Market Overview

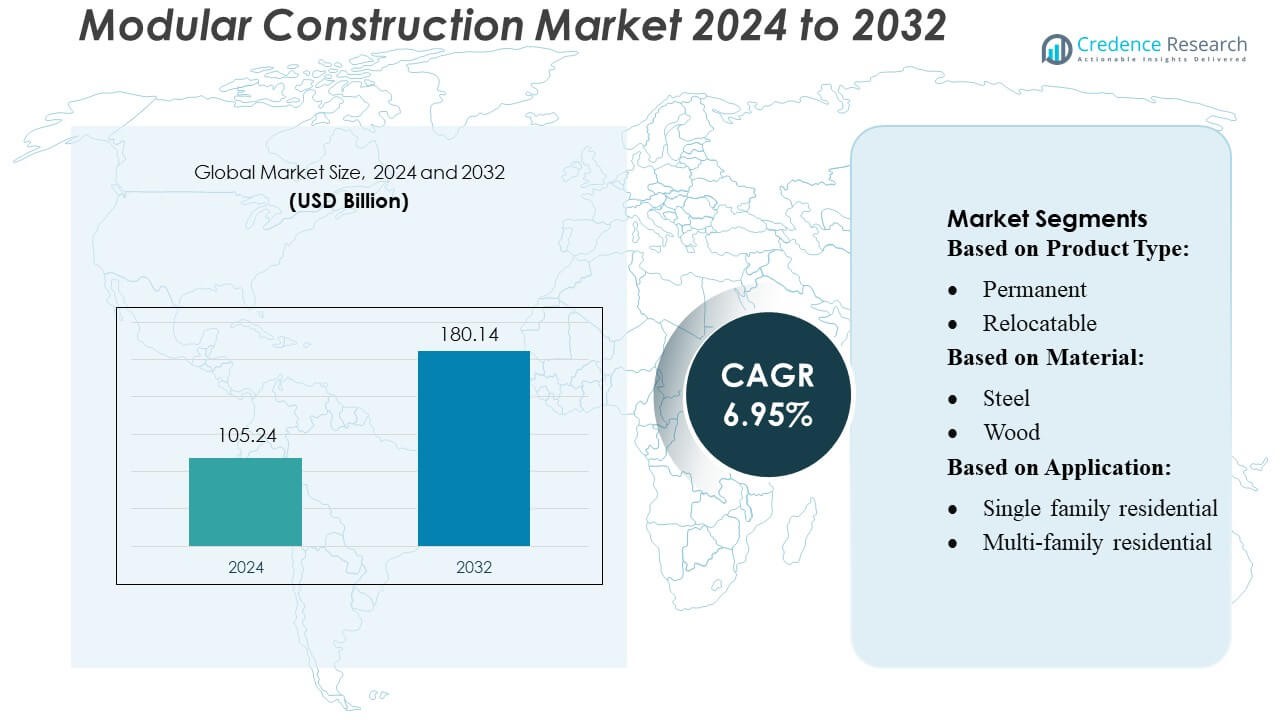

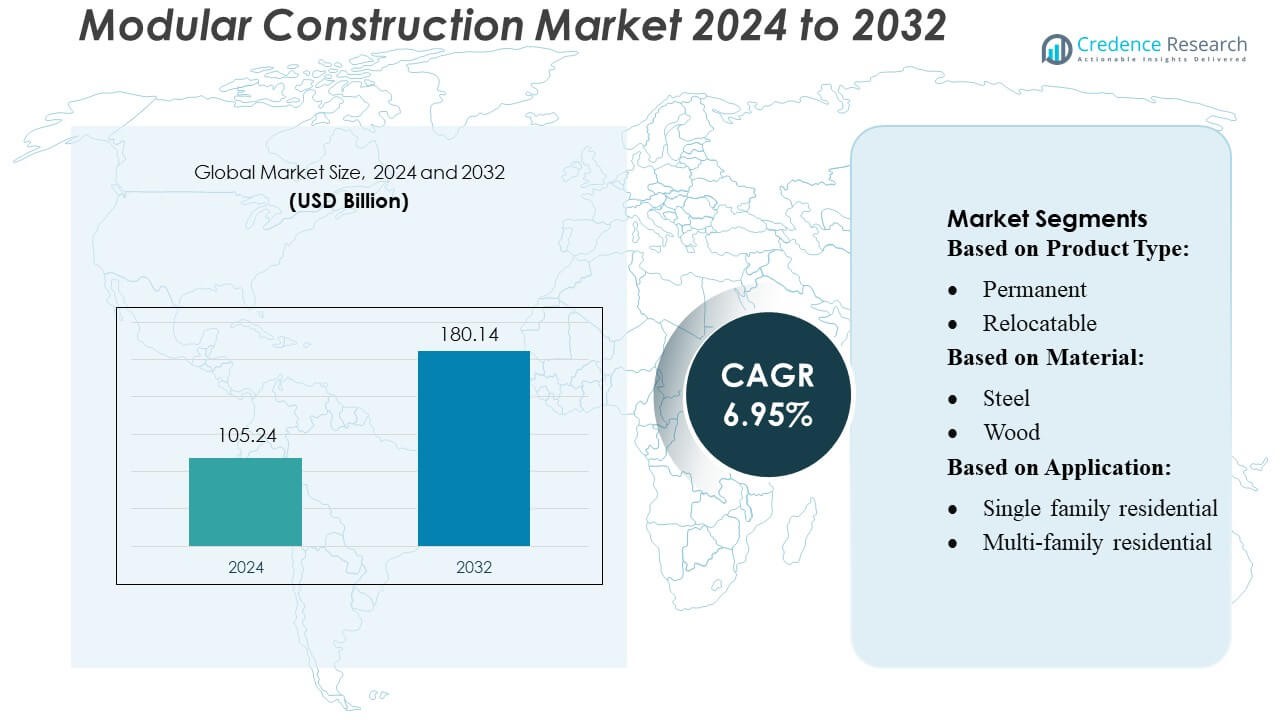

Modular Construction Market size was valued USD 105.24 billion in 2024 and is anticipated to reach USD 180.14 billion by 2032, at a CAGR of 6.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modular Construction Market Size 2024 |

USD 105.24 Billion |

| Modular Construction Market, CAGR |

6.95% |

| Modular Construction Market Size 2032 |

USD 180.14 Billion |

The modular construction market such as Premier Modular Limited, Skanska, LEUSBERG GmbH & Co KG, DuBox, Bouygues Construction, CIMC Modular Building Systems Holdings Co., Ltd., Wernick Group, LAING O’ROURKE, Red Sea International, and Sekisui House Ltd. aggressively expand their modular capabilities to address rising demand for scalable, sustainable construction. These firms leverage off-site production, digital design integration, and global partnerships to strengthen their competitive positions. Regionally, Asia-Pacific leads the global modular construction market, commanding approximately 47 % of revenue share, driven by rapid urbanization, strong manufacturing capabilities, and supportive government housing policies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The modular construction market size reached USD 105.24 billion in 2024 and is projected to hit USD 180.14 billion by 2032, registering a CAGR of 6.95% during the forecast period.

- Rising demand for faster project delivery, labor efficiency, and sustainable building methods drives broader adoption of volumetric and panelized modular systems across residential and commercial segments.

