| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Disposable Medical Supplies Market Size 2023 |

USD 10,370.83 Million |

| South Korea Disposable Medical Supplies Market, CAGR |

5.96% |

| South Korea Disposable Medical Supplies Market Size 2032 |

USD 17,478.12 Million |

Market Overview

South Korea Disposable Medical Supplies market size was valued at USD 10,370.83 million in 2023 and is anticipated to reach USD 17,478.12 million by 2032, at a CAGR of 5.96% during the forecast period (2023-2032).

The South Korea disposable medical supplies market is experiencing steady growth, driven by several key factors and emerging trends. The rising aging population and increasing prevalence of chronic diseases have significantly elevated the demand for single-use medical products to prevent cross-contamination and ensure patient safety. Additionally, government initiatives to enhance healthcare infrastructure and support infection control practices are further fueling market expansion. Technological advancements in materials and manufacturing processes are leading to the development of more efficient, eco-friendly, and cost-effective disposable supplies. The COVID-19 pandemic has also heightened awareness regarding hygiene and infection prevention, reinforcing long-term demand across hospitals, clinics, and home care settings. Moreover, the growing adoption of home-based healthcare and telemedicine services is driving the use of disposable items such as gloves, syringes, and diagnostic kits.

South Korea’s disposable medical supplies market is characterized by a strong concentration of key players across various regions, driven by the country’s advanced healthcare infrastructure and significant demand for high-quality medical products. The Seoul Metropolitan Area, with its concentration of top-tier hospitals and medical institutions, serves as a major hub for healthcare innovation and supply distribution. In addition, Gyeonggi Province, Busan, and Ulsan also contribute significantly to the market due to their growing healthcare needs and proximity to major urban centers. Key players in the South Korean market include global medical suppliers such as Smith+Nephew, Medtronic, and Procter & Gamble, along with regional manufacturers like Shanghai Neo-Medical Co., Ltd. and Molnlycke Health Care. These companies play a vital role in shaping the market through continuous innovation in product offerings, strategic partnerships, and local manufacturing capabilities to meet the diverse needs of South Korean healthcare providers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The South Korea disposable medical supplies market was valued at USD 10,370.83 million in 2023 and is projected to reach USD 17,478.12 million by 2032, growing at a CAGR of 5.96% during the forecast period.

- The global Disposable Medical Supplies market was valued at USD 2,45,000 million in 2023 and is expected to reach USD 3,93,306.92 million by 2032, growing at a CAGR of 5.40% during the forecast period.

- Increased healthcare spending and an aging population are significant drivers, creating steady demand for disposable medical products.

- The rise in chronic diseases, particularly diabetes and cardiovascular conditions, is contributing to a higher need for medical disposables.

- Innovation in product development, especially eco-friendly and technologically advanced disposables, is a key trend in the market.

- The competitive landscape features global players like Smith+Nephew, Medtronic, and local manufacturers such as Shanghai Neo-Medical Co., Ltd.

- Regulatory pressures and environmental sustainability concerns are major restraints, forcing manufacturers to adapt.

- Seoul, Gyeonggi Province, Busan, and Daegu dominate the market, with Seoul leading as the primary hub for medical supply distribution.

