| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Content Screening Market Size 2024 |

USD 2,105.0 million |

| High Content Screening Market, CAGR |

7.29% |

| High Content Screening Market Size 2032 |

USD 3,690.7 million |

Market Overview:

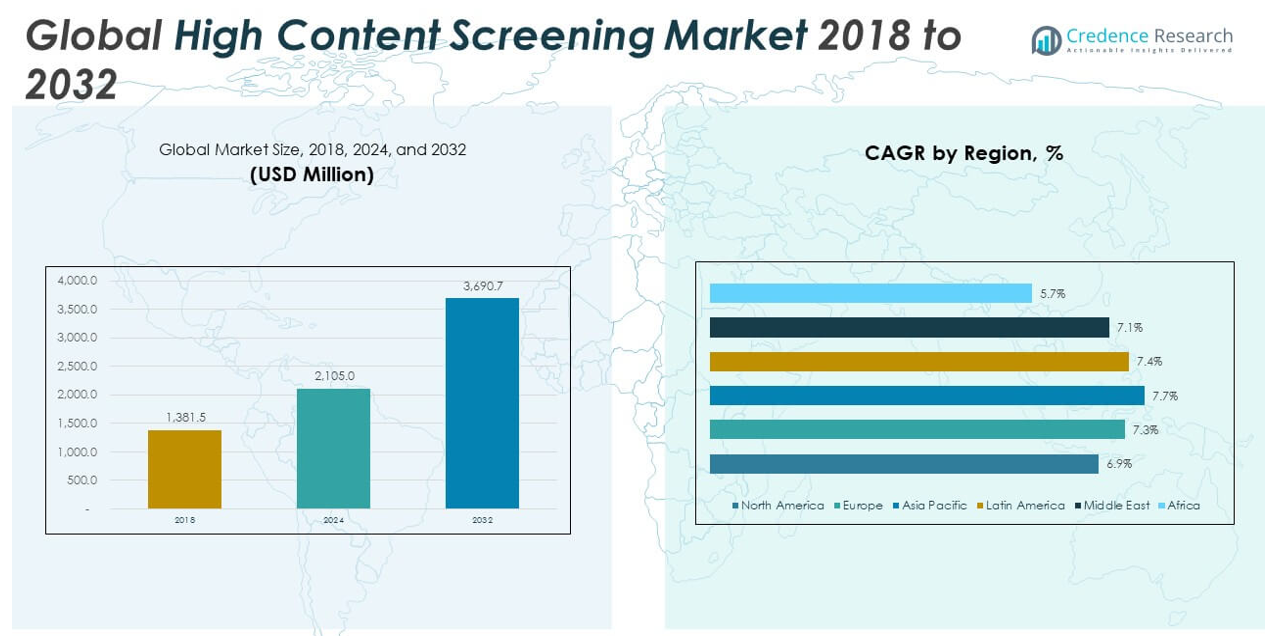

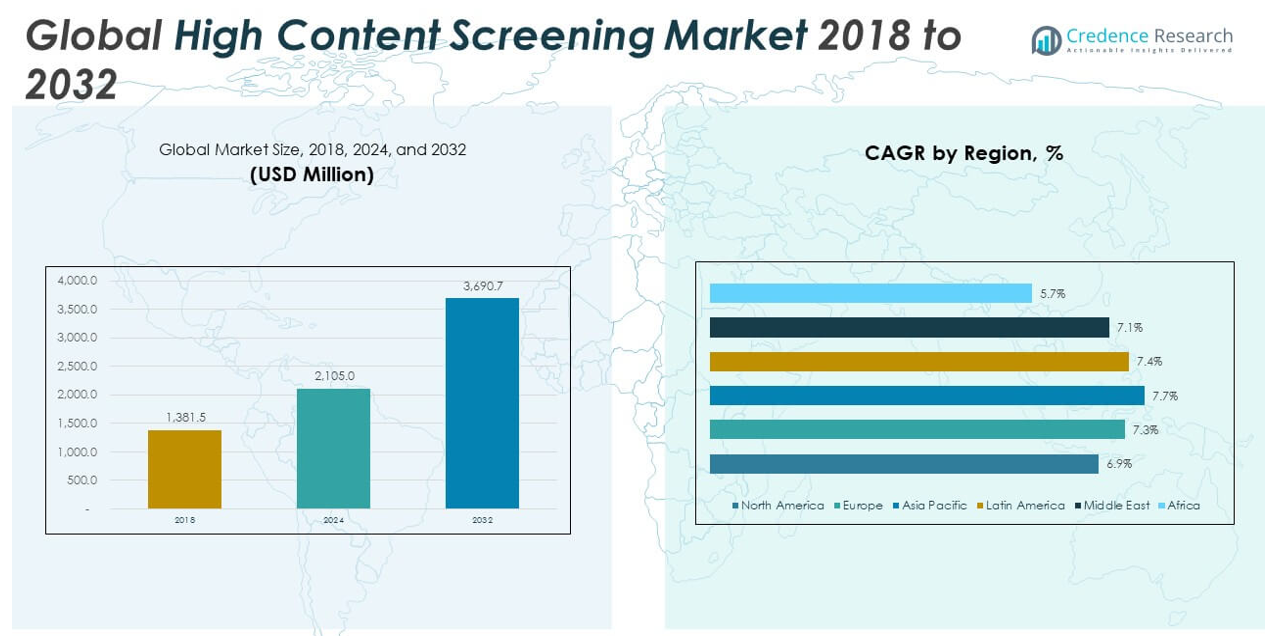

The Global High Content Screening Market size was valued at USD 1,381.5 million in 2018 to USD 2,105.0 million in 2024 and is anticipated to reach USD 3,690.7 million by 2032, at a CAGR of 7.29% during the forecast period.

One of the major drivers of this market is the accelerating demand for efficient drug discovery and development tools. Pharmaceutical companies are increasingly using HCS to screen large compound libraries, evaluate drug toxicity, and identify cellular responses under various conditions. The integration of high-speed cameras, machine learning algorithms, and automated microscopy has greatly enhanced throughput and precision. Regulatory encouragement for non-animal testing and the global burden of chronic diseases have also compelled researchers to adopt more predictive, in vitro screening technologies like HCS. The COVID-19 pandemic further highlighted the utility of HCS platforms in virology and immunology, where rapid, high-content data collection proved critical to accelerating therapeutic development.

Regionally, North America leads the Global High Content Screening Market, with the United States at the forefront due to its strong pharmaceutical industry, established academic research ecosystem, and consistent investment in advanced screening technologies. The presence of key HCS vendors and high adoption of AI-driven analytical tools solidify the region’s dominance. Europe