- Advanced manufacturing automation, BIM-enabled design, and standardized modular platforms shape the key market trends, enabling reduced construction time and improved cost predictability.

- Competitive intensity increases as major players expand global capacity and invest in digital fabrication, though challenges such as high initial setup costs and transportation constraints restrain wider penetration.

- Asia-Pacific dominates with nearly 47% market share, benefiting from large-scale urban development and strong factory-based production capacity, while the residential segment continues to lead overall adoption due to rapid housing demand.

Market Segmentation Analysis:

By Product Type

The permanent modular segment dominates the modular construction market, accounting for an estimated 65–70% share, driven by growing demand for high-quality, long-lifespan structures across residential, healthcare, and commercial sectors. Its market leadership stems from improved structural integrity, reduced lifecycle costs, and the ability to integrate advanced building systems with factory precision. Relocatable modular units capture the remaining share, supported by rising adoption in temporary offices, classrooms, and disaster-relief facilities; however, their growth is comparatively slower due to shorter service life and fewer customization capabilities.

- For instance, Novartis Cambridge Campus Expansion project, Skanska prefabricated mechanical, plumbing, lab gas, telecom-data, and electrical systems into custom rack modules in their warehouse, cutting 5,600 high-risk labor hours and saving eight weeks from the project schedule.

