Market Overview

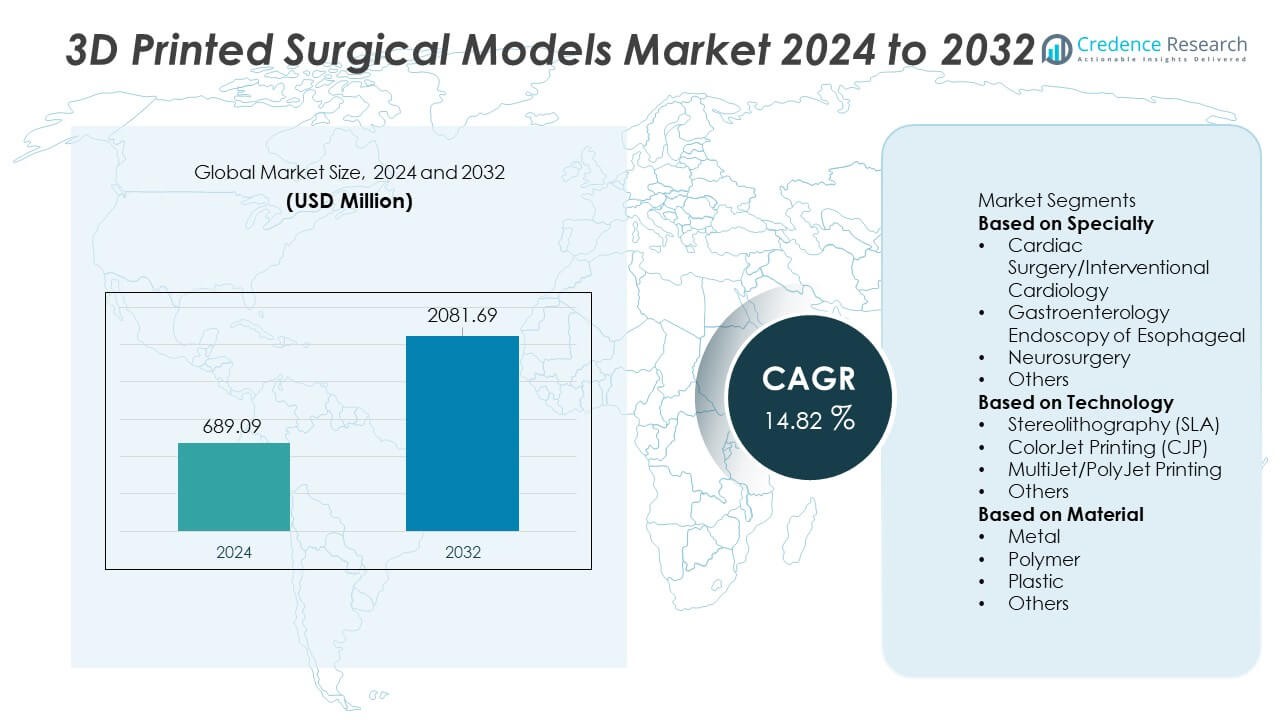

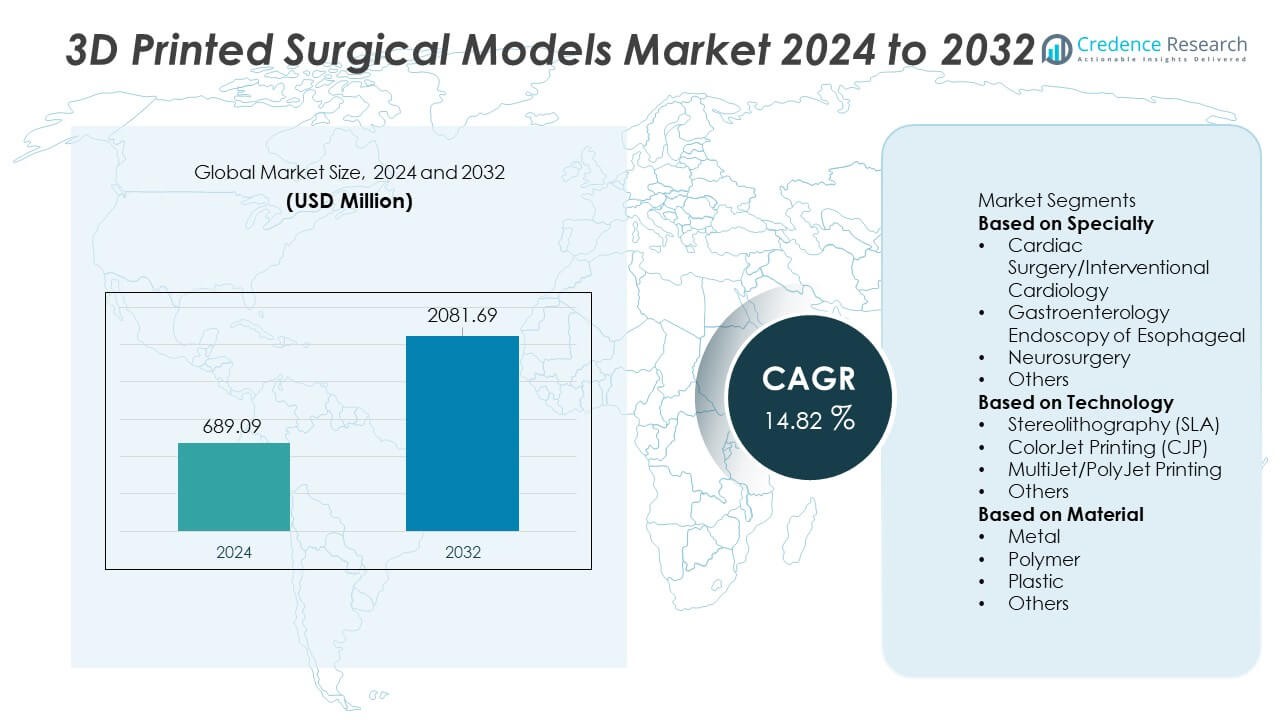

The 3D Printed Surgical Models Market reached USD 689.09 million in 2024 and is projected to grow to USD 2,081.69 million by 2032, registering a CAGR of 14.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Printed Surgical Models Market Size 2024 |

USD 689.09 Million |

| 3D Printed Surgical Models Market, CAGR |

14.82% |

| 3D Printed Surgical Models Market Size 2032 |

USD 2,081.69 Million |

Leading players in the 3D Printed Surgical Models market include Materialise NV, Formlabs, Axial3D, 3D LifePrints U.K. Ltd., Lazarus 3D LLC, WhiteClouds Inc., Stratasys Ltd., Osteo3D, Onkos Surgical, and 3D Systems Inc. These companies expand their presence through high-precision printing technologies, biocompatible materials, and advanced anatomical modeling solutions that support surgical planning and medical training. North America leads the global market with a 39% share, driven by strong integration of 3D printing in hospitals and research centers. Europe follows with a 29% share, supported by advanced clinical adoption, robust research activity, and increasing demand for patient-specific surgical models.

Market Insights

Market Insights

- The market reached USD 689.09 million in 2024 and will grow at a CAGR of 14.82% through 2032.

- Demand rises as patient-specific cardiac models lead the specialty segment with a 37% share, driven by their role in improving surgical accuracy and preoperative planning.

- Multi-material and high-precision printing technologies strengthen market trends as hospitals adopt SLA and PolyJet systems to enhance training and simulation capabilities.

- Competition intensifies as Materialise, Formlabs, Stratasys, Axial3D, and Lazarus 3D invest in advanced anatomical modeling and collaborate with clinical institutions to expand adoption while facing restraints such as high production costs and limited reimbursement.

