Market Overview:

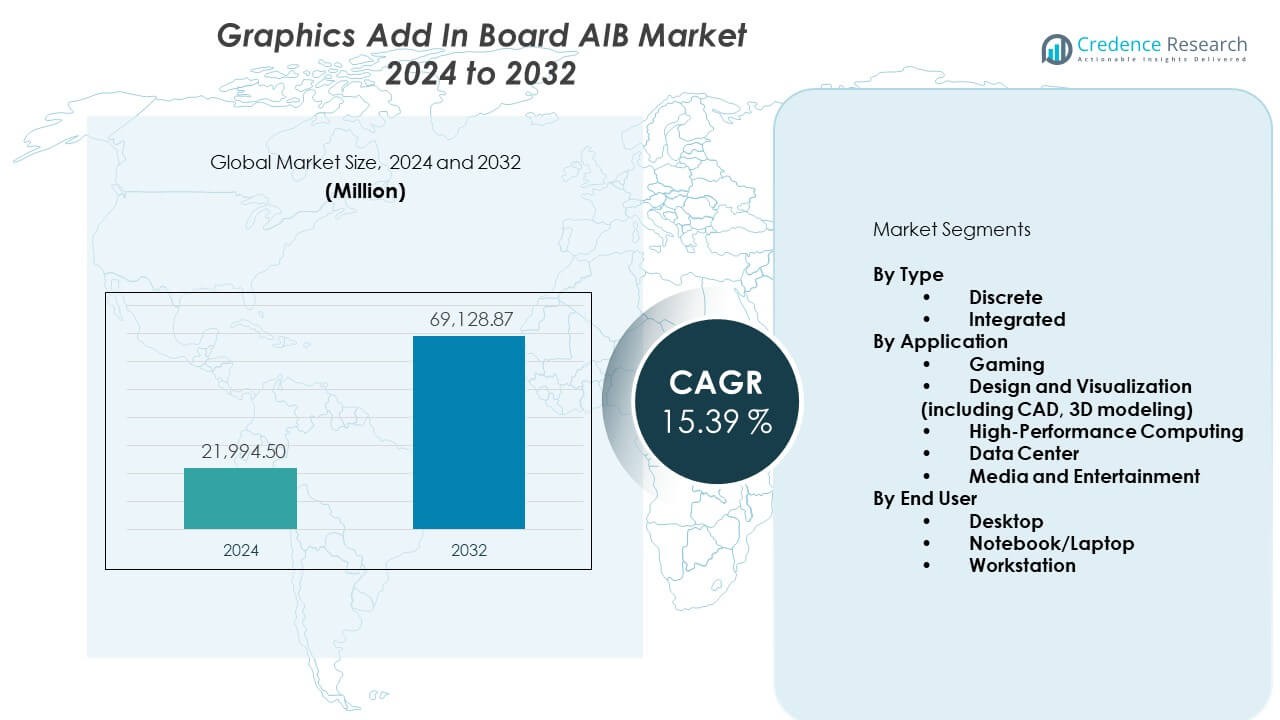

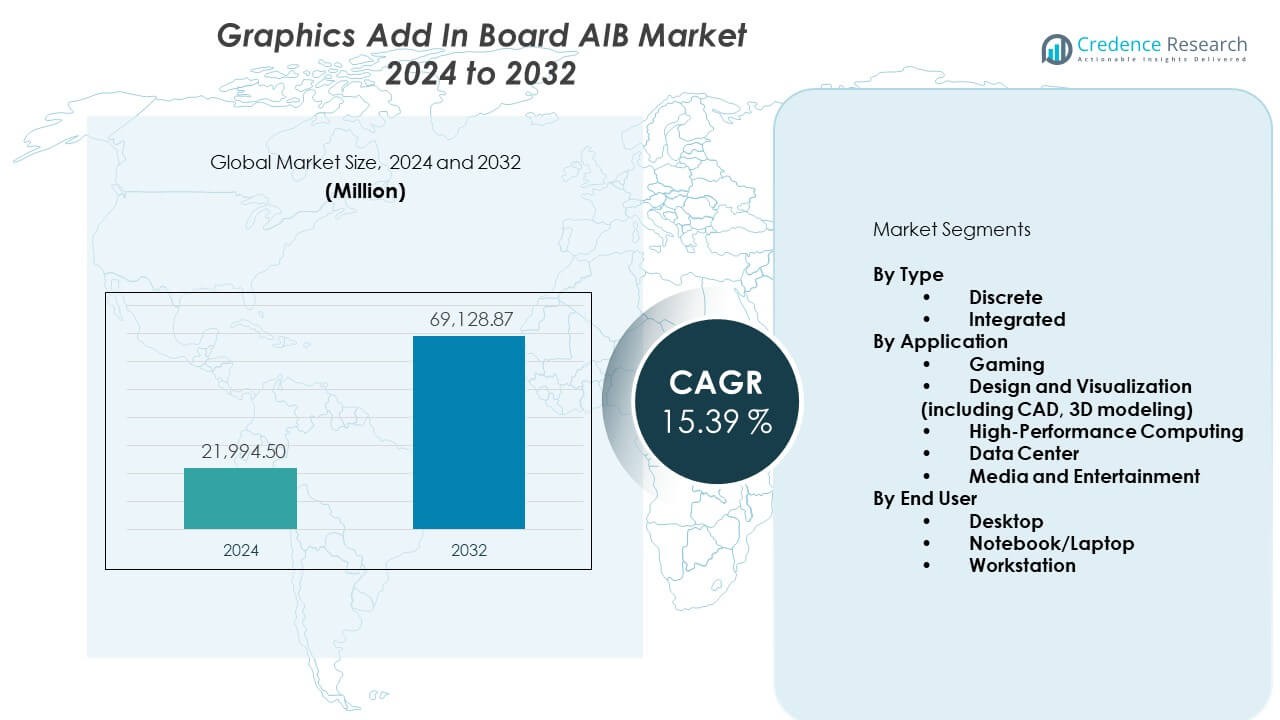

The Graphics Add-In Board (AIB) market is projected to grow from USD 21,994.5 million in 2024 to USD 69,128.87 million by 2032, advancing at a CAGR of 15.39% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Graphics Add-In Board (AIB) market Size 2024 |

USD 21,994.5 Million |

| Graphics Add-In Board (AIB) market, CAGR |

15.39% |

| Graphics Add-In Board (AIB) market Size 2032 |

USD 69,128.87 Million |

Rising adoption across gaming PCs, creative production, and data-intensive applications drives sustained demand. Vendors expand GPU memory, improve ray-tracing capabilities, and integrate AI-based acceleration to enhance performance. Content creators, simulation engineers, and competitive gamers adopt new-generation AIB models for faster workflows and stable frame rates. The rapid expansion of esports and AAA titles supports recurring upgrades. Semiconductor advances support higher efficiency and new cooling architectures, increasing GPU replacement cycles. Broad availability of PC-based AI tools also boosts the appeal of discrete add-in boards for mainstream users.

North America holds the leading position due to strong PC gaming communities, early GPU adoption, and high spending on advanced hardware. Europe follows because many countries maintain strong gaming cultures and professional creative industries. Asia Pacific emerges as the fastest-growing region, driven by rising gaming cafés, expanding esports teams, and growing consumer adoption in China, South Korea, and Japan. Latin America sees steady progress as gaming access widens through better retail networks. The Middle East and Africa show emerging traction as interest