Report Scope

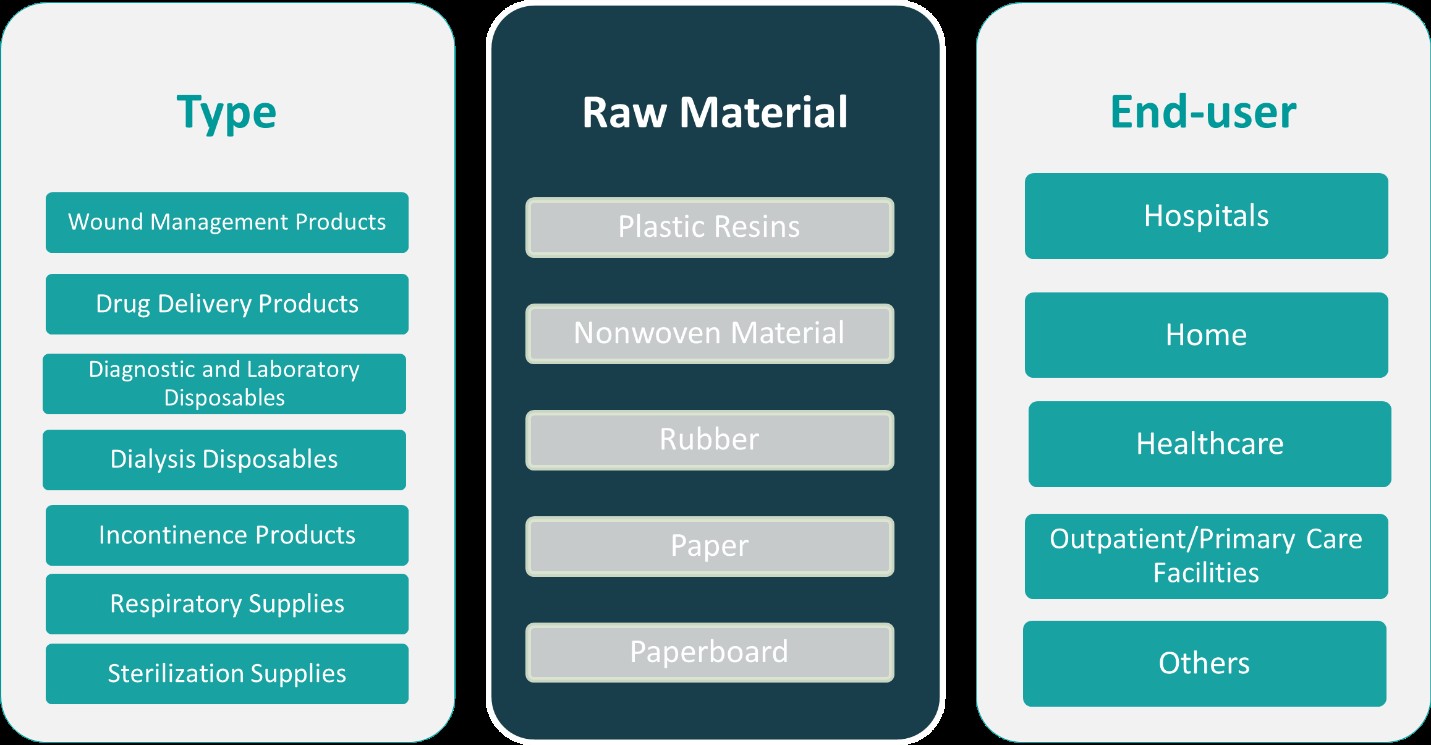

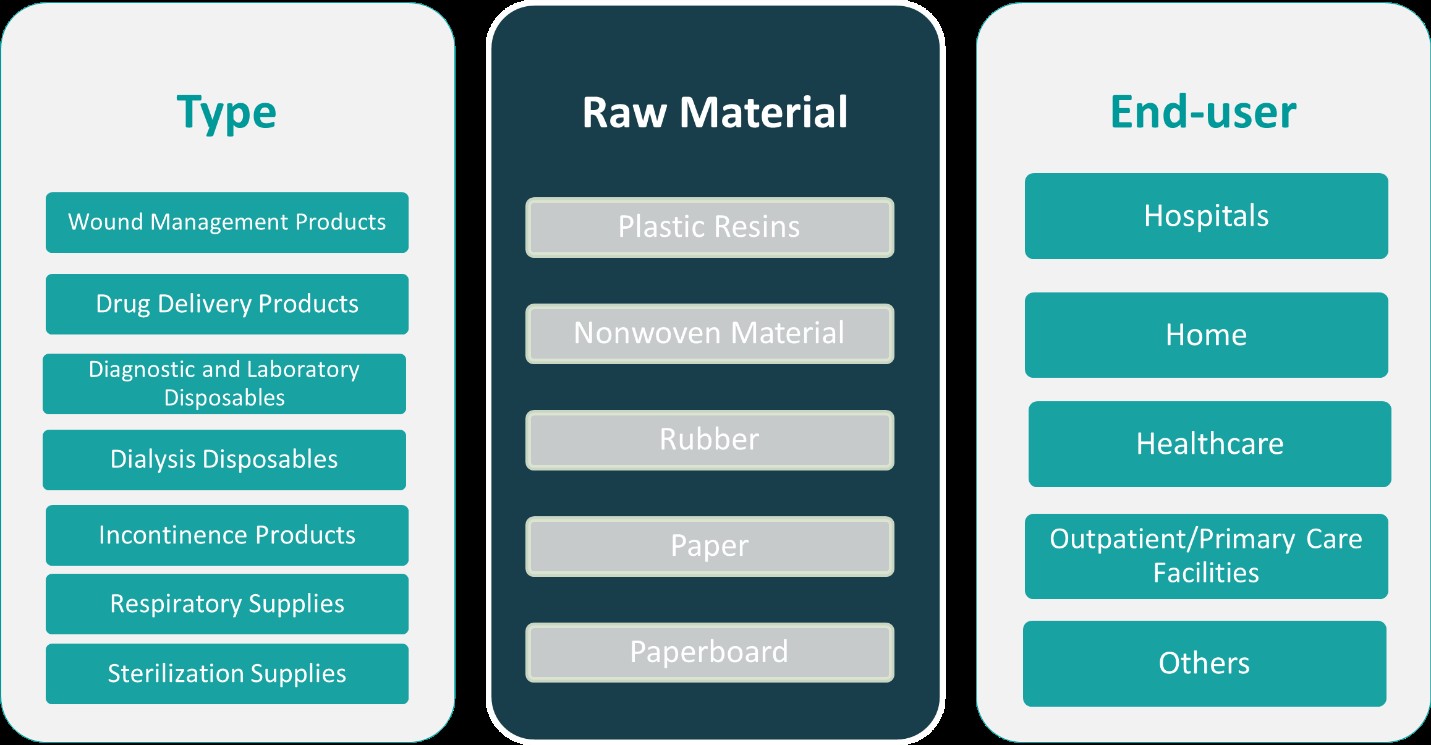

This report segments the South Korea Disposable Medical Supplies Market as follows:

Market Drivers

Growing Aging Population and Rising Chronic Disease Burden

South Korea is undergoing a significant demographic shift, with a rapidly aging population. For instance, the Korean Statistical Information Service (KOSIS) reports that by 2032, over 25% of the population is projected to be aged 65 and above. Aging individuals are more prone to chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders, which require frequent medical attention and continuous use of disposable medical supplies like gloves, syringes, catheters, and wound care products. This demographic trend directly contributes to the growing consumption of such products, driving the market forward.

Heightened Focus on Infection Control and Hygiene Standards

Post-pandemic awareness of hygiene, sterilization, and infection prevention has become a critical driver of the disposable medical supplies market. For instance, the Ministry of Food and Drug Safety (MFDS) has revised its K-GMP regulations to prioritize the use of single-use medical items in healthcare facilities. South Korean healthcare institutions are increasingly prioritizing the use of single-use medical items to prevent cross-contamination and hospital-acquired infections (HAIs). Government health agencies and private hospitals alike have implemented stricter protocols that favor disposable items over reusable ones, ensuring patient safety and regulatory compliance. This shift in standard operating procedures has boosted the consistent demand for a range of disposable products across hospitals, outpatient clinics, diagnostic centers, and long-term care facilities.

Advancements in Medical Technology and Product Innovation

Innovations in material science and manufacturing processes are propelling the disposable medical supplies market in South Korea. Manufacturers are developing products that are more efficient, safer, and environmentally sustainable. Biodegradable materials, improved fluid absorption technology, and ergonomically designed disposables are gaining traction among healthcare providers. Furthermore, the integration of automation and digital monitoring capabilities into some disposable diagnostic devices enhances the accuracy and ease of use, particularly in home healthcare settings. These advancements not only meet clinical demands but also cater to the growing preference for convenience and quality in medical care.

