Market Overview:

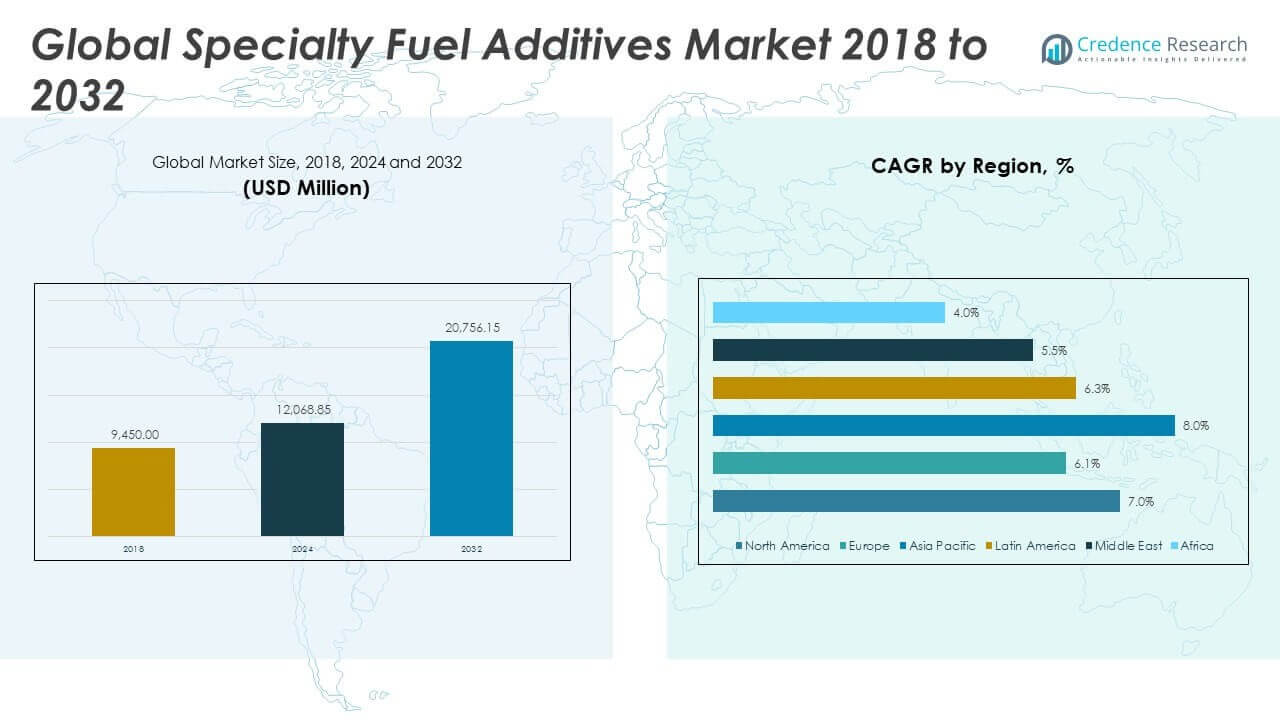

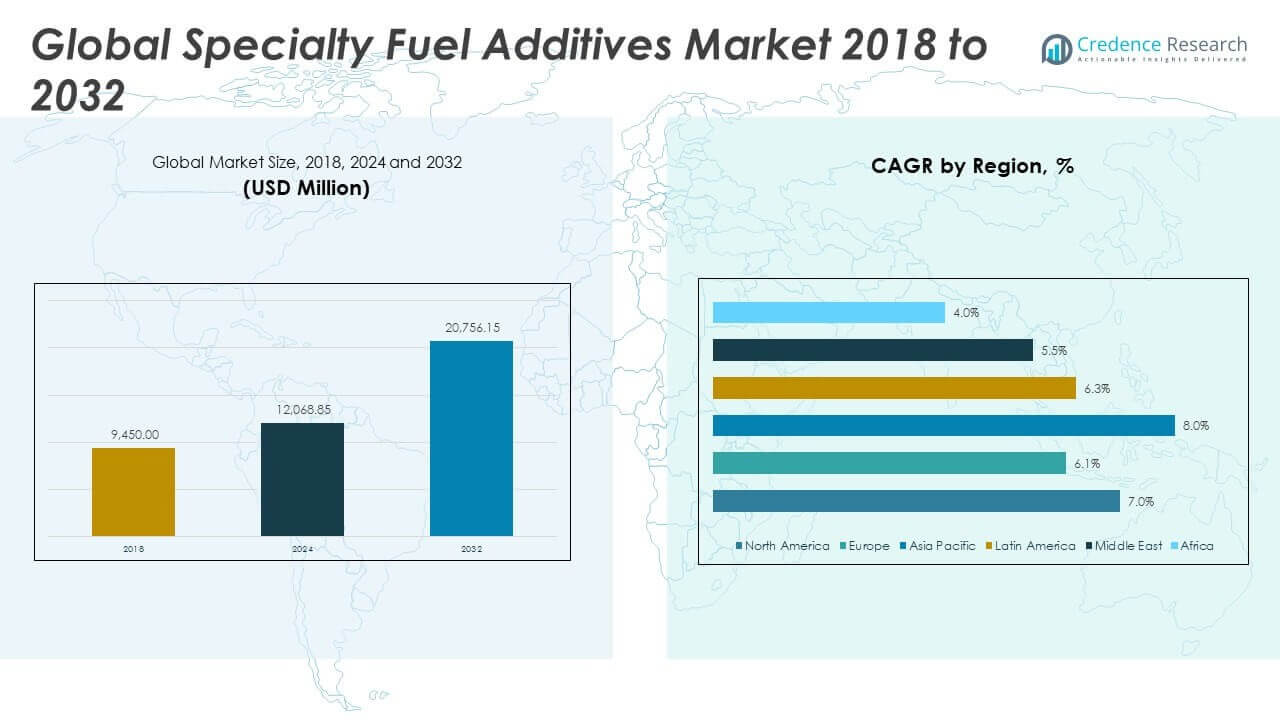

The Global Specialty Fuel Additives Market size was valued at USD 9,450.00 million in 2018 to USD 12,068.85 million in 2024 and is anticipated to reach USD 20,756.15 million by 2032, at a CAGR of 7.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Fuel Additives Market Size 2024 |

USD 12,068.85 Million |

| Specialty Fuel Additives Market, CAGR |

7.04% |

| Specialty Fuel Additives Market Size 2032 |

USD 20,756.15 Million |

The primary drivers of this market include stringent environmental regulations across major regions that require fuels to comply with emission norms such as Euro VI and U.S. EPA Tier 3. To meet these standards, fuel suppliers rely on additives that optimize combustion, lower particulate matter, and reduce nitrogen oxide emissions. Another major factor is the widespread adoption of ultra-low sulfur diesel (ULSD), which, while environmentally necessary, reduces natural lubricity in fuel. Specialty additives compensate for this loss, ensuring engine longevity and performance. The continued growth in vehicle fleets, industrial engines, and commercial aviation has also led to increased consumption of both diesel and gasoline, further fueling additive demand. Additionally, rising consumer focus on fuel economy and reduced maintenance has boosted the use of multifunctional additives that clean fuel injectors, improve cold starts, and inhibit corrosion. Innovation in bio-based and environmentally friendly additives is gaining traction as manufacturers seek to align product development with global sustainability goals.