grows in competitive gaming and workstation-grade computing. Each region benefits from broader awareness of performance-oriented GPUs and greater access to custom PC ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Graphics add in board AIB market reached USD 21,994.5 million in 2024 and is projected to hit USD 69,128.87 million by 2032, advancing at a CAGR of 15.39%.

- North America leads with 36.8% share due to strong gaming adoption, followed by Europe at 27.6% driven by creative and workstation demand, while Asia Pacific holds 25.4% supported by large gaming populations.

- Asia Pacific is the fastest-growing region with 25.4% share, supported by rising esports engagement, youth demographics, and rapid digital expansion across major markets.

- Discrete GPUs dominate with the highest segment share, driven by gaming, workstation, and AI workloads that require dedicated performance levels.

- Desktop systems hold the largest end-user share due to stronger power capacity, superior thermal management, and higher compatibility with premium AIB models.

Market Drivers:

Rising Demand for High-Performance Gaming Hardware

The Graphics add in board AIB market grows due to strong interest in premium gaming hardware. Gamers seek stable frame rates and smooth visuals in open-world and competitive titles. New GPUs support better ray tracing and deliver sharper lighting effects. It drives higher adoption across custom gaming PCs and prebuilt models. Esports expansion encourages frequent upgrades among players. Developers push graphic intensity in new game engines, which pushes users toward stronger AIB units. VR and AR gaming also increase demand for higher processing power. It supports consistent uptake in consumer and enthusiast segments.

