Market Overview

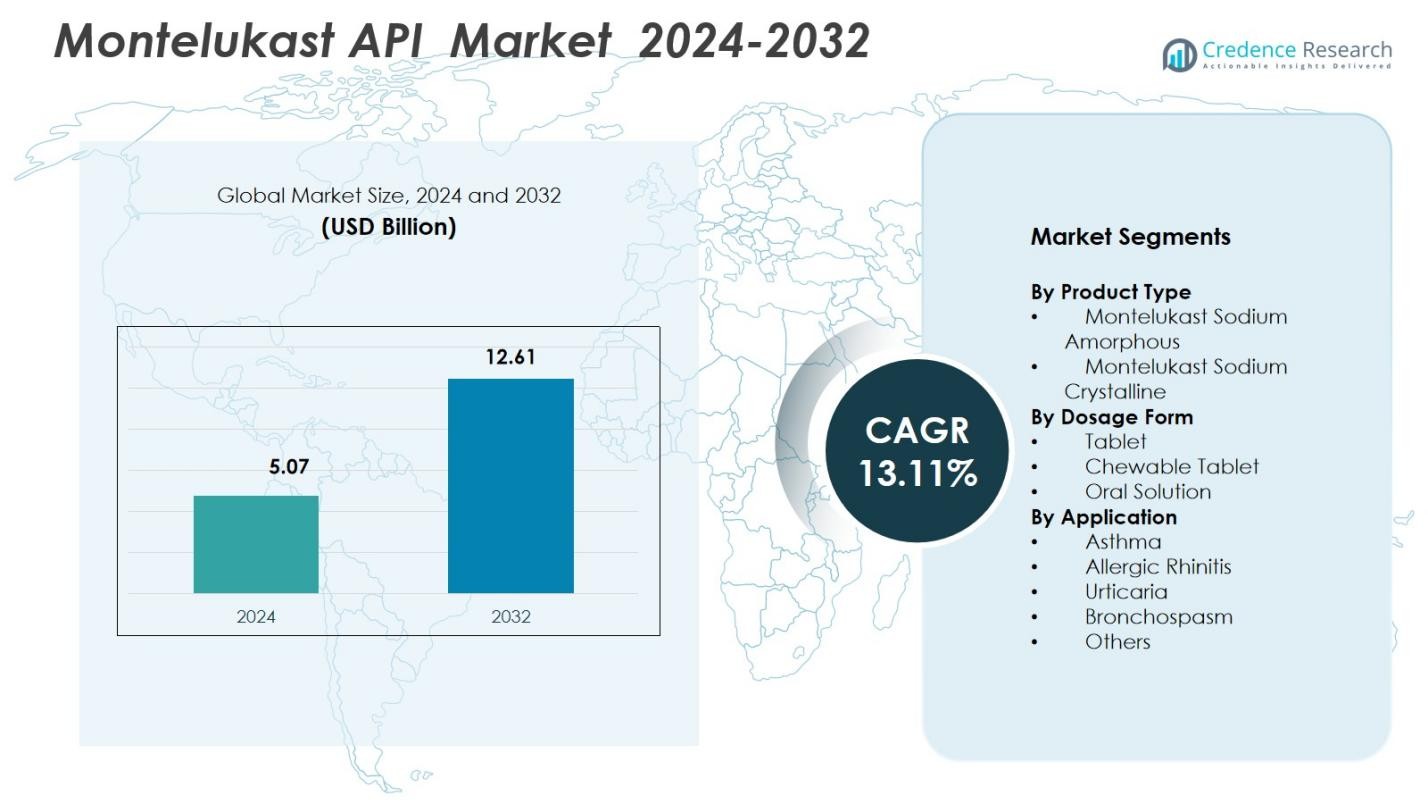

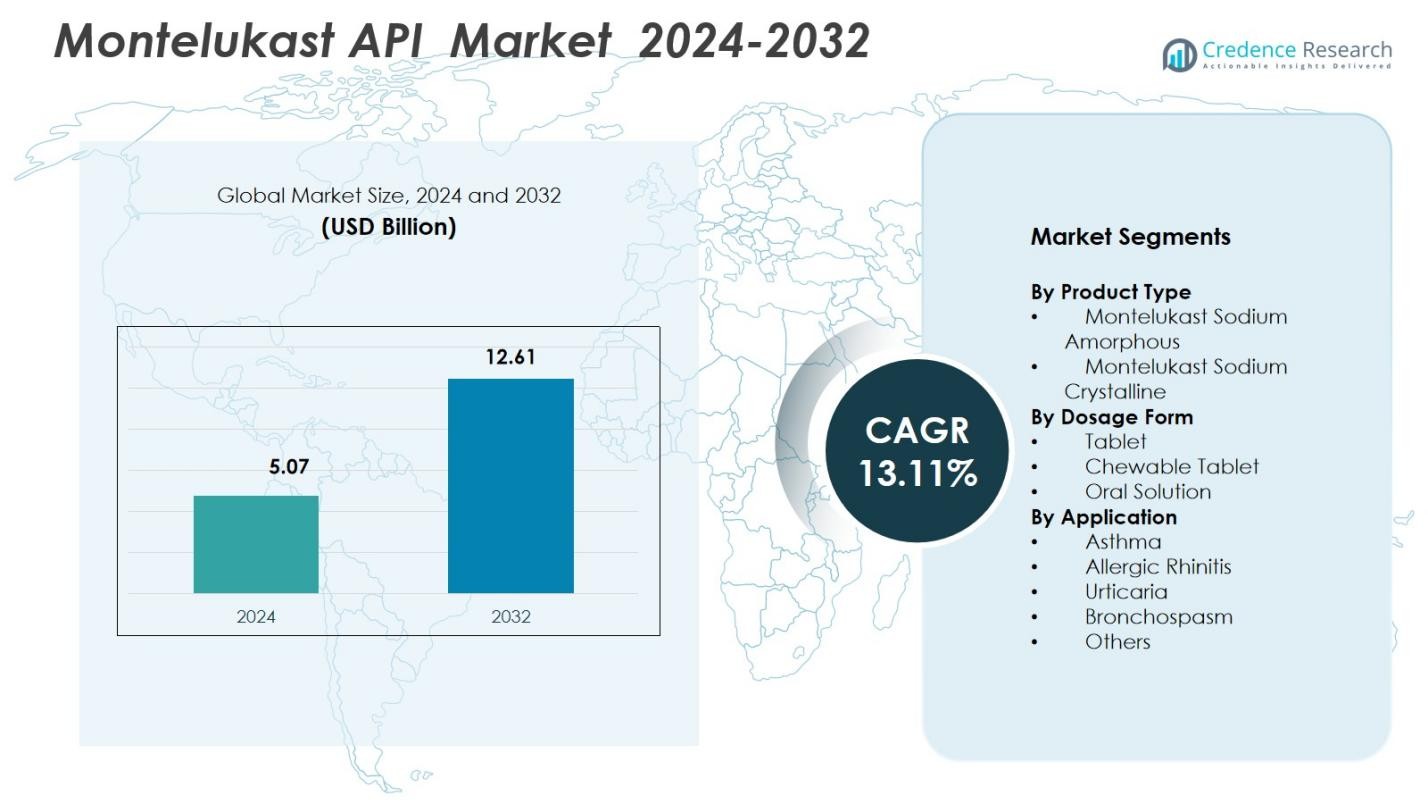

Montelukast API market size was valued at USD 5.07 Billion in 2024 and is anticipated to reach USD 12.61 Billion by 2032, at a CAGR of 13.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Montelukast API Market Size 2024 |

USD 5.07 Billion |

| Montelukast API Market, CAGR |

13.11% |

| Montelukast API Market Size 2032 |

USD 12.61 Billion |

Montelukast API market features leading pharmaceutical suppliers such as Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Cipla Ltd., Aurobindo Pharma Ltd. and Hetero Labs Ltd. among others, which supply Montelukast API globally and maintain robust regulatory compliance, broad manufacturing capacity and distribution networks. The market’s largest region in 2024 was North America, which held a 40.5% share, supported by high asthma and allergy prevalence, established healthcare infrastructure and widespread prescriptions. Europe followed with a 30.0% share, driven by generic drug adoption and strong regulatory standards. The Asia Pacific region accounted for 18.5%, fueled by increasing healthcare access, rising respiratory disease burden, and growing generic manufacturing capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Montelukast API market was valued at USD 5.07 Billion in 2024 and is anticipated to reach USD 12.61 Billion by 2032, growing at a CAGR of 13.11% during the forecast period.

- The increasing prevalence of chronic respiratory diseases, such as asthma and allergic rhinitis, is a key driver, with growing awareness and better diagnostic techniques contributing to higher demand for Montelukast therapies globally.

- The market is witnessing a shift towards generics, with the Montelukast Sodium Amorphous sub‑segment dominating the product type category, capturing 65.0% market share due to its manufacturing efficiency and improved solubility.

- North America leads the market with a 40.5% share, followed by Europe with 30.0%, driven by high disease prevalence, robust healthcare infrastructure, and adoption of cost-effective generics.

