| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Africa Multimode Dark Fiber Market Size 2024 |

USD 63.74 Million |

| Africa Multimode Dark Fiber Market, CAGR |

3.11% |

| Africa Multimode Dark Fiber Market Size 2032 |

USD 81.46 Million |

Market Overview

The Africa Multimode Dark Fiber Market is projected to grow from USD 63.74 million in 2024 to an estimated USD 81.46 million by 2032, with a compound annual growth rate (CAGR) of 3.11% from 2025 to 2032. The market growth is fueled by the rising demand for high-speed internet, increased data consumption, and the expansion of broadband infrastructure across the continent.

Key drivers of the Africa Multimode Dark Fiber Market include the ongoing digital transformation of the region, increasing adoption of cloud-based services, and the rise in internet penetration rates. Additionally, the demand for reliable and high-capacity network solutions is growing due to the expansion of data centers and the increasing reliance on high-bandwidth applications such as video streaming and e-commerce. The growing investments in ICT infrastructure from both private and government entities are also contributing to market expansion.

Geographically, the market is expanding across various regions of Africa, with significant growth in countries like South Africa, Kenya, and Nigeria, which are leading the way in fiber optic infrastructure development. Key players in the market include Liquid Telecom, Telkom South Africa, MTN Group, and Vodacom Group, which are focusing on expanding their fiber optic networks to address the increasing demand for high-speed connectivity in urban and rural areas. These companies are working to enhance network capacity and improve service reliability, supporting the market’s long-term growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Africa Multimode Dark Fiber Market is projected to grow from USD 63.74 million in 2024 to USD 81.46 million by 2032, at a CAGR of 3.11% from 2025 to 2032.

- The global multimode dark fiber market is expected to grow from USD 3,652.64 million in 2024 to USD 6,242.00 million by 2032, with a CAGR of 6.93% from 2025 to 2032.

- Key drivers include the rising demand for high-speed internet, digital transformation, increased data consumption, and the expansion of broadband infrastructure.

- The increasing use of cloud-based services across businesses and consumers is driving the demand for high-capacity, reliable network solutions such as dark fiber.

- High capital investment and infrastructure development costs remain significant barriers to rapid deployment, particularly in rural and underserved areas.

- South Africa, Kenya, and Nigeria are leading the expansion of fiber optic networks, with these regions experiencing the highest growth in dark fiber demand.

- Telecom companies like Liquid Telecom, Telkom South Africa, MTN Group, and Vodacom Group are heavily investing in expanding their fiber optic networks across urban and rural areas.

- The market is benefiting from technological improvements in fiber optic materials and installation processes, driving increased adoption in high-demand sectors like data centers and cloud services.

Market Drivers

Increasing Demand for High-Speed Internet and Bandwidth-Intensive Applications

The Africa Multimode Dark Fiber Market is experiencing significant growth due to the escalating demand for high-speed internet services. As businesses, institutions, and consumers increasingly rely on internet connectivity for everyday operations, the need for more robust and higher-capacity networks becomes imperative. Applications such as video conferencing, cloud computing, IoT (Internet of Things), e-commerce, and high-definition streaming are bandwidth-intensive and require a reliable, low-latency network infrastructure. For instance, telecom companies in Africa have reported a surge in data traffic, with some experiencing over 50% growth in internet usage during peak periods. The growing adoption of these services across Africa is driving telecom companies to invest in expanding their fiber optic networks. As a result, dark fiber offers a solution that can cater to these increased bandwidth requirements, providing flexibility for telecom operators to scale their networks in response to traffic growth. The demand for high-speed internet is also closely tied to the increasing data consumption across the continent. With more consumers accessing online content, the usage of mobile data, broadband internet, and cloud applications has surged. This trend is especially notable in urban regions, where economic activity is concentrated, and there is a growing need to provide consumers with uninterrupted, fast internet services. Dark fiber, with its high capacity and ability to transmit large amounts of data efficiently, addresses these needs by providing the infrastructure necessary to support the increased digital traffic and growing data center needs in the region. For example, data centers in Africa have reported a significant increase in demand for high-capacity networks to support cloud services.