Regionally, Asia-Pacific leads the global specialty fuel additives market. China, India, and Southeast Asian countries are witnessing strong growth due to rapid industrialization, rising automotive production, and increasingly strict emissions policies. North America follows, representing the global market, with the U.S. being a key contributor. The widespread implementation of ULSD and consistent investment in cleaner fuel technologies are supporting growth in this region. Europe also holds a significant share, driven by regulatory compliance, vehicle modernization, and consistent demand from aviation and shipping sectors. Germany, the UK, and France remain the dominant markets within Europe. Meanwhile, Latin America, the Middle East, and Africa are expected to register steady gains as fuel standards improve and infrastructure investment increases, though their current market share remains comparatively smaller. These regional dynamics highlight a global trend toward high-efficiency fuels and environmentally responsible engine performance solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Specialty Fuel Additives Market size was valued at USD 9,450.00 million in 2018, reached USD 12,068.85 million in 2024, and is anticipated to reach USD

- 20,756.15 million by 2032, at a CAGR of 7.04%.

- Stricter emission regulations such as Euro VI and U.S. EPA Tier 3 are key drivers, prompting demand for additives that reduce particulate matter and nitrogen oxide emissions across major fuel markets.

- Widespread adoption of ultra-low sulfur diesel (ULSD), which lacks natural lubricity, is increasing the use of additives like lubricity improvers, stabilizers, and corrosion inhibitors to protect engine components and maintain performance.

- Rising fuel prices and aging vehicle fleets are encouraging the use of additives that improve fuel economy, clean injectors, enhance ignition quality, and reduce carbon deposits in both on-road and off-road vehicles.

- The market is witnessing growth in bio-based and environmentally friendly additive formulations as manufacturers align with global sustainability goals and respond to green fuel policies.