Expanding Home Healthcare and Outpatient Services

With a growing emphasis on patient-centered care and healthcare cost reduction, home healthcare and outpatient services are expanding across South Korea. Patients increasingly seek treatments in non-hospital settings, which fuels the demand for easy-to-use, pre-packaged, and safe disposable supplies. Products such as single-use insulin pens, wound dressings, diagnostic strips, and incontinence care items are widely used in home care environments. The government’s support for community-based care, along with insurance coverage for home treatments, further accelerates this trend. As a result, disposable medical supplies are not only confined to hospitals but are becoming essential across a broader spectrum of healthcare delivery models.

Market Trends

Technological Advancements and Product Innovation

One of the most significant trends shaping the disposable medical supplies market in South Korea is the rapid advancement in medical technology and the innovation of product design. For instance, the Korea Health Industry Development Institute (KHIDI) highlights the adoption of next-generation syringes with safety-engineered mechanisms to prevent needle-stick injuries. Leading manufacturers are integrating smart features and ergonomic improvements into their disposable products to enhance usability, patient safety, and healthcare outcomes. For instance, next-generation syringes with safety-engineered mechanisms and advanced wound dressings with antimicrobial properties are being widely adopted. The development of eco-friendly and biodegradable disposable items is also gaining momentum, as environmental concerns influence product preferences in both public and private healthcare institutions. These innovations are not only meeting stricter regulatory standards but are also positioning South Korean products competitively on the global stage.

Increased Emphasis on Infection Prevention and Sterility

Since the COVID-19 pandemic, there has been a marked shift in awareness and policy surrounding infection prevention and control across South Korea’s healthcare system. For instance, the Ministry of Food and Drug Safety (MFDS) has implemented stricter guidelines mandating the use of disposable face masks, gloves, and surgical drapes in high-risk settings like intensive care units and operating rooms. Healthcare providers are increasingly opting for single-use items to uphold stricter hygiene protocols, particularly in high-risk settings like intensive care units, operating rooms, and emergency departments. This focus on sterility continues to drive consistent demand for a wide range of disposable supplies, and the trend is expected to remain strong, even in a post-pandemic environment, as part of standard operating procedures.

Growth of Home Healthcare and Remote Patient Management

The increasing prevalence of chronic conditions such as diabetes, cardiovascular diseases, and cancer has led to a rising need for home-based care and outpatient services. South Korea’s aging population further accelerates this demand, with many elderly individuals opting for treatment and monitoring from the comfort of their homes. Consequently, there is a surge in the use of disposable medical items like insulin pens, infusion sets, diagnostic test kits, and wound care products. Government support for community healthcare programs and the expansion of telemedicine infrastructure are reinforcing this shift. Patients and caregivers are also showing a clear preference for disposable, easy-to-use products that ensure safety and reduce the burden of sterilization and maintenance.

Medical Tourism and Expansion of Ambulatory Care Services

South Korea is recognized as a global leader in medical tourism, attracting thousands of international patients annually for cosmetic procedures, fertility treatments, and specialized surgeries. This influx of patients has increased the volume of outpatient and short-stay surgical procedures, thereby boosting the demand for high-quality disposable medical supplies. Ambulatory care centers and private clinics are relying heavily on single-use items to deliver quick, safe, and hygienic services. Moreover, the growing adoption of minimally invasive techniques, which typically involve shorter recovery times and require precision-focused disposables, supports this trend. As medical tourism and outpatient care continue to flourish, the disposable medical supplies market is set to benefit significantly from this parallel growth.

