Market Overview

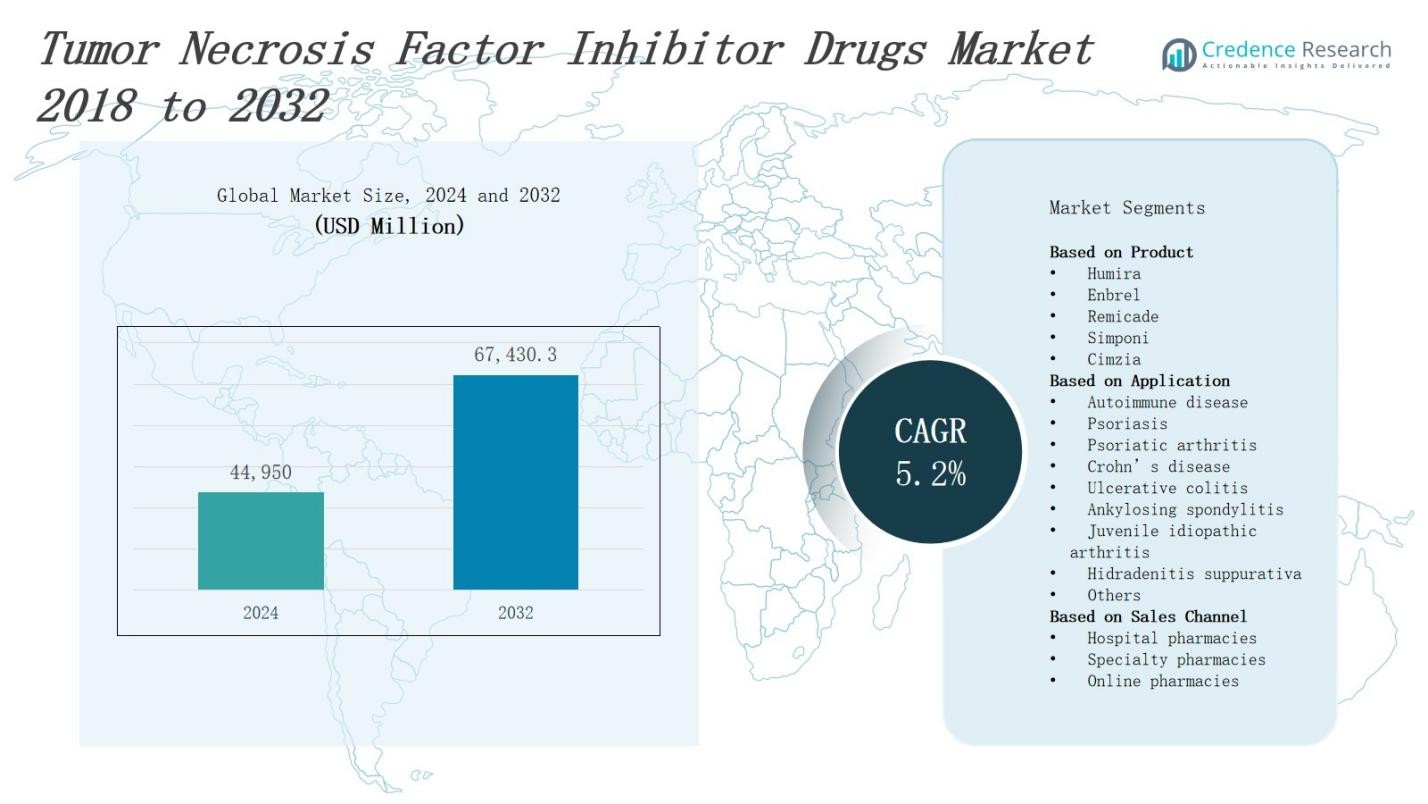

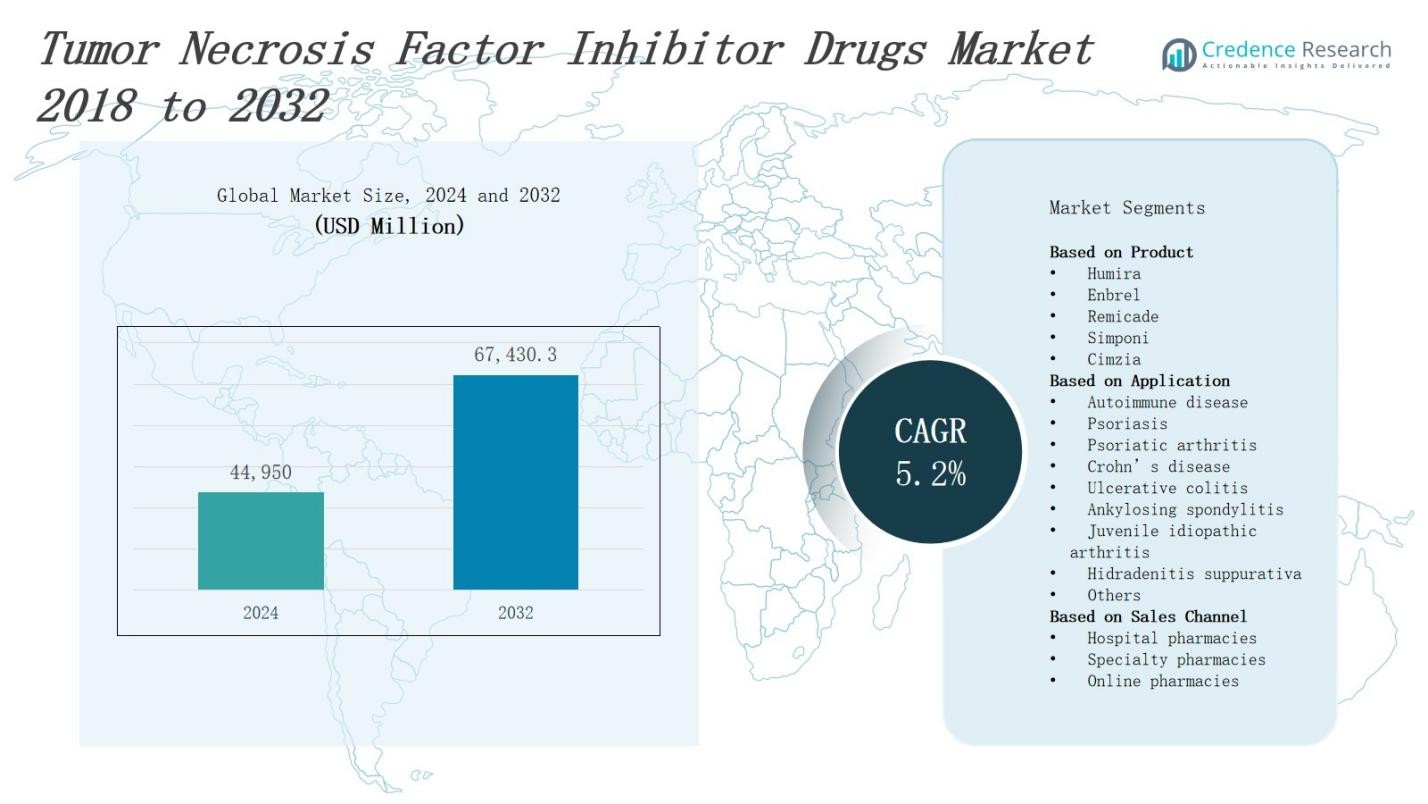

The Tumor Necrosis Factor Inhibitor Drugs Market is projected to grow from USD 44,950 million in 2024 to USD 67,430.3 million by 2032, expanding at a CAGR of 5.2%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tumor Necrosis Factor Inhibitor Drugs Market Size 2024 |

USD 44,950 Million |

| Tumor Necrosis Factor Inhibitor Drugs Market, CAGR |

5.2% |

| Tumor Necrosis Factor Inhibitor Drugs Market Size 2032 |

USD 67,430.3 Million |

The tumor necrosis factor inhibitor drugs market grows driven by increasing prevalence of autoimmune diseases such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease. Rising awareness and early diagnosis boost demand for effective treatments. Advances in biologic therapies enhance drug efficacy and safety profiles, encouraging physician adoption. Expanding access to healthcare in emerging markets further supports growth. Trends include the development of biosimilars to reduce treatment costs and improve affordability. Additionally, personalized medicine approaches and combination therapies gain traction, optimizing patient outcomes. Continuous innovation and strong pipeline development sustain competitive momentum in this dynamic market.

