Market overview

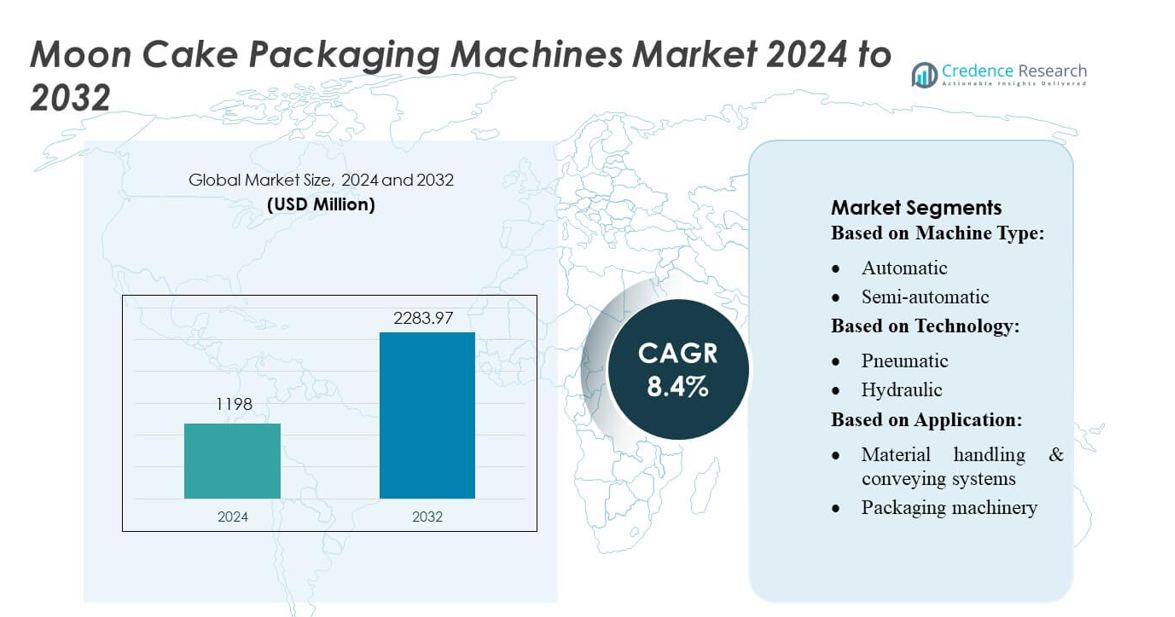

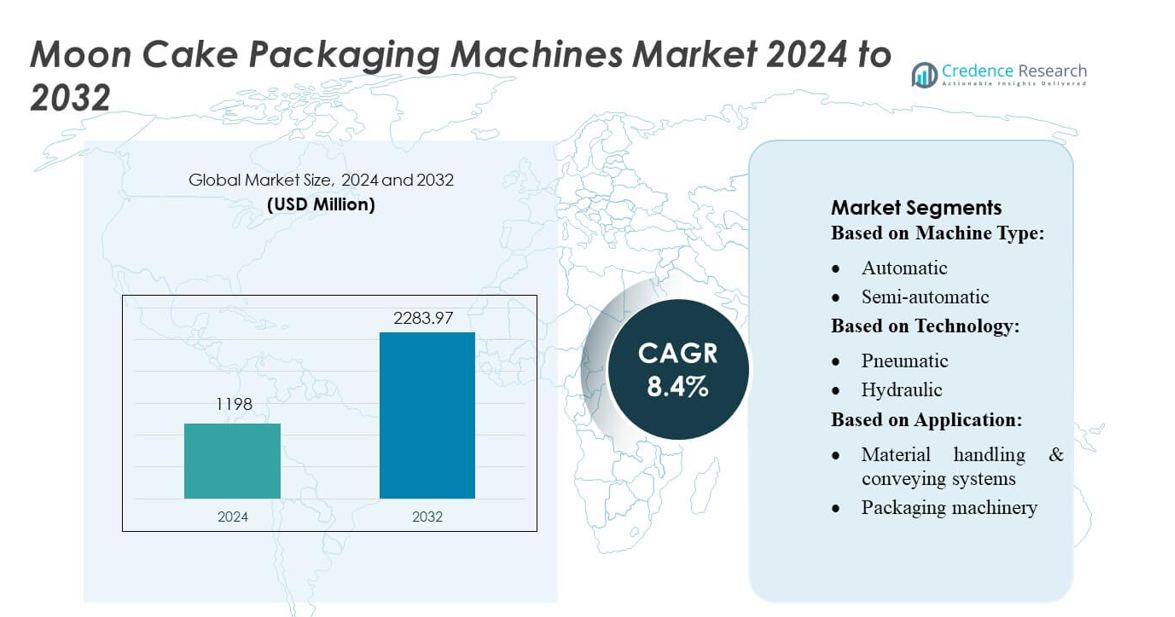

Moon Cake Packaging Machines Market size was valued USD 1198 million in 2024 and is anticipated to reach USD 2283.97 million by 2032, at a CAGR of 8.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Moon Cake Packaging Machines Market Size 2024 |

USD 1198 million |

| Moon Cake Packaging Machines Market, CAGR |

8.4% |

| Moon Cake Packaging Machines Market Size 2032 |

USD 2283.97 million |

The Moon Cake Packaging Machines Market is shaped by a competitive group of global manufacturers that focus on automation, precision, and high-volume packaging capabilities to meet seasonal demand surges. These companies invest in advanced technologies such as servo-driven systems, intelligent monitoring, and sustainable packaging designs to enhance operational efficiency and product presentation. Asia-Pacific remains the dominant region, holding an exact 48% market share, driven by large-scale mooncake production, rapid industrial automation, and the strong concentration of bakery manufacturers in China and other East Asian countries. This regional leadership continues to influence global innovation trends and equipment development strategies.

Market Insights

- The Moon Cake Packaging Machines Market was valued at USD 1198 million in 2024 and is projected to reach USD 2283.97 million by 2032 at a CAGR of 8.4%, reflecting steady demand for automated, high-precision packaging systems.

- Automation and efficiency serve as key growth drivers as manufacturers adopt servo-driven mechanisms, intelligent monitoring, and faster wrapping solutions to address seasonal production peaks and rising global consumption.

- Market trends highlight increasing preference for sustainable, energy-efficient packaging machinery and advanced digital inspection tools that improve accuracy while reducing material waste.

- Competitive analysis shows intensified innovation as global players enhance product portfolios with flexible, high-volume machines while strengthening after-sales service networks to support bakery modernization.