follows, with Germany, the UK, and France investing in drug safety testing and translational research, supported by public-private collaborations and ethical considerations regarding animal use. Asia-Pacific is the fastest-growing region, driven by expanding pharmaceutical R&D in China, India, and Japan, cost-effective manufacturing, and rising demand for effective therapeutic solutions. Meanwhile, Latin America and the Middle East & Africa are emerging markets, with growing infrastructure for biomedical research and rising government interest in life sciences innovation. These regions offer untapped potential as awareness and investments in advanced screening technologies increase.

Market Insights:

- The Global High Content Screening Market was valued at USD 1,381.5 million in 2018 and reached USD 2,105.0 million in 2024; it is expected to hit USD 3,690.7 million by 2032, growing at a CAGR of 7.29%.

- Pharmaceutical companies are increasingly adopting HCS for drug discovery, toxicity screening, and phenotypic profiling, making it essential for early-stage R&D efficiency.

- Advances in automated microscopy, AI-driven analytics, and multi-channel fluorescence imaging are enhancing throughput, accuracy, and application breadth in high content screening.

- The adoption of 3D cell cultures, organoids, and co-culture models is fueling demand for HCS tools that can analyze biologically relevant, complex systems.

- North America leads the market due to its strong pharmaceutical base, research ecosystem, and widespread use of AI-integrated HCS platforms.

- Asia-Pacific is the fastest-growing region, supported by rising pharmaceutical R&D in China and India, cost-effective production, and increasing demand for advanced screening tools.

