| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Egypt Single-Use Bio-Processing Systems Market Size 2024 |

USD 64.37 Million |

| Egypt Single-Use Bio-Processing Systems Market, CAGR |

12.46% |

| Egypt Single-Use Bio-Processing Systems Market Size 2032 |

USD 164.66 Million |

Market Overview

Egypt Single-Use Bio-Processing Systems Market size was valued at USD 64.37 million in 2024 and is anticipated to reach USD 164.66 million by 2032, at a CAGR of 12.46% during the forecast period (2024-2032).

The Egypt Single-Use Bio-Processing Systems market is driven by the growing demand for cost-effective and flexible biomanufacturing solutions in the biopharmaceutical industry. Single-use technologies offer significant advantages, such as reduced operational costs, faster turnaround times, and lower risk of cross-contamination, making them ideal for small and large-scale production. The rising adoption of biologic drugs and vaccines further fuels the need for efficient production systems. Additionally, advancements in single-use system designs, such as improved scalability and enhanced performance, are attracting more investment in the sector. Regulatory support and the push for more sustainable manufacturing practices also contribute to the market’s expansion. These trends indicate a strong future for the single-use bio-processing systems market in Egypt, driven by technological innovation and increasing industry demand for flexible, cost-efficient solutions.

The geographical analysis of the Egypt Single-Use Bio-Processing Systems market highlights the key regions of Cairo, Alexandria, Suez Canal Region, and Upper Egypt as focal points for market growth. Cairo leads as the primary hub due to its concentration of biopharmaceutical companies and research facilities. Alexandria benefits from its strategic location near Mediterranean ports, fostering industrial growth. The Suez Canal Region offers logistical advantages, while Upper Egypt is emerging with government-backed initiatives for healthcare development. Key players driving this market include global and regional leaders such as Aspen Pharmacare Holdings Limited, Thermo Fisher Scientific, Merck KGaA, Sartorius, and Danaher. These companies are crucial in providing advanced bio-processing solutions and contributing to Egypt’s growing biopharmaceutical industry. Their presence in Egypt underscores the increasing adoption of single-use systems, helping to improve production efficiency, flexibility, and cost-effectiveness across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Egypt Single-Use Bio-Processing Systems market was valued at USD 64.37 million in 2024 and is projected to reach USD 164.66 million by 2032, growing at a CAGR of 12.46% during the forecast period.

- The global single-use bio-processing systems market was valued at USD 17,326.05 million in 2024 and is projected to reach USD 57,663.39 million by 2032, growing at a CAGR of 16.22% from 2024 to 2032.

- The increasing demand for biopharmaceuticals, including vaccines and biologic drugs, is driving the adoption of single-use systems in Egypt.

- Single-use systems offer cost-efficiency, flexibility, and reduced contamination risks, making them an attractive solution for manufacturers.

- Technological advancements, such as real-time data monitoring and improved system integration, are enhancing the performance of these systems.

- The competition in the market includes global players like Thermo Fisher Scientific, Sartorius, and Merck KGaA, as well as local players.

- High initial capital investments and supply chain challenges are the key market restraints limiting the rapid adoption of single-use systems.

- Cairo and Alexandria are the primary regions driving market growth, while Upper Egypt shows potential due to increasing government support for healthcare infrastructure.