- Asia-Pacific leads the Global Specialty Fuel Additives Market, driven by rapid industrialization and rising automotive output in China, India, and Southeast Asia, followed by North America and Europe with strong demand from the U.S., Germany, UK, and France.

- The industry faces pressure from volatile raw material prices, logistics disruptions, and regulatory inconsistencies across regions, which slow innovation and increase operational costs, especially for new market entrants.

Market Drivers:

Stringent Emissions Regulations Are Forcing Compliance through Advanced Fuel Additive Technologies:

Tightening global emissions standards are one of the most significant growth drivers for the Global Specialty Fuel Additives Market. Governments in North America, Europe, and parts of Asia are enforcing regulations that limit particulate matter, nitrogen oxides, and unburned hydrocarbons from internal combustion engines. Fuel suppliers must integrate additives that enable compliance with Euro VI, EPA Tier 3, and equivalent regional norms. These additives enhance combustion efficiency, reduce soot formation, and lower greenhouse gas emissions. It is critical for refiners and fuel distributors to adopt customized additive packages to meet regulatory benchmarks without compromising engine performance. These legislative measures continue to create a favorable environment for innovation and investment in emission-control additives.

- For instance, BASF’s Keropur® fuel additive technology has been adopted by several European fuel suppliers to meet Euro VI emission standards, with documented reductions of up to 20 mg/km in particulate matter and significant decreases in nitrogen oxide emissions in certified engine tests during 2023.

Increasing Demand for Ultra-Low Sulfur Diesel Is Accelerating Additive Consumption Across Fleets:

The shift to ultra-low sulfur diesel (ULSD) across major markets has directly increased the use of specialty fuel additives. Removing sulfur from diesel improves environmental performance but compromises the fuel’s natural lubricity and oxidative stability. The Global Specialty Fuel Additives Market is responding by offering lubricity improvers, stabilizers, and corrosion inhibitors tailored for ULSD applications. Fleet operators and engine manufacturers rely on these additives to protect critical components, extend maintenance intervals, and maintain engine efficiency. It is essential to balance environmental benefits with operational needs, making additives indispensable to modern diesel distribution systems. The expanding logistics and transportation sectors are amplifying demand for high-performance fuel additives to support continuous engine reliability.

- Innospec has developed multi-functional lubricity improvers, such as the Octamar LI-5 and OLI-9000 series, specifically for ultra-low sulfur diesel (ULSD). These additives restore lubricity lost during sulfur removal processes, preventing excessive wear of fuel pumps and injectors.

Rising Fuel Prices and Efficiency Concerns Are Pushing Demand for Additives That Enhance Mileage:

Fuel cost volatility is prompting consumers and businesses to seek performance-enhancing additives that reduce consumption and extend engine life. The Global Specialty Fuel Additives Market benefits from this trend as manufacturers develop detergent-based formulations and combustion enhancers that improve mileage and minimize carbon deposits. These solutions are particularly relevant in regions with aging vehicle fleets and inconsistent fuel quality. It is becoming increasingly important for operators to maximize every unit of fuel, especially in commercial and off-road applications. Additives also help prevent injector clogging, improve ignition quality, and enable cleaner burn cycles. Such performance gains align with cost-efficiency strategies across automotive, marine, and industrial end users.

Growing Emphasis on Engine Protection and After-Treatment System Longevity Is Influencing Product Design:

Engine downsizing, turbocharging, and exhaust after-treatment systems require cleaner, more stable fuels to function reliably over time. The Global Specialty Fuel Additives Market addresses this need by supplying antioxidants, demulsifiers, and anti-corrosion agents that preserve fuel integrity and protect critical systems. Engine manufacturers often recommend additive use to prevent damage from moisture, microbial growth, and fuel degradation. It is also crucial to safeguard exhaust gas recirculation (EGR) and diesel particulate filters (DPF) from premature fouling. These evolving technical demands are reshaping additive formulation strategies and encouraging OEM partnerships. Long-term engine health and emissions compliance depend heavily on additive effectiveness, making it a central factor in fuel system engineering.

Market Trends:

Growing Shift Toward Bio-Based and Renewable Additive Formulations Is Shaping Product Portfolios:

The increasing focus on sustainability is pushing manufacturers to develop bio-based and renewable specialty fuel additives. Traditional petroleum-derived additives face scrutiny due to their environmental impact, prompting a shift toward plant-based or biodegradable alternatives. The Global Specialty Fuel Additives Market is seeing an uptick in investment in eco-friendly formulations, especially for use in markets with strong green mandates. It supports carbon reduction goals and aligns with global decarbonization policies. Fuel producers and additive suppliers are prioritizing raw materials with lower environmental footprints while maintaining performance standards. This trend is encouraging innovation across supply chains, from raw material sourcing to end-product development.