- North America leads with a 39% share, followed by Europe at 29% and Asia Pacific at 24%, supported by strong healthcare infrastructure, rising medical training needs, and increasing adoption of personalized surgical planning tools.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Specialty

Cardiac surgery and interventional cardiology lead this segment with a 37% share, driven by rising adoption of patient-specific heart models for preoperative planning and complex procedure simulation. Surgeons rely on 3D printed cardiac structures to improve accuracy in valve repair, congenital defect correction, and stent placement. Neurosurgery follows as demand grows for detailed brain models that support tumor mapping and cranial reconstruction planning. Gastroenterology endoscopy applications expand as clinicians use esophageal models for training and device testing. Increasing clinical acceptance, better anatomical accuracy, and growing investment in surgical training centers reinforce the dominance of cardiac applications across this segment.

- For instance, Philips’ IntelliSpace Portal workflow is used to support surgical planning across major cardiac centers and create patient-specific models, with the platform supporting the export of 3D models for printing.

By Technology

Stereolithography (SLA) holds the dominant position with a 42% share, supported by its high precision, smooth surface quality, and suitability for creating complex anatomical structures. Hospitals and research facilities prefer SLA when producing highly detailed organ replicas for surgical simulation and education. MultiJet/PolyJet printing follows due to its multi-material capability, which allows replication of soft-tissue textures. ColorJet printing finds use in educational models requiring color-coded anatomy. Growth in SLA adoption is driven by increasing demand for accurate, patient-specific models and continuous improvements in resin-based materials that enhance realism and structural fidelity.

- For instance, Formlabs’ customers, such as Northwell Health, produced over 100,000 nasopharyngeal swabs using a fleet of Form 3B printers during the COVID-19 pandemic.

By Material

Polymer-based materials lead this segment with a 44% share, supported by their flexibility, durability, and compatibility with advanced 3D printing technologies. Polymers allow high anatomical accuracy and realistic tissue simulation, making them the preferred choice for creating patient-specific surgical models. Plastic materials follow due to their cost-effectiveness and use in routine training models. Metal-based models hold a smaller share but support specialized orthopedic and maxillofacial applications that require high structural strength. Rising demand for lightweight, customizable, and biocompatible materials drives the growth of polymers, while ongoing material innovations continue to expand the application scope across clinical training and preoperative planning.

Key Growth Driver

Rising Adoption of Patient-Specific Surgical Planning

Demand increases as surgeons rely on patient-specific 3D printed models to enhance procedural accuracy and reduce intraoperative risks. These models support clearer visualization of complex anatomy and help teams rehearse surgical steps before entering the operating room. Hospitals adopt them to improve outcomes in cardiac, orthopedic, and neurosurgical procedures. Growing focus on precision medicine strengthens their use across preoperative planning. As more clinicians recognize the value of customized anatomical replicas, adoption rises across both advanced and developing healthcare systems.

- For instance, Mayo Clinic has produced thousands of patient-specific anatomical models through its 3D Anatomic Modeling Lab, supporting a wide range of complex cardiac and orthopedic procedures. The lab now consistently produces many models each year to enhance patient care.

Expansion of Advanced 3D Printing Technologies

Advances in SLA, PolyJet, and multi-material printing drive wider use of surgical models. These technologies produce high-resolution structures with realistic textures, enabling better simulation and training. Improvements in speed, accuracy, and material compatibility make printers more suitable for clinical use. Healthcare institutions invest in modern printing systems to support research, education, and surgical planning. As production capabilities expand and turnaround times shorten, hospitals gain greater flexibility in creating detailed anatomical models.

- For instance, Formlabs deployed medical SLA prints through its Form 3B and Form 3B+ systems for patient diagnostic testing during the global health crisis. These items were nasopharyngeal swabs used for actual COVID-19 sample collection, which helped address significant supply chain shortages experienced by health systems including Northwell Health and USF Health.

Growing Need for Enhanced Medical Training and Simulation

3D printed surgical models become essential tools for medical education, allowing trainees to practice on lifelike structures before treating patients. These models help reduce learning curves for complex procedures and improve clinical confidence. Training institutions adopt them to replace traditional cadaver-based learning, which presents availability and ethical limitations. Surgeons also use models to demonstrate procedures to patients, supporting informed decision-making. Increased emphasis on hands-on training and skill development drives rapid market growth.