- High capital costs, integration complexity, and a shortage of skilled personnel continue to challenge widespread HCS adoption, especially in small to mid-sized labs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Advanced Drug Discovery Tools and Predictive Toxicology:

The pharmaceutical and biotechnology sectors are placing increasing emphasis on early-stage drug discovery and toxicity screening, driving demand for high content screening (HCS) platforms. These systems provide detailed, image-based cellular analysis that helps researchers identify compound effects on cell morphology, viability, and pathways. The Global High Content Screening Market is benefiting from this trend, as HCS enables rapid and reliable multiparametric analysis, reducing the risk of late-stage failures. It supports predictive toxicology, helping companies evaluate off-target effects before investing in costly clinical trials. Regulatory agencies are encouraging in vitro models, further boosting the relevance of HCS in early decision-making. High-throughput capabilities and automation are enhancing lab productivity and minimizing manual errors, making HCS an integral tool in preclinical research.

- For instance, PerkinElmer’s Opera Phenix system supports high-throughput imaging of 96- and 384-well plates with dual 16-bit sCMOS cameras capturing 2100 x 2100 pixel images, enabling researchers to conduct complex 3D cell culture assays with unprecedented speed and resolution.

Technological Advancements in Imaging, AI, and Automated Platforms:

Continuous innovation in imaging technologies, software, and automation is expanding the capabilities of high content screening systems. The integration of artificial intelligence (AI), machine learning, and advanced algorithms allows researchers to extract meaningful data from large image datasets with high accuracy. The Global High Content Screening Market is experiencing growth from improvements in camera resolution, multi-channel fluorescence, and real-time imaging capabilities. These innovations reduce variability, improve reproducibility, and support complex applications such as phenotypic screening and cell signaling studies. AI-based analysis also accelerates data interpretation, allowing scientists to focus on experimental design and decision-making. This convergence of technologies is enhancing system scalability and flexibility for a wide range of research settings.

- For instance, Molecular Devices’ ImageXpress Micro Confocal system enables acquisition of statistically relevant data faster with a large field of view and over 3 log dynamic range, supporting high-throughput phenotypic screening with multi-dimensional imaging.

Increased Adoption of Cell-Based Assays and 3D Cell Culture Models:

The shift from traditional biochemical assays to cell-based approaches has significantly contributed to the expansion of HCS applications. Researchers are now using 3D cell cultures, organoids, and co-culture systems that more accurately mimic physiological conditions. The Global High Content Screening Market is gaining traction from this transition, as HCS offers the resolution and sensitivity needed to analyze complex biological systems. These models are critical for studying cell behavior, disease mechanisms, and therapeutic responses in a biologically relevant context. The demand for physiologically relevant screening tools is especially strong in oncology, neuroscience, and regenerative medicine. HCS platforms are uniquely positioned to extract meaningful insight

Growing Investment in Life Sciences Research and Personalized Medicine:

Governments and private organizations are increasing funding for biomedical research, drug development, and personalized medicine initiatives. This funding supports the deployment of advanced screening technologies, including HCS, in both academic and industrial laboratories. The Global High Content Screening Market is expanding in response to the need for precision tools that can handle high-volume, data-rich experiments aligned with patient-specific drug responses. Personalized medicine relies on detailed cellular and molecular profiling, a core strength of HCS platforms. Research institutions are investing in high-throughput systems to accelerate translational studies and biomarker discovery. This focus on individualized treatment approaches will continue to strengthen HCS demand in the coming years.

Market Trends:

Expansion of High Content Screening in Toxicology and Environmental Safety Testing:

Beyond its traditional role in drug discovery, high content screening is increasingly used in environmental toxicology and chemical safety assessments. Regulatory agencies and industrial researchers rely on HCS to evaluate the impact of chemicals on human cells using image-based assays. The Global High Content Screening Market is growing through its role in reducing reliance on animal testing and providing human-relevant data for chemical safety evaluation. It offers detailed morphological and phenotypic insights for assessing cytotoxicity, genotoxicity, and endocrine disruption. This trend aligns with evolving global regulatory frameworks promoting non-animal alternative methods. HCS is becoming a key tool in industrial toxicology labs and regulatory science initiatives.

- For instance, Thermo Fisher Scientific’s CellInsight CX7 LZR Pro platform offers 7-channel confocal imaging with laser illumination and a back-illuminated sCMOS camera with 95% peak quantum efficiency, enabling faster and more sensitive detection in toxicity assays.

