Market Overview

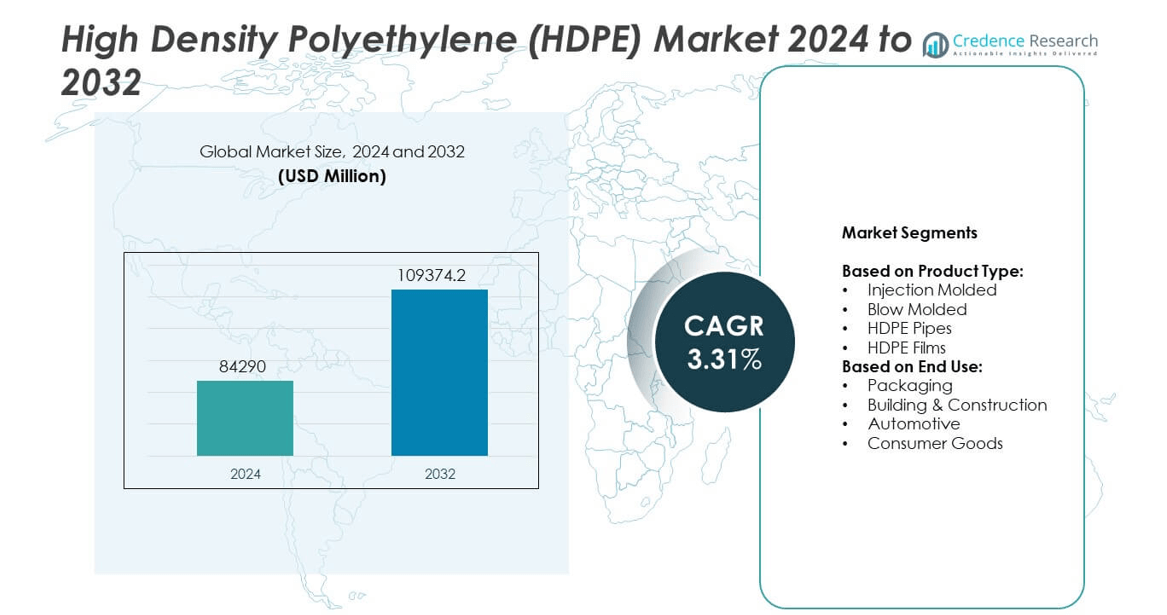

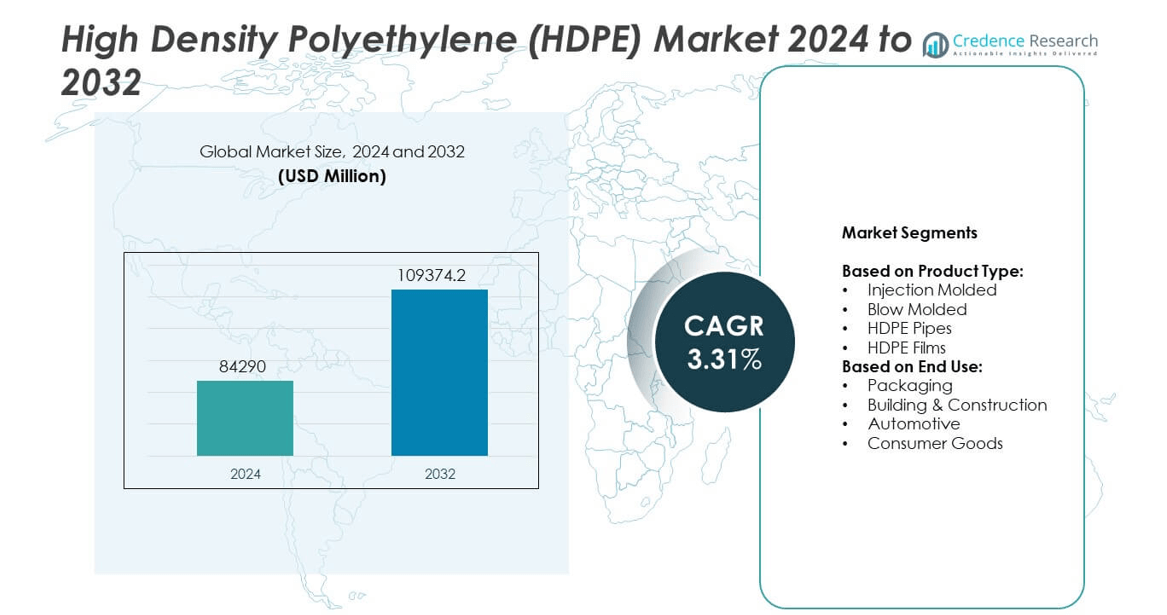

High Density Polyethylene (HDPE) Market size was valued at USD 84,290 million in 2024 and is anticipated to reach USD 109,374.2 million by 2032, at a CAGR of 3.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Density Polyethylene (HDPE) Market Size 2024 |

USD 84,290 million |

| High Density Polyethylene (HDPE) Market, CAGR |

3.31% |

| High Density Polyethylene (HDPE) Market Size 2032 |

USD 109,374.2 million |

The High Density Polyethylene (HDPE) market grows through strong demand in packaging, construction, and automotive industries, supported by its durability, lightweight properties, and recyclability. Rising urbanization and infrastructure projects increase use in pipes and fittings, while automakers adopt HDPE to enhance fuel efficiency. Sustainability initiatives encourage higher integration of recycled HDPE in consumer and industrial applications. Advances in processing technology improve product performance and expand applications. Growing retail and e-commerce activities further strengthen market momentum across global regions.

The High Density Polyethylene (HDPE) market shows strong presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with Asia Pacific leading growth due to rapid industrialization and infrastructure projects. North America and Europe emphasize sustainability and advanced packaging solutions, while Latin America and the Middle East expand through construction and utilities. Key players shaping the market include Dow, Exxon Mobil Corporation, SABIC, and LyondellBasell Industries Holdings BV, all focusing on innovation and capacity expansion.

Market Insights

- The High Density Polyethylene (HDPE) market was valued at USD 84,290 million in 2024 and is projected to reach USD 109,374.2 million by 2032, growing at a CAGR of 3.31%.