By Material

Steel leads the material segmentation with an estimated 45–50% share, supported by its superior strength-to-weight ratio, high recyclability, and ability to support multi-story modular buildings. Demand for steel modules continues to rise as developers prioritize durability, fire resistance, and long-term structural stability. Wood follows as a fast-growing material, driven by sustainability concerns and lower construction costs, particularly in low-rise residential applications. Concrete modules hold a moderate share, favored for sound insulation and thermal performance, while materials like aluminum, polyurethane, and glass fiber serve niche, lightweight, and specialty design requirements.

- For instance, KLEUSBERG GmbH & Co. KG (the company often confused with “Leusberg”) delivered a modular administration building in Zwickau comprising 236 steel modules, which were assembled into an 8,800 m² structure in just 28 days.

By Application

The multi-family residential segment holds the largest market share at roughly 35–40%, supported by urban housing shortages, faster project timelines, and improved cost efficiency delivered by modular manufacturing. Developers increasingly prefer modular methods to meet demand for affordable and mid-segment housing with consistent quality. Single-family residential units follow, driven by customization flexibility and reduced on-site labor needs. Offices, hospitality, and retail segments continue expanding due to rapid commercial project deployment. Healthcare and educational buildings also show strong uptake as modular designs allow scalable expansions, controlled manufacturing environments, and accelerated facility readiness.

Key Growth Drivers

- Rapid Project Delivery and Cost Efficiency

Accelerated construction timelines remain a primary growth driver in the modular construction market, as off-site manufacturing reduces on-site disruptions, labor requirements, and weather-related delays. Developers increasingly adopt modular solutions to shorten project schedules by up to 30–50% while lowering overall costs. The ability to conduct site preparation and module fabrication simultaneously enhances productivity and enables earlier revenue generation for commercial and residential projects. These efficiencies are particularly attractive for time-sensitive sectors such as healthcare, hospitality, and multifamily housing, where speed-to-market is a critical competitive advantage.

- For instance, DuBox facility produces 16 volumetric concrete modules per day, shifting 85% of work from on-site to factory conditions. This approach cut manpower requirements by 30% during the Red Sea Global project.

- Rising Demand for Sustainable and Energy-Efficient Buildings

Sustainability initiatives significantly drive modular construction adoption, as controlled factory environments reduce material waste by nearly 80% and improve energy efficiency across the building lifecycle. Modular units also support the integration of green technologies such as high-performance insulation, solar-ready modules, and low-carbon materials. Governments and developers are prioritizing eco-friendly construction methods to meet regulatory standards and ESG commitments. Additionally, modular buildings’ relocatable and recyclable components appeal to environmentally conscious consumers, strengthening demand across residential, commercial, and institutional applications.

- For instance, Bagneux modular middle school project, Bouygues prefabricated over 100 wooden modules off-site using roughly 131 kg/m² of bio-sourced materials.

- Growing Urbanization and Housing Shortages

Rapid urbanization and the global demand for affordable housing continue to propel modular construction. High-density cities face rising land costs and acute supply gaps, pushing developers to adopt faster, scalable building systems. Modular construction enables efficient production of multi-family units, student housing, and workforce accommodations without compromising quality. Its repeatable design capabilities allow standardized housing solutions while offering customization options. Governments increasingly support modular technologies through incentive programs and public housing initiatives, positioning modular construction as a viable path to meeting long-term residential demand.

Key Trends & Opportunities

- Technological Advancements in Modular Design and Automation

Digitalization is reshaping modular construction, with BIM-integrated workflows, automated fabrication, and advanced robotics enhancing precision and quality. Manufacturers increasingly use 3D volumetric design, digital twins, and AI-driven planning tools to reduce errors, optimize material use, and streamline supply chains. These technologies enable mass customization, faster prototyping, and improved collaboration between architects and engineers. As automation scales, production facilities achieve higher throughput, providing opportunities for developers to deliver large-scale residential, commercial, and institutional projects with consistent performance and minimized rework costs.

- For instance, CIMC Modular Building Systems (CIMC MBS) flagship factory in Jiangmen, staffed by 4,000 employees, outputs around 8,000 modules annually. CIMC uses patented high-strength bolt connection technology in its steel-structure modules, enabling buildings that exceed 100 meters in height.