Market Challenges Analysis

Regulatory Pressures and Environmental Concerns

One of the primary challenges facing the South Korea disposable medical supplies market is the increasing regulatory pressure regarding product safety, quality assurance, and environmental sustainability. For instance, the Ministry of Food and Drug Safety (MFDS) has implemented revised K-GMP regulations that mandate stringent quality control measures for medical disposables. While these regulations enhance healthcare standards, they also impose significant compliance costs on manufacturers, especially smaller players with limited resources. Furthermore, the global emphasis on reducing plastic waste has intensified scrutiny over the use of non-biodegradable materials in disposable products. South Korea’s environmental policies are evolving to favor sustainable and recyclable solutions, compelling manufacturers to invest in eco-friendly raw materials and adopt greener production processes. This transition, although necessary, increases production costs and limits the availability of affordable alternatives, posing a challenge to businesses trying to balance cost-efficiency with environmental responsibility.

Price Sensitivity and Competitive Market Dynamics

The South Korean healthcare system emphasizes cost containment, leading to price sensitivity among healthcare providers, particularly in public hospitals and insurance-supported facilities. As a result, there is constant pressure on suppliers to offer competitively priced disposable products without compromising quality. This cost-driven procurement environment creates challenges for manufacturers attempting to innovate or differentiate through advanced features or sustainable materials. Additionally, the market is highly competitive, with a mix of domestic producers and multinational corporations vying for market share. While global brands often bring technological superiority and brand recognition, local manufacturers leverage lower production costs and proximity advantages. This intense competition compresses profit margins and limits pricing flexibility. Moreover, supply chain disruptions—such as those witnessed during the COVID-19 pandemic—highlight the sector’s vulnerability to global shortages of raw materials, logistics delays, and dependence on imported components. These challenges collectively create a complex environment in which companies must remain agile, cost-efficient, and innovative to maintain long-term competitiveness.

Market Opportunities

The South Korea disposable medical supplies market presents numerous growth opportunities driven by evolving healthcare demands and technological innovation. With the country’s aging population steadily increasing, there is a growing need for long-term care and chronic disease management, which relies heavily on the consistent use of disposable medical products. This demographic shift offers strong market potential, particularly for items such as wound dressings, incontinence products, disposable syringes, and diagnostic kits. Additionally, the government’s ongoing efforts to expand and modernize healthcare infrastructure, including digital health systems and community-based care, are fostering a favorable environment for the broader adoption of disposable supplies across primary, secondary, and home healthcare settings.

Moreover, the increasing integration of advanced materials and eco-friendly production methods opens up new avenues for innovation and differentiation in the market. Companies investing in biodegradable and sustainable disposables are likely to benefit from rising environmental consciousness among healthcare providers and policymakers. There is also a significant opportunity in expanding the role of disposable devices in telemedicine and remote patient monitoring, where ease of use, hygiene, and portability are critical. As South Korea continues to strengthen its position as a hub for medical tourism and outpatient procedures, the demand for reliable, high-quality disposable products will grow in tandem. These factors collectively create a dynamic and attractive market landscape for both domestic manufacturers and international players seeking to capitalize on South Korea’s advanced healthcare system and growing patient needs.

Market Segmentation Analysis:

By Type:

The South Korea disposable medical supplies market is segmented into wound management products, drug delivery products, diagnostic and laboratory disposables, dialysis disposables, and incontinence products. Among these, wound management products and diagnostic disposables represent a significant share due to the increasing prevalence of chronic wounds, diabetic ulcers, and infectious diseases requiring frequent testing. The demand for drug delivery products—such as syringes, IV sets, and infusion pumps—has also increased, driven by rising chronic conditions like diabetes and cancer. Incontinence products are gaining traction with the aging population, which continues to drive their consistent use in both hospitals and home care environments. Dialysis disposables are expected to grow steadily, supported by advancements in renal care and an increase in end-stage renal disease cases. Each segment reflects the broader trend of moving toward patient-centric, hygienic, and single-use solutions, highlighting the essential role disposable products play across all levels of care within South Korea’s evolving healthcare landscape.