Digital Transformation and Economic Growth in Africa

Africa is undergoing a significant digital transformation, driven by the expansion of internet access, mobile technology, and the development of e-commerce, fintech, and digital services. These advancements are a key driver for the Multimode Dark Fiber Market, as businesses across sectors such as finance, healthcare, education, and retail increasingly rely on digital tools and platforms for their operations. Telecom providers and internet service providers (ISPs) are expanding their fiber optic networks to meet the growing demand for digital services and internet connectivity. For instance, the African Union has launched initiatives to improve broadband penetration, aiming to achieve 10% annual growth in internet access across member states. The rise of digital platforms has led to a boom in data-driven industries across Africa, which is fueling the need for scalable and high-performance networks. The rapid adoption of mobile phones, coupled with the growing use of mobile applications, has driven the need for faster internet speeds and higher data transmission rates. In response, businesses in Africa are investing in upgrading their network infrastructure, particularly in regions with higher levels of economic activity. Moreover, governments in Africa are actively supporting the digital transformation by promoting ICT infrastructure development through investments in broadband networks, further driving the adoption of dark fiber for telecommunications. For example, several African governments have partnered with private companies to deploy nationwide fiber optic networks.

Increasing Investments in Telecom Infrastructure and Data Centers

The African telecom sector is seeing substantial investments in network infrastructure, particularly in fiber optics, to support the region’s digital growth. With the increasing demand for internet services, telecom operators and investors are prioritizing the development of fiber optic networks to ensure they can handle growing traffic and provide reliable, high-speed services. Multimode dark fiber has become a preferred solution due to its ability to offer cost-effective and scalable solutions for data transmission. Telecom providers can lease dark fiber infrastructure to avoid the high upfront costs of building networks from scratch, while simultaneously meeting the increasing demand for data and bandwidth. In addition to fiber networks, the expansion of data centers across Africa is another key factor driving market growth. The rise of cloud services and the increasing reliance on cloud-based applications has spurred the need for more data centers. Africa is becoming a global hub for data storage and processing, with companies and governments investing heavily in building and upgrading data centers to store critical data. These data centers require high-bandwidth, low-latency connections to operate efficiently, and dark fiber is an ideal solution for this purpose. Data center providers are increasingly relying on dark fiber networks to ensure that they have the capacity to meet the high demands of their customers, further fueling the market for multimode dark fiber.

Government Support and Regulatory Initiatives

Governments across Africa are actively supporting the expansion of telecom and broadband infrastructure as part of their development agendas. Policies aimed at enhancing digital connectivity, fostering technological innovation, and promoting inclusive economic growth are playing a crucial role in driving the demand for multimode dark fiber. National and regional governments are implementing broadband strategies and offering incentives to encourage investments in network infrastructure, including fiber optics. In several countries, governments are collaborating with private telecom companies to improve broadband access, especially in rural and underserved areas. For instance, initiatives aimed at reducing the digital divide between urban and rural areas are encouraging the deployment of fiber networks. Furthermore, regulatory frameworks that encourage competition in the telecom sector are driving companies to invest in improving their network capabilities. By ensuring that fiber infrastructure is available at competitive prices, these regulatory measures are creating an environment where the demand for dark fiber solutions can thrive. This government support is crucial for expanding fiber optic networks in regions that have historically been underserved or lacked the necessary infrastructure to support high-speed internet services.

Market Trends

Expansion of Fiber Optic Networks by Telecom Providers

Telecommunication providers across Africa are increasingly focusing on expanding their fiber optic networks to meet the growing demand for high-speed internet services. The need for robust infrastructure is driven by the surge in digital services such as e-commerce, cloud computing, and video streaming, all of which require high-bandwidth, reliable connectivity. For instance, as of 2021, nearly 57% of the population in Sub-Saharan Africa lived within 25 kilometers of an operational fiber optic network node. Telecom operators are heavily investing in fiber optics, particularly in urban areas where the demand for fast internet is highest. The deployment of multimode dark fiber is becoming a popular choice due to its cost-effectiveness and scalability. Telecom providers are leasing dark fiber to enhance their service offerings, avoiding the significant capital expenditure required to build new infrastructure from the ground up. This trend is expected to continue as Africa’s digital ecosystem matures and demand for data increases.