Integration of HCS Platforms with Cloud Computing and Data Management Systems:

The adoption of cloud computing and centralized data platforms is transforming how researchers store, analyze, and share high-content screening data. High-resolution image datasets generated by HCS platforms require robust data infrastructure for storage and interpretation. The Global High Content Screening Market is witnessing increasing adoption of cloud-based platforms to support collaborative workflows and remote access to complex image analysis tools. Centralized systems enhance data integrity, facilitate cross-lab studies, and support long-term data tracking in large-scale drug screening projects. Integration with laboratory information management systems (LIMS) further improves operational efficiency. This trend is creating new opportunities for software vendors and service providers in the HCS ecosystem.

- For instance, GE Healthcare’s Health Cloud, running on AWS, connects over 500,000 imaging devices and stores close to 1 petabyte of medical imaging data, facilitating secure, scalable, and collaborative data management for large-scale screening projects.

Use of High Content Screening in Biomarker Validation and Companion Diagnostics:

The focus on biomarker discovery and validation is expanding the utility of HCS in clinical research and diagnostic development. Researchers use HCS to identify phenotypic signatures associated with disease states and drug responses. The Global High Content Screening Market is gaining value from this application, particularly in the context of developing companion diagnostics for targeted therapies. High-throughput, image-based analysis helps link cellular responses to specific biomarkers, supporting personalized treatment strategies. HCS enables simultaneous measurement of multiple parameters, making it effective for validating molecular targets. This trend is driving collaboration between pharmaceutical developers and diagnostic companies to co-develop therapeutic solutions.

Growing Use of Artificial Intelligence for Predictive Modeling and Phenotypic Profiling:

Artificial intelligence is moving beyond data analysis and into predictive modeling using high content data. Machine learning tools now allow researchers to classify phenotypes, forecast treatment responses, and identify subtle cellular changes invisible to the human eye. The Global High Content Screening Market is adopting AI to enhance the predictive power of phenotypic screens in complex disease models. This trend supports a shift toward hypothesis-free screening approaches and the exploration of polypharmacology. AI-driven phenotypic profiling also aids in repurposing existing drugs and discovering unexpected therapeutic effects. The combination of deep learning with large-scale imaging datasets is redefining the capabilities of modern HCS platforms.

Market Challenges Analysis:

High Capital Investment and Complex System Integration Limiting Broader Adoption:

High content screening platforms require substantial upfront investment in advanced imaging systems, automated instrumentation, and specialized software. Many small and mid-sized research institutions face financial barriers that restrict their ability to adopt or scale HCS technologies. The Global High Content Screening Market faces adoption challenges where budget constraints delay procurement or limit the use of advanced features. Integration of HCS platforms with existing laboratory systems, such as LIMS and data analytics tools, adds technical complexity and operational costs. Organizations must also invest in staff training to operate and maintain sophisticated systems. These challenges slow market penetration, particularly in cost-sensitive and resource-limited environments.

Shortage of Skilled Personnel and Standardization Issues Affecting Performance Consistency:

Effective implementation of HCS requires expertise in cell biology, imaging technologies, and data analysis. The limited availability of professionals with cross-disciplinary skills creates a bottleneck in the adoption and utilization of high content screening systems. The Global High Content Screening Market is also affected by the lack of universal protocols and assay standardization, which impacts data reproducibility and inter-laboratory comparisons. Variability in sample preparation, staining procedures, and analysis algorithms can lead to inconsistent results. This inconsistency complicates data interpretation and slows regulatory acceptance of HCS-derived outcomes. Expanding training programs and establishing industry-wide standards remain critical to address these limitations.

Market Opportunities:

Rising Demand for Personalized Medicine and Precision Therapeutics:

The increasing focus on personalized medicine offers significant opportunities for high content screening technologies. Researchers and pharmaceutical companies require tools that can analyze patient-derived cells and generate phenotypic profiles to support individualized treatment strategies. The Global High Content Screening Market can capitalize on this trend by enabling high-throughput assessment of drug responses in diverse cellular models. HCS platforms support biomarker discovery and companion diagnostics development, which are essential for tailoring therapies. With healthcare shifting toward precision-based interventions, demand for phenotypic screening and cellular profiling tools is expected to grow steadily. HCS systems are positioned to play a central role in patient-specific drug testing and clinical decision support.

