| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Off-Road Electric Pallet Truck Market Size 2024 |

USD 742.94 Million |

| Off-Road Electric Pallet Truck Market, CAGR |

6.21% |

| Off-Road Electric Pallet Truck Market Size 2032 |

USD 1,245.75 Million |

Market Overview

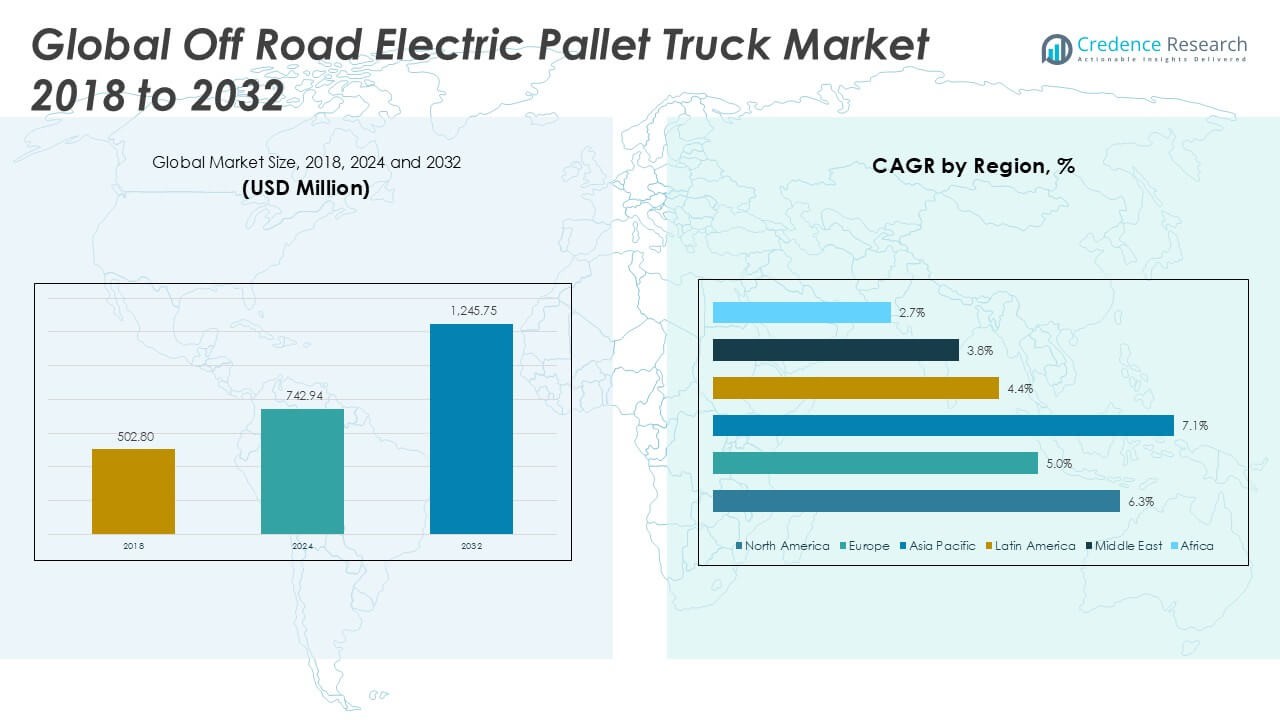

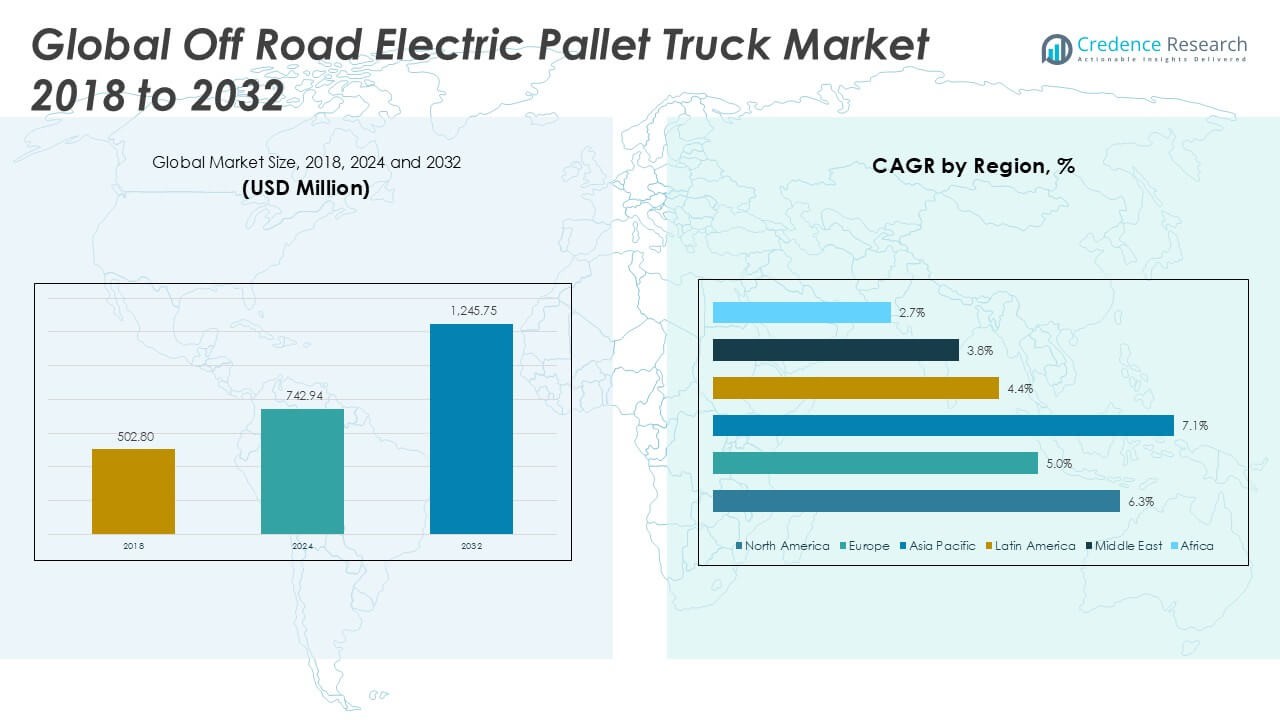

The Off-Road Electric Pallet Truck Market was valued at USD 502.80 million in 2018, reached USD 742.94 million in 2024, and is anticipated to reach USD 1,245.75 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.21% during the forecast period.

The Off-Road Electric Pallet Truck Market is experiencing significant growth driven by increasing demand for efficient material handling solutions across industries such as construction, agriculture, and mining. Companies prioritize electric-powered trucks to enhance productivity, reduce operational costs, and comply with stringent environmental regulations. The adoption of off-road electric pallet trucks is supported by advancements in battery technology, improved durability, and user-friendly features that address challenging terrain and heavy-load requirements. Rising labor costs and the ongoing shift toward warehouse automation further accelerate market expansion. Manufacturers are investing in innovative designs, integrating telematics and IoT connectivity to improve fleet management and ensure workplace safety. Trends indicate a growing preference for eco-friendly equipment, fueled by sustainability initiatives and government incentives promoting the use of electric vehicles in industrial operations. As a result, the market continues to evolve, offering versatile and robust solutions to meet the dynamic needs of modern logistics and supply chain management.

