| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Protein Based Sports Supplements Market Size 2024 |

USD 2,151.60 Million |

| U.S. Protein Based Sports Supplements Market, CAGR |

7.60% |

| U.S. Protein Based Sports Supplements Market Size 2032 |

USD 3,864.64 Million |

Market Overview

U.S. Protein Based Sports Supplements Market size was valued at USD 2,151.60 million in 2024 and is anticipated to reach USD 3,864.64 million by 2032, at a CAGR of 7.60% during the forecast period (2024-2032).

The U.S. protein-based sports supplements market is experiencing robust growth, driven by increasing health consciousness and rising participation in fitness activities such as bodybuilding, athletics, and recreational sports. Consumers are actively seeking high-protein products to support muscle recovery, enhance performance, and meet nutritional goals. The growing popularity of plant-based and clean-label supplements is further influencing purchasing decisions, particularly among millennials and Gen Z. Additionally, the rise of e-commerce and digital fitness influencers has significantly expanded product visibility and accessibility, fostering market expansion. Innovations in product formulations—such as ready-to-drink protein shakes and protein bars fortified with functional ingredients—are also propelling demand. Moreover, strategic marketing campaigns and endorsements by professional athletes continue to boost brand credibility and consumer engagement. As personalized nutrition gains traction, companies are focusing on tailored protein solutions, aligning with evolving consumer preferences and wellness trends, thereby positioning the market for sustained growth over the forecast period.

The U.S. protein-based sports supplements market exhibits strong geographical diversity, with significant demand across the Western, Midwestern, Southern, and Northeastern regions. Urban centers in states like California, Texas, New York, and Illinois serve as key consumption hubs, fueled by high fitness awareness, expanding retail networks, and shifting dietary preferences. The market thrives on a growing culture of health, wellness, and active living, with each region displaying unique preferences for product type and source. Key players operating in this space include Glanbia PLC, Abbott Laboratories, MusclePharm Corporation, NOW Foods, Dymatize Enterprises, Iovate Health Sciences International Inc. (MuscleTech), CytoSport Inc. (Muscle Milk), Garden of Life LLC, Quest Nutrition LLC, and Amazing Grass. These companies focus on product innovation, clean-label ingredients, and strategic marketing to capture diverse consumer segments. Their widespread distribution channels spanning retail, e-commerce, and specialty stores further strengthen their market presence and brand loyalty across the U.S. supplement landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. protein-based sports supplements market was valued at USD 2,151.60 million in 2024 and is projected to reach USD 3,864.64 million by 2032, growing at a CAGR of 7.60%.

- The global protein-based sports supplements market was valued at USD 7,372.05 million in 2024 and is projected to reach USD 13,140.51 million by 2032, growing at a CAGR of 7.49%.

- Increasing focus on fitness, muscle recovery, and active lifestyles is driving the adoption of protein supplements among both athletes and casual users.

- The market is witnessing strong demand for plant-based and clean-label protein products due to rising health and environmental consciousness.

- Consumers are favoring convenient formats like protein bars and ready-to-drink beverages, reflecting a shift toward on-the-go nutrition.

- Key players such as Glanbia, Abbott Laboratories, MusclePharm, and Iovate Health Sciences dominate the competitive landscape through innovation and broad distribution.

- Challenges such as product mislabeling, high costs of premium formulations, and regulatory concerns may hinder market growth.

- Regional demand is led by Western states, followed by the Midwest, South, and Northeast, each showing unique product preferences and growth dynamics.