Expansion into Academic Research and Emerging Markets:

Academic institutions and government-funded research centers are expanding their use of advanced screening platforms. The Global High Content Screening Market can tap into this segment by offering modular, scalable systems suitable for educational and exploratory research. Emerging economies in Asia, Latin America, and the Middle East are investing in life sciences infrastructure, creating new markets for HCS adoption. These regions are building capabilities in cell-based research and early drug development. Offering cost-effective, user-friendly solutions can open doors for vendors targeting smaller labs and academic users. This expansion supports broader scientific collaboration and long-term market growth.

Market Segmentation Analysis:

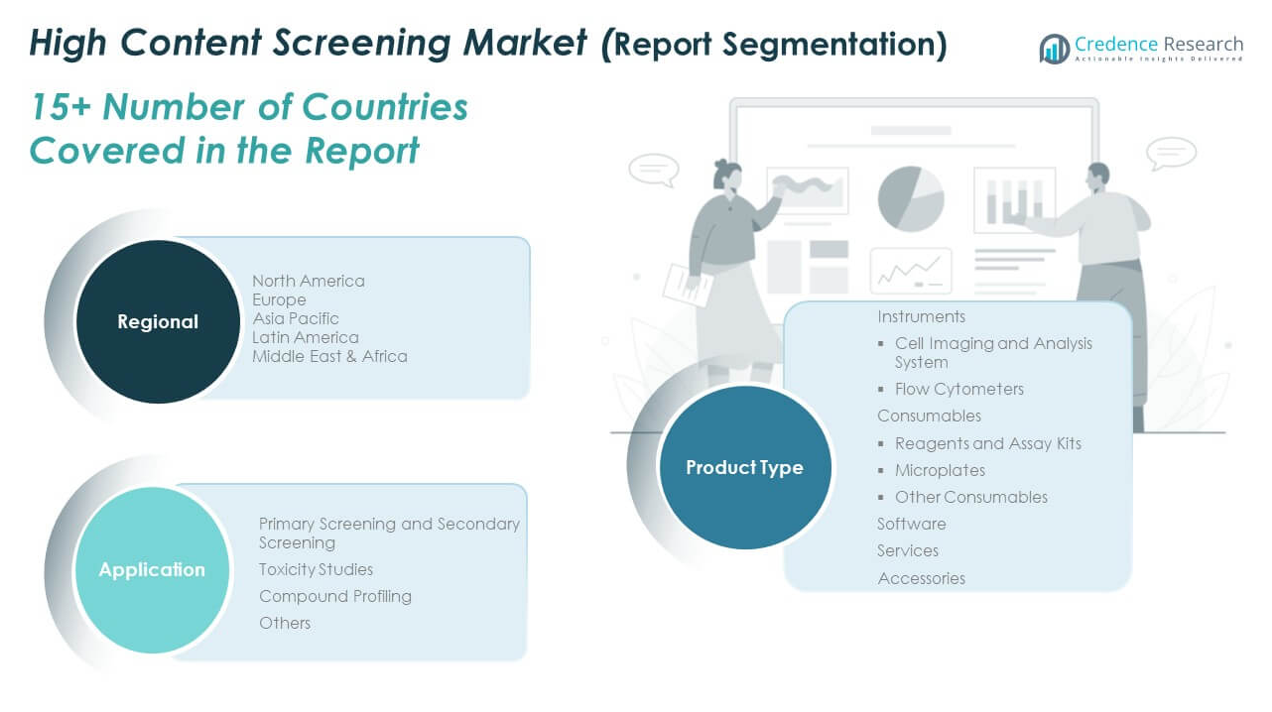

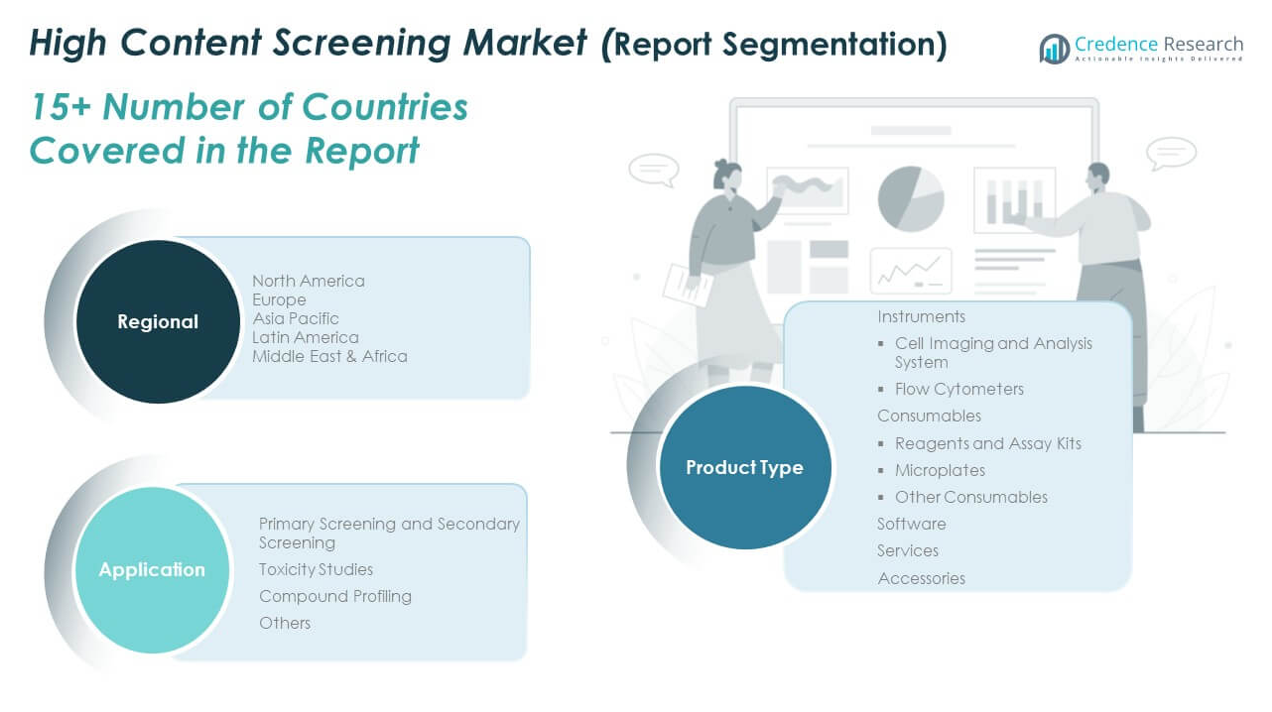

By Product Type

The Global High Content Screening Market is segmented into instruments, consumables, software, services, and accessories. Instruments account for the largest share, with cell imaging and analysis systems leading due to their critical role in visualizing complex cellular processes. Flow cytometers contribute significantly by enabling high-throughput cell population analysis. Consumables form a recurring revenue stream, driven by the high usage of reagents and assay kits in routine experiments, followed by microplates and other consumables essential for consistent assay performance. Software supports advanced image analysis, machine learning integration, and data management. Services, including assay development and consulting, are expanding as labs outsource specialized tasks. Accessories complement these systems and support customization and operational efficiency.

- For instance, BD Biosciences’ FACSCelesta flow cytometer enables analysis of up to 35,000 events per second, supporting high-throughput cell population studies critical for screening applications.

By Application