Key Trend & Opportunity

Integration of Multi-Material and Biocompatible Materials

Use of multi-material printing expands opportunities for producing models that closely mimic soft tissue, bone, and vascular structures. Material innovation improves anatomical realism and functional testing capabilities. Biocompatible options support deeper surgical simulation, allowing clinicians to practice cutting, suturing, and device placement with greater accuracy. These advancements open new pathways for research and product development. As material costs decrease and performance improves, broader adoption across hospitals and academic institutions is expected.

- For instance, Stratasys manufactured biocompatible anatomical models for surgical planning and clinical simulation programs using its high-resolution materials. These models help surgeons visualize complex patient-specific anatomy, plan intricate procedures, and practice techniques in a risk-free environment, which can lead to improved surgical outcomes.

Increasing Use of 3D Models in Preoperative Patient Engagement

Clinicians use 3D printed models to explain surgical procedures and expected outcomes to patients more effectively. This improves understanding, reduces anxiety, and strengthens shared decision-making. Personalized models help illustrate treatment risks and benefits with greater clarity. Hospitals that prioritize patient communication adopt 3D models to enhance satisfaction scores and streamline consent processes. Growing emphasis on patient-centered care creates strong opportunities for wider integration across specialties.

- For instance, Boston Children’s Hospital used many pediatric heart and airway models to support family counseling before surgery.

Key Challenge

High Production Costs and Limited Reimbursement

Complex 3D printing systems, advanced materials, and specialized labor contribute to high production expenses. Many healthcare systems struggle to justify costs without clear reimbursement pathways. Limited insurance coverage restricts adoption across smaller hospitals and clinics. These financial hurdles delay investment in in-house printing facilities. Without standardized reimbursement guidelines, institutions may rely on external service providers, adding further cost pressure and slowing market penetration.

Limited Technical Expertise and Workflow Integration

Successful adoption requires skilled technicians, surgeons, and engineers who understand 3D design and anatomical modeling. Many hospitals lack trained staff or established workflows for model creation and validation. Integration challenges arise when coordinating imaging data, software design, and printing processes. Delays in production can affect surgical timelines. Without proper training and streamlined workflows, institutions face operational barriers that limit the routine use of 3D printed surgical models.

Regional Analysis

North America

North America leads the 3D Printed Surgical Models market with a 39% share, driven by strong adoption of precision medicine and wide integration of advanced 3D printing technologies in hospitals and research centers. High healthcare spending, coupled with rapid uptake of patient-specific surgical planning tools, accelerates market growth. Medical schools and training institutions increasingly use anatomical models for simulation-based learning. Strong collaborations between hospitals, universities, and 3D printing companies support ongoing innovation. The region’s well-established infrastructure, availability of skilled professionals, and increasing investment in complex surgical procedures reinforce its dominant market position.

Europe

Europe holds a 29% share, supported by widespread use of patient-specific anatomical models in cardiac, orthopedic, and neurosurgical applications. Strong regulatory support for clinical validation of 3D printed tools enhances adoption across hospitals. Countries such as Germany, the UK, and France lead in surgical innovation, benefiting from advanced research capabilities and strong academic-industry partnerships. Demand rises as healthcare providers focus on improving surgical accuracy and reducing operative risks. Training centers across the region use 3D models extensively for skill development. Growing interest in multi-material printing and biocompatible materials further fuels market expansion.

Asia Pacific

Asia Pacific accounts for a 24% share, driven by rapid healthcare modernization, growing investment in surgical infrastructure, and increasing cases requiring complex interventions. Hospitals in China, Japan, India, and South Korea adopt 3D printed models to support preoperative planning and medical education. Rising medical tourism strengthens demand for advanced surgical planning tools. The region benefits from expanding manufacturing capabilities, making 3D printing technologies more cost-effective. Awareness of personalized surgical care grows among clinicians and patients. Continued investment in research institutions and training programs positions Asia Pacific as a fast-growing region in this market.