- Regional analysis indicates Asia-Pacific holds a dominant 48% share, driven by large-scale production in China and expanding bakery facilities, while the flow-wrapping segment leads the market with the highest share due to its speed, versatility, and suitability for premium boxed mooncake formats.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Machine Type

Automatic moon cake packaging machines dominate the market, capturing the largest share due to their high efficiency, reduced labor dependency, and ability to maintain consistent product quality during peak seasonal demand. Manufacturers prefer automatic systems because they support higher throughput, integrate easily with upstream processes, and minimize human error. Semi-automatic machines hold a moderate share as they balance cost and performance for mid-scale producers, while manual systems continue to decline, limited mainly to small workshops with low production volumes and budget constraints.

- For instance, Fuji Electric Co., Ltd. supplies servo systems like the ALPHA5 Smart series, which achieves a maximum rotational speed of 5,000 rpm when paired with Fuji’s gear heads, enabling rapid and highly responsive motion control on integrated packaging lines.

By Technology

Electric technology leads the moon cake packaging machines market, accounting for the highest share as manufacturers prioritize energy-efficient, low-noise, and precision-controlled systems. Electric drives enable greater operational stability, reduced maintenance, and enhanced automation compatibility, making them ideal for high-speed packaging lines. Pneumatic systems maintain a significant presence due to their reliability and cost-effectiveness for repetitive motion tasks, while hydraulic solutions remain niche for heavy-duty requirements. Robotic technology is emerging rapidly, driven by demand for flexible, high-accuracy pick-and-place operations, although its adoption is limited by higher initial investment.

- For instance, Royal Vendors, Inc. designs its Merlin IV vending controls around a 24 V direct-drive motor system that supports up to 650 twelve-ounce can capacity per unit.