The Off-Road Electric Pallet Truck Market demonstrates robust growth across diverse regions, with North America, Europe, and Asia Pacific emerging as leading hubs for adoption due to advanced logistics infrastructure, strong industrial activity, and a rising focus on sustainability. North America leverages high demand from sectors such as construction and warehousing, while Europe’s growth is supported by stringent environmental regulations and strong manufacturing capabilities. Asia Pacific experiences rapid expansion fueled by urbanization and large-scale infrastructure projects, with countries like China and Japan driving innovation and competitive pricing. Key players such as Jungheinrich AG, KION Group AG, and Toyota Industries Corporation play pivotal roles in shaping the competitive landscape. These companies invest in advanced technology, broad product portfolios, and robust after-sales support, positioning themselves as preferred suppliers for industries seeking reliable and efficient off-road electric pallet trucks tailored to demanding outdoor environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Off-Road Electric Pallet Truck Market was valued at USD 502.80 million in 2018, reached USD 742.94 million in 2024, and is projected to hit USD 1,245.75 million by 2032, registering a CAGR of 6.21%.

- The market experiences strong momentum from increasing demand for efficient material handling in sectors such as construction, agriculture, mining, and logistics.

- Companies focus on electric-powered pallet trucks to reduce emissions, lower operational costs, and comply with evolving environmental regulations, which serves as a primary driver for adoption.