By Raw Material:

Based on raw material, the market is categorized into plastic resins, nonwoven materials, rubber, paper, and paperboard. Plastic resins dominate the segment due to their versatility, cost-effectiveness, and ease of mass production, making them essential in manufacturing syringes, catheters, and IV sets. Nonwoven materials are increasingly used in products like surgical masks, gowns, and drapes, especially in infection-prone environments, due to their breathability and protective properties. Rubber materials, commonly used in gloves and tubing, remain critical for their flexibility and durability. Meanwhile, paper and paperboard are gaining relevance, particularly in sterile packaging and disposable medical packaging solutions, offering a biodegradable alternative to plastics. The rise in eco-conscious healthcare policies is creating opportunities for innovations in sustainable materials, especially nonwovens and recyclable paper-based disposables. As healthcare providers in South Korea continue to balance performance, safety, and environmental impact, raw material selection becomes a crucial factor in product development and market competitiveness.

Segments:

Based on Type:

- Wound Management Products

- Drug Delivery Products

- Diagnostic and Laboratory Disposables

- Dialysis Disposables

- Incontinence Products

Based on Raw Material:

- Plastic Resins

- Nonwoven Material

- Rubber

- Paper

- Paperboard

Based on End- User:

- Hospitals

- Home

- Healthcare

- Outpatient/Primary Care Facilities

- Others

Based on the Geography:

- Seoul Metropolitan Region

- Gyeonggi Province

- Busan and Ulsan Regions

- Daegu Region

Regional Analysis

Seoul Metropolitan Region

The Seoul Metropolitan Region holds the dominant position in the South Korean disposable medical supplies market, accounting for approximately 38% of the total market share. As the capital and most densely populated region, Seoul is home to some of the country’s largest and most advanced healthcare institutions, including tertiary hospitals, university-affiliated medical centers, and specialized surgical clinics. This region benefits from high healthcare spending, a strong emphasis on quality care, and significant medical tourism activity, which increases the demand for a wide range of disposable products. Items such as surgical gloves, wound dressings, and diagnostic kits see particularly high consumption in Seoul due to its concentration of high-volume, high-acuity medical procedures. Additionally, the presence of key distributors and regulatory agencies in the region further supports efficient supply chain operations.

Gyeonggi Province

The Gyeonggi Province, surrounding the capital region, contributes to around 27% of the national market share for disposable medical supplies. With a rapidly growing population and expanding suburban healthcare infrastructure, Gyeonggi serves as a critical support region to Seoul, housing many secondary hospitals, eldercare centers, and outpatient clinics. The region has witnessed increased demand for home healthcare products and chronic disease management supplies, including incontinence products, drug delivery devices, and nonwoven disposables. Gyeonggi is also a strategic base for several domestic manufacturers, allowing for faster distribution and lower logistics costs. As more residents seek convenient and preventive healthcare services, the demand for disposable items in home and community settings is expected to rise steadily.

Busan and Ulsan Regions

The Busan and Ulsan Regions jointly represent approximately 19% of the South Korean disposable medical supplies market. Busan, being the second-largest city, hosts several large hospitals, while Ulsan’s industrial background contributes to occupational health demands. Together, these regions serve the southeastern population and support a growing number of outpatient procedures, rehabilitation centers, and public health initiatives. There is a rising need for disposable items such as surgical gowns, masks, syringes, and dialysis consumables. Busan’s medical tourism and its push to become a healthcare innovation hub further enhance its market potential.

Daegu Region

The Daegu Region captures around 16% of the market share. Known for its innovation-driven healthcare clusters and regional research institutions, Daegu is a center for medical R&D and localized healthcare services. The region has a strong network of hospitals and rehabilitation centers, especially for the elderly, fueling the demand for incontinence products, wound care items, and diagnostic disposables. Daegu’s commitment to smart healthcare solutions is also fostering interest in environmentally friendly and technologically advanced disposable supplies, contributing to the evolution of the regional market.

Key Player Analysis

- Smith+Nephew

- Shanghai Neo-Medical Co., Ltd

- Procter & Gamble

- Principle Business Enterprises, Inc

- Ontex

- Medtronic

- Nu-Life Medical & Surgical Supplies Inc

- Narang Medical Limited

- Molnlycke Health Care

- Mellon Medical B.V.