By Application

Packaging machinery represents the dominant application segment, holding the largest market share as moon cake manufacturers increasingly invest in high-speed flow wrapping, sealing, and labeling systems to meet stringent hygiene and product integrity standards. The segment benefits from the rapid shift toward automated lines capable of handling delicate pastry textures without deformation. Material handling and conveying systems follow closely, supporting smoother production flow. Fabrication, cutting & drilling, and welding & joining machinery occupy smaller shares, largely serving auxiliary roles in equipment manufacturing and maintenance rather than direct moon cake processing.

Key Growth Drivers

Rising Automation Demand in Food Packaging

The moon cake packaging machines market grows significantly as manufacturers shift toward automation to improve speed, hygiene, and product consistency. High-volume seasonal demand drives producers to adopt automated wrapping, sealing, and labeling systems that minimize labor dependency and reduce operational errors. Increasing consumer expectations for tamper-proof, visually appealing packaging also accelerates this transition. Automated machines enable standardized output, longer production cycles, and better integration across processing lines, strengthening their adoption among medium and large bakery groups that aim to enhance productivity and reduce long-term operational costs.

- For instance, Westomatic Vending Services Limited’s Easy 6000 multi-drum machine features 8 retractable drums, each configurable into 4 to 48 compartments, giving a maximum capacity of 384 vendable items, and supports first-in, first-out (FIFO) dispensing to minimize waste.

Expansion of Moon Cake Exports and Premium Product Lines

Growing global demand for premium moon cakes, particularly in markets such as North America, Europe, and Southeast Asia, fuels investments in advanced packaging machinery. Export-oriented bakeries require equipment that ensures durability, extended shelf life, and compliance with international food safety standards. Premium moon cakes with delicate fillings and customized shapes further increase the need for precise, high-quality packaging solutions. As brands differentiate through luxury designs and gift-ready assortments, manufacturers prefer machines capable of handling multi-layer packaging, decorative finishes, and specialized formats, boosting market growth.

- For instance, Selecta Group integrates telemetry into its smart-vending fleet, enabling remote refill alerts and predictive maintenance; its machines—such as the Mars Intelligent Vending 1—offer real-time diagnostics across 130,000+ active units.

Increasing Focus on Hygienic and Sustainable Packaging

Rising regulatory pressure and consumer preference for hygienic, contamination-free food packaging drive demand for modern moon cake packaging machines equipped with sanitation-friendly designs and automated cleaning features. At the same time, sustainability initiatives encourage producers to adopt machines compatible with biodegradable films, recyclable materials, and reduced-waste packaging processes. Equipment that optimizes material consumption, minimizes product damage, and supports eco-friendly packaging formats gains traction. These sustainability-driven upgrades help manufacturers lower their environmental footprint while enhancing brand reputation, contributing significantly to market expansion.

Key Trends & Opportunities

Adoption of Smart and IoT-Enabled Packaging Systems

A major trend shaping the market is the integration of IoT, data analytics, and smart sensors into packaging machinery. Advanced systems provide real-time monitoring of operating parameters, predictive maintenance alerts, and automated adjustments that improve accuracy and reduce downtime. This digitalization trend offers opportunities for manufacturers to deliver more efficient, self-regulating equipment tailored to high-capacity production lines. The shift toward Industry 4.0 compliance also enables bakeries to improve traceability, reduce energy consumption, and enhance overall equipment effectiveness, presenting long-term growth potential.

- For instance, Azkoyen Group now supports more than 68,500 connected machines via its cloud-based telemetry platform, up from ~ 66,500 a year earlier.

Rising Demand for Customization and Flexible Packaging Formats

The market experiences increasing demand for machines capable of handling varied moon cake shapes, sizes, fillings, and luxury gift-box configurations. As premiumization and personalization trends grow, bakeries invest in flexible packaging machinery that supports rapid changeovers, multi-format compatibility, and small-batch customization. This enables manufacturers to respond quickly to festival-specific designs, corporate gifting trends, and brand differentiation strategies. Equipment suppliers offering modular, easy-to-upgrade systems gain a competitive edge, unlocking opportunities in both domestic and export-focused production facilities.