The tumor necrosis factor inhibitor drugs market spans key regions including North America, Europe, Asia-Pacific, and the Rest of the World. North America leads with 38% market share, followed by Europe at 29%, Asia-Pacific at 22%, and the Rest of the World holding 11%. Major players driving growth across these regions include AbbVie Inc., Janssen Biotech, Amgen Inc., Pfizer Inc., Merck & Co., and Samsung Bioepis. These companies focus on expanding regional presence through product innovation, biosimilar development, and strategic collaborations to capture diverse patient populations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The tumor necrosis factor inhibitor drugs market is projected to grow from USD 44,950 million in 2024 to USD 67,430 million by 2032, at a CAGR of 5.2%.

- Increasing prevalence of autoimmune diseases like rheumatoid arthritis, psoriasis, and inflammatory bowel disease drives demand for effective treatments.

- Advances in biologic therapies improve drug efficacy and safety, boosting physician adoption and patient compliance.

- Expanding healthcare access in emerging markets supports market growth by reaching new patient populations.

- Development and adoption of biosimilars reduce treatment costs and enhance affordability, especially in price-sensitive regions.

- Personalized medicine and combination therapies gain traction, optimizing patient outcomes and treatment customization.

- North America leads with 38% market share, followed by Europe at 29%, Asia-Pacific at 22%, and the Rest of the World at 11%, driven by regional healthcare infrastructure and policies.

Market Drivers

Rising Prevalence of Autoimmune Diseases

The tumor necrosis factor inhibitor drugs market benefits from the growing prevalence of autoimmune disorders such as rheumatoid arthritis, psoriasis, and Crohn’s disease worldwide. Increasing patient populations create steady demand for effective therapeutic options. Early diagnosis and improved disease awareness among healthcare professionals drive prescription rates. Patients seek targeted therapies that manage symptoms and improve quality of life. This growing patient base propels market expansion and encourages further drug development.

- For instance, infliximab, a TNF-targeting monoclonal antibody developed by Janssen, is FDA-approved for Crohn’s disease, rheumatoid arthritis, and psoriasis, and works by blocking TNF to reduce inflammation.

Advancements in Biologic Therapies

Innovations in biologic drugs enhance the efficacy and safety of tumor necrosis factor inhibitors, encouraging physician preference and patient compliance. It enables treatment customization based on patient needs and disease severity. New formulations offer improved delivery methods and reduced side effects. Ongoing clinical trials focus on expanding indications and refining therapeutic protocols. These advancements maintain strong market momentum and support adoption across diverse healthcare settings.

- For instance, AbbVie’s Humira, a leading TNF inhibitor, continues to demonstrate high effectiveness in multiple autoimmune disorders such as rheumatoid arthritis and Crohn’s disease, supported by extensive clinical data that enhance physician confidence and patient trust.

Expansion of Healthcare Access in Emerging Markets

The tumor necrosis factor inhibitor drugs market gains from increasing healthcare infrastructure and insurance coverage in developing regions. Enhanced access to medical services and rising disposable incomes expand patient reach. Governments and private sectors invest in disease awareness programs and treatment availability. It creates new growth opportunities beyond traditional markets. Expansion in emerging economies diversifies revenue streams and strengthens global market presence.

Development and Adoption of Biosimilars

Biosimilars present cost-effective alternatives to original tumor necrosis factor inhibitors, reducing treatment expenses and increasing affordability. Growing acceptance among physicians and patients supports wider biosimilar use. Regulatory frameworks become more favorable, accelerating approval and market entry. This drives competitive pricing and broader insurance reimbursement. It encourages market penetration in price-sensitive regions and stimulates overall demand for inhibitor therapies.

Market Trends

Increasing Adoption of Biosimilars to Enhance Market Affordability

The tumor necrosis factor inhibitor drugs market experiences a growing shift toward biosimilars, which provide cost-effective alternatives to original biologics. It enables broader patient access by lowering treatment costs and expanding insurance coverage. Physicians show increased confidence in biosimilars due to improved regulatory standards and demonstrated clinical equivalence. Competitive pricing among manufacturers drives market penetration, especially in price-sensitive regions. The trend supports sustainable growth while maintaining therapeutic efficacy.