- Major trends include rising integration of telematics, IoT connectivity, and advanced battery technology, which enhance equipment reliability, fleet management, and user safety in challenging terrains.

- Leading players such as Jungheinrich AG, KION Group AG, and Toyota Industries Corporation hold a strong presence by investing in innovation, broadening product portfolios, and expanding after-sales service networks.

- Market restraints include high initial investment requirements and limited charging infrastructure, particularly in remote or underdeveloped regions, which can slow broader market adoption.

- Regional analysis shows Asia Pacific leading growth, followed by North America and Europe, while Latin America, the Middle East, and Africa offer niche opportunities driven by targeted infrastructure projects and modernization efforts.

Market Drivers

Rising Demand for Efficient Material Handling in Challenging Environments

The Off-Road Electric Pallet Truck Market benefits from a surge in demand for efficient material handling solutions in sectors such as construction, agriculture, mining, and forestry. Companies face operational challenges in rough terrain and require robust equipment that ensures safe and reliable transportation of heavy goods. Off road electric pallet trucks deliver enhanced maneuverability and productivity in outdoor environments where conventional equipment struggles. It supports industries aiming to reduce manual labor while improving throughput and safety. Businesses also seek solutions that help lower accident rates and protect both workers and materials. The increased emphasis on operational efficiency in remote and demanding locations directly supports market expansion.

- For instance, Jungheinrich AG’s EJE 118 electric pallet truck is designed for outdoor use and delivers a top travel speed of 6.0 km/h fully loaded, and can move loads of up to 1,800 kg over rough surfaces.

Focus on Environmental Sustainability and Regulatory Compliance

Heightened awareness of environmental sustainability fuels the adoption of electric-powered alternatives in industrial operations. The Off-Road Electric Pallet Truck Market aligns with strict emission standards and evolving government regulations focused on reducing carbon footprints. Companies transition from diesel-powered trucks to electric options to meet these legal requirements and corporate sustainability goals. It enables organizations to demonstrate social responsibility while benefiting from lower emissions and quieter operation. Many regulatory bodies now provide incentives for adopting green equipment, increasing the attractiveness of electric pallet trucks. Firms also benefit from enhanced brand reputation when prioritizing sustainable technology.

- For instance, Toyota Industries Corporation’s latest electric pallet trucks with lithium-ion batteries support up to 5,000 charging cycles—over twice the life of conventional lead-acid batteries reducing environmental waste and energy use.

Advancements in Battery Technology and Product Innovation

Recent advances in battery technology and engineering drive growth in the Off-Road Electric Pallet Truck Market. Manufacturers focus on developing trucks with longer battery life, faster charging capabilities, and increased load capacities. It addresses critical challenges related to downtime and maintenance costs, enabling businesses to optimize fleet performance. Product innovation leads to more durable models that can withstand harsh conditions and extended use. The integration of telematics and smart sensors enables real-time tracking and diagnostics, helping managers maximize uptime and safety. Companies view technological progress as an essential lever for operational excellence.

Shift Toward Automation and Integration of Smart Features

Automation and digital transformation trends support rapid adoption in the Off-Road Electric Pallet Truck Market. Many organizations aim to streamline logistics by introducing autonomous and semi-autonomous vehicles for repetitive, labor-intensive tasks. It brings increased precision and efficiency to warehouse and outdoor site operations. The adoption of IoT and data-driven technologies further empowers managers to monitor fleets, track assets, and optimize routes in real time. This shift not only enhances productivity but also addresses labor shortages and cost pressures facing logistics and industrial sectors. The market continues to evolve with smarter and more connected pallet truck solutions.

Market Trends

Expansion of Electrification and Growth in Green Logistics Solutions

The Off-Road Electric Pallet Truck Market reflects a broader trend toward electrification across logistics and industrial sectors. Many businesses replace diesel-powered equipment with electric alternatives to meet sustainability objectives and respond to tightening emission standards. Companies prefer electric pallet trucks due to their lower noise levels, zero direct emissions, and reduced operational costs. This shift supports the growth of green logistics networks that prioritize environmental responsibility. It reinforces the demand for high-performance, eco-friendly equipment across construction sites, agricultural operations, and remote industrial settings. Market participants invest in research and development to introduce more efficient electric models that meet these evolving needs.