- Expansion of Modular Solutions in Healthcare and Commercial Sectors

Growing demand for flexible and rapidly deployable infrastructure creates strong opportunities in healthcare, office, and hospitality applications. Modular facilities enable fast installation of clinics, testing centers, and hospital expansions—an advantage highlighted during global health emergencies. Commercial sectors leverage modular systems for retail spaces, hotels, and office buildings that require quick market entry and design adaptability. The shift toward hybrid workplaces further increases demand for modular office pods and reconfigurable layouts. These trends position modular construction as a scalable solution for evolving operational and spatial needs.

- For instance, Peterborough Hospital, Wernick installed a two-storey building using 22 modules, adding 20 beds including en-suite facilities, alongside reception, pantry, offices, and utility rooms.

- Increasing Adoption of Hybrid Modular Systems

Hybrid modular construction, which blends volumetric modules with panelized or traditional methods, is gaining momentum as developers seek greater design flexibility and structural efficiency. This approach allows high-rise capabilities, optimized material use, and enhanced architectural aesthetics. Hybrid systems reduce transportation constraints and support complex layouts, opening new opportunities in urban commercial towers, educational institutions, and mixed-use developments. As architects push for innovative designs, hybrid modular solutions provide a balance between speed, customization, and cost efficiency, elevating modular construction’s role in large-scale built environments.

Key Challenges

- Transportation Limitations and Logistics Complexity

Transportation constraints remain a major challenge for modular construction, as volumetric units require specialized handling, oversized-load permits, and well-coordinated logistics. Distance between manufacturing plants and job sites affects cost efficiency, and navigating narrow roads or urban environments can lead to delays. Additionally, damage risks during transport increase insurance costs and require reinforced packaging. These logistical hurdles limit modular construction’s scalability in remote or congested regions. Overcoming these challenges will require strategic factory locations, advanced transportation planning, and innovations in module sizing and assembly.

- Regulatory Barriers and Lack of Standardization

The modular construction market faces compliance challenges due to inconsistent building codes, zoning requirements, and permitting processes across regions. Traditional regulations often do not account for off-site manufacturing, causing approval delays and increased administrative burden. Variations in industry standards—such as fire safety, structural design, and module certification—further complicate cross-border or multi-state operations. Developers and manufacturers must navigate fragmented regulatory ecosystems, which slows adoption and increases project risk. Establishing unified standards and modular-friendly policies will be essential for accelerating market growth and improving industry-wide efficiency.

Regional Analysis

North America

North America holds an estimated 35–38% share of the modular construction market, driven by strong adoption in healthcare, education, and multifamily housing. The region benefits from high labor costs and skilled labor shortages, which make off-site construction an attractive alternative for reducing project timelines and improving cost efficiency. Government support for sustainable building practices and increasing investments in modular commercial spaces further strengthen growth. The U.S. leads regional demand with rising interest in permanent modular solutions for residential and institutional applications, while Canada sees expanding uptake in remote and industrial infrastructure projects.

Europe

Europe accounts for roughly 28–30% of the global market, supported by stringent environmental regulations, increasing green-building certifications, and high demand for energy-efficient construction. Countries such as the U.K., Germany, and the Netherlands lead adoption as modular methods align with carbon-reduction targets and circular economy principles. The region sees strong growth in modular residential buildings due to urban housing shortages and government-backed affordable housing programs. Advanced manufacturing technologies and well-established quality standards further enhance market penetration, enabling modular builders to deliver high-performance structures with reduced waste and faster completion timelines.

Asia-Pacific

Asia-Pacific represents the fastest-growing region with an estimated 30–32% share, driven by rapid urbanization, infrastructure expansion, and large-scale residential development across China, Japan, and Australia. Governments increasingly promote modular construction to meet rising housing demand and improve construction productivity. China leads the region with extensive adoption of high-rise modular buildings, while Japan benefits from precision manufacturing and advanced modular engineering. Growing investments in commercial and hospitality projects, along with disaster-resilient building requirements, further accelerate regional growth. The scalability and speed of modular solutions make them particularly suitable for densely populated urban environments.

