructure data.

- In March 2025, Vertiv introduced new solutions to support dense AI and high-performance computing workloads, including consolidated infrastructure management software and prefabricated modular overhead infrastructure.

- In March 2025, Siemens announced a $285 million investment in U.S. manufacturing, including establishing new facilities in California and Texas. This investment aims to enhance manufacturing capabilities and advance AI technologies, supporting sectors such as commercial, industrial, construction, and AI data centers.

Market Concentration and Characteristics

The Indonesia Data Center Containment Market is moderately concentrated, with a few key global players dominating the space, including ABB Ltd., Honeywell, Emerson Electric Co., Panduit Corporation, and Siemens. These companies lead the market by providing advanced containment solutions designed to optimize energy efficiency, improve cooling systems, and ensure the sustainability of data centers. The market characteristics reflect a trend toward technological innovation, driven by the increasing demand for data storage and processing due to the rise in digital services, cloud computing, and e-commerce. While multinational corporations lead in providing high-end containment technologies, local players are also emerging, offering more cost-effective solutions tailored to regional needs. As the market expands, competition is expected to intensify, with a focus on enhancing energy efficiency, scalability, and sustainability to cater to the growing data center infrastructure in Indonesia.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Containment Type, Data Center Type, Arrangement and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Indonesia Data Center Containment Market is expected to experience robust growth driven by digital transformation and the expanding need for data storage and cloud services. Rising investments in data centers will fuel demand for advanced containment solutions.

- Sustainability will become a top priority for data center operators, leading to greater adoption of energy-efficient containment systems to reduce power consumption. Environmental regulations and the push for greener operations will promote eco-friendly solutions.

- The development of more efficient and innovative containment systems will continue, such as liquid cooling and AI-driven airflow management. These solutions will help address the growing challenges of cooling high-density server configurations.

- Modular data centers, offering flexibility and scalability, will gain momentum as businesses look for cost-effective and adaptable solutions. These centers will require specialized containment systems to optimize space and energy use.

- With the rise of edge computing, regional data centers will proliferate, requiring specialized containment solutions to manage localized processing and cooling needs. This will drive demand for compact and efficient containment systems in smaller, distributed facilities.

- The rapid expansion of cloud services and hyperscale data centers will boost demand for high-performance containment solutions to manage massive data loads. These centers will push for innovative technologies to support increasing energy and cooling needs.

- Data centers will increasingly incorporate smart building technologies to enhance containment systems. Integration with AI and IoT will enable real-time monitoring and management of cooling, airflow, and energy usage, improving operational efficiency.

- As Indonesia’s regional digital infrastructure improves, areas beyond Jakarta will see increased investments in data centers, pushing the demand for containment systems in emerging markets like West Java and Surabaya.

- The growth of the colocation data center market in Indonesia will drive the need for scalable containment solutions that can accommodate multiple clients within the same facility, enhancing space utilization and operational efficiency.

- Government initiatives aimed at improving the country’s digital economy and infrastructure will support the growth of data centers. These policies will likely include incentives for businesses to invest in energy-efficient and sustainable data center containment technologies.