- For instance, KION Group AG developed the Linde MT15 pallet truck with regenerative braking, enabling up to 20% energy recovery during operation, helping reduce total energy consumption per shift.

Rising Popularity of Smart Technologies and Connectivity

The Off-Road Electric Pallet Truck Market witnesses an increasing adoption of smart technologies such as telematics, GPS tracking, and IoT integration. Businesses value real-time data insights for fleet management, predictive maintenance, and route optimization. It enhances operational visibility and helps companies minimize unplanned downtime while improving asset utilization. Manufacturers focus on developing user-friendly interfaces and customizable digital dashboards that offer actionable intelligence. This trend accelerates the transition from manual fleet supervision to data-driven decision-making in material handling operations. The market rewards innovative products that support seamless connectivity and advanced monitoring features.

- For instance, Mitsubishi Logisnext’s iFleet fleet management platform enables monitoring and control of up to 100 trucks per facility, allowing managers to reduce idle time by as much as 15%.

Product Customization and Demand for Versatility

Customization emerges as a key trend, with end-users in the Off-Road Electric Pallet Truck Market seeking solutions tailored to their unique operational challenges. Industries with diverse working environments require pallet trucks equipped with specialized tires, reinforced frames, and adaptable controls. It encourages manufacturers to offer modular designs and a range of configurable options to address customer-specific requirements. This focus on versatility extends to battery types, load capacities, and ergonomic enhancements, catering to a wide spectrum of use cases. Customization drives differentiation and customer loyalty, fostering long-term relationships between suppliers and buyers.

Focus on Safety Innovations and Regulatory Alignment

The Off-Road Electric Pallet Truck Market places strong emphasis on safety innovations in response to evolving industry standards and workplace safety regulations. Companies prioritize features such as automatic braking systems, stability controls, and proximity sensors to protect operators in harsh outdoor environments. It aligns product development strategies with stricter regulatory frameworks and growing awareness of occupational safety. Manufacturers invest in rigorous testing and certification to ensure compliance and enhance product credibility. This commitment to safety not only supports risk mitigation but also increases the adoption of advanced electric pallet truck solutions in demanding sectors.

Market Challenges Analysis

High Initial Investment and Limited Charging Infrastructure

The Off-Road Electric Pallet Truck Market faces challenges related to high upfront costs and insufficient charging infrastructure in remote and industrial areas. Electric pallet trucks typically require a larger capital outlay compared to traditional diesel models, which may deter small and medium-sized enterprises from adopting this technology. Companies must also invest in compatible charging stations, which can be difficult to implement in rugged environments with limited access to power grids. It restricts widespread adoption, particularly in regions with underdeveloped logistics infrastructure. Concerns about battery range and the downtime required for recharging further complicate procurement decisions. These factors create barriers for organizations aiming to transition from conventional to electric equipment.

Technical Limitations and Maintenance Complexities

Technical constraints pose ongoing challenges for the Off-Road Electric Pallet Truck Market, with many models facing difficulties in handling extreme conditions such as uneven terrain, heavy loads, and adverse weather. While advancements in design and battery technology have improved performance, reliability issues persist in highly demanding outdoor settings. It leads to increased maintenance requirements and higher lifecycle costs for some users. Availability of specialized spare parts and skilled technicians often lags behind market growth, especially in remote areas. Manufacturers must address these technical and service challenges to support broader market penetration. Ongoing innovation and stronger service networks remain essential for overcoming these hurdles.

Market Opportunities

Expansion into Emerging Markets and Infrastructure Projects

The Off-Road Electric Pallet Truck Market presents strong opportunities through expansion into emerging economies and major infrastructure projects. Rapid industrialization in regions such as Asia Pacific, Latin America, and the Middle East fuels demand for advanced material handling solutions in construction, mining, and agriculture. Governments and private investors are allocating resources to upgrade infrastructure, which requires reliable equipment that performs well on challenging terrain. It positions electric pallet trucks as attractive solutions for improving site efficiency and safety. Growing awareness of environmental regulations in these markets creates favorable conditions for electric-powered alternatives. Market participants can leverage local partnerships and distribution networks to accelerate market entry and gain competitive advantage.