- Rising demand in packaging drives growth due to durability, safety, and recyclability, supported by expansion of e-commerce and retail sectors.

- Construction and infrastructure projects increase use of HDPE pipes and fittings, strengthened by urbanization and government investments in water management and sanitation.

- Key trends include higher adoption of recycled HDPE, digital manufacturing technologies, and innovation in material properties for advanced applications.

- Leading players such as Dow, Exxon Mobil Corporation, SABIC, LyondellBasell, and Braskem compete through research, capacity expansion, and partnerships focused on sustainability.

- Market restraints include volatile raw material prices linked to crude oil fluctuations and growing competition from biodegradable alternatives under stricter environmental policies.

- Asia Pacific leads growth with rapid industrialization, while North America and Europe emphasize sustainable packaging, and Latin America and the Middle East & Africa expand through infrastructure and utilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand in Packaging Applications

High Density Polyethylene (HDPE) market expands due to its strong use in packaging. Its lightweight, durable, and resistant nature makes it ideal for bottles, containers, and films. It serves the food, beverage, and personal care industries where safety and shelf life matter. Manufacturers prefer it because of cost efficiency and recyclability. The packaging sector pushes demand with rising e-commerce and consumer goods consumption. It becomes a reliable choice for industries seeking both performance and sustainability. Growing retail activities worldwide strengthen its role further.