- For instance, Amgen launched Amjevita, a biosimilar of Humira (adalimumab), which has gained significant market share in the U.S. by offering a cost-effective alternative while maintaining clinical equivalence.

Integration of Personalized Medicine in Treatment Approaches

Personalized medicine gains traction within the tumor necrosis factor inhibitor drugs market, allowing tailored therapies based on genetic and biomarker profiles. It improves treatment outcomes by optimizing drug selection and dosage for individual patients. Clinicians increasingly rely on diagnostic tools to identify responders and reduce adverse effects. This approach enhances patient adherence and long-term disease management. Personalized strategies reflect a trend toward precision healthcare that transforms treatment paradigms in autoimmune disorders.

Expansion of Combination Therapy Practices to Improve Efficacy

Combination therapies that include tumor necrosis factor inhibitors alongside other immunomodulatory agents gain popularity for managing complex autoimmune diseases. It offers synergistic effects that improve symptom control and reduce disease progression. Healthcare providers adopt these protocols to address varied patient responses and enhance overall efficacy. Clinical research continues to explore novel drug combinations and dosing regimens. This trend contributes to diversified treatment options and improved patient outcomes within the market.

- For instance, Novartis is also investigating secukinumab paired with conventional immunosuppressants in psoriatic arthritis to address varied patient responses and optimize treatment efficacy.

Advances in Drug Delivery Systems to Boost Patient Compliance

Innovations in drug delivery methods enhance the tumor necrosis factor inhibitor drugs market by improving convenience and reducing administration-related discomfort. It includes the development of pre-filled syringes, auto-injectors, and subcutaneous formulations. These technologies simplify dosing schedules and minimize hospital visits. Patient compliance improves, leading to better disease control and reduced healthcare costs. The focus on user-friendly delivery aligns with broader efforts to optimize treatment experience and adherence.

Market Challenges Analysis

High Treatment Costs and Reimbursement Barriers Limit Market Growth

The tumor necrosis factor inhibitor drugs market faces challenges related to the high cost of biologic therapies, which restricts patient access in several regions. It creates financial burdens for healthcare systems and patients, particularly where insurance coverage remains limited or inconsistent. Payers impose stringent reimbursement criteria that delay or deny treatment approval. This situation hampers market expansion, especially in low- and middle-income countries. Manufacturers and policymakers must address affordability to ensure wider adoption and sustainable growth.

Safety Concerns and Risk of Adverse Effects Impact Adoption Rates

Safety issues linked to tumor necrosis factor inhibitors pose significant challenges for market acceptance and long-term use. It carries risks of infections, immunogenic reactions, and other serious side effects that necessitate careful patient monitoring. Concerns over safety influence physician prescribing behavior and patient compliance. Ongoing pharmacovigilance and post-market surveillance require substantial resources. These factors complicate treatment protocols and may limit uptake, especially among patients with comorbidities or compromised immune systems.

Market Opportunities

Expanding Indications and Emerging Therapeutic Areas Drive Market Potential

The tumor necrosis factor inhibitor drugs market gains significant opportunities from expanding indications beyond traditional autoimmune diseases. It explores applications in conditions such as hidradenitis suppurativa, uveitis, and certain rare inflammatory disorders. Clinical trials investigating novel uses broaden therapeutic scope and patient populations. This expansion increases demand and encourages innovation in drug development. Growing interest in early intervention strategies further supports market growth by targeting disease progression and improving long-term outcomes.

Growth Potential in Emerging Markets through Improved Healthcare Infrastructure

Emerging markets offer promising opportunities for the tumor necrosis factor inhibitor drugs market due to rising healthcare investments and expanding insurance coverage. It benefits from increasing awareness of autoimmune diseases and improved diagnostic capabilities. Government initiatives focus on enhancing treatment accessibility and affordability in these regions. Collaborations between local and global pharmaceutical companies accelerate market penetration. Expanding patient populations and rising disposable incomes also contribute to revenue growth, positioning emerging markets as key drivers for future expansion.