Development of Advanced Battery Technology and Value-Added Services

Advancements in battery technology and integration of value-added services open new growth avenues for the Off-Road Electric Pallet Truck Market. Longer battery life, rapid charging, and improved durability address operational limitations and increase user confidence in electric solutions. It encourages industries to adopt electric pallet trucks for heavy-duty and continuous operations in remote environments. Opportunities exist for manufacturers to offer tailored service packages, including predictive maintenance, fleet management software, and remote diagnostics. These solutions create value by reducing downtime and optimizing total cost of ownership. Strong focus on customer support and technological innovation helps drive market adoption and foster long-term relationships with clients.

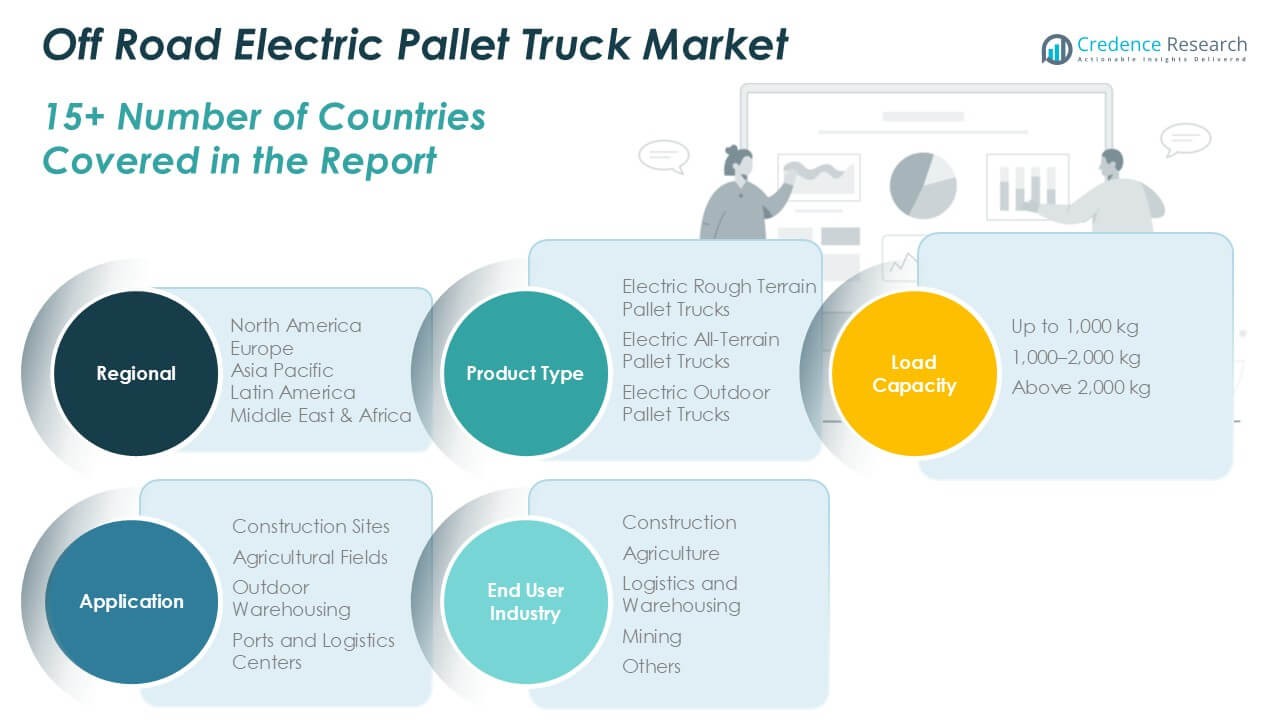

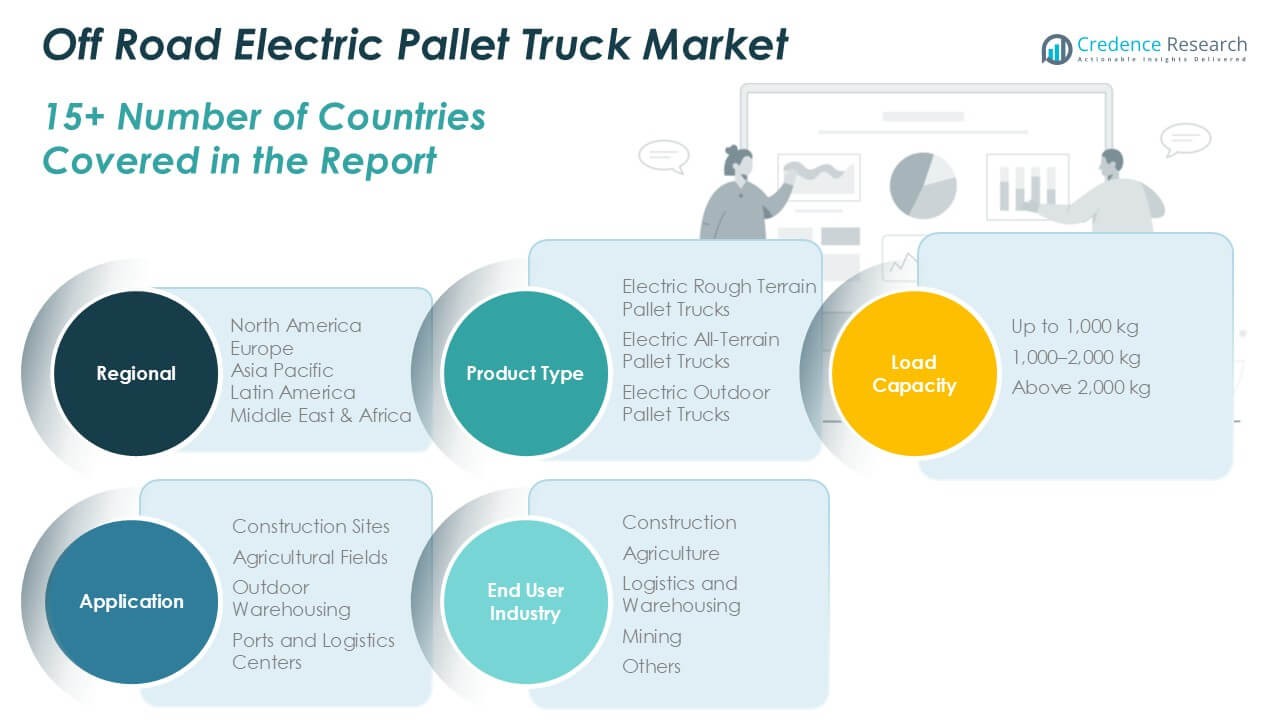

Market Segmentation Analysis:

By Product Type:

The market consists of Electric Rough Terrain Pallet Trucks, Electric All-Terrain Pallet Trucks, and Electric Outdoor Pallet Trucks. Electric Rough Terrain Pallet Trucks hold appeal in construction and mining environments where uneven surfaces demand durable solutions. Electric All-Terrain Pallet Trucks provide flexibility across various outdoor settings, appealing to operations that require versatility and adaptability. Electric Outdoor Pallet Trucks address the needs of warehousing and logistics companies that manage inventory in open or semi-exposed areas, providing reliability and ease of use.

- For instance, Hyster-Yale’s P2.0S platform pallet truck is IP54-rated for weather protection and is engineered to operate reliably in outdoor environments with up to 2,000 kg capacity.