Report Scope

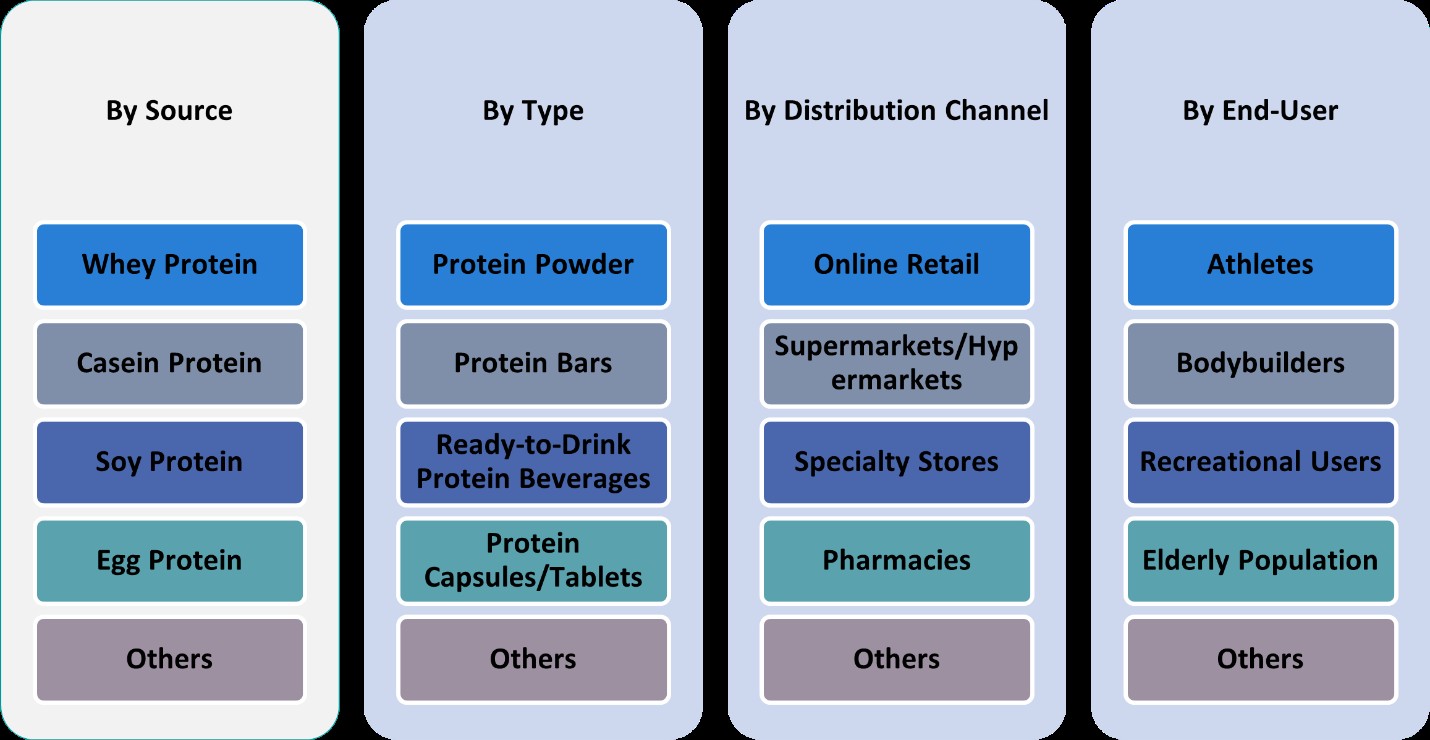

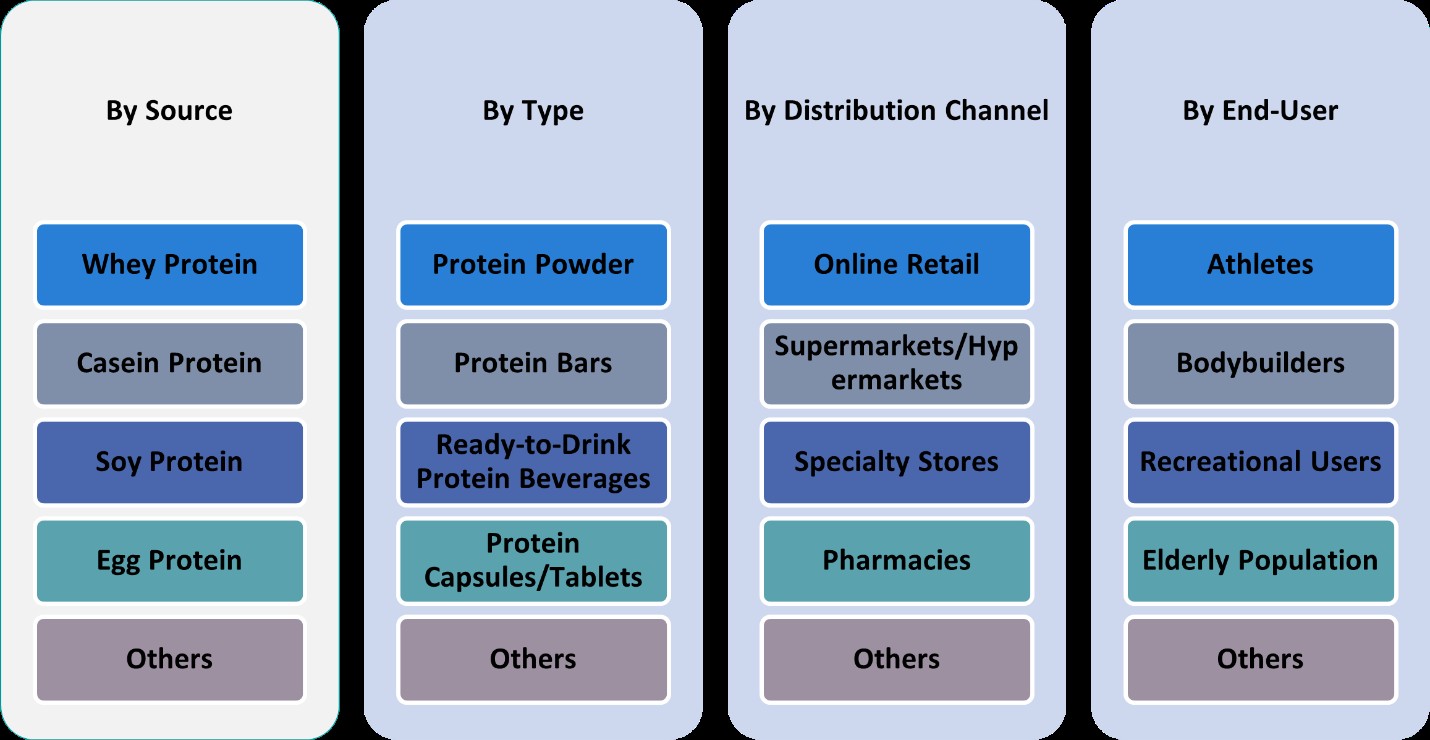

This report segments the U.S. Protein Based Sports Supplements Market as follows:

Market Drivers

Rising Health Consciousness and Active Lifestyle Adoption

The increasing awareness of health and wellness among U.S. consumers has significantly fueled the demand for protein-based sports supplements. For instance, a report by the Centers for Disease Control and Prevention (CDC) highlighted that more Americans are engaging in physical activities such as gym workouts, running, and cycling to combat lifestyle-related diseases and improve overall well-being. This shift in lifestyle has led to heightened interest in high-protein nutrition that supports muscle repair, weight management, and sustained energy levels. As people become more informed about the benefits of protein intake, particularly post-exercise, they are more likely to incorporate supplements into their daily routines. The aging population is also contributing to this trend, as older adults seek products that help preserve muscle mass and strength. The emphasis on preventive healthcare and wellness continues to drive consumers toward protein-rich supplements as an essential part of a balanced and proactive health strategy.

Growing Popularity of Plant-Based and Clean-Label Products

A notable market driver is the increasing demand for plant-based and clean-label protein supplements. Consumers are becoming more conscious of the ingredients used in their nutritional products, with a strong preference for natural, organic, and minimally processed formulations. Plant-based proteins derived from sources such as pea, rice, and