Government Initiatives to Promote Broadband Connectivity

Government support plays a critical role in the growth of the Africa Multimode Dark Fiber Market. Many African governments are actively promoting the development of broadband infrastructure through national strategies and policies aimed at improving internet connectivity across the continent. For instance, Kenya’s government has implemented the National Broadband Strategy, which aims to provide broadband access to all citizens by 2030. These initiatives often focus on expanding access to underserved and rural areas where fiber optic networks have traditionally been underdeveloped. In countries such as South Africa and Nigeria, government-backed efforts to improve digital access, reduce the digital divide, and foster economic growth have led to increased investments in telecom infrastructure, including dark fiber networks. With regulatory frameworks that encourage telecom operators to expand their networks and improve service quality, these government initiatives are expected to continue driving the adoption of multimode dark fiber across the continent.

Growing Demand for Data Centers and Cloud Services

The growing reliance on cloud-based services is one of the key trends in the Africa Multimode Dark Fiber Market. As more businesses and governments migrate to the cloud, the demand for data centers and reliable high-bandwidth connections has surged. Data centers, which require large amounts of data transmission capacity, are increasingly turning to dark fiber solutions to meet their needs. Dark fiber networks allow data centers to handle large volumes of data with low latency and high reliability. This trend is particularly significant in countries like South Africa, where major data center hubs are emerging. The shift towards cloud computing and the need for data storage solutions is expected to keep fueling demand for multimode dark fiber in Africa as companies and governments seek efficient ways to manage and transfer data.

Adoption of 5G Networks and Increased Network Traffic

The rollout of 5G networks is accelerating across Africa, and this new technology is expected to significantly impact the demand for multimode dark fiber. 5G networks require an extensive fiber optic infrastructure to deliver ultra-fast speeds, low latency, and high network reliability. The increased network traffic generated by 5G devices, along with the expected explosion in the number of connected devices in the IoT ecosystem, is driving the need for high-capacity fiber networks. Telecom companies are investing heavily in the installation of dark fiber to support 5G networks and ensure that they can provide the high-speed connectivity required by these technologies. As more African countries begin their 5G rollouts, the demand for multimode dark fiber solutions will grow, positioning it as a key enabler of the next generation of wireless technology.

Market Challenges

High Capital Investment and Infrastructure Development Costs

One of the major challenges facing the Africa Multimode Dark Fiber Market is the high capital investment required for the deployment of fiber optic networks. Although dark fiber offers significant benefits in terms of scalability and long-term cost-effectiveness, the initial investment for infrastructure development remains a considerable barrier for telecom operators. Building and maintaining fiber optic networks, especially in remote and rural areas, requires significant financial resources. The process involves laying fiber cables, setting up necessary equipment, and ensuring adequate network maintenance. In regions with low population density or challenging terrains, the cost of deploying fiber can be prohibitive, resulting in slow infrastructure development. Many African countries are still facing challenges in terms of having a comprehensive broadband network, with large gaps in connectivity between urban and rural areas. The high upfront cost of fiber optic infrastructure can also deter private companies from making the necessary investments in expanding their networks. Although governments are increasingly supporting infrastructure development, the financial burden remains a significant challenge for telecom operators in many parts of Africa.

Regulatory and Policy Challenges

Another key challenge affecting the growth of the Africa Multimode Dark Fiber Market is the inconsistency in regulatory frameworks and policies across the continent. Different countries in Africa have varying approaches to telecom regulation, which can create confusion and hinder the efficient deployment of fiber networks. While some nations, like South Africa, have established policies to encourage the expansion of broadband infrastructure, others still lack clear regulations that provide incentives for investment. In addition, complex bureaucratic procedures, delayed approval processes, and regulatory uncertainty can slow down the rollout of dark fiber networks. For instance, obtaining permits for digging and laying fiber cables in certain areas can be a time-consuming and costly process. Moreover, issues related to cross-border connectivity and spectrum licensing can pose further challenges for operators looking to expand their dark fiber networks. A lack of uniformity in policies and regulations across the continent can lead to inefficiencies and make it difficult for telecom companies to operate seamlessly across different markets. Addressing these regulatory challenges is essential for unlocking the full potential of the Africa Multimode Dark Fiber Market.

