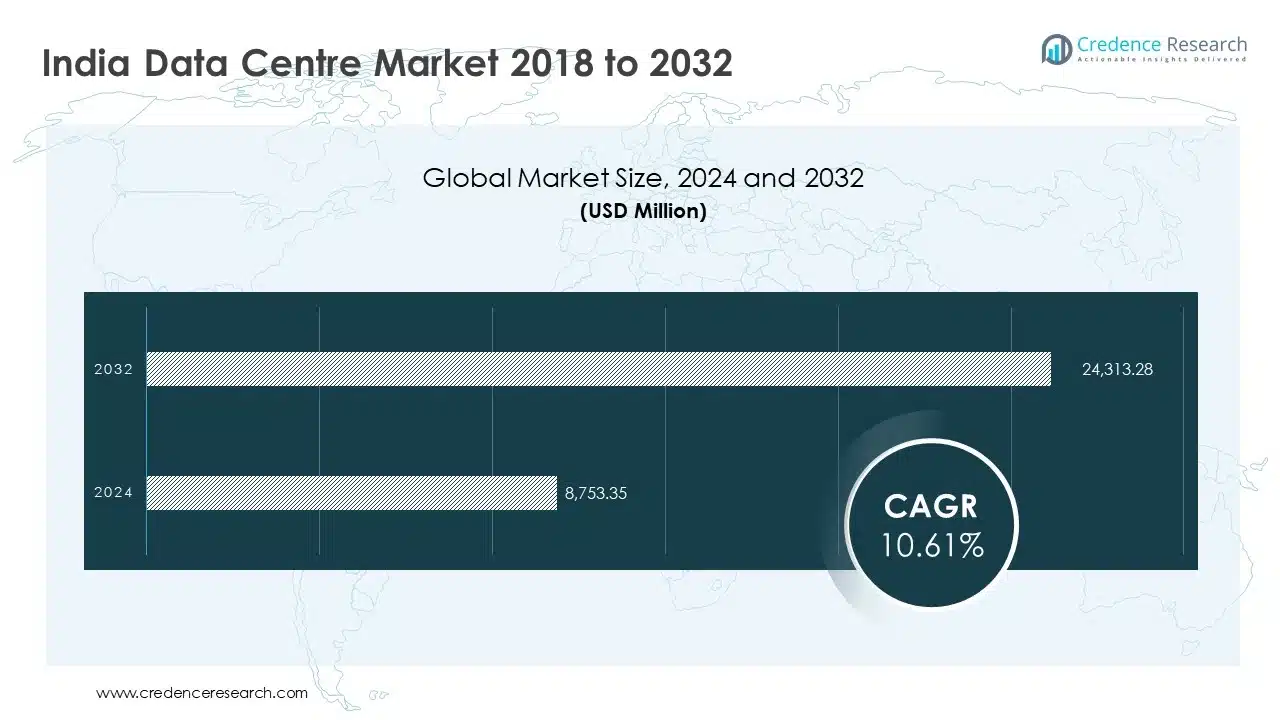

According to the latest report published by Credence Research, “India Data Centre Market: Growth, Share, Opportunities & Competitive Analysis, 2024–2032,” the India Data Centre Market was valued at USD 8,753.35 million in 2023 and is expected to reach USD 24,313.28 million by 2032, growing at a CAGR of 10.61% during the forecast period from 2024 to 2032.

India’s data centre market has witnessed substantial expansion in recent years, driven by accelerated digital adoption, exponential data generation, and strategic government initiatives. Increasing reliance on cloud computing, edge services, and digital applications across critical industries continues to fuel infrastructure investment and service innovation. Western and Southern India dominate the market, with Mumbai emerging as a principal hub due to its superior connectivity, strategic coastal location, and concentration of industry stakeholders.

Rapid Economic Growth Stimulating Infrastructure Demand

India’s sustained economic development has significantly accelerated industrialization, urbanization, and digital transformation, directly impacting the demand for advanced data infrastructure. The proliferation of e-commerce, digital payments, online education, and enterprise digitalization has escalated the volume of data generation, necessitating robust and scalable storage and processing solutions. Notably, foreign direct investment inflows have shown resilience, reinforcing international confidence in India’s digital economy.

For instance, the Reserve Bank of India reported strong net FDI flows in FY24, indicative of expanding international participation across sectors. These trends underscore a growing need for high-capacity data centres that align with global standards in security, availability, and compliance. With multinational corporations establishing operations across Indian cities, demand for enterprise-grade data management infrastructure continues to surge. Economic growth, coupled with a supportive policy ecosystem, positions India as a strategically favorable market for long-term investment in data centre operations.