- For instance, Clariant launched its Vita 100% bio-based surfactant and fuel additive range in 2024. These products are made from renewable feedstocks with at least a 98% Renewable Carbon Index and can help save up to 85% of CO₂ emissions per ton compared to fossil-based alternatives.

Integration of Digital Monitoring and Smart Dispensing Systems Is Enhancing Additive Precision:

Digitalization is entering the fuel additive supply chain through advanced monitoring, metering, and dosing technologies. The Global Specialty Fuel Additives Market is increasingly incorporating smart additive systems that enable real-time control over dosage rates in refinery and distribution operations. These systems reduce additive waste, improve blending accuracy, and optimize overall fuel performance. It allows suppliers to meet specific performance or regulatory targets with high precision, especially in applications where slight deviations can affect engine behavior. This trend supports operational efficiency and offers greater traceability for fuel quality assurance. Fuel marketers and commercial fleets are adopting these technologies to enhance service reliability and minimize costs.

- For instance, Dorf Ketal commissioned over 200 automated additive dosing systems in refineries and fuel terminals worldwide in 2024, each capable of real-time adjustment with a dosing accuracy of ±0.1%, ensuring compliance with fuel quality and regulatory standards.

Demand for Multi-Function Additives Is Leading to Product Consolidation and Simplified Logistics:

End users are demanding fewer, more efficient fuel additive packages that offer multiple benefits in a single formulation. The Global Specialty Fuel Additives Market is witnessing product consolidation as manufacturers develop multi-function additives that combine detergents, lubricity improvers, stabilizers, and cold flow agents. It reduces the need for separate additive handling, simplifies logistics, and lowers procurement complexity for fuel blenders. These comprehensive additive blends also enable fuel retailers to offer consistent quality across regions with varying environmental conditions. Customers in marine, aviation, and industrial sectors increasingly prefer all-in-one solutions to reduce handling risks and ensure compatibility across engine types. The trend supports higher margins and supply chain efficiency for additive producers.

Focus on Aviation and Marine Fuel Applications Is Driving Specialized Additive Development:

The aviation and marine sectors are demanding specialized additive formulations that address unique fuel performance and safety requirements. The Global Specialty Fuel Additives Market is responding with tailor-made products that enhance thermal stability, prevent microbial growth, and ensure clean combustion in harsh environments. Aviation turbine fuels and marine diesel require distinct additive chemistries to meet performance, storage, and safety standards. It has led to increased R&D investment and product line expansion in these segments. Operators in these industries prioritize fuel reliability under variable load and temperature conditions, making high-performance additives essential. These application-specific needs are fostering niche innovation and long-term supplier relationships.

Market Challenges Analysis:

Volatility in Raw Material Prices and Supply Chain Disruptions Are Pressuring Profit Margins:

The specialty fuel additives industry depends heavily on petrochemical derivatives, specialty chemicals, and performance intermediates whose prices fluctuate with crude oil and global commodity cycles. Sudden shifts in raw material availability, logistics bottlenecks, and geopolitical instability have disrupted supply chains, forcing manufacturers to adjust pricing strategies or absorb increased costs. The Global Specialty Fuel Additives Market faces profitability risks when procurement volatility limits production flexibility. Long-term supply agreements can mitigate some challenges, but rising freight costs and sourcing constraints continue to strain operational efficiency. Smaller players struggle more with price fluctuations, which may lead to market consolidation. Manufacturers must balance cost management with the need for consistent quality and regulatory compliance.

Regulatory Uncertainty and Regional Variability Are Slowing Product Innovation and Market Entry:

Diverse regulatory frameworks across countries make it difficult for manufacturers to standardize product formulations and streamline global distribution. The Global Specialty Fuel Additives Market encounters inconsistent approval processes, varying performance benchmarks, and fragmented compliance criteria in North America, Europe, and Asia. These inconsistencies slow down time-to-market for new products and increase R&D costs due to required regional customization. It also affects long-term planning, especially for companies aiming to expand into emerging markets with evolving or unclear fuel standards. Navigating this complexity requires substantial investment in regulatory affairs and localized expertise. This challenge restricts the scalability of innovations and complicates international growth strategies for fuel additive suppliers.