- For instance, Seaga Manufacturing Inc. offers its IIC Guard™ intelligent inventory-control module with 12 configurable compartments that can be combined in various ways to support different product formats.

Growth in Sustainable Material-Compatible Equipment

Manufacturers increasingly seek packaging machines engineered to process recyclable films, compostable wraps, and reduced-plastic materials. This shift creates opportunities for equipment designed with enhanced tension control, improved sealing technologies, and lower-temperature operations that preserve the integrity of eco-friendly substrates. As sustainability regulations tighten across major markets, machinery capable of meeting green-packaging requirements becomes more attractive. This trend encourages innovation in material-flexible systems, opening revenue opportunities for suppliers positioned at the intersection of environmental compliance and advanced packaging technology.

Key Challenges

High Capital Investment and Maintenance Costs

One of the primary challenges is the substantial upfront investment required for advanced automated and robotic packaging machines. Many small and mid-size moon cake producers struggle to justify the cost, especially given the seasonal nature of moon cake production. Additionally, high-tech machines require skilled technicians for maintenance, spare parts, and periodic calibration, further increasing operational expenses. This cost barrier slows adoption among emerging manufacturers and restricts the wider deployment of fully automated packaging solutions in cost-sensitive markets.

Complex Operation and Skill Shortages

Modern moon cake packaging machines often incorporate sophisticated control systems, multi-axis motion components, and digital interfaces that require trained operators. However, many bakeries face workforce shortages in technical roles, making it difficult to fully leverage advanced equipment capabilities. Insufficient training can lead to inefficient use, higher error rates, and increased downtime. The complexity of integrating new machines into existing production lines also poses challenges. As a result, manufacturers must invest in operator training and digital skill development to overcome these operational bottlenecks.

Regional Analysis

North America

North America holds 15–18% of the market share, supported by rising mooncake consumption among Asian-origin populations in the U.S. and Canada. The region invests heavily in automated wrapping and sealing machines to meet strict food safety standards and improve packaging durability. Bakeries and private-label brands adopt digital inspection systems to ensure consistent quality. The premiumization trend, especially in specialty retail channels, encourages manufacturers to use advanced decorative packaging machinery. Increasing imports of mooncakes for seasonal festivals also drive repackaging needs. Continuous modernization of food processing infrastructure sustains the region’s equipment demand.

Asia-Pacific

Asia-Pacific leads the Moon Cake Packaging Machines Market with an estimated 45–50% market share in 2024, driven by strong production volumes in China, Japan, Vietnam, and Malaysia. Growing industrial bakeries and rapid automation adoption significantly strengthen demand. Chinese manufacturers continue to invest in high-speed flow-wrapping and robotic systems to boost productivity during peak festival seasons. Rising exports of mooncakes to the U.S. and Europe further increase reliance on efficient, high-capacity packaging machinery. Expanding mid-tier bakery operations and increasing preference for premium boxed packaging formats sustain long-term market growth across APAC.

Europe

Europe accounts for 12–15% of the Moon Cake Packaging Machines Market, driven by growing popularity of Asian bakery products in the U.K., Germany, France, and the Netherlands. Rising festival-related demand and the expansion of Asian specialty stores support market growth. European manufacturers prioritize energy-efficient and sustainable packaging machinery to comply with stringent environmental standards. Importers and retailers increasingly use automated sealing and box-forming equipment to enhance product shelf appeal. Adoption of servo-driven systems and smart quality-monitoring tools contributes to improved packaging accuracy. Demand for premium, gift-oriented packaging formats strengthens equipment sales.

Latin America

Latin America holds 7–9% of the market share, driven by increasing exposure to Asian foods in Brazil, Mexico, Chile, and Argentina. Although mooncake production remains small, seasonal imports prompt manufacturers and distributors to adopt automated packaging solutions for retail preparation. Growing urban bakery culture supports gradual uptake of flow-wrapping and carton-forming machinery. Local producers prefer durable, cost-efficient equipment suitable for moderate output. Food industry modernization programs in major economies continue to support equipment adoption. Rising interest in premium and festival-themed bakery products creates opportunities for advanced packaging technologies across Latin America.

Middle East & Africa (MEA)

The Middle East & Africa secures 8–10% market share, supported by rising festival consumption among expatriate communities and expanding retail distribution in the UAE, Saudi Arabia, and South Africa. Local bakeries adopt semi-automatic packaging machines to balance operational efficiency with affordability. Tourism-driven hospitality outlets increasingly introduce premium mooncake offerings, boosting demand for aesthetic wrapping and sealing equipment. Import-driven markets rely on repackaging solutions for retail customization. As urban populations grow and international bakery chains expand regionally, MEA shows stable demand for mid-range, user-friendly packaging machinery designed for varying production capacities.

Market Segmentations:

By Machine Type:

By Technology:

By Application:

- Material handling & conveying systems

- Packaging machinery

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Moon Cake Packaging Machines Market features a diverse competitive landscape led by key players such as Sellmat s.r.l., Fuji Electric Co., Ltd., Royal Vendors, Inc., Westomatic Vending Services Limited, Selecta Group, Azkoyen Group, Seaga Manufacturing Inc., Sanden Holding Corp., Orasesta S.p.A, and Glory Ltd. The Moon Cake Packaging Machines Market exhibits a highly competitive environment characterized by rapid technological innovation, rising automation investments, and increasing demand for efficient, high-volume packaging solutions. Manufacturers focus on enhancing speed, accuracy, and versatility to accommodate diverse mooncake formats, premium gift packaging, and seasonal production spikes. The market also sees strong emphasis on sustainability, pushing companies to develop energy-efficient systems and reduce material waste. Advanced features such as servo-driven mechanisms, robotic pick-and-place systems, and digital quality-inspection tools are becoming standard, enabling greater consistency and reduced downtime. Expanding bakery production in Asia-Pacific and growing global consumption further intensify competition, encouraging continuous product upgrades and wider service networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sellmat s.r.l.

- Fuji Electric Co., Ltd.

- Royal Vendors, Inc.

- Westomatic Vending Services Limited

- Selecta Group

- Azkoyen Group

- Seaga Manufacturing Inc.

- Sanden Holding Corp.

- Orasesta S.p.A

- Glory Ltd.

Recent Developments

- In September 2024, Okuma America Corporation launched CNC horizontal machining centers – the MA-4000H. The MA-4000H features one of the largest machining areas and has spindle power and speed for maximum efficiency and productivity.

- In May 2024, Walker’s Shortbread, goods company, launched world’s first ever shortbread vending machine at the Scottish airport. The shortbread vending machine provides passengers to take a digital quiz to help match them to the perfect Walker’s product for any occasion.

- In April 2024, Bühler and Premier Tech launched the CHRONOS OMP-2090 B, a fully automatic bagging station for powdery products, designed to increase productivity and safety. The system offers precise bagging accuracy, reliable operation, and high operational and product safety, and is intended to help mills meet the demand for higher packaging capacities.

- In March 2024, PAC Machinery highlighted a number of cost-saving packaging solutions that reduce materials expenses for companies, assist in boosting production, and offer adaptable solutions for eco-friendly packaging. PAC Machinery’s newest solution in automated bagging and fulfillment, the Rollbag R3200 Fulfillment Automatic Bagger, operates with three various material types for greater cost savings and flexibility

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will adopt more advanced automation systems to handle rising seasonal production volumes with higher efficiency.

- Manufacturers will integrate smart sensors and digital monitoring tools to improve accuracy and reduce packaging defects.

- Demand for sustainable and eco-friendly packaging technologies will increase as regulations tighten globally.

- Compact and flexible machines will gain prominence to support diverse mooncake sizes and premium gift-box formats.

- Robotics and AI-driven inspection systems will become more common to enhance speed and quality consistency.

- Companies will expand service networks in Asia-Pacific to capitalize on the region’s strong production growth.

- Customizable packaging solutions will see higher adoption, driven by premiumization trends in retail and gifting.

- Remote diagnostics and predictive maintenance capabilities will grow to minimize machine downtime.

- Cross-border bakery expansion will stimulate higher investment in automated packaging equipment.

- Integration of cloud-based data analytics will improve operational efficiency and enable real-time production optimization.