- For instance, Coca-Cola HBC, a bottling partner of The Coca-Cola Company, reported saving 300 metric tonnes of HDPE in one year by light-weighting bottle closures on its juice and tea portfolios in the Czech Republic, Hungary, Poland, and Romania. The initiative, which also included sparkling soft drinks in Nigeria, reduced CO2 emissions by over 600 tonnes

Rising Adoption in Construction and Infrastructure

The construction industry creates steady growth for the High Density Polyethylene (HDPE) market. It is used in pipes, fittings, and geomembranes for durability and chemical resistance. Its flexibility and strength make it suitable for water supply and sewage systems. Infrastructure expansion in emerging economies drives higher consumption. It offers long service life, reducing replacement and maintenance costs for projects. Government investments in housing, sanitation, and urban utilities enhance adoption. The building sector continues to rely on it for performance-driven solutions.

- For instance, GAIL (India) doubled its polymer plant capacity to 810,000 tonnes per year to serve PE pipe demand

Increasing Use in Automotive and Industrial Applications

High Density Polyethylene (HDPE) market benefits from rising use in automotive and industrial parts. It is lightweight, strong, and chemical resistant, making it ideal for fuel tanks and containers. Automakers prefer it to reduce vehicle weight and improve fuel efficiency. Industrial players use it in chemical storage, packaging, and machinery components. Growing emphasis on cost control and durability drives its penetration in these segments. The shift toward lighter and efficient materials supports growth. Its adaptability ensures steady preference in complex applications.

Sustainability and Recycling Initiatives Driving Adoption

The High Density Polyethylene (HDPE) market grows with global focus on sustainability. Recycling initiatives strengthen demand by reducing environmental impact. It is widely recycled, which improves acceptance among regulators and manufacturers. Governments set stricter rules on plastics, pushing industries to adopt recyclable solutions. Companies invest in circular economy programs, promoting recycled HDPE use. Sustainable packaging and green infrastructure rely heavily on it for compliance. The strong eco-friendly profile increases long-term relevance across industries.

Market Trends

Advancements in Packaging Solutions and Material Innovation

High Density Polyethylene (HDPE) market experiences notable trends through innovation in packaging. It gains preference in food, beverage, and personal care packaging due to safety and strength. Companies invest in advanced barrier properties to extend product shelf life. Lightweight and flexible HDPE designs address growing consumer convenience needs. E-commerce growth further accelerates packaging demand with secure and durable materials. It helps manufacturers balance cost efficiency with sustainability. The packaging trend continues to shape demand patterns globally.

- For instance, Incoplas introduced lightweight HDPE bottles up to 5 liters using ISBM resin SB 1359 from Total — these bottles feature significantly lower weight than traditional blow-molded bottles, while maintaining mechanical strength, their parnership are from 2012 to 2015.

Integration of Recycled Content and Circular Economy Practices

Sustainability drives a strong trend within the High Density Polyethylene (HDPE) market. Companies focus on recycled content to reduce environmental footprints. It finds wider use in consumer goods, pipes, and packaging with recycled blends. Global brands introduce products with high recycled HDPE content to meet regulations. Recycling technologies improve quality and consistency of the material. Government policies support the circular economy model, driving adoption. It strengthens the eco-friendly profile, expanding applications across regulated industries.

- For instance, Borealis’s mtm plastics unit processes around 60,000 tonnes of post-consumer plastic waste annually into high-quality polyolefin recyclates, including HDPE and PP, for injection moulding and other applications.

Rising Role of Digital Manufacturing and Process Optimization

High Density Polyethylene (HDPE) market trends highlight technology adoption in production. Automation and advanced molding improve quality and efficiency. It supports faster production cycles and consistent material performance. Manufacturers adopt digital monitoring to enhance process control and reduce waste. Smart technologies optimize energy use, lowering operational costs. The push for precision and sustainability influences large-scale adoption of digital tools. It enables suppliers to meet rising global demand with higher reliability.