hemp are gaining traction among health-conscious individuals, vegans, and those with dairy intolerances. This shift is supported by broader consumer trends emphasizing sustainability, animal welfare, and environmental impact. Clean-label products—free from artificial sweeteners, preservatives, and allergens—are becoming a key differentiator in brand positioning. As consumers scrutinize product labels more closely, manufacturers are responding by innovating with transparent ingredient lists and certifications, such as non-GMO and USDA Organic. These offerings not only cater to dietary preferences but also align with the broader wellness movement, reinforcing long-term consumer trust and loyalty.

Expansion of Online Retail and Digital Influence

The rapid expansion of e-commerce platforms and the influence of digital marketing have significantly accelerated market growth. For instance, a study by the U.S. Department of Commerce highlighted the role of major e-commerce players like Amazon and Walmart in boosting product accessibility across diverse demographics. Additionally, the role of social media influencers, fitness bloggers, and athletes in promoting protein supplements has been instrumental in shaping consumer preferences. These digital channels not only educate consumers but also create brand awareness and loyalty through authentic endorsements and targeted advertising. Subscription models and direct-to-consumer (DTC) strategies are also gaining popularity, allowing brands to build recurring revenue streams and gather valuable consumer insights. This evolving digital ecosystem continues to reshape how consumers discover, evaluate, and purchase sports nutrition products.