Market Opportunities:

Expanding Demand in Emerging Economies Is Creating Long-Term Growth Potential for Additive Manufacturers:

Rapid industrialization, urbanization, and rising vehicle ownership in emerging markets are creating strong demand for high-efficiency fuels. Countries in Asia-Pacific, Latin America, and Africa are increasing investments in transportation infrastructure and tightening fuel quality regulations. The Global Specialty Fuel Additives Market has an opportunity to supply cost-effective, multifunctional additives tailored for low-to-mid grade fuel systems in these regions. It can address challenges like inconsistent fuel quality, poor combustion, and rising emissions. Local partnerships, regional manufacturing hubs, and tailored formulations will help companies tap into this growing customer base. Early market entry and localized compliance strategies offer a competitive advantage.

Development of Next-Generation Additives for Alternative Fuels Can Support Sustainability Goals:

The global energy transition is accelerating the use of alternative fuels such as biodiesel, ethanol blends, and synthetic fuels. These fuels often present storage, stability, and compatibility challenges that specialty additives can solve. The Global Specialty Fuel Additives Market has a significant opportunity to lead innovation in additive systems that support low-emission and renewable fuel platforms. It can help extend shelf life, improve cold weather performance, and ensure clean combustion in diverse applications. Engine and fuel system OEMs are increasingly seeking collaborative partners to co-develop additives that align with next-generation powertrain requirements. This shift opens a pathway for long-term product differentiation and regulatory alignment.

Market Segmentation Analysis:

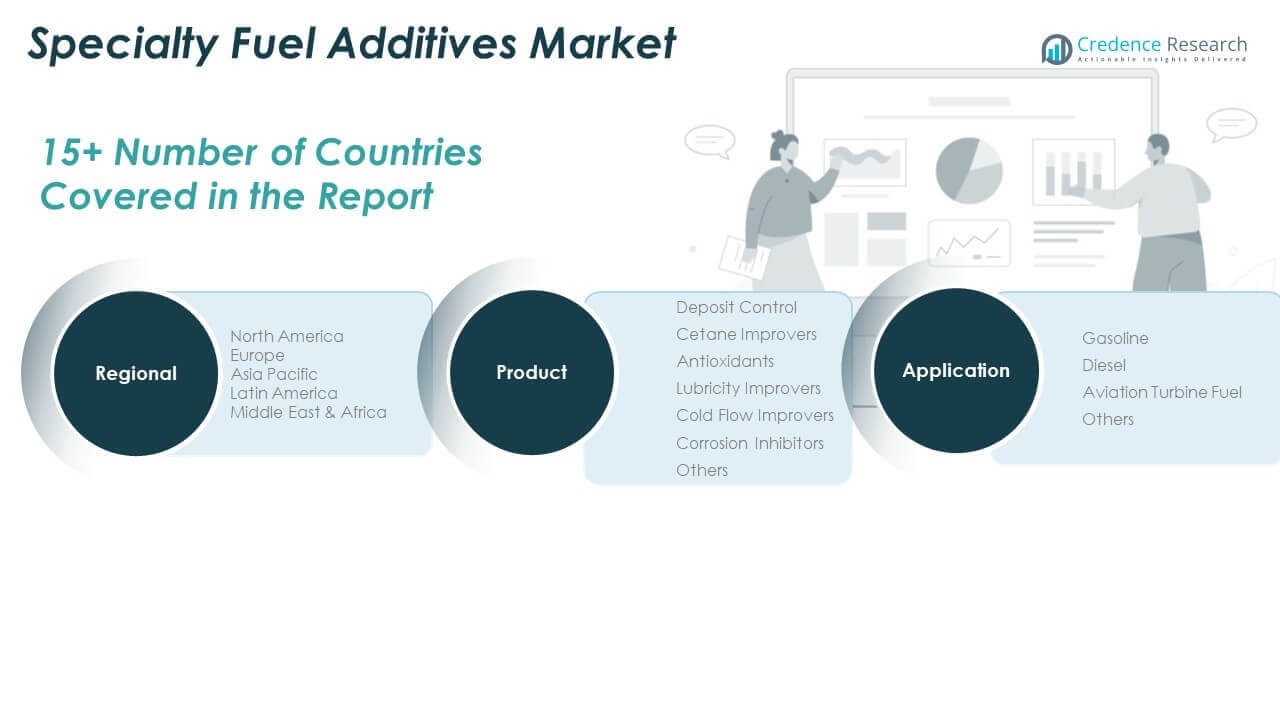

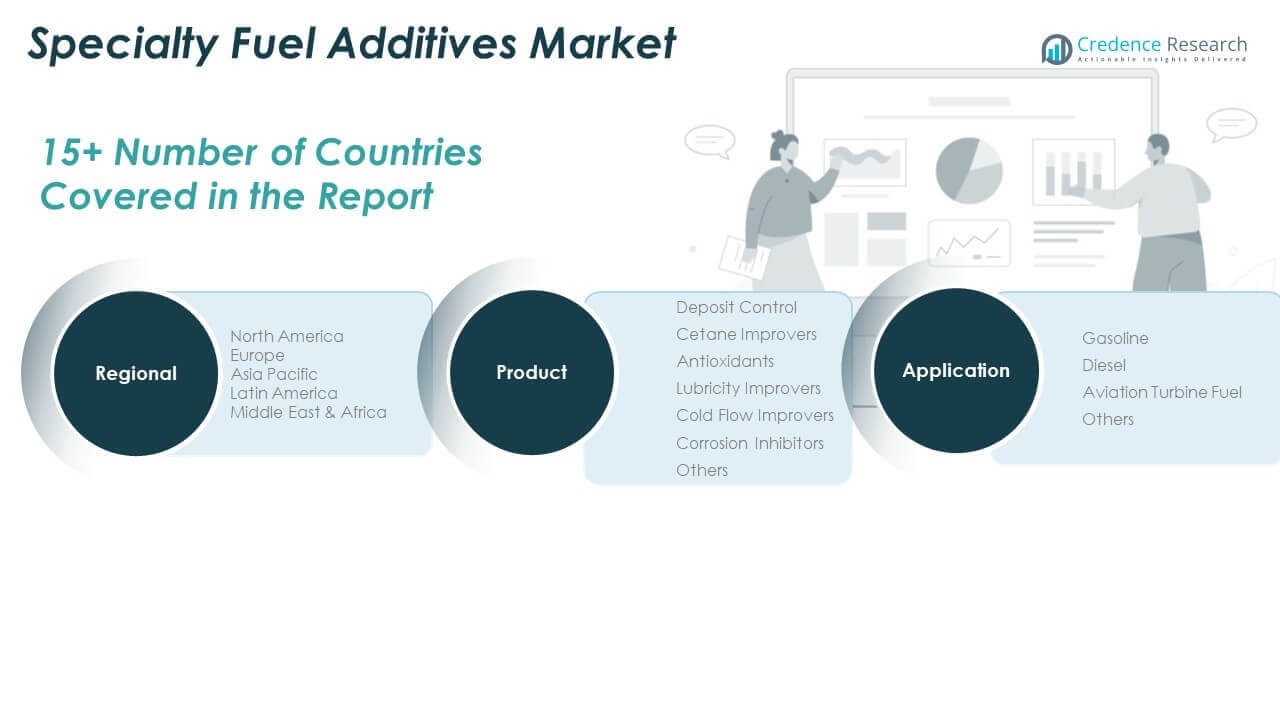

By Product

The Global Specialty Fuel Additives Market is segmented into deposit control additives, cetane improvers, antioxidants, lubricity improvers, cold flow improvers, corrosion inhibitors, and others. Deposit control additives account for the largest revenue share due to their effectiveness in maintaining injector cleanliness and engine efficiency. Cetane improvers are widely used in diesel applications to enhance ignition quality and reduce engine noise. Antioxidants help prevent fuel degradation during storage and transport, especially in unstable or blended fuels. Lubricity improvers are critical in ultra-low sulfur diesel to protect fuel system components from excessive wear. Cold flow improvers enable reliable fuel performance in cold climates by minimizing wax crystal formation. Corrosion inhibitors prevent rust and metal damage, particularly in pipelines and storage tanks. Other additives cater to niche performance requirements in various fuel blends.

- For instance, Afton Chemical’s HiTEC® series, such as HiTEC® 46600 are used in both diesel and gasoline applications. These additives deliver rapid clean-up of injectors, improved fuel economy, and superior corrosion control, with proven effectiveness in industry-standard tests and real-world fleet trials.

By Application

By application, the market is classified into gasoline, diesel, aviation turbine fuel, and others. Diesel holds the dominant share due to high usage in commercial vehicles, industrial machinery, and freight operations. It supports the rising demand for additives that improve fuel economy, engine protection, and emissions control. Gasoline applications continue to grow in passenger vehicles, driven by a focus on cleaner combustion and injector maintenance. Aviation turbine fuel is gaining traction with the growth in global air travel and increasing requirements for fuel stability and thermal resistance. Other applications include marine and stationary engines, where consistent performance and compliance with evolving fuel standards are essential.

- For instance, Lubrizol supplies specialty additives for a wide range of fuels, including aviation turbine fuel and industrial applications.