Market Opportunities

Expansion of Telecom Infrastructure in Underserved Regions

One of the key opportunities in the Africa Multimode Dark Fiber Market lies in the expansion of telecom infrastructure to underserved and rural areas. Despite significant growth in urban areas, large parts of Africa still face limited internet access, with gaps in connectivity particularly in remote regions. Governments and telecom operators are increasingly focusing on bridging this digital divide by investing in infrastructure projects aimed at expanding broadband coverage. Dark fiber offers a cost-effective and scalable solution for extending high-speed internet to rural areas, where traditional telecom infrastructure might be challenging to deploy. The ability to lease dark fiber infrastructure allows telecom companies to provide reliable, high-speed internet services without the need for significant upfront capital expenditure. As Africa continues to invest in broadband access as part of its digital transformation, the demand for dark fiber solutions to support infrastructure expansion in rural and underserved regions is expected to grow.

Growth in Data Centers and Cloud Computing Demand

Another significant opportunity for the Africa Multimode Dark Fiber Market stems from the increasing demand for data centers and cloud computing services. With businesses across various sectors shifting to digital operations, the demand for secure and reliable data storage solutions is rising. Data centers require high-capacity, low-latency connectivity to handle the growing volume of data being generated, processed, and stored. Multimode dark fiber networks provide the necessary bandwidth and flexibility to support these data centers, enabling efficient data transfer and high-performance cloud services. The continued growth of industries such as e-commerce, fintech, and telecommunications is driving the need for more robust infrastructure, and dark fiber is well-positioned to cater to these demands. As cloud adoption accelerates in Africa, there is a significant opportunity for telecom operators and data center providers to expand their dark fiber networks to meet this rising demand.