Latin America

Latin America holds a 5% share, influenced by growing adoption of advanced surgical planning tools in large urban hospitals. Countries such as Brazil and Mexico lead demand as they expand access to imaging technologies and modern operating environments. Medical institutions increasingly use 3D printed models for training and preoperative evaluation of complex cardiac and orthopedic procedures. However, limited budgets and inconsistent reimbursement slow widespread adoption. Partnerships with global 3D printing companies help support technology transfer and training. Rising investment in tertiary care centers strengthens long-term growth prospects across the region.

Middle East & Africa

The Middle East & Africa region captures a 3% share, driven by growing investment in high-end surgical facilities, particularly in the UAE, Saudi Arabia, and South Africa. Hospitals adopt 3D printed models to support advanced neurosurgical and cardiac procedures and to enhance patient communication. Government-led healthcare modernization initiatives improve access to imaging and digital design technologies. Despite progress, limited technical expertise and high equipment costs constrain broader adoption across several African nations. Medical tourism and increasing collaboration with global technology providers continue to strengthen regional capabilities and expand market reach.

Market Segmentations:

By Specialty

- Cardiac Surgery/Interventional Cardiology

- Gastroenterology Endoscopy of Esophageal

- Neurosurgery

- Others

By Technology

- Stereolithography (SLA)

- ColorJet Printing (CJP)

- MultiJet/PolyJet Printing

- Others

By Material

- Metal

- Polymer

- Plastic

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The 3D Printed Surgical Models market is shaped by leading companies such as Materialise NV, Formlabs, Axial3D, 3D LifePrints U.K. Ltd., Lazarus 3D LLC, WhiteClouds Inc., Stratasys Ltd., Osteo3D, Onkos Surgical, and 3D Systems Inc. These players compete by advancing high-precision printing technologies, multi-material capabilities, and patient-specific anatomical modeling. Companies invest in resin innovation, biocompatible materials, and faster production workflows to improve surgical planning accuracy. Strategic partnerships with hospitals and academic institutions strengthen adoption and expand clinical applications. Firms also focus on software integration to streamline conversion of medical imaging into 3D printable models. As demand for personalized surgical preparation and training grows, competition intensifies around scalability, model realism, and regulatory compliance. Continuous R&D investment and expansion into emerging healthcare markets further enhance competitive positioning across the sector.

Key Player Analysis

- Materialise NV

- Formlabs

- Axial3D

- 3D LifePrints U.K. Ltd.

- Lazarus 3D, LLC

- WhiteClouds Inc.

- Stratasys Ltd.

- Osteo3D

- Onkos Surgical

- 3D Systems, Inc.

Recent Developments

- In November 2025, Stratasys Ltd. showcased lifelike surgical models at Formnext 2025, enabling surgeons to rehearse real procedures — including rare pathologies — without cadavers.

- In October 2025, Axial3D received PCCP approval from the US FDA for its AI-driven segmentation & planning platform Axial3D INSIGHT.

- In 2024, Formlabs launched a large-format SLA printer (Form 4L) and expanded its material and post-processing ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Specialty, Technology, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for patient-specific surgical planning models will increase across major specialties.

- Adoption of multi-material and biocompatible materials will strengthen anatomical realism.

- Medical training programs will expand the use of 3D printed models for skill development.

- Faster and more precise printing technologies will improve production efficiency.

- AI-driven automation in image-to-model conversion will streamline workflows.

- Hospitals will integrate in-house 3D printing labs to reduce turnaround time.

- Collaborative partnerships between manufacturers and healthcare institutions will accelerate innovation.

- Growth in minimally invasive procedures will drive need for detailed preoperative models.

- Emerging regions will invest more in advanced surgical training and planning tools.

- Regulatory frameworks will evolve to support clinical validation and broader adoption.

Market Insights

Market Insights