Latin America

Latin America holds a smaller but expanding share of around 4–5%, supported by the growing need for affordable housing, disaster-relief structures, and rapid commercial expansions. Countries such as Brazil, Mexico, and Chile increasingly adopt modular solutions to address construction delays, budget constraints, and labor shortages. The region shows rising interest in relocatable units for mining camps, remote industrial sites, and educational facilities. Although infrastructure limitations and funding constraints slow broader adoption, improving governmental focus on efficient building methods and private-sector investment in modular technologies contribute to steady market growth.

Middle East & Africa

The Middle East & Africa region captures approximately 3–4% share, with growth concentrated in the Gulf countries where large-scale infrastructure and hospitality projects drive demand. Modular construction supports rapid project deployment, especially for worker accommodations, hotels, and healthcare facilities. The UAE and Saudi Arabia lead adoption as part of smart city and megaproject developments that prioritize speed and cost efficiency. In Africa, modular solutions gain traction for schools, clinics, and housing projects in remote areas. Despite challenges related to manufacturing capacity and skilled labor, increasing public-private partnerships support gradual market expansion.

Market Segmentations:

By Product Type:

By Material:

By Application:

- Single family residential

- Multi-family residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The modular construction market features a diverse competitive landscape led by Premier Modular Limited, Skanska, LEUSBERG GmbH & Co KG, DuBox, Bouygues Construction, CIMC Modular Building Systems Holdings Co., Ltd., Wernick Group, LAING O’ROURKE, Red Sea International, and Sekisui House Ltd. The modular construction market exhibits a highly competitive landscape driven by rising demand for faster project delivery, cost efficiency, and sustainability-focused building solutions. Companies compete through advancements in off-site manufacturing, integration of digital design technologies, and improved structural engineering capabilities that support large-scale and multi-story modular projects. The industry continues to shift toward automated production lines, precision-driven fabrication, and standardized module platforms that enable scalability across regions. Strategic partnerships, cross-border expansion, and investments in R&D further strengthen competitive positions, while firms increasingly prioritize low-carbon materials and waste-reduction practices to meet regulatory and client expectations. As competition intensifies, market participants differentiate through specialized offerings in residential, healthcare, commercial, and remote-site applications, along with service models that ensure faster installation and reduced lifecycle costs.

Key Player Analysis

- Premier Modular Limited

- Skanska

- LEUSBERG GmbH & Co KG

- DuBox

- Bouygues Construction

- CIMC Modular Building Systems Holdings Co., Ltd.

- Wernick Group

- LAING O’ROURKE

- Red Sea International

- Sekisui House Ltd.

Recent Developments

- In August 2025, JCB is about to transform the construction equipment scenario in India, when it will introduce a new generation of machines. It will be equipped with prototypes that are hydrogen-powered, fully electric, low-fuel consumption hybrid equipment, and enhanced diesel-powered machines that are approved to the CEV Stage-V norms.

- In July 2025, New Holland Construction W100D compact wheel loader was launched, featuring a redesigned, operator-centric cab focused on comfort and control, and a compact design for high productivity.

- In January 2025, Sunbelt Modular Inc. acquired BRITCO Structures, USA (BUSA), a Texas-based manufacturer of modular buildings known for complex commercial projects. This acquisition, which was finalized aligns with Sunbelt’s strategy of providing custom modular solutions.

- In January 2025, Volvo CE introduces New Generation Excavators in Southeast Asia to enhance efficiency, productivity and safety of the customers. The New Generation 5 models include: EC210, EC220, EC230, EC300 and EC360 and they will be sold throughout the region starting January 2025.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will adopt more automated and robotics-driven modular manufacturing to improve precision and reduce labor dependency.

- Demand for sustainable and low-carbon modular materials will rise as governments strengthen green building regulations.

- Digital twins and BIM-integrated workflows will become standard tools for optimizing module design and project planning.

- Urban housing shortages will accelerate the use of modular systems for affordable and rapid residential development.

- Large infrastructure and healthcare projects will increasingly shift to modular due to faster timelines and predictable quality.

- Cross-border module supply chains will expand as firms standardize components for global deployment.

- Hybrid modular–traditional construction models will gain traction to address complex architectural requirements.

- Investors will show growing interest in modular platforms as stable, scalable, and repeatable construction solutions.

- Smart-building technologies will be integrated directly into modules during factory assembly.

- Companies will focus on circular design principles to enhance recyclability and reduce construction waste.