- Challenges such as safety concerns, including neuropsychiatric side effects, and competition from alternative therapies like biologics and inhaled corticosteroids may restrain the market’s growth.

Market Segmentation Analysis:

By Product Type

The Montelukast Sodium Amorphous sub‑segment dominated the product‑type category with a 65.0% market share in 2024. Manufacturers favored the amorphous form because it improved solubility and bioavailability and required fewer processing steps, reducing time‑to‑market and lowering production cost. The remaining 35.0% was held by the Montelukast Sodium Crystalline sub‑segment, which retained demand where long‑term stability and batch-to-batch consistency mattered. The amorphous form’s manufacturing efficiency and formulation flexibility remain the primary drivers of its dominance.

- For instance, Teva Pharmaceutical Industries is also recognized among the top companies producing Montelukast Sodium, serving diverse markets with regulatory compliance and manufacturing capabilities to meet global demand.

By Dosage Form

Within the dosage-form segment, the Tablet form commanded a leading 75.0% share in 2024, reflecting strong demand for standard, easy-to-administer dosage forms in both prescription asthma and allergic rhinitis therapies. Chewable Tablets captured 15.0% of the share, driven by pediatric and geriatric patient preferences, while Oral Solutions accounted for the remaining 10.0%, serving niche cases requiring dose flexibility or swallowing avoidance. The Tablet’s dominance stems from established manufacturing infrastructure, lower per-unit costs, and widespread patient acceptance.

- For instance, Montelukast widely prescribed for asthma and allergic rhinitis is available as a film-coated tablet, chewable tablet, and even oral granules, offering flexibility across age groups.

By Application

In the application segment, Asthma emerged as the dominant sub‑segment with a 55.0% share in 2024, owing to the prevalence of chronic asthma worldwide and frequent prescription of montelukast as maintenance therapy. Allergic Rhinitis held 25.0%, buoyed by rising allergy incidence and physicians’ growing preference for leukotriene-modifier therapy. Urticaria represented 10.0%, Bronchospasm 7.0%, and Others combined 3.0%. Demand in Allergic Rhinitis and other respiratory-related conditions contributed significantly to overall volume, but Asthma remained the principal driver of growth.

Key Growth Drivers

Increasing prevalence of chronic respiratory diseases drives demand

The rising global incidence of asthma and allergic rhinitis fuels the expansion of the Montelukast API market. As more patients are diagnosed with chronic respiratory disorders, demand for controller medications like the API for Montelukast increases substantially. The chronic nature of these diseases ensures recurring prescriptions, boosting consistent upstream demand for API. Healthcare providers’ growing reliance on Montelukast for long‑term management of asthma, allergic rhinitis, and related conditions sustains API consumption. Furthermore, increasing awareness and better diagnostic techniques lead to earlier detection, further driving the demand for Montelukast therapies.

- For instance, Merck’s Singulair, one of the leading Montelukast-based therapies, is regularly prescribed in asthma management, contributing to a substantial volume of Montelukast API consumption in global markets.

Growing geriatric and pediatric populations widen the patient base

Demographic shifts toward an increasing elderly population often more susceptible to respiratory diseases expand the target patient pool for Montelukast. Additionally, the growing number of pediatric patients with asthma and allergic rhinitis is driving demand for Montelukast, a treatment that is safe and effective for children. Montelukast’s suitability for pediatric and adolescent use makes it a preferred choice in younger populations too. This dual demographic growth (geriatric + pediatric) significantly enlarges the total treatable population, raising demand for Montelukast API. As the population ages and environmental triggers increase, this trend is expected to continue.

- For instance, Dr. Reddy’s Laboratories produces Montelukast Sodium API with a diverse portfolio exceeding 250 APIs and over 1,980 Drug Master Files (with over 1,638 active DMFs) filed across global markets.

Rising environmental pollution and lifestyle changes exacerbate respiratory conditions

Deteriorating air quality, increasing urbanization, and environmental pollution are significant contributors to the rising prevalence of allergic rhinitis, bronchospasm, and asthma. As environmental triggers such as pollutants and allergens become more widespread, more patients require long-term anti‑inflammatory and leukotriene-receptor antagonist therapy. This trend increases prescription volumes of Montelukast, directly boosting the API market. Additionally, changing lifestyle habits, including diet and sedentary living, contribute to the rising incidence of respiratory disorders, further increasing the demand for effective management solutions like Montelukast.