- For instance, Nvidia’s GeForce RTX 5090, powered by the Blackwell architecture, delivers up to 2x higher performance compared to the RTX 4090, leveraging features like DLSS 4 with Multi Frame Generation. It features 21,760 CUDA cores and 4th-gen RT cores, with Nvidia announcing up to 380 RT TFLOPS. Its enhanced capabilities make it fully capable of enabling cinematic-quality visuals at 4K resolution.

Rapid Growth of Content Creation and Professional Workloads

The content creation community contributes steady demand growth across this segment. Designers, editors, and engineers rely on discrete GPUs for faster rendering. It supports real-time editing and smooth playback across 4K and 8K projects. Workstation users depend on advanced AIBs for simulation and modeling tasks. AI-driven editing tools use GPU acceleration to shorten production time. Studios build multi-GPU setups to handle heavy files. This shift moves more users from integrated graphics to stronger AIB units. The trend improves replacement cycles across professional environments.

- For instance, AMD’s Radeon RX 7900 XTX is a capable card for high-end 1440p gaming, but its ray tracing performance lags behind Nvidia’s competitors in demanding titles. While it supports 24 GB of GDDR6 memory, which is beneficial for handling large files in 4K and 8K workflows, its performance in professional content creation tasks is mixed. While it can perform real-time video editing, specialized workstations for simulation and modeling tasks overwhelmingly prefer professional-grade graphics cards, often from Nvidia, which offer better software optimization and stability.

Expansion of AI, Machine Learning, and Compute-Intensive Applications

AI workloads increase the need for dedicated graphics boards across industry users. Developers train models using consumer and prosumer GPUs for affordability and speed. It drives strong adoption among researchers and small firms. GPU acceleration improves inference tasks and boosts productivity. Enterprises use AIBs for robotics, imaging, and predictive analysis. Demand rises for boards with larger memory and better parallel processing. New software ecosystems support GPU-centric pipelines. This development pushes more users toward higher-end AIB solutions.

Shift Toward Advanced Semiconductor Technologies and GPU Architecture

Manufacturers adopt smaller nodes to deliver better power efficiency. It enables faster clock speeds and stronger thermal performance. New architectures improve multi-task handling and ray-based workloads. AIB vendors integrate advanced cooling to support stable performance. Gamers and creators welcome these improvements, driving replacement demand. AI functions in GPUs create new user groups beyond gaming. OEMs ship advanced GPUs in premium desktops. This evolution increases interest across mass-market and premium tiers.

Market Trends:

Rise of Hybrid GPU Use Across Gaming, AI, and Streaming Workflows

The Graphics add in board AIB market experiences rising hybrid usage across gaming and AI tasks. Users run streaming setups alongside gameplay on the same system. GPU-based AI tools help creators automate editing. It encourages buyers to choose multi-purpose high-end GPUs. Many consumers now blend productivity and entertainment on one device. Cloud gaming growth still pushes users to keep strong local hardware for offline play. Multi-display setups become common in hybrid offices. This trend expands the GPU utility beyond entertainment.

- For instance, Gigabyte’s GeForce RTX 5050 OC Low Profile GPU operates with a maximum thermal design power (TDP) of 130W (based on the low-profile model), supporting both gaming and AI workloads in compact systems. Due to its small form factor, its fans are audible under load, a common trade-off for its size. GPU-based AI tools, using the card’s Tensor Cores, help creators automate editing and accelerate workflows.

Growth of Compact and Energy-Efficient AIB Designs

Vendors design compact GPUs for smaller form-factor systems. These designs deliver strong performance within lower power envelopes. It supports users who prefer mini-PC builds for limited spaces. Energy-efficient GPUs appeal to environmentally conscious buyers. Thermal improvements allow quieter systems with better stability. Low-profile boards attract business users who avoid bulky towers. Demand grows for GPUs that balance efficiency with mid-range power. Vendors respond by widening the compact AIB portfolio.

- For instance, ASUS’s ROG NUC 2025 mini PC features advanced thermal design with three fans and a unified vapor chamber, delivering solid 4K performance while operating with remarkable silence even under stress, and supporting up to 40 Gbps data transfer via Thunderbolt 4.

Increasing Popularity of Ray-Tracing and Path-Tracing in Mainstream Titles

Game developers add ray-tracing features to more titles. It pushes gamers toward stronger GPUs for better lighting effects. It accelerates the demand for updated AIB generations. Users seek smoother performance at higher resolutions. GPU makers enhance ray-tracing cores to manage heavier scenes. It helps raise interest in long-term upgrades. VR platforms also benefit from ray-based visuals. This trend keeps the premium AIB category active.