Browse market data Figures spread through 220 + Pages and an in-depth TOC on “India Data Centre Market”

Emphasis on Sustainability and the Rise of Hyperscale Facilities

The India data centre market is undergoing a significant transformation shaped by the dual imperatives of performance and environmental sustainability. Operators are increasingly focusing on integrating energy-efficient infrastructure to reduce operational costs and carbon emissions. This shift aligns with broader ESG commitments and national sustainability goals.

Green data centres, equipped with renewable energy sources such as solar and wind, advanced cooling systems, and optimized power usage effectiveness (PUE), are becoming standard. For instance, Yotta Infrastructure’s facility in Navi Mumbai operates at a PUE of 1.4 and integrates a dedicated solar plant and natural gas-powered generation. Similarly, STT GDC India has achieved 34% renewable energy penetration across its operations and is targeting 50% within four years.

Simultaneously, the demand for hyperscale data centres is growing. These facilities, designed to support the computational demands of cloud computing, big data analytics, and AI workloads, are being developed in regions with strong energy availability and digital backbone infrastructure. Global cloud service providers and colocation companies are actively scaling hyperscale campuses to address increasing client demand. These developments signal India’s readiness to emerge as a global hyperscale hub, offering high-performance and sustainable digital infrastructure at scale.

Land Acquisition, Energy Costs, and Infrastructure Constraints

Despite the promising outlook, the India data centre market faces several structural challenges. Chief among these are difficulties related to land acquisition and energy sourcing. Identifying suitable land parcels in proximity to connectivity nodes remains problematic due to urban zoning constraints, scarcity of available plots, and escalating land prices in metro regions.

Cities like Mumbai and Delhi, while strategically advantageous, are witnessing high real estate costs and limited availability, inflating capital expenditure requirements for new facilities. Compounding these issues are rising electricity costs, which significantly affect the total cost of ownership for data centre operators. Given the sector’s high energy dependency, any volatility in energy pricing undermines profitability and long-term financial planning.

Additionally, adherence to emerging sustainability regulations requires substantial capital investments in green technologies, complicating project economics. Developers must now balance the imperatives of compliance, performance, and cost-efficiency in a highly competitive market. These challenges necessitate cross-sector collaboration, innovation in modular construction, and strategic site selection to maintain project viability and ensure long-term scalability.

Key Players

- CtrlS Datacenters Ltd

- Equinix Inc.

- ESDS Software Solution Ltd

- Go4hosting

- NTT Ltd

- Nxtra Data Ltd

- Pi Datacenters Pvt Ltd

- Reliance

- Sify Technologies Ltd

- STT GDC Pte Ltd

- WebWerks

- Yotta Infrastructure Solutions

Market Segmentation

By Type

- Enterprise

- Edge

- Colocation

- Hyperscale

- Managed

- Modular

By Component

- Hardware

- Power Systems

- Cooling Systems

- Racks

- Servers

- Networking Devices

- Others

- India Data Centre Infrastructure Management Software

- Cloud-based

- On-premises

- Service

- Professional Services

- Integration & Implementation

- Consulting

- Support & Maintenance

- Managed Services

By Size

- Small

- Mid-Sized

- Large

By Tier

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Industry

- IT & Telecom

- BFSI

- Manufacturing

- Healthcare

- Government

- Others

By Geography

- Northern

- Western

- Southern

- Eastern

Northern Region: A Key Hub for Data Centre Growth

The Northern region accounts for nearly 25% of India’s data centre market, with Delhi-NCR emerging as a primary hub for business, government, and IT services. The region benefits from strong infrastructure, including reliable power grids and expanding fiber-optic networks, which are vital for the smooth operation of data centres. Demand is further supported by industries such as finance, telecom, e-commerce, and IT that require advanced data management solutions. The presence of government agencies and multinational corporations adds to the need for secure and resilient storage facilities. Ongoing government programs promoting digital transformation and smart city initiatives are also accelerating investments in data centre infrastructure, reinforcing the region’s position as a key growth area.

About Us:

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives.

Contact Us

Credence Research Inc.

North America – +1 304 308 1216

Australia – +61 4192 46279

Asia Pacific – +81 5050 50 9250

+64 22 017 0275

India – +91 6232 49 3207

sales@credenceresearch.com

www.credenceresearch.com