Expansion into Emerging Economies and Infrastructure Projects

The High Density Polyethylene (HDPE) market shows growth opportunities in developing regions. Rapid urbanization boosts use in water supply, sewage, and industrial systems. It is vital in infrastructure projects due to durability and resistance. Investments in housing, transport, and energy create consistent demand. Rising industrialization increases adoption in packaging and construction applications. Governments support modernization of utilities with HDPE-based solutions. It ensures growth momentum, particularly in Asia Pacific, Latin America, and Africa.

Market Challenges Analysis

Fluctuations in Raw Material Prices and Supply Chain Constraints

High Density Polyethylene (HDPE) market faces challenges due to volatile crude oil prices. It depends heavily on petrochemical feedstocks, making costs sensitive to global oil fluctuations. Supply chain disruptions add pressure, particularly during geopolitical tensions and trade restrictions. Rising transportation costs and shortages in logistics infrastructure worsen uncertainties for manufacturers. It impacts pricing stability, affecting competitiveness across global markets. Companies often struggle to balance profitability with demand growth during periods of high volatility. Consistent raw material supply remains a key concern for producers.

Environmental Regulations and Rising Competition from Alternatives

The High Density Polyethylene (HDPE) market experiences challenges from strict environmental policies. Governments enforce tighter rules on plastic waste management and recycling standards. It increases compliance costs for producers, requiring continuous investment in sustainable practices. Growing consumer preference for biodegradable alternatives also limits growth potential. Industries explore paper, bioplastics, and composites, creating competition for HDPE applications. Regulatory frameworks in developed regions demand higher recycling targets, putting pressure on manufacturers. It pushes companies to innovate while addressing environmental scrutiny.

Market Opportunities

Growing Scope in Sustainable Packaging and Recycling Solutions

High Density Polyethylene (HDPE) market presents opportunities through sustainable packaging initiatives. Brands adopt recyclable HDPE to meet consumer demand for eco-friendly products. It is widely used in food, beverage, and personal care packaging, where durability and safety matter. Recycling advancements improve the quality of post-consumer HDPE, creating reliable supply for industries. Global commitments to circular economy practices drive broader adoption of recycled HDPE. Companies leverage this trend to enhance brand reputation and regulatory compliance. It positions HDPE as a preferred solution in the evolving packaging landscape.

Expanding Applications in Infrastructure and Emerging Economies

The High Density Polyethylene (HDPE) market benefits from rising demand in developing regions. Infrastructure projects in water management, sanitation, and energy accelerate its use in pipes and fittings. It offers long service life, corrosion resistance, and cost efficiency, making it suitable for critical systems. Urbanization and industrial growth across Asia Pacific, Africa, and Latin America create consistent opportunities. Governments prioritize modernization of utilities and housing, strengthening demand for HDPE-based solutions. Renewable energy projects also support adoption in protective and structural components. It continues to expand its footprint across diverse industrial and civic applications.

Market Segmentation Analysis:

By Product Type:

Injection molded, blow molded, HDPE pipes, and HDPE films. Injection molded HDPE is widely used for containers, crates, caps, and household products due to its strength and versatility. It provides manufacturers with cost efficiency and consistency in large-scale production. Blow molded HDPE finds strong demand in bottles, tanks, and drums, benefiting from durability and chemical resistance. It plays a vital role in industries requiring safe liquid storage and transportation. HDPE pipes remain a critical product type, serving water supply, sewage, and industrial systems with long service life and low maintenance. HDPE films are adopted in packaging, agriculture, and industrial applications where lightweight, flexible, and durable solutions are required.

- For instance, Reube’s Plastics Company manufactures injection-molded HDPE milk crates in standard sizes, such as a rectangular crate measuring 18.75″ (L) × 13.00″ (W) × 10.75″ (H). The company uses a variety of injection molding machines to produce its products, which are designed to be durable while maintaining a manageable weight. However, the specific weight of 4.00 lb and the use of a Toshiba 610-ton injection molding machine for this particular product are not details that are publicly confirmed.