By Load Capacity:

The Off-Road Electric Pallet Truck Market covers three categories: up to 1,000 kg, 1,000–2,000 kg, and above 2,000 kg. Pallet trucks with up to 1,000 kg capacity serve small-scale construction sites, agricultural operations, and businesses focused on lighter materials. The 1,000–2,000 kg segment targets medium-sized logistics and warehousing companies that require balance between strength and efficiency. Trucks designed for above 2,000 kg are critical for heavy-duty industries such as mining, infrastructure development, and port operations, where high-capacity material handling equipment ensures operational continuity.

- For instance, Doosan Industrial Vehicle offers the BPL18/20S-7 series electric pallet trucks that can handle loads up to 2,000 kg, catering to medium and heavy-duty applications.

By Application:

The Off-Road Electric Pallet Truck Market addresses distinct operational needs across construction sites, agricultural fields, outdoor warehousing, and ports and logistics centers. Construction sites demand rugged pallet trucks capable of transporting heavy and bulky materials across challenging surfaces. Agricultural fields benefit from all-terrain models that can navigate variable ground conditions and enhance productivity during harvest and transport activities. Outdoor warehousing relies on electric outdoor pallet trucks for efficient handling of goods exposed to weather and fluctuating storage requirements. Ports and logistics centers use high-capacity trucks to streamline loading and unloading, reduce manual labor, and improve safety standards. This comprehensive segmentation highlights the market’s adaptability and its ability to meet the evolving requirements of diverse end users.