Report Scope

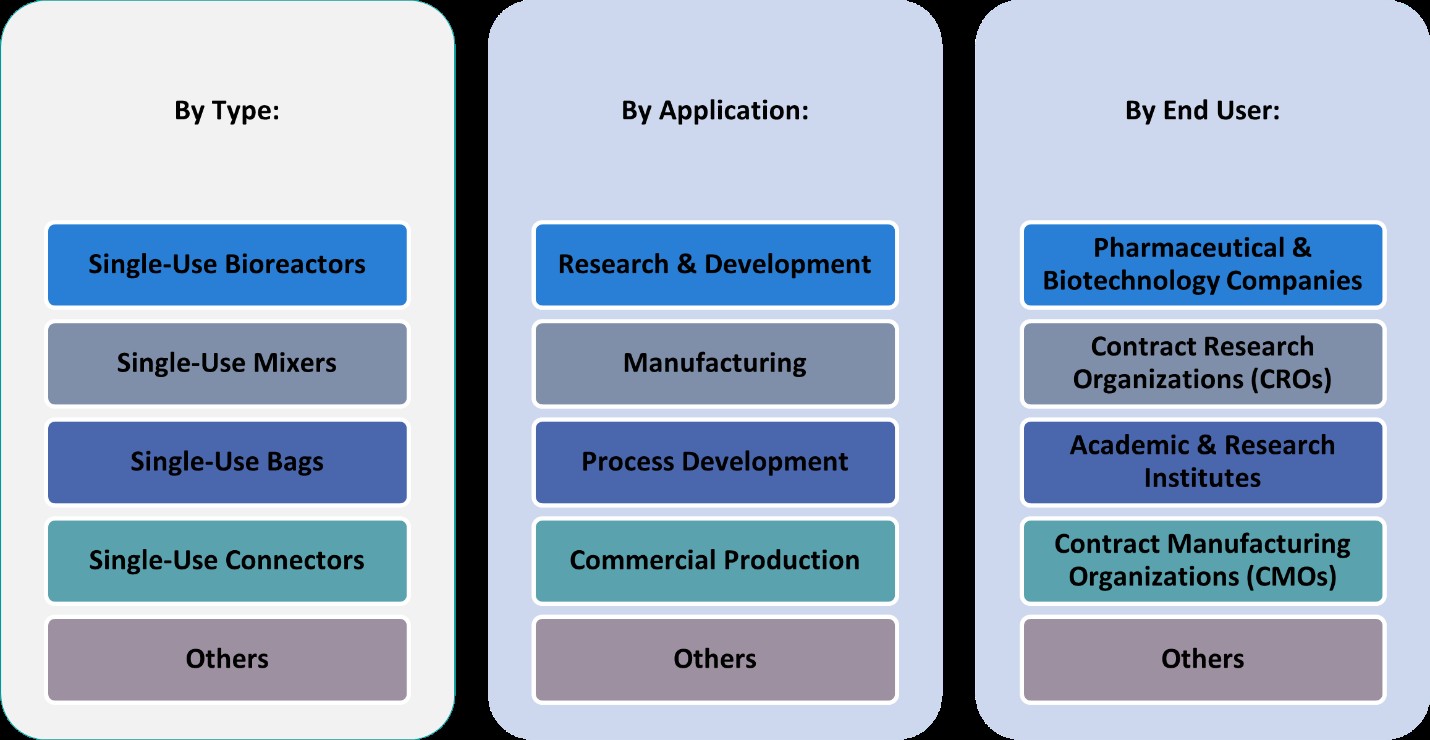

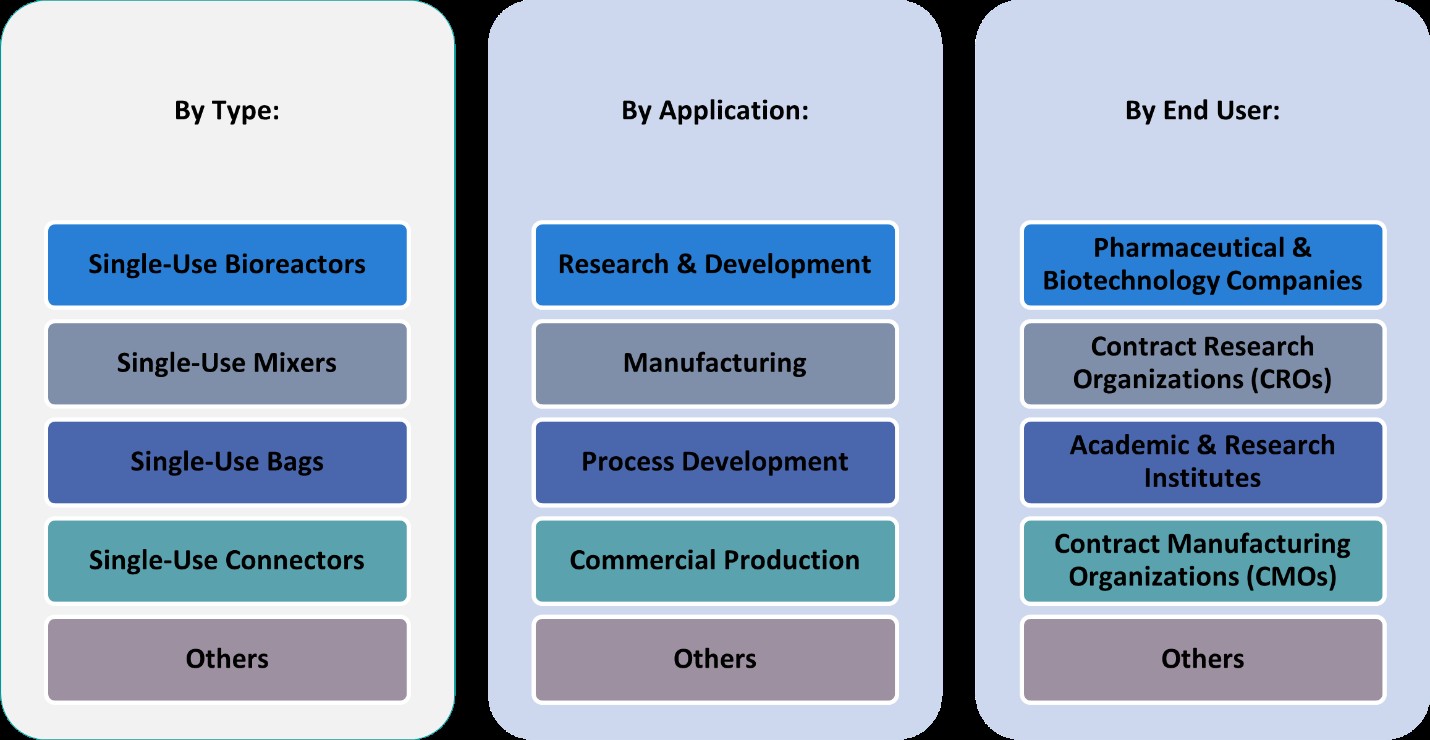

This report segments the Egypt Single-Use Bio-Processing Systems Market as follows:

Market Drivers

Increasing Demand for Biopharmaceuticals

One of the primary drivers of the Egypt Single-Use Bio-Processing Systems market is the growing demand for biopharmaceuticals. For instance, the Egyptian Drug Authority (EDA) has been actively supporting the expansion of biologics manufacturing, particularly in vaccine production, to meet regional healthcare needs. The United Nations Industrial Development Organization (UNIDO) has also emphasized the importance of bio-based industries in Egypt’s healthcare sector, promoting sustainable and scalable production methods. Single-use bio-processing systems offer biomanufacturers an agile, flexible, and cost-effective solution to meet this rising demand. In Egypt, as the biopharmaceutical sector expands, particularly in response to regional healthcare needs and vaccine production, there is an increasing need for scalable and efficient manufacturing solutions. Single-use systems, with their ability to handle small batches and adapt quickly to different production requirements, are well-suited for this growing market segment. This demand for biologics, combined with single-use system capabilities, is expected to drive market growth substantially.

Regulatory Support and Sustainability Initiatives

Regulatory support and sustainability efforts are key factors in the growth of the single-use bio-processing systems market in Egypt. For instance, the Egyptian Ministry of Environment has been actively promoting circular economy initiatives to enhance sustainability in industrial production. The Egyptian government and regulatory bodies are increasingly recognizing the importance of flexible, scalable manufacturing solutions in meeting the demand for biopharmaceuticals. Regulations are evolving to accommodate newer, more sustainable technologies, allowing for faster approval and adoption of single-use systems. Additionally, sustainability concerns are becoming a significant driver in the adoption of these systems. Single-use technologies reduce the need for extensive cleaning, which decreases water and chemical consumption, aligning with global sustainability goals. The growing emphasis on eco-friendly production practices is further incentivizing manufacturers in Egypt to adopt single-use solutions, enhancing market growth. As both regulatory bodies and manufacturers push for more sustainable, efficient processes, the demand for single-use systems is expected to continue rising.