Innovation in Product Formats and Personalized Nutrition

Product innovation is another critical factor driving the U.S. protein-based sports supplements market. Manufacturers are continually introducing novel delivery formats such as protein-infused waters, cookies, chips, and smoothies to appeal to consumers seeking convenience and variety. These innovations cater to busy lifestyles and broaden the appeal of protein supplements beyond traditional powder forms. Moreover, the emergence of personalized nutrition is reshaping product development strategies. Consumers increasingly prefer supplements tailored to their specific fitness goals, metabolic profiles, and dietary needs. This demand has encouraged companies to invest in research and development and collaborate with nutrition tech platforms offering DNA-based or biomarker-driven recommendations. Customizable supplement solutions not only enhance consumer engagement but also improve product efficacy and satisfaction. As personalization becomes a central theme in wellness consumption, it is expected to play a key role in sustaining the growth trajectory of the protein-based sports supplements market.

Market Trends

Increasing Shift Toward Plant-Based and Vegan Protein Options

One of the most prominent trends reshaping the U.S. protein-based sports supplements market is the growing shift toward plant-based and vegan protein sources. For instance, a report by the Plant Based Foods Association highlighted that consumers are increasingly opting for protein derived from peas, rice, soy, hemp, and pumpkin seeds due to dietary preferences, ethical considerations, and environmental concerns. The trend is particularly strong among millennials and Gen Z consumers, who prioritize sustainability and animal welfare in their purchasing decisions. Moreover, advancements in food technology have enabled manufacturers to improve the taste, texture, and nutritional value of plant-based protein products, making them more competitive with traditional dairy-based options. As this trend gains momentum, it is encouraging brands to diversify their product portfolios with innovative, plant-forward solutions that cater to a broader and more health-conscious audience.

Rising Demand for Functional and Multi-Benefit Formulations

Consumers in the U.S. are increasingly looking for protein supplements that go beyond basic muscle building. There is a noticeable trend toward multifunctional products that offer additional health benefits such as immune support, digestive health, energy enhancement, and stress reduction. This demand is driving the incorporation of functional ingredients such as adaptogens, probiotics, prebiotics, vitamins, and minerals into protein supplements. For instance, protein powders infused with turmeric, ashwagandha, or collagen are gaining popularity for their added health attributes. This multifunctionality appeals to consumers who are adopting a holistic approach to wellness and prefer consolidated nutritional support through a single product. As a result, manufacturers are investing heavily in research and development to create differentiated offerings that meet evolving consumer expectations. This trend is expected to intensify, particularly as the wellness industry continues to merge with sports nutrition.

Premiumization and Clean-Label Transparency

Premiumization is emerging as a key trend in the U.S. protein-based sports supplements market, with consumers increasingly willing to pay more for high-quality, transparent, and ethically produced products. Clean-label formulations—those free from artificial additives, GMOs, gluten, soy, and synthetic flavors—are becoming a major purchasing criterion. Today’s consumers are more informed and scrutinize product labels for authenticity, ingredient sourcing, and nutritional value. Transparency in manufacturing processes, certifications such as USDA Organic or NSF Certified for Sport, and third-party lab testing are playing crucial roles in brand differentiation. Furthermore, the rise of boutique brands that focus on authenticity and transparency is putting pressure on larger players to elevate their standards. As trust becomes a decisive factor in purchasing decisions, brands that demonstrate quality, safety, and responsibility are more likely to maintain customer loyalty and command premium pricing.

Growth of Personalization and Tech-Driven Nutrition

The integration of personalization and technology is redefining the U.S. sports supplement landscape. For instance, a report by the National Institutes of Health highlighted the role of artificial intelligence and biomarker testing in delivering customized nutrition solutions tailored to individual fitness goals and dietary restrictions. Subscription-based models that offer tailored protein blends based on lifestyle and health data are gaining popularity, particularly among tech-savvy consumers. Wearable fitness devices and mobile health apps are also influencing how individuals track their progress and adjust their supplement intake accordingly. This tech-driven approach enhances consumer engagement, provides real-time feedback, and fosters long-term brand relationships. As personalized health and wellness become mainstream, brands that offer adaptive and interactive supplement solutions are well-positioned to capitalize on this evolving trend.