Wider Adoption of AI-Driven Upscaling Technologies Across Gaming Ecosystems

AI upscalers support better visuals at lower native resolutions. It enables mid-range GPUs to handle demanding titles. It supports stable experiences in open-world environments. GPU firms refine AI algorithms to improve clarity. It encourages longer use of existing hardware. Many users see AI upscaling as a performance boost without full upgrades. Developers integrate these tools into game settings. This trend improves the value proposition across many GPU tiers.

Market Challenges Analysis:

High Production Costs, Supply-Chain Limits, and Pricing Pressure

The Graphics add in board AIB market faces challenges from high development and production costs. Semiconductor shortages impact manufacturing cycles. It pushes vendors to manage long lead times and allocation issues. Pricing pressure grows when new generations arrive quickly. Consumers hesitate when GPU prices fluctuate. Supply gaps create demand spikes across major buyer groups. Competition from integrated GPUs affects entry-level AIB demand. This situation creates uncertainty for suppliers across global markets.

Thermal Constraints, Power Requirements, and Rapid Technology Obsolescence

High-end GPUs require strong cooling and higher power draw. It limits adoption among users with older systems. Many buyers struggle with upgrade compatibility. New models reach the market quickly, creating shorter product life cycles. It challenges users who seek stable hardware planning. Thermal output in premium AIBs demands better cases and airflow. Smaller systems face heat limitations during heavy tasks. This challenge reduces interest among budget users.

Market Opportunities:

Growth of AI-Centric Consumer Applications and Creativity Workflows

The Graphics add in board AIB market gains opportunities from rising AI-centric consumer tools. Home users try AI image editing, coding assistants, and modeling tasks. It drives higher demand for boards with strong compute capabilities. Creators depend on GPUs for real-time renders and automated effects. GPU vendors introduce AI-boost features to attract new user groups. This transition creates new lanes beyond gaming. Many students also adopt GPUs for learning projects. It supports broader market penetration.

Expanding Demand for Premium Gaming, Simulation, and Esports Systems

Premium gaming interest supports strong GPU upgrades across global regions. Esports players push demand for stable performance at high refresh rates. It increases adoption of mid-range and upper-tier AIBs. Simulation communities need strong hardware for realistic visuals. VR users prefer high-performance GPUs for smoother sessions. Regional gaming ecosystems grow with better broadband access. Many buyers shift toward custom PCs for deeper control. This opportunity strengthens retail and online GPU sales.

Market Segmentation Analysis:

By Type

The Graphics add in board AIB market records strong dominance from discrete GPUs due to their higher performance levels in gaming, creative workloads, and compute tasks. Discrete boards deliver superior frame rates and support advanced ray-tracing features, which strengthens their position across consumer and professional users. Integrated GPUs hold a steady share among entry-level buyers and thin-and-light devices. It supports basic workloads and low-power tasks in mainstream notebooks. Discrete units remain the preferred choice for users who require dedicated acceleration across visuals and compute-heavy functions.

- For instance, ZOTAC’s MAGNUS mini-PCs integrate desktop GeForce RTX 50 series GPUs, including the RTX 5070 with 12GB GDDR7 memory, and potentially a higher-end RTX 5070 Ti with 16GB GDDR7 memory, enabling high-end gaming and productivity in ultra-compact form factors. Discrete boards deliver superior frame rates and support advanced ray-tracing features, which strengthens their position across consumer and professional users.

By Application

Gaming leads demand with users seeking smooth performance in high-resolution titles. New game engines increase GPU intensity, which drives frequent upgrades. Design and visualization users depend on advanced GPUs for CAD, 3D modeling, and rendering tasks. High-performance computing uses AIBs to speed up parallel workloads across engineering and research activities. Data centers integrate GPUs for AI inference, image processing, and analytics pipelines. Media and entertainment workflows rely on dedicated boards for editing, compositing, and animation work. Each application group contributes consistent demand across performance classes.

- For instance, AMD’s Radeon RX 7000 series achieves up to 869 FPS in 1440p with SAM and RSR enabled in Valorant, and up to 299 FPS in Apex Legends, demonstrating the high frame rates possible with modern discrete GPUs. New game engines increase GPU intensity, which drives frequent upgrades.

By End User

Desktop systems hold the largest share because they support high-power AIB units and offer greater thermal headroom. Gamers, creators, and engineers prefer desktop-based builds for stronger output and easier upgrade paths. Notebooks use integrated and mid-tier AIBs for mobile performance needs. Workstations depend on high-end GPUs for stable performance in design, engineering, and simulation workloads. It supports professional users who require reliability and high compute density. Each end-user category maintains unique performance needs that shape product choices across the market.