Cost-Effectiveness and Operational Efficiency

Cost efficiency remains a key factor influencing the widespread adoption of single-use bio-processing systems in Egypt. Traditional stainless-steel systems require high capital investment, extensive cleaning, and sterilization, which can lead to increased operational costs. In contrast, single-use systems eliminate the need for cleaning validation and sterilization procedures, significantly reducing both operational time and costs. These systems also offer lower upfront capital expenditures, making them particularly attractive to small and mid-sized biopharmaceutical companies in Egypt. The ability to scale production quickly without the need for large, permanent infrastructure is another factor contributing to the cost-effectiveness of single-use technologies. As the biopharmaceutical industry in Egypt continues to grow, cost-effective production processes will remain a driving force for market expansion.

Technological Advancements and System Integration

The continuous advancement of single-use bio-processing systems technology is another significant market driver. Innovations in system design, such as higher capacity, improved scalability, and enhanced performance, are expanding the capabilities of these systems. For example, the integration of advanced sensors, automation, and real-time data monitoring has increased the operational efficiency and control offered by single-use systems. These technological improvements allow manufacturers to maintain high-quality production standards while improving yield and reducing the risk of contamination. Moreover, advancements in system integration are enabling seamless connectivity between different stages of the production process, from upstream to downstream, optimizing the entire workflow. In Egypt, as local manufacturers seek to modernize their facilities, the adoption of cutting-edge single-use systems is helping to boost production capacity and overall system efficiency.

Market Trends

Expansion in Biopharmaceutical Applications

The adoption of single-use bio-processing systems in Egypt is increasingly driven by their application in the production of monoclonal antibodies, vaccines, and cell therapies. These systems facilitate efficient, scalable, and cost-effective manufacturing processes, essential for meeting the rising demand for biopharmaceuticals. As Egypt aims to enhance its biomanufacturing capabilities, the integration of single-use technologies is pivotal in advancing the production of complex biologics.

Collaborations and Strategic Partnerships

Strategic collaborations between local biopharmaceutical companies and global suppliers of single-use bio-processing systems are accelerating market growth in Egypt. For instance, the Egyptian Vaccine Manufacturers Alliance (EVMA) has played a pivotal role in establishing Egypt as a regional biomanufacturing hub. Additionally, Praj Industries and Egyptian Sugar and Integrated Industries Company (ESIIC) have partnered to develop bioethanol projects, supporting Egypt’s transition to sustainable biomanufacturing. These partnerships enable knowledge transfer, access to advanced technologies, and capacity building, enhancing the overall competitiveness of Egypt’s biomanufacturing sector. Such collaborations are instrumental in positioning Egypt as a key player in the Middle East and Africa’s biopharmaceutical industry.

Technological Advancements in System Integration

Recent innovations in single-use bio-processing systems have led to enhanced system integration, offering improved scalability and performance. For instance, the incorporation of advanced sensors, automation, and real-time data monitoring has optimized production processes, resulting in higher efficiency and reduced contamination risks. These technological advancements are particularly beneficial for Egypt’s growing biopharmaceutical sector, enabling manufacturers to meet international production standards.

Regulatory Support and Sustainability Initiatives

The Egyptian government’s increasing support for flexible and sustainable manufacturing solutions is fostering the growth of single-use bio-processing systems. Regulatory bodies are evolving to accommodate these technologies, facilitating faster approvals and encouraging their adoption. Additionally, the emphasis on sustainability aligns with global trends, as single-use systems reduce the need for extensive cleaning and sterilization, thereby minimizing environmental impact.

Market Challenges Analysis

High Initial Capital Investment

One of the key challenges facing the Egypt Single-Use Bio-Processing Systems market is the high initial capital investment required for adopting these technologies. Although single-use systems are cost-effective in the long run due to reduced operational and maintenance costs, the upfront investment in purchasing and setting up these systems can be a barrier for smaller biopharmaceutical companies. In Egypt, where many local companies are in the early stages of adopting advanced manufacturing technologies, the financial burden of transitioning to single-use systems may deter some organizations from making the shift. This financial challenge can slow the overall adoption of these systems, particularly in a market where capital is often limited, and biopharmaceutical companies may prioritize short-term profitability over long-term investments.