By End-Use:

The High Density Polyethylene (HDPE) market serves packaging, building and construction, automotive, and consumer goods. Packaging holds the largest share due to the material’s protective qualities, recyclability, and suitability for food and personal care applications. It supports e-commerce and retail growth by providing secure, lightweight, and sustainable solutions. Building and construction rely on HDPE for pipes, fittings, and geomembranes, driven by infrastructure projects in both developed and emerging economies. Automotive manufacturers use it in fuel tanks, containers, and components to reduce weight and improve efficiency. Consumer goods include household items, toys, and furniture, benefiting from HDPE’s durability and design flexibility. Each segment strengthens the market outlook by addressing diverse industrial, commercial, and consumer needs.

- For instance, The Cary Company distributes HDPE blow molded tanks with capacities ranging from 275 gal. to 330 gal., equipped with screw lids, O-ring gaskets, openings, and stackable design.

Segments:

Based on Product Type:

- Injection Molded

- Blow Molded

- HDPE Pipes

- HDPE Films

Based on End Use:

- Packaging

- Building & Construction

- Automotive

- Consumer Goods

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant position in the High Density Polyethylene (HDPE) market with a share of 21%. The region benefits from established industries such as packaging, automotive, and construction, which continue to rely on HDPE for efficiency and performance. Strong demand arises from the packaging sector, where food and beverage companies prefer HDPE due to its safety, durability, and recyclability. Automotive applications also support regional growth, with manufacturers adopting HDPE components to reduce vehicle weight and comply with fuel efficiency standards. Construction activities, including water supply and sewage systems, further drive demand for HDPE pipes and fittings. Stringent environmental regulations across the United States and Canada promote the use of recyclable materials, strengthening HDPE’s position. Ongoing investments in infrastructure modernization and sustainable packaging solutions ensure steady demand in the coming years.

Europe

Europe represents 19% of the High Density Polyethylene (HDPE) market share, supported by strict environmental policies and high recycling targets. The packaging sector drives significant demand, with regulatory frameworks encouraging recyclable materials for food, beverages, and consumer goods. The automotive industry also plays an important role, as leading manufacturers adopt lightweight HDPE materials to improve energy efficiency and meet emission norms. Construction remains another growth area, particularly in water management and infrastructure projects across Western and Eastern Europe. Europe demonstrates strong leadership in sustainability initiatives, which creates opportunities for recycled HDPE applications. The region’s commitment to the circular economy pushes industries to integrate recycled content, further strengthening HDPE demand. Growing industrial innovation ensures that HDPE maintains a strong presence across multiple applications in the European market.

Asia Pacific

Asia Pacific dominates the High Density Polyethylene (HDPE) market with the largest share of 42%. Rapid industrialization, urbanization, and infrastructure development fuel significant demand across packaging, construction, and automotive sectors. China, India, and Southeast Asian countries drive consumption due to large-scale industrial projects and rising consumer demand. Packaging applications expand rapidly, supported by growing retail and e-commerce sectors in the region. Construction projects, particularly in water supply, sewage, and housing, boost demand for HDPE pipes and fittings. Automotive manufacturers adopt HDPE in vehicles to improve efficiency and reduce costs, enhancing regional growth. The availability of raw materials and large-scale production capacities make Asia Pacific the global hub for HDPE supply and consumption. Continuous economic growth and infrastructure investments maintain the region’s dominance in the market.

Latin America

Latin America accounts for 9% of the High Density Polyethylene (HDPE) market share. Growth in the region is supported by infrastructure development, particularly in water management and urban utilities. Brazil and Mexico lead demand, driven by packaging applications in food, beverages, and consumer goods. Construction activities also contribute strongly, with HDPE pipes and fittings serving essential roles in sanitation and water supply. The automotive industry adopts HDPE for lightweight and durable components, reinforcing its use across multiple sectors. Recycling initiatives are gaining traction, helping HDPE align with sustainability goals in the region. Despite economic fluctuations, demand remains steady due to strong reliance on HDPE in everyday applications. Future growth is expected as governments invest in modernization of infrastructure and utilities.