Market Segmentation Analysis:

By Product

The tumor necrosis factor inhibitor drugs market divides into key products including Humira, Enbrel, Remicade, Simponi, and Cimzia. Humira leads due to its wide approval across multiple indications and strong physician preference. Enbrel and Remicade hold significant market shares supported by established clinical data and global presence. Simponi and Cimzia target specific patient groups with differentiated delivery methods. It benefits from continuous product lifecycle management and patent expirations driving biosimilar competition within this segment.

- For instance, Humira (adalimumab) is approved for multiple chronic inflammatory conditions, including rheumatoid arthritis, Crohn’s disease, and psoriasis, and is available in various administration forms such as prefilled pens and syringes, with several interchangeable biosimilars approved by the FDA as recent as 2024.

By Application

The tumor necrosis factor inhibitor drugs market covers a broad range of autoimmune and inflammatory conditions. It addresses autoimmune diseases, psoriasis, psoriatic arthritis, Crohn’s disease, ulcerative colitis, ankylosing spondylitis, juvenile idiopathic arthritis, and hidradenitis suppurativa. Autoimmune diseases and psoriasis remain the largest application areas due to high prevalence. Emerging indications such as hidradenitis suppurativa contribute to incremental growth. The diverse application base supports steady demand and encourages tailored therapeutic development.

- For instance, infliximab, a monoclonal antibody drug developed by Janssen, is FDA-approved for Crohn’s disease, rheumatoid arthritis, ankylosing spondylitis, and chronic plaque psoriasis, demonstrating broad therapeutic use across autoimmune conditions.

By Sales Channel

The tumor necrosis factor inhibitor drugs market distributes products through hospital pharmacies, specialty pharmacies, and online pharmacies. Hospital pharmacies dominate due to direct access in clinical settings and inpatient care. Specialty pharmacies focus on managing complex therapies and patient support programs. Online pharmacies gain traction through convenience and wider reach, particularly in regions with advanced digital infrastructure. It adapts sales strategies to optimize channel efficiency and enhance patient accessibility across geographies.

Segments:

Based on Product

- Humira

- Enbrel

- Remicade

- Simponi

- Cimzia

Based on Application

- Autoimmune disease

- Psoriasis

- Psoriatic arthritis

- Crohn’s disease

- Ulcerative colitis

- Ankylosing spondylitis

- Juvenile idiopathic arthritis

- Hidradenitis suppurativa

- Others

Based on Sales Channel

- Hospital pharmacies

- Specialty pharmacies

- Online pharmacies

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share in the tumor necrosis factor inhibitor drugs market with 38% market dominance. It benefits from a high prevalence of autoimmune diseases and strong healthcare infrastructure. Advanced diagnostics and early disease detection support widespread adoption of these therapies. Favorable reimbursement policies and well-established pharmaceutical distribution networks enhance market penetration. The presence of major biopharmaceutical companies and continuous research investments sustain innovation. It also gains from growing patient awareness and physician preference for biologic treatments. North America remains a critical region for market growth and product launches.

Europe

Europe commands 29% of the tumor necrosis factor inhibitor drugs market, driven by increasing government initiatives promoting access to biologic therapies. It maintains comprehensive healthcare systems and reimbursement frameworks that facilitate patient access. Rising incidence of autoimmune and inflammatory diseases fuels demand. European countries focus on biosimilar adoption to reduce treatment costs and improve affordability. It benefits from active clinical trials and collaborations between public and private sectors. Stringent regulatory standards ensure high-quality therapies, strengthening market confidence and expansion.

Asia-Pacific

Asia-Pacific represents 22% of the tumor necrosis factor inhibitor drugs market, demonstrating the fastest growth trajectory. Rising healthcare expenditure and improving medical infrastructure support market expansion. Increasing disease awareness and expanding middle-class populations drive demand for effective therapies. It experiences growing acceptance of biosimilars due to cost sensitivity and accessibility challenges. Emerging economies implement policies to enhance healthcare coverage and treatment availability. The region attracts investment from global pharmaceutical companies seeking new patient bases and growth opportunities.