Limited Local Manufacturing and Supply Chain Challenges

Another challenge for the Egypt Single-Use Bio-Processing Systems market is the limited local manufacturing of the components required for these systems. Most single-use bio-processing system components, such as bioreactors, filters, and bags, are imported from global suppliers, which exposes manufacturers in Egypt to supply chain disruptions, fluctuations in costs, and longer lead times. For instance, the Egyptian government has launched initiatives to localize drug manufacturing and reduce reliance on imports, aiming to strengthen domestic production capabilities. In the event of geopolitical instability or global trade disruptions, such as those seen during the COVID-19 pandemic, supply chains can become strained, leading to delays in production and higher costs for Egyptian biopharmaceutical companies. Additionally, the lack of local production capacity for these systems means that companies must rely on international partnerships and collaborations, which may not always align with their production timelines or cost expectations. This reliance on external sources for critical components remains a significant challenge for market growth.

Market Opportunities

The Egypt Single-Use Bio-Processing Systems market presents significant opportunities due to the growing demand for biopharmaceuticals in both local and regional markets. As Egypt’s healthcare sector continues to evolve, there is an increasing need for efficient and scalable manufacturing solutions for biologic drugs, vaccines, and therapies. Single-use systems offer biopharmaceutical manufacturers in Egypt the ability to rapidly scale production, reduce contamination risks, and improve flexibility, making them an attractive solution for meeting the rising demand for complex biologics. The market for biologic therapies in the Middle East and North Africa (MENA) region is expected to expand, creating a favorable environment for the growth of single-use technologies. With regulatory bodies becoming more supportive of flexible, cost-efficient production solutions, Egypt is positioned to capitalize on these opportunities, particularly as the country seeks to enhance its biomanufacturing capabilities.

Additionally, strategic collaborations between local manufacturers and global suppliers of single-use bio-processing systems present a notable growth opportunity. Such partnerships would allow Egyptian companies to access advanced technologies, enhance their production capacities, and integrate more efficient systems into their operations. Furthermore, these collaborations can foster local knowledge transfer and boost the domestic manufacturing of system components, reducing reliance on imports and minimizing supply chain disruptions. With the growing emphasis on sustainability and green manufacturing practices, there is also an opportunity for Egyptian companies to adopt more eco-friendly, cost-effective production methods that align with global trends. As these opportunities unfold, the market for single-use bio-processing systems in Egypt is poised for significant expansion, offering both local and international players the chance to establish a strong foothold in the region.

Market Segmentation Analysis:

By Type:

The Egypt Single-Use Bio-Processing Systems market can be segmented by type, with key components including single-use bioreactors, single-use mixers, single-use bags, single-use connectors, and others. Among these, single-use bioreactors hold the largest market share due to their pivotal role in the upstream production process of biologic drugs. These bioreactors allow for the cultivation of cells and microorganisms in a controlled environment, essential for producing biologics such as monoclonal antibodies and vaccines. Single-use mixers and bags are also gaining significant traction, particularly for their flexibility and efficiency in handling media, buffers, and other solutions during both production and research phases. Single-use connectors, which ensure sterile fluid transfer between different components of the system, are increasingly in demand due to their role in preventing contamination and maintaining a sterile production environment. The “others” category includes filtration systems, sensors, and other minor components that contribute to the overall functionality of single-use systems, supporting specialized applications in biopharmaceutical production.

By Application:

The market is also segmented by application, including research and development (R&D), manufacturing, process development, commercial production, and others. R&D remains a critical application, particularly for the development of new biologics and vaccines, where small-scale, flexible, and cost-efficient production systems are essential. Single-use bio-processing systems are ideal for this purpose, offering scalability and ease of use in laboratory settings. Manufacturing and process development applications also dominate the market as companies focus on increasing production capacity and streamlining operations. Single-use systems facilitate rapid scaling of manufacturing processes, which is critical in meeting the growing demand for biopharmaceuticals. Commercial production is another significant application, driven by the need for high-quality, large-scale production of biologics. The “others” category includes applications in contract manufacturing organizations (CMOs) and academic research institutions, where single-use systems are used to test and develop new bio-manufacturing techniques. As biopharmaceutical industries expand in Egypt, the demand for these systems across various applications will continue to rise.