By application, the market is categorized into primary and secondary screening, toxicity studies, compound profiling, and others. Primary and secondary screening dominates, fueled by pharmaceutical R&D and large-scale compound library evaluation. Toxicity studies are gaining importance with growing regulatory support for in vitro testing and the need to predict adverse effects early. Compound profiling plays a crucial role in understanding multi-parametric drug effects in complex biological systems. The others segment includes advanced applications such as pathway analysis, biomarker discovery, and disease modelling, further expanding the relevance of HCS across drug discovery and translational research fields.

- For instance, Yokogawa’s CellVoyager CV8000 platform supports screening of millions of compounds with multi-parameter imaging, enabling identification of novel therapeutic candidates and biomarker discovery in large-scale pharmaceutical research.

Segmentation:

By Product Type

- Instruments

- Cell Imaging and Analysis System

- Flow Cytometers

- Consumables

- Reagents and Assay Kits

- Microplates

- Other Consumables

- Software

- Services

- Accessories

By Application

- Primary Screening and Secondary Screening

- Toxicity Studies

- Compound Profiling

- Others

By Region and Country

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America High Content Screening Market size was valued at USD 339.30 million in 2018 to USD 505.09 million in 2024 and is anticipated to reach USD 857.72 million by 2032, at a CAGR of 6.9% during the forecast period. North America holds the largest share of the Global High Content Screening Market, driven by a robust pharmaceutical industry and strong presence of major HCS technology providers. The United States leads with high R&D spending, advanced research infrastructure, and growing adoption of AI-based image analysis tools. Academic institutions and contract research organizations across the region are accelerating investments in phenotypic screening and 3D cell culture studies. Strong regulatory support for in vitro testing and personalized medicine continues to shape demand. The region benefits from consistent funding and established collaborations between academia and industry.