Key Trends & Opportunities

Expansion of Montelukast into multiple respiratory and allergy‑related indications

While asthma remains the core indication, Montelukast’s role in treating allergic rhinitis, exercise‑induced bronchoconstriction, and other related respiratory or allergic conditions is expanding. This broadened therapeutic scope presents opportunities for higher API demand as manufacturers supply varied formulations and dosage forms to meet diverse patient needs. Montelukast is also increasingly being considered for adjunct therapy in combination with other treatments. As healthcare providers look for cost-effective solutions, this expansion of indications opens up new treatment areas, positioning Montelukast as a versatile drug with a broad therapeutic footprint.

- For instance, Merck’s Montelukast demonstrated sustained symptom improvement in seasonal allergic rhinitis patients over four weeks of treatment, showing significant relief compared to placebo across multiple nasal and eye symptom scores.

Growth in generic Montelukast API suppliers and cost‑competitive manufacturing

With the expiration of original patents and the increasing production of generic drugs globally, API suppliers can now produce Montelukast at significantly lower costs, enabling more affordable pricing for finished drugs. This trend is driving the wider adoption of Montelukast, especially in price-sensitive markets where generic medications have become the preferred choice. Generic drug manufacturers continue to improve their production efficiency, enhancing their ability to meet growing market demands. Lower cost and easier access to Montelukast APIs also contribute to an overall expansion in market volume and help reduce healthcare costs globally.

- For instance, JW Pharmaceutical from South Korea leverages advanced manufacturing technology to maintain steady production outputs without compromising quality, meeting both USFDA and GMP compliance.

Key Challenges

Safety concerns and regulatory scrutiny may restrain market growth

Although Montelukast remains widely used, increasing awareness of potential neuropsychiatric and other side effects has led to caution among clinicians, regulators, and patients. Safety concerns such as mood changes, sleep disturbances, and suicidal thoughts have triggered warnings and monitoring guidelines from health authorities. These concerns may lead to stricter prescribing guidelines or regulatory limitations, which would negatively impact demand for Montelukast API. Despite its widespread use, these safety issues remain a challenge in ensuring its continued growth and acceptance among healthcare professionals.

Competition from alternative therapies and treatment modalities

Alternative asthma and allergy treatments such as inhaled corticosteroids, biologics, or other leukotriene inhibitors may reduce reliance on Montelukast. While Montelukast is a widely accepted treatment, newer biologics such as monoclonal antibodies have emerged as promising therapies, especially for severe asthma. As these newer, potentially more effective or safer therapies gain regulatory approval, the growth of the Montelukast API market may be challenged by shifts in clinical preference and treatment guidelines. Moreover, these alternatives often promise fewer side effects, which can make them more attractive to both patients and healthcare providers.

Regional Analysis

North America

North America held a dominant share of 40.5% in the Montelukast API market in 2024, driven by high demand in the United States and Canada. The prevalence of chronic respiratory diseases such as asthma and allergic rhinitis, along with a well-established healthcare system, supports strong market growth in the region. The region’s advanced healthcare infrastructure and early adoption of therapeutic innovations further contribute to the widespread use of Montelukast. Additionally, the growing awareness of respiratory conditions and the high number of pediatric and geriatric patients in the region also play a crucial role in the market’s expansion.

Europe

Europe accounted for 30.0% of the Montelukast API market in 2024. The region has a high incidence of asthma and allergic rhinitis, particularly in countries such as Germany, the UK, and France, driving demand for Montelukast-based therapies. The increasing preference for cost-effective generics and Montelukast’s inclusion in standard treatment guidelines support its wide adoption across European nations. Additionally, the European Union’s regulatory framework ensures high-quality production of APIs, which further boosts the confidence in Montelukast as a reliable treatment. Growth in the pediatric and elderly population segments also contributes significantly to the market.

Asia Pacific

Asia Pacific represented 18.5% of the Montelukast API market in 2024 and is anticipated to grow at a rapid pace during the forecast period. The region’s large, diverse population and increasing healthcare access in countries such as China, India, and Japan drive strong demand for Montelukast. Rising pollution levels and urbanization contribute to a higher prevalence of respiratory diseases, which in turn boosts the demand for Montelukast treatments. The increasing number of generics manufacturers in the region and the growing healthcare infrastructure also support the market’s expansion, with Montelukast being a widely prescribed treatment for asthma and allergic rhinitis.

Latin America

Latin America accounted for 6.5% of the Montelukast API market share in 2024. The rising healthcare expenditures and improving access to treatment options in countries such as Brazil, Mexico, and Argentina are contributing to the market’s growth. Asthma and allergic rhinitis are prevalent in the region, leading to an increased demand for Montelukast therapies. Additionally, the expansion of healthcare systems and the rising awareness of respiratory disorders are propelling the growth of the Montelukast API market. The increasing penetration of generics, combined with economic improvements, further supports the demand for affordable treatments across the region.