Segments:

Based on Type:

- Single-Use Bioreactors

- Single-Use Mixers

- Single-Use Bags

- Single-Use Connectors

- Others

Based on Application:

- Research & Development

- Manufacturing

- Process Development

- Commercial Production

- Others

Based on End- User:

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Contract Manufacturing Organizations (CMOs)

- Others

Based on the Geography:

- Cairo

- Alexandria

- Suez Canal Region

- Upper Egypt

Regional Analysis

Cairo

Cairo holds the largest market share, accounting for approximately 40% of the overall market. As the capital and largest city in Egypt, Cairo is home to the majority of the country’s biopharmaceutical companies, research institutions, and healthcare providers. The concentration of manufacturing facilities, research and development (R&D) centers, and governmental support for healthcare innovation makes Cairo the epicenter for the adoption of single-use bio-processing systems. This centralization of resources and infrastructure is expected to drive continued growth in Cairo, positioning it as the dominant region for bio-processing technology adoption.

Alexandria

Alexandria follows with a notable market share of around 25%. The city is strategically positioned as a key industrial hub, with its proximity to Mediterranean ports facilitating easier access to global suppliers of single-use bio-processing systems. Alexandria’s well-established infrastructure, coupled with a growing focus on biopharmaceuticals, makes it an attractive location for manufacturers seeking to expand their production capabilities. The development of biopharmaceutical clusters and the increasing presence of international companies in Alexandria contribute to the rising demand for advanced manufacturing technologies, including single-use systems, further solidifying its position in the market.

Suez Canal

The Suez Canal Region accounts for approximately 15% of the market share. As an essential global shipping corridor, the Suez Canal Region plays a crucial role in the movement of raw materials, components, and finished goods for the biopharmaceutical industry. This strategic geographic location also positions the region as a hub for pharmaceutical and chemical industries, with an increasing number of biopharmaceutical facilities being established to take advantage of its logistical benefits. The region’s growing infrastructure and industrial base are driving the adoption of single-use bio-processing systems to meet the demands of both local and export markets, supporting its growth in the sector.

Upper Egypt

Upper Egypt represents around 10% of the market share, with growth primarily driven by the region’s increasing focus on improving healthcare infrastructure and biopharmaceutical production. While traditionally less industrialized compared to other regions, Upper Egypt is gradually emerging as a site for biopharmaceutical manufacturing due to governmental initiatives aimed at decentralizing industry and promoting regional development. The government’s efforts to encourage investment in Upper Egypt’s healthcare sector, combined with the availability of skilled labor and lower operational costs, are likely to drive further adoption of single-use bio-processing systems in the coming years. Despite its smaller market share, Upper Egypt’s potential for growth remains significant, making it a region to watch in the future.

Key Player Analysis

- Aspen Pharmacare Holdings Limited

- Biovac Institute

- Thermo Fisher Scientific Middle East

- Merck KGaA Middle East

- Sartorius Middle East

- Danaher Middle East

- Lonza Middle East

- Getinge AB Middle East

- Mabion SA

- Afrigen Biologics

Competitive Analysis

The competitive landscape of the Egypt Single-Use Bio-Processing Systems market is characterized by the presence of both global and regional players that offer advanced solutions for biopharmaceutical manufacturing. Leading companies in the market include Aspen Pharmacare Holdings Limited, Thermo Fisher Scientific, Merck KGaA, Sartorius, Danaher, Lonza, Getinge AB, Mabion SA, and Afrigen Biologics. These companies are at the forefront of providing innovative single-use bio-processing systems that cater to various applications such as research and development, process development, and commercial production. These companies differentiate themselves through technological innovation, cost-effective solutions, and the ability to provide scalable, customizable systems that meet the requirements of both small and large manufacturers. Additionally, competition is influenced by factors like product quality, regional support services, and supply chain efficiency. Companies are increasingly focusing on forming strategic partnerships with local manufacturers and healthcare providers to enhance their presence and expand market share in Egypt. The ability to adapt to local regulatory requirements and offer efficient, sustainable production processes is a key differentiator in this market. While global players dominate the high-end market segments, regional players are gaining traction by offering cost-effective and flexible solutions tailored to the specific needs of the Egyptian market. The competitive dynamics in the sector continue to evolve as innovation and cost-efficiency become pivotal in attracting customers.