Europe

The Europe High Content Screening Market size was valued at USD 300.89 million in 2018 to USD 459.56 million in 2024 and is anticipated to reach USD 808.26 million by 2032, at a CAGR of 7.3% during the forecast period. Europe accounts for a significant share of the Global High Content Screening Market, led by countries such as Germany, the UK, and France. The region emphasizes ethical research practices and non-animal testing, which aligns with the growing use of HCS in toxicity and safety assessments. Public-private partnerships and European Commission funding programs are supporting HCS adoption across biomedical and pharmaceutical research. Demand for advanced screening platforms is rising due to increasing activity in drug repurposing and translational research. The market reflects strong demand from both academic and industry users.

Asia Pacific

The Asia Pacific High Content Screening Market size was valued at USD 465.57 million in 2018 to USD 725.18 million in 2024 and is anticipated to reach USD 1,308.35 million by 2032, at a CAGR of 7.7% during the forecast period. Asia Pacific is the fastest-growing region in the Global High Content Screening Market, fueled by expanding pharmaceutical R&D capabilities and increasing investment in biotechnology infrastructure. China, India, Japan, and South Korea are leading contributors, supported by government funding and the rise of CROs offering HCS services. The region benefits from a skilled scientific workforce and a growing focus on automation and AI integration in research environments. Demand is strong in oncology, infectious diseases, and regenerative medicine research. Global players are expanding their presence through partnerships and local manufacturing.

Latin America

The Latin America High Content Screening Market size was valued at USD 145.33 million in 2018 to USD 222.80 million in 2024 and is anticipated to reach USD 393.80 million by 2032, at a CAGR of 7.4% during the forecast period. Latin America represents an emerging market within the Global High Content Screening Market, with growing interest in drug screening and toxicology research. Brazil and Mexico are primary markets, supported by national health research initiatives and increasing collaborations with international pharmaceutical companies. Research institutions are gradually incorporating HCS systems into disease modeling and compound profiling efforts. Infrastructure development and training programs are essential for accelerating adoption. The market shows promise with rising demand for efficient preclinical analysis tools.

Middle East

The Middle East High Content Screening Market size was valued at USD 92.56 million in 2018 to USD 139.23 million in 2024 and is anticipated to reach USD 239.89 million by 2032, at a CAGR of 7.1% during the forecast period. The Middle East is building momentum in the Global High Content Screening Market, driven by increased investment in life sciences and medical research. Countries like the UAE, Saudi Arabia, and Israel are enhancing biomedical infrastructure and adopting advanced laboratory systems. Research centers are exploring HCS for toxicity testing and cellular diagnostics. Partnerships with global academic institutions and biotech companies are supporting regional market growth. Government-led initiatives to localize R&D are expanding market opportunities for HCS providers.

Africa

The Africa High Content Screening Market size was valued at USD 37.85 million in 2018 to USD 53.17 million in 2024 and is anticipated to reach USD 82.67 million by 2032, at a CAGR of 5.7% during the forecast period. Africa currently holds a smaller share in the Global High Content Screening Market but presents long-term growth potential. South Africa leads with several public research initiatives in disease biology and pharmacology. The market is gradually gaining traction as regional institutions adopt modern imaging and screening platforms. Investments in healthcare and life sciences education are laying the foundation for future adoption. Expansion depends on improving infrastructure, access to technology, and international collaboration. Awareness campaigns and training programs are essential to unlock the region’s potential in advanced screening applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BD

- Bio-Rad Laboratories, Inc.

- BioTek Instruments, Inc.

- Danaher Corporation

- GE Healthcare

- Merck Millipore Corporation

- Olympus Corporation

- Tecan Group

- PerkinElmer, Inc.