Middle East & Africa

The Middle East & Africa held a 4.5% share of the Montelukast API market in 2024. The region is seeing an increase in the incidence of respiratory conditions due to rising pollution levels, urbanization, and lifestyle changes. Countries such as Saudi Arabia, the UAE, and South Africa are key contributors to the demand for Montelukast in the region. While healthcare access in certain parts of Africa remains limited, improvements in medical infrastructure and rising awareness of respiratory diseases in the Middle East are helping drive market growth. The expanding use of generics also supports affordability in these regions.

Market Segmentations:

By Product Type

- Montelukast Sodium Amorphous

- Montelukast Sodium Crystalline

By Dosage Form

- Tablet

- Chewable Tablet

- Oral Solution

By Application

- Asthma

- Allergic Rhinitis

- Urticaria

- Bronchospasm

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Montelukast API market is highly competitive, with key players such as Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories, Cipla Ltd., Aurobindo Pharma Ltd., and Hetero Labs dominating the market. These companies maintain strong market positions through extensive production capabilities, regulatory approvals, and global distribution networks. Large players invest heavily in R&D and manufacturing scale, ensuring high-quality standards and compliance with global regulations, especially in North America and Europe. Smaller players and generics manufacturers, however, provide competitive pricing, contributing to market fragmentation. They focus on cost-efficient production, catering to price-sensitive markets, and offering flexible contracts for smaller-scale operations. This competitive environment, characterized by both large multinational corporations and nimble regional players, drives continuous innovation, with companies vying to capture market share by optimizing operational efficiency and enhancing product offerings in the growing demand for Montelukast API.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Aurobindo Pharma Ltd.

- Dr. Reddy’s Laboratories

- Hetero Labs Ltd.

- Mylan N.V. (also referenced as part of Viatris Inc.)

- Glenmark Pharmaceuticals

- Metrochem API Private Limited

- Morepen Laboratories Ltd.

Recent Developments

- In August 2025 a regulatory panel in India evaluated a proposal by Ravenbhel Healthcare for a fixed‑dose combination of Montelukast Sodium and Bilastine for pediatric use.

- In January 2025, regulatory authorities in India identified and detained counterfeit batches of “Montek‑LC” (Montelukast Sodium + Levocetirizine Hydrochloride) tablets purporting to be from Sun Pharmaceutical Industries Ltd.; Sun Pharma confirmed that these seized batches were spurious, highlighting ongoing quality‑control issues in the Montelukast market.

- In 2024, Cipla Limited included “Montelukast Sodium IP 10 mg + Fexofenadine HCl IP 120 mg Tablets” on its generic product list. This confirms the product is part of their commercial generic offerings, available under brand names such as Fexigra M and Montecip-FX, which have been on the market for several years prior to 2024.

Report Coverage

The research report offers an in-depth analysis based on Dosage Form, Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The global Montelukast API market will continue expanding as the prevalence of chronic respiratory diseases such as asthma and allergic rhinitis increases worldwide, sustaining steady demand for Montelukast‑based therapies.

- Growing healthcare expenditure and expanding access to affordable medicines in emerging economies will widen the patient pool for Montelukast, boosting API demand as generic manufacturers meet rising needs.

- Increased environmental pollution, urbanization, and changing lifestyles will raise the incidence of respiratory and allergy-related conditions, thereby supporting long-term growth for Montelukast API.

- Expansion of generic drug manufacturing capacity and lower-cost API production will enable broader global distribution of Montelukast, making it more accessible in price-sensitive and emerging markets.

- Regulatory support for generic versions and wider acceptance of cost‑effective leukotriene-receptor antagonists will encourage prescribers to recommend Montelukast, sustaining API demand.

- Manufacturers’ investment in process optimization and supply‑chain scaling will improve API availability and reduce lead times, making Montelukast production more efficient and responsive to market needs.

- Opportunities will arise from development of new dosage forms and formulations (e.g., chewable tablets, pediatric-friendly formats, or alternative delivery methods) to serve diverse patient demographics and improve compliance.

- Growth in preventive healthcare awareness and early diagnosis of allergic and respiratory conditions will increase patient adoption of maintenance therapies like Montelukast, expanding the API’s market base.

- Expanding use of Montelukast in broader indications beyond asthma — such as allergic rhinitis, exercise-induced bronchoconstriction, and other respiratory conditions — will diversify demand and support sustained API growth.

- Entry of new regional producers and contract manufacturing organizations (CMOs) will intensify competition, potentially driving down API costs while increasing supply reliability and accessibility globally.