Recent Developments

- In April 2025, Thermo Fisher Scientific launched the 5L DynaDrive Single-Use Bioreactor, a bench-scale system designed for seamless scalability from 1 to 5,000 liters. This new bioreactor offers a 27% productivity increase over glass bioreactors, enhanced sustainability with biobased films, and consistent performance across different scales, supporting both large and small biopharma manufacturers. The DynaDrive S.U.B. supports robust production across scales and has the flexibility to accommodate a variety of cell lines and processing modalities.

- In April 2025, Sartorius Stedim Biotech entered a strategic partnership with Tulip Interfaces to drive digital transformation in single-use bioprocessing. The collaboration introduced Biobrain® Operate powered by Tulip, a suite of digital manufacturing applications that integrate with Sartorius equipment to reduce process variability, digitize operations, and ensure regulatory compliance. This partnership aims to advance paperless manufacturing and optimize resource efficiency in bioprocessing.

- In March 2025, Corning introduced new technologies to support advanced therapy applications, including the Ascent™ Fixed Bed Reactor (FBR) and expanded cell expansion platforms like HYPERStack®, HYPERFlask®, and CellSTACK®. These platforms feature closed systems and automation to reduce contamination risk and enhance scalability for bioprocess applications.

- In April 2023, Merck KGaA launched the Ultimus® Single-Use Process Container Film, featuring ten times greater abrasion resistance than other films, improved durability, and leak resistance for single-use assemblies. The technology is now available in Mobius® 3D process containers, enhancing operational efficiency and cell growth performance.

Market Concentration & Characteristics

The Egypt Single-Use Bio-Processing Systems market exhibits moderate concentration, with a mix of global leaders and regional players driving competition. While multinational companies dominate the high-end segments, local manufacturers and suppliers are gradually increasing their market presence by offering tailored, cost-effective solutions. This creates a dynamic market environment where global players, leveraging their technological expertise and vast resources, compete with regional companies that can provide flexible, budget-friendly systems suited to local needs. The market is characterized by continuous innovation, with companies focusing on improving system efficiency, scalability, and reducing production costs. Additionally, a growing emphasis on sustainability and regulatory compliance is reshaping market dynamics. As demand for biopharmaceuticals increases, more players are expected to enter the market, further intensifying competition. The market’s characteristics reflect a balance between cutting-edge technologies and a focus on cost-effectiveness, catering to a diverse range of manufacturers in Egypt’s evolving biopharmaceutical landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Egypt’s single-use bio-processing systems market is expected to experience significant growth due to the increasing demand for cost-effective and flexible production methods.

- The adoption of single-use technology in biopharmaceutical manufacturing will lead to a reduction in operational costs and enhanced scalability for local companies.

- The growing focus on biomanufacturing and cell-based therapies in Egypt will drive the demand for innovative and efficient single-use systems.

- Key industries in Egypt, such as vaccines, biologics, and gene therapies, will benefit from faster production timelines and improved product quality.

- Egypt’s strategic location and economic initiatives will attract global companies to invest in single-use technologies, enhancing local manufacturing capabilities.

- The regulatory environment in Egypt is expected to evolve, promoting the use of advanced bio-processing solutions and supporting industry growth.

- Increasing partnerships between international and local companies will foster knowledge exchange and further expand Egypt’s bio-processing infrastructure.

- The rising focus on sustainability and environmental concerns will make single-use systems a preferred choice due to their reduced waste generation.

- Research and development in bio-processing technologies will continue to advance, driving innovation and improving the performance of single-use systems in Egypt.

- As the healthcare sector evolves, Egypt is positioned to become a key hub for biopharmaceutical manufacturing, leveraging the benefits of single-use bio-processing systems.