Market Overview:

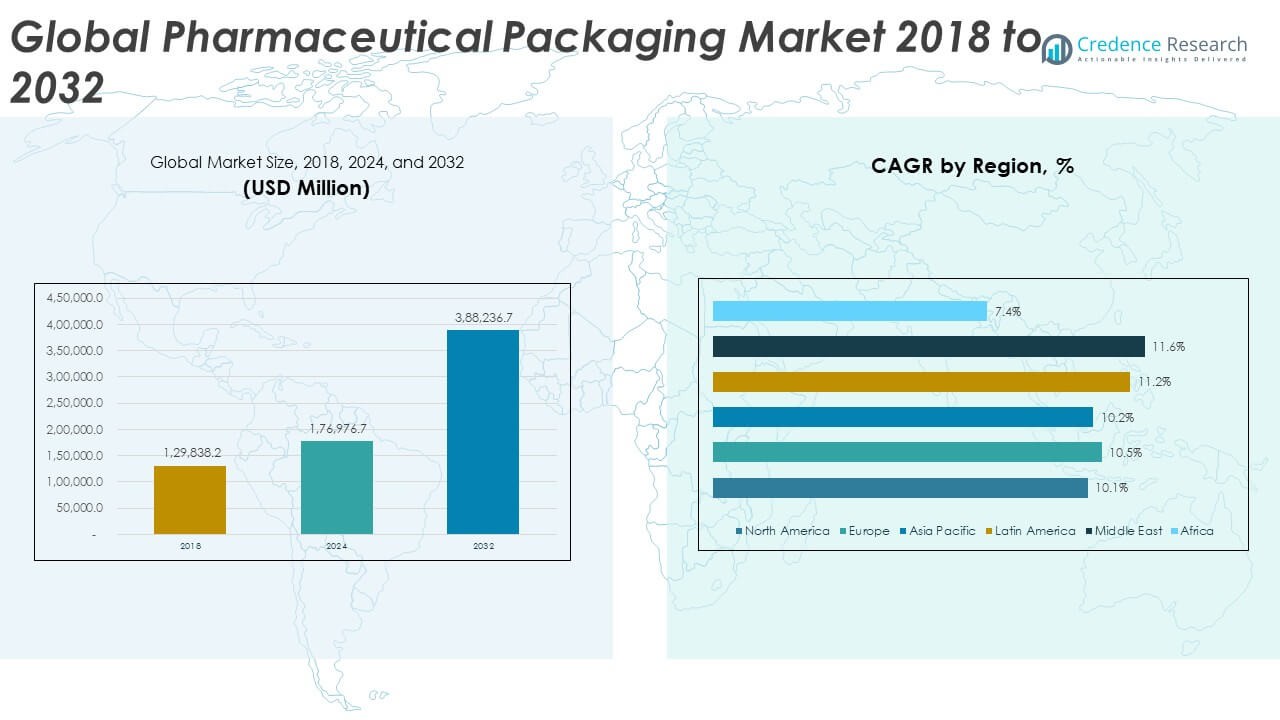

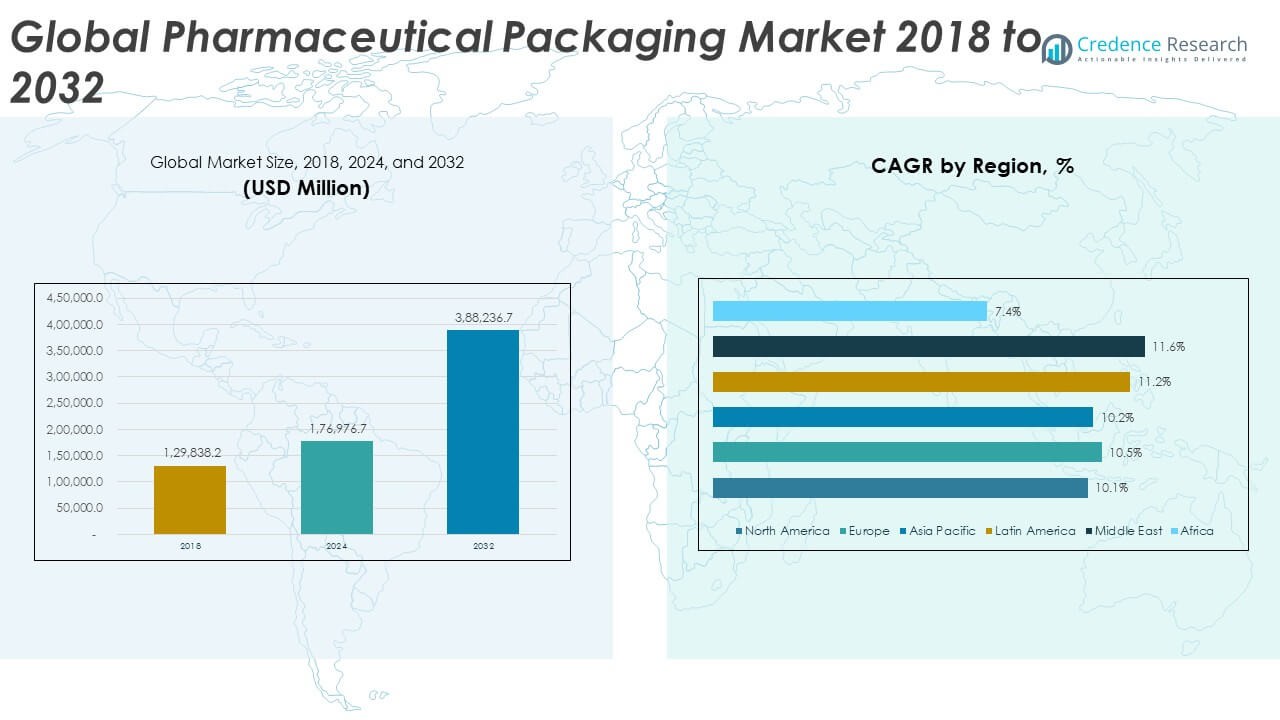

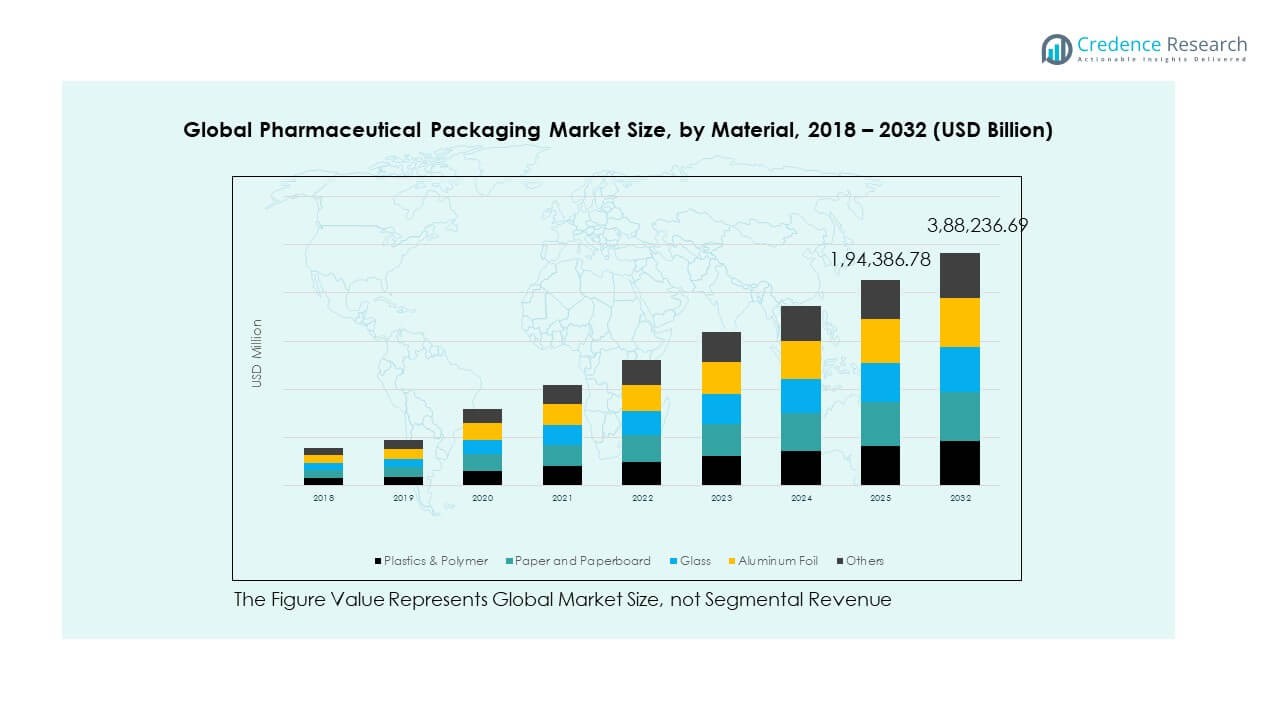

The Global Pharmaceutical Packaging Market size was valued at USD 1,29,838.2 million in 2018 to USD 1,76,976.7 million in 2024 and is anticipated to reach USD 3,88,236.7 million by 2032, at a CAGR of 10.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pharmaceutical Packaging Market Size 2024 |

USD 1,76,976.7 Million |

| Pharmaceutical Packaging Market, CAGR |

10.39% |

| Pharmaceutical Packaging Market Size 2032 |

USD 3,88,236.7 Million |

The market growth is driven by rising demand for secure, sustainable, and innovative packaging solutions that ensure product integrity and extend shelf life. Increasing pharmaceutical production, rising consumption of biologics, and expanding contract manufacturing are boosting the adoption of advanced materials and smart packaging technologies. Regulatory focus on patient safety and counterfeit prevention is also accelerating investments in tamper-evident and traceable packaging systems.

North America leads the market due to high pharmaceutical output and stringent regulatory standards supporting safe packaging practices. Europe follows closely, driven by the adoption of sustainable materials and automation in packaging lines. Asia-Pacific is emerging as the fastest-growing region, supported by rapid healthcare expansion, large-scale generic drug manufacturing, and increasing investments in local pharmaceutical production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Pharmaceutical Packaging Market size was valued at USD 1,29,838.2 million in 2018, increased to USD 1,76,976.7 million in 2024, and is anticipated to reach USD 3,88,236.7 million by 2032, growing at a CAGR of 10.39% during the forecast period.

- Asia Pacific (35%), Europe (27%), and North America (19%) hold the top three regional shares. Their dominance stems from strong pharmaceutical production, advanced infrastructure, and a robust focus on innovation and compliance standards.

- The Middle East is the fastest-growing region with a CAGR of 11.6%. Growth is driven by expanding healthcare infrastructure, government-backed manufacturing, and rising investments in sterile and high-barrier packaging.

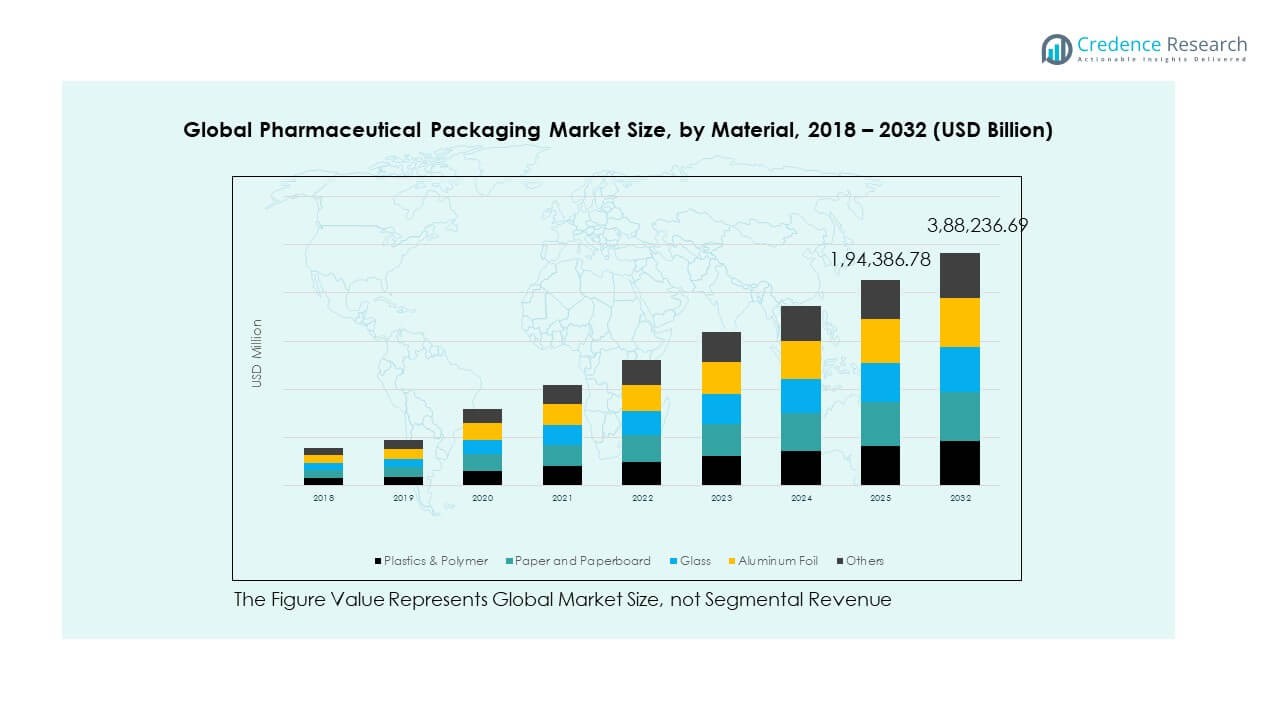

- Plastics & Polymer account for nearly 40% of the total material segment, supported by durability, affordability, and compatibility with diverse pharmaceutical products.

- Glass and Aluminum Foil together hold about 35% share, attributed to their superior barrier properties and extensive use in injectable and blister packaging for biologics and vaccines.

Market Drivers:

Growing Demand for Safe and Sustainable Packaging Solutions in the Pharmaceutical Industry

The Global Pharmaceutical Packaging Market is expanding rapidly due to increasing demand for safety-compliant and eco-friendly materials. Rising health awareness and stringent drug safety regulations have encouraged manufacturers to use packaging that ensures product integrity and reduces contamination risks. The transition from traditional glass and plastic containers to biodegradable and recyclable materials supports sustainability initiatives. Companies are focusing on tamper-proof and child-resistant designs to comply with international safety standards. The growth in biologics and personalized medicines has further pushed the need for temperature-sensitive and moisture-controlled packaging. Pharmaceutical companies are investing in smart labeling and track-and-trace technologies to ensure authenticity and reduce counterfeiting. Sustainable packaging innovations are now a major differentiator for leading pharmaceutical brands globally.

- For instance, in April 2025, Amcor launched its AmSky blister system, a PVC-free solution that is fully recycle-ready and was commercially adopted by top US retailers for products like TheraBreath Invigorating Icy Mint chewing gum, meeting stringent sustainability criteria and providing enhanced product protection.

Rising Global Pharmaceutical Production and Expanding Generic Drug Market

Growing drug production and the expansion of the generic drug industry are key contributors to the growth of the Global Pharmaceutical Packaging Market. Emerging economies are increasing their pharmaceutical manufacturing capacities to meet domestic and export demand. The rising prevalence of chronic diseases such as diabetes and cardiovascular disorders has increased the demand for affordable medications. Packaging suppliers are developing cost-effective solutions that maintain product stability and compliance with health regulations. The proliferation of contract manufacturing organizations (CMOs) and contract packaging organizations (CPOs) is expanding the customer base for packaging providers. Governments are implementing initiatives to enhance healthcare accessibility, driving packaging demand. Increased investment in automation and modular packaging lines is improving operational efficiency. Pharmaceutical companies rely heavily on flexible and scalable packaging systems to meet production timelines.

- For instance, West Pharmaceutical Services operates over 50 automated assembly cells worldwide, Integrating more than 2 billion component assemblies annually and providing scalable packaging, track and trace, and UDI (unique device identification) serialization services for pharmaceutical manufacturers.

Technological Advancements in Smart and Active Pharmaceutical Packaging

Innovation in packaging technology is transforming the Global Pharmaceutical Packaging Market by improving functionality and patient compliance. Smart packaging technologies, including RFID tags, sensors, and QR codes, allow real-time tracking and verification of products. Active packaging systems help maintain drug potency by controlling moisture and oxygen exposure. Integration of data analytics and digital monitoring is enabling efficient inventory management. These technologies enhance supply chain transparency and patient safety. Manufacturers are adopting advanced barrier materials and coatings that preserve sensitive formulations. The use of 3D printing for prototype development and customized packaging designs is increasing. Rapid digitalization across pharmaceutical operations is reshaping packaging practices for precision and traceability.

Stringent Regulatory Frameworks Driving Packaging Innovation and Quality Assurance

Tightening global regulations have significantly influenced the evolution of the Global Pharmaceutical Packaging Market. Authorities such as the FDA and EMA are enforcing strict guidelines for labeling, serialization, and traceability. Compliance with these standards requires high-quality packaging materials capable of maintaining product efficacy throughout the lifecycle. Pharmaceutical firms are compelled to adopt serialization and anti-counterfeit solutions to meet legal requirements. The emphasis on product identification and patient safety drives innovation in labeling and coding technologies. Standardization across regions has encouraged manufacturers to upgrade facilities and adopt automated quality inspection systems. The regulatory push toward environmentally sustainable materials has led to increased adoption of recyclable and biodegradable options. These frameworks continue to shape competitive strategies and product development priorities in the market.

Market Trends:

Shift Toward Biodegradable and Recyclable Packaging Materials Across the Pharmaceutical Sector

A strong movement toward eco-friendly materials defines current trends in the Global Pharmaceutical Packaging Market. Environmental concerns and corporate sustainability goals have increased the use of paper-based, bioplastic, and recyclable aluminum solutions. Companies are phasing out non-recyclable plastics to align with international waste reduction targets. Governments worldwide are implementing regulations favoring green packaging alternatives. The rise of eco-conscious consumers is also influencing manufacturers to adopt sustainable production processes. Suppliers are focusing on lifecycle analysis to minimize environmental impact. Technological innovation has made biodegradable packaging more durable and compatible with sensitive drugs. This sustainability-driven trend is reshaping procurement strategies and long-term supply chain planning.

- For instance, Gerresheimer’s EcoLine range applies criteria of weight, material, and recyclability to all new product developments, achieving reduced tare weight, lower energy use, and improved full-product lifecycle sustainability for pharmaceutical containers introduced for global customers since 2023.

Integration of Digital Technologies and Connected Packaging for Enhanced Transparency

Digital transformation is driving the adoption of connected packaging in the Global Pharmaceutical Packaging Market. QR codes, NFC chips, and blockchain-based systems are increasingly used to ensure authenticity and prevent counterfeiting. These technologies allow patients and healthcare professionals to verify products instantly. Integration of smart sensors helps monitor storage conditions and expiration dates. Connected packaging enhances patient engagement by delivering digital instructions and reminders. Manufacturers use real-time data to optimize logistics and manage recalls efficiently. The trend reflects a broader shift toward digital health ecosystems. It is reinforcing trust between consumers, healthcare providers, and pharmaceutical brands.

- For instance, Schreiner MediPharm and SCHOTT Pharma jointly launched smart RFID/NFC labels for prefilled syringes, providing secure patient-level data, enhancing hospital inventory control, and improving first-opening indication for pharmaceutical safety, as presented at industry conferences.

Growing Preference for Personalized and Small-Batch Packaging Solutions

The increasing focus on personalized medicine has created new demand patterns in the Global Pharmaceutical Packaging Market. Drug formulations are becoming more patient-specific, requiring flexible and small-batch packaging. Manufacturers are adapting to modular and digital printing technologies to handle low-volume production efficiently. Customization enables unique labeling, variable data printing, and compliance with region-specific regulations. Small-batch packaging supports reduced waste and faster turnaround times for specialized drugs. The trend is particularly visible in clinical trials and biologics manufacturing. Automation in packaging lines ensures precision in handling varied product forms. The personalized approach enhances brand value and meets the growing need for targeted therapies.

Expansion of E-Commerce and Direct-to-Consumer Pharmaceutical Distribution Models

The rapid rise of online pharmacies and direct-to-consumer channels is influencing the Global Pharmaceutical Packaging Market. Packaging designs are evolving to ensure product stability during extended shipping and handling. Tamper-proof seals and temperature-controlled containers are gaining prominence. Pharmaceutical companies are focusing on durable, lightweight, and easy-to-handle materials to optimize logistics. E-commerce expansion has increased demand for unit-dose and portioned packaging suitable for doorstep delivery. The trend also promotes the use of trackable and interactive packaging for real-time delivery verification. Packaging suppliers are collaborating with logistics providers to develop specialized solutions for online distribution. This evolution in the supply chain continues to redefine end-user expectations.

Market Challenges Analysis:

Rising Material Costs and Supply Chain Disruptions Impacting Production Efficiency

The Global Pharmaceutical Packaging Market faces growing pressure from volatile raw material prices and global supply chain disruptions. Fluctuations in resin, glass, and aluminum costs are increasing production expenses for manufacturers. Global trade restrictions and logistic bottlenecks have delayed deliveries and raised operational costs. Pharmaceutical firms struggle to maintain inventory stability during transportation delays and raw material shortages. The pandemic-driven restructuring of supply networks exposed vulnerabilities in sourcing strategies. Maintaining high-quality packaging while managing costs has become a balancing challenge. Limited availability of sustainable alternatives further complicates procurement strategies. Companies are being forced to develop localized supply chains to mitigate risks and improve resilience.

Regulatory Complexity and Counterfeit Threats Across Global Distribution Channels

Regulatory diversity across countries poses a major challenge for the Global Pharmaceutical Packaging Market. Compliance with varying standards for labeling, serialization, and sustainability increases operational complexity. Manufacturers face high costs for frequent audits, testing, and documentation to meet regional laws. The proliferation of counterfeit drugs in developing markets undermines consumer trust and brand reputation. Implementing anti-counterfeit measures requires advanced technology investments that not all players can afford. Packaging design constraints also limit creative flexibility while maintaining compliance. Managing global distribution while ensuring consistent quality adds another operational burden. The need for harmonized regulatory frameworks remains a critical concern for sustainable growth.

Market Opportunities:

Rising Demand for Smart and Connected Packaging to Improve Safety and Patient Engagement

The Global Pharmaceutical Packaging Market presents strong opportunities through the adoption of intelligent packaging technologies. Smart labels and connected solutions enable real-time tracking, ensuring authenticity and safety across supply chains. Integration of digital health applications enhances communication between patients and healthcare providers. Manufacturers can leverage data analytics to monitor usage patterns and improve adherence rates. These advancements improve transparency and reduce counterfeit circulation. Growing use of IoT-based packaging systems offers significant potential for differentiation. Companies investing in digital packaging are expected to achieve stronger market positions.

Expanding Pharmaceutical Production in Emerging Economies Creating New Growth Prospects

Emerging markets are becoming critical growth zones for the Global Pharmaceutical Packaging Market. Rapid urbanization and expanding healthcare infrastructure in Asia-Pacific, Latin America, and the Middle East are boosting demand. Governments are supporting local manufacturing to reduce import dependency. Affordable labor and increasing foreign investment make these regions attractive for packaging production facilities. Local suppliers are collaborating with global firms to enhance quality standards and compliance. Growing generic drug production and export activities are opening new business avenues. Companies adopting localized strategies will gain long-term advantages in these high-potential markets.

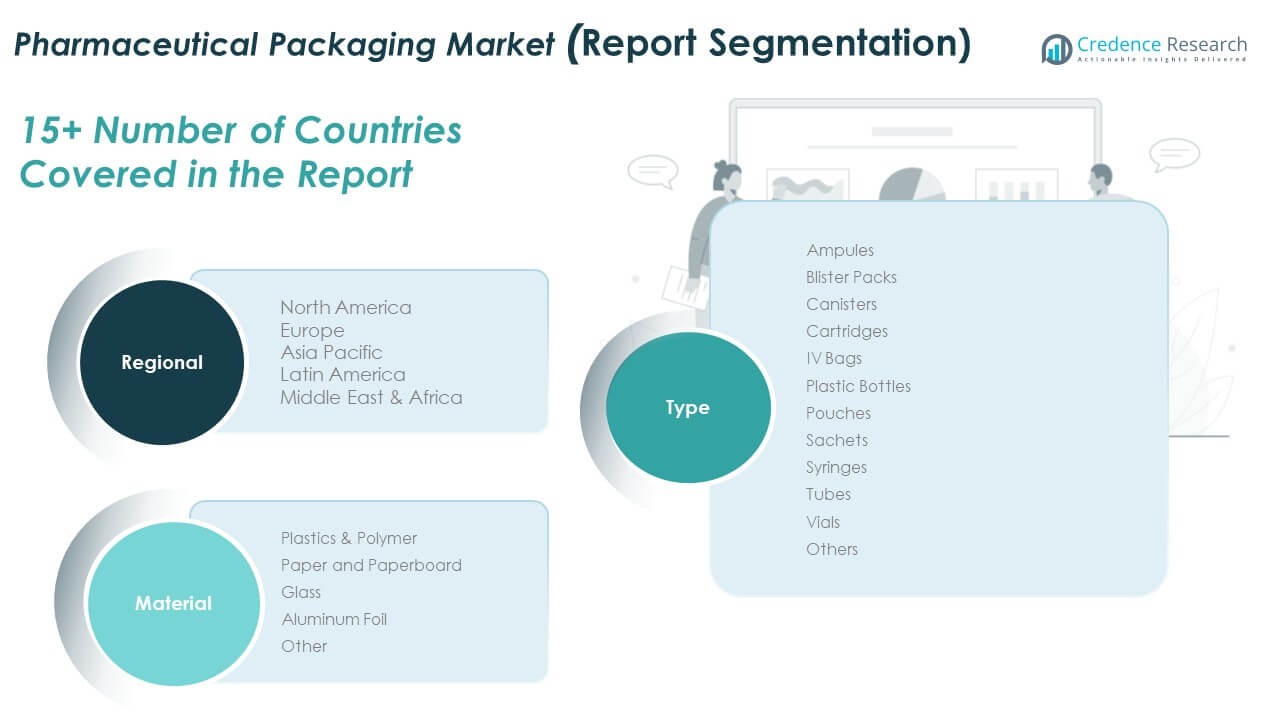

Market Segmentation Analysis:

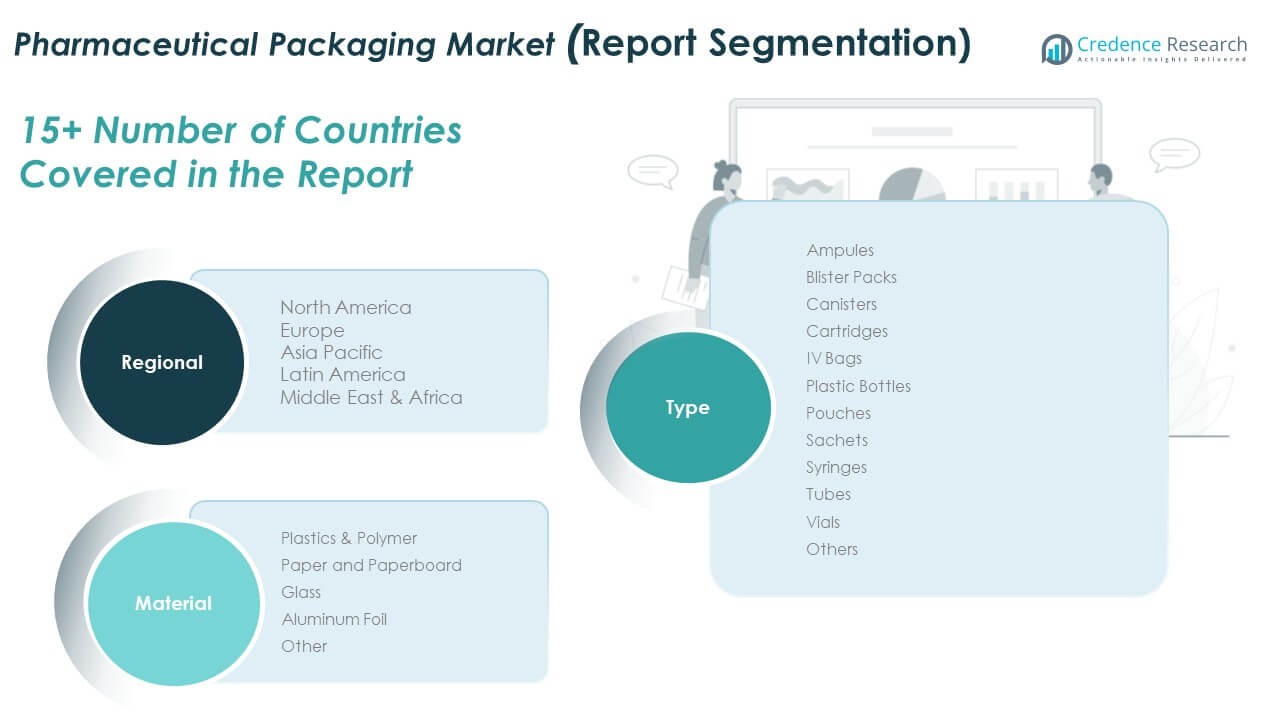

By Type

The Global Pharmaceutical Packaging Market is segmented into ampules, blister packs, canisters, cartridges, IV bags, plastic bottles, pouches, sachets, syringes, tubes, vials, and others. Plastic bottles, blister packs, and vials dominate due to their versatility, cost efficiency, and compatibility with various drug formulations. Syringes and IV bags are gaining traction with the growing use of injectable and infusion therapies. Ampules and cartridges remain preferred for high-purity and single-dose applications. Flexible formats like pouches and sachets are expanding in over-the-counter and nutraceutical packaging. The demand for tamper-evident, lightweight, and patient-friendly designs continues to drive product innovation. It reflects the industry’s shift toward user-centric and compliance-driven solutions that improve drug safety and convenience.

- For instance, SGD Pharma launched a partnership with Corning in 2023 to co-manufacture Velocity Vials at its India plant, equipped with new high-capacity lines and advanced siliconization, expanding output for Type I borosilicate vials while introducing additional ready-to-use formats for sterile biologics and biosimilars in 2024.

By Material

By material, the Global Pharmaceutical Packaging Market includes plastics & polymer, paper and paperboard, glass, aluminum foil, and others. Plastics and polymers hold the largest share due to their adaptability, durability, and low cost. Glass remains essential for injectable and sensitive formulations requiring chemical resistance and purity. Aluminum foil is widely used in blister packs for its barrier properties against moisture and oxygen. Paper and paperboard are emerging in sustainable secondary and tertiary packaging. Companies are increasingly integrating recyclable and biodegradable materials to meet environmental regulations. It continues to evolve with material advancements enhancing performance, protection, and sustainability across pharmaceutical applications.

- For instance, SCHOTT AG, in 2023, launched FIOLAX Pro (Type I borosilicate glass) tubing offering superior chemical quality and hydrolytic resistance, with enhanced profiles for extractables and leachables to address the rising demand in biotech and complex molecule pharmaceuticals.

Segmentation:

By Type

- Ampules

- Blister Packs

- Canisters

- Cartridges

- IV Bags

- Plastic Bottles

- Pouches

- Sachets

- Syringes

- Tubes

- Vials

- Others

By Material

- Plastics & Polymer

- Paper and Paperboard

- Glass

- Aluminum Foil

- Others

By Region

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Regional Analysis:

North America

The North America Global Pharmaceutical Packaging Market size was valued at USD 25,681.99 million in 2018 to USD 34,437.14 million in 2024 and is anticipated to reach USD 73,881.44 million by 2032, at a CAGR of 10.1% during the forecast period. North America holds a 19% market share in the global landscape. It is driven by advanced pharmaceutical manufacturing and strict regulatory standards supporting product safety and quality. The U.S. leads regional growth, supported by strong demand for biologics, injectables, and specialty drugs. Technological integration in packaging automation and serialization ensures high traceability. Sustainable packaging solutions are gaining traction due to environmental policies and consumer awareness. Canada and Mexico contribute through expanding contract packaging and pharmaceutical exports. The presence of major global suppliers and innovation centers enhances competitiveness. The region continues to invest in eco-friendly and smart packaging solutions aligned with healthcare modernization.

Europe

The Europe Global Pharmaceutical Packaging Market size was valued at USD 34,705.75 million in 2018 to USD 47,510.66 million in 2024 and is anticipated to reach USD 1,04,823.91 million by 2032, at a CAGR of 10.5% during the forecast period. Europe accounts for a 27% market share globally. Strong regulatory compliance and established pharmaceutical industries drive steady demand. Germany, France, and the U.K. dominate due to extensive R&D and biologics production. Sustainable material usage and circular economy principles are influencing packaging choices. Companies are shifting toward recyclable glass and paperboard solutions to reduce carbon footprints. Technological advancement in tamper-proof and anti-counterfeit features enhances safety. Growing geriatric populations and chronic disease prevalence strengthen packaging requirements for precision dosage formats. The European market maintains leadership in innovation and eco-friendly material adoption.

Asia Pacific

The Asia Pacific Global Pharmaceutical Packaging Market size was valued at USD 46,313.28 million in 2018 to USD 62,619.41 million in 2024 and is anticipated to reach USD 1,35,882.84 million by 2032, at a CAGR of 10.2% during the forecast period. Asia Pacific represents a 35% market share, making it the largest regional contributor. Rising healthcare spending and expanding pharmaceutical manufacturing in China, India, and Japan are major growth drivers. The region benefits from a vast generic drug industry and lower production costs. Local firms are partnering with global players to enhance packaging quality and regulatory compliance. Government support for healthcare reforms and drug export growth further boosts packaging demand. The trend toward flexible and low-cost packaging solutions aligns with the rise in over-the-counter medicines. Technological adoption in smart and sustainable packaging is also increasing. The region is poised for long-term dominance due to its strong manufacturing base and rising healthcare infrastructure.

Latin America

The Latin America Global Pharmaceutical Packaging Market size was valued at USD 13,853.73 million in 2018 to USD 19,816.33 million in 2024 and is anticipated to reach USD 46,200.17 million by 2032, at a CAGR of 11.2% during the forecast period. Latin America holds an 11% market share in the global landscape. Market growth is supported by the expanding pharmaceutical sector in Brazil, Argentina, and Mexico. Increasing healthcare accessibility and generic drug production enhance packaging requirements. Companies are adopting modern packaging formats to meet international export standards. The focus on child-resistant and tamper-evident designs is strengthening product safety. Local manufacturers are investing in sustainable packaging to align with global practices. Government initiatives supporting healthcare expansion and R&D activities are boosting regional competitiveness. The market continues to benefit from growing pharmaceutical exports and rising consumer awareness.

Middle East

The Middle East Global Pharmaceutical Packaging Market size was valued at USD 5,634.98 million in 2018 to USD 8,257.23 million in 2024 and is anticipated to reach USD 19,800.07 million by 2032, at a CAGR of 11.6% during the forecast period. The region contributes around 6% market share globally. Rising investments in healthcare infrastructure and pharmaceutical manufacturing are key drivers. GCC countries lead with expanding production capacities and government-backed healthcare reforms. Demand for high-barrier and sterile packaging is increasing with the growth of injectable and biologic drugs. Companies are emphasizing local production to reduce dependency on imports. Smart packaging adoption is gaining pace to support regulatory traceability requirements. Israel’s strong R&D base adds to technological advancements. The regional market continues to evolve toward high-quality, export-ready packaging standards.

Africa

The Africa Global Pharmaceutical Packaging Market size was valued at USD 3,648.45 million in 2018 to USD 4,335.93 million in 2024 and is anticipated to reach USD 7,648.26 million by 2032, at a CAGR of 7.4% during the forecast period. Africa accounts for a 2% market share globally. Growing demand for essential medicines and expansion of local pharmaceutical manufacturing are fueling market development. South Africa and Egypt are the primary contributors due to improving healthcare infrastructure. Limited access to advanced packaging materials remains a challenge but presents opportunities for foreign investment. Governments are supporting domestic drug production to reduce import reliance. Increasing awareness of drug safety and regulatory enforcement is enhancing quality standards. Sustainable and cost-effective packaging solutions are gaining traction. The region is gradually emerging as a potential growth hub within the global market ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- BD

- AptarGroup, Inc.

- Drug Plastics Group

- Gerresheimer AG

- Schott AG

- Owens Illinois Inc.

- West Pharmaceutical Services, Inc.

- Berry Global Inc.

- WestRock Company

- SGD Pharma

Competitive Analysis:

The Global Pharmaceutical Packaging Market is moderately consolidated, featuring a mix of global leaders and regional manufacturers. It is dominated by companies such as Amcor plc, Gerresheimer AG, Schott AG, BD, West Pharmaceutical Services, and AptarGroup Inc. These players focus on material innovation, smart packaging integration, and sustainability-driven product development. Intense competition revolves around enhancing product safety, compliance, and eco-efficiency. Companies are investing in R&D and expanding their global manufacturing capacities to strengthen market presence. Strategic collaborations with pharmaceutical producers and contract packaging firms are common. It continues to evolve with mergers, acquisitions, and advancements that support smart, traceable, and environmentally responsible packaging solutions.

Recent Developments:

- In July 2025, BD (Becton, Dickinson and Company) agreed to combine its biosciences and diagnostic solutions business with Waters Corporation in a $17.5 billion Reverse Morris Trust transaction. This partnership will create a new life science and diagnostics company, operating under the Waters name, and is anticipated to accelerate value creation in high-growth pharmaceutical testing and diagnostics markets.

- During October 2025, AptarGroup, Inc. extended its collaboration with Nasus Pharma Ltd., with new agreements aimed at advancing digital health development for pharmaceutical packaging. Earlier this year in August, Aptar acquired the clinical trial manufacturing capabilities of Mod3 Pharma to bolster its support for customers managing Phase 1 and Phase 2 drug development. This acquisition enhances Aptar’s technical footprint in the pharmaceutical packaging space.

- Gerresheimer AG, after acquiring Bormioli Pharma earlier in 2025, is set to provide a strategy update at its Capital Market Day this October regarding its expanded business segmentation. The acquisition increased Gerresheimer’s portfolio of glass and plastic primary packaging and positions the company to integrate high-value solutions for injectable drugs and biologics.

- West Pharmaceutical Services, Inc. announced ongoing partnerships with Corning Incorporated throughout 2025, notably launching the West Ready Pack featuring Corning Valor RTU vials with SG EZ-fill technology. The expanded collaboration is aimed at enabling advanced packaging solutions for injectable medications and biologics, addressing evolving needs in the pharmaceutical industry.

Report Coverage:

The research report offers an in-depth analysis based on Type and Material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing adoption of smart packaging technologies for real-time tracking and patient adherence.

- Rising focus on recyclable and biodegradable materials driven by global sustainability goals.

- Expansion of contract packaging organizations to meet increasing outsourcing demand.

- Strong growth potential in emerging markets due to rising drug production.

- Increased integration of automation and digital monitoring in packaging lines.

- Stringent global regulations encouraging innovations in safety and traceability.

- Rising investment in tamper-evident and child-resistant packaging formats.

- Continued dominance of plastic-based solutions, with ongoing material optimization.

- Rapid advancement in active packaging for biologics and temperature-sensitive drugs.

- Strategic collaborations between packaging suppliers and pharmaceutical manufacturers for innovation-led growth.