- Other Key Players

Competitive Analysis:

The Global High Content Screening Market is moderately consolidated, with a mix of established players and emerging companies competing on innovation, scalability, and service integration. Leading companies such as PerkinElmer, Thermo Fisher Scientific, BD, GE Healthcare, and BioTek Instruments dominate through extensive product portfolios and global distribution networks. It features strong technological differentiation, with firms focusing on advanced imaging systems, AI-powered analysis software, and integrated automation platforms. Strategic collaborations with pharmaceutical companies, academic institutions, and contract research organizations enhance competitive positioning. Companies are also expanding service offerings such as assay development and data analysis to capture value beyond instrumentation. The market rewards vendors that provide flexible, user-friendly systems with high throughput and compatibility across various applications. The Global High Content Screening Market continues to attract investment in software innovation, personalized medicine tools, and data integration, supporting long-term growth and global expansion.

Recent Developments:

- In May 2025, BD (Becton, Dickinson and Company) launched the BD FACSDiscover™ A8 Cell Analyzer, the world’s first cell analyzer to combine breakthrough spectral flow cytometry with real-time cell imaging technologies. This system enables researchers to analyze more than 50 characteristics of a single cell simultaneously, providing high-resolution and sensitivity for advanced biomarker discovery and cell interaction studies. The BD CellView™ Image Technology allows high-speed fluorescent and label-free imaging of single cells, offering real-time spatial and morphological insights that were previously unattainable in flow cytometry experiments.

- In February 2025, Bio-Rad Laboratories, Inc. entered into a binding agreement to acquire Stilla Technologies, a developer of advanced digital PCR systems. Stilla’s Nio® series delivers comprehensive digital PCR capabilities for genetic testing, liquid biopsy, cell and gene therapy, and infectious disease diagnostics. The acquisition, expected to close by the end of Q3 2025, will enhance Bio-Rad’s digital PCR offerings and expand its reach in automated, high-throughput molecular analysis for research and clinical diagnostics.

- In January 2025, Molecular Devices, a Danaher Corporation company, introduced the ImageXpress® HCS.ai High-Content Screening System. This fifth-generation platform leverages AI-driven analysis and high-speed imaging to complete a 96-well plate with two channels in under 90 seconds and perform 3D volumetric analysis of a 384-well plate in just 25 minutes. The system’s modular design supports easy upgrades, while its sCMOS camera achieves 95% peak quantum efficiency, delivering detailed, high-resolution images for both 2D and 3D cell models.

- In July 2024, GE HealthCare announced an agreement to acquire the clinical artificial intelligence business of Intelligent Ultrasound Group PLC for approximately $51 million. This acquisition will add real-time image recognition technology and AI-driven analysis to GE HealthCare’s portfolio, supporting precision care and improving workflow efficiency for clinicians, particularly in OBGYN ultrasound applications.

Market Concentration & Characteristics:

The Global High Content Screening Market is moderately concentrated, with a handful of major players holding significant market share through advanced product offerings and strong distribution networks. It features a technology-driven landscape where innovation in imaging systems, software analytics, and assay integration defines competitive advantage. The market is characterized by high capital investment, long sales cycles, and strong demand for customization and scalability. It supports a mix of instrument sales, consumables, and services, creating recurring revenue opportunities for suppliers. The presence of academic institutions, pharmaceutical companies, and contract research organizations ensures a diverse customer base. It continues to evolve toward automation, AI integration, and multi-parameter analysis capabilities, reflecting its critical role in early-stage drug discovery and translational research.

Report Coverage:

The research report offers an in-depth analysis based on by product type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for high-throughput drug discovery will drive wider adoption of high content screening technologies.

- Integration of AI and machine learning will enhance image analysis accuracy and predictive modelling.

- Expanding use of 3D cell cultures and organoids will increase demand for advanced imaging platforms.

- Growth in personalized medicine will boost the need for phenotypic screening and biomarker validation.

- Increased regulatory support for in vitro toxicology testing will strengthen non-animal assay adoption.

- Emerging economies will contribute significantly through investment in biomedical research infrastructure.

- Cloud-based platforms will improve data management, collaboration, and remote analysis capabilities.

- Academic and government-funded research initiatives will expand the user base across public institutions.

- Service-based HCS models will gain traction, offering flexible access to advanced screening tools.

- Continued innovation in consumables and assay kits will support recurring revenue streams and workflow optimization.