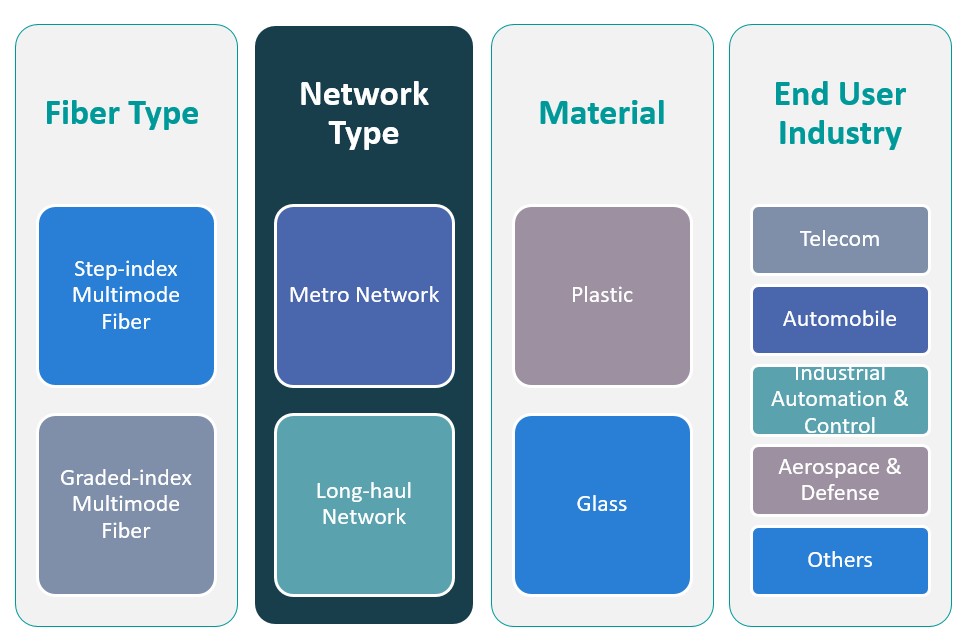

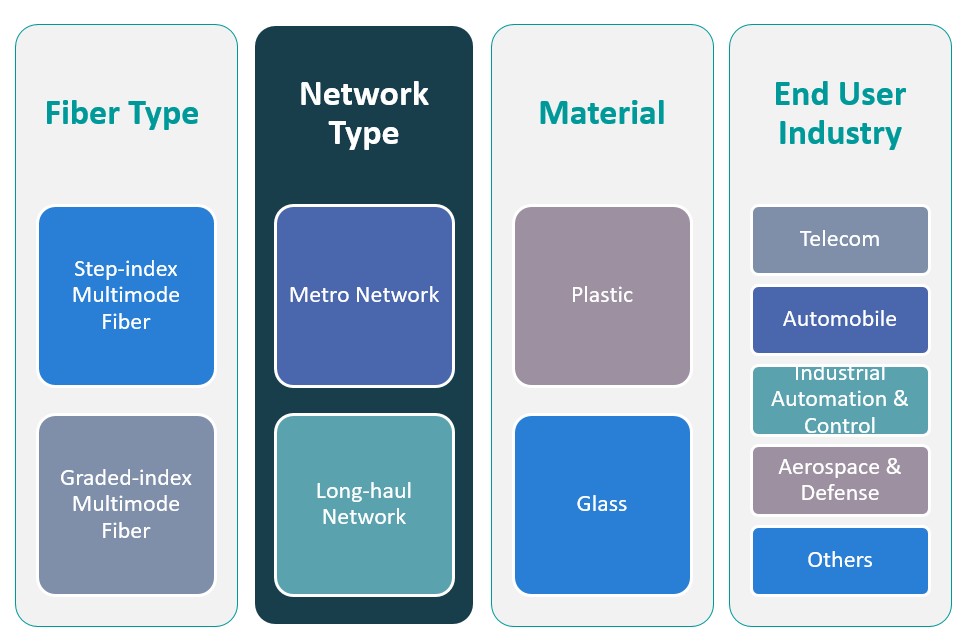

Market Segmentation Analysis

By Fiber Type

The Africa Multimode Dark Fiber Market is primarily divided into two types of fibers: Step-index Multimode Fiber and Graded-index Multimode Fiber. Step-index Multimode Fiber is characterized by its simple structure and lower cost, making it ideal for short-distance applications. However, it offers less performance in terms of bandwidth and signal attenuation compared to Graded-index Multimode Fiber, which has a more complex structure but provides better performance for longer distances with higher data rates. Graded-index fibers are becoming more popular in the market as they offer better scalability and are suited for high-demand applications like data centers and long-haul transmission, which are expected to grow in Africa.

By Network Type

The market is also segmented by network type, including Metro Network and Long-haul Network. Metro networks serve urban areas and facilitate high-speed communication across cities and large towns. These networks are essential for supporting businesses, government services, and educational institutions in metropolitan areas. Long-haul networks, on the other hand, extend over longer distances, connecting cities and even countries, and are particularly important for supporting intercontinental connectivity. Long-haul networks are becoming increasingly critical for facilitating the global digital economy, and as Africa’s broadband penetration increases, both metro and long-haul networks are expected to see substantial growth.

Segments

Based on Fiber Type

- Step-index Multimode Fiber

- Graded-index Multimode Fiber

Based on Network Type

- Metro Network

- Long-haul Network

Based on Material Type

Based on End User

- Telecom

- Automobile

- Industrial Automation & Control

- Aerospace & Defense

- Others

Based on Region

- North Africa

- Sub-Saharan Africa

- Others

Regional Analysis

North Africa (40%)

North Africa holds a significant share of the Africa Multimode Dark Fiber Market, with countries like Egypt, Morocco, and Algeria leading the charge. The region is experiencing rapid infrastructure development, driven by both government initiatives and private sector investments. Governments in these countries are actively working to improve digital infrastructure through national broadband strategies and policies aimed at boosting internet penetration. In Egypt, for example, the government has heavily invested in expanding fiber optic networks to enhance broadband access. North Africa accounts for approximately 40% of the total market share due to its established telecom infrastructure and higher levels of urbanization compared to other regions. The region’s economic growth, coupled with increased demand for digital services in sectors such as education, finance, and government services, is driving the adoption of multimode dark fiber solutions.

Sub-Saharan Africa (45%)

Sub-Saharan Africa is the fastest-growing region in the Africa Multimode Dark Fiber Market, with increasing demand for high-speed internet and broadband services, especially in countries like South Africa, Nigeria, Kenya, and Ethiopia. This region has been lagging behind North Africa in terms of telecom infrastructure, but rapid urbanization and a growing middle class are pushing telecom operators to expand their fiber networks. South Africa leads the region in fiber optic deployments, with significant investments in both metro and long-haul fiber networks. The Sub-Saharan region holds a market share of around 45%, and this is expected to grow significantly as more countries roll out their broadband networks. Governments and private enterprises are investing in digital infrastructure to support the rising demand for data, cloud services, and internet access in urban and rural areas alike.