- MedGyn Products, Inc

- MED-CON Inc.

Competitive Analysis

The South Korea disposable medical supplies market is highly competitive, with both global and local players striving for market dominance. Leading international companies such as Smith+Nephew, Medtronic, Procter & Gamble, and Molnlycke Health Care have established strong presences in the region due to their advanced product portfolios and technological innovations. These players leverage their global networks, extensive research and development, and brand recognition to cater to the growing demand for high-quality disposable medical products. For example, Medtronic’s diverse product offerings in surgical, wound care, and diagnostic disposables provide a competitive edge in hospitals and outpatient clinics. These players emphasize a broad product portfolio that includes surgical disposables, wound care items, and diagnostic tools, ensuring a diverse offering to meet the needs of various healthcare institutions. Domestic manufacturers, on the other hand, capitalize on their proximity to local markets, which allows for more flexible and cost-effective production and distribution. These companies often focus on offering competitive pricing while meeting the local demand for medical disposables in hospitals, clinics, and home healthcare settings. Innovation is a key focus for many competitors, with an increasing emphasis on sustainable and eco-friendly materials, particularly as environmental regulations become more stringent. Companies are also focusing on enhancing product safety and improving the user experience by incorporating advanced features into disposables. As a result, competition remains strong, with companies vying for market share through technological advancements, cost leadership, and regulatory compliance.

Recent Developments

- In March 2025, At the AAOS Annual Meeting, Smith+Nephew introduced the TESSA Spatial Surgery System, a 510(k)-pending technology combining augmented reality and advanced imaging for arthroscopic surgeries.

- In March 2025, Ontex inaugurated a new R&D center in Segovia, Spain, focusing on sustainable feminine care innovations and eco-friendly production processes.

- In May 2024, PBE invested in expanding production capacity for plus-size incontinence products, launching new 3XL disposable pull-on underwear with breathable materials to enhance comfort and skin health.

- In 2024, Medtronic initiated the limited release of its Evolut FX+ Transcatheter Aortic Valve Replacement device for minimally invasive heart surgeries.

- In May 2023, P&G acquired an established antiseptic brand to strengthen its hygiene portfolio, reflecting a strategic expansion into the personal hygiene market.

Market Concentration & Characteristics

The South Korea disposable medical supplies market exhibits a moderate level of concentration, with a mix of global leaders and local manufacturers driving competition. Major international players dominate the market in terms of innovation, technological advancement, and global reach. However, regional players remain highly competitive by offering cost-effective solutions and leveraging strong local networks. The market is characterized by high product differentiation, with companies constantly innovating to meet evolving healthcare demands, such as the need for eco-friendly and patient-safe products. Regulatory compliance is crucial, with strict standards governing product quality, sterilization, and packaging. Additionally, the market is shaped by the growing trend of home healthcare, increasing demand for chronic disease management supplies, and a rising focus on infection prevention. As healthcare providers increasingly prioritize disposable medical supplies for their efficiency, hygiene, and cost-effectiveness, the market is expected to continue evolving, with both global and local players adapting to emerging needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Raw Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- South Korea’s disposable medical supplies market is expected to grow due to an aging population and increasing healthcare demands.

- Advancements in technology will lead to more efficient and cost-effective production processes for medical supplies.

- Rising awareness about infection control and safety protocols will drive demand for disposable products.

- The global market expansion will offer South Korean manufacturers opportunities for international growth and export.

- Government support through healthcare reforms and initiatives will enhance the local production capacity for disposable medical products.

- South Korea’s strong research and development sector will foster innovation in disposable medical supplies, improving quality and functionality.

- Increased investment in healthcare infrastructure will lead to a higher consumption of disposable medical supplies in hospitals and clinics.

- Growing emphasis on environmental sustainability may lead to the development of eco-friendly disposable medical products.

- South Korea’s robust manufacturing capabilities and supply chain will help maintain competitive pricing for medical supplies.

- The COVID-19 pandemic has heightened awareness of the need for disposable medical products, influencing future market dynamics.