Segments:

Based on Product Type:

- Electric Rough Terrain Pallet Trucks

- Electric All-Terrain Pallet Trucks

- Electric Outdoor Pallet Trucks

Based on Load Capacity:

- Up to 1,000 kg

- 1,000–2,000 kg

- Above 2,000 kg

Based on Application:

- Construction Sites

- Agricultural Fields

- Outdoor Warehousing

- Ports and Logistics Centers

Based on End User Industry:

- Construction

- Agriculture

- Logistics and Warehousing

- Mining

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Off-Road Electric Pallet Truck Market

North America Off-Road Electric Pallet Truck Market grew from USD 168.15 million in 2018 to USD 245.10 million in 2024 and is projected to reach USD 412.47 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.3%. North America is holding a 33% market share. The United States and Canada lead adoption, driven by advanced logistics infrastructure, strong demand for automation, and emphasis on operator safety in harsh environments. The region benefits from established supply chains and significant investment in green logistics. High labor costs push businesses to invest in efficient electric pallet trucks for both construction and warehousing sectors. Key industry players maintain robust distribution and service networks in the U.S., supporting market penetration. North America’s focus on sustainability further drives electric equipment adoption.

Europe Off-Road Electric Pallet Truck Market

Europe Off-Road Electric Pallet Truck Market grew from USD 96.81 million in 2018 to USD 135.45 million in 2024 and is projected to reach USD 207.19 million by 2032, reflecting a CAGR of 5.0%. Europe is holding a 22% market share. Germany, France, and the UK account for a large portion of regional demand, supported by strict emissions regulations and progressive sustainability goals. European businesses prioritize equipment reliability and compliance with safety standards, fostering ongoing investments in electric pallet trucks. The region’s established manufacturing sector and need for efficient outdoor material handling create consistent market growth. Government incentives promote technology upgrades, particularly in Germany. Product innovation and integration of smart features further enhance regional competitiveness.

Asia Pacific Off-Road Electric Pallet Truck Market

Asia Pacific Off-Road Electric Pallet Truck Market grew from USD 196.41 million in 2018 to USD 302.20 million in 2024 and is projected to reach USD 541.16 million by 2032, reflecting a CAGR of 7.1%. Asia Pacific is holding a 43% market share. China, Japan, and India serve as primary growth engines, fueled by rapid industrialization and expanding construction and logistics sectors. Increasing urbanization and investment in large-scale infrastructure projects accelerate demand for off-road electric pallet trucks. Companies in the region focus on cost-effective, high-capacity models to address diverse operational needs. Competitive pricing, local manufacturing, and government support for electric vehicles contribute to strong market performance. Asia Pacific remains the largest and fastest-growing market globally.

Latin America Off-Road Electric Pallet Truck Market

Latin America Off-Road Electric Pallet Truck Market grew from USD 21.41 million in 2018 to USD 31.20 million in 2024 and is projected to reach USD 45.64 million by 2032, reflecting a CAGR of 4.4%. Latin America is holding a 4% market share. Brazil and Mexico drive regional adoption, mainly in agriculture, mining, and port operations. Companies respond to growing demand for equipment that ensures operational safety and cost-efficiency in challenging environments. Logistics modernization and government initiatives for sustainable development encourage market uptake. However, budget constraints and lower capital investment levels may slow wider adoption. Local distributors focus on service quality to attract new customers. Market participants target niche applications to maximize growth.

Middle East Off-Road Electric Pallet Truck Market

Middle East Off-Road Electric Pallet Truck Market grew from USD 13.25 million in 2018 to USD 17.78 million in 2024 and is projected to reach USD 24.84 million by 2032, reflecting a CAGR of 3.8%. The Middle East is holding a 2% market share. The United Arab Emirates and Saudi Arabia lead demand, especially for large-scale construction and infrastructure projects. The region values equipment capable of withstanding extreme temperatures and sand-laden environments. Investments in logistics hubs and port facilities contribute to ongoing adoption. Slow infrastructure development in some areas may limit growth potential. Companies emphasize durability and after-sales support as differentiators. Demand aligns closely with regional construction cycles.

Africa Off-Road Electric Pallet Truck Market

Africa Off-Road Electric Pallet Truck Market grew from USD 6.77 million in 2018 to USD 11.21 million in 2024 and is projected to reach USD 14.45 million by 2032, reflecting a CAGR of 2.7%. Africa is holding a 1% market share. South Africa and Egypt account for most of the demand, with applications in mining, agriculture, and port operations. Limited infrastructure and economic constraints challenge widespread market expansion. Companies seek cost-effective solutions and prioritize ruggedness in equipment selection. Imports dominate the regional supply chain, with few local manufacturers. Market penetration remains low but stable, with opportunities emerging in key urban and industrial centers. Strategic partnerships with local dealers help improve service reach.