Rest of the World

The Rest of the World accounts for 11% of the tumor necrosis factor inhibitor drugs market. It includes Latin America, the Middle East, and Africa, where market growth depends on improving healthcare infrastructure and increasing disease diagnosis rates. It faces challenges such as limited reimbursement and affordability constraints, which slow adoption. Governments and international organizations focus on raising awareness and expanding access to advanced therapies. The market shows potential through gradual penetration of biosimilars and growing patient populations. Strategic partnerships aim to address unmet medical needs and unlock new opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Janssen Biotech, Inc.

- Sandoz Group AG

- Merck & Co., Inc.

- AbbVie Inc.

- Bio-Thera Solutions, Ltd.

- Pfizer Inc.

- Samsung Bioepis Co., Ltd.

- Amgen Inc.

- UCB, Inc.

- Boehringer Ingelheim Pharmaceuticals, Inc.

Competitive Analysis

The tumor necrosis factor inhibitor drugs market features intense competition among leading pharmaceutical companies focusing on innovation, product differentiation, and strategic collaborations. Key players such as AbbVie Inc., Janssen Biotech, Inc., Amgen Inc., and Pfizer Inc. compete by expanding their biologic portfolios and launching biosimilars to capture broader patient segments. It emphasizes research and development to improve drug efficacy and safety profiles, addressing unmet medical needs. Competitive pricing strategies and global market expansion drive revenue growth. Partnerships and acquisitions enable companies to enhance manufacturing capabilities and distribution networks. The market’s dynamic landscape demands continuous investment in clinical trials and regulatory approvals to maintain leadership positions and respond to evolving healthcare demands.

Recent Developments

- On February 26, 2025, TNF Pharmaceuticals commenced a Phase 2b clinical trial for isomyosamine, an oral TNF-alpha inhibitor, targeting sarcopenia and frailty in patients post-hip fracture.

- In May 2024, Teva Pharmaceuticals (US) partnered with Alvotech (Luxembourg) to launch SIMLANDI (adalimumab-ryvk) injection in the U.S. This is an interchangeable biosimilar to Humira for treating various autoimmune conditions such as rheumatoid arthritis, Crohn’s disease, and psoriasis.

- In August 2023, CVS Health launched Cordavis, which partners on commercializing FDA-approved biosimilar products including TNF inhibitors in the U.S.

- On April 14, 2025, Sandoz initiated an antitrust lawsuit against Amgen in the U.S. District Court for the Eastern District of Virginia. Sandoz alleges that Amgen unlawfully acquired exclusive rights to certain etanercept-related patents, known as the Brockhaus Patents, to block biosimilar competition.

Market Concentration & Characteristics

The tumor necrosis factor inhibitor drugs market demonstrates a moderately concentrated structure dominated by a few key players, including AbbVie Inc., Janssen Biotech, Amgen Inc., and Pfizer Inc. It features intense competition driven by innovation, patent expirations, and the entry of biosimilars. Market leaders focus on expanding their biologic portfolios and enhancing drug efficacy through continuous research and development. It balances high barriers to entry due to complex manufacturing and regulatory requirements with opportunities created by growing demand for autoimmune disease treatments. The presence of biosimilars intensifies price competition, encouraging affordability and wider adoption. Companies invest in strategic partnerships, acquisitions, and geographic expansion to strengthen market share and diversify offerings. This dynamic competitive environment fosters rapid technological advancements and supports sustained growth in the tumor necrosis factor inhibitor drugs market.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The tumor necrosis factor inhibitor drugs market will expand due to rising autoimmune disease prevalence worldwide.

- Advances in biologic therapies will improve treatment effectiveness and safety profiles.

- Biosimilar development will increase affordability and access to these drugs.

- Emerging markets will become key growth areas with improving healthcare infrastructure.

- Personalized medicine approaches will enhance treatment customization and patient outcomes.

- Combination therapies will gain popularity to address complex autoimmune conditions.

- Digital health technologies will support better disease monitoring and patient adherence.

- Regulatory frameworks will evolve to accelerate biosimilar approvals and market entry.

- Strategic collaborations and partnerships will drive innovation and expand geographic reach.

- Continuous pipeline development will introduce novel inhibitors targeting unmet medical needs.