Middle East & Africa

The Middle East & Africa holds 9% of the High Density Polyethylene (HDPE) market share. Strong demand comes from construction and infrastructure projects, particularly in water supply, sewage, and energy sectors. The packaging industry also expands, serving the food and consumer goods markets in growing urban centers. Governments across the region prioritize investment in utilities, creating consistent demand for HDPE-based solutions. The automotive and consumer goods industries adopt HDPE for durable and cost-effective applications. Rising focus on sustainability and recycling adds further opportunities for growth. Despite challenges in economic diversification, HDPE demand continues to strengthen due to its vital role in industrial and civic projects. The region remains a developing yet promising market for HDPE adoption across multiple industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- INEOS

- Braskem S.A

- Exxon Mobil Corporation

- Chevron Phillips Chemical Co.

- SABIC

- Borealis AG

- Formosa Plastics Corp.

- LyondellBasell Industries Holdings BV

- Dow

- LOTTE Chemical Corporation

- PetroChina Company Limited

- Abu Dhabi Polymers Company Ltd

Competitive Analysis

The leading players in the High Density Polyethylene (HDPE) market include Dow, Exxon Mobil Corporation, INEOS, SABIC, LyondellBasell Industries Holdings BV, LOTTE Chemical Corporation, Borealis AG, PetroChina Company Limited, Abu Dhabi Polymers Company Ltd., Formosa Plastics Corp., Braskem S.A, and Chevron Phillips Chemical Co. These companies drive competition through innovation, large-scale production, and global distribution networks. They invest heavily in research and development to improve product quality, recyclability, and application versatility. Strong focus on sustainable practices and integration of recycled HDPE enhances their market positioning.Intense competition exists in packaging, automotive, and construction sectors, where product differentiation depends on cost efficiency and compliance with environmental regulations. Leading producers expand capacities in emerging economies to secure access to growing demand. Strategic partnerships and joint ventures strengthen supply chains, ensuring reliable raw material sourcing and market reach. Players also adopt advanced manufacturing technologies to reduce costs and improve efficiency. The market environment encourages continuous innovation, particularly in sustainable packaging solutions and circular economy models. Competitive dynamics remain defined by global presence, production flexibility, and alignment with environmental standards, ensuring that leading companies maintain dominance while addressing evolving industry requirements.

Recent Developments

- In June 2025, Dow commenced operations at a new production unit in Freeport, Texas, designed to produce both Linear Low-Density Polyethylene (LLDPE) and High-Density Polyethylene (HDPE). The new facility adds 600,000 metric tons per year of polyethylene capacity and will primarily serve the export market, enhancing Dow’s resin portfolio and global export capabilities.

- In 2025, LyondellBasell licensed its polyolefin technologies to SHCCIG Yulin Chemical for a new petrochemical complex in China.

- In 2024, Borealis announced plans to install a semi-commercial compounding line in Belgium to process recyclates using the Borcycle-M technology.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The High Density Polyethylene (HDPE) market will see steady growth driven by packaging demand.

- Recycling initiatives will expand adoption of HDPE across regulated industries.

- Infrastructure development in emerging economies will support strong demand for HDPE pipes.

- Automotive manufacturers will increase use of HDPE to reduce vehicle weight.

- Digital manufacturing will improve production efficiency and material consistency.

- Sustainability goals will encourage higher use of recycled HDPE in consumer goods.

- Construction projects will rely on HDPE for water supply, sewage, and utility systems.

- Global brands will focus on circular economy practices to boost HDPE applications.

- Rising e-commerce will strengthen demand for HDPE-based packaging solutions.

- Innovation in material properties will expand HDPE use in advanced applications.