Key Player Analysis

- Jungheinrich AG

- KION Group AG

- LiuGong Machinery

- Volvo Construction Equipment

- Oshkosh Corporation

- Toyota Industries Corporation

- Mitsubishi Logisnext

- Hyster-Yale Materials Handling

- Clark Material Handling Company

- Doosan Industrial Vehicle

Competitive Analysis

The Off-Road Electric Pallet Truck Market features a highly competitive landscape with leading players including Jungheinrich AG, KION Group AG, Toyota Industries Corporation, Mitsubishi Logisnext, Hyster-Yale Materials Handling, Volvo Construction Equipment, LiuGong Machinery, Clark Material Handling Company, Doosan Industrial Vehicle, and Oshkosh Corporation. These companies leverage extensive industry experience, global distribution networks, and strong R&D capabilities to drive innovation and maintain their leadership positions. Each player focuses on expanding product portfolios with advanced features such as enhanced battery technology, telematics, and IoT connectivity to meet the evolving needs of demanding outdoor environments. Market leaders prioritize customer-centric solutions, investing in robust after-sales support and tailored service packages that address diverse client requirements. Strategic partnerships and targeted acquisitions strengthen their market reach and technological edge. Competitive differentiation relies on continuous improvement in product durability, operator safety, and fleet management solutions. The intense competition compels market participants to optimize manufacturing processes and accelerate time-to-market for new innovations, ensuring they remain agile and responsive to shifts in industry demand and regulatory requirements.

Recent Developments

- In April 2025, Volvo CE unveiled the world’s first serial-produced battery-electric articulated haulers, the A30 Electric and A40 Electric, at Bauma 2025. These haulers, with 29-ton and 39-ton payloads, are designed for quarrying, mining, and construction, delivering off-road performance with zero emissions. They will be available to select European customers starting in 2026.

- In June 2024, LiuGong North America announced its commitment to launch a zero-emissions electric reach stacker in 2025. This move signifies a shift towards sustainable heavy material handling in the U.S. market, particularly in the waste management industry. The launch includes the 856HE MAX Electric Wheel Loader and the 922FE Electric Excavator at WasteExpo 2025 in Las Vegas, showcasing LiuGong’s commitment to reducing emissions and promoting sustainable waste handling solutions.

Market Concentration & Characteristics

The Off-Road Electric Pallet Truck Market displays moderate to high market concentration, with a handful of global manufacturers commanding significant influence over technological innovation, pricing strategies, and distribution networks. Leading players such as Jungheinrich AG, KION Group AG, and Toyota Industries Corporation set industry benchmarks through their continuous investment in research and development, ensuring a steady flow of advanced models tailored to harsh operating conditions. The market features strong barriers to entry, driven by the need for advanced engineering capabilities, regulatory compliance, and established service infrastructure. It reflects a mix of standardized offerings for mainstream applications and customized solutions designed for niche sectors such as mining, construction, and agriculture. The market favors suppliers who deliver robust after-sales support, value-added services, and a high degree of product reliability. Regional expansion and local adaptation play key roles in competitive positioning, with manufacturers forming strategic alliances to strengthen market presence in emerging economies. The sector’s overall characteristics include a focus on operational efficiency, sustainability, and adaptability to a wide range of outdoor material handling challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Load Capacity, Application, End User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption will accelerate in emerging markets due to infrastructure upgrades and urban expansion.

- Manufacturers will release models with extended battery life and faster charging.

- Demand will grow for vehicles equipped with advanced telematics and fleet management tools.

- Companies will offer predictive maintenance services to reduce downtime and operating costs.

- Regulatory bodies will push for zero-emission equipment, increasing electric pallet truck adoption.

- Integration of autonomous features will expand for repetitive tasks in outdoor environments.

- Collaboration between OEMs and energy providers will improve charging infrastructure in remote areas.

- Product customization for industry-specific needs will grow in sectors like mining and agriculture.

- Partnerships between manufacturers and technology firms will drive innovation in safety features.

- Enhanced after-sales service networks will support wider geographic reach and customer retention.