Segmentation:

By Product

- Deposit Control

- Cetane Improvers

- Antioxidants

- Lubricity Improvers

- Cold Flow Improvers

- Corrosion Inhibitors

- Others

By Application

- Gasoline

- Diesel

- Aviation Turbine Fuel

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Specialty Fuel Additives Market size was valued at USD 2,630.88 million in 2018 to USD 3,306.79 million in 2024 and is anticipated to reach USD 5,676.84 million by 2032, at a CAGR of 7.0% during the forecast period. North America holds a substantial 27.4% share of the Global Specialty Fuel Additives Market. The region benefits from stringent environmental regulations, widespread adoption of ultra-low sulfur diesel (ULSD), and strong demand for fuel-efficient technologies. The U.S. leads in consumption due to its extensive automotive, aviation, and industrial base. It continues to invest in clean fuel technologies and infrastructure modernization. Canada and Mexico contribute to growth with increased transportation activity and rising adoption of performance additives. The market remains competitive, with a strong presence of global and regional additive manufacturers.

Europe

The Europe Specialty Fuel Additives Market size was valued at USD 2,037.42 million in 2018 to USD 2,478.61 million in 2024 and is anticipated to reach USD 3,971.74 million by 2032, at a CAGR of 6.1% during the forecast period. Europe accounts for 20.5% of the Global Specialty Fuel Additives Market. Strict Euro VI and upcoming Euro VII emission norms are driving demand for advanced fuel additives. Countries like Germany, France, and the UK lead in the adoption of clean fuels and additive technologies. Diesel and aviation sectors rely heavily on additive solutions to ensure regulatory compliance and fuel system longevity. The shift toward alternative fuels and electric vehicles affects long-term demand but encourages innovation in hybrid-compatible additives. Regional players continue to focus on sustainability and compliance-driven formulations.

Asia Pacific

The Asia Pacific Specialty Fuel Additives Market size was valued at USD 3,475.71 million in 2018 to USD 4,569.82 million in 2024 and is anticipated to reach USD 8,432.93 million by 2032, at a CAGR of 8.0% during the forecast period. Asia Pacific leads the Global Specialty Fuel Additives Market with a dominant 37.9% share. China and India are major growth engines due to expanding automotive production, industrialization, and urban development. Emission mandates in China and fuel quality improvements across Southeast Asia support increased additive adoption. Japan and South Korea contribute with high-performance requirements in transportation and aviation. It is a key manufacturing hub for global additive suppliers, enhancing local access and cost efficiency. Growing demand for premium fuels and cold-weather additives in northern regions further drives product diversification.

Latin America

The Latin America Specialty Fuel Additives Market size was valued at USD 765.45 million in 2018 to USD 970.21 million in 2024 and is anticipated to reach USD 1,574.77 million by 2032, at a CAGR of 6.3% during the forecast period. Latin America holds a 8.0% share of the Global Specialty Fuel Additives Market. Brazil leads in consumption, driven by its large transportation sector and ethanol-blended fuel usage. Diesel additives dominate due to demand from freight and agricultural machinery. Argentina and other countries are adopting cleaner fuel policies, supporting moderate market expansion. Economic fluctuations and inconsistent regulatory frameworks pose challenges to uniform growth. It offers long-term opportunities in infrastructure, energy, and transport sectors with growing emphasis on efficiency and environmental compliance.

Middle East

The Middle East Specialty Fuel Additives Market size was valued at USD 326.03 million in 2018 to USD 387.33 million in 2024 and is anticipated to reach USD 593.74 million by 2032, at a CAGR of 5.5% during the forecast period. The Middle East represents 3.2% of the Global Specialty Fuel Additives Market. Rising investment in refining capacity, logistics, and aviation supports additive consumption. Gulf countries are improving fuel quality standards, leading to wider adoption of cetane improvers and corrosion inhibitors. The region’s dependency on diesel and jet fuels creates steady demand across transportation and industrial sectors. Fuel exports and aviation hubs like the UAE also contribute to additive usage. Domestic production and import dependency shape pricing and supply stability.

Africa

The Africa Specialty Fuel Additives Market size was valued at USD 214.52 million in 2018 to USD 356.08 million in 2024 and is anticipated to reach USD 506.12 million by 2032, at a CAGR of 4.0% during the forecast period. Africa accounts for 2.9% of the Global Specialty Fuel Additives Market. South Africa remains the key market, supported by a relatively developed refining and transport network. Diesel additives dominate, especially in mining, construction, and off-road applications. Other countries are gradually upgrading fuel standards, opening opportunities for additive suppliers. Infrastructure limitations and inconsistent policy enforcement slow broader adoption. It offers untapped potential as governments prioritize emissions control and fuel efficiency over the next decade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- NewMarket Corporation