Market Challenges Analysis

Regulatory Scrutiny and Quality Control Issues

The U.S. protein-based sports supplements market faces persistent challenges related to regulatory oversight and product quality assurance. For instance, a report by the U.S. Food and Drug Administration (FDA) highlighted that dietary supplements are not subject to pre-market approval, which can lead to inconsistencies in product labeling, ingredient transparency, and efficacy claims. Instances of adulteration, contamination, and mislabeling have raised concerns among both consumers and healthcare professionals. Additionally, the proliferation of unverified claims such as promises of rapid muscle gain or weight loss—has attracted scrutiny from regulatory bodies and advocacy groups. Manufacturers must navigate a complex landscape of federal and state-level guidelines, along with third-party certifications, to demonstrate compliance and ensure product integrity. As consumer awareness grows, brands that fail to uphold high standards of safety and transparency risk reputational damage and market share erosion.

Intense Market Competition and Price Pressure

Another significant challenge is the intense competition within the U.S. sports supplements market, which creates pricing pressure and makes product differentiation increasingly difficult. The market is saturated with a wide array of local and international brands offering similar protein-based products, often with marginal differences in formulation or packaging. This crowded landscape forces companies to compete aggressively on price, which can compress profit margins and hinder long-term growth. Moreover, smaller or emerging brands struggle to gain visibility amid well-established players with robust marketing budgets and retail partnerships. The dominance of e-commerce platforms adds further complexity, as consumer loyalty can easily shift based on promotions, reviews, and influencer endorsements. To remain competitive, brands must continuously invest in innovation, customer engagement, and value-added offerings. However, balancing cost-efficiency with product quality, marketing effectiveness, and operational scalability remains a major hurdle for many market participants.

Market Opportunities

The U.S. protein-based sports supplements market presents significant growth opportunities driven by the rising demand for personalized nutrition and technological integration in the health and wellness sector. As consumers increasingly seek tailored solutions to meet specific fitness goals, there is a growing opportunity for brands to develop customized protein supplements based on individual health profiles, dietary preferences, and activity levels. Advancements in AI-driven health platforms and wearable fitness technologies allow companies to offer data-backed, personalized recommendations, enhancing consumer engagement and product effectiveness. This shift toward individualized nutrition not only elevates user satisfaction but also creates long-term brand loyalty and recurring revenue opportunities through subscription models. Moreover, expanding consumer interest in holistic wellness is creating room for multifunctional protein supplements that combine muscle-building benefits with immunity support, stress reduction, and digestive health—offering brands a chance to differentiate their portfolios through innovation.

Another promising opportunity lies in the continued expansion of plant-based and clean-label protein products. As awareness around sustainability, ethical consumption, and food sensitivities increases, consumers are actively shifting away from traditional animal-based proteins to alternatives derived from pea, rice, soy, and hemp. This transition is especially evident among younger demographics and health-conscious individuals who prioritize transparency, natural ingredients, and environmentally friendly sourcing. Additionally, the rise of flexitarian diets and vegan lifestyles has opened new market segments that were previously underserved by conventional protein offerings. By developing high-quality, great-tasting, and nutrient-dense plant-based supplements, companies can tap into this expanding consumer base. Strategic partnerships with fitness influencers, health professionals, and retail channels can further strengthen brand reach and trust. As these consumer preferences continue to evolve, companies that proactively align with emerging trends and invest in R&D and brand authenticity are well-positioned to capitalize on the next wave of growth in the U.S. protein-based sports supplements market.

Market Segmentation Analysis:

By Type:

The U.S. protein-based sports supplements market is segmented into protein powder, protein bars, ready-to-drink (RTD) protein beverages, protein capsules/tablets, and others. Among these, protein powder holds the largest market share due to its widespread adoption among fitness enthusiasts and athletes for muscle building, recovery, and meal replacement purposes. Its customizable serving size and versatile usage—mixed with water, milk, or smoothies—make it a convenient choice. However, protein bars and RTD beverages are gaining strong momentum owing to increasing consumer demand for on-the-go, portable, and convenient nutrition options. RTD beverages, in particular, cater to time-constrained consumers and are increasingly available in various flavors and functional formulations. Protein capsules and tablets remain a niche segment but are preferred by consumers looking for minimal-calorie and supplement-style protein intake. As the market evolves, innovation in taste, texture, and packaging across all formats is expected to drive product diversification and appeal to a broader range of consumer lifestyles and preferences.