Segmentation:

By Type

By Application

- Gaming

- Design and Visualization (including CAD, 3D modeling)

- High-Performance Computing

- Data Center

- Media and Entertainment

By End User

- Desktop

- Notebook/Laptop

- Workstation

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The Graphics add in board AIB market secures the largest share in North America at 36.8%, driven by strong gaming culture, high disposable income, and rapid adoption of advanced GPUs. Consumers upgrade frequently to support high-refresh gaming and demanding AAA titles. It gains further support from a large base of content creators who rely on GPUs for editing, rendering, and streaming. Enterprises deploy AIBs for AI workloads, training systems, and simulation tasks. Esports growth strengthens retail and online GPU demand. A mature PC hardware ecosystem and strong OEM presence keep North America at the forefront of premium AIB adoption.

Europe

Europe holds 27.6% of the global share, supported by strong uptake across gaming communities, engineering firms, and creative studios. Users adopt discrete GPUs to power 3D modeling, CAD work, and design visualization. It gains traction within professional sectors that require stable workstation performance. Esports events, gaming cafés, and digital entertainment platforms promote continued hardware upgrades. Countries such as Germany, France, and the U.K. show high interest in custom PC builds. Regional manufacturers and distributors maintain strong supply chains that support steady product availability.

Asia Pacific

Asia Pacific accounts for 25.4% of the market and stands as the fastest-growing region due to large gamer populations in China, South Korea, Japan, and India. Rising income levels and strong youth demographics support higher GPU demand. It expands further through the growth of esports, VR gaming, and online streaming. Local PC component brands strengthen access to affordable AIB units. Data center investments also increase interest in GPU-based acceleration across AI workloads. Wider broadband availability and rapid digital adoption keep Asia Pacific on an upward growth path.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Graphics add in board AIB market displays strong competition driven by rapid product cycles and aggressive performance gains across leading brands. Nvidia and AMD dominate the landscape with advanced architectures, while Intel expands its position in the mid-range category. It encourages AIB partners such as ASUS, Gigabyte, EVGA, Sapphire, and Zotac to differentiate through cooling design, clock tuning, and custom PCB layouts. Vendors compete through AI acceleration features, ray-tracing cores, and energy-efficient designs. Market players invest in workstation-grade GPUs to support CAD, 3D design, and compute workloads. Firms expand distribution networks to reach gaming and creator communities. The competitive field continues to intensify due to rising demand from gamers, creators, and data-driven users.

Recent Developments:

- In November 2025, Nvidia Corporation partnered with Microsoft and Anthropic to invest up to $15 billion in Anthropic, focusing on next-generation AI advancements. Nvidia and Nokia also formed a strategic partnership in October 2025 to develop AI-powered telecommunications infrastructure, with Nvidia investing $1 billion and acquiring a 2.9% stake in Nokia. Additionally, in September 2025, Nvidia and OpenAI announced a collaboration to deploy 10 gigawatts of Nvidia systems for advanced AI factories.

- In October 2025, Advanced Micro Devices, Inc. (AMD) announced a strategic partnership with OpenAI to deploy 6 gigawatts of AMD GPUs, starting with the AMD Instinct MI450 series and extending to future product generations. In November 2025, AMD also acquired MK1, an AI software startup founded by former Neuralink engineers, to bolster its AI inference capabilities.

- In September 2025, Intel Corporation and Nvidia jointly announced plans to develop multiple generations of custom data center and PC products integrating both companies’ technologies. Intel also rolled out the Gaudi 3 AI accelerator chip in late 2025, collaborating with leading OEMs for enterprise AI deployment.

Report Coverage:

The research report offers an in-depth analysis based on By Type (Discrete, Integrated), By Application (Gaming, Design and Visualization, High-Performance Computing, Data Center, Media and Entertainment), and By End User (Desktop, Notebook/Laptop, Workstation). It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand rises as gaming hardware upgrades increase across global markets.

- AI-driven workloads expand adoption among home users and small firms.

- Workstation GPUs gain traction in engineering, medical imaging, and CAD uses.

- AIB vendors focus on better cooling and efficient silicon designs.

- Esports growth pushes more consumers toward mid-range and premium GPUs.

- Laptops integrate stronger AIB options to meet creator requirements.

- Data center AI inference opens new lanes for professional GPU models.

- Hybrid gaming-and-work PCs raise interest in multi-purpose AIBs.

- Regional expansion accelerates in Asia Pacific due to younger gaming audiences.

- Custom PC culture strengthens aftermarket GPU sales worldwide.