Key players

- Du Telecom

- Ooredoo

- Menasat

- QTel

- Zain Group

Competitive Analysis

The Africa Multimode Dark Fiber Market is highly competitive, with several telecom giants dominating the market. Du Telecom, based in the UAE, is a key player in the region, known for its extensive fiber optic network infrastructure across the Middle East and Africa. Ooredoo, another significant telecom provider, has a strong presence in the region, offering a wide range of services, including fiber optic solutions for businesses. Menasat, a leading player in the Middle East and North Africa (MENA) region, focuses on providing high-speed broadband and dark fiber services to enterprises. QTel has established itself as a prominent player in Qatar and beyond, expanding its dark fiber services to meet the increasing demand for data-intensive applications. Zain Group is a major telecom operator in several African countries, focusing on network expansion to support the growing demand for high-bandwidth services. These companies’ continuous investments in telecom infrastructure and strategic partnerships are driving the market forward.

Recent Developments

- In June 2024, Telstra InfraCo’s intercity fiber network project completed approximately 1,800 kilometers of fiber construction, enhancing connectivity across Australia.

- As of June 2023, TPG Group held a wholesale market share of around 22% of Australian National Broadband Network services.

- As of June 2023, Optus had a wholesale market share of approximately 13% of Australian National Broadband Network residential broadband services.

- In August 2024, Lumen Technologies entered a two-year agreement with Corning Incorporated, securing 10% of Corning’s global fiber capacity to interconnect AI-enabled data centers. This deal is Lumen’s largest cable purchase to date and will more than double its U.S. intercity fiber miles, enhancing capacity for cloud data centers and high-bandwidth applications driven by AI workloads.

- In February 2025, Deutsche Telekom praised T-Systems for its improved performance in FY24, reflecting the company’s strategic focus on enhancing its dark fiber services for enterprise customers.

- In December 2024, the GCC Sustainability Innovation Hub, which includes Etisalat, released a white paper outlining pathways for telecom operators to achieve net-zero emissions, drive renewable adoption, and foster regional collaboration.

- In 2024, Claro Argentina reported an operating profit of 706 billion pesos, a 10.1% growth compared to 2023, indicating strong performance in its telecom operations, including dark fiber services.

Market Concentration and Characteristics

The Africa Multimode Dark Fiber Market exhibits a moderate level of market concentration, with a few large telecom operators dominating the landscape while also leaving room for regional and smaller players to compete. Major telecom providers such as Du Telecom, Ooredoo, Menasat, QTel, and Zain Group hold a significant market share, leveraging their extensive network infrastructure and strong financial capabilities to expand fiber optic networks across the continent. The market is characterized by rapid infrastructure development, driven by the increasing demand for high-speed internet and broadband services. Additionally, telecom companies are focusing on providing scalable and flexible dark fiber solutions to cater to various industries, including telecom, data centers, and cloud computing. Despite the dominance of these key players, the market is growing due to increasing investments in rural and underserved areas, creating opportunities for new entrants and regional service providers. The competitive dynamics in the market are shaped by a blend of government support, technological innovation, and strategic partnerships between telecom companies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Network Type, Material Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The growing reliance on digital services is driving the need for robust and high-speed internet infrastructure across Africa.

- The rollout of 5G technology necessitates the deployment of extensive fiber optic networks to support its high bandwidth requirements.

- The proliferation of data centers and the increasing adoption of cloud services are fueling the demand for reliable and scalable dark fiber solutions.

- Governments across Africa are investing in digital infrastructure projects to enhance broadband connectivity and bridge the digital divide.

- Rapid urbanization and the development of smart cities are creating a surge in demand for high-capacity fiber networks to support IoT and other technologies.

- Telecom operators and private enterprises are increasingly investing in fiber optic infrastructure to meet the growing demand for high-speed internet services.

- Efforts to extend fiber optic networks to rural and underserved areas are expanding the reach of dark fiber solutions across the continent.

- Multimode fiber is gaining popularity due to its cost-effectiveness and suitability for short to medium-distance applications, making it ideal for metro networks.

- Dark fiber networks are being integrated with emerging technologies such as artificial intelligence and machine learning to enhance network performance and efficiency.

- The market is witnessing increased competition and potential consolidation as companies strive to expand their fiber optic networks and service offerings.