By Source:

Based on source, the market includes whey protein, casein protein, soy protein, egg protein, and others such as hemp, rice, and pea protein. Whey protein dominates this segment due to its complete amino acid profile, fast digestibility, and strong scientific support for muscle recovery and performance enhancement. It remains a top choice for professional athletes and gym-goers. Casein protein, known for its slow-release properties, is typically consumed at night or between meals, appealing to consumers focused on muscle maintenance. Soy protein serves as a popular plant-based alternative, widely accepted by vegans and lactose-intolerant individuals. Egg protein offers high bioavailability and is favored by those seeking animal-based, non-dairy options. The “others” category particularly pea and hemp proteins is witnessing rising demand driven by the plant-based movement and clean-label trends. This diversification of protein sources reflects evolving consumer preferences and creates opportunities for brands to introduce hybrid and novel protein blends catering to targeted nutritional needs.

Segments:

Based on Type:

- Protein Powder

- Protein Bars

- Ready-to-Drink Protein Beverages

- Protein Capsules/Tablets

- Others

Based on Source:

- Whey Protein

- Casein Protein

- Soy Protein

- Egg Protein

- Others

Based on End- User:

- Athletes

- Bodybuilders

- Recreational Users

- Elderly Population

- Others

Based on Distribution Channel:

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- Others

Based on the Geography:

- Western United States

- Midwestern United States

- Southern United States

- Northeastern United States

Regional Analysis

Western United States

The Western United States leads the U.S. protein-based sports supplements market, accounting for approximately 34% of the total market share in 2024. States such as California, Washington, and Colorado are major contributors, driven by a high concentration of health-conscious consumers, fitness culture, and a large population base. The region has a strong presence of fitness centers, organic stores, and premium supplement brands, supporting the widespread adoption of protein powders, RTD beverages, and plant-based formulations. Additionally, the Western U.S. is a hub for wellness trends and sustainable living, fueling demand for clean-label and vegan protein supplements. Urban consumers in cities like Los Angeles and San Francisco are particularly responsive to personalized nutrition and tech-integrated wellness solutions. E-commerce penetration and influencer marketing also play vital roles in enhancing product visibility and brand engagement across this region.

Midwestern United States

The Midwestern United States holds an estimated 24% market share and continues to demonstrate steady growth in protein supplement consumption. States like Illinois, Ohio, and Michigan are seeing increased fitness awareness and dietary shifts toward high-protein regimens. While traditionally more price-sensitive, Midwestern consumers are now embracing premium and functional protein-based products, especially in urban and suburban areas. Gyms, community wellness programs, and growing retail availability have improved accessibility. Moreover, demand for protein bars and RTD beverages is expanding due to busy lifestyles and rising participation in sports and outdoor activities. The region also sees rising acceptance of plant-based proteins, though whey and casein remain dominant. Manufacturers targeting this region focus on value-based offerings without compromising quality or efficacy.

Southern United States

The Southern United States accounts for approximately 23% of the market share, supported by population growth, improving fitness infrastructure, and rising health awareness in states such as Texas, Florida, and Georgia. Increasing obesity rates and chronic health concerns are motivating consumers to adopt protein supplements as part of weight management and muscle-building programs. While traditional protein powders remain popular, there is notable growth in flavored RTD beverages and protein snacks designed for convenience and taste. Southern consumers are becoming more conscious of nutritional content, with growing interest in high-protein, low-sugar, and allergen-free options. The expanding network of retail chains and e-commerce platforms is also boosting product accessibility across both urban and rural markets.

Northeastern United States

The Northeastern United States holds a market share of about 20%, with strong demand emerging from densely populated states like New York, Massachusetts, and Pennsylvania. The region benefits from a highly educated consumer base, strong fitness culture, and widespread access to premium health food retailers. Northeastern consumers are inclined toward scientifically-backed, clean-label, and multifunctional protein supplements, including those that support immunity, mental clarity, and digestive health. While protein powders remain a staple, protein bars and capsules are gaining popularity among busy professionals and gym-goers. The presence of innovative startups and nutraceutical companies in the region also contributes to product diversity and innovation. Additionally, subscription-based delivery models and mobile app integrations are driving personalized supplement usage, appealing to the region’s tech-savvy and health-driven population.

Key Player Analysis

- Glanbia PLC

- Abbott Laboratories

- MusclePharm Corporation

- NOW Foods

- Dymatize Enterprises, LLC

- Iovate Health Sciences International Inc. (MuscleTech)

- CytoSport, Inc. (Muscle Milk)

- Garden of Life, LLC

- Quest Nutrition LLC

- Amazing Grass

Competitive Analysis

The U.S. protein-based sports supplements market is highly competitive, characterized by the presence of both global corporations and specialized nutrition brands. Leading players such as Glanbia PLC, Abbott Laboratories, MusclePharm Corporation, NOW Foods, Dymatize Enterprises LLC, Iovate Health Sciences International Inc. (MuscleTech), CytoSport Inc. (Muscle Milk), Garden of Life LLC, Quest Nutrition LLC, and Amazing Grass dominate the landscape through continuous innovation, diversified product offerings, and strong distribution networks. These companies focus on developing high-quality protein formulations in various formats including powders, bars, ready-to-drink beverages, and capsules to meet evolving consumer preferences. Innovation in plant-based and clean-label products has become a central strategy to appeal to health-conscious and vegan consumers. Moreover, brand visibility through strategic partnerships, influencer marketing, and presence in major retail and e-commerce platforms enhances market reach. Companies also invest significantly in R&D to differentiate their products with added health benefits, improved taste, and functional ingredients, maintaining their competitive edge in a saturated market.

Recent Developments

- In March 2025, Quest Nutrition introduced Quest Protein Milkshakes, ready-to-drink beverages with a category-leading 45 grams of protein per bottle. Available in chocolate, vanilla, and strawberry flavors, these shakes cater to high-protein diets with minimal sugar and carbs.

- In December 2024, Dymatize launched Performance Protein Shakes and Energyze Pre-Workout Powder. The ready-to-drink shakes contain 30 grams of high-quality proteins along with BCAAs for muscle recovery and growth.

- In November 2024, Myprotein expanded operations in India by manufacturing locally to meet growing demand. The brand introduced localized flavors such as Kesar Badam and Nimbu Pani and launched Clear Whey Isolate as a refreshing alternative to traditional protein shakes.

- In January 2024, Abbott launched Protality, a high-protein weight-loss shake designed for individuals on weight-loss medications. Each serving contains 30 grams of protein and is tailored to preserve muscle mass while supporting weight loss.

Market Concentration & Characteristics

The U.S. protein-based sports supplements market exhibits moderate to high market concentration, with a few well-established players holding significant shares due to strong brand recognition, extensive product portfolios, and widespread distribution channels. Companies like Glanbia PLC, Abbott Laboratories, and Iovate Health Sciences International Inc. drive market leadership through innovation, quality, and customer loyalty. The market is characterized by high competition, rapid product innovation, and increasing consumer demand for functional and clean-label supplements. While traditional whey and casein protein products remain dominant, there is a noticeable shift toward plant-based and hybrid protein blends, reflecting evolving consumer preferences. Market dynamics are shaped by rising health consciousness, expanding fitness culture, and the increasing popularity of convenient nutrition formats like bars and ready-to-drink beverages. Additionally, digital marketing, e-commerce platforms, and personalized nutrition trends are influencing purchasing behavior. Despite entry barriers like regulatory compliance and high R&D costs, the market continues to attract new entrants seeking niche opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. protein-based sports supplements market is expected to witness consistent growth driven by rising health and fitness awareness.

- Increased participation in sports, gym culture, and endurance activities will continue to fuel demand.

- Consumers are showing a preference for clean-label and plant-based protein supplements, shaping future product innovation.

- E-commerce and direct-to-consumer channels will play a vital role in market expansion and customer engagement.

- Personalized nutrition trends are likely to boost the demand for tailored protein-based formulations.

- Strategic collaborations and product launches by major players will enhance market competitiveness.

- Technological advancements in protein extraction and formulation will support high-quality product development.

- Regulatory clarity and safety assurance will remain crucial for consumer trust and long-term market sustainability.

- Demand from aging populations seeking muscle maintenance and recovery solutions will rise steadily.

- Influencer marketing and social media trends will continue to shape consumer preferences and purchasing decisions.