- Innospec

- BASF

- Infineum International Limited

- Albemarle Corporation

- Baker Hughes Company

- Dow

- Chevron Oronite Company LLC

- The Lubrizol Corporation

- TotalEnergies

- Dorf Ketal

- Clariant

- Eurenco

- NALCO Champion

- Evonik Industries AG

Competitive Analysis:

The Global Specialty Fuel Additives Market is highly competitive, with key players focusing on product innovation, regulatory compliance, and strategic partnerships. Leading companies such as NewMarket Corporation, Innospec, BASF, Infineum International Limited, and The Lubrizol Corporation dominate the market through diversified portfolios and strong global distribution networks. It features ongoing R&D to develop multifunctional, bio-based, and region-specific formulations that meet evolving fuel standards. Players are also expanding production capacities and investing in emerging markets to capture regional growth. Competitive intensity remains high, especially in diesel and aviation fuel segments, where performance and emissions compliance are critical. Price volatility in raw materials and varying regulatory landscapes across regions challenge both global and regional suppliers. Companies that align innovation with compliance and customer-specific performance requirements are likely to maintain leadership in this evolving landscape. Strategic mergers, acquisitions, and technology collaborations will continue shaping the competitive positioning across key application areas.

Recent Developments:

- In June 2025, Dow announced an agreement to sell its 50% interest in the DowAksa Advanced Composites joint venture to Aksa Akrilik Kimya Sanayii A.Ş., with the transaction expected to close in the third quarter of 2025. This move aligns with Dow’s strategy to focus on core, high-value downstream businesses.Additionally, in August 2024, Dow extended its partnership with Richard Childress Racing to advance science-based innovation in automotive applications for the 2025 NASCAR season.

- In April 2025, Albemarle Corporation reported record energy storage lithium salt production and double-digit volume growth in its Specialties segment. The company maintained its 2025 outlook, citing exemptions from new tariffs and continued global demand for essential minerals. Albemarle also achieved approximately 90% of its cost and productivity improvement targets through April 2025.

- In April 2025, BASF launched three new natural-based ingredients for personal care at the in-cosmetics Global event in Amsterdam. These products—Verdessence® Maize, Lamesoft® OP Plus, and Dehyton® PK45 GA/RA—are designed to provide sustainable alternatives to traditional ingredients, supporting BASF’s commitment to biodegradable and eco-friendly solutions.In January 2025, BASF also introduced a new concept of climate-adaptive, eco-conscious formulations at Cosmet’Agora in Paris, focusing on hydration, UV protection, and sustainable beauty routines.

- In February 2025, Innospec entered a strategic partnership with UNESCO’s International Institute for Higher Education in Latin America and the Caribbean (IESALC) to launch a STEM education initiative for indigenous students in Brazil. The program, developed in collaboration with the Federal University of Minas Gerais, aims to train 40 indigenous students directly and benefit 200 more, reflecting Innospec’s commitment to sustainable development and social responsibility.

Market Concentration & Characteristics:

The Global Specialty Fuel Additives Market is moderately concentrated, with a mix of global leaders and regional players competing across application segments. It is characterized by high entry barriers due to regulatory requirements, formulation complexity, and the need for technical validation. Established companies dominate through proprietary technologies, long-term client contracts, and integrated supply chains. The market exhibits a strong focus on innovation, with continuous development of customized, multifunctional, and environmentally compliant additives. Demand varies by fuel type and regional standards, influencing product differentiation strategies. Suppliers prioritize reliability, fuel compatibility, and compliance with emissions norms to secure long-term partnerships with refineries and OEMs. Competitive dynamics remain stable, but pressure from raw material costs and emerging bio-based alternatives continues to shape market behavior.

Report Coverage:

The research report offers an in-depth analysis based on product and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for multifunctional additives will rise as users seek cost-effective, high-performance fuel solutions.

- Bio-based and renewable additive development will accelerate to meet global sustainability targets.

- Diesel and aviation segments will remain dominant due to ongoing reliance in commercial transport and logistics.

- Growth in emerging economies will create new opportunities through fuel quality upgrades and industrial expansion.

- Regulatory tightening across regions will continue to drive innovation in emissions-reducing additive technologies.

- Cold flow and lubricity improvers will see higher demand in colder regions and ULSD markets.

- OEM collaborations will increase to align additive performance with evolving engine technologies.

- Digital dosing and monitoring systems will gain traction for improved additive management and fuel optimization.

- Price volatility in petrochemical feedstocks may influence supply chain strategies and margin pressures.

- Market consolidation may intensify as major players